Professional Documents

Culture Documents

Corporate Finance Crasher 1

Uploaded by

Arpita PatraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Finance Crasher 1

Uploaded by

Arpita PatraCopyright:

Available Formats

Corporate Finance Crasher

Finance and Investments Club

Financial Statements and Ratios

Financial Analysis E.I.C. Framework

Economic Analysis

Industry Analysis

Company Analysis

Financial Performance Analysis

Trend, Common Size, Financial Ratios, Composite Scores

Operating Performance

Financial Performance per unit of operating measure

Non Financial Measures

Requires primary data, typically not available in financial

reports

Sometimes data are available in industry publication

May 1, 2012 3

Trend Analysis

Base year is 100,

remaining years

numbers are % of the

base year number,

therefore represent

cumulative rate of

growth / decline

relative to the base year

Useful for

Studying growth,

Studying directional changes

Identifying improvement and

deterioration in financial

performance

Trend Analysis 20x1 % 20x0 %

Sales 10,000 125 8,000 100

Less COGS (5,500) 110 (5,000) 100

Gross Profit 4,500 150 3,000 100

Less Operating Exp (2,100) 105 (2,000) 100

Operating Income 2,400 240 1,000 100

Less Interest Exps (400) 100 (400) 100

Less Income Taxes (900) 225 (400) 100

Profit After Taxes 1,100 550 200 100

Fixed Assets 5,600 112 5,000 100

Current Assets 2,400 96 2,500 100

Total Assets 8,000 107 7,500 100

Current Liabilities 1,600 80 2,000 100

Long Term Debt 2,400 120 2,000 100

Equity 4,000 114 3,500 100

May 1, 2012 4

Common Size Statements

B/S # are % of TA

I/S # are % of Sales

Useful for

Comparing performance

across years and firms

Identifying Strength and

Weakness of a firm by

comparing its performance

with those of its industry

peers

Identifying Improvement and

Deterioration in its financial

performance, by comparing

its performance across years

May 1, 2012 5

Common Size 20x1 % 20x0 %

Sales 10,000 100% 8,000 100%

Less COGS (5,500) (55%) (5,000) (63%)

Gross Profit 4,500 45% 3,000 38%

Less Operating Exp (2,100) (21%) (2,000) (25%)

Operating Income 2,400 24% 1,000 13%

Less Interest Exps (400) (4%) (400) (5%)

Less Income Taxes (900) (9%) (400) (5%)

Profit After Taxes 1,100 11% 200 3%

Fixed Assets 5,600 70% 5,000 67%

Current Assets 2,400 30% 2,500 33%

Total Assets 8,000 100% 7,500 100%

Current Liabilities 1,600 20% 2,000 27%

Long Term Debt 2,400 30% 2000 27%

Equity 4,000 50% 3,500 47%

Financial Ratio Analysis

Financial ratio represents a relative measure where both the

numerator and the denominator are financial numbers

Designed to illuminate some aspect of how the business is

doing and identify its Strengths and Weaknesses

Depending upon the source of the numbers, 3 groups of ratio

Balance Sheet Ratio

Where both the variables are taken from the B/S

Use Ending Values of the B/S numbers in B/S Ratios

Profit and Loss Ratio

Where both the variables are taken from P&L

Mixed Ratio

Where one variable is taken from B/S and the other from P&L

Use average Values of the B/S numbers in Mixed Ratios

May 1, 2012 6

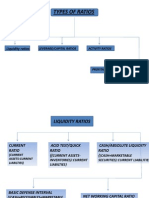

Ratio Analysis: Types of Ratios

Financial Ratios

Profitability Ratio

Activity or Efficiency Ratio

Liquidity Ratios

Leverage Ratios

Multiples or Market Ratios

May 1, 2012 7

Profitability Ratios 1

Gross Profit (GP) Ratio

Operating Profit (OP) Ratio

Net Profit (NP) Ratio

COGS Ratio = COGS / Sales

COS Ratio = 1 OP Ratio

ETR = Income Tax Exps /

EBT

May 1, 2012 8

Sales

Profit Operating

=

Sales

Profit Gross

=

Sales

Profit Net

=

Profitability Ratios 20x1 20x0

Sales 10,000 8,000

Less COGS -5,500 -5,000

Gross Profit 4,500 3,000

Less Operating Exp -2,100 -2,000

Operating Profit 2,400 1,000

Less Interest Exps -400 -400

PBT 2,000 600

Less Income Taxes -900 -400

PAT 1,100 200

GP Ratio 45% 38%

OP Ratio 24% 13%

NP Ratio 11% 3%

COGS Ratio 55% 62%

COS Ratio 76% 87%

Effective Tax Rate 45% 67%

Return on Assets (ROA)

Return on Capital

Employed or Investment

(ROCE or ROI)

Return on Equity

EPS = Earnings Per Share

DPS = Dividends Per Share

Pay Out Ratio = DPSEPS

NOPAT = EBIT * (1-ETR) = PAT + Interest

Exp * (1-ETR)

Profitability Ratios 2

May 1, 2012 9

.) . ( Exp Misc TA Average

NOPAT

=

) (Equity Average

Profit Net

=

) (CE Average

NOPAT

=

Profitability

Ratios 2

20x1 20x0 Avg.

Operating Profit 2,400 1,000

Less Interest Exp (400) (400)

PAT 1,100 200

Total Assets 8,000 7,500 7,750

Long Term Debt 2,400 2000 2,200

Equity 4,000 3,500 3,750

Effective Tax Rate 45% 67%

NOPAT 1,320 333

Average CE

5,950

ROA

17%

ROI

22%

ROE

29%

Activity or Efficiency Ratios 1

Total Asset Turnover

Fixed Asset Turnover

Working Capital Turnover

Current Asset Turnover

Capital Employed

Turnover

May 1, 2012 10

) ( CapWIP NB Average

Sales

+

=

.) . ( Exp Misc TA Average

Sales

=

) (CA Average

Sales

=

) ( CL CA Average

Sales

=

) (CE Average

Sales

=

Activity Ratios 20x1 20x0 Avg

Sales 10,000 8,000

Fixed Assets 5,600 5,000

5,300

Current Assets 2,400 2,500 2,450

Total Assets 8,000 7,500

7,750

Current Liabilities 1,600 2,000

1,800

Long Term Debt 2,400 2000

2,200

Equity 4,000 3,500 3,750

TA Turnover

1.29

FA Turnover

1.89

WC Turnover

15.38

CA Turnover

4.08

CE Turnover

1.68

Activity or Efficiency Ratios 2

Inventory Days

Receivables Days

Payables Days

Operating Cycle Days

Inventory Days

+Receivables Days

Payables Days

Turnover Ratio = 360/Days Ratio

May 1, 2012 11

360

) (

COGS

Inventory Average

=

360

) / / (

Sales Credit

R B R A Average

+

=

360

) / / (

Purchases Credit

P B P A Average

+

=

Activity Ratios 20x1 20x0 Avg

Sales 10,000 8,000

Less COGS (5,500) (5,000)

