Professional Documents

Culture Documents

Commodity Market in India

Uploaded by

Joseph Anbarasu0 ratings0% found this document useful (0 votes)

363 views18 pagesBasic understanding about commodity market in India. It is useful to the students of Finance

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBasic understanding about commodity market in India. It is useful to the students of Finance

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

363 views18 pagesCommodity Market in India

Uploaded by

Joseph AnbarasuBasic understanding about commodity market in India. It is useful to the students of Finance

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 18

Commodity Market in India

Joseph Anbarasu on 12 – 1 - 2011

Commodity market

A potato producer could purchase potato

futures on a commodity exchange to lock

in a price for a sale of a specified amount

of potato at a future date, while at the

same time a speculator could buy and sell

potato futures with the hope of profiting

from future changes in potato prices.

Model Process

Introduction

A revolution in Commodity derivatives and

risk management

Commodity options banned between 1952 and

2002

Commodity market began from 2003 onwards

Almost all stock exchanges have commodity

market segments apart from 3 national level

electronic exchanges

Almost Eighty commodities are in the list now

History

Cotton Trade Association started

futures trading in 1875

Derivatives trading started in

oilseeds in Bombay (1900), raw

jute and jute goods in Calcutta

(1912), wheat in Hapur (1913)

and in Bullion in Bombay (1920)

The Government of Bombay

prohibited options business in

cotton in 1939

In 1943, forward trading was

prohibited in oilseeds and some

other commodities including

food-grains, spices, vegetable

oils, sugar and cloth.

After Independence

The Parliament passed Forward Contracts (Regulation) Act,

1952

The Act envisages three-tier regulation:

◦ The Exchange which organizes forward trading in commodities can

regulate trading on a day-to-day basis;

◦ the Forward Markets Commission provides regulatory oversight

under the powers delegated to it by the central Government, and

◦ the Central Government - Department of Consumer Affairs, Ministry

of Consumer Affairs, Food and Public Distribution is the ultimate

regulatory authority.

In 1960s, following several years of severe draughts that

forced many farmers to default on forward contracts (and even

caused some suicides), forward trading was banned in many

commodities considered primary or essential.

Policy Shift – Kabra Committee

Government set up a

Committee in 1993 to examine

the role of futures trading. The

Kabra Committee

recommended allowing futures

trading in 17 commodity

groups.

It recommended certain

amendments to Forward

Contracts (Regulation) Act

1952, particularly allowing

options trading in goods and

registration of brokers with

Forward Markets Commission.

After Effect

The Government accepted

most of these

recommendations and futures

trading was permitted in all

recommended commodities.

Derivatives do perform a role

in risk management led the

government to change its

stance.

Liberalization facilitates

market forces to act freely

The next decade is being

touted as the decade of

commodities.

Why Derivatives?

The possibility of adverse

price changes in future

creates risk for businesses.

Derivatives are used to

reduce or eliminate price risk

arising from unforeseen price

changes.

A derivative is a financial

contract whose price depends

on, or is derived from, the

price of another asset.

Two important derivatives

are futures and options.

Commodity Futures Contracts

A futures contract is an

agreement for buying or

selling a commodity for a

predetermined delivery

price at a specific future

time.

They are Standardized

Contracts

Traded in Future Exchanges

(Default is taken care)

Chicago Board of Trade in

1848

Commodity Options contracts

Like futures, options are also

financial instruments used for

hedging and speculation.

The commodity option holder

has the right, but not the

obligation, to buy (or sell) a

specific quantity of a commodity

at a specified price on or before a

specified date.

Buyer and Selling.

Call Option and Put option

The option holder will exercise

the option only if it is beneficial

to him; otherwise he will let the

option lapse.

Example

For example, suppose a farmer buys a put option to sell 100 Quintals of wheat

at a price of $25 per quintal and pays a ‘premium’ of $0.5 per quintal (or a total

of $50). If the price of wheat declines to say $20 before expiry, the farmer will

exercise his option and sell his wheat at the agreed price of $25 per quintal.

However, if the market price of wheat increases to say $30 per quintal, it would

be advantageous for the farmer to sell it directly in the open market at the spot

price, rather than exercise his option to sell at $25 per quintal.

Multi Commodity Exchange (MCX)

Multi Commodity Exchange (MCX) is an

independent commodity exchange based in

India.

◦ Established in 2003 and Based in Mumbai

◦ Turnover in 2009 was USD 1.24 trillion

◦ Sixth largest commodity exchange

◦ It was established in 2003 and is based in Mumbai.

