Professional Documents

Culture Documents

Chapter 5 - Accounting For Merchandising Operations

Uploaded by

maziahesaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 5 - Accounting For Merchandising Operations

Uploaded by

maziahesaCopyright:

Available Formats

The McGraw-Hill Companies, Inc.

, 2005

Ropidah, Haslinda, Aryati, Liana

Accounting for

Merchandising

Operations

Chapter

5

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Learning Objectives

Describe merchandising

activities and identify income

components for a

merchandising company.

Identify and explain the

inventory asset of a

merchandising company.

Describe both perpetual and

periodic inventory systems.

Analyze and record transactions

for merchandise purchases

using a perpetual system.

Analyze and record transactions

for merchandise sales using a

perpetual system.

Analyze and interpret cost flows

and operating activities of a

merchandising company.

Prepare adjustments and close

accounts for a merchandising

company.

Define and prepare multiple-

step and single-step income

statements.

Record and compare

merchandising transactions

using both periodic and

perpetual inventory systems.

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Merchandising Activities

Service organizations sell time to earn revenue.

Examples: accounting firms, law firms, and

plumbing services

Revenues Expenses

Minus

Net

income

Equals

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Manufacturer Wholesaler Retailer Customer

Merchandising Companies

Merchandising Activities

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Reporting Income for a Merchandiser

Merchandising companies sell products to earn revenue.

Examples: sporting goods, clothing, and auto parts

stores

Cost of

Goods Sold

Gross

Profit

Expenses

Net

Income

Net

Sales

Minus Equals Minus Equals

Merchandising Company

Income Statement

For Year Ended 31 December 2005

Sales revenues 150,000 $

Less: Cost of goods sold 80,000

Gross profit 70,000 $

Less: Operating expenses 46,500

Net income 23,500 $

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Operating Cycle for a Merchandiser

Begins with the purchase of merchandise and ends

with the collection of cash from the sale of

merchandise.

Purchases

Merchandise

inventory

Credit sales

Account

receivable

Cash

collection

Purchases

Merchandise

inventory

Cash

sales

Cash Sale

Credit Sale

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Inventory Systems

+

+

Beginning

inventory

Net cost of

purchases

Merchandise

available for sale

Ending Inventory

Cost of Goods

Sold

=

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Inventory Systems

Perpetual

Inventory

System

Periodic

Inventory

System

Detailed records of the cost of each

item are maintained, and the cost

of each item sold is determined

from records when the sale occurs.

Cost of goods sold is determined

only at the end of an accounting

period.

Applied in this chapter

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Accounting for Merchandise Purchases

On 20 June, Jason Inc. purchased $14,000 of

Merchandise Inventory paying cash.

Jun. 20 Merchandise Inventory . . . . . . . . . 14,000

Cash . . . . . . . . . . . . . . . . 14,000

Purchase merchandise for cash

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Main Source, Inc. Invoice

614 Tech Avenue Date Number

Nashville, TN 37651 5/4/05 358-BI

S

o

l

d

T

o

Name: Barbee, Inc.

Attn: Tom Bell

Address: One Willow Plaza

Cookeville, Tennessee

38501

P.O. 167 Sales: 25 Terms 2/10,n/30 Ship: FedEx Prepaid

Item Description Quanity Price Amount

AC417 250 Backup System 500 54.00 $ 27,000 $

Sub Total 27,000

We appreciate your business! Ship Chg. -

Tax -

Total 27,000 $

OSeller OInvoice date

OPurchaser OOrder number

OCredit terms OFreight terms

OGoods OInvoice amount

O

O

O

O

O O O

O

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Trade Discounts

Used by manufacturers and wholesalers to offer

better prices for greater quantities purchased.

Example

Matrix, Inc. offers a 30% trade

discount on orders of 1,000

units or more of their popular

product Racer. Each

Racer has a list price of $5.25.