Inventory 800 700 750

A/R 400 600 500

B/R 300 400 450

A/P 900 700 800

B/P 200 200 200

Purchases 5,600

Days Turnover Ratio

Inventory Days

49.1 7.3

Receivables Days

30.6 11.8

Payables Days

64.3 5.6

Operating Cycle

13.5 26.7

Liquidity Ratios

Current Ratio

Quick Ratio

Interest Expense CFO

Current Liability CFO

Total Liability CFO

May 1, 2012 12

CL

CA

=

CL

Inventory CA

=

Liquidity Ratios 20x1 20x0

Less Interest Exps (400) (400)

Inventory 800 700

Current Assets 2,400 2,500

Current Liabilities 1,600 2,000

Long Term Debt 2,400 2,000

Total Liability 4,000 4,000

Quick CA 1,600 1,800

Current Ratio 1.50 1.25

Quick Ratio 1.00 0.90

Leverage Ratios 1

Debt Equity Ratio

Total Debt = Long Term Debt +

Current Portion of LT Debt

included in Current Liabilities +

Short Term Debt.

Weight of Debt in CE

Weight of Equity in CE

= 1 Weight of Debt

Interest Coverage Ratio

May 1, 2012 13

Equity

Debt Total

=

Interest

Interest PAT +

=

Ratio DE

Equity Debt

Debt

+

=

+

=

1

1

1

Leverage Ratios 20x1 20x0

Less Interest Exps (400) (400)

Less Income Taxes (900) (400)

Profit After Taxes 1,100 200

Equity 4,000 3,500

Long Term Debt 2,400 2,000

LTD: Current Portion 300 500

Short Term Debt 200 400

Total Debt 2,900 2,900

Debt Equity Ratio 0.73 0.83

Weight of Debt

0.42 0.45

Weight of Equity

0.58 0.55

Interest Coverage

3.75 1.50

Leverage Ratios 2

Debt Service Coverage

Ratio (DSCR)

Debt Related Payments = Interest

on Borrowings+ Current

Portion of LT Debt + Short

Term Debt.

Financial Service

Coverage Ratio (FSCR)

Financial Payments = Interest

on Borrowings + Current

Portion of LT Debt + Short

Term Debt + Lease Rental

Payments.

May 1, 2012 14

Payment Related Debt

CFO

=

Payments Financial

CFO

=

Leverage Ratios 20x1 20x0

CFO 3,000 2,400

Interest Exps 400 400

LTD: Current Portion 300 500

Short Term Debt 200 400

Lease Liability:

Current Portion

- 200

Debt Related

Payment

900 1,300

Financial Payment

900 1,500

DSCR

3.33 1.85

FSCR

3.33 1.60

Market Ratios and

Multiples

Market to Book Ratio

Price (Equity Total Shares

#)

Dividend Yield

DPS Price

Earnings Yield

EPS Price = 1 PE Ratio

Price Multiples

P-E Ratio = Price EPS

P-Sales, P-CFO Multiples = P

Sales or CFO per share

Total Return to

Shareholders

= (Equity Cash Dividend + (End of the

current year Share Price End of the last

year Share Price)) End of the last years

Share Price

May 1, 2012 15

Market Ratios 20x1 20x0

Profit After Taxes 1,100 200

Equity 4,000 3,500

# of Shares 1,000 1,000

Share Price 30 22

Capital Gains 8

Dividend 600 -

DPS 0.60 -

EPS 1.10 0.20

BV of Equity per share

4.00 3.50

MTB

7.5 6.3

Dividend Yield

2.0%

-

Earnings Yield

3.7% 0.9%

P-E Ratio

27.3 110.0

P-S Ratio

3.00 2.75

P-CFO Ratio

10.0 9.2

TRS

39% -

Drivers of ROE

ROE = Net Profit Margin

x Capital Employed Turnover

x Financial Leverage Multiplier

= ROI x Financial Leverage Multiplier

Financial Leverage Multiplier = 1 + [Avg(Debt) / Avg(Equity)]

May 1, 2012 16

) (Equity Average

Income Net

ROE=

uity) Average(Eq

CE Average

CE Average

Sales

Sales

Income Net ) (

) (

=

Overall

Profitability

11%

Overall

Efficiency

= 1.68

Overall

Leverage

= 1.59

Drivers of ROE

Net

Profit

Margin

COGS%

Operating Exp%

Interest Exp%

Other Income%

Income Tax%

Capital

Employed

Turnover

FA Turnover

WC Turnover

CA Turnover

Inv Turnover

A/R Turnover

CL Turnover

A/P Turn

Financial

Leverage

Multiplier

Debt Equity Ratio

Weight of Debt

Weight of Equity

May 1, 2012 17

B/S, I/S & Other numbers used

B/S 20x1 20x0

Fixed Assets 5,600 5,000

Current Assets 2,400 2,500

Inventory 800 700

A/R 400 600

B/R 300 400

Other CA 500 500

Cash 400 300

Total Assets 8,000 7,500

Current Liabilities 1,600 2,000

A/P 900 700

B/P 200 200

LT Debt: Current 300 500

Short Term Debt 200 400

Lease Liab: Current 0 200

Long Term Debt 2,400 2,000

Equity 4,000 3,500

Total Liab & Eq. 8,000 7,500

May 1, 2012 18

I/S 20x1 20x0

Sales 10,000 8,000

Less COGS (5,500) (5,000)

Gross Profit 4,500 3,000

Less Operating Exp (2,100) (2,000)

Operating Income 2,400 1,000

Less Interest Exps (400) (400)

Less Income Taxes (900) (400)

Profit After Taxes 1,100 200

Other Info. 20x1 20x0

CFO

3,000 2,400

# of Shares 1,000 1,000

Share Price $30.00 $22.00

Financial Management

Financial Management

Financial Management involves three decisions:

Investment Decisions

Financing Decisions

Dividend Decisions

Whether a financial decision involves investing

and/or financing, it also will be concerned with two

specific factors: expected return and risk.

Expected return is the difference between potential

benefits and potential costs. Risk is the degree of

uncertainty associated with these expected returns.

The Agency Relationship

An agent is a person who acts forand exerts

powers ofanother person or group of

persons.

The person (or group of persons) the agent

represents is referred to as the principal.

The relationship between the agent and his or

her principal is an agency relationship.

There is an agency relationship between the

managers and the shareholders of

corporations.

Costs of Agency Relationship

There are costs involved with any effort

to minimize the potential for conflict

between the principals interest and the

agents interest.

These are:

Monitoring Costs

Bonding Costs

Residual Costs

How to reduce Agency Costs?

