Professional Documents

Culture Documents

Organised Banking Sector in India

Uploaded by

Nidhi DedhiaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Organised Banking Sector in India

Uploaded by

Nidhi DedhiaCopyright:

Available Formats

Laws and regulations that outline the legal requirements to be met.

They may also be implemented by many policies, standards , directives and guidelines.

Regulatory framework is necessary for the preparation of financial statements. Financial statements are used by investors, lenders and customers and must be helpful for those stakeholders for making decisions. Statements should be comparable and provide basic information.

Reserve Bank of India Banking Regulation Act 1949 Cash Reserve Ratio Statutory Liquidity Ratio Bank Rate Prime Lending Rate Repo Rate

Originally constituted as a shareholders bank in India. Under Reserve Bank of India Act 1934 to regulate issue of bank notes and keeping of reserves. The bank was nationalised on 1st January,1949

The Law relating to banking is outcome of the gradual process of evolution . Banking Companies Act was passed in 1949 and it has changed to Banking Regulation Act 1949. Section 8: banking company emerging directly or indirectly. Section 11: provisions to ensure adequacy of minimum paid

Section 22: comprehensive system of licensing of banks by RBI. Section 23: requires every banking company to take RBIs permission. Section 35: the RBI may eitherat its initiatives or at the instance of the Central government.

How is CRR used as a tool of credit control? CRR was introduced in 1950 primarily as a measure to ensure safety and liquidity of bank deposits, however over the years it has become an important and effective tool for directly regulating the lending capacity of banks and controlling the money supply in the economy.

Statutory Liquidity Ratio is the amount of liquid assets , such as cash , precious metals or other approved securities , that a financial institution must maintain as reserves other than the the cash with the central bank. Objectives: 1.To restrict expansion of bank credit. 2.To augment the investment of banks in Government securities. 3.To ensure solvency of banks.

Bank rate , also referred to as the discount rate,is the rate of interest which a central bank charges on loans and advances that it extends to commercial banks and another financial banks intermediaries.

The interest rate that commercial banks charge their best , most credit worthy customers . Generally a banks best customers consist of large corporations . The rate is determined by the Federal Reserves decision to raise or lower prevailing interest rates for short-term borrowing.

The repo rate is the rate at which the bank market lends short term money to RESERVE BANK OF INDIA.

Repo rate is powerful signal from Reserve BANK OF INDIA on the interests rates outlook.

Objectives of bank regulation The objectives of bank regulation, and the emphasis, vary between jurisdictions. The most common objectives are: Prudentialto reduce the level of risk bank creditors are exposed to (i.e. to protect depositors) Systemic risk reductionto reduce the risk of disruption resulting from adverse trading conditions for banks causing multiple or major bank failures Avoid misuse of banksto reduce the risk of banks being used for criminal purposes, e.g. laundering the proceeds of crime To protect banking confidentiality Credit allocationto direct credit to favored sectors

Minimum requirements Supervisory review Market discipline

Instruments and requirements of bank regulation Capital requirement Reserve requirement Financial reporting and disclosure requirements

In the Internet Banking system , information is considered as an asset and so worthy of protection. According to online banking Banking Association member institutions rated security as the most important issue of online banking. Privacy and protection against fraud.

You might also like

- Bank Is ADocument8 pagesBank Is AJohn ImranNo ratings yet

- New Microsoft Word DocumentDocument18 pagesNew Microsoft Word DocumentAnkita DharodNo ratings yet

- How Is CRR Used As A Tool of Credit ControlDocument14 pagesHow Is CRR Used As A Tool of Credit ControlHimangini SinghNo ratings yet

- Module-III Banking Regulation: Course OutlineDocument36 pagesModule-III Banking Regulation: Course OutlineSanjay ParidaNo ratings yet

- Bank RegulationDocument3 pagesBank RegulationMhai PenolioNo ratings yet

- Interview Questions For Bank in BangladeDocument7 pagesInterview Questions For Bank in BangladeKhaleda Akhter100% (1)