Quantity sold 1,000

Price per unit 5.25 $

Total 5,250

Less 30% discount (1,575)

Invoice price 3,675 $

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Purchase Discounts

A deduction from the invoice price granted to

induce early payment of the amount due.

Terms

Time

Due

Discount Period

Full amount

less discount

Credit Period

Full amount due

Purchase or Sale

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

2/10,n/30

Purchase Discounts

Discount

Percent

Number of

Days

Discount Is

Available

Otherwise,

Net (or All)

Is Due

Credit

Period

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Purchase Discounts

On 7 May, Jason Inc. purchased $27,000 of

Merchandise Inventory on account, credit

terms are 2/10, n/30.

May 7 Merchandise Inventory 27,000

Accounts Payable 27,000

Purchase merchandise on account

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Purchase Discounts

On 15 May, Jason Inc. paid the amount due on

the purchase of 7 May.

May 15 Accounts Payable 27,000

Cash 26,460

Marchandise Inventory 540

Paid accounts payable in full

$27,000 2% = $540 discount

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Purchase Discounts

After we post these entries, the accounts

involved look like this:

Merchandise Inventory

Accounts Payable

5/7 27,000

5/7 27,000

5/15 540

5/15 27,000

Bal. 26,460

Bal. 0

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Failure to Pay Within the Discount Period

If we fail to take a 2/10, n/30

discount, is it really expensive?

365 days 20 days 2% = 36.5% annual rate

Days

in a

year

Number

of additional

days before

payment

Percent

paid to

keep

money

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Purchase Returns and Allowances

Purchase Return . . .

Merchandise returned by the purchaser to

the supplier.

Purchase Allowance . . .

A reduction in the cost of defective

merchandise received by a purchaser from a

supplier.

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Purchase Returns and Allowances

On 9 May, Matrix Inc. purchased $20,000 of

Merchandise Inventory on account, credit

terms are 2/10, n/30.

May 9 Merchandise Inventory 20,000

Accounts Payable 20,000

Purchased merchandise on account

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Purchase Returns and Allowances

On 10 May, Matrix Inc. returned $500 of

defective merchandise to the supplier.

May 10 Accounts Payable 500

Merchandise Inventory 500

Returned defective merchandise

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Purchase Returns and Allowances

On 18 May, Matrix Inc. paid the amount owed for

the purchase of 9 May.

Purchase 20,000 $

Less: Returns (500)

Amount Due 19,500

Less: Discount (390)

Cash Paid 19,110 $

May 18 Accounts Payable 19,500

Cash 19,110

Merchandise Inventory 390

Paid account in full

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Transportation Costs

FOB shipping point

(buyer pays)

FOB destination

(seller pays)

Merchandise

Seller Buyer

Terms

Ownership transfers

to buyer when goods

are passed to

Transportation

costs paid by

FOB shipping point Carrier Buyer

FOB destination Buyer Seller

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Transportation Costs

On 12 May, Jason Inc. purchased $8,000 of

Merchandise Inventory for cash and also paid

$100 transportation costs.

May 12 Merchandise Inventory 8,100

Cash 8,100

Paid for merchandise and transportation

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Quick Check E

On 6 July 2005 Seller Co. sold $7,500 of

merchandise to Buyer Co.; terms of 2/10,n/30. The

shipping terms were FOB shipping point. The

shipping cost was $100. Which of the following will

be part of Buyers 6July journal entry?

a. Credit Sales $7,500

b. Credit Purchase Discounts $150

c. Debit Merchandise Inventory $100

d. Debit Accounts Payable $7,450

FOB shipping point indicates the buyer

ultimately pays the freight. This is recorded with

a debit to Merchandise Inventory.

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Itemized Cost of Merchandise Purchased

Invoice cost of merchandise purchases 692,500 $

Less:

Purchase discounts (10,388)

Purchase returns and allowances (4,275)

Add:

Freight-in 4,895

Total cost of merchandise purchases 682,732 $

Matrix Inc.