Motivating Managers: Executive

Compensation-

Salary

Bonus

ESOP

Stock Appreciation Rights

Sweat Equity

EVA-linked Bonus

Financial Markets: Debt Market

Bonds, notes, and medium-term notes are

issued by corporations, the government,

government agencies, and municipal bodies.

Corporate debt securities backed by specific

assets as collateral are referred to as secured

notes or secured bonds.

If they are not backed by specific assets, they

are referred to as debentures.

In India, bonds and debentures have different

connotations.

Corporate Bond Market

The corporate bond market involves all bonds

that have credit risk, i.e., bonds issued by all

entities other than the Central Government

This includes not just the bonds issued by

private Indian firms but, more significantly,

bonds issued by sub-national agencies such as

state governments (SG) and municipalities, as

well as the Public Sector Units

Compared to the stock of central government

bonds, issues of bonds by the state

government are significantly smaller

Corporate Bond Market

Corporate debt issued by firms is either in the

form of short-term instruments called

commercial paper (CP) or corporate

debentures/bonds (CB)

Debt Market

The Wholesale Debt Market (WDM) deals in fixed

income securities

Trades in a variety of debt instruments including

Government Securities, Treasury Bills and Bonds

issued by Public Sector Undertakings/ Corporates/

Banks like Floating Rate Bonds, Zero Coupon Bonds,

Commercial Papers, Certificate of Deposits,

Corporate Debentures, State Government loans, SLR

and Non-SLR Bonds issued by Financial Institutions,

Units of Mutual Funds and Securitized debt by banks,

financial institutions, corporate bodies, trusts and

others

The Retail Debt Market (RDM) trades in central

government long-term securities for retail investors

Equity Market

Primary Market

Secondary Market

OTC Market: are arrangements in

which investors or their

representatives trade securities

without sharing a physical location.

Stocks traded on the OTC markets

are called unlisted

Some Concepts

Firm Value:

present value of the firms cash flows.

Tricky part is determining the size, timing, and risk

of those cash flows.

Time Value of Money

Compounding/Discounting

Compounding Conversion

Annual/Semi-annual/Quarterly/Continuous

Present Value Concept

Perpetuity

Perpetuity

Cash flows expected to continue forever

Growing Perpetuity

Cash flows growing at a constant rate and

continuing forever

Can g be more than r forever? Can it be more than

r for a few years?

PV=CF/i

g r

C

PV

=

Annuity

Series of cash flows of equal amount occurring

at regular even interval

With constant cash flows

Future Value

Present Value

Growing Annuity

Growing stream of cash flows with fixed maturity

(

(

|

|

.

|

\

|

+

+

=

T

r

g

g r

C

PV

) 1 (

1

1

What is the present value of a four-year annuity of $100

per year that makes its first payment two years from today if the

discount rate is 9%?

22 . 297 $

09 . 1

97 . 327 $

0

= = PV

0 1 2 3 4 5

$100 $100 $100 $100 $323.97 $297.22

97 . 323 $

) 09 . 1 (

100 $

) 09 . 1 (

100 $

) 09 . 1 (

100 $

) 09 . 1 (

100 $

) 09 . 1 (

100 $

4 3 2 1

4

1

1

= + + + = =

= t

t

PV

Day count convention

Day count convention refers to the

method used for arriving at the holding

period (number of days) of a bond to

calculate the accrued interest.

the conventions followed in Indian

market are given below:

Bond market: The day count convention followed

is 30/360

Money market: The day count convention

followed is actual/ 365

Yield of a treasury bill

Yield = [(100-P)/P] X 365/D X 100

Assuming that the price of a 91 day Treasury

bill at issue is Rs.98.20. Whats the yield?

After say, 41 days, if the same Treasury bill is

trading at a price of Rs. 99, whats the yield?

Bond Mathematics

Classifying Bonds:

Issuer:

Govt.

Corporate

Municipality

Maturity;

Short

Medium

Long

Coupon Rate:

Fixed

Floating

Zero coupon

Redemption Features:

Callable

Putable

Convertible

Bond Yield

Current yield

Yield-to-maturity (YTM)

Yield-to-call (YTC) and yield-to-put (YTP)

Bond Equivalent Yield

Annual Percentage Rate (APR)

Effective Annual Rate (EAR)

Yield Measures

Current Yield = (Annual Rupee Amount of

interest / Price)

Yield to Maturity (YTM) = It is the interest rate

which equals the Present Value of Cash flows

with Price. YTM computed on the basis of

market conventions ( frequency and basis) is

called bond equivalent yield

Yield to Call: The issuer of the bond may

exercise call option, if the market interest

rates are falling below the coupon rate. The

Price at which the bond may be called is

referred as Call Price. YTM computed on the

basis of Call Price instead of Redemption

price is Yield to Call.

Bond Yield

Yield to Put: In a bond issue if an investor is

having a Put Option and YTM computed by

taking Put Price is Yield to Put.

Taxable Equivalent Yield

= Nominal Tax-free Yield / (1- Marginal Tax-

Rate)

Bond Yield

Yield for a Portfolio: It is the interest rate that

equates the present value of cash flows of the

portfolio with market value of portfolio.

Annual Percentage Rate

Certain annualized yields are quoted so often

that they are given special names.

For example, when a 6-month yield is quoted

on an annualized basis, the quote is referred

to as bond equivalent yield.

When a one-month yield is quoted on an

annualized basis (by multiplying one month

rate by 12), it is referred to as Annual

Percentage Rate.

Accrued Interest

When an investor purchases a bond between

coupon payments, the investor must

compensate the seller of the bond for the

coupon earned from time of the last coupon

payment to settlement date of the bond. This

amount is called accrued interest. In

computation of accrued interest days count is

very much important

Accrued Interest

The accrued interest is calculated according to

the formula

AI = (rate X days/360) X FV

where rate = coupon rate on the GOI security

FV= face value being purchased.

days = number of days between the last

coupon payment date and the settlement

date calculated as per the 30/360

convention.

Clean and dirty price

The amount that the buyer pays the seller is

the agreed upon price plus accrued interest.

This is often referred to as the full price or

dirty price.

The price of the bond without accrued

interest is called the clean price

Risks of Fixed Income Securities

Credit Risk: Government Securities and

Treasury Bills do not have any Credit Risk. But

other bonds carry this

Price Risk

Reinvestment Risk: All coupon payment

securities have re-investment risk

Bond Pricing

A bond is typically issued at par value of the principal

amount.

However, in the secondary market, the price of a

bond can fluctuate greatly from its par value.

The price of a bond is determined by:

Expected periodic cash flows

The discount rate used for each cash flow.

Value of debt security = Present value of future

interest payments + Present value of maturity value.

Bond Pricing

The present value of a debt security, V, is:

A simple example

A fixed-rate bond, currently priced at 102.9,

has one year remaining to maturity and is

paying 8% coupon. Assuming the coupon is

paid semiannually, what is the yield of the

bond?

