Professional Documents

Culture Documents

On 21 March

Uploaded by

Atif Khan0 ratings0% found this document useful (0 votes)

35 views21 pages231

Original Title

ppt on 21 march

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document231

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

35 views21 pagesOn 21 March

Uploaded by

Atif Khan231

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 21

Presented To:

Sir Atif Mir

Student Name:

Saeed ur Rehman,

Muhammad Nazir,

Ibn e ali naqvi

1-Bank

Banks are the financial institution that lend and

borrow money from public and investa the borrowed

money in heavy returning projects and receive the

interest on money which he lend to investor or needy

people who receive money from banks.

2-History of banking

History of banks is very old as 1800 BC. In know

history first of all babelyon and Roman People

introduce banking techniques, But in that time

banking was very simple as people put their valuable

thing like coin and gold to goldsmiths for

safeguarding. They took gold from people and issues a

receipt to asset owners and that goldsmith were bind

to pay back on demand.

Banking again revised in 12 & 13th century from the

italian town of florence. While in 16th century German

family named fugger and augsburg was the very

famous bankers. People keep their precious goods,

gold and coins before these bankers for safety purpose

and get the receipt (promissory note).They also

received the loan by these bankers and pay the interest

over his original borrowing .

Along businessman and common people, Government

also takes loan to fulfill their expenditure which

cannot meet by tese low level lenders. To respond the

befittingly to this situation, group of financier come

together and make the first bank “Bank of England”

and for the first time give the loan to government of 1.2

million pounds, which were the massive loan in that

days and receive the 8 % interest over financing. The

bank of England was founded in 1694

3-Banking in Pakistan

State bank of Pakistan was first bank of pakistan and

it is central bank of Pakistan. It is founded by Quid e

Azam Muhammad Ali Jinnah in 1948. It becomes

government owned bank. State bank issued the

national currency of the country.

It set the rules and regulation for next upcoming

banks with the passage of time many commercial and

industrial banks are opened e.g Habib bank, Muslim

commercial bank etc.

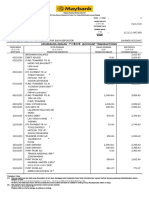

4-Introduction of Meezan Bank

Meezan bank is the first Islamic bank of Pakistan,

which paid up capital, is more than 10 billion. It is the

first initiator of Islamic banking. To facilitate those

people who have religious mind and who believe in

Islamic way of banking

Meezan bank is founded in 1997 and it operate along

276 branches in 83 cities.

The motive of meezan bank is “The premier Islamic

banking” It serves across country with 8500

employees. It is registered in stock Exchange of

Pakistan and it is traded with the name of MEBL.

5-Meezan Bank services to

customers

Internet Banking:

Meezan bank provides the following facilities

Funds transfer

Bill payment

Account management

Account service

Mutual fund

Request fund

Mobile Banking:

Meezan bank providing mobile banking app for its

customer

By using mobile banking customer can:

Check the last eight transactions

Bills payment

Transfer amount within Meezan bank

Detail of bank transaction

Temporally activate and deactivate the debit card

QR Payment Facilities:

Meeezan bank provides its customer facility to made

payment by using QR code payment facility. In case of

cashless, customer can pay the bill by scanning QR

code via phonepay app directly from his Meezan bank

account.

SMS Alerts:

Meezan bank aware its customer for the transaction

taken place on his account. It informs the customer if

his/her account debited or credited and even if his/her

cheque get bounce.

Debit Card:

Meezan bank offers three types of debit card to its

customers

Visa Debit card

Titanium Master card

Platinum Master card

Platinum master card provides the access to its

customers worldwide 2.1 millions compatible ATMs

machines.

ATMs:

Bank made cash availability to its customer in

different cities across the country. More over its Debit

card is also accessible over than 8000 1 link and MNET

ATM machines.

By ATM machines customer can transfer funds

without any charges within the meezan networks.

Meezan bank account holder can also transfer fund to

other banks having 1-link members accounts.

6 Minor:

A minor is a person who did not attain the age of 18.

And in case of land property after age of 21 he or she

will become adult. Contract with the minor is void. But

a minor can open his account with his guardian or

parents.

7.Who can open the account of

minor:

A natural guardian on behalf of guardian.

A legal guardian in the name of minor.

A natural guardian in joint account with minor.

