Professional Documents

Culture Documents

2008 Second Quarter Results: TSX: Lun Nyse: LMC Omx: Lumi

Uploaded by

Eunice Kalaw VargasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2008 Second Quarter Results: TSX: Lun Nyse: LMC Omx: Lumi

Uploaded by

Eunice Kalaw VargasCopyright:

Available Formats

TSX: LUN

NYSE: LMC

OMX: LUMI

2008 Second Quarter Results

Cautionary Statements

Caution Regarding Forward Looking Statements

This presentation contains forward-looking statements. These forward-looking

statements are not based on historical facts, but rather on current expectations and

projections about future events. These forward-looking statements are subject to risks

and uncertainties. These risks and uncertainties could cause actual results to differ

materially from the future results expressed or implied by the forward-looking statements.

Caution Regarding Inferred Resources

This presentation uses the terms "Measured", "Indicated" and "Inferred" Resources. U.S.

investors are advised that while such terms are recognized and required by Canadian

regulations, the Securities and Exchange Commission does not recognize them.

"Inferred Resources" have a great amount of uncertainty as to their existence, and great

uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any

part of an inferred resource will ever be upgraded to a higher category. Under Canadian

rules, estimated of Inferred Resources may not form the basis of feasibility or other

economic studies. U.S. investors are cautioned not to assume that all or any part of

Measured or Indicated Resources will ever be converted into reserves.

Corporate Operations Projects Exploration Growth

Presenter

PHIL WRIGHT PRESIDENT & CEO

Questions

ANDERS HAKER VP & CFO

JOAO CARRELO EXEC. VP & COO

NEIL O’BRIEN SR. VP EXPL. & BUS. DEV.

Corporate Operations Projects Exploration Growth

Significant Highlights

First half operating earnings of $320 million exceeds internal

expectations by 8%

Production, excluding Aljustrel, exceeds internal expectations –

2008 production forecast to be revised upwards

Copper 65% of revenue for first half 2008

Zinc and nickel prices fallen substantially

Large price adjustments affecting comparison quarter to quarter

Non-cash impairment charge of $165 million related to write

down of Aljustrel results in net loss for the quarter of $108 million

Major new zinc-copper discovery at Neves-Corvo – potential to

be largest combined zinc-copper deposit at this mine

Corporate Operations Projects Exploration Growth

Non-Cash Impairment Charge

Aljustrel in pre-production phase

High cost zinc mine in a low zinc price environment

Write down of carrying value to net $nil

Impairment charge of $165 million (153 million + future income

tax expense of $12 million)

The write down expenses the previously written-down figure of

$27 million, 2008 capex; pre-production start up costs; and makes

provision for contractual obligations if closed

Studying potential for early extraction of copper resources

Decision on the future of Aljustrel is expected before year end

Corporate Operations Projects Exploration Growth

Production & Metal Prices: Q2’08 and Q2’07

Production Prices

(tonnes) (US $/t, US $/lb)

Q2’08 Q2’07 Q2’08 Q2’07

Copper 23,478 22,375 8,448 7,637

3.83 3.46

Zinc 46,452 40,549 2,115 3,673

0.96 1.67

Lead 12,397 13,237 2,316 2,174

1.05 0.99

Nickel 1,954 - 25,730 48,185

11.67 21.86

Corporate Operations Projects Exploration Growth

Change In Production Q1’08 to Q2’08

30,000

50,000 2,701 (234) 991 46,452

24,939 9 (986) (484) 23,478 42,994

Contained metal

Contained metal

(tonnes)

(tonnes)

Throughput

Throughput

Recovery

Recovery

Grade

Grade

Q1 08 Cu Q2 08 Q1 08 Zn Q2 08

207 (86)

14,000 (16) 1,954

12,577 449 (578)

(51) 12,397 2,000 1,884

Contained metal

Contained metal

(tonnes)

(tonnes)

Throughput

Throughput

Recovery

Recovery

Grade

Grade

Q1 08 Pb Q2 08 Q1 08 Ni Q2 08

Corporate Operations Projects Exploration Growth

Second Quarter: Financial Results

$ Millions Q2’08 Q2’08 Q2’07

(incl. impairment)

Sales 294 294 320

Operating Earnings 137 137 219

Add (deduct):

General Exploration (10) (10) (8)

Amortization (55) (55) (35)

Derivatives 7 7 (28)

Forex (2) (2) (9)

