Professional Documents

Culture Documents

06 - 2pm - Hedge - Fund - Presentation - Bourland

Uploaded by

Himanshu GondOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

06 - 2pm - Hedge - Fund - Presentation - Bourland

Uploaded by

Himanshu GondCopyright:

Available Formats

THE STRUCTURE AND OPERATIONS OF HEDGE FUNDS

First

Hedge Fund

Formed by Alfred Winslow Jones in 1949 Started with $100,000 Between 1955-1965 had returns of 670% Primarily long positions, but also short

Black

Box Funds

Esoteric Portfolio Theory Highly complex mathematical formulas Computer driven Quants

Hedge

Fund

a private investment vehicle that engages in the active trading of various types of securities and commodities, employ sophisticated investment techniques, such as arbitrage, leverage, and hedging and whose structure and operations are designed to promote the goal of absolute returns.

Pooled/Partnerships

of Investment advisors registered with the Securities & Exchange Commission

Frequently invested in one or more upper tier partnerships Low turn over of investments Low turn over of partners and partners are often committed to additional contributions There are usually no distributions until investment in upper tier is sold

Long

Term Capital

When Genius Failed by Roger Lowenstein

Players

James Simons John Paulson

Former

Math Professor Code Breaker for Department of Defense Uses computer driven models to detect pricing anomalies in stocks, commodities, futures, and options Charges 5 and 44 Earns over 20% for his partners over a multi-year period

Worked in mergers & acquisitions at

Bear Stearns

Founded his own hedge fund with $2 million and 2 employees Under his direction, Paulson & Co. capitalized on the problem in the foreclosure and mortgage backed

securities market In 2007 alone his firm earned $15 billion! He personally made $3.7 billion In 2008, his firm hired former Fed Chairman, Alan Greenspan

Management Incentive

Fee

% of total assets in fund usually 2%

Fee

% of net income usually 20% High water mark

Meaning no compensation for manager if he/she has net income in year one but, falls behind in year 2, than no more incentive until he gets back to where he was. High water mark may only apply for 2 years

Absolute

Return Strategy vs. Relative Return Strategy

Relative is relative to something else, i.e., Standard & Poors You cant eat relative returns! Absolute returns stand alone Alpha producing returns not tied to an index

Four

Primary Characteristics

Organized as partnerships with the General Partner having a significant investment Managers are compensated based on fund performance Investors purchase interest in fund for a % of a fund profit. Interests are significant, restricted transferability and limited redemption Provide liquidity and capital to the market place

A role that has been vacated by the large brokerage firms as they have shut down their proprietary trading desks

Limited

Partnerships/LLC Fees typically are 2 and 20 Normally utilize a high water mark or hurdle rate

No

Claw back provision

Limited

redemption opportunities Governed by the partnership agreement Approximately 8,000 hedge funds with more than $2.68 trillion currently

Unlimited types of investments Shorts permitted Margins permitted

rules

Types

Fund of Funds Master Feeder Funds

of Funds

3(c)(7) Fund under 500 investors, limited to only qualified investors (investors with over $5 million in liquid, investable assets) 3(c)(1) Fund under 100 investors and limited to 35 nonaccredited sophisticated investors (accredited investors have excess of $200,000 of annual income or a minimum of $1 million in net worth exclusive of Primary residence Except for the exemption under Sec. 3(c)(1) or Sec. (c) (7) above, hedge funds would fall under the regulations for regulated investment companies

Assets are pooled into one account and managed as a single portfolio Profits and losses are allocated on where funds come from (capital contributions/distributions)

Entry

normally limited to yearly, quarterly, or monthly per partnership agreement Sold through a private placement memorandum

Partnership Agreement Subscription Agreement

Administration/Operations

Prime Broker

Execution of trades done monthly through trading screens piped through the internet to a broker Provides portfolio reporting, securities lending, office space, technology help, leverage, etc. Could be the prime broker or a non-clearing broker Provides office space, computer, and the rest of build out in the office quarters

