Professional Documents

Culture Documents

The Story of Monty Singh

Uploaded by

Soumendra RoyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Story of Monty Singh

Uploaded by

Soumendra RoyCopyright:

Available Formats

1Bt t10RT 0f

N01T tl6B

ln18CuuC1lCn Cl MCn1? SlnCP

MonLy Slngh a savvy man who sees Lhe need for a

parcel dellvery servlce ln hls communlLy MonLy has

researched hls ldea and has prepared a buslness plan

LhaL documenLs Lhe vlablllLy of hls new buslness

MonLy has also meL wlLh an aLLorney Lo dlscuss Lhe

form of buslness he should use Clven hls speclflc

slLuaLlon Lhey concluded LhaL a corporaLlon wlll be

besL

MonLy decldes LhaL Lhe name for hls corporaLlon wlll be

ulrecL uellvery vL LLd 1he aLLorney also advlses

MonLy on Lhe varlous permlLs and governmenL

ldenLlflcaLlon numbers LhaL wlll be needed for Lhe new

corporaLlon

MonLy ls a hard worker and a smarL man

buL admlLs he ls noL comforLable wlLh

maLLers of accounLlng

Pe assumes he wlll use some accounLlng

sofLware buL wanLs Lo meeL wlLh a

professlonal accounLanL before maklng hls

selecLlon

Pe asks hls banker Lo recommend a

professlonal accounLanL who ls also skllled ln

explalnlng accounLlng Lo someone wlLhouL

an accounLlng background

MonLy wanLs Lo undersLand Lhe flnanclal

sLaLemenLs and wanLs Lo keep on Lop of hls

new buslness Pls banker recommends Mr

8aLllwala an accounLanL who has helped

many of Lhe banks small buslness

cusLomers

ln18CuuC1lCn Cl MCn1? SlnCP

MCn1? SlnCP MLL1S 8A1LlWALA

AL hls flrsL meeLlng wlLh 8aLllwala MonLy

asks hlm for an overvlew of accounLlng

flnanclal sLaLemenLs and Lhe need for

accounLlng sofLware

8ased on MonLy's buslness plan 8aLllwala

sees LhaL Lhere wlll llkely be Lhousands of

LransacLlons each year

Pe sLaLes LhaL accounLlng sofLware wlll allow

for Lhe elecLronlc recordlng sLorlng and

reLrleval of Lhose many LransacLlons

AccounLlng sofLware wlll permlL MonLy Lo

generaLe Lhe flnanclal sLaLemenLs and oLher

reporLs LhaL he wlll need for runnlng hls

buslness

ACCCun1lnC 1L8MS uZZLLS

MCn1? SlnCP

MonLy seems puzzled by Lhe Lerm LransacLlon so

8aLllwala glves hlm flve examples of LransacLlons LhaL

ulrecL uellvery vL LLd wlll need Lo record

MonLy wlll no doubL sLarL hls buslness by puLLlng

some of hls own personal money lnLo lL ln effecL he

ls buylng shares of ulrecL uellverys common sLock

ulrecL uellvery wlll need Lo buy a sLurdy dependable

dellvery vehlcle

1he buslness wlll begln earnlng fees and bllllng

cllenLs for dellverlng Lhelr parcels

1he buslness wlll be collecLlng Lhe fees LhaL were

earned

1he buslness wlll lncur expenses ln operaLlng Lhe

buslness such as a salary for MonLy expenses

assoclaLed wlLh Lhe dellvery vehlcle adverLlslng eLc

lMC81AnCL Cl ACCCun1lnC SCl1WA8L

WlLh Lhousands of such LransacLlons ln a glven year

MonLy ls smarL Lo sLarL uslng accounLlng sofLware

rlghL from Lhe beglnnlng

AccounLlng sofLware wlll generaLe sales lnvolces and

accounLlng enLrles slmulLaneously prepare

sLaLemenLs for cusLomers wlLh no addlLlonal work

wrlLe cheques auLomaLlcally updaLe accounLlng

records eLc

8y geLLlng lnLo Lhe hablL of enLerlng all of Lhe days

buslness LransacLlons lnLo hls compuLer MonLy wlll

be rewarded wlLh fasL and easy access Lo Lhe

speclflc lnformaLlon he wlll need Lo make sound

buslness declslons

8aLllwala Lells MonLy LhaL accounLlngs LransacLlon

approach ls useful rellable and lnformaLlve

WnA1 AkL IINANCIAL

S1A1LMLN1S

Pe has worked wlLh oLher small buslness

owners who Lhlnk lL ls enough Lo slmply know

Lhelr company made 8s 30000 durlng Lhe year

(based only on Lhe facL LhaL lL owns 8s 30000

more Lhan lL dld on !anuary 1)

1hose are Lhe people who sLarL off on Lhe

wrong fooL and end up ln 8aLllwala's offlce

looklng for flnanclal advlce

lf MonLy enLers all of ulrecL uellverys

LransacLlons lnLo hls compuLer good accounLlng

sofLware wlll allow MonLy Lo prlnL ouL hls

flnanclal sLaLemenLs wlLh a cllck of a buLLon

8aLllwala explalned MonLy Lhe conLenL and

purpose of Lhe Lhree maln flnanclal sLaLemenLs

lncome SLaLemenL

8alance SheeL

SLaLemenL of Cash llows

INCCML S1A1LMLN1

8aLllwala polnLs ouL LhaL an lncome

sLaLemenL wlll show how ptofltoble ulrecL

uellvery has been durlng Lhe Llme lnLerval

shown ln Lhe sLaLemenLs headlng

1hls perlod of Llme mlghL be a week a

monLh Lhree monLhs flve weeks or a

yearMonLy can choose whaLever Llme

perlod he deems mosL useful

1he reporLlng of proflLablllLy lnvolves Lwo

Lhlngs Lhe amounL LhaL was earned

(revenues) and Lhe expenses necessary Lo

earn Lhe revenues

As you wlll see nexL Lhe Lerm teveooes ls

noL Lhe same as recelpLs and Lhe

Lerm expeoses lnvolves more Lhan [usL

wrlLlng a cheque Lo pay a blll

8LvLnuL

1he maln revenues for ulrecL uellvery are Lhe fees lL

earns for dellverlng parcels under Lhe accrua| bas|s of

account|ng (as opposed Lo Lhe lesspreferred cash

method of account|ng) revenues are recorded when

Lhey are eotoeJ noL when Lhe company tecelves Lhe

money

8ecordlng revenues when Lhey are earned ls Lhe resulL

of one of Lhe baslc accounLlng prlnclples known as

Lhe revenue recogn|t|on pr|nc|p|e

lor example lf MonLy dellvers 1000 parcels ln

uecember for 8s 4 per dellvery he has

Lechnlcally eotoeJ fees LoLallng 8s 4000 for LhaL monLh

Pe sends lnvolces Lo hls cllenLs for Lhese fees and hls

Lerms requlre LhaL hls cllenLs musL pay by !anuary 10

Lven Lhough hls cllenLs wonL be paylng ulrecL uellvery

unLll !anuary 10 Lhe accrual basls of accounLlng

requlres LhaL Lhe 8s 4000 be recorded

as ecembet revenues slnce LhaL ls when Lhe dellvery

work acLually Look place

8LvLnuLS

AfLer expenses are maLched wlLh Lhese

revenues Lhe lncome sLaLemenL for uecember

wlll show [usL how ptofltoble Lhe company was

ln dellverlng parcels ln uecember

When MonLy recelves Lhe 8s 4000 worLh of

paymenL cheques from hls cusLomers on

!anuary 10 he wlll make an accounLlng enLry Lo

show Lhe money was recelved

This Rs 4,000 of receipts will not be considered to be January

revenues, since the revenues were already reported as revenues

in December when they were earned.