Total Cost of Merchandise Purchases

For Year Ended 31 May 2005

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Accounting for Merchandise Sales

Matrix Inc.

Computation of Gross Profit

For Year Ended 31 December 2005

Sales 2,451,000 $

Less:

Sales discounts 29,412 $

Sales returns and allowances 18,500 47,912

Net sales 2,403,088 $

Less: Cost of goods sold (1,928,600)

Gross profit 474,488 $

Sales discounts and returns and allowances are Contra Revenue accounts.

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Sales of Merchandise

On 18 March, Diamond Store sold $25,000 of

merchandise on account. The merchandise was

carried in inventory at a cost of $18,000.

Mar. 18 Accounts Receivable 25,000

Sales 25,000

Sales of merchandise on credit

Cost of Goods Sold 18,000

Merchandise Inventory 18,000

To record cost of sales

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Sales Discounts

On 8 June, Barton Co. sold merchandise costing $3,500

for $6,000 on account. Credit terms were 2/10, n/30.

Lets prepare the journal entries.

Jun. 8 Accounts Receivable 6,000

Sales 6,000

Sales of merchandise on credit

Cost of Goods Sold 3,500

Merchandise Inventory 3,500

To record cost of sales

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Sales Discounts

On 17 June, Barton Co. received a check for

$5,880 in full payment of the 8 June sale.

Jun. 17 Cash 5,880

Sales Discount 120

Accounts Receivable 6,000

Received payment less discount

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Sales Returns and Allowances

On 12 June, Barton Co. sold merchandise

costing $4,000 for $7,500 on account The

credit terms were 2/10, n/30.

Jun. 12 Accounts Receivable 7,500

Sales 7,500

Sales of merchandise on credit

Cost of Goods Sold 4,000

Merchandise Inventory 4,000

To record cost of sales

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Sales Returns and Allowances

On 14 June, merchandise with a sales price of $800 and

a cost of $470 was returned to Barton. The return is

related to the 12 June sale.

Jun. 14 Sales Returns and Allowances 800

Accounts Receivable 800

Customer returned merchandise

Merchandise Inventory 470

Cost of Goods Sold 470

Returned goods placed in inventory

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Sales Returns and Allowances

On 20 June, Barton received the amount owed

to it from the sale of 12 June.

Sale 7,500 $

Less: Return (800)

Amount due 6,700 $

Less: Discount (134)

Cash received 6,566 $

Jun. 20 Cash 6,566

Sales Discount 134

Accounts Receivable 6,700

Received payment less discount

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Lets complete the

accounting cycle

by preparing the

closing entries for

Barton.

Barton Company

Adjusted Trial Balance

31 December 2005

Cash 7,700 $

Accounts receivable 11,200

Merchandise inventory 14,300

Supplies 1,300

Equipment 41,200

Accum. depr.- Equip. 7,000 $

Accounts payable 16,400

Salaries payable 1,000

Barton, Capital 42,400

Barton, Withdrawal 4,000

Sales 323,800

Sales discounts 4,300

Sales return & allowance 2,000

Cost of goods sold 233,200

Admin. salaries expense 18,200

Sales salaries expense 29,600

Insurance expense 1,200

Rent expense 8,100

Supplies expense 1,000

Advertising expense 13,300

390,600 $ 390,600 $

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Step 1: Close Credit Balances in Temporary Accounts

to Income Summary.

323,800

Income Summary

Dec. 31 Sales . . . . . . . . . . . . . . . . . . . . 323,800

Income summary . . . . . . 323,800

To close credit balance in temporary accounts

Barton Company

Adjusted Trial Balance

31 December 2005

Salaries payable 1,000

Barton, Capital 42,400

Barton, Withdrawal 4,000

Sales 323,800

Sales discounts 4,300

Sales return & allowance 2,000

Cost of goods sold 233,200

Admin. salaries expense 18,200

Sales salaries expense 29,600

Insurance expense 1,200

Rent expense 8,100

Supplies expense 1,000

Advertising expense 13,300

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Step 2: Close Debit Balances in Temporary Accounts

to Income Summary.

