Professional Documents

Culture Documents

Customer Identification: Presented By: Sajjad Hamidi

Uploaded by

MZakki23Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Customer Identification: Presented By: Sajjad Hamidi

Uploaded by

MZakki23Copyright:

Available Formats

CUSTOMER IDENTIFICATION

PRESENTED BY: SAJJAD HAMIDI

5. Customer Identification (Key Issues for Supervisors)

National supervisors should develop:

customer

identification program guidelines and best practices reflecting the various types of transactions that are most prevalent in the national banking system.

5. Customer Identification (Process of Customer Identification)

i. ii. iii.

Collecting the identification information Screening the customer Assessing the customers risk profile Reconfirming the identification information Obtaining additional information Reconfirming the identification information

(if general due diligence is believed to be enough)

(if enhanced due diligence is believed to be required)

iv. v.

5. Customer Identification (Natural Persons)

Identification Information

Legal name and any other names used (such as maiden name) Correct permanent address (the full address should be obtained: a Post Office box number is not sufficient) Telephone number, fax number, and e-mail address Date and place of birth Nationality Occupation, public position held and/or name of employer An official personal identification number or other unique identifier contained in an unexpired official documents that bears a photograph of the customer Type of account and nature of the banking relationship Signature

(source: General Guide to Account Opening and Customer Identification, BCBS)

5. Customer Identification (Natural Persons) Screening customers

new

customer applications existing customer base against lists of known or suspected money launderers/terrorists

5. Customer Identification (Natural Persons)

Obtaining Additional Identification Documents

If the financial institution believes that enhanced due diligence is required after the initial assessment of the customers risk profile, it should obtain additional information, such as:

Evidence of an individuals permanent address sought through a credit reference agency search or through independent verification by home visits Personal reference (i.e. by an existing customer of the same institution) Prior bank reference and contact with the bank regarding the customer Source of wealth Verification of employment, public position held (where appropriate)

5. Customer Identification (Natural Persons)

Reconfirming the Identification

Confirming the date of birth from an official document (birth certificate, passport, identity card, social security records) Confirming the permanent address

Utility bill, tax assessment, bank statement, a letter from a public authority

Contacting the customer by telephone or by letter to confirm the information supplied after an account has been opened

A disconnected phone or returned mail should warrant further investigation

Confirming the validity of the official documentation provided through certification by an authorized person

Embassy official, notary public

5. Customer Identification (Legal Persons/Arrangements)

Legal Elements of the Customer Identification

1.

Verify that any person acting on behalf of the legal person/arrangement is so authorized. Identify any person acting on behalf of the legal persons/arrangements.

2.

Verification of the identity of directors/signatories

Directors: A directors exercises control over the business and thus over funds passing through the account Signatories: A signatory to an account is able to exercise control or authority over funds passing through the account

5. Customer Identification (Legal Persons or Arrangements)

Legal Elements of the Customer Identification

3.

Identify the legal person/arrangement

Verification of the lawful existence of the company Verification of the license if it is required in operating such business

Is the legal person/arrangement regulated? Is the legal person/arrangement required to observe AML/CFT controls?

Verification of the type of legal form and business purposes

5. Customer Identification (Legal Persons/Arrangements)

Business Elements of the Customer Identification

1. 2. 3. 4. 5.

Annual audited accounts, copies of business plan. Location of the headquarter, branches, plants, warehouses, overseas offices. Major customers/suppliers. Other financial institutions the legal person/arrangement has business relationships. Likely level of account activity and format (cash, checks, wires)

It is important to obtain sufficient documentation to prove or establish that the business exist.

5. Customer Identification (Legal Persons/Arrangements)

Ownership/Identification

Mr. T Ms. U

Company E

Company D

Mr. V

Mr. W

Bearer Shares

Mr. S

Company C

Company B

Mr. X

Mr. Y

Ms. Z

Company F

Company A

Company A requested a new account. Which entities should be identified?