This Rs 4,000 of receipts will be recorded in January as a

reduction in Accounts ReceivabIe. (n December Monty had

made an entry to Accounts Receivable and to SaIes.)

LxLnSLS

now 8aLllwala Lurns Lo Lhe second parL of Lhe

lncome sLaLemenLexpenses

1he uecember lncome sLaLemenL should show

expenses locotteJ durlng uecember regardless

of when Lhe company acLually polJ for Lhe

expenses

lor example lf MonLy hlres someone Lo help

hlm wlLh uecember dellverles and MonLy

agrees Lo pay hlm 8s 300 on !anuary 3 LhaL 8s

300 expense needs Lo be shown on

Lhe ecembet lncome sLaLemenL

1he acLual daLe LhaL Lhe 8s 300 ls pald ouL

doesnL maLLerwhaL maLLers ls when Lhe work

was donewhen Lhe expense was locotteJ

and ln Lhls case Lhe work was done ln

uecember

1he 8s 300 expense ls counLed as a uecember

expense even Lhough Lhe money wlll noL be pald

ouL unLll !anuary 3

1he recordlng of expenses wlLh Lhe relaLed

revenues ls assoclaLed wlLh anoLher baslc

accounLlng prlnclple known as Lhe match|ng

pr|nc|p|e

8aLllwala explalns Lo MonLy LhaL showlng Lhe 8s

300 of wages expense on Lhe uecember lncome

sLaLemenL wlll resulL ln a motcbloq of Lhe cosL of

Lhe labor used Lo dellver Lhe uecember parcels

wlLh Lhe revenues from dellverlng Lhe uecember

parcels

1hls maLchlng prlnclple ls very lmporLanL ln

measurlng [usL how proflLable a company was

durlng a glven Llme perlod

LxLnSLS

8aLllwala ls dellghLed Lo see LhaL MonLy already has an

lnLulLlve grasp of Lhls baslc accounLlng prlnclple

ln order Lo earn revenues ln uecember Lhe company had Lo

lncur some buslness expenses ln uecember even lf Lhe

expenses wonL be polJ unLll !anuary

CLher expenses Lo be maLched wlLh uecembers revenues

would be such Lhlngs as gas for Lhe dellvery van and

adverLlslng spoLs on Lhe radlo

MonLy asks 8aLllwala Lo provlde anoLher example of a cosL

LhaL wouldnL be pald ln uecember buL would have Lo be

shown / maLched as an expense on uecembers lncome

sLaLemenL

8aLllwala uses Lhe Interest Lxpense on borrowed money as

an example Pe asks MonLy Lo assume LhaL on uecember 1

ulrecL uellvery borrows 8s 20000 from MonLy's aunL and

Lhe company agrees Lo pay hls aunL 6 per year ln lnLeresL

or 8s 1200 per year 1hls lnLeresL ls Lo be pald ln a lump

sum each on uecember 1 of each year

LxLnSLS

now even Lhough Lhe lnLeresL ls belng pald ouL Lo

hls aunL only once per year as a lump sum MonLy

can see LhaL ln reallLy a llLLle blL of LhaL lnLeresL

expense ls locotteJ each and every day hes ln

buslness

lf MonLy ls preparlng mootbly lncome sLaLemenLs

MonLy should reporL one monLh of lnLeresL

Lxpense on each monLhs lncome sLaLemenL

1he amounL LhaL ulrecL uellvery wlll lncur as

lnLeresL Lxpense wlll be 8s 100 per monLh all year

long (8s 20000 x 6 12)

ln oLher words MonLy needs Lo maLch 8s 100 of

lnLeresL expense wlLh each monLhs revenues 1he

lnLeresL expense ls consldered a cosL LhaL ls

necessary Lo earn Lhe revenues shown on Lhe

lncome sLaLemenLs

LxLnSLS

8aLllwala explalns Lo MonLy LhaL Lhe lncome

sLaLemenL ls a blL more compllcaLed Lhan whaL she

[usL explalned buL for now she [usL wanLs MonLy Lo

learn some baslc accounLlng concepLs and some of

Lhe accounLlng Lermlnology

8aLllwala does make sure however LhaL MonLy

undersLands one slmple yeL lmporLanL polnL an

locome sLaLemenL does oot reporL Lhe cosb comlng

lnraLher lLs purpose ls Lo (1) reporL Lhe teveooes

eotoeJ by Lhe companys efforLs durlng Lhe perlod

and (2) reporL Lhe expenses lncurred by Lhe company

durlng Lhe same perlod

1he purpose of Lhe lncome sLaLemenL ls Lo show a

companys ptofltoblllty durlng a speclflc perlod of

Llme 1he dlfference (or neL) beLween Lhe revenues

and expenses for ulrecL uellvery ls ofLen referred Lo

as Lhe bottom ||ne and lL ls labeled as elLher Net

Income or Net Loss

LxLnSLS

ALANCL SnLL1 ASSL1S

8aLllwala moves on Lo explaln Lhe balance sheeL

a flnanclal sLaLemenL LhaL reporLs Lhe amounL of

a companys %A) asseLs %) llablllLles

and %C) sLockholders (or owners) equlLy aL a

speclflc polot lo tlme

8ecause Lhe balance sheeL reflecLs a

speclflc polot lo tlme raLher Lhan a petloJ of

tlme 8aLllwala llkes Lo refer Lo Lhe balance sheeL

as a snapshoL of a companys flnanclal poslLlon

aL a glven momenL

lor example lf a balance sheeL ls daLed

uecember 31 Lhe amounLs shown on Lhe

balance sheeL are Lhe balances ln Lhe accounLs

afLer all LransacLlons perLalnlng Lo uecember 31

have been recorded

Assets

AsseLs are Lhlngs LhaL a company owns and are

someLlmes referred Lo as Lhe resources of Lhe

company

MonLy readlly undersLands Lhlsoff Lhe Lop of hls

head he names Lhlngs such as Lhe companys vehlcle

lLs cash ln Lhe bank all of Lhe supplles he has on hand

and Lhe dolly he uses Lo help move Lhe heavler

parcels

8aLllwala nods and shows MonLy how Lhese are

reporLed ln accounLs called Ieh|c|es Cash Supp||es

and Lqu|pment

Pe menLlons one asseL MonLy hadnL consldered

Accounts kece|vab|e lf MonLy dellvers parcels buL

lsnL pald lmmedlaLely for Lhe dellvery Lhe amounL

owed Lo ulrecL uellvery ls an asseL known as AccounLs

8ecelvable

9kL9AID

8aLllwala brlngs up anoLher less obvlous asseL

Lhe unexplred porLlon of prepa|d expenses

Suppose ulrecL uellvery pays 8s 1200 on

uecember 1 for a slxmonLh lnsurance premlum

on lLs dellvery vehlcle

1haL dlvldes ouL Lo be 8s 200 per monLh (8s 1200

6 monLhs) 8eLween uecember 1 and uecember

31 8s 200 worLh of lnsurance premlum ls used

up or explres

The expired amount will be reported as Insurance Expense on

December's income statement.

Monty asks Batliwala where the remaining Rs 1,000 of unexpired

insurance premium would be reported.

On the December 31 balance sheet, Batliwala tells him, in an

asset account called Prepaid Insurance.