Interest and Other Items (4) (4) 6

Investments (1) (1) 50

Impairment - (165) -

Earnings Before Income Tax 71 (81) 195

Net Earnings 56 (108) 154

Corporate Operations Projects Exploration Growth

Change in Pre-Tax Earnings Q1’08 to Q2’08

Pre-Impairment

140

120 109.4

(68.7)

100

US$ (million)

41.7 (11.1)

80

(4.3) 5.0 71.4

60 Costs Forex Other

40

Price & price Sales

20 adjustments Volume

Pretax Pretax

earnings earnings

Q1 08 Q2 08

Corporate Operations Projects Exploration Growth

Effect of Price Adjustments on Reporting

Indicative only

Q2’08 Q1’08

Net Sales Reported 294.1 305.7

Price Adjustments 11.3 (42.5)

Restated Actuals 305.4 263.2

Q2’08 Q1’08

Operating Earnings Reported 137.2 182.9

Price Adjustments 11.3 (42.5)

Restated Actuals 148.5 140.4

Corporate Operations Projects Exploration Growth

Project Progress

Tenke Copper Project

Construction progress improved significantly

First copper expected 2nd half 2009

Expansion planning underway

No developments in contract review process

Ozernoe Project

In discussion with partners. No progress to report

Zinkgruvan Copper Project

On-budget (in EUR) and on schedule

Targeting 2010 for first copper

Project improves zinc mining flexibility

Corporate Operations Projects Exploration Growth

Tenke Construction Progress

Corporate Operations Projects Exploration Growth

Iberian Projects

Neves-Corvo Expansion

New zinc-copper deposit discovered: thick, high-grade zinc

intersections with good copper potential

Presently assessing doubling zinc production from existing ore

bodies to 1 million tpa ore (+ 50,000 tpa zinc in concentrate)

Also studying large-scale development utilizing Lombador

deposit. Pre-feasibility studies expected by end of year.

Aguablanca

Assessing underground expansion

Aljustrel

Assessing copper portential

Corporate Operations Projects Exploration Growth

Growing Our Reserves and Resources

Exploration Q2/08 Q2/07 2008 est. 2007

Expenditure - $millions $10 $7.9 40.0 35.4

Approx. two-thirds is near-mine & one-third is regional exploration

Highlights

Neves-Corvo: 9,198 m drilled, major new Lombador East

zinc/copper discovery

Aljustrel: 6,035 m drilled, expansion and delineation of Feitais

copper resource

Aguablanca: 7,853 m drilled, expansion of nickel/copper

mineralization to northwest and south

Zinkgruvan: 5,340 m drilled, encouraging results

Corporate Operations Projects Exploration Growth

Outlook

Contained metal production outlook: 96,000 (92,000) tonnes

copper, 181,000 (202,000) tonnes zinc, 45,000 (47,000) tonnes

of lead and 7,000 (6,800) tonnes nickel. (Previous forecasts in brackets)

Aljustrel and Ozernoe under review

2008 Capital expenditure expected to be $400 to $450 million,

result of paste deposition at Neves-Corvo and weaker US Dollar

Balance sheet remains strong

Positioning ourselves for potentially tough few years in zinc/lead;

focusing on developing resource base and expansion of existing

operations

Continue to assess opportunities created by present market

conditions

Corporate Operations Projects Exploration Growth

Questions

PHIL WRIGHT PRESIDENT & CEO

ANDERS HAKER VP & CFO

JOAO CARRELO EXEC. VP & COO

NEIL O’BRIEN SR. VP EXPL. & BUS. DEV.

Corporate Operations Projects Exploration Growth

TSX: LUN

NYSE: LMC

OMX: LUMI

You might also like

- q1 2022 Production ReportDocument16 pagesq1 2022 Production ReportMichel M.No ratings yet

- 2019 LEPANTO FINAL PDF FILE - CompressedDocument90 pages2019 LEPANTO FINAL PDF FILE - CompressedMIGUEL BUENAVENTURA VIRAYNo ratings yet

- Toromocho Jan2017 Competent Persons ReportDocument147 pagesToromocho Jan2017 Competent Persons Reportmaría joséNo ratings yet

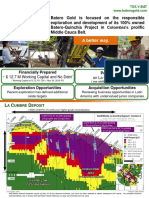

- A Better Way.: $ 12.7 M Working Capital and No Debt On La Cumbre DepositDocument2 pagesA Better Way.: $ 12.7 M Working Capital and No Debt On La Cumbre Depositmilton74No ratings yet