310,900 323,800

12,900

Income Summary

Dec. 31 Income Summary 310,900

Sales Discounts 4,300

Sales Return & Allowance 2,000

Cost of Goods Sold 233,200

Adm. Salaries Expense 18,200

Sales Salaries Expense 29,600

Insurance Expense 1,200

Rent Expense 8,100

Supplies Expense 1,000

Advertising Expense 13,300

To close debit balances in temporary accounts

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Step 3: Close Income Summary to Owners Capital

310,900 323,800

12,900

Income Summary

310,900 323,800

12,900

-0-

Income Summary

Dec. 31 Income Summary 12,900

Barton, Capital 12,900

To close Income Summary account

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Step 4: Close Withdrawals Account to Owners Capital.

Dec. 31 Barton, Capital 4,000

Barton, Withdrawals 4,000

To close the withdrawals account

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Income Statement Formats

Multiple-Step

Single-Step

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

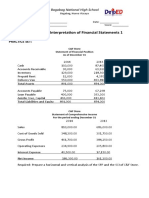

Multiple-Step Income Statement

Sales 323,800 $

Less: Sales discounts 4,300 $

Sales return & allowance 2,000 6,300

Net sales 317,500 $

Cost of Goods Sold 233,200

Gross profit from sales 84,300 $

Less: Operating expenses:

Selling expenses:

Salaries expense 29,600 $

Advertising expense 13,300 42,900 $

General and administrative expenses:

Adm. salaries expense 18,200 $

Insurance expense 1,200

Rent expense 8,100

Supplies expense 1,000 28,500

Total operating expenses 71,400

Net income 12,900 $

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Single-Step Income Statement

Barton Company

Income Statement

For Year Ended 31 December 2005

Net sales 317,500 $

Less:Cost of goods sold 233,200 $

Operating expenses 71,400

Total expense 304,600

Net income 12,900 $

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

Classified Balance Sheet

Fixed Assets:

Equipment 16,000

Current Assets:

Cash 10,200 $

Merchandise Inventory 1,200 11,400

Less: Current Liabilities:

Accounts payable 1,200 $ 1,200

Working Capital 10,200

26,200 $

Financed by:

Equity 22,200

Long-term Liabilities:

Notes payable 4,000

26,200 $

Merchandising Company

Balance Sheet

31 December 2005

The McGraw-Hill Companies, Inc., 2005

Ropidah, Haslinda, Aryati, Liana

End of Chapter 5

You might also like

- Problems Accounting Equation 1 5 UnsolvedDocument5 pagesProblems Accounting Equation 1 5 UnsolvedRaja NarayananNo ratings yet

- 2009 F-1 Class NotesDocument4 pages2009 F-1 Class NotesgqxgrlNo ratings yet

- Writing Up The Bible EssayDocument2 pagesWriting Up The Bible Essaywokky77No ratings yet

- Statement of Comprehensive Income (SCI) : Lesson 2Document20 pagesStatement of Comprehensive Income (SCI) : Lesson 2Rojane L. AlcantaraNo ratings yet

- Chapter 3 Statement of Changes in EquityDocument22 pagesChapter 3 Statement of Changes in EquityRonald De La RamaNo ratings yet

- Ch2-International Flow of FundsDocument11 pagesCh2-International Flow of FundsfabianNo ratings yet

- Periodic and Perpetual Inventory SystemDocument19 pagesPeriodic and Perpetual Inventory SystemMichelle RotairoNo ratings yet

- Practice Set - Analysis of FS1Document1 pagePractice Set - Analysis of FS1marissa casareno almueteNo ratings yet