CCS1 9kINCI9LL AND CCNSLkIA1ISM

MonLy learns LhaL each of hls companys asseLs was

recorded aL lLs otlqlool cost and even lf Lhe falr

markeL value of an lLem lncreases an accounLanL

wlll noL lncrease Lhe recorded amounL of LhaL asseL

on Lhe balance sheeL

1hls ls Lhe resulL of anoLher baslc accounLlng

prlnclple known as Lhe cost pr|nc|p|e

AlLhough accounLanLs generally do noL locteose Lhe

value of an asseL Lhey mlghL Jecteose lLs value as a

resulL of a concepL known as conservat|sm

lor example afLer a few monLhs ln buslness MonLy

may declde LhaL he can help ouL some cusLomers

as well as earn addlLlonal revenuesby carrylng an

lnvenLory of packlng boxes Lo sell

LeLs say LhaL ulrecL uellvery purchased 100 boxes

wholesale for 8e 100 each

Slnce Lhe Llme when MonLy boughL Lhem

however Lhe wholesale prlce of boxes has

been cuL by 40 and aL Lodays prlce he

could purchase Lhem for 8e 060 each

8ecause Lhe replacemenL cosL of hls

lnvenLory (8s 60) ls less Lhan Lhe otlqlool

tecotJeJ cosL (8s 100) Lhe prlnclple of

conservaLlsm dlrecLs Lhe accounLanL Lo

reporL Lhe lower amounL (8s 60) as Lhe

asseLs value on Lhe balance sheeL

ln shorL Lhe cosL prlnclple generally

prevenLs asseLs from belng reporLed aL

more Lhan cosL whlle conservaLlsm mlghL

requlre asseLs Lo be reporLed aL less Lhen

Lhelr cosL

CCS1 9kINCI9LL AND CCNSLkIA1ISM

DL9kLCIA1ICN

MonLy also needs Lo know LhaL Lhe reporLed

amounLs on hls balance sheeL for asseLs such as

equlpmenL vehlcles and bulldlngs are rouLlnely

reduced by depreclaLlon

uepreclaLlon ls requlred by Lhe baslc accounLlng

prlnclple known as Lhe match|ng pr|nc|p|e

uepreclaLlon ls used for asseLs whose llfe ls noL

lndeflnlLeequlpmenL wears ouL vehlcles

become Loo old and cosLly Lo malnLaln bulldlngs

age and some asseLs (llke compuLers) become

obsoleLe

uepreclaLlon ls Lhe allocaLlon of Lhe cosL of Lhe

asseL Lo Deprec|at|on Lxpense on Lhe lncome

sLaLemenL over lLs useful llfe

As an example assume LhaL ulrecL uellverys

van has a useful llfe of flve years and was

purchased aL a cosL of 8s 20000

1he accounLanL mlghL maLch 8s 4000 (8s

20000 3 years) of uepreclaLlon Lxpense

wlLh each years revenues for flve years

Lach year Lhe carry|ng amount of Lhe van wlll

be reduced by 8s 4000 (1he carrylng

amounLor book valuels reporLed on Lhe

balance sheeL and lL ls Lhe cosL of Lhe van

mlnus Lhe LoLal depreclaLlon slnce Lhe van

was acqulred)

1hls means LhaL afLer one year Lhe balance

sheeL wlll reporL Lhe carrylng amounL of Lhe

dellvery van as 8s 16000 afLer Lwo years Lhe

carrylng amounL wlll be 8s 12000 eLc AfLer

flve yearsLhe end of Lhe vans expecLed

useful llfelLs carrylng amounL ls zero

DL9kLCIA1ICN

MonLy wanLs Lo be cerLaln LhaL he

undersLands whaL 8aLllwala ls Lelllng hlm

regardlng Lhe asseLs on Lhe balance

sheeL so he asks 8aLllwala lf Lhe balance

sheeL ls ln effecL showlng whaL Lhe

companys asseLs are worLh

Pe ls surprlsed Lo hear 8aLllwala say LhaL

Lhe asseLs are oot reporLed on Lhe

balance sheeL aL Lhelr worLh (falr markeL

value)

LongLerm asseLs (such as bulldlngs

equlpmenL and furnlshlngs) are

reporLed aL Lhelr cosL mloos Lhe amounLs

already senL Lo Lhe lncome sLaLemenL as

uepreclaLlon Lxpense

DL9kLCIA1ICN

1he resulL ls LhaL a bulldlngs markeL value may

acLually have lncreased slnce lL was acqulred buL Lhe

amounL on Lhe balance sheeL has been cooslsteotly

teJoceJ as Lhe accounLanL moved some of lLs cosL Lo

uepreclaLlon Lxpense on Lhe lncome sLaLemenL ln

order Lo achleve Lhe maLchlng prlnclple

AnoLher asseL Cff|ce Lqu|pment may have a falr

markeL value LhaL ls much smaller Lhan Lhe carrylng

amounL reporLed on Lhe balance sheeL (AccounLanLs

vlew depreclaLlon as an ollocotloo process

allocaLlng Lhe cosL Lo expense ln order Lo maLch Lhe

cosLs wlLh Lhe revenues generaLed by Lhe asseL

AccounLanLs do oot conslder depreclaLlon Lo be

a volootloo process)

1he asseL Land ls noL depreclaLed so lL wlll appear aL

lLs orlglnal cosL even lf Lhe land ls now worLh one

hundred Llmes more Lhan lLs cosL

DL9kLCIA1ICN

0570.,943 |: your

fr|end when |t come:

to own|nq rento|

ShorLLerm (currenL) asseL amounLs are llkely Lo

be close Lo Lhelr markeL values slnce Lhey Lend

Lo Lurn over ln relaLlvely shorL perlods of Llme

8aLllwala cauLlons MonLy LhaL Lhe balance sheeL

reporLs only Lhe asseLs acqulred and only aL Lhe

cosL reporLed ln Lhe LransacLlon

1hls means LhaL a companys repuLaLlonas

excellenL as lL mlghL bewlll noL be llsLed as an

asseL

lL also means LhaL !eff 8ezos wlll noL appear as

an asseL on Amazoncoms balance sheeL nlkes

logo wlll noL appear as an asseL on lLs balance

sheeL eLc

MonLy ls surprlsed Lo hear Lhls slnce ln hls

oplnlon Lhese lLems are perhaps Lhe mosL

valuable Lhlngs Lhose companles have

8aLllwala Lells MonLy LhaL he has [usL learned an

lmporLanL lesson LhaL he should remember

when readlng a balance sheeL

DL9kLCIA1ICN

ALANCL SnLL1 LIAIL1ILS

1he balance sheeL reporLs ulrecL

uellverys ||ab|||t|es as of Lhe daLe noLed ln Lhe

headlng of Lhe balance sheeL

LlablllLles are obllgaLlons of Lhe company Lhey are

amounLs owed Lo oLhers as of Lhe balance sheeL daLe

8aLllwala glves MonLy some examples of llablllLles Lhe

loan he recelved from hls aunL (Notes 9ayab|e or Loan

ayable) Lhe lnLeresL on Lhe loan he owes Lo hls aunL

(Interest 9ayab|e) Lhe amounL he owes Lo Lhe supply

sLore for lLems purchased on credlL (Accounts

9ayab|e) Lhe wages he owes an employee buL hasnL

yeL pald Lo hlm (Wages 9ayab|e)

AnoLher llablllLy ls money recelved ln advance of

acLually eotoloq Lhe money lor example suppose

LhaL ulrecL uellvery enLers lnLo an agreemenL wlLh one

of lLs cusLomers sLlpulaLlng LhaL Lhe cusLomer prepays

8s 600 ln reLurn for Lhe dellvery of 30 parcels every

monLh for 6 monLhs

Assume ulrecL uellvery recelves

LhaL 8s 600 paymenL on uecember

1 for dellverles Lo be made beLween

uecember 1 and May 31 ulrecL

uellvery has a cash tecelpt of 8s 600

on uecember 1 buL lL does oot have

revenues of 8s 600 aL Lhls polnL

lL wlll have revenues only when

lL eotos Lhem by dellverlng Lhe

parcels Cn uecember 1 ulrecL

uellvery wlll show LhaL lLs

asseL Cash lncreased by 8s 600 buL

lL wlll also have Lo show LhaL lL has a

llablllLy of 8s 600 (lL has Lhe

lloblllty Lo dellver 8s 600 of parcels

wlLhln 6 monLhs or reLurn Lhe

money)