Valuing a Straight Coupon Bond

What will be the value of the bond, if the interest is paid

semi-annually?

Bond: Price Yield Relationship

A fundamental property of a bond is that its

price changes in the opposite direction of the

change in the interest rates.

Compute the price of a bond with a par value

of Rs.1000 to be paid in ten years, a coupon

rate of 10%, and a required yield of 3%, 5%,

15% and 25%. Coupon payments are made

annually.

Bond: Price-Yield Relationship

If the coupon rate is more than the yield,

the security is worth more than its maturity

valueit sells at a premium.

If the coupon rate is less than the yield, the

security is less than its maturity valueit sells

at a discount.

If the coupon rate is equal to the yield, the

security is valued at its maturity value.

Term Structure

The term structure describes the relationship

of spot rates with different maturities.

One needs zero rates to construct the term

structure.

Zero Rates

A zero rate (or spot rate), for maturity T is the

rate of interest earned on an investment that

provides a payoff only at time T

Example

Maturity

(years)

Zero Rate

(% cont comp)

0.5 5.0

1.0 5.8

1.5 6.4

2.0 6.8

Bond Pricing

To calculate the cash price of a bond we discount

each cash flow at the appropriate zero rate

The theoretical price of a two-year bond providing a

6% coupon (face value 100) semiannually is

3 3 3

103 9839

0 05 0 5 0 058 1 0 0 064 1 5

0 068 2 0

e e e

e

+ +

+ =

. . . . . .

. .

.

Bond Yield

The bond yield is the discount rate that makes the

present value of the cash flows on the bond equal

to the market price of the bond

Suppose that the market price of the bond in our

example equals its theoretical price of 98.39

The bond yield (continuously compounded) is

given by solving

to get y=0.0676 or 6.76%.

3 3 3 103 9839

0 5 1 0 15 2 0

e e e e

y y y y

+ + + =

. . . .

.

Par Yield

The par yield for a certain maturity is the

coupon rate that causes the bond price to equal

its face value.

In our example we solve

g) compoundin s.a. (with get to 87 6

100

2

100

2 2 2

0 . 2 068 . 0

5 . 1 064 . 0 0 . 1 058 . 0 5 . 0 05 . 0

. c=

e

c

e

c

e

c

e

c

=

|

.

|

\

|

+ +

+ +

Common (Equity) Stocks

Because common stock never matures, todays value

is the present value of an infinite stream of cash

flows (i.e., dividend).

But dividends are not fixed.

Not knowing the amount of the dividendsor even

if there will be future dividends makes it difficult to

determine the value of common stock.

So what are we to do?

Basic Valuation Models

Dividend Valuation Model (DVM):

Constant dividend: Let D be the constant DPS:

The required rate of return (r

e

) is the return shareholders

demand to compensate them for the time value of money tied up in

their investment and the uncertainty of the future cash flows from

these investments.

Valuation Models

Dividend growth at a constant rate (g): (also

known as Gordon Model)

OR

OR

Dividend and Earnings Growth

Growth in dividends occurs primarily as a result of

growth in EPS.

Growth in earnings, in turn, results from a number of

factors, including (1) inflation, (2) retention ratio; and

(3) ROE.

Shareholders care about all dividends, both current

and those in the future.

If most of a stocks value is due to long-term cash

flows, why do managers and analysts pay so much

attention to quarterly earnings?

Valuation Models

Varying Dividend Growth Rate:

For many companies, it is unreasonable to assume

that it grows at a constant rate.

P

0

= Present value of dividends based on short-run

non-constant rate + Present value of dividends

using constant growth rate.

Differential Growth

Assume that dividends will grow at different

rates in the foreseeable future and then will

grow at a constant rate thereafter.

To value a Differential Growth Stock, we need

to:

Estimate future dividends in the foreseeable

future.

Estimate the future stock price when the stock

becomes a Constant Growth Stock .

Compute the total present value of the estimated

future dividends and future stock price at the

appropriate discount rate.

Differential Growth

) (1 Div Div

1 0 1

g + =

- Assume that dividends will grow at rate g

1

for N

years and grow at rate g

2

thereafter.

2

1 0 1 1 2

) (1 Div ) (1 Div Div g g + = + =

N

N N

g g ) (1 Div ) (1 Div Div

1 0 1 1

+ = + =

) (1 ) (1 Div ) (1 Div Div

2 1 0 2 1

g g g

N

N N

+ + = + =

+

.

.

.

.

.

.

Differential Growth

) (1 Div

1 0

g +

Dividends will grow at rate g

1

for N years and grow

at rate g

2

thereafter

2

1 0

) (1 Div g +

N

g ) (1 Div

1 0

+

) (1 ) (1 Div

) (1 Div

2 1 0

2

g g

g

N

N

+ + =

+

0 1 2

N N+1

Differential Growth

We can value this as the sum of:

an N-year annuity growing at rate g

1

(

+

+

=

T

T

A

R

g

g R

C

P

) 1 (

) 1 (

1

1

1

plus the discounted value of a perpetuity growing at

rate g

2

that starts in year N+1

N

B

R

g R

P

) 1 (

Div

2

1 N

+

|

|

.

|

\

|

=

+

Differential Growth

Consolidating gives:

N T

T

R

g R

R

g

g R

C

P

) 1 (

Div

) 1 (

) 1 (

1

2

1 N

1

1

+

|

|

.

|

\

|

+

(

+

+

=

+

Or, we can cash flow it out.

A Differential Growth Example

A common stock just paid a dividend of $2. The

dividend is expected to grow at 8% for 3 years,

then it will grow at 4% in perpetuity.

What is the stock worth? The discount rate is 12%.

Estimates of Parameters

The value of a firm depends upon its growth

rate, g, and its discount rate, R.

Where does g come from?

g = Retention ratio Return on retained earnings

Where does R come from?

The discount rate can be broken into two

parts.

The dividend yield

The growth rate (in dividends)

In practice, there is a great deal of estimation

error involved in estimating R.

Concept of Risk and Return

The Concept of Risk

Whenever you make a financing or investment

decision, there is some uncertainty about the

outcome.

Though the terms risk and uncertainty are often

used to mean the same thing, there is a distinction

between them.

Uncertainty is not knowing what is going to happen.

Risk is the degree of uncertainty.

Thus, greater the uncertainty, the greater the risk.

Types of Risks

Cash flow risk

Business risk

Sales risk

Operating risk

Financial risk

Default risk

Reinvestment risk

Prepayment risk

Call risk

Interest rate risk

Purchasing power risk

Currency risk

Portfolio risk

Diversifiable risk

Nondiversifiable risk

Cash Flow Risk

Cash flow risk is the risk that the cash flows of

an investment will not materialize as

expected.

Business risk is the risk associated with

operating cash flows.

The greater the fixed operating costs relative

to variable operating costs, the greater the

operating risk.