MCX offers futures trading in

◦ bullion, ferrous and non-ferrous metals, energy, and a

number of agricultural commodities (menthol oil,

cardamom, potatoes, palm oil and others).

Organisation

MCX has also set up in joint

venture the MCX Stock

Exchange.

Earlier spin-offs from the

company include the National

Spot Exchange, an electronic

spot exchange for bullion and

agricultural commodities, and

National Bulk Handling

Corporation (NBHC) India's

largest collateral management

company which provides bulk

storage and handling of

agricultural products.

MCX Achievement

It is regulated by the Forward Markets Commission.

◦ MCX is India's No. 1 commodity exchange with 83% market share in

2009

◦ Competitor is National Commodity & Derivatives Exchange Ltd

◦ Globally, MCX ranks no. 1 in silver, no. 2 in natural gas, no. 3 in crude

oil and gold in futures trading

◦ The highest traded item is gold.

◦ MCX has several strategic alliances with leading exchanges across the

globe

◦ As of early 2010, the normal daily turnover of MCX was about US$ 6

to 8 billion

◦ MCX now reaches out to about 800 cities and towns in India with the

help of about 126,000 trading terminals

◦ MCX COMDEX is India's first and only composite commodity futures

price index

Key shareholders

Financial Technologies Corporation Bank,

(I) Ltd., Union Bank of India,

State Bank of India and Canara Bank,

its associates, Bank of India,

National Bank for Bank of Baroda ,

Agriculture and Rural HDFC Bank,

Development SBI Life Insurance Co.

(NABARD), Ltd.,

National Stock Exchange ICICI ventures,

of India Ltd. (NSE), IL & FS, Merrill Lynch, and

Fid Fund (Mauritius) Ltd. New York Stock Exchange

Unresolved Issues

Commodity Options

◦ Farmers not beneficiaries in price rise

The Warehousing and Standardization

◦ Physical Delivery needs backup

Cash Versus Physical Settlement

The Regulator

◦ week FMC

Lack of Economy of Scale

Tax and Legal bottlenecks

◦ Across States impossible

Thanks

Narender L. Ahuja for his article “Commodity

Derivatives Market in India: Development, Regulation and Future

Prospects” International Research Journal of Finance and Economics,

ISSN 1450-2887 Issue 2 (2006), Euro-Journals Publishing, Inc. 2006

http://www.eurojournals.com/finance.htm

Investopedia

MCX website

SEBI website

You might also like

- Fitment - Ugc 6th Pay CommissionDocument10 pagesFitment - Ugc 6th Pay CommissionJoseph Anbarasu100% (3)

- Killer Commodities: How to Cash in on the Hottest New Trading TrendsFrom EverandKiller Commodities: How to Cash in on the Hottest New Trading TrendsNo ratings yet

- Commodity Market: Presented By: Akhilesh Gadkar PG-13-14 Pritesh Shah PG-13-50 Arpit Shah PG-13-59Document37 pagesCommodity Market: Presented By: Akhilesh Gadkar PG-13-14 Pritesh Shah PG-13-50 Arpit Shah PG-13-59Laura ButlerNo ratings yet

- Commodity Futures As An Investment AvenueDocument62 pagesCommodity Futures As An Investment Avenuejitendra jaushik50% (4)

- A Case Study On Commodities Trading-Investment and SpeculationDocument95 pagesA Case Study On Commodities Trading-Investment and SpeculationNishant Sharma100% (1)

- Swaps NewDocument46 pagesSwaps NewJoseph Anbarasu100% (5)

- Operations Management Toffee IncDocument12 pagesOperations Management Toffee IncRonak PataliaNo ratings yet

- Managing The Risk: Joseph AnbarasuDocument25 pagesManaging The Risk: Joseph AnbarasuJoseph AnbarasuNo ratings yet

- Zen: PrimerDocument38 pagesZen: PrimerJoseph Anbarasu100% (1)

- Commodity Derivatives Market in India: DevelopmentDocument10 pagesCommodity Derivatives Market in India: DevelopmentmsarchanabNo ratings yet

- Applied Economics Week 3 With WorksheetDocument12 pagesApplied Economics Week 3 With WorksheetKate D. Paglinawan50% (2)

- A Beginners' Guide To Commodity Market (Spot and Futures)Document47 pagesA Beginners' Guide To Commodity Market (Spot and Futures)vintosh_pNo ratings yet

- Organization DevelopmentDocument23 pagesOrganization DevelopmentJoseph Anbarasu83% (6)

- Evangelism of Early ChurchDocument27 pagesEvangelism of Early ChurchJoseph Anbarasu100% (2)