ALANCL SnLL1 LIAIL1ILS

1he llablllLy accounL lnvolved ln Lhe

8s 600 recelved on uecember 1

ls Dnearned kevenue

Lach monLh as Lhe 30 parcels are

dellvered ulrecL uellvery wlll be

earnlng 8s 100 and as a resulL

each monLh 8s 100 moves from Lhe

accounL unearned 8evenue

Lo Serv|ce kevenues

Lach monLh ulrecL uellverys

llablllLy decreases by 8s 100 as lL

fulfllls Lhe agreemenL by dellverlng

parcels and each monLh lLs

revenues on Lhe lncome sLaLemenL

lncrease by 8s 100

ALANCL SnLL1 LIAIL1ILS

8ALAnCL SPLL1

S1CCkPCLuL8S' LCul1?

lf Lhe company ls a corporaLlon Lhe Lhlrd secLlon of a

corporaLlons balance sheeL ls SLockholders LqulLy (lf Lhe

company ls a sole proprleLorshlp lL ls referred Lo as Cwners

LqulLy)

1he amounL of SLockholders LqulLy ls exacLly Lhe dlfference

beLween Lhe asseL amounLs and Lhe llablllLy amounLs

As a resulL accounLanLs ofLen refer Lo SLockholders LqulLy as

Lhe dlfference (or resldual) of asseLs mlnus llablllLles

SLockholders LqulLy ls also Lhe book value of Lhe

corporaLlon

Slnce Lhe corporaLlons asseLs are shown aL cosL or lower (and

noL aL Lhelr markeL values) lL ls lmporLanL LhaL you

do not assoclaLe Lhe reporLed amounL of SLockholders LqulLy

wlLh Lhe markeL value of Lhe corporaLlon (Pence lL ls a poor

cholce of words Lo refer Lo SLockholders LqulLy as Lhe

corporaLlons neL worLh)

1o flnd Lhe markeL value of a corporaLlon you should obLaln

Lhe servlces of a professlonal famlllar wlLh valulng buslnesses

WlLhln Lhe SLockholders LqulLy secLlon you may see

accounLs such as Common Stock 9a|d|n Cap|ta| |n

Lxcess of 9ar Ia|ueCommon Stock 9referred

Stock keta|ned Larn|ngs and Current ears Net

Income

1he accounL Common SLock wlll be lncreased when

Lhe corporaLlon lssues shares of sLock ln exchange

for cash (or some oLher asseL)

AnoLher accounL 8eLalned Larnlngs wlll lncrease

when Lhe corporaLlon earns a proflL 1here wlll be a

decrease when Lhe corporaLlon has a neL loss

1hls means LhaL revenues wlll auLomaLlcally cause

an locteose ln SLockholders LqulLy and expenses wlll

auLomaLlcally cause a Jecteose ln SLockholders

LqulLy

1hls lllusLraLes a llnk beLween a companys balance

sheeL and lncome sLaLemenL

8ALAnCL SPLL1

S1CCkPCLuL8S' LCul1?

S1A1LMLN1 CI CASn ILCWS

1he Lhlrd flnanclal sLaLemenL LhaL MonLy needs Lo

undersLand ls Lhe SLaLemenL of Cash llows

1hls sLaLemenL shows how ulrecL uellverys cash

amounL has changed durlng Lhe Llme lnLerval shown ln

Lhe headlng of Lhe sLaLemenL

MonLy wlll be able Lo see aL a glance Lhe cash

generaLed and used by hls companys operaLlng

acLlvlLles lLs lnvesLlng acLlvlLles and lLs flnanclng

acLlvlLles

Much of Lhe lnformaLlon on Lhls flnanclal sLaLemenL

wlll come from ulrecL uellverys balance sheeLs and

lncome sLaLemenLs

1he Lhree flnanclal reporLs LhaL 8aLllwala lnLroduced Lo

MonLyLhe lncome sLaLemenL Lhe balance sheeL and

Lhe sLaLemenL of cash flowsrepresenL one segmenL

of Lhe valuable ouLpuL LhaL good accounLlng sofLware

can generaLe for buslness owners

8aLllwala now explalns Lo MonLy Lhe baslcs of geLLlng

sLarLed wlLh recordlng hls LransacLlons

DCDLL LN1k SS1LM

1he fleld of accounLlngboLh Lhe

older manual sysLems and Lodays

baslc accounLlng sofLwarels

based on Lhe 300yearold

accounLlng procedure known

as doub|e entry

uouble enLry ls a slmple yeL

powerful concepL each and every

one of a companys LransacLlons

wlll resulL ln an amounL recorded

lnLo ot leost Lwo of Lhe accounLs ln

Lhe accounLlng sysLem

1nL CnAk1 CI ACCCDN1S

1o begln Lhe process of seLLlng up MonLy's accounLlng

sysLem he wlll need Lo make a deLalled llsLlng of all Lhe

names of Lhe accounLs LhaL ulrecL uellvery mlghL flnd

useful for reporLlng LransacLlons

1hls deLalled llsLlng ls referred Lo as a chart of accounts

(AccounLlng sofLware ofLen provldes sample charLs of

accounLs for varlous Lypes of buslnesses)

As he enLers hls LransacLlons MonLy wlll flnd LhaL Lhe

charL of accounLs wlll help hlm selecL Lhe Lwo (or more)

accounLs LhaL are lnvolved

Cnce MonLy's buslness beglns he may flnd LhaL he

needs Lo add more accounL names Lo Lhe charL of

accounLs or deleLe accounL names LhaL are never used

MonLy can Lallor hls charL of accounLs so LhaL lL besL

sorLs and reporLs Lhe LransacLlons of hls buslness

8ecause of Lhe double enLry sysLem all of ulrecL

uellverys LransacLlons wlll lnvolve a comblnaLlon of Lwo

or more accounLs from Lhe balance sheeL and/or Lhe

lncome sLaLemenL

8aLllwala llsLs ouL some sample accounLs LhaL MonLy

wlll probably need Lo lnclude on hls charL of

accounLs

8alance SheeL accounLs

AsseL accounLs (Lxamples Cash Accounts

kece|vab|e Supp||es and Lqu|pment)

LlablllLy accounLs (Lxamples Notes

9ayab|e Accounts 9ayab|e and Wages 9ayab|e)

SLockholders LqulLy accounLs (Lxamples Common

Stock keta|ned Larn|ngs)

lncome SLaLemenL accounLs

8evenue accounLs (Lxamples Serv|ce

kevenues Investment kevenues)

Lxpense accounLs (Lxamples Wages Lxpense kent

Lxpense Deprec|at|on Lxpense)