Documents:

Following documents needs to be furnished.

Proof of minor date of birth

Form B.

Specimen signature of guardian. Minor specimen

signature in case he/she is 10 years old.

Form:

The typical account opening from can be filled up to

open a minor account. Details like the minors name,

address, guardian details and signature must be

furnished.

8.State Bank of Pakistan Rules

for Minor account:

Eligibility to open account:

A minor can open his/her account jointly with

consent of his parents a minor with the age of

above than 10 years, account can be opened on his

own name if he can make his own signature.

9.Can minor operate this account:

This account will be operated jointly with parents or

guardian and minor.

Checkbook facility:

Checkbook will be issued to minor or guardian

/parents if minor makes the sign uniformly.

E-Banking:

Both have a per day transaction limit of RS 5000.One can

make the bill payment, interbank transfer and may get the

demand draft.

10.How minor withdraw

Amounts:

Minor withdraw amounts through cheques, debit card.

THE END

You might also like

- Example of SOP-Payroll & Petty CashDocument7 pagesExample of SOP-Payroll & Petty CashCruise MardionoNo ratings yet

- The Payment System and Instruments of PaymentDocument15 pagesThe Payment System and Instruments of PaymentMedina KNo ratings yet

- 2022 April StatementDocument2 pages2022 April StatementAvishekNo ratings yet

- Online Fee Payment System OFPSDocument45 pagesOnline Fee Payment System OFPSSarah Hussain100% (1)

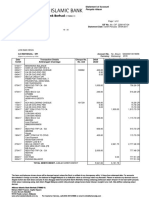

- Penyata Akaun: Tarikh Date Keterangan Description Terminal ID ID Terminal Amaun (RM) Amount (RM) Baki (RM) Balance (RM)Document7 pagesPenyata Akaun: Tarikh Date Keterangan Description Terminal ID ID Terminal Amaun (RM) Amount (RM) Baki (RM) Balance (RM)Amad100% (1)

- BANKING NOTESDocument14 pagesBANKING NOTESjagankilari80% (5)

- Looting in Kenya-Kroll Report (Hapa Kenya Version)Document101 pagesLooting in Kenya-Kroll Report (Hapa Kenya Version)hapakenya100% (7)

- Chapter 2 Developing Marketing Strategies and PlansDocument36 pagesChapter 2 Developing Marketing Strategies and PlansAtif Khan80% (5)

- Standard Chartered Bank ATM FlowDocument11 pagesStandard Chartered Bank ATM FlowJayavant MaliNo ratings yet

- BCCI ProjectDocument74 pagesBCCI ProjectAtif KhanNo ratings yet

- MBBsavings - 112111 083189 - 2020 12 31Document8 pagesMBBsavings - 112111 083189 - 2020 12 31Kevin WhitteNo ratings yet

- Your Electricity Bill at A Glance: Total Due 198.32Document2 pagesYour Electricity Bill at A Glance: Total Due 198.32rodrigo batistaNo ratings yet

- My Vodafone Bill 2022-10-03Document2 pagesMy Vodafone Bill 2022-10-03Solomon0% (1)

- Role of Artificial Intelligence in RecruitmentDocument3 pagesRole of Artificial Intelligence in RecruitmentAtif KhanNo ratings yet

- Sn53sup 20170430 001 2200147134Document2 pagesSn53sup 20170430 001 2200147134Henry LowNo ratings yet

- WP StateofArtificialIntelligenceinHR HarbingerSystems 112717 PDFDocument26 pagesWP StateofArtificialIntelligenceinHR HarbingerSystems 112717 PDFAtif KhanNo ratings yet

- Unit IDocument11 pagesUnit IShahid AfreedNo ratings yet

- MBFI NotesDocument27 pagesMBFI NotesSrikanth Prasanna BhaskarNo ratings yet

- Chapter - 01 Introduction of BankDocument37 pagesChapter - 01 Introduction of BankJeeva JeevaNo ratings yet

- Introduction To BankingDocument6 pagesIntroduction To BankingGraciously meNo ratings yet

- Origin and Growth of Commercial BankingDocument47 pagesOrigin and Growth of Commercial BankingPushpa LathaNo ratings yet

- History of Bank: Prepired by Bdifatah SaidDocument5 pagesHistory of Bank: Prepired by Bdifatah SaidAbdifatah SaidNo ratings yet