- Pharmasim Annual Brief - Period 3 - Garden Grove PDFDocument5 pagesPharmasim Annual Brief - Period 3 - Garden Grove PDFThu HàNo ratings yet

- Commodity TradingDocument0 pagesCommodity TradingNIKNISHNo ratings yet

- Jainism: PrimerDocument24 pagesJainism: PrimerJoseph Anbarasu100% (1)

- Commodity MarketDocument61 pagesCommodity Marketrocklife_sagarNo ratings yet

- Forward Markets Commission FMC Economics Study Material Amp NotesDocument3 pagesForward Markets Commission FMC Economics Study Material Amp NotesRaghav DhillonNo ratings yet

- Micro Economics Slides - Before MidDocument43 pagesMicro Economics Slides - Before Midshahfaisal gfgNo ratings yet

- Financial MarketsDocument6 pagesFinancial Marketsheynuhh gNo ratings yet

- Commodity DerivativeDocument40 pagesCommodity Derivative1989_guru100% (2)

- Comodity Market in IndiaDocument6 pagesComodity Market in IndiaCrystal ScottNo ratings yet

- Commodity Market in India: An: Shiv S. ShrivastavaDocument11 pagesCommodity Market in India: An: Shiv S. ShrivastavakomuledwaniNo ratings yet

- Commodities Exchange: For Example, A Corn Producer Could Purchase Corn Futures On ADocument11 pagesCommodities Exchange: For Example, A Corn Producer Could Purchase Corn Futures On ANMRaycNo ratings yet

- What Is Commodity Trading?: MBA Education & CareersDocument0 pagesWhat Is Commodity Trading?: MBA Education & CareersprajuprathuNo ratings yet

- What Is Commodity TradingDocument2 pagesWhat Is Commodity TradingYash JainNo ratings yet

- A Study On Future Scenario of Bullion MarketDocument86 pagesA Study On Future Scenario of Bullion Marketjonathan-vaz-622867% (6)

- CommodityDocument14 pagesCommodityChamp DsouzaNo ratings yet

- Mba 1Document89 pagesMba 1Hariharan KuppusamyNo ratings yet

- 11 Chapter 4Document12 pages11 Chapter 4CuriosityShopNo ratings yet

- Price Discovery, Return and Market Conditions: Evidence From Commodity Futures MarketsDocument22 pagesPrice Discovery, Return and Market Conditions: Evidence From Commodity Futures MarketssravanakumarNo ratings yet

- Indian Commodity Market - GroundnutDocument42 pagesIndian Commodity Market - GroundnutAnjali PanchalNo ratings yet

- Doneraj1 170312143519Document79 pagesDoneraj1 170312143519Rishikesh MishraNo ratings yet

- Commodity Market Full NotesDocument83 pagesCommodity Market Full NotesHarshitha RNo ratings yet

- History of Commodity Market in IndiaDocument4 pagesHistory of Commodity Market in Indiamahesh_he28100% (1)

- Commodity Market ProjectDocument23 pagesCommodity Market ProjectVinay MeherNo ratings yet

- Project Report On Commodity MarketsDocument65 pagesProject Report On Commodity Marketskrittika03No ratings yet

- Commodity Market in India WordDocument24 pagesCommodity Market in India WordMilan KakkadNo ratings yet

- About ODIN Errors PDFDocument58 pagesAbout ODIN Errors PDFSaravana Kumar S SNo ratings yet

- Synopsis On Commodity MarketDocument8 pagesSynopsis On Commodity MarketsonaliasudaniNo ratings yet

- Unit 1Document22 pagesUnit 1Aryaom DasNo ratings yet

- Definition of CommoditiesDocument16 pagesDefinition of CommoditiesDeepika MahnaNo ratings yet

- S AshfaqDocument45 pagesS AshfaqCMA-1013 V.NAVEENNo ratings yet

- Forward Markets CommissionDocument4 pagesForward Markets CommissionAnkur LakhaniNo ratings yet

- Doing Business in India: Market OpportunitiesDocument5 pagesDoing Business in India: Market OpportunitiesMarisol LeiraNo ratings yet

- Performance Analysis of Indian Commodity Market: March 2020Document16 pagesPerformance Analysis of Indian Commodity Market: March 2020Suraj O V 1820368No ratings yet

- Project ReportDocument91 pagesProject ReportSunil BhatiaNo ratings yet

- Executive Summary: Commodities Market in IndiaDocument67 pagesExecutive Summary: Commodities Market in IndiaSushil RajguruNo ratings yet

- FM PPT - Commodities MKTDocument18 pagesFM PPT - Commodities MKTrichabhagat2906No ratings yet