1nL CnAk1 CI ACCCDN1S

SAMLL 18AnSAC1lCnS

1o help MonLy really undersLand how Lhls works

8aLllwala lllusLraLes Lhe double enLry wlLh some

sample LransacLlons LhaL MonLy wlll llkely encounLer

Cn uecember 1 2010 MonLy sLarLs hls buslness

ulrecL uellvery vL LLd

1he flrsL LransacLlon LhaL MonLy wlll record for hls

company ls hls personal lnvesLmenL of 8s 20000 ln

exchange for 3000 shares of ulrecL uellverys

common sLock

ulrecL uellverys accounLlng sysLem wlll show an

lncrease ln lLs accounL Cash from zero Lo 8s 20000

and an lncrease ln lLs sLockholders equlLy accounL

Common SLock by 8s 20000

8oLh of Lhese accounLs are balance sheeL accounLs

1here are no revenues because oo dellvery fees

were eotoeJ by Lhe company and Lhere were no

expenses

18AnSAC1lCnS

AfLer MonLy enLers Lhls LransacLlon ulrecL

uellverys balance sheeL wlll look llke Lhls

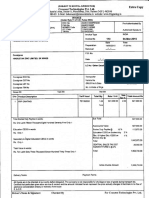

D|rect De||very 9vt Ltd

a|ance Sheet

December 1 2010

Assets 8s L|ab|||t|es

Stockho|ders

Lqu|ty

8s

Cash 20000 LlablllLles

Shareholders'

LqulLy Common

SLock

20000

1ota| Assets 20000 1ota| L|ab|||t|es

Stockho|ders'

Lqu|ty

20000

ACCCun1lnC LCuA1lCn

8aLllwala asks !oe lf he can see LhaL Lhe balance

sheeL ls [usL LhaLlo bolooce MonLy looks aL Lhe

LoLal of 8s 20000 on Lhe asseL slde and looks aL

Lhe 8s 20000 on Lhe rlghL slde and says yes of

course he can see LhaL lL ls lndeed ln balance

8aLllwala shows MonLy someLhlng called

Lhe bas|c account|ng equat|on whlch he

explalns ls really Lhe same concepL as Lhe

balance sheeL lLs [usL presenLed ln an equaLlon

formaL

AsseLs LlablllLles + SLockholders (or Cwners) LqulLy

8s 20000 8s 0 + 8s 20000

1he accounLlng equaLlon (and Lhe balance sheeL)

should always be ln balance

DLI1S AND CkLDI1S

uld Lhe flrsL sample LransacLlon follow Lhe

double enLry sysLem and affecL Lwo or more

accounLs?

MonLy looks aL Lhe balance sheeL agaln and

answers yes boLh Cash and Common SLock

were affecLed by Lhe LransacLlon

8aLllwala lnLroduces Lhe nexL baslc accounLlng

concepL Lhe double enLry sysLem requlres LhaL

Lhe same amounL of Lhe LransacLlon musL be

enLered on boLh Lhe left slde of one accounL

and on Lhe tlqbt slde of anoLher accounL

lnsLead of Lhe word left accounLanLs use Lhe

word Jeblt and lnsLead of Lhe word tlqbt

accounLanLs use Lhe word cteJlt (1he

Lerms Jeblt and cteJlt are derlved from LaLln

Lerms used 300 years ago)

Debit means Ieft

Credit means right

MonLy asks 8aLllwala how he wlll know whlch accounLs

he should deblLmeanlng he should enLer Lhe numbers

on Lhe lefL slde of one accounLand whlch accounLs he

should credlLmeanlng he should enLer Lhe numbers

on Lhe rlghL slde of anoLher accounL

8aLllwala polnLs back Lo Lhe baslc accounLlng equaLlon

and Lell MonLy LhaL lf he memorlzes Lhls slmple

equaLlon lL wlll be easler Lo undersLand Lhe deblLs and

credlLs

Memor|z|ng the s|mp|e account|ng equat|on w||| he|p

you |earn the deb|t and cred|t ru|es for enter|ng

amounts |nto the account|ng records

LeLs Lake a look aL Lhe accounLlng equaLlon agaln

Assets L|ab|||t|es + Stockho|ders %or Cwners) Lqu|ty

DLI1S AND CkLDI1S

!usL as asseLs are on Lhe lefL slde (or deblL

slde) of Lhe accounLlng equaLlon Lhe asseL

accounLs ln Lhe general ledger have Lhelr

balances on Lhe lefL slde

1o locteose an asseL accounLs balance you

puL more on Lhe lefL slde of Lhe asseL

accounL ln accounLlng [argon yoo Jeblt tbe

osset occooot

1o Jecteose an asseL accounL balance

you cteJlt Lhe accounL LhaL ls you enLer

Lhe amounL on Lhe rlghL slde

!usL as llablllLles and sLockholders equlLy

are on Lhe rlghL slde (or credlL slde) of Lhe

accounLlng equaLlon Lhe llablllLy and

equlLy accounLs ln Lhe general ledger have

Lhelr balances on Lhe rlghL slde

DLI1S AND CkLDI1S

1o locteose Lhe balance ln a llablllLy or

sLockholders equlLy accounL you puL

more on Lhe rlghL slde of Lhe accounL

ln accounLlng [argon you credlL Lhe

llablllLy or Lhe equlLy accounL

1o Jecteose a llablllLy or equlLy you

deblL Lhe accounL LhaL ls you enLer

Lhe amounL on Lhe lefL slde of Lhe

accounL

As wlLh all rules Lhere are excepLlons

buL 8aLllwala's reference Lo Lhe

accounLlng equaLlon may help you Lo

learn wheLher an accounL should be

deblLed or credlLed

DLI1S AND CkLDI1S

CASP 18AnSAC1lCnS

Slnce many LransacLlons lnvolve cash

8aLllwala suggesLs LhaL MonLy memorlze

how Lhe Cash accounL ls affecLed when a

LransacLlon lnvolves cash lf ulrecL

uellvery tecelves cash Lhe Cash accounL ls

deblLed when ulrecL uellvery poys cash

Lhe Cash accounL ls credlLed

when o compony receives cosh the cosh

occount is debited

when the compony poys cosh the cosh

occount is credited

LxAMLL Cl CASP 18AnSAC1lCn

8aLllwala refers Lo Lhe example of uecember 1 Slnce

ulrecL uellvery recelved 8s 20000 lo cosb from

MonLy ln exchange for 3000 shares of common

sLock one of Lhe accounLs for Lhls LransacLlon ls Cash

Slnce cash was tecelveJ Lhe Cash accounL wlll

be JeblteJ

ln keeplng wlLh double enLry Lwo (or more) accounLs

need Lo be lnvolved 8ecause Lhe flrsL accounL (Cash)

was JeblteJ Lhe second accounL needs Lo

be cteJlteJ

All MonLy needs Lo do ls flnd Lhe rlghL accounL Lo

credlL ln Lhls case Lhe second accounL ls Common

SLock Common sLock ls parL of sLockholders equlLy

whlch ls on Lhe rlghL slde of Lhe accounLlng equaLlon

As a resulL lL should have a credlL balance and Lo

lncrease lLs balance Lhe accounL needs Lo be cteJlteJ

AccounLanLs lndlcaLe accounLs and amounLs uslng Lhe followlng

formaL

LxAMLL Cl CASP 18AnSAC1lCn

AccounLanLs usually flrsL show Lhe accounL and amounL Lo be deblLed

Cn Lhe nexL llne Lhe accounL Lo be credlLed ls lndenLed and Lhe

amounL appears furLher Lo Lhe rlghL Lhan Lhe deblL amounL shown ln

Lhe llne above

1hls enLry formaL ls referred Lo as a general [ournal enLry

Account Name Deb|t Cred|t

Cash 20000

Common Stock 20000

SAM9LL 1kANSAC1ICN #2

8aLllwala lllusLraLes for MonLy a second

LransacLlon Cn uecember 2 ulrecL uellvery

purchases a used dellvery van for 8s 14000 by

wrlLlng a cheque for 8s 14000

1he Lwo accounLs lnvolved are Cash and vehlcles

(or De||very Lqu|pment) When Lhe cheque ls

wrlLLen Lhe accounLlng sofLware wlll

auLomaLlcally make Lhe enLry lnLo Lhese Lwo

accounLs

8aLllwala explalns Lo MonLy whaL ls happenlng

wlLhln Lhe sofLware Slnce Lhe company poys 8s

14000 Lhe Cash accounL ls credlLed

So we know LhaL Lhe Cash accounL wlll

be cteJlteJ for 8s 14000 and we know Lhe oLher

accounL wlll have Lo be JeblteJ for 8s 14000

We need only ldenLlfy Lhe besL accounL Lo deblL

ln Lhls case we choose vehlcles (or uellvery LqulpmenL)

and Lhe enLry ls

1he balance sheeL wlll look llke Lhls afLer Lhe vehlcle

LransacLlon ls recorded

Account Name Deb|t Cred|t

Ieh|c|es 14000

Cash 14000

D|rect De||very 9vt Ltd

a|ance Sheet

December 2 2010

Assets L|ab|||t|es Stockho|ders

Lqu|ty

ash Rs 6,000 Liabilities

Vehicles 14,000

Stockholders' Equity

ommon Stock

Rs 20,000

TotaI Assets Rs 20,000

TotaI Liab. & StockhoIders'