Cash Flow Risk

Financial risk is the risk associated with how a

company finances its operations.

The more fixed-cost obligations (i.e., debt) incurred

by the firm, the greater its financial risk.

The cash flow risk of a debt security is default risk or

credit risk.

Default risk is affected by both business riskwhich

includes sales risk and operating riskand financial

risk.

Reinvestment Risk

Consider two 5-year bonds-Bond X (bearing

10% coupon, payable annually) and Bond Y(

Zero-coupon with 10% yield). Suppose,

intermittent coupons can be reinvested 9%,

8%, 7%, 6% and 5% respectively.

Which bond has higher reinvestment risk and

why?

Reinvestment Risk

If we compare two bonds with the same yield-

to-maturity and the same time to maturity,

the bond with the greater coupon rate has

more reinvestment rate risk.

Two types of risk closely related to

reinvestment risk of debt securities are

prepayment risk and call risk.

There is reinvestment risk for assets other

than stocks and bonds, as well.

Interest Rate Risk

Interest rate risk is the sensitivity of the change in an

assets value to changes in market interest rates.

Lets compare the change in the value of the

Company X bond to the change in the value of the

Company Y bond as the market interest rate changes.

Suppose that it is now January 1, Year 2. Whats the

value of the bonds if: yields remain at 10%, yield

increases to 12%; yield decreases to 8%?

Interest Rate Risk

Company Ys bond value is more sensitive to

changes in yield.

For a given maturity, the greater the coupon

rate, the less sensitive the bonds value to a

change in the yield. Why?

For a given coupon rate, the longer the

maturity of the bond, the more sensitive the

bonds value to changes in market interest

rates.

Purchasing Power Risk

Purchasing power risk is the risk that the price

level may increase unexpectedly.

Purchasing power risk is the risk that future

cash flows may be worth less or more in the

future because of inflation or deflation,

respectively, and that the return on the

investment will not compensate for the

unanticipated inflation.

Purchasing Power Risk

Consider the 11.0% and 9.1% inflation rates for the years

Year 1and Year 2, respectively. If you borrowed Rs.1,000

at the beginning of Year 1 and paid it back two years

later. But how much is a Year 2 rupee worth relative to

beginning-of-Year 1 rupees?

Financial managers need to assess purchasing power risk

in terms of both their investment decisionsmaking sure

to figure in the risk from a change in purchasing power of

cash flowsand their financing decisions

understanding how purchasing power risk affects the

costs of financing.

Currency Risk

Currency risk is the risk that the relative values of the

domestic and foreign currencies will change in the

future, changing the value of the future cash flows.

As financial managers, we need to consider currency

risk in our investment decisions that involve other

currencies and make sure that the returns on these

investments are sufficient compensation for the risk

of changing values of currencies.

Holding Period Returns

The holding period return is the return

that an investor would get when holding

an investment over a period of n years,

when the return during year i is given as

r

i

:

1 ) 1 ( ) 1 ( ) 1 (

return period holding

2 1

+ + + =

=

n

r r r

Holding Period Return: Example

Suppose your investment provides the following

returns over a four-year period:

Year Return

1 10%

2 -5%

3 20%

4 15%

% 21 . 44 4421 .

1 ) 15 . 1 ( ) 20 . 1 ( ) 95 (. ) 10 . 1 (

1 ) 1 ( ) 1 ( ) 1 ( ) 1 (

return period holding Your

4 3 2 1

= =

=

+ + + + =

=

r r r r

Risk Premium

Added return obtained from investing in securities

with greater risk

measures of risk that we discuss are variance and standard

deviation

Expected Return, Risk and Diversification

As managers, we are concerned about the

overall risk of the businesss portfolio of

assets.

The return on a portfolio (r

p

) is the weighted

average of the returns on the assets in the

portfolio, where the weights are the

proportion invested in each asset.

Portfolio Risk

Portfolio risk depends not only on stand alone risk of

each individual asset in the portfolio but also on their

co-movement.

A statistical measure of how two variablesin this

case, the returns on two different investments

move together is the covariance.

The portfolios variance depends on:

The weight of each asset in the portfolio.

The standard deviation of each asset in the portfolio.

The covariance of the assets returns.

Portfolio Variance

Let cov

1,2

represent the covariance of two

assets returns. We can write the portfolio

variance as:

It can be shown that for a large portfolio of multiple

of assets, the portfolio variance depends more on

the covariances than on the respective variances of

individual assets.

Portfolo Risk and Return Combinations

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

11.0%

12.0%

0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0%

Portfolio Risk (standard deviation)

P

o

r

t

f

o

l

i

o

R

e

t

u

r

n

% in stocks Risk Return

0% 8.2% 7.0%

5% 7.0% 7.2%

10% 5.9% 7.4%

15% 4.8% 7.6%

20% 3.7% 7.8%

25% 2.6% 8.0%

30% 1.4% 8.2%

35% 0.4% 8.4%

40% 0.9% 8.6%

45% 2.0% 8.8%

50.00% 3.08% 9.00%

55% 4.2% 9.2%

60% 5.3% 9.4%

65% 6.4% 9.6%

70% 7.6% 9.8%

75% 8.7% 10.0%

80% 9.8% 10.2%

85% 10.9% 10.4%

90% 12.1% 10.6%

95% 13.2% 10.8%

100% 14.3% 11.0%

The Efficient Set for Two Assets

We can consider other

portfolio weights besides

50% in stocks and 50% in

bonds

100%

bonds

100%

stocks

Portfolo Risk and Return Combinations

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

11.0%

12.0%

0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0%

Portfolio Risk (standard deviation)

P

o

r

t

f

o

l

i

o

R

e

t

u

r

n

% in stocks Risk Return

0% 8.2% 7.0%

5% 7.0% 7.2%

10% 5.9% 7.4%

15% 4.8% 7.6%

20% 3.7% 7.8%

25% 2.6% 8.0%

30% 1.4% 8.2%

35% 0.4% 8.4%

40% 0.9% 8.6%

45% 2.0% 8.8%

50% 3.1% 9.0%

55% 4.2% 9.2%

60% 5.3% 9.4%

65% 6.4% 9.6%

70% 7.6% 9.8%

75% 8.7% 10.0%

80% 9.8% 10.2%

85% 10.9% 10.4%

90% 12.1% 10.6%

95% 13.2% 10.8%

100% 14.3% 11.0%

The Efficient Set for Two Assets

100%

stocks

100%

bonds

Note that some portfolios are

better than others. They have

higher returns for the same level of

risk or less.

The Efficient Set for Many Securities

The section of the opportunity set above the

minimum variance portfolio is the efficient frontier.

r

e

t

u

r

n

o

P

minimum

variance

portfolio

Individual Assets

Riskless Borrowing and Lending

Now investors can allocate their money across

the T-bills and a balanced mutual fund.