Hedge Fund Hotels

Administrator

Provide general ledger accounting The allocation of income and expenses and gains and losses to the partners Calculation of management and incentive fees, high-water-marks and hurdle rates There is an interface between what the prime broker provides and what the administrator provides

The prime broker often provides a special trade date run that complies with U.S. GAAP

Accounting

Break Period

Occurs as partners ownership percentages changes through purchases and redemptions

Aggregate Method vs. Layering Method

The Aggregate Method does not take into account each partners individual portion of unrealized gain or loss for each security held by the fund

Allocations are based on the unrealized gain or loss of the partnerships securities as a whole

The Layering Method accounts for each partners share of unrealized gain or loss generated on each security over a period of time

Rule 206(4), an investment advisor registered with the Sec and acting as general partner to a pooled investment vehicle, such as a hedge fund, and has custody of the clients assets is subject to this rule. 1

Must maintain clients funds and securities with a qualified custodian Must be audited annually Must distribute audited U.S. GAAP financial statements to all investors within 120 days of the end of the fiscal year or 180 days for Fund-of-Funds Must have a compliance officer

1

Hedge funds must register with the Securities and Exchange Commission when they have $100 million in assets.

You might also like

- Vanguard InvestingDocument40 pagesVanguard InvestingrasmussenmachineNo ratings yet

- 6 components of the Code of Ethics and 7 Standards of Professional ConductDocument258 pages6 components of the Code of Ethics and 7 Standards of Professional ConductBrook Rene Johnson71% (7)

- Blackstone IPO Group 13Document12 pagesBlackstone IPO Group 13AnirudhNo ratings yet

- Private Equity ExplainedDocument27 pagesPrivate Equity Explainedleonnox100% (2)

- 1 - 11 Process MappingDocument54 pages1 - 11 Process MappingRajanishshetty100% (4)

- Fund Structure, Fundraising & FeesDocument20 pagesFund Structure, Fundraising & Feesvarunbhalla91No ratings yet

- Recent Development of Digital Oil FieldDocument23 pagesRecent Development of Digital Oil FieldMohit AgarwalNo ratings yet

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.From EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.No ratings yet

- Investor PresentationDocument39 pagesInvestor PresentationhowellstechNo ratings yet

- Commercial RE Private Equity Understand and Navigating The Options Workshop PrimerDocument65 pagesCommercial RE Private Equity Understand and Navigating The Options Workshop PrimerPropertywizz100% (2)

- Ebook FB AdsDocument86 pagesEbook FB AdsPMK100% (2)

- Logical and Physical Access Control PresentationDocument18 pagesLogical and Physical Access Control PresentationHimanshu GondNo ratings yet

- FMV of Equity Shares As On 31st January 2018Document57 pagesFMV of Equity Shares As On 31st January 2018Manish Maheshwari100% (2)

- FinQuiz - Smart Summary - Study Session 18 - Reading 60Document14 pagesFinQuiz - Smart Summary - Study Session 18 - Reading 60Rafael0% (1)

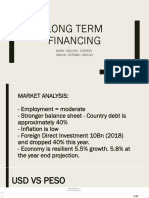

- Long-Term Financing Options for Fultex's $81M ExpansionDocument36 pagesLong-Term Financing Options for Fultex's $81M ExpansionJane Baylon100% (2)

- Concise Australian Commercial Law by Clive Trone Turner John Gamble Roger - NewDocument659 pagesConcise Australian Commercial Law by Clive Trone Turner John Gamble Roger - NewPhương TạNo ratings yet

- Operations Management of Coca ColaDocument3 pagesOperations Management of Coca ColaWahab Javaid58% (12)

- Hedge Funds. A Basic OverviewDocument41 pagesHedge Funds. A Basic OverviewBilal MalikNo ratings yet

- Understanding Investment ObjectivesDocument5 pagesUnderstanding Investment ObjectivesDas RandhirNo ratings yet

- Asset Alliance Manager Participation Fund FactsheetDocument2 pagesAsset Alliance Manager Participation Fund FactsheetAsset AllianceNo ratings yet