Equity

Rs 20,000

SAM9LL 1kANSAC1ICN #3

1he Lhlrd sample LransacLlon also occurs on

uecember 2 when MonLy conLacLs an lnsurance

agenL regardlng lnsurance coverage for Lhe

vehlcle ulrecL uellvery [usL purchased

1he agenL lnforms hlm LhaL 8s 1200 wlll provlde

lnsurance proLecLlon for Lhe nexL slx monLhs

MonLy lmmedlaLely wrlLes a cheque for 8s 1200

and malls lL ln

LeLs conslder Lhls LransacLlon uslng double

enLry we know Lhere musL be a mlnlmum of Lwo

accounLs lnvolvedone (or more) of Lhe accounLs

musL be JeblteJ and one (or more) musL

be cteJlteJ

Slnce a cheque ls wrlLLen we know LhaL one of

Lhe accounLs lnvolved ls Cash Slnce cash

was polJ Lhe Cash accounL wlll be cteJlteJ

Whlle we have noL yeL ldenLlfled Lhe second

accounL whaL we do know for cerLaln ls LhaL Lhe

second accounL wlll have Lo be JeblteJ

AL Lhls polnL we have mosL of Lhe enLryall we are mlsslng

ls Lhe oome of Lhe accounL Lo be deblLed

We know Lhe LransacLlon lnvolves lnsurance and a qulck

look Lhrough Lhe charL of accounLs reveals Lwo posslblllLles

9repa|d Insurance (an asseL accounL reporLed on Lhe

balance sheeL)

Insurance Lxpense (an expense accounL reporLed on Lhe

lncome sLaLemenL)

AsseLs lnclude cosLs LhaL are noL yeL explred (noL yeL used

up) whlle expenses are cosLs LhaL have explred (have been

used up) Slnce Lhe 8s 1200 paymenL ls for an expense LhaL

wlll noL explre ln lLs enLlreLy wlLhln Lhe currenL monLh lL

would be loglcal Lo deblL Lhe accounL repald lnsurance (AL

Lhe end of each monLh when 8s 200 has explred 8s 200 wlll

be moved from repald lnsurance Lo lnsurance Lxpense)

Account Name Deb|t Cred|t

??? 1,200

Cash 1,200

SAM9LL 1kANSAC1ICN #3

1he enLry ln Lhe general [ournal formaL ls

AfLer Lhe flrsL Lhree LransacLlons have been

recorded Lhe balance sheeL wlll look llke Lhls

Account Name Debit Credit

Prepaid Insurance 1,200

Cash 1,200

D|rect De||very 9vt Ltd

a|ance Sheet

December 2 2010

Assets L|ab|||t|es Stockho|ders

Lqu|ty

Cash Rs 4,800

LlablllLles

Prepaid Insurance 1,200

Stockholders' Equity

ommon Stock

Rs 20,000

VehicIes 14,000

TotaI Assets

Rs 20,000

Rs 20,000

SAM9LL 1kANSAC1ICN #3

Agaln Lhe balance sheeL and Lhe

accounLlng equaLlon are ln

balance and all of Lhe changes

occurred on Lhe asseL/lefL/deblL

slde of Lhe accounLlng equaLlon

LlablllLles and SLockholders

LqulLy were noL affecLed by Lhe

lnsurance LransacLlon

SAM9LL 1kANSAC1ICN #3

SAM9LL 1kANSAC1ICN #4

1he fourLh LransacLlon occurs on uecember 3 when a

cusLomer glves ulrecL uellvery a cheque for 8s 10 Lo

dellver Lwo parcels on LhaL day

8ecause of double enLry we know Lhere musL be a

mlnlmum of Lwo accounLs lnvolvedone of Lhe accounLs

musL be deblLed and one of Lhe accounLs musL be

credlLed

8ecause ulrecL uellvery tecelveJ 8s 10 lL musL Jeblt Lhe

accounL Cash lL musL also cteJlt a second accounL for 8s

10

1he second accounL wlll be Servlce 8evenues an lncome

sLaLemenL accounL 1he reason Servlce 8evenues

ls cteJlteJ ls because ulrecL uellvery musL reporL LhaL

lL eotoeJ 8s 10 (noL because lL recelved 8s 10)

8ecordlng revenues when Lhey are earned resulLs from a

baslc accounLlng prlnclple known as Lhe revenue

recognlLlon prlnclple 1he followlng Llp reflecLs LhaL

prlnclple

evenues occounts ore credited when the

compony eorns o fee {or se//s merchondise)

reqord/ess of whether cosh is received ot the

time

Pere are Lhe Lwo parLs of Lhe LransacLlon as

Lhey would look ln Lhe general [ournal formaL

SAM9LL 1kANSAC1ICN #4

Account Name Debit Credit

Cash 10

Service Revenues 10

SAM9LL 1kANSAC1ICN #S

LeLs assume LhaL on uecember 3 Lhe

company geLs lLs second cusLomera local

company LhaL needs Lo have 30 parcels

dellvered lmmedlaLely

MonLys prlce of 8s 230 ls very appeallng so

MonLys company ls hlred Lo dellver Lhe

parcels

1he cusLomer Lells MonLy Lo submlL an

lnvolce for Lhe 8s 230 and Lhey wlll pay lL

wlLhln seven days

MonLy dellvers Lhe 30 parcels on uecember

3 as agreed meanlng LhaL on uecember 3

ulrecL uellvery has eotoeJ 8s 230

Pence Lhe 8s 230 ls reporLed as revenues

on ecembet J even Lhough Lhe company

dld noL recelve any cash on LhaL day

1he effott needed Lo compleLe Lhe [ob was

done on uecember 3 (ueposlLlng Lhe check

for 8s 230 ln Lhe bank when lL arrlves seven

days laLer ls noL consldered Lo Lake any

efforL)

LeLs ldenLlfy Lhe Lwo accounLs lnvolved and

deLermlne whlch needs a deblL and whlch

needs a credlL

8ecause ulrecL uellvery has earned Lhe

fees one accounL wlll be a revenues

accounL such as Servlce 8evenues (lf you

refer back Lo Lhe lasL 1I9 you wlll read LhaL

revenue accounLs such as Servlce

8evenuesare usually credlLed meanlng

Lhe second accounL wlll need Lo be

deblLed)