100%

bonds

100%

stocks

r

f

r

e

t

u

r

n

o

Balanced

fund

Riskless Borrowing and Lending

With a risk-free asset available and the efficient frontier

identified, we choose the capital allocation line with the

steepest slope.

r

e

t

u

r

n

o

P

r

f

Diversifiable and Non-diversifiable Risks

We refer to the risk that goes away as we add assets

to a portfolio as diversifiable risk (also known as

unsystematic risk).

We refer to the risk that cannot be reduced by

adding more assets as nondiversifiable risk (also

known as systematic risk).

The idea that we can reduce the risk of a portfolio by

introducing assets whose returns are not highly

correlated with one another is the basis of modern

portfolio theory (MPT).

Diversifiable and Nondiversifiable Risks

Total Risk

Total risk = systematic risk + unsystematic risk

The standard deviation of returns is a measure

of total risk.

For well-diversified portfolios, unsystematic

risk is very small.

Consequently, the total risk for a diversified

portfolio is essentially equivalent to the

systematic risk.

The Capital Asset Pricing Model

William Sharpe took the idea that portfolio return and

risk are the only elements to consider and developed a

model that deals with how assets are priced.

This model is referred to as the capital asset pricing

model (CAPM).

All the assets in each portfolio, even on the frontier, have

some risk.

However, regardless of the level of risk one chooses, one

can get the highest expected return by a mixture of a

portfolio in the efficient frontier and a risk free asset

(lending or borrowing).

Capital Market Line

This line is referred to as the capital market line

(CML).

If the portfolios along the capital market line are the

best deals and are available to all investors, it follows

that the returns of these risky assets will be priced to

compensate investors for the risk they bear relative

to that of the market portfolio.

The CML specifies the returns an investor can expect

for a given level of risk.

CAPM

The CAPM uses this relationship between expected

return and risk to describe how assets are priced.

The CAPM specifies that the return on any asset is a

function of the return on a risk-free asset plus a risk

premium.

The return on the riskfree asset is compensation for

the time value of money.

The risk premium is the compensation for bearing

risk.

CAPM

The expected return on an individual asset is

the sum of the expected return on the risk-

free asset and the premium for bearing

market risk.

If we represent the expected return on each asset and its beta as a

point on a graph and connect all the points, the result is the security

market line (SML).

Beta and CAPM

A portfolio that combines the risk-free asset

and the market portfolio has an expected

return of 12% and a SD of 18%. The risk-free

rate is 5%, and the expected return on the

market portfolio is 14%. Assume CAPM holds.

What expected rate of return would a security

earn if it had a 0.45 correlation with the

market portfolio and a SD of 40%?

SML

Suppose you observe the following situation:

Security: Pete Corp.

Beta 1.3

E(Return) 23%

Repete Co

Beta 0.6

E(Return) 13%

Assume that securities are correctly priced. Based on CAPM

what is the expected Rm? What is the risk-free rate?

Capital Structure Theories

What is Capital Structure?

The combination of debt and equity used to

finance a firms projects is referred to as its

capital structure.

The capital structure of a firm is some mix of

debt, internally generated equity, and new

equity.

But what is the right mixture?

Why do some industries tend to have firms

with higher debt ratios than other industries?

M&M Hypothesis

M&M reasoned that if the following conditions hold, the value of the firm

is not affected by its capital structure:

Condition 1: Individuals and corporations are able to borrow and lend

at the same terms (referred to as equal access).

Condition #2: There is no tax advantage associated with debt financing

(relative to equity financing).

Condition #3: Debt and equity trade in a market where assets that are

substitutes for one another trade at the same price. This is referred to

as a perfect market.

Condition #4: There are no bankruptcy costs

Condition #5: All cash flow streams are perpetuities (i.e., no growth)

Condition #6: Corporate insiders and outsiders have the same

information (i.e., no signalling opportunities)

Condition #7: Managers always maximize shareholders wealth (i.e., no

agency cost)

Condition # 8: Firms only issue two types of claims: risk-free debt and

(risky) equity

Condition # 9: Operating cash flows are completely unaffected by

changes in capital structure

Condition # 10: All firms are assumed to be in the same risk class

(operating risk)

M&M Hypotheses

Proposition I (1958): World without tax

The market value of a firm is independent of its capital structure

and is given by capitalizing its expected return at the rate K

u

appropriate to its risk class.

Proposition II: World with only corporate tax

The market value of a levered firm is equal to market value of

the unlevered firm plus present value of tax shield on debt

Proposition III (Miller, 1977): World with both personal

and corporate tax

Personal Tax and Capital Structure

If debt income (interest) and equity income (dividends and

capital appreciation) are taxed at the same rate, the interest

tax shield is still D and increasing leverage increases the value

of the firm

If debt income is taxed at rates higher than equity income,

some of the tax advantage to debt is offset by a tax

disadvantage to debt income. Whether the tax advantage

from the deductibility of interest expenses is more than or

less than the tax disadvantage of debt income depends on:

the firms tax rate; the investors tax rate on debt income; and

the investors tax rate on equity income. But since different

investors are subject to different tax rates (for example,

pension funds are not taxed), determining this is a problem

If investors can use the tax laws effectively to reduce to zero

their tax on equity income, firms will take on debt up to the

point where the tax advantage to debt is just offset by the tax

disadvantage to debt income

Trade-off Theory of Capital Structure

A firms debt equity decision is a trade-off between

interest tax shields and the cost of financial distress.

It recognises that target debt ratios may vary from firm to

firm.

Unlike M&M theory, it avoids extreme predictions and

rationalises moderate debt ratios.

Higher profits imply more debt servicing capacity and

more taxable income to shield and so should give a

higher target debt ratio.

Capital Structure and Financial Distress

Costs of Financial Distress:

Cost of forgoing a long term profitable project

Cost of lost sales

Costs associated with suppliers.

Legal costs

Value of the firm = Value of the firm if all-

equity financed + Present value of the interest

tax shield Present value of financial distress

Pecking Order Theory

Firms prefer using internally generated capital (retained

earnings) to externally raised funds (issuing equity or debt).

Firms try to avoid sudden changes in dividends.

When internally generated funds are greater than needed for

investment opportunities, firms pay off debt or invest in

marketable securities.

When internally generated funds are less than needed for

investment opportunities, firms use existing cash balances or

sell off marketable securities.

If firms need to raise capital externally, they issue the safest

security first; for example, debt is issued before preferred

stock, which is issued before common equity.

Signaling Theory

MM assumed that investors have the same

information about a firms prospects as its

managers- this is called symmetric

information.

Agency Cost

Optimal Capital Structure

The mix of debt and equity that maximizes the

value of the firm is referred to as the optimal

capital structure.

So what good is this analysis of the tradeoff

between the value of the interest tax shields

and the costs of distress if we cannot apply it

to a specific firm?

While we cannot specify a firms optimal

capital structure, we do know the factors that

affect the optimum.