- 1.1 Concept of BankingDocument12 pages1.1 Concept of BankingsidharthNo ratings yet

- BANKING AND INSURANCE LAW HISTORYDocument12 pagesBANKING AND INSURANCE LAW HISTORYSekar M KPRCAS-CommerceNo ratings yet

- Law - of BankingDocument6 pagesLaw - of BankingapyeqaxufNo ratings yet

- Final Report Bbs 4yh Resesach Report by Bibek - Docx.odtDocument25 pagesFinal Report Bbs 4yh Resesach Report by Bibek - Docx.odtBikash ShresthaNo ratings yet

- Philippine Banking SystemDocument20 pagesPhilippine Banking SystempatriciaNo ratings yet

- Introduction To BankingDocument35 pagesIntroduction To Bankingকাশী নাথNo ratings yet

- Origin of Banking: By: Dr. Swati GargDocument56 pagesOrigin of Banking: By: Dr. Swati GargSwati GargNo ratings yet

- Israr History of BankDocument4 pagesIsrar History of BankMian ZainNo ratings yet

- Imran Khan Internship Report 2019Document35 pagesImran Khan Internship Report 2019Imran KhanNo ratings yet

- History of Banking IndustryDocument7 pagesHistory of Banking IndustryKimberly PasaloNo ratings yet

- The Effect of Branchless Banking On Financial Performance of Conventional and Islamic Banking in PakistanDocument2 pagesThe Effect of Branchless Banking On Financial Performance of Conventional and Islamic Banking in Pakistanshah khalidNo ratings yet

- Unit - 1 Intorduction Meaning and Concept of Bank and Financial InstitutionDocument8 pagesUnit - 1 Intorduction Meaning and Concept of Bank and Financial InstitutionAnkit AgarwalNo ratings yet

- Accounting Takes An Important Role in Operating An OrganizationDocument4 pagesAccounting Takes An Important Role in Operating An OrganizationchardNo ratings yet

- What Is A Bank ? Introduction: - CrowtherDocument29 pagesWhat Is A Bank ? Introduction: - CrowtherHarbrinder GurmNo ratings yet

- What Is A Payment Bank PDFDocument76 pagesWhat Is A Payment Bank PDFsmithNo ratings yet

- Banking and Ins PDFDocument94 pagesBanking and Ins PDFsakshiNo ratings yet

- Page NoDocument53 pagesPage No16july1994No ratings yet

- Banking & Insurance NotesDocument26 pagesBanking & Insurance NotesMinatoNo ratings yet

- Baking PPPTDocument69 pagesBaking PPPTJøñë ÊphrèmNo ratings yet

- Origin, History and Types of Banking SystemDocument44 pagesOrigin, History and Types of Banking Systemriajul islam jamiNo ratings yet

- PART - I ThesisDocument5 pagesPART - I ThesisRizvi KhanalNo ratings yet

- Banking TheoryDocument56 pagesBanking TheoryChella KuttyNo ratings yet

- Submitted To: Submitted By: Mrs. Sumeet Kaur Srishti Pahwa Professor-G.G.D.S.D College, Sem. Chandigarh Roll No-1515021Document7 pagesSubmitted To: Submitted By: Mrs. Sumeet Kaur Srishti Pahwa Professor-G.G.D.S.D College, Sem. Chandigarh Roll No-1515021radhika marwahNo ratings yet

- LSF Banking - 230817 - 121722Document14 pagesLSF Banking - 230817 - 121722pathlavathlaxman765No ratings yet

- Banking Innovation.: EtymologyDocument78 pagesBanking Innovation.: EtymologyFaisal AnsariNo ratings yet

- Modern BankingDocument9 pagesModern BankingAyisha NasnaNo ratings yet

- Anitha HDFCDocument84 pagesAnitha HDFCchaluvadiinNo ratings yet

- Indian BankingDocument7 pagesIndian BankingMONIKA RUBINNo ratings yet

- Document 2323Document50 pagesDocument 2323Ajay JumaniNo ratings yet

- Banking and BanksDocument5 pagesBanking and BanksElena NutaNo ratings yet

- Banking LawDocument22 pagesBanking LawRASHIKA TRIVEDINo ratings yet

- BankingDocument123 pagesBankingRohit MehraNo ratings yet

- Internship Report Habib Bank LimitedDocument68 pagesInternship Report Habib Bank Limitedmisbahsanam67% (3)