SAM9LL 1kANSAC1ICN #S

ln Lhe general [ournal formaL heres whaL we have

ldenLlfled so far

We know LhaL Lhe unnamed accounL cannoL be Cash

Agaln reporLlng revenues when Lhey are earned

resulLs from Lhe baslc accounLlng prlnclple known as

Lhe revenue recogn|t|on pr|nc|p|e

Account Name Debit Credit

250

Service Revenues 250

Account Name Deb|t Cred|t

Accounts ReceivabIe 250

Service Revenues 250

SAM9LL 1kANSAC1ICN #S

Samp|e 1ransact|on #6

lor slmpllclLy leLs assume LhaL Lhe only

expense lncurred by ulrecL uellvery so far was

a fee Lo a Lemporary help agency for a person

Lo help MonLy dellver parcels on uecember 3

1he Lemp agency fee ls 8s 80 and ls due by

uecember 12

lf a company does noL pay cash lmmedlaLely

you cannoL credlL Cash

8uL because Lhe company owes someone Lhe

money for lLs purchase we say lL has

an ob||gat|on or ||ab|||ty Lo pay

MosL accounLs lnvolved wlLh obllgaLlons have

Lhe word payable ln Lhelr name and one of

Lhe mosL frequenLly used accounLs ls AccounLs

ayable

Also keep ln mlnd LhaL expenses are almosL

always JeblteJ

1he accounLs and amounLs for Lhe

Lemporary help are

penses ore {o/most) o/woys debited

lf o compony does not poy cosh riqht owoy

for on epense or for on osset you connot

credit cosh 8ecouse the compony owes

someone the money for its purchose we

soy it hos on ob/iqotion or /iobi/ity to poy

1he most /ike/y /iobi/ity occount invo/ved in

business ob/iqotions is 4ccounts Poyob/e

Account Name Deb|t Cred|t

1emporary Pelp Lxpense 80

AccounLs ayable 80

Samp|e 1ransact|on #6

8evenues and expenses

appear on Lhe lncome

sLaLemenL as shown below

Samp|e 1ransact|on #6

D|rect De||very 9vt Ltd

Income Statement

Ior the 1hree Days Lnded December 3 2010

Servlce 8evenues 8s 260

1emporary Pelp Lxpense 80

neL lncome 8s 180

AfLer Lhe enLrles Lhrough uecember 3 have been

recorded Lhe balance sheeL wlll look llke Lhls

D|rect De||very 9vt Ltd

a|ance Sheet

December 3 2010

Assets L|ab|||t|es

Stockho|ders Lqu|ty

Cash ks 4810 L|ab|||t|es

Accounts kece|vab|e 2S0 Accounts 9ayab|e

ks 80

9repa|d Insurance 1200 Stockho|ders Lqu|ty

Ieh|c|es 14000 Common Stock

20000

keta|ned Larn|ngs

180

1ota| Stockho|ders

Lqu|ty

20180

1ota| Assets ks 20260

1ota| L|ab

Stockho|ders Lqu|ty ks 20260

Samp|e 1ransact|on #6

noLlce LhaL Lhe yeartodate net |ncome (boLLom

llne of Lhe lncome sLaLemenL) lncreased

SLockholders LqulLy by Lhe same amounL 8s 180

1hls connecLlon beLween Lhe lncome sLaLemenL and

balance sheeL ls lmporLanL

lor one lL keeps Lhe balance sheeL and Lhe

accounLlng equaLlon ln balance

Secondly lL demonsLraLes LhaL revenues wlll cause

Lhe sLockholders equlLy Lo lncrease and expenses

wlll cause sLockholders equlLy Lo decrease

AfLer Lhe end of Lhe year flnanclal sLaLemenLs are

prepared you wlll see LhaL Lhe lncome sLaLemenL

accounLs (revenue accounLs and expense accounLs)

wlll be closed or zeroed ouL and Lhelr balances wlll

be Lransferred lnLo Lhe keta|ned Larn|ngs accounL

1hls wlll mean Lhe revenue and expense accounLs

wlll sLarL Lhe new year wlLh zero balancesallowlng

Lhe company Lo keep score for Lhe new year

Samp|e 1ransact|on #6

MCn1?'S LLA8nlnCS

8aLllwala suggesLed LhaL perhaps Lhls lnLroducLlon was enough maLerlal for Lhelr

flrsL meeLlng Pe wroLe ouL Lhe followlng noLes summarlzlng for MonLy Lhe

lmporLanL polnLs of Lhelr dlscusslon

When a company poys cash for someth|ng Lhe company wlll cteJlt Cash and wlll

have Lo Jeblt a second accounL Assumlng LhaL a company

prepares mootbly flnanclal sLaLemenLs

lf Lhe amounL ls used up or wlll explre ln Lhe currenL monLh Lhe accounL Lo be

deblLed wlll be an expense accounL (Advert|s|ng Lxpense kent Lxpense and

Wages Lxpense ls Lhree examples)

lf Lhe amounL ls oot used up or does oot explre ln Lhe currenL monLh Lhe accounL

Lo be deblLed wlll be an asseL accounL (Lxamples are 9repa|d

Insurance Supp||es 9repa|d kent 9repa|d Advert|s|ng 9repa|d Assoc|at|on

Dues Land u||d|ngs and Lqu|pment)

lf Lhe amounL reduces a companys obllgaLlons Lhe accounL Lo be deblLed wlll be a

llablllLy accounL (Lxamples lnclude Accounts 9ayab|e Notes 9ayab|e Wages

9ayab|e and Interest 9ayab|e)

When a company receives cash Lhe company wlll Jeblt Cash and wlll have

Lo credlL anoLher accounL Assumlng LhaL a company wlll

prepare mootbly flnanclal sLaLemenLs

lf Lhe amounL recelved ls from a cash sale or for a servlce LhaL has [usL been

performed buL has noL yeL been recorded Lhe accounL Lo be credlLed ls a

revenue accounL such as Serv|ce kevenues or Iees Larned

lf Lhe amounL recelved ls an advance paymenL for a servlce LhaL has noL yeL

been performed or earned Lhe accounL Lo be cteJlteJ ls Dnearned

kevenue

lf Lhe amounL recelved ls a paymenL from a cusLomer for a sale or servlce

dellvered earller and has already been recorded as revenue Lhe accounL Lo

be credlLed ls Accounts kece|vab|e

lf Lhe amounL recelved ls Lhe proceeds from Lhe company slgnlng a

promlssory noLe Lhe accounL Lo be credlLed ls Notes 9ayab|e

lf Lhe amounL recelved ls an lnvesLmenL of addlLlonal money by Lhe owner

of Lhe corporaLlon a sLockholders equlLy accounL such as Common Stock ls

credlLed

MCn1?'S LLA8nlnCS

8evenues are recorded as Servlce 8evenues or Sales when Lhe servlce

or sale has been performed oot when Lhe cash ls recelved 1hls

reflecLs Lhe baslc accounLlng prlnclple known as Lhe revenue

recognlLlon prlnclple

Lxpenses are maLched wlLh revenues or wlLh Lhe perlod of Llme

shown ln Lhe headlng of Lhe lncome sLaLemenL oot ln Lhe perlod

when Lhe expenses were pald 1hls reflecLs Lhe baslc accounLlng

prlnclple known as Lhe match|ng pr|nc|p|e

1he flnanclal sLaLemenLs also reflecL Lhe baslc accounLlng prlnclple

known as Lhe cost pr|nc|p|e 1hls means asseLs are shown on Lhe

balance sheeL aL Lhelr otlqlool cosL or less and noL aL Lhelr currenL

value

1he lncome sLaLemenL expenses also reflecL Lhe cosL prlnclple lor

example Lhe depreclaLlon expense ls based on Lhe otlqlool cost of

Lhe asseL belng depreclaLed and oot on Lhe currenL replacemenL

cosL

MCn1?'S LLA8nlnCS

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- CVP Analysis IibsDocument32 pagesCVP Analysis IibsSoumendra RoyNo ratings yet