- Bsba - Bacc-1 - Midterm Exam - ADocument3 pagesBsba - Bacc-1 - Midterm Exam - AMechileNo ratings yet

- Accounting For Merchandising OperationsDocument63 pagesAccounting For Merchandising OperationsWijdan saleemNo ratings yet

- Drills On Accounting Concepts and Principles: I. True or FalseDocument5 pagesDrills On Accounting Concepts and Principles: I. True or FalseAnne AlagNo ratings yet

- Accounting ConceptsDocument4 pagesAccounting ConceptsAjmal KhanNo ratings yet

- Chapter - 1-Introduction To Accounting and BusinessDocument49 pagesChapter - 1-Introduction To Accounting and BusinessAsaye TesfaNo ratings yet

- Abm1 PPTDocument161 pagesAbm1 PPTPavi Antoni Villaceran100% (1)

- Accounting EquationDocument12 pagesAccounting EquationAishah Rafat Abdussattar100% (1)

- Wiley - Chapter 8: Valuation of Inventories: A Cost-Basis ApproachDocument23 pagesWiley - Chapter 8: Valuation of Inventories: A Cost-Basis ApproachIvan Bliminse100% (1)

- Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument74 pagesPrepared by Coby Harmon University of California, Santa Barbara Westmont CollegeH.R. RobinNo ratings yet

- FABM1 Lesson8-1 Five Major Accounts-LIABILITIESDocument13 pagesFABM1 Lesson8-1 Five Major Accounts-LIABILITIESWalter MataNo ratings yet

- Users of Accounting Information - Chapter IIIDocument28 pagesUsers of Accounting Information - Chapter IIIJimwel DiloyNo ratings yet

- Financial Accounting 4th Edition Chapter 2Document67 pagesFinancial Accounting 4th Edition Chapter 2Joey TrompNo ratings yet

- Accounting Cycle of A Merchandising BusinessDocument16 pagesAccounting Cycle of A Merchandising BusinessGennelyn Lairise RiveraNo ratings yet

- Chapter 2 Cost Concepts and ClassificationDocument40 pagesChapter 2 Cost Concepts and ClassificationJean Rae RemiasNo ratings yet

- Basic Financial Accounting PPT 1Document26 pagesBasic Financial Accounting PPT 1anon_254280391100% (1)

- Assignment-1 (Eco & Actg For Engineers) Exercise - 1Document4 pagesAssignment-1 (Eco & Actg For Engineers) Exercise - 1Nayeem HossainNo ratings yet

- Lesson 1 - Accounting and GAAPDocument4 pagesLesson 1 - Accounting and GAAPMazumder SumanNo ratings yet

- Fabm 1 Quiz TheoriesDocument4 pagesFabm 1 Quiz TheoriesJanafaye Krisha100% (1)

- Accounting 5 - Closing EntriesDocument13 pagesAccounting 5 - Closing EntriesOanh NguyenNo ratings yet

- Accounting Concepts and Accounting Equation DrillsDocument3 pagesAccounting Concepts and Accounting Equation Drillsken garciaNo ratings yet

- Wey AP 8e Ch01Document47 pagesWey AP 8e Ch01Bintang RahmadiNo ratings yet

- Chapter: 1 Meaning, Objectives and Basic Accounting TermsDocument19 pagesChapter: 1 Meaning, Objectives and Basic Accounting TermsGudlipNo ratings yet

- Chapter 1 - EthicsDocument7 pagesChapter 1 - EthicsEzekylah AlbaNo ratings yet

- Lesson 2 ACCOUNTING AS THE LANGUAGE OF BUSINESSDocument9 pagesLesson 2 ACCOUNTING AS THE LANGUAGE OF BUSINESSamora elyseNo ratings yet

- Lecture in FUNAC 2Document84 pagesLecture in FUNAC 2Shaira Bloom RagonjanNo ratings yet