Thank You

You might also like

- AML Regulation and Compliance Requirements in AfghanistanDocument30 pagesAML Regulation and Compliance Requirements in AfghanistandaucNo ratings yet

- BEST PRACTICE KYC CODEDocument111 pagesBEST PRACTICE KYC CODEUmer SafdarNo ratings yet

- Banking Report On KYC, NPA & FactoringDocument19 pagesBanking Report On KYC, NPA & FactoringKaushal Patel100% (1)

- What Is KYC?Document4 pagesWhat Is KYC?Sumesh NairNo ratings yet

- Corp Bank NotesDocument9 pagesCorp Bank NotessvmkishoreNo ratings yet

- Final Caiib MatDocument227 pagesFinal Caiib MatPrince VenkatNo ratings yet

- AML Refresher COCDocument3 pagesAML Refresher COCakshay kasanaNo ratings yet

- Know Your Customer GuidelinesDocument23 pagesKnow Your Customer GuidelinesShradha TripathiNo ratings yet

- Kyc - Guidelines - Ihfl9 6 15 0408232001552896472Document9 pagesKyc - Guidelines - Ihfl9 6 15 0408232001552896472Chinmay PawarNo ratings yet

- Guidelines On Amlcft and TFS For Labuan Key Reporting InstitutionsDocument8 pagesGuidelines On Amlcft and TFS For Labuan Key Reporting Institutionswongkathy99No ratings yet

- 7-MM 7A-Know Your Customer (KYC) and AMLDocument55 pages7-MM 7A-Know Your Customer (KYC) and AMLsenthamarai krishnanNo ratings yet

- Unit - 2 Banking Law Sem 7Document27 pagesUnit - 2 Banking Law Sem 7Kushal Dube CorleoneNo ratings yet

- Anti Money Laundering PolicyDocument8 pagesAnti Money Laundering PolicySumeetNo ratings yet

- Frequently Asked Questions On KYC Norms and Anti Money LaunderingDocument3 pagesFrequently Asked Questions On KYC Norms and Anti Money LaunderingsonuNo ratings yet

- Anti Money LaunderingDocument6 pagesAnti Money LaunderingAbin Issac John RCBSNo ratings yet

- Customer Verification FormDocument2 pagesCustomer Verification FormDarko SvetozarevskiNo ratings yet

- Know Your CustomerDocument3 pagesKnow Your CustomerMardi RahardjoNo ratings yet

- 1) - What Kind of Account You Offer and What Are The Details You Ask For Opening It?Document14 pages1) - What Kind of Account You Offer and What Are The Details You Ask For Opening It?Pawan Jaju100% (1)

- Guidelines on KYC AML CFT for BanksDocument16 pagesGuidelines on KYC AML CFT for BanksNethaji MudaliyarNo ratings yet

- KYC HANDOUT 21 January 2021Document7 pagesKYC HANDOUT 21 January 2021RupamNo ratings yet

- Account Opening GuidelinesDocument11 pagesAccount Opening GuidelinesGraphic MasterNo ratings yet

- AML KYC Booklet 3rd Dec 2020Document12 pagesAML KYC Booklet 3rd Dec 2020Sawansolanki7167gmail.com Sawansam7167No ratings yet

- Aml Policy Dolphin - enDocument8 pagesAml Policy Dolphin - enloyality bewafaiNo ratings yet

- Know Your CustomerDocument3 pagesKnow Your Customerkannan sunilNo ratings yet

- AML Policy SummaryDocument7 pagesAML Policy SummaryFlavianaAbreuNo ratings yet

- Retail KycDocument11 pagesRetail KycTwinkle SuriNo ratings yet

- KYC - Know Your CustomerDocument2 pagesKYC - Know Your CustomerRatnadeep Mitra0% (1)

- KYC and AML PolicyDocument21 pagesKYC and AML PolicySakshiNo ratings yet

- AML Policy and Procedure ManualDocument8 pagesAML Policy and Procedure ManualAbhimanyu Yashwant AltekarNo ratings yet

- Anti Money Laundering Policy: Legal DocumentationDocument5 pagesAnti Money Laundering Policy: Legal DocumentationKhalifa SamuelNo ratings yet

- KYC Operational GuidelinesDocument40 pagesKYC Operational GuidelinesLakshmi Priya GodabaNo ratings yet