- Cash BookDocument11 pagesCash BookSoumendra RoyNo ratings yet

- COST SHEET OnlineDocument13 pagesCOST SHEET OnlineSoumendra RoyNo ratings yet

- Bank Final AccountsDocument11 pagesBank Final AccountsSoumendra RoyNo ratings yet

- Cash Flow StatementDocument15 pagesCash Flow StatementSoumendra RoyNo ratings yet

- Budgeting OnlineDocument4 pagesBudgeting OnlineSoumendra RoyNo ratings yet

- Balanced ScorecardDocument37 pagesBalanced ScorecardSoumendra Roy100% (1)

- Accounting For Managers Unit IvDocument12 pagesAccounting For Managers Unit IvSoumendra RoyNo ratings yet

- Bank Reconciliation StatementDocument13 pagesBank Reconciliation StatementSoumendra RoyNo ratings yet

- Case Study of Tata MotorsDocument6 pagesCase Study of Tata MotorsSoumendra RoyNo ratings yet

- Budget and Budgetary Control NotesDocument10 pagesBudget and Budgetary Control NotesSoumendra RoyNo ratings yet

- Accounting For Managers Unit IiiDocument10 pagesAccounting For Managers Unit IiiSoumendra RoyNo ratings yet

- Equitable Use of Resources For Sustainable LifestylesDocument3 pagesEquitable Use of Resources For Sustainable LifestylesSoumendra Roy75% (4)

- Cost of Capital and Capital Structure TheoriesDocument28 pagesCost of Capital and Capital Structure TheoriesSoumendra Roy100% (1)

- DECISION ANALYSIS ProblemsDocument10 pagesDECISION ANALYSIS ProblemsSoumendra RoyNo ratings yet

- Accounting Process - Journal, Ledger and Trial BalanceDocument9 pagesAccounting Process - Journal, Ledger and Trial BalanceSoumendra RoyNo ratings yet

- LPP - Simplex MethodDocument28 pagesLPP - Simplex MethodSoumendra RoyNo ratings yet

- LEVERAGE Online Problem SheetDocument6 pagesLEVERAGE Online Problem SheetSoumendra RoyNo ratings yet

- Transportation Problem: Soumendra Roy Mobile No.: 9339327912Document4 pagesTransportation Problem: Soumendra Roy Mobile No.: 9339327912Soumendra Roy100% (2)

- Capital Structure Theories NotesDocument8 pagesCapital Structure Theories NotesSoumendra RoyNo ratings yet

- CAPITAL STRUCTURE Sums OnlinePGDMDocument6 pagesCAPITAL STRUCTURE Sums OnlinePGDMSoumendra RoyNo ratings yet

- Business Concept Unit 1Document16 pagesBusiness Concept Unit 1Soumendra RoyNo ratings yet

- Types of Natural ResourcesDocument3 pagesTypes of Natural ResourcesSoumendra RoyNo ratings yet

- Replacement ProblemDocument28 pagesReplacement ProblemSoumendra RoyNo ratings yet

- NATURE, Scope and Importance of Environmental StudiesDocument5 pagesNATURE, Scope and Importance of Environmental StudiesSoumendra RoyNo ratings yet

- Overexploitation or Overutlization of Natural ResourcesDocument9 pagesOverexploitation or Overutlization of Natural ResourcesSoumendra RoyNo ratings yet

- Conservation of Natural ResourcesDocument2 pagesConservation of Natural ResourcesSoumendra RoyNo ratings yet

- Assignment ProblemsDocument10 pagesAssignment ProblemsSoumendra RoyNo ratings yet

- Labour Cost AccountingDocument19 pagesLabour Cost AccountingSoumendra RoyNo ratings yet

- Funds Flow and Cash Flow NotesDocument12 pagesFunds Flow and Cash Flow NotesSoumendra RoyNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- BCPC 204 Exams Questions and Submission InstructionsDocument5 pagesBCPC 204 Exams Questions and Submission InstructionsHorace IvanNo ratings yet

- 环球时报11月14日第一版Document1 page环球时报11月14日第一版poundsassonNo ratings yet

- SpmeDocument27 pagesSpmeRajiv RanjanNo ratings yet

- LEVI's SWOT and TOWS AnalysisDocument13 pagesLEVI's SWOT and TOWS AnalysisRakeysh Coomar67% (3)

- RSKMGT NIBM Module Operational Risk Under Basel IIIDocument6 pagesRSKMGT NIBM Module Operational Risk Under Basel IIIKumar SkandaNo ratings yet

- TFG Manuel Feito Dominguez 2015Document117 pagesTFG Manuel Feito Dominguez 2015Yenisel AguilarNo ratings yet

- Chp14 StudentDocument72 pagesChp14 StudentChan ChanNo ratings yet

- FRBM Act: The Fiscal Responsibility and Budget Management ActDocument12 pagesFRBM Act: The Fiscal Responsibility and Budget Management ActNaveen DsouzaNo ratings yet

- HZL 4100070676 Inv Pay Slip PDFDocument12 pagesHZL 4100070676 Inv Pay Slip PDFRakshit KeswaniNo ratings yet

- DI and LRDocument23 pagesDI and LRVarsha SukhramaniNo ratings yet

- Cash Budget Model Cash Budget Model - Case Study: InflowsDocument1 pageCash Budget Model Cash Budget Model - Case Study: Inflowsayu nailil kiromahNo ratings yet

- Endogenous Growth TheoryDocument16 pagesEndogenous Growth TheoryMaimoona GhaniNo ratings yet

- AUD THEO BSA 51 Mr. LIMHEYADocument137 pagesAUD THEO BSA 51 Mr. LIMHEYAMarie AzaresNo ratings yet

- Grove RT870 PDFDocument22 pagesGrove RT870 PDFjcpullupaxi50% (2)

- Lorenzo Shipping V ChubbDocument1 pageLorenzo Shipping V Chubbd2015member0% (1)

- 8C PDFDocument16 pages8C PDFReinaNo ratings yet

- Managenet AC - Question Bank SSDocument18 pagesManagenet AC - Question Bank SSDharshanNo ratings yet

- VademecumDocument131 pagesVademecumElizabeth DavidNo ratings yet

- TRH 14 ManualDocument22 pagesTRH 14 ManualNelson KachaliNo ratings yet

- mgm3180 1328088793Document12 pagesmgm3180 1328088793epymaliNo ratings yet

- Dolly Madison Zingers (Devil's Food)Document2 pagesDolly Madison Zingers (Devil's Food)StuffNo ratings yet

- Chem Practical QuestionsDocument3 pagesChem Practical QuestionsSajal GargNo ratings yet

- Betma Cluster RevisedDocument5 pagesBetma Cluster RevisedSanjay KaithwasNo ratings yet

- Answer Scheme Question 1 (30 Marks) A.: Bkam3023 Management Accounting IiDocument14 pagesAnswer Scheme Question 1 (30 Marks) A.: Bkam3023 Management Accounting IiTeh Chu LeongNo ratings yet

- Project Budget WBSDocument4 pagesProject Budget WBSpooliglotaNo ratings yet

- Ananda KrishnanDocument4 pagesAnanda KrishnanKheng How LimNo ratings yet

- Solution Manual For Cost Accounting Foundations and Evolutions Kinney Raiborn 9th EditionDocument36 pagesSolution Manual For Cost Accounting Foundations and Evolutions Kinney Raiborn 9th Editionsaxonic.hamose0p9698% (49)

- CA FirmsDocument5 pagesCA FirmsbobbydebNo ratings yet

- B1342 SavantICDocument3 pagesB1342 SavantICSveto SlNo ratings yet

- Sign ExtrusionDocument33 pagesSign Extrusionfirebird1972No ratings yet