- SKI employee dismissed after resignation from India projectDocument4 pagesSKI employee dismissed after resignation from India projectJB GuevarraNo ratings yet

- Introduction To Hedge FundsDocument45 pagesIntroduction To Hedge Fundseschmi04No ratings yet

- 5418 Assignment # 01Document24 pages5418 Assignment # 01noorislamkhanNo ratings yet

- AIM3Document12 pagesAIM3prachiNo ratings yet

- Glossary of Investment Terms Guide for Online ReportDocument5 pagesGlossary of Investment Terms Guide for Online ReportGantulga NamdaldagvaNo ratings yet

- The A 2 Z of Hedge Funds ': by Gaurav ChorariaDocument15 pagesThe A 2 Z of Hedge Funds ': by Gaurav ChorariaajayindianNo ratings yet

- Alternative Investment CharacteristicsDocument8 pagesAlternative Investment CharacteristicsMayura KatariaNo ratings yet

- 308-Hedge Fund, ETF, Mutual FundaDocument10 pages308-Hedge Fund, ETF, Mutual FundaMohammad AnikNo ratings yet

- 02. Private Equity Fees, ExitDocument69 pages02. Private Equity Fees, Exitharshit.dwivedi320No ratings yet

- What Are Mutual FundsDocument8 pagesWhat Are Mutual Fundsrushi4youNo ratings yet

- Money For Old HopeDocument50 pagesMoney For Old Hoperitu6687No ratings yet

- Hedge Fund Fees and Performance Charges ExplainedDocument19 pagesHedge Fund Fees and Performance Charges ExplainedRussell MckayNo ratings yet

- Corporate Strategic Change & Alternative Investment Strategies ChapterDocument11 pagesCorporate Strategic Change & Alternative Investment Strategies ChapterYisfalem AlemayehuNo ratings yet

- Sapm Investment ObjectivesDocument16 pagesSapm Investment ObjectivesBrindha RajuNo ratings yet

- Investment and International OperationsDocument53 pagesInvestment and International Operationsmukul3087_305865623No ratings yet

- BUSINESS FINANCE: THE FUNCTIONS OF A FINANCIAL MANAGERDocument67 pagesBUSINESS FINANCE: THE FUNCTIONS OF A FINANCIAL MANAGERMatin Chris KisomboNo ratings yet

- Bba 3rd Cap. Mkt.Document44 pagesBba 3rd Cap. Mkt.ybatra23No ratings yet

- Hedge Fund Overview PPT NewDocument40 pagesHedge Fund Overview PPT NewMonica NallathambiNo ratings yet

- (Type The Document Title) : What Is A Hedge Fund?Document6 pages(Type The Document Title) : What Is A Hedge Fund?Dhanaj NayakNo ratings yet

- Private Equity Basics by - Shahid AnwarDocument8 pagesPrivate Equity Basics by - Shahid Anwarvinaymaladi24No ratings yet

- Module 1 A Investment ProcessDocument46 pagesModule 1 A Investment ProcesssateeshjorliNo ratings yet

- Afu08501 - Lect 1Document42 pagesAfu08501 - Lect 1Criss JasonNo ratings yet

- Dividend PolicDocument11 pagesDividend PolicYash PatilNo ratings yet

- Dividend Is The Portion of Earnings Available To Equity Shareholders That Equally (Per Share Bias) Is Distributed Among The ShareholdersDocument21 pagesDividend Is The Portion of Earnings Available To Equity Shareholders That Equally (Per Share Bias) Is Distributed Among The ShareholdersKusum YadavNo ratings yet

- Vanguard Core Bond Fund Summary Prospectus: January 26, 2018Document8 pagesVanguard Core Bond Fund Summary Prospectus: January 26, 201876132No ratings yet

- Hedge Fund Performance FeesDocument5 pagesHedge Fund Performance Feesfreebanker777741No ratings yet