- 1accounting Equation RevisedDocument4 pages1accounting Equation RevisedReniel MillarNo ratings yet

- AssignmentDocument8 pagesAssignmentNegil Patrick DolorNo ratings yet

- Part 2 - Module 7 - The Nature of Merchandising Business 1Document13 pagesPart 2 - Module 7 - The Nature of Merchandising Business 1jevieconsultaaquino2003No ratings yet

- 2 Overview of Transaction Processing and ERP SystemDocument25 pages2 Overview of Transaction Processing and ERP SystemLisna SetiawatiNo ratings yet

- Module 2Document6 pagesModule 2Maria Andres100% (1)

- Financial Accounting Study Guide Ch5 AnswersDocument7 pagesFinancial Accounting Study Guide Ch5 AnswersSummerNo ratings yet

- Basic Acctg 4th SatDocument11 pagesBasic Acctg 4th SatJerome Eziekel Posada PanaliganNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document20 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB Cloyd100% (1)

- Merchandising Lecture NotesDocument7 pagesMerchandising Lecture Notesjaywalker83No ratings yet

- The Accounting Cycle:: Accruals and DeferralsDocument41 pagesThe Accounting Cycle:: Accruals and Deferralsmahtab_rasheedNo ratings yet

- LESSON 1: Introduction To AccountingDocument5 pagesLESSON 1: Introduction To AccountingUnamadable UnleomarableNo ratings yet

- Solution Ex Adjustment Entries PDFDocument3 pagesSolution Ex Adjustment Entries PDFAli Sher BalochNo ratings yet

- Chapter 6 Motivation - NotesDocument6 pagesChapter 6 Motivation - NotesAli NehanNo ratings yet

- 09 Books of AccountsDocument17 pages09 Books of AccountsKezia Gwyneth Bofill OrisNo ratings yet

- ch04.ppt - Income Statement and Related InformationDocument68 pagesch04.ppt - Income Statement and Related InformationAmir ContrerasNo ratings yet

- 2.0 The Recording ProcessDocument14 pages2.0 The Recording ProcessSarah Jane Dulnuan NipahoyNo ratings yet

- Chapter 4 Statement of Cash FlowsDocument33 pagesChapter 4 Statement of Cash FlowsSucreNo ratings yet

- Chapter1 Final 1Document96 pagesChapter1 Final 1Mạnh Đỗ ĐứcNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document18 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Principles of Accounting ExercisesDocument3 pagesPrinciples of Accounting ExercisesAB D'oriaNo ratings yet

- Balance Sheet Component Matching Exercise: Account DescriptionDocument2 pagesBalance Sheet Component Matching Exercise: Account Descriptionnishant jindalNo ratings yet

- Recording TransactionsDocument40 pagesRecording Transactionsasad19100% (10)

- Fundamentals of Accountancy, Business and Management 1Document20 pagesFundamentals of Accountancy, Business and Management 1Gel MeNo ratings yet

- 20111101121111PPT Chap04Document45 pages20111101121111PPT Chap04batraz79No ratings yet

- Ch06 12edDocument52 pagesCh06 12edAhmed Mahmoud AbouzaidNo ratings yet

- Ch05-Accounting PrincipleDocument9 pagesCh05-Accounting PrincipleEthanAhamed100% (2)

- FinanceDocument5 pagesFinanceDHRUV SONAGARANo ratings yet

- Basic Facts About ESOPs2Document20 pagesBasic Facts About ESOPs2Quant TradingNo ratings yet

- Mpb-404 Financial ManagementDocument6 pagesMpb-404 Financial ManagementMohammad Zahirul IslamNo ratings yet

- Citi Summer Internship Experience Iim LucknowDocument3 pagesCiti Summer Internship Experience Iim LucknowBibaswan Banerjee100% (1)

- Trading Places ReflectionDocument2 pagesTrading Places ReflectionGerald Villarta MangananNo ratings yet