- Bank Interview Question For Business GraduateDocument7 pagesBank Interview Question For Business GraduateHumayun KabirNo ratings yet

- Indian Banking System and ConceptsDocument42 pagesIndian Banking System and ConceptsKaran AroraNo ratings yet

- Overview of Lending Activity: by Dr. Ashok K. DubeyDocument19 pagesOverview of Lending Activity: by Dr. Ashok K. DubeySmitha R AcharyaNo ratings yet

- LAB - Study Note - 3Document19 pagesLAB - Study Note - 3ANANDMAYEE TRIPATHY PGP 2021-23 Batch100% (1)

- Principles of Bank Lending & Priority Sector LendingDocument22 pagesPrinciples of Bank Lending & Priority Sector LendingSheejaVarghese100% (8)

- 18MBAFM301: Mr. Varun K Assistant Professor Department of Business Administration MITE, MoodbidriDocument36 pages18MBAFM301: Mr. Varun K Assistant Professor Department of Business Administration MITE, MoodbidriHariprasad bhatNo ratings yet

- Important Questiins For PlacementDocument9 pagesImportant Questiins For PlacementKUMARI PUJA-MBANo ratings yet

- PreambleDocument7 pagesPreambleSudhir Kumar SinghNo ratings yet

- Regulatory Framework For Financial Services in IndiaDocument25 pagesRegulatory Framework For Financial Services in IndiaBishnu PhukanNo ratings yet

- Public Sector BanksDocument47 pagesPublic Sector Bankspoorvi agrawalNo ratings yet

- 45 NBFC PDFDocument109 pages45 NBFC PDFTushar JainNo ratings yet

- Ba7026 Banking Financial Services ManagementDocument22 pagesBa7026 Banking Financial Services Managementnandhini chokkanathanNo ratings yet

- Bank Regulation: A Presentation byDocument16 pagesBank Regulation: A Presentation byabdalla osmanNo ratings yet

- CRR SLRDocument25 pagesCRR SLRSamhitha KandlakuntaNo ratings yet

- What Are The Basic Principals of Banking? Discuss BrieflyDocument19 pagesWhat Are The Basic Principals of Banking? Discuss BrieflyNihathamanie PereraNo ratings yet

- Retail Banking: NtroductionDocument13 pagesRetail Banking: NtroductionAmit PandeyNo ratings yet

- Introduction To Financial Markets and Institutions:: Hide Links Within DefinitionsDocument10 pagesIntroduction To Financial Markets and Institutions:: Hide Links Within DefinitionsfananjelinaNo ratings yet

- Overview of Banking PrinciplesDocument22 pagesOverview of Banking PrinciplesMichael TochukwuNo ratings yet

- BANKDocument21 pagesBANKLASER RJNo ratings yet

- Original... PerDocument95 pagesOriginal... PerDixonbaby KattuchiraNo ratings yet

- Banking Digest - IBPS ClerkDocument37 pagesBanking Digest - IBPS ClerkSaikrupaVempatiNo ratings yet

- Literature ReviewDocument4 pagesLiterature Reviewdilip998850% (2)

- Module 4 Eco Sem 3Document18 pagesModule 4 Eco Sem 3sruthikadug22No ratings yet

- Institute of Management Studies Davv Indore Mba (Financial Administration) Iiird Semester - Fa 303C Insurance and Bank ManagementDocument4 pagesInstitute of Management Studies Davv Indore Mba (Financial Administration) Iiird Semester - Fa 303C Insurance and Bank ManagementjaiNo ratings yet

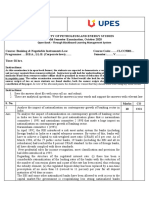

- Roll No.-103 SAP ID - 500071323: Open Book - Through Blackboard Learning Management SystemDocument4 pagesRoll No.-103 SAP ID - 500071323: Open Book - Through Blackboard Learning Management SystemAryan DevNo ratings yet