- GLEN 2020-HY ProductionReportDocument20 pagesGLEN 2020-HY ProductionReportbenwarrenallianceoliNo ratings yet

- Stillwater Mining Company presentation highlights growth opportunitiesDocument40 pagesStillwater Mining Company presentation highlights growth opportunitiesDiego MinasNo ratings yet

- Overview of Mineral Reserves EstimationDocument38 pagesOverview of Mineral Reserves EstimationJohanes Cevin GintingNo ratings yet

- Metorex Int Dec07Document12 pagesMetorex Int Dec07Take OneNo ratings yet

- Calcium CarbiedDocument26 pagesCalcium CarbiedRobel KefelewNo ratings yet

- Gold and Silver Processing Though Carbon in Leach - EditedDocument10 pagesGold and Silver Processing Though Carbon in Leach - EditedRoberto Antonio Mercado AngustiaNo ratings yet

- Washington in 2005Document7 pagesWashington in 2005jeremyNo ratings yet

- (RS) (RS) (RS) (%) (%) (RS) (RS) (RS) (RS)Document2 pages(RS) (RS) (RS) (%) (%) (RS) (RS) (RS) (RS)Paramdeep SinghNo ratings yet

- Executive Summery-Integrated Steel CompanyDocument2 pagesExecutive Summery-Integrated Steel Companyjeet3184No ratings yet

- 2008 Q2 ProductionDocument20 pages2008 Q2 ProductionTimBarrowsNo ratings yet

- GLEN 2023-Q3 ProductionReportDocument17 pagesGLEN 2023-Q3 ProductionReportKinzimbu Asset ManagementNo ratings yet

- Asiamet FS Ars - PDF - 2 - Exec - SummaryDocument37 pagesAsiamet FS Ars - PDF - 2 - Exec - SummaryOwm Close CorporationNo ratings yet

- MiningDocument9 pagesMiningBiplab GhoshNo ratings yet

- Tata Steel - Value Chain AnalysisDocument11 pagesTata Steel - Value Chain AnalysisKiranNo ratings yet

- SilverCrest Announces Positive Feasibility Study Results for Las Chispas ProjectDocument10 pagesSilverCrest Announces Positive Feasibility Study Results for Las Chispas ProjectMahdi Tukang BatuNo ratings yet

- Monthly Report OPEX September 2018 Cerro Verde Mine DivisionDocument39 pagesMonthly Report OPEX September 2018 Cerro Verde Mine DivisionNEZNo ratings yet

- Exploring HPGR Technology For Heap Leaching of Fresh Rock Gold OresDocument27 pagesExploring HPGR Technology For Heap Leaching of Fresh Rock Gold Oresjimena BautistaNo ratings yet

- Collaboration and FinanceDocument11 pagesCollaboration and FinanceAditya JainNo ratings yet

- 5-1 Recent Research Developments in Belt Conveyor TechnologyDocument17 pages5-1 Recent Research Developments in Belt Conveyor TechnologyPLSNo ratings yet

- 2011 1T Analisis de La GerenciaDocument8 pages2011 1T Analisis de La Gerencialgp500h2No ratings yet

- Gud IronDocument13 pagesGud IronRajat WadhwaNo ratings yet

- Advance Release: April 11, 2016Document3 pagesAdvance Release: April 11, 2016MauricioBernalRamosNo ratings yet

- Jean-Raymond Boulle, Titanium Resources GroupDocument30 pagesJean-Raymond Boulle, Titanium Resources Groupinvestorseurope offshore stockbrokersNo ratings yet

- RKH 5 Oktober 2022 NSDocument1 pageRKH 5 Oktober 2022 NSMuh.Mushawwir AliNo ratings yet

- Casting - Solidification.Document3 pagesCasting - Solidification.__Caro26__No ratings yet

- MDKA Consolidated Mineral Resources and Ore Reserves Statement 31 Dec 2020Document13 pagesMDKA Consolidated Mineral Resources and Ore Reserves Statement 31 Dec 2020Leonie SaputriNo ratings yet

- Summary of Capital Cost: DWSS (Gravity Flow)Document5 pagesSummary of Capital Cost: DWSS (Gravity Flow)Mohsin ShahzadNo ratings yet

- Tata Steel - Value Chain AnalysisDocument11 pagesTata Steel - Value Chain AnalysisKiranNo ratings yet

- National Transmission Company Contract for 500kV Transmission LineDocument38 pagesNational Transmission Company Contract for 500kV Transmission LineMuhammad Arshad JawadNo ratings yet