- Capital GainDocument3 pagesCapital GainHarsh GadaNo ratings yet

- HistoryDocument36 pagesHistoryMeghna VoraNo ratings yet

- What Is A Hedge Fund?Document2 pagesWhat Is A Hedge Fund?Chua Rui TingNo ratings yet

- Financial Services 1Document21 pagesFinancial Services 1JEFFERSON OPSIMANo ratings yet

- Long-Term Funds:: Sources and CostsDocument23 pagesLong-Term Funds:: Sources and CostsArmilyn Jean Castones0% (1)

- CFA Investing+in+Hedge+Funds +a+surveyDocument29 pagesCFA Investing+in+Hedge+Funds +a+surveyKsenia TerebkovaNo ratings yet

- Sessions 19, 20 and 21Document16 pagesSessions 19, 20 and 21Deedra ColeNo ratings yet

- BFIN300 Full Hands OutDocument46 pagesBFIN300 Full Hands OutGauray LionNo ratings yet

- Mutual FundsDocument28 pagesMutual FundsDanish KhanNo ratings yet

- Yacktman PresentationDocument34 pagesYacktman PresentationVijay MalikNo ratings yet

- Dividend Policy of Bank Asia LTDDocument13 pagesDividend Policy of Bank Asia LTDFarzanaNasreenNo ratings yet

- Ed Sources of FinanceDocument28 pagesEd Sources of FinanceShubham SaraogiNo ratings yet

- American Income PortfolioDocument9 pagesAmerican Income PortfoliobsfordlNo ratings yet

- Dividend Decision Part 1Document10 pagesDividend Decision Part 1avinashchoudhary2043No ratings yet

- L1 R48 HY NotesDocument4 pagesL1 R48 HY Notesayesha ansariNo ratings yet

- CORFISER SIMI Fund CV SEPTEMBER 2012 +3.1397% For A YTD of +41.4916Document2 pagesCORFISER SIMI Fund CV SEPTEMBER 2012 +3.1397% For A YTD of +41.4916Finser GroupNo ratings yet

- Dividend Policy AfmDocument10 pagesDividend Policy AfmPooja NagNo ratings yet

- Chapter Three: Dividend Decision/PolicyDocument38 pagesChapter Three: Dividend Decision/PolicyMikias DegwaleNo ratings yet

- Sources of Finance: Professional RegistersDocument18 pagesSources of Finance: Professional Registersakash tyagiNo ratings yet

- Reacher PaperDocument10 pagesReacher PaperHimanshu GondNo ratings yet

- Know MGMTDocument22 pagesKnow MGMTHimanshu GondNo ratings yet

- BPMSDocument57 pagesBPMSHimanshu Gond100% (1)

- HRMDocument39 pagesHRMHimanshu GondNo ratings yet

- MBA student's semester 1 grade cardDocument1 pageMBA student's semester 1 grade cardHimanshu GondNo ratings yet

- Puzzles To Puzzle YouDocument136 pagesPuzzles To Puzzle Youshahisk100% (1)

- BPMS Project - IT HelpDeskDocument17 pagesBPMS Project - IT HelpDeskHimanshu Gond100% (1)

- IR Overview v5 MidDocument1 pageIR Overview v5 MidHimanshu GondNo ratings yet

- IR Overview v5 MidDocument1 pageIR Overview v5 MidHimanshu GondNo ratings yet

- Recruitment and Selection Policy - EnglishDocument2 pagesRecruitment and Selection Policy - EnglishHimanshu GondNo ratings yet

- BrazilDocument10 pagesBrazilHimanshu GondNo ratings yet

- Academic Calendar 2012-13 - (Vr.1)Document1 pageAcademic Calendar 2012-13 - (Vr.1)qwertyNo ratings yet

- User-Defined Gestures For Surface ComputingDocument10 pagesUser-Defined Gestures For Surface ComputingtinkrboxNo ratings yet

- Academic Calendar 2012-13 - (Vr.1)Document1 pageAcademic Calendar 2012-13 - (Vr.1)qwertyNo ratings yet