- Religare Dibya ProjectDocument19 pagesReligare Dibya Projectkrishna shah100% (2)

- Final ProjectDocument90 pagesFinal Projectaryanabhi123No ratings yet

- A Study On "Commodities Trading-Investment and Speculation"Document98 pagesA Study On "Commodities Trading-Investment and Speculation"jaiiikumar16No ratings yet

- Navneet SinghDocument88 pagesNavneet SinghNavneet SinghNo ratings yet

- Commodity Market Unit - 4Document17 pagesCommodity Market Unit - 4Rahul SainiNo ratings yet

- 1.1 Brief Introduction To Commodity MarketsDocument35 pages1.1 Brief Introduction To Commodity Marketsvenkatesh29191158No ratings yet

- Commodity Derivatives ProjectDocument22 pagesCommodity Derivatives ProjectdesaikeyurNo ratings yet

- Reasons For Trading in Commodity ExchangesDocument114 pagesReasons For Trading in Commodity ExchangesSharath PoojariNo ratings yet

- Commodity Futures Markets in India: Riding The Growth Phase: Dr. Alok Kumar MishraDocument28 pagesCommodity Futures Markets in India: Riding The Growth Phase: Dr. Alok Kumar MishraDrSatish RadhakrishnanNo ratings yet

- Commodities Trading-Investment andDocument99 pagesCommodities Trading-Investment andSyed MurthzaNo ratings yet

- Faq Booklet EnglishDocument30 pagesFaq Booklet EnglishSameer MishraNo ratings yet

- Commodity Basics - The Financial DoctorsDocument30 pagesCommodity Basics - The Financial DoctorsAnsumanNathNo ratings yet

- The Expert Committee To Study The Impact of Futures Trading ON Agricultural Commodity PricesDocument104 pagesThe Expert Committee To Study The Impact of Futures Trading ON Agricultural Commodity PricesBhanu PratapNo ratings yet

- Commodity Marketalsounderstanding The Investment Pattern of The People On The Basis ofDocument42 pagesCommodity Marketalsounderstanding The Investment Pattern of The People On The Basis ofjeetNo ratings yet

- Commodity Derivative Market in IndiaDocument16 pagesCommodity Derivative Market in IndiaNaveen K. JindalNo ratings yet

- III. The Indian Market Evolution and RegulationDocument3 pagesIII. The Indian Market Evolution and RegulationvaibhavNo ratings yet

- Commodity Derivatives in IndiaDocument3 pagesCommodity Derivatives in IndiaIntelivisto Consulting India Private LimitedNo ratings yet

- Organisational Climate in IndiaDocument17 pagesOrganisational Climate in IndiaJoseph AnbarasuNo ratings yet

- Organisational BehaviourDocument21 pagesOrganisational BehaviourJoseph AnbarasuNo ratings yet

- M.phil Entrance QuestionDocument3 pagesM.phil Entrance QuestionJoseph AnbarasuNo ratings yet

- Quantitative MethodsDocument27 pagesQuantitative MethodsJoseph AnbarasuNo ratings yet

- M.phil Entrance QuestionDocument3 pagesM.phil Entrance QuestionJoseph AnbarasuNo ratings yet

- Table III CDocument9 pagesTable III CJoseph AnbarasuNo ratings yet

- Global Factors On Indian Financial MarketDocument8 pagesGlobal Factors On Indian Financial MarketJoseph AnbarasuNo ratings yet

- Unit I Commercial BanksDocument63 pagesUnit I Commercial BanksJoseph AnbarasuNo ratings yet

- Indian Economy in 2009Document16 pagesIndian Economy in 2009Joseph Anbarasu100% (1)

- Matching Theory - Nobel Prize Winning ModelDocument25 pagesMatching Theory - Nobel Prize Winning ModelJoseph AnbarasuNo ratings yet

- Table IIIDocument5 pagesTable IIIJoseph AnbarasuNo ratings yet

- Bishop Heber College, TiruchirappalliDocument12 pagesBishop Heber College, TiruchirappalliJoseph AnbarasuNo ratings yet

- Presentation On Academic Performance Indicator (API)Document15 pagesPresentation On Academic Performance Indicator (API)Joseph Anbarasu43% (7)

- Presenation On Weightage PointsDocument6 pagesPresenation On Weightage PointsJoseph AnbarasuNo ratings yet

- UGC VI Pay G.ODocument28 pagesUGC VI Pay G.Osmeetha_vNo ratings yet

- Policy Note On Higher Education in Tamil NaduDocument94 pagesPolicy Note On Higher Education in Tamil NaduJoseph AnbarasuNo ratings yet