- Resource Estimate Report For: Author (S)Document71 pagesResource Estimate Report For: Author (S)riecuantiqueNo ratings yet

- PROCEMIN 2023 - M2F Process Optimization @toromocho MineDocument32 pagesPROCEMIN 2023 - M2F Process Optimization @toromocho Mineachint GoelNo ratings yet

- Principle of Natural and Artificial Radioactive Series EquivalencyDocument9 pagesPrinciple of Natural and Artificial Radioactive Series Equivalencychinuuu85br5484No ratings yet

- RKH 3 Oktober 2022Document2 pagesRKH 3 Oktober 2022Muh.Mushawwir AliNo ratings yet

- Executive Summary TUBAN - SELATAN - PPMDocument17 pagesExecutive Summary TUBAN - SELATAN - PPMBimo Septyo PrabowoNo ratings yet

- Mechanical Works RFQ for KSA Casing and Forging ProjectDocument5 pagesMechanical Works RFQ for KSA Casing and Forging ProjectMohammed Mostafa El HaddadNo ratings yet

- Sprott 22-11-10-Ctm-Scp-MreDocument6 pagesSprott 22-11-10-Ctm-Scp-Mrecarlosmarco87No ratings yet

- CMMC Investor Presentation January 2022Document27 pagesCMMC Investor Presentation January 2022Mike stefanykNo ratings yet

- RKH SHIFT REPORT PT. Bakti Pertiwi Nusantara Site SepoDocument2 pagesRKH SHIFT REPORT PT. Bakti Pertiwi Nusantara Site SepoMuh.Mushawwir AliNo ratings yet

- Mining Statistics 2018 DENRDocument1 pageMining Statistics 2018 DENRJustin TayabanNo ratings yet

- GLEN 2022-Q1 ProductionReportDocument17 pagesGLEN 2022-Q1 ProductionReportPrabhakar BhandarkarNo ratings yet

- Revised BOQ For C&S Vadodara-12th March-Sunil SirDocument238 pagesRevised BOQ For C&S Vadodara-12th March-Sunil SirParth SadadiwalaNo ratings yet

- JIJEL - Chemical - Clarification - ELECTROCHEMICAL - 190502 - 4th Comment AnsweredDocument2 pagesJIJEL - Chemical - Clarification - ELECTROCHEMICAL - 190502 - 4th Comment AnsweredZaki nouiNo ratings yet

- 2 BQQ Insulation Con Datos de TuberiaDocument11 pages2 BQQ Insulation Con Datos de Tuberiamario almaguerNo ratings yet

- Management's Discussion and Analysis: For The Nine Months Ended September 30, 2011 and 2010Document25 pagesManagement's Discussion and Analysis: For The Nine Months Ended September 30, 2011 and 2010cloogisNo ratings yet

- HKTDC NTE1OTE1OTI0 enDocument2 pagesHKTDC NTE1OTE1OTI0 enaminNo ratings yet

- PT8'' EdificioDocument2 pagesPT8'' EdificioIvan PorrasNo ratings yet

- 155 MM ObusDocument1 page155 MM Obus6x7bx9kwknNo ratings yet

- Heron Resources Limited 2015Document34 pagesHeron Resources Limited 2015Yojan Ccoa CcopaNo ratings yet

- CENTRAL ELECTRICITY AUTHORITY DAILY COAL STOCK REPORTDocument6 pagesCENTRAL ELECTRICITY AUTHORITY DAILY COAL STOCK REPORTMANOJ MURLIDHARAN KUMARNo ratings yet

- Analyst Meet Presentation Jan 08Document37 pagesAnalyst Meet Presentation Jan 08Varun KumarNo ratings yet

- FIT Technology OverviewDocument13 pagesFIT Technology OverviewshahinNo ratings yet

- 002 - JCamus Presentation - 2010 CRU Copper ConferenceDocument20 pages002 - JCamus Presentation - 2010 CRU Copper ConferenceDe La Cruz Calderon EdwardNo ratings yet

- Orica Nitric Acid Plant 1 Verification ReportDocument45 pagesOrica Nitric Acid Plant 1 Verification ReportmariatiNo ratings yet

- Daily Staging Plan 2206023Document21 pagesDaily Staging Plan 2206023Andy Dwi SaputraNo ratings yet

- Green Building For Environment and Green Technology EducationDocument80 pagesGreen Building For Environment and Green Technology EducationMae Ann GonzalesNo ratings yet