- Internship Report UBL6Document125 pagesInternship Report UBL6dilhNo ratings yet

- UBL Bank Financial AnalysisDocument107 pagesUBL Bank Financial AnalysisAftabMughal100% (1)

- Darshan Online BankingDocument14 pagesDarshan Online BankingdarshanNo ratings yet

- An Internship Report On Kumari Bank, NepalDocument33 pagesAn Internship Report On Kumari Bank, NepalAmul Shrestha63% (8)

- Introduction to SbankingDocument53 pagesIntroduction to SbankingLove NijaiNo ratings yet

- Importance of the bank system to the economyDocument12 pagesImportance of the bank system to the economyEmil SalmanliNo ratings yet

- History Banking Activities Types of Banks References: The Bank of England, Established in 1694Document3 pagesHistory Banking Activities Types of Banks References: The Bank of England, Established in 1694Karam Al-MashhadiNo ratings yet

- Law of Banking Updated-2Document14 pagesLaw of Banking Updated-2Ashraf AliNo ratings yet

- History: The, Established in 1694Document19 pagesHistory: The, Established in 1694Kāŕąñ JëthãñíNo ratings yet

- Introduction to the Indian Banking SectorDocument94 pagesIntroduction to the Indian Banking SectorDinesh ChahalNo ratings yet

- Bank - WikipediaDocument38 pagesBank - WikipediaShruthi AmmuNo ratings yet

- IntershipDocument65 pagesIntershipainashaikhNo ratings yet

- BANKING HISTORY AND SERVICESDocument33 pagesBANKING HISTORY AND SERVICESSuksham Sood60% (5)

- Banking Industry: Definition of BankDocument10 pagesBanking Industry: Definition of BankNikhitha ShettyNo ratings yet

- UBL Internship ReportDocument102 pagesUBL Internship ReportkamilbismaNo ratings yet

- Banking LawDocument32 pagesBanking LawAJAY TAJANo ratings yet

- Sanjay 31011Document58 pagesSanjay 31011Sanjay NawleNo ratings yet

- The Fireside Chats of Franklin Delano Roosevelt Radio Addresses to the American People Broadcast Between 1933 and 1944From EverandThe Fireside Chats of Franklin Delano Roosevelt Radio Addresses to the American People Broadcast Between 1933 and 1944No ratings yet

- Case Studies - Final PDFDocument80 pagesCase Studies - Final PDFAtif KhanNo ratings yet

- Questionnaire Quantified1Document21 pagesQuestionnaire Quantified1Atif KhanNo ratings yet

- Case Studies - FinalDocument39 pagesCase Studies - FinalAtif KhanNo ratings yet

- Bs Commerce Subjects ListDocument110 pagesBs Commerce Subjects ListAtif Khan0% (1)

- The Importance of Transaction Signing To Banks: © 2014 EntersektDocument8 pagesThe Importance of Transaction Signing To Banks: © 2014 EntersektAtif KhanNo ratings yet

- Conceptual Framework LiteratureDocument14 pagesConceptual Framework LiteratureAtif KhanNo ratings yet

- Artificial Intelligence (A I) and HRDocument3 pagesArtificial Intelligence (A I) and HRAtif KhanNo ratings yet

- AI technologies improve HR analysisDocument4 pagesAI technologies improve HR analysisAtif KhanNo ratings yet

- Conceptual Framework LiteratureDocument14 pagesConceptual Framework LiteratureAtif KhanNo ratings yet

- Presentated By: Rimsha, Rabbia, Hajra and Sehreen Presented To: Atif Mir Khan Roll No: 6, 44, 84 and 85Document27 pagesPresentated By: Rimsha, Rabbia, Hajra and Sehreen Presented To: Atif Mir Khan Roll No: 6, 44, 84 and 85Atif KhanNo ratings yet

- Consumer Behaviour 2Document11 pagesConsumer Behaviour 2Atif KhanNo ratings yet

- EstaCode-2011 For KPKDocument324 pagesEstaCode-2011 For KPKHina Ali60% (5)

- Human Resources Management Research Paper TopicsDocument4 pagesHuman Resources Management Research Paper TopicsPruthviraj RathoreNo ratings yet