- Wrong and Manupulated Draft About UGC QualificationsDocument37 pagesWrong and Manupulated Draft About UGC QualificationsgdkhedkarNo ratings yet

- UGC - Minimum Qualification and Career AdvancementDocument59 pagesUGC - Minimum Qualification and Career AdvancementJoseph AnbarasuNo ratings yet

- Delivering LectureDocument30 pagesDelivering LectureJoseph AnbarasuNo ratings yet

- Non-Life Insurance in IndiaDocument1 pageNon-Life Insurance in IndiaJoseph Anbarasu0% (1)

- Banking in IndiaDocument15 pagesBanking in IndiaJoseph AnbarasuNo ratings yet

- Ugc GoDocument20 pagesUgc GoJoseph Anbarasu100% (3)

- CAPE AccountingDocument10 pagesCAPE Accountingget thosebooksNo ratings yet

- Five Generic Business Level Strategies: Session 8Document20 pagesFive Generic Business Level Strategies: Session 8uzair ahmed siddiqiNo ratings yet

- Case 1Document2 pagesCase 1Ashish ChauhanNo ratings yet

- Chapter 10 Lecture PresentationDocument51 pagesChapter 10 Lecture PresentationDina SamirNo ratings yet

- CEL 2105 Worksheet 6 (Week 6) SEM120202021Document7 pagesCEL 2105 Worksheet 6 (Week 6) SEM120202021VS Shirley50% (2)

- 2024 L1 Book 4drDocument62 pages2024 L1 Book 4drbayanidashboardsNo ratings yet

- Chapter-2 Forwards and FuturesDocument34 pagesChapter-2 Forwards and FuturesAnil SharmaNo ratings yet

- Problem Set 5 SolutionDocument4 pagesProblem Set 5 Solutionvincent brandonNo ratings yet

- An Example of A Fixed-Income Security Would Be A 5% Fixed-Rate Government Bond Where ADocument8 pagesAn Example of A Fixed-Income Security Would Be A 5% Fixed-Rate Government Bond Where AOumer ShaffiNo ratings yet

- Price Quotation Form: PurposeDocument1 pagePrice Quotation Form: PurposeKhael Angelo Zheus JaclaNo ratings yet

- 2016-Uber Case StudyDocument2 pages2016-Uber Case Studyqa diiNo ratings yet

- Mukiwa Strategic Managment Model AnswersDocument12 pagesMukiwa Strategic Managment Model AnswersMadalitso MukiwaNo ratings yet

- Exam 3 TestbankDocument76 pagesExam 3 Testbankpauline leNo ratings yet

- 6 New PPT On Unit 5 ProductionDocument23 pages6 New PPT On Unit 5 ProductionUmar shaikhNo ratings yet

- Bond With Pidilite 2022 - Team FixersDocument3 pagesBond With Pidilite 2022 - Team FixersAbhishek KhaiwalNo ratings yet

- Cheat SheetDocument2 pagesCheat SheetCharlotte GillandersNo ratings yet

- SAHIR KHAN Notes Class 1Document17 pagesSAHIR KHAN Notes Class 1MuhammadAwaisKhalidNo ratings yet

- Topic: Government Bonds: Not To Be Copied or Distributed in Any WayDocument28 pagesTopic: Government Bonds: Not To Be Copied or Distributed in Any WayL SNo ratings yet

- UNIT 1 Three Approaches To ValuesDocument5 pagesUNIT 1 Three Approaches To ValuesMichelle GozonNo ratings yet

- Financial Risk Management ExercisesDocument20 pagesFinancial Risk Management ExercisesChau NguyenNo ratings yet

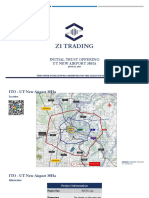

- UT New Airport 38ha - Project InformationDocument10 pagesUT New Airport 38ha - Project InformationPaul KitNo ratings yet

- San Mateo Municipal College: General Luna ST., Guitnang Bayan I, San Mateo, Rizal Tel. No. (02) 997-9070Document10 pagesSan Mateo Municipal College: General Luna ST., Guitnang Bayan I, San Mateo, Rizal Tel. No. (02) 997-9070Chan YeolNo ratings yet

- Financial ReportingDocument7 pagesFinancial ReportingInnocent MollaNo ratings yet

- Assignment January 2022 SemesterDocument7 pagesAssignment January 2022 SemesterRozha PurnamaNo ratings yet

- Math TestDocument9 pagesMath TestFretzie CambiadoNo ratings yet