- Labor ExamDocument9 pagesLabor ExamEunice Kalaw VargasNo ratings yet

- Article II of The 1987 Constitution Particularly Provides That The State Values The DignityDocument1 pageArticle II of The 1987 Constitution Particularly Provides That The State Values The DignityEunice Kalaw VargasNo ratings yet

- Criminal Law ReviewerDocument28 pagesCriminal Law ReviewerEunice Kalaw VargasNo ratings yet

- Recentjuris Remedial LawDocument81 pagesRecentjuris Remedial LawChai CabralNo ratings yet

- Homework No 3 Topic ADocument1 pageHomework No 3 Topic AEunice Kalaw VargasNo ratings yet

- Corporation v. MYTC, Felipe Monserrat, and Rosario Vda. de Monserrat (The Manila Case)Document174 pagesCorporation v. MYTC, Felipe Monserrat, and Rosario Vda. de Monserrat (The Manila Case)Eunice Kalaw VargasNo ratings yet

- Code of Judicial Conduct RulesDocument5 pagesCode of Judicial Conduct RulesKat MirandaNo ratings yet

- Information Prac. CourtDocument2 pagesInformation Prac. CourtEunice Kalaw VargasNo ratings yet

- Edited Information Investigation Data Form Affidavit Complaint Annexes Subpoena Warrant of ArrestDocument16 pagesEdited Information Investigation Data Form Affidavit Complaint Annexes Subpoena Warrant of ArrestEunice Kalaw VargasNo ratings yet

- ResolutionDocument2 pagesResolutionEunice Kalaw VargasNo ratings yet

- Judicial Counter AffidavitDocument5 pagesJudicial Counter AffidavitEunice Kalaw VargasNo ratings yet

- Tapbrey Vs Silvano Case On The MeritsDocument14 pagesTapbrey Vs Silvano Case On The MeritsEunice Kalaw VargasNo ratings yet

- 2019 Ust Ethics PWDocument50 pages2019 Ust Ethics PWjohn joseph100% (2)

- Legal Counseling First Exam Reviewer PDFDocument20 pagesLegal Counseling First Exam Reviewer PDFMirai KuriyamaNo ratings yet

- SirDocument296 pagesSirEunice Kalaw VargasNo ratings yet

- Elements of Estafa Are:: The FactsDocument2 pagesElements of Estafa Are:: The FactsEunice Kalaw VargasNo ratings yet

- Rule 59 Prov RemDocument6 pagesRule 59 Prov RemGretchen Alunday SuarezNo ratings yet

- Remedial Law Review II - Mid-Term Examination - Part 1: Cordillera Career Development CollegeDocument6 pagesRemedial Law Review II - Mid-Term Examination - Part 1: Cordillera Career Development CollegeEunice Kalaw VargasNo ratings yet

- Nestor P. Abes:, NPS DOCKET NO. 10-00552 Complainant - Versus - For-, ESTAFA Under RPC Art. Respondent. 315 para 2 (D)Document5 pagesNestor P. Abes:, NPS DOCKET NO. 10-00552 Complainant - Versus - For-, ESTAFA Under RPC Art. Respondent. 315 para 2 (D)Eunice Kalaw VargasNo ratings yet

- Rule 60-PR ReplevinDocument7 pagesRule 60-PR ReplevinKarla Marie TumulakNo ratings yet

- ResolutionDocument2 pagesResolutionEunice Kalaw VargasNo ratings yet

- Mte Remlr2 - Part1 (06 March 2021)Document10 pagesMte Remlr2 - Part1 (06 March 2021)Eunice Kalaw VargasNo ratings yet

- Civpro 39 - April 24, 2018 - Rule 41 & 42Document9 pagesCivpro 39 - April 24, 2018 - Rule 41 & 42Eunice Kalaw VargasNo ratings yet

- Problem: Petitioner Alleged That Respondent, "Doing Business Under The Name and Style ofDocument2 pagesProblem: Petitioner Alleged That Respondent, "Doing Business Under The Name and Style ofEunice Kalaw VargasNo ratings yet

- Civ Pro Complation NG Make Up ClassDocument12 pagesCiv Pro Complation NG Make Up ClassEunice Kalaw VargasNo ratings yet

- HW1 No.31, 58, 87Document3 pagesHW1 No.31, 58, 87Eunice Kalaw VargasNo ratings yet

- 50 57Document14 pages50 57Eunice Kalaw VargasNo ratings yet

- CIVPRO 1st-14 CompliledDocument38 pagesCIVPRO 1st-14 CompliledEunice Kalaw Vargas100% (1)