- CM - CHPT 1 NOTESDocument12 pagesCM - CHPT 1 NOTESPranav ChandaneNo ratings yet

- State Bank of India Punjab National Bank Icici Bank Lakh CroresDocument18 pagesState Bank of India Punjab National Bank Icici Bank Lakh CroresPooja PatnaikNo ratings yet

- wk3 Tutorial 3 SolutionDocument4 pageswk3 Tutorial 3 SolutionStylez 2707No ratings yet

- Credit ControlDocument5 pagesCredit Controlsrikanthuas100% (1)

- Objectives of Bank RegulationDocument15 pagesObjectives of Bank RegulationParul RamaniNo ratings yet

- Bank Regulation: Citations VerificationDocument5 pagesBank Regulation: Citations Verificationsbajaj23No ratings yet

- Bank RegulationDocument6 pagesBank RegulationAndre WestNo ratings yet

- Functions of CBDocument33 pagesFunctions of CBpareshNo ratings yet

- L-3 Regulatory Framework For Banks - RBIDocument46 pagesL-3 Regulatory Framework For Banks - RBIVinay SudaniNo ratings yet

- Bangladesh University of ProfessionalsDocument7 pagesBangladesh University of Professionalstajul tonoyNo ratings yet

- Union Bank of IndiaDocument58 pagesUnion Bank of Indiadivyesh_variaNo ratings yet

- Role of RBIDocument24 pagesRole of RBImontu9No ratings yet

- Banking Theory Law and PracticeDocument17 pagesBanking Theory Law and PracticeDr.Satish RadhakrishnanNo ratings yet

- Role of Central BankDocument32 pagesRole of Central BankAsadul Hoque100% (3)

- Tools For Managing Liquidity in The Money MarketDocument17 pagesTools For Managing Liquidity in The Money MarketSagar Mv67% (3)

- Banks and NBFCsDocument4 pagesBanks and NBFCsdecoykukiNo ratings yet

- BankingDocument37 pagesBankingSangeeta SehrawatNo ratings yet

- Untitled DocumentDocument12 pagesUntitled DocumentRajeev UpadhayayNo ratings yet

- Bfs - Unit II Short NotesDocument12 pagesBfs - Unit II Short NotesvelmuruganbNo ratings yet

- Summary Banking BusinessDocument37 pagesSummary Banking Businesssahil sharmaNo ratings yet

- Banking: GDP of A Country Excludes Pensions, Subsidies, Employment Allowances, and ScholarshipsDocument10 pagesBanking: GDP of A Country Excludes Pensions, Subsidies, Employment Allowances, and ScholarshipsTushar KhatriNo ratings yet

- NBFCDocument21 pagesNBFCNiraj PatelNo ratings yet

- Financial IndicatorsDocument20 pagesFinancial Indicatorsmajid_khan_4No ratings yet

- 45 NBFCDocument109 pages45 NBFCViji RangaNo ratings yet

- Literature ReviewDocument4 pagesLiterature ReviewJimmy JonesNo ratings yet

- Bankers Adda - Banking Notes For RBI & SBI ExamsDocument4 pagesBankers Adda - Banking Notes For RBI & SBI Examsbalu56kvNo ratings yet

- Perspectives in Banking Lecture 1Document27 pagesPerspectives in Banking Lecture 1RajeshwariNo ratings yet

- Bank Fundamentals: An Introduction to the World of Finance and BankingFrom EverandBank Fundamentals: An Introduction to the World of Finance and BankingRating: 4.5 out of 5 stars4.5/5 (4)

- Tushar Raheja - Anything For You Ma'amDocument180 pagesTushar Raheja - Anything For You Ma'amPoonam JainNo ratings yet

- Understanding Disciplines Unit IDocument3 pagesUnderstanding Disciplines Unit INidhi DedhiaNo ratings yet