Capital Structure: Different Industries

The greater the marginal tax rate, the greater the benefit

from the interest deductibility and, hence, the more

likely a firm is to use debt in its capital structure.

The greater the business risk of a firm, the greater the

present value of financial distress and, therefore, the less

likely the firm is to use debt in its capital structure.

The greater extent that the value of the firm depends on

intangible assets, the less likely it is to use debt in its

capital structure.

Cost of Capital

Beta

You might also like

- MA Study Notes and Question BankDocument410 pagesMA Study Notes and Question BankVăn Mạnh100% (2)

- Understanding IFRS Fundamentals: International Financial Reporting StandardsFrom EverandUnderstanding IFRS Fundamentals: International Financial Reporting StandardsNo ratings yet

- Ritical Oncepts For The Xam: Ethical and Professional StandardsDocument6 pagesRitical Oncepts For The Xam: Ethical and Professional StandardsIdham Idham IdhamNo ratings yet

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsFrom EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsNo ratings yet

- Financial Reporting For Financial Institutions MUTUAL FUNDS & NBFC'sDocument77 pagesFinancial Reporting For Financial Institutions MUTUAL FUNDS & NBFC'sParvesh Aghi0% (1)

- Morningstar Guide to Mutual Funds: Five-Star Strategies for SuccessFrom EverandMorningstar Guide to Mutual Funds: Five-Star Strategies for SuccessNo ratings yet

- TOPCIMA - Improve Your Skills For This Final Test.Document6 pagesTOPCIMA - Improve Your Skills For This Final Test.jhb31048No ratings yet

- CFA - L2 - Quicksheet Sample PDFDocument1 pageCFA - L2 - Quicksheet Sample PDFMohit PrasadNo ratings yet

- ss1 SampleDocument25 pagesss1 SamplejagjitbhaimbbsNo ratings yet

- Dokumen - Tips Finquiz Cfa Level I Mock Exam 1 Solutions Am Questions Topic MinutesDocument76 pagesDokumen - Tips Finquiz Cfa Level I Mock Exam 1 Solutions Am Questions Topic MinutesНаталия МорзаNo ratings yet

- Fin119 CSG PDFDocument514 pagesFin119 CSG PDFjamesbook100% (1)

- 11-Level 1 Smart Summaries PDFDocument273 pages11-Level 1 Smart Summaries PDFBadAss Babbar100% (1)

- Acca Aaa s18 NotesDocument156 pagesAcca Aaa s18 NotesYashrajsing LuckkanaNo ratings yet

- E3Document155 pagesE3suvarnaashriNo ratings yet

- Unit 22 - Financial Statement Analysis Introduction - 2013Document13 pagesUnit 22 - Financial Statement Analysis Introduction - 2013cytishNo ratings yet

- Level I Volume 5 2019 IFT NotesDocument258 pagesLevel I Volume 5 2019 IFT NotesNoor QamarNo ratings yet

- Level III: Taxes and Private Wealth Management in A Global ContextDocument29 pagesLevel III: Taxes and Private Wealth Management in A Global ContextRayBrianCasazolaNo ratings yet

- Actuaries in General InsurancebhanuuuuuuuuuuuuuDocument35 pagesActuaries in General InsurancebhanuuuuuuuuuuuuuKirti ChotwaniNo ratings yet

- 2014 10 05T18!50!34 R54 Instroduction To Asset Backed SecuritiesDocument37 pages2014 10 05T18!50!34 R54 Instroduction To Asset Backed SecuritiesmishikaNo ratings yet

- Cfa Level III 4 Months Study PlanDocument12 pagesCfa Level III 4 Months Study Planvidit1No ratings yet

- SBL Models and Concepts IndiaDocument128 pagesSBL Models and Concepts IndiaM Basil0% (1)

- CMA Dec2012Document128 pagesCMA Dec2012mohamedayazuddin100% (1)

- FinQuiz Level1Mock2016Version1JuneAMQuestions PDFDocument39 pagesFinQuiz Level1Mock2016Version1JuneAMQuestions PDFAnimesh ChoubeyNo ratings yet

- CFA Level 2 Cheat SheetDocument24 pagesCFA Level 2 Cheat SheetdbohnentvNo ratings yet

- SFMDocument731 pagesSFMBasavaraj MtNo ratings yet

- P4 ACCA Summary + Revision Notes 2021Document139 pagesP4 ACCA Summary + Revision Notes 2021Farman ShaikhNo ratings yet

- Solutions Paper - TVMDocument4 pagesSolutions Paper - TVMsanchita mukherjeeNo ratings yet

- FinQuiz - Smart Summary, Study Session 1, Reading 2Document15 pagesFinQuiz - Smart Summary, Study Session 1, Reading 2Amanat1994No ratings yet

- CFA Level 1 Course Details, Study Material and TrainingDocument3 pagesCFA Level 1 Course Details, Study Material and TrainingSmart HandsNo ratings yet

- Subject CA1 Actuarial Risk Management Syllabus: For The 2016 ExamsDocument11 pagesSubject CA1 Actuarial Risk Management Syllabus: For The 2016 ExamszubboNo ratings yet

- Exam Focused Revision Notes May 2009: Strategic Level CimaDocument84 pagesExam Focused Revision Notes May 2009: Strategic Level Cimamk59030100% (2)

- ACCA F9 Lecture 2Document37 pagesACCA F9 Lecture 2Fathimath Azmath AliNo ratings yet

- Valuation CopenhagenDocument103 pagesValuation CopenhagensuksesNo ratings yet

- FinQuiz - Smart Summary - Study Session 10 - Reading 34Document2 pagesFinQuiz - Smart Summary - Study Session 10 - Reading 34RafaelNo ratings yet

- Level II Alt Summary SlidesDocument25 pagesLevel II Alt Summary SlidesRaabiyaal IshaqNo ratings yet

- Acca p4 Notes From EmilyDocument139 pagesAcca p4 Notes From EmilyCường Lê TựNo ratings yet

- Registered Prep Provider of CFA InstituteDocument18 pagesRegistered Prep Provider of CFA InstituteSergiu CrisanNo ratings yet

- First Intuition - MA - PM Q&A - Final PDFDocument552 pagesFirst Intuition - MA - PM Q&A - Final PDFRasul ShabanNo ratings yet

- Cfa Level 1 LOS Command WordsDocument0 pagesCfa Level 1 LOS Command WordsHummingbird11688No ratings yet

- Cima f3 Workbook Q & A 2015 PDFDocument139 pagesCima f3 Workbook Q & A 2015 PDFCharleneGentleSchoeman100% (1)

- FinQuiz - Smart Summary - Study Session 8 - Reading 28Document3 pagesFinQuiz - Smart Summary - Study Session 8 - Reading 28RafaelNo ratings yet