- Labor CasesDocument6 pagesLabor CasesEunice Kalaw VargasNo ratings yet

- HW1 No.31, 58, 87Document3 pagesHW1 No.31, 58, 87Eunice Kalaw VargasNo ratings yet

- Controversies and conflicts of the Jacksonian EraDocument2 pagesControversies and conflicts of the Jacksonian EraDaniel CoteNo ratings yet

- KSCAA September 10 NewsletterDocument28 pagesKSCAA September 10 Newsletterramachandran_ca8060No ratings yet

- The Airline IndustryDocument8 pagesThe Airline IndustryDan Hardy100% (1)

- Retail MCQ ModuleDocument19 pagesRetail MCQ ModuleBattina AbhisekNo ratings yet

- Murimi Betty M - Factors Affecting The Success of Start Up of Youth Enterprises in Nairobi County, KenyaDocument82 pagesMurimi Betty M - Factors Affecting The Success of Start Up of Youth Enterprises in Nairobi County, KenyaSteven OchiengNo ratings yet

- Donors TaxDocument4 pagesDonors TaxRo-Anne LozadaNo ratings yet

- HR SopDocument7 pagesHR SopDen PamatianNo ratings yet

- Interpreting Financial StatementsDocument30 pagesInterpreting Financial StatementsAkshata Masurkar100% (2)

- The Concept of Relationship Marketing: Lesson 2.1Document66 pagesThe Concept of Relationship Marketing: Lesson 2.1Love the Vibe0% (1)

- Mini Case ToyotaDocument4 pagesMini Case ToyotahkNo ratings yet

- Variations in Construction ContractsDocument20 pagesVariations in Construction Contractsahmedmushtaq041No ratings yet

- Essay About MonopolyDocument15 pagesEssay About MonopolyNguyễn Lan HươngNo ratings yet

- Article On Investors Awareness in Stock Market-1Document10 pagesArticle On Investors Awareness in Stock Market-1archerselevatorsNo ratings yet

- Chapter 7 - Accepting The Engagement and Planning The AuditDocument9 pagesChapter 7 - Accepting The Engagement and Planning The Auditsimona_xoNo ratings yet

- Unit 2 Income From SalariesDocument21 pagesUnit 2 Income From SalariesShreya SilNo ratings yet

- Savings Groups and Banks Complements or Substitutes Financial IDocument31 pagesSavings Groups and Banks Complements or Substitutes Financial IBesufekad MamoNo ratings yet

- Balaji Wafers (FINAL)Document38 pagesBalaji Wafers (FINAL)Urja BhavsarNo ratings yet

- ACCA F5 Introduction To The PaperDocument4 pagesACCA F5 Introduction To The Paperalimran77No ratings yet

- Chapter 7 Process ApproachDocument12 pagesChapter 7 Process Approachloyd smithNo ratings yet

- SOP Guidelines For AustraliaDocument1 pageSOP Guidelines For AustraliaShivam ChadhaNo ratings yet

- Case-8, Group-8Document59 pagesCase-8, Group-8njtithiNo ratings yet

- Volkswagen AG PresentationDocument29 pagesVolkswagen AG PresentationBilly DuckNo ratings yet

- CH 2 POP PRACTICE EXAMDocument9 pagesCH 2 POP PRACTICE EXAMErik WeisenseeNo ratings yet

- NikeDocument33 pagesNikeRocking Heartbroker DebNo ratings yet

- Integration of Project Management Software/Application To 888 Acy EnterprisesDocument27 pagesIntegration of Project Management Software/Application To 888 Acy EnterprisesCymon ConcepcionNo ratings yet

- Setting The Right Price at The Right TimeDocument5 pagesSetting The Right Price at The Right TimeTung NgoNo ratings yet

- Ifrs at A Glance IFRS 7 Financial Instruments: DisclosuresDocument5 pagesIfrs at A Glance IFRS 7 Financial Instruments: DisclosuresNoor Ul Hussain MirzaNo ratings yet

- What Is Cabin Crew and Air HostessDocument8 pagesWhat Is Cabin Crew and Air HostessKolkata air Hostess academyNo ratings yet

- Urban Liveability in The Context of Sustainable Development: A Perspective From Coastal Region of West BengalDocument15 pagesUrban Liveability in The Context of Sustainable Development: A Perspective From Coastal Region of West BengalPremier PublishersNo ratings yet

- Chapter 4 ExerciseDocument7 pagesChapter 4 ExerciseJoe DicksonNo ratings yet