- SBI Clerks Current Affairs Quick Reference GuideDocument48 pagesSBI Clerks Current Affairs Quick Reference Guiderajkumar222No ratings yet

- Notes & Question BankDocument1 pageNotes & Question BankNidhi DedhiaNo ratings yet

- Action Research Economics Anushka PDFDocument52 pagesAction Research Economics Anushka PDFNidhi DedhiaNo ratings yet

- For Your Beautiful Dreams - Satyapal Chandra PDFDocument129 pagesFor Your Beautiful Dreams - Satyapal Chandra PDFNidhi DedhiaNo ratings yet

- 3.it's Not Right - .But It's Okay - Anuj TiwariDocument155 pages3.it's Not Right - .But It's Okay - Anuj Tiwarisreemahasaraswath71% (14)

- Course I Question Bank 2015 17childhoodandgrowingup 1 PDFDocument4 pagesCourse I Question Bank 2015 17childhoodandgrowingup 1 PDFNidhi DedhiaNo ratings yet

- Course I Question Bank 2015 17childhoodandgrowingup 1 PDFDocument4 pagesCourse I Question Bank 2015 17childhoodandgrowingup 1 PDFNidhi DedhiaNo ratings yet

- A Half Baked Love Story - Anurag Garg PDFDocument129 pagesA Half Baked Love Story - Anurag Garg PDFAbhrankash Nit Dgp76% (21)

- Hidden Curriculum in Schools Its Role in PDFDocument9 pagesHidden Curriculum in Schools Its Role in PDFNidhi DedhiaNo ratings yet

- 7 PsDocument2 pages7 PsNidhi DedhiaNo ratings yet

- Hidden Curriculum: Learning and Experiences: Saurabh Khanna 3 December, 2015Document13 pagesHidden Curriculum: Learning and Experiences: Saurabh Khanna 3 December, 2015Nidhi DedhiaNo ratings yet

- EconomicsDocument17 pagesEconomicsNidhi DedhiaNo ratings yet

- Beautiful Homes GuideDocument28 pagesBeautiful Homes Guidemsdixit2006100% (2)

- B.ed Syllabus 2017-18Document134 pagesB.ed Syllabus 2017-18Nidhi DedhiaNo ratings yet

- B.Ed-sem-childhood and Growing Up11-1-2016Document1 pageB.Ed-sem-childhood and Growing Up11-1-2016Nidhi DedhiaNo ratings yet

- Question Bank EmfsDocument1 pageQuestion Bank EmfsNidhi DedhiaNo ratings yet

- AnnualReport12 13Document156 pagesAnnualReport12 13Nidhi DedhiaNo ratings yet

- Concepts QuestionsDocument10 pagesConcepts Questionsmanojpatel51No ratings yet

- International Equity MarketsDocument6 pagesInternational Equity Marketsmanojpatel51No ratings yet

- Print: Director ReportDocument10 pagesPrint: Director ReportNidhi DedhiaNo ratings yet

- India Micro Finance Investment Environment ProfileDocument27 pagesIndia Micro Finance Investment Environment ProfileAniruddha PatilNo ratings yet

- Direct Foreign InvestmentDocument7 pagesDirect Foreign InvestmentNidhi DedhiaNo ratings yet

- BBIDocument18 pagesBBIPunit VoraNo ratings yet

- Annexure 2 - Case Studies - CitiDocument3 pagesAnnexure 2 - Case Studies - CitiNidhi DedhiaNo ratings yet

- CFPDocument23 pagesCFPNidhi DedhiaNo ratings yet

- Asset Based FinanceDocument54 pagesAsset Based FinancekezzieeeeNo ratings yet

- National Stock Exchange'S Certification in Financial Markets (NCFM)Document4 pagesNational Stock Exchange'S Certification in Financial Markets (NCFM)Neelesh PachauriNo ratings yet

- 100 Marks Project.Document62 pages100 Marks Project.bhavika30391% (23)