- Bayesian Fault Identification of Multistage ProcessesDocument5 pagesBayesian Fault Identification of Multistage ProcessesHimanshu GondNo ratings yet

- Security agency cost report for NCRDocument25 pagesSecurity agency cost report for NCRRicardo DelacruzNo ratings yet

- FedEx Strategic AnalysisDocument30 pagesFedEx Strategic Analysishs138066No ratings yet

- From Local To Global BrandingDocument6 pagesFrom Local To Global BrandingSuraj JobanputraNo ratings yet

- Activity #1:: V F3QpgxbtdeoDocument4 pagesActivity #1:: V F3QpgxbtdeoSafaNo ratings yet

- ENY MRGN 016388 31012024 NSE DERV REM SignDocument1 pageENY MRGN 016388 31012024 NSE DERV REM Signycharansai0No ratings yet

- GROUP 4 FinalDocument33 pagesGROUP 4 FinalHuong MleNo ratings yet

- General Awareness 2015 For All Upcoming ExamsDocument59 pagesGeneral Awareness 2015 For All Upcoming ExamsJagannath JagguNo ratings yet

- Schneider EnglishDocument134 pagesSchneider EnglishpepitoNo ratings yet

- Guru Kirpa ArtsDocument8 pagesGuru Kirpa ArtsMeenu MittalNo ratings yet

- Tutorial Chapter 4 Product and Process DesignDocument29 pagesTutorial Chapter 4 Product and Process DesignNaKib NahriNo ratings yet

- (Income Computation & Disclosure Standards) : Income in Light of IcdsDocument25 pages(Income Computation & Disclosure Standards) : Income in Light of IcdsEswarReddyEegaNo ratings yet

- Edms ErmsDocument1 pageEdms Ermsprsiva2420034066No ratings yet

- Murphy Et Al v. Kohlberg Kravis Roberts & Company Et Al - Document No. 16Document15 pagesMurphy Et Al v. Kohlberg Kravis Roberts & Company Et Al - Document No. 16Justia.comNo ratings yet

- Economy in Steel - A Practical GuideDocument30 pagesEconomy in Steel - A Practical Guidechandabhi70No ratings yet

- Wilchez Cromatógrafo A Gás 370xa Rosemount PT 5373460Document140 pagesWilchez Cromatógrafo A Gás 370xa Rosemount PT 5373460Mantenimiento CoinogasNo ratings yet

- Norkis Distributors v. CA (CD-Asia)Document4 pagesNorkis Distributors v. CA (CD-Asia)Pia GNo ratings yet

- North America Equity ResearchDocument8 pagesNorth America Equity ResearchshamashmNo ratings yet

- Project Proposal: ESC472 - Electrical and Computer Capstone Design Division of Engineering ScienceDocument19 pagesProject Proposal: ESC472 - Electrical and Computer Capstone Design Division of Engineering Scienceapi-140137201No ratings yet

- XUB 3rd Convocation 22nd March2017Document160 pagesXUB 3rd Convocation 22nd March2017Chinmoy BandyopadhyayNo ratings yet

- Advertising and Consumerism in The Food IndustryDocument42 pagesAdvertising and Consumerism in The Food IndustryIoana GoiceaNo ratings yet

- Purchase Order: Pt. Prastiwahyu Tunas EngineeringDocument1 pagePurchase Order: Pt. Prastiwahyu Tunas EngineeringBowoNo ratings yet

- Order in Respect of Application Filed by Munjal M Jaykrishna Family Trust Under Regulation 11 of Takeover Regulations, 2011 For Acquisition of Shares in AksharChem (India) LimitedDocument10 pagesOrder in Respect of Application Filed by Munjal M Jaykrishna Family Trust Under Regulation 11 of Takeover Regulations, 2011 For Acquisition of Shares in AksharChem (India) LimitedShyam SunderNo ratings yet

- Design Thinking: by Cheryl Marlitta Stefia. S.T., M.B.A., QrmaDocument18 pagesDesign Thinking: by Cheryl Marlitta Stefia. S.T., M.B.A., QrmaRenaldiNo ratings yet