- Affiliation Criteria HecDocument13 pagesAffiliation Criteria HecShayan Ahmad QureshiNo ratings yet

- The Pathans PDFDocument546 pagesThe Pathans PDFAtif KhanNo ratings yet

- R&S Book ContentsDocument6 pagesR&S Book ContentsAtif KhanNo ratings yet

- Data Collection Methods & Sources: Selecting the Right Fit for Your ResearchDocument23 pagesData Collection Methods & Sources: Selecting the Right Fit for Your ResearchManish RauniyarNo ratings yet

- The Pathans PDFDocument546 pagesThe Pathans PDFAtif KhanNo ratings yet

- Zain PresentationDocument12 pagesZain PresentationAtif KhanNo ratings yet

- All Dpo Address in NWFP PeshawarDocument5 pagesAll Dpo Address in NWFP PeshawarAtif KhanNo ratings yet

- Project OutlineDocument1 pageProject OutlineAtif KhanNo ratings yet

- Frozen KababDocument1 pageFrozen KababAtif KhanNo ratings yet

- Islamic BankingDocument5 pagesIslamic BankingAtif KhanNo ratings yet

- ICT For EntrepreneurshipDocument6 pagesICT For EntrepreneurshipAtif KhanNo ratings yet

- Termination of Utilities Supply FormDocument1 pageTermination of Utilities Supply Formsri2727No ratings yet

- Chapter 6 (Payment Systems in E-Commerce)Document40 pagesChapter 6 (Payment Systems in E-Commerce)Atik Israk LemonNo ratings yet

- Indwdhi 20183107 PDFDocument1 pageIndwdhi 20183107 PDFtuyiNo ratings yet

- Geneva OverviewDocument54 pagesGeneva OverviewNishant KumarNo ratings yet

- Sap Guide 2 0 1Document13 pagesSap Guide 2 0 1api-359265393No ratings yet

- Presented By:: Muhammad Numan Zamir Muhammad Irfan Ahmad Muhammad Sufyan Akram 121 148 120Document59 pagesPresented By:: Muhammad Numan Zamir Muhammad Irfan Ahmad Muhammad Sufyan Akram 121 148 120kiarakhoNo ratings yet

- DBBL Internet Banking ReportDocument5 pagesDBBL Internet Banking ReportJakiul MajidNo ratings yet

- JMB 962/2018 water invoiceDocument1 pageJMB 962/2018 water invoicescribble_55No ratings yet

- Faq Change of Cimb Bank Account Number Format 20150316 PDFDocument1 pageFaq Change of Cimb Bank Account Number Format 20150316 PDFOthman A. MughniNo ratings yet

- Hong Leong Connect Terms and Conditions - Version 010 Last Updated: 160503 YY HoDocument36 pagesHong Leong Connect Terms and Conditions - Version 010 Last Updated: 160503 YY Hoit4728No ratings yet

- Allied Bank's Objectives and OverviewDocument69 pagesAllied Bank's Objectives and OverviewAdil MuradNo ratings yet

- EDIDocument9 pagesEDIrajivagnihotri1No ratings yet

- Standing Order Application / Information Update FormDocument1 pageStanding Order Application / Information Update FormЛена КиселеваNo ratings yet

- Impact of Information Technology (It) On Banking Sector: Madhushree L. M., Revathi Radhakrishnan, & P. S. AithalDocument8 pagesImpact of Information Technology (It) On Banking Sector: Madhushree L. M., Revathi Radhakrishnan, & P. S. Aithaltushar vatsNo ratings yet

- RTGSDocument2 pagesRTGSMithun Roy0% (1)

- BizChannel@CIMB Application Form - Ver1.8Document6 pagesBizChannel@CIMB Application Form - Ver1.8Aziel AzharNo ratings yet

- ECSS Regular Donation 20210319Document2 pagesECSS Regular Donation 20210319Hanny BoonNo ratings yet

- Campaign Period: Terms and Conditions "CIMB 4.7% FD/FRIA-i Bundle With CASA/-i"Document6 pagesCampaign Period: Terms and Conditions "CIMB 4.7% FD/FRIA-i Bundle With CASA/-i"Tan Ah LiannNo ratings yet

- Service Charges - BoB - As On 6.11.17Document63 pagesService Charges - BoB - As On 6.11.17Praneta pandeyNo ratings yet