- MIFOS KYC SLIDESDocument8 pagesMIFOS KYC SLIDESAllanNo ratings yet

- Final-General Banking .Document27 pagesFinal-General Banking .Salman AhmedNo ratings yet

- New Era University: Etbanan@neu - Edu.phDocument10 pagesNew Era University: Etbanan@neu - Edu.phRed YuNo ratings yet

- Opening & Operation of Bank AccountDocument21 pagesOpening & Operation of Bank AccountNazmul H. PalashNo ratings yet

- KYC Full Standard Format(mm)Document24 pagesKYC Full Standard Format(mm)AZHAR HASANNo ratings yet

- Application For Student PERMITDocument1 pageApplication For Student PERMITJerome ReyesNo ratings yet

- Introduction of The Customer: 2. Customer Identification Requirements - Indicative GuidelinesDocument6 pagesIntroduction of The Customer: 2. Customer Identification Requirements - Indicative Guidelinesgvgirish2901No ratings yet

- Customer Due Diligence - Opening of Accounts: Digital TrainingDocument4 pagesCustomer Due Diligence - Opening of Accounts: Digital TrainingAjay Singh PhogatNo ratings yet

- Aml Policy Stockity - enDocument8 pagesAml Policy Stockity - enjavarobusta321No ratings yet

- KYC AMLCFT RegulationsDocument113 pagesKYC AMLCFT RegulationsRaheela AkramNo ratings yet

- KYC Part1Document31 pagesKYC Part1socialmedia.manager.incNo ratings yet

- Kyc-Policy1 0Document21 pagesKyc-Policy1 0UtiyyalaNo ratings yet

- M2 Account OpeningDocument58 pagesM2 Account OpeningGouri K MakatiNo ratings yet

- IIFL Account Opening Form Non-IndividualDocument36 pagesIIFL Account Opening Form Non-IndividualidkwhiiNo ratings yet

- Receipt Lo1Document11 pagesReceipt Lo1Nigus AyeleNo ratings yet

- Questionnaire For Anti-Money Laundering, Combating The Financing of Terrorism and Knowing Your CustomerDocument4 pagesQuestionnaire For Anti-Money Laundering, Combating The Financing of Terrorism and Knowing Your CustomerJared PobleteNo ratings yet

- Know Your Custimer PolicyDocument15 pagesKnow Your Custimer PolicyPrathmesh GharatNo ratings yet

- AML FinalDocument2 pagesAML FinalKarthik DhandayuthamNo ratings yet

- NSDL E-Sign: Part A - VERSION 21.2Document31 pagesNSDL E-Sign: Part A - VERSION 21.2Dj Spark IndiaNo ratings yet

- NSDL E-Sign: Part A - VERSION 21.5Document32 pagesNSDL E-Sign: Part A - VERSION 21.5prakash kumar singhNo ratings yet

- Zerodha FormDocument35 pagesZerodha FormNeal CaffereyNo ratings yet

- KYC AmlDocument44 pagesKYC Amlakshay2orionNo ratings yet

- UPDATED 12.10.23 REF 467/2023 Ravi Kumar Notes: Kyc/Aml/CftDocument47 pagesUPDATED 12.10.23 REF 467/2023 Ravi Kumar Notes: Kyc/Aml/CftharisrajpothiNo ratings yet

- Kyc Exam TipsDocument9 pagesKyc Exam TipsVijaya ShanthiNo ratings yet

- ZerodhaDocument20 pagesZerodhaThava Selvan100% (2)

- DPMS AML TrainingDocument66 pagesDPMS AML TrainingEmilioNo ratings yet

- FS Form 1071 (Statement of Ownership)Document2 pagesFS Form 1071 (Statement of Ownership)Benne James100% (3)

- Client Due Diligence Factsheet 0621Document4 pagesClient Due Diligence Factsheet 0621Robinson JeybarajNo ratings yet

- Motions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsFrom EverandMotions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsRating: 4.5 out of 5 stars4.5/5 (12)

- Dcom203 DMGT204 Quantitative Techniques I PDFDocument320 pagesDcom203 DMGT204 Quantitative Techniques I PDFritesh MishraNo ratings yet