- FinQuiz - Smart Summary - Study Session 9 - Reading 31Document3 pagesFinQuiz - Smart Summary - Study Session 9 - Reading 31RafaelNo ratings yet

- Module II Final 04082017Document446 pagesModule II Final 04082017nizam100% (1)

- Three Basic Accounting Statements:: - Income StatementDocument14 pagesThree Basic Accounting Statements:: - Income Statementamedina8131No ratings yet

- Cfa Level2 ExamDocument74 pagesCfa Level2 ExamLynn Hollenbeck BreindelNo ratings yet

- FM Ebook - Part 2-Financial ModellingDocument36 pagesFM Ebook - Part 2-Financial ModellingtejaasNo ratings yet

- Acf8 (RN) Mar19 LR PDFDocument84 pagesAcf8 (RN) Mar19 LR PDFDiana IlievaNo ratings yet

- CMA Part I PDFDocument173 pagesCMA Part I PDFNicolai AquinoNo ratings yet

- Professional Ethics and Corporate Governance Section 1 and Seminar 2Document50 pagesProfessional Ethics and Corporate Governance Section 1 and Seminar 2Trần Đức TàiNo ratings yet

- Cfa QuantsDocument102 pagesCfa QuantsANASNo ratings yet

- FinQuiz - Smart Summary - Study Session 14 - Reading 49Document6 pagesFinQuiz - Smart Summary - Study Session 14 - Reading 49Rafael100% (1)

- FMDocument77 pagesFMYawar Khan KhiljiNo ratings yet

- Usgaap, Igaap & IfrsDocument7 pagesUsgaap, Igaap & IfrsdhangarsachinNo ratings yet

- GARP FRM Practice Exams - 2007 PDFDocument116 pagesGARP FRM Practice Exams - 2007 PDFLe Dinh Nhat ThuyenNo ratings yet

- LUMBA Placement Brochure Batch 2011-2013Document28 pagesLUMBA Placement Brochure Batch 2011-2013Rudra Pratap Singh Sengar100% (1)

- PWC Ifrs Ifrs9 New Way Hedging StrategiesDocument2 pagesPWC Ifrs Ifrs9 New Way Hedging StrategiesfabiopnoronhaNo ratings yet

- Actuarial Science Program at The University of ConnecticutDocument9 pagesActuarial Science Program at The University of ConnecticutRohit VenkatNo ratings yet

- R36 Evaluating Portfolio PerformanceDocument65 pagesR36 Evaluating Portfolio PerformanceRayBrianCasazolaNo ratings yet

- Financial Statement AnalysisDocument53 pagesFinancial Statement Analysisremon4hrNo ratings yet

- Some Case Studies To Discuss: ISA 200, ISA 210, ISA 240Document8 pagesSome Case Studies To Discuss: ISA 200, ISA 210, ISA 240jjanice96No ratings yet

- Commodity PDFDocument85 pagesCommodity PDFSuyash Kumar100% (2)

- Construction Contracts: International Accounting Standard 11Document5 pagesConstruction Contracts: International Accounting Standard 11Babu babuNo ratings yet

- Business Plan For Creative AgencyDocument27 pagesBusiness Plan For Creative AgencySajeed Alam75% (8)

- King's College London: 6Ssmn352 Financial Statement AnalysisDocument7 pagesKing's College London: 6Ssmn352 Financial Statement AnalysisnehmatNo ratings yet

- WCM QuestionsDocument5 pagesWCM QuestionsBhavin BaxiNo ratings yet

- Energy Pro USA - Executive SummaryDocument7 pagesEnergy Pro USA - Executive SummaryS. Michael Ratteree100% (2)

- 39 Ratio Analysis All Formula by MeDocument9 pages39 Ratio Analysis All Formula by Meangelohero6643No ratings yet

- Valuation of Goodwill (Akshit)Document12 pagesValuation of Goodwill (Akshit)akshit jainNo ratings yet

- HDFC Life ProGrowth Plus IllustrationDocument3 pagesHDFC Life ProGrowth Plus IllustrationSrikanth DornaluNo ratings yet

- Richard Ellson ConsultingDocument4 pagesRichard Ellson Consultingnrhuron13No ratings yet

- Go Live StrategyDocument9 pagesGo Live StrategyRaheem531985No ratings yet

- Chapter 6 Verification of Assets and Liabilities PMDocument60 pagesChapter 6 Verification of Assets and Liabilities PMKhalid Mustafa100% (1)

- Dolphin Fund PresentationDocument40 pagesDolphin Fund Presentationgpanagi1No ratings yet

- Burimi V AlbaniaDocument7 pagesBurimi V AlbaniakrishnakumariramNo ratings yet

- Business Plan Broiler Production SaburDocument17 pagesBusiness Plan Broiler Production SaburRafikul Islam100% (2)

- Economics 102 Orange Grove CaseDocument21 pagesEconomics 102 Orange Grove CaseairtonfelixNo ratings yet

- Procurement of Venture CapitalDocument8 pagesProcurement of Venture CapitalLaxman SheralNo ratings yet

- Tenaris V Venezuela PDFDocument206 pagesTenaris V Venezuela PDFKylie Kaur Manalon DadoNo ratings yet

- BAS Application Form Moldova.1-2Document2 pagesBAS Application Form Moldova.1-2Павел МанжосNo ratings yet

- National Bank of Pakistan Internship ReportDocument74 pagesNational Bank of Pakistan Internship Reportbbaahmad89No ratings yet

- House Hearing, 111TH Congress - Capital Markets Regulatory Reform: Strengthening Investor Protection, Enhancing Oversight of Private Pools of Capital, and Creating A National Insurance OfficeDocument325 pagesHouse Hearing, 111TH Congress - Capital Markets Regulatory Reform: Strengthening Investor Protection, Enhancing Oversight of Private Pools of Capital, and Creating A National Insurance OfficeScribd Government DocsNo ratings yet

- Consolidations - Changes in Ownership InterestsDocument34 pagesConsolidations - Changes in Ownership InterestsKaremAl-AradiNo ratings yet

- UN System ChartDocument1 pageUN System ChartAndrés MatallanaNo ratings yet

- Tocqueville Gold Investor Letter - Third Quarter 2012Document18 pagesTocqueville Gold Investor Letter - Third Quarter 2012Gold Silver WorldsNo ratings yet

- FABM2Document6 pagesFABM2Maedelle Anne TiradoNo ratings yet

- 2019 NVC FS and NotesDocument23 pages2019 NVC FS and NotesNVC FoundationNo ratings yet

- Importance of Volume in Stock TradingDocument24 pagesImportance of Volume in Stock TradingMuhammad Mubasher Rafique100% (2)

- Fiscal Stimulus - Pros and ConsDocument4 pagesFiscal Stimulus - Pros and ConsDillip KhuntiaNo ratings yet

- Tax PresentationDocument21 pagesTax PresentationSumeet TamrakarNo ratings yet