- Coprorate Finance Question Paper (3 Hours 1000 Words)Document2 pagesCoprorate Finance Question Paper (3 Hours 1000 Words)Vasu PothunuruNo ratings yet

- Questions To Ask AboutDocument3 pagesQuestions To Ask AboutSeif AbdelghanyNo ratings yet

- SdsasacsacsacsacsacDocument4 pagesSdsasacsacsacsacsacIden PratamaNo ratings yet

- Lecture Week 14Document23 pagesLecture Week 14XS3 GamingNo ratings yet

- Circular Memo No. 1331-359-A1-PC.I-2008, Dt. 7.12.2009 - HRADocument2 pagesCircular Memo No. 1331-359-A1-PC.I-2008, Dt. 7.12.2009 - HRASekharNo ratings yet

- Mathematis & Decision Making PDFDocument19 pagesMathematis & Decision Making PDFXahed AbdullahNo ratings yet

- 3 Spreadsheet PR 3.5ADocument2 pages3 Spreadsheet PR 3.5ARizkyDirectioners'ZaynsterNo ratings yet

- Strategic Level-2 (S6) Strategic Management: Part - Aweightage 15%Document7 pagesStrategic Level-2 (S6) Strategic Management: Part - Aweightage 15%Tabish RehmanNo ratings yet

- ADL 56 Cost & Management Accounting V2Document8 pagesADL 56 Cost & Management Accounting V2solvedcareNo ratings yet

- ACCTG 112 Chapter 2Document1 pageACCTG 112 Chapter 2C E DNo ratings yet

- Paper 2 Marking Scheme Nov 2009Document11 pagesPaper 2 Marking Scheme Nov 2009MSHNo ratings yet

- Smart Money Concept (SMC)Document26 pagesSmart Money Concept (SMC)nguyenthaihung1986No ratings yet

- How To Game Your Sharpe RatioDocument21 pagesHow To Game Your Sharpe RatioCervino InstituteNo ratings yet

- Discription On Fixation of Assistants in Revised PayDocument47 pagesDiscription On Fixation of Assistants in Revised Payvadrevusri100% (7)

- FE 8507 Lecture 2 More On Dynamic Security Markets StudentsDocument52 pagesFE 8507 Lecture 2 More On Dynamic Security Markets Studentsseng0022No ratings yet

- IC 38 Short Notes (2) 61Document1 pageIC 38 Short Notes (2) 61Anil KumarNo ratings yet

- Credit BookDocument115 pagesCredit Bookapi-26366579100% (2)

- Cfas Exam3 ProblemsDocument8 pagesCfas Exam3 ProblemspolxrixNo ratings yet

- L & T Fundamental & Technical AnalysisDocument13 pagesL & T Fundamental & Technical AnalysisAnsh OzaNo ratings yet

- SIP PROJECT - Praveen AgarwalDocument90 pagesSIP PROJECT - Praveen AgarwalRohit SachdevaNo ratings yet

- Indian Salon Hair and Skin Products Industry ReportDocument24 pagesIndian Salon Hair and Skin Products Industry ReportReevolv Advisory Services Private LimitedNo ratings yet

- (Application Format For Empanelment of Valuers With Banks) (To Be Obtained in The Letterhead of The Valuer)Document5 pages(Application Format For Empanelment of Valuers With Banks) (To Be Obtained in The Letterhead of The Valuer)Subramaniam GanesanNo ratings yet

- Financial Markets (Beginner Module)Document98 pagesFinancial Markets (Beginner Module)gauravNo ratings yet

- AP - Property, Plant and EquipmentDocument6 pagesAP - Property, Plant and EquipmentRhuejane Gay MaquilingNo ratings yet

- Lista Acte CanadaDocument2 pagesLista Acte CanadaDinulescu Marius0% (1)

- Agencies Tasked With PFADocument13 pagesAgencies Tasked With PFAKrissie LimNo ratings yet