- RULE 130 (Testimonial Part 4)Document14 pagesRULE 130 (Testimonial Part 4)Joseph Rinoza PlazoNo ratings yet

- CMA June 2018 ExamDocument2 pagesCMA June 2018 ExamMuhammad Ziaul HaqueNo ratings yet

- Packaging Material Manufacturer Vendor Qualification Questionnaire1Document17 pagesPackaging Material Manufacturer Vendor Qualification Questionnaire1Blank Serm100% (1)

- BDI Org Chart For Oct 2019 WebDocument5 pagesBDI Org Chart For Oct 2019 WebbowiejkNo ratings yet

- Hafiz Muhammad Arfan ACCA/UAECA Financial Analyst ResumeDocument3 pagesHafiz Muhammad Arfan ACCA/UAECA Financial Analyst ResumeNasir AhmedNo ratings yet

- Fleet Strategy ProposalDocument15 pagesFleet Strategy ProposalBheki MhlongoNo ratings yet

- Sea Gull AirframesDocument10 pagesSea Gull AirframesRigoreBiasNo ratings yet

- Employee Background Verification SystemDocument5 pagesEmployee Background Verification SystemPayal ChauhanNo ratings yet

- SCM Chapter 6Document8 pagesSCM Chapter 6anneliban499No ratings yet

- DepEd Focal Point SystemDocument2 pagesDepEd Focal Point SystemJudy Panguito AralarNo ratings yet

- Print - Udyam Registration CertificateDocument2 pagesPrint - Udyam Registration CertificateRaki GowdaNo ratings yet

- Chap 016Document44 pagesChap 016Megan HoNo ratings yet

- Part II QuizDocument2 pagesPart II QuizReymark GalasinaoNo ratings yet

- Ingles en GrupoDocument8 pagesIngles en GrupoDiana RiañoNo ratings yet

- Certified Accounting Professional: Become A Zoho BooksDocument8 pagesCertified Accounting Professional: Become A Zoho BooksanthikadNo ratings yet

- Environmental AuditDocument26 pagesEnvironmental AuditVivek Yadav100% (6)

- Tugas ManajemenDocument226 pagesTugas ManajemenFatwaNo ratings yet

- CY2014 Report On Salaries and AllowancesDocument1,124 pagesCY2014 Report On Salaries and AllowancesIlisa ParilNo ratings yet

- What Is Strategic Business Analysis?: Vision, Mission, and ValuesDocument6 pagesWhat Is Strategic Business Analysis?: Vision, Mission, and ValuesJoseph VillartaNo ratings yet

- Three Main Reasons For PlanningDocument28 pagesThree Main Reasons For PlanningXhaNo ratings yet

- Health and SafetyDocument15 pagesHealth and Safetygroup2sd1314No ratings yet

- 20 CIR vs. Raul GonzalezDocument8 pages20 CIR vs. Raul GonzalezKarla Marie TumulakNo ratings yet

- Implementing Rules for 13th NCR Cup Quiz CompetitionDocument11 pagesImplementing Rules for 13th NCR Cup Quiz CompetitionAries BautistaNo ratings yet

- Management E3 E4 QB IIDocument18 pagesManagement E3 E4 QB IIsks.in109No ratings yet

- All Girls Are Devil But My Wife Is ": A Line Written On A Husband's T ShirtDocument10 pagesAll Girls Are Devil But My Wife Is ": A Line Written On A Husband's T Shirtbhatiasanjay89No ratings yet

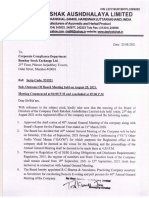

- Ted Umnty, Lain: Desh Rakshak Aushdhalaya LimitedDocument5 pagesTed Umnty, Lain: Desh Rakshak Aushdhalaya Limitednaresh kayadNo ratings yet

- Panel Data ModelsDocument112 pagesPanel Data ModelsAlemuNo ratings yet

- Audit of Insurance CompaniesDocument6 pagesAudit of Insurance CompaniesKrishna Jha100% (1)

- List-Of Quality StandardsDocument4 pagesList-Of Quality StandardsSankesh JathanNo ratings yet