Professional Documents

Culture Documents

JKF - Intro

Uploaded by

UnnikrishnanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JKF - Intro

Uploaded by

UnnikrishnanCopyright:

Available Formats

One of India’s Premier

brand in Mens wear.

Redefining branded fashion for all generations

Key Milestones

• Kavitha 1993 • JK Fashions 2013 • Kocaine

Exports • Karlsburg @ Women’s brand

• Stalls in 44

• Direct Exports Chennai airport airports

1984 Canada,

2005 across India 2015

Europe, US

2018 • Retail outlets

outside Airports

Goes multiple outlets of own /

franchise / partnership

2017

First generation entrepreneur founded

Kavitha exports in 1984, after reasonable stint

with J.P.COATS & Hindustan Lever Ltd. His

Ranjit Jacob success triggered to found JK Fashions an

Founder and Managing

Director

collaborative venture to promote the mens

brand “Karlsburg”. In support he started two

more Manufacturing units Chennai Exports

and Suriya Exports.

Our Journey

JKF commenced its operations in 2005 with a paid up capital

of Rs. 4,00,00,000/- ( Four Crores).

Powered by Kavitha Exports, producer of well known Global

Brands H & M, Chevalier, Central Station & Rohnish Sports wear.

Pioneers in establishing regular shopping in Indian airports by

the first Karlsburg shop at Chennai airport in 2005.

JKF Promoted the mens Clothing & accessories

under the Brand “Karlsburg” and recently

included the women’s brand “Kocaine” .

Vision

Emerging “Karlsburg” as a leading brand of

premium Men’s ware in Asia Pacific by 2020.

Mission

Open retail outlets across the region through own,

franchise, partnership and dealer network includes

obtaining shelf space at major multi-brand retail

outlets.

Instant Gratification On-Demand Service Value for Money

Looking for immediate Looks for fast as and Want the most

benefit rather then wait when required delivery contemporary product at

for long period of services most affordable price

Building a Valuable Brand

Heighten Brand Develop Favorable

Awareness Associations

Brand Equity

Consistent Create Emotional

Reinforcement Connections

To establish 300 outlets owned and operated through Franchise.

To market JKF products through reputed distributors to reach the product

to MBO’s in smaller towns and cities.

To establish a centralized ware housing facility to cater to the Indian market

from the point of logistics.

To establish JKF stores internationally to start with Colombo, Singapore,

Malaysia, Hong Kong, Australia, Bahrain, Saudi Arabia, Muscat and Doha. (

karlsburg is currently available in Kuwait, Sharjah and Dubai.)

To advertise in Mass Media Networks.

To enhance the current production capacity to meet the growing demands

Indian Apparel Market – Large and Growing Rapidly

Driven by organized retail growth of ~18% over 5 years

Growth of Organized Retail Apparel - largest share in Organized Retail

FY14: USD ~40 bn

Organized Retail

Market (USD bn) Footwear Others 1%

Pharmacy 5%

2% Food &

Grocery

18%

93 Apparel

28%

Jewelery,

40 Home Watches, etc.

Products

3% 27%

15

Consumer

Durables,

FY FY FY

IT 16%

09 14E 19E

JK Fashions well poised to exploit the growth opportunity

Source: Industry Reports

Notes:(1) FX rate of USD 1 = INR 60

Indian Apparel

Market Men’s Apparel Market Indian E- com

Growing at

1 Indian Apparel Market Size 9% Market

394,000 Crores By 2020 E CAGR

Indian Online Apparel Market Size

(Indian Fashion Forum 2016)

(Technopak 1 12,900 Crores by 2020E

Advisor) (Etailing India 2016)

2 Men’s Apparel Share

169,500 Crores OR 43% Apparel Comprises

of the Apparel Market 2 30% of the online sales 2017

2020E - (Technopak Advisor) - (Etailing India 2016)

3 Shirt will constitute 36% Online Shoppers in India

OR 60,999 Crores of Men’s

3 320 Million

Wear Market by 2020 by 2020. India is Adding

(Italian Trade Commission) 3 Internet Users / Second

4 Branded & Unbranded (economictimes.com)

4 Ecommerce Share

Men’s wear will constitute

Of total Retail will increase

18% AND 20% from1.7% TO 4.8% by 2020

of Men’s wear Market by 2020

(Statista)

(IWazir Advisor 2016 report)

Key pillars of Future Growth

Capitalize on strong brand portfolio of Karlsburg

Brand

Multiple opportunities to build brands: Youth, kids, casuals, denim, etc.

Rapidly expand network by leveraging multiple formats

Channel

Strong & focused attention to emerging channels Franchise- Network

Highly experienced management team

Capability

Combination of experienced design teams: repository of knowledge

and innovation Leverage combined high quality consumer insights

Multiple Operating Synergies – Sourcing, Real Estate, Supply Chain & IT

Revenue Model Go-To-Market Strategy

√Shop & Shelf Space Sales

√Online Sales Long-Term Objective Short-Term Objective

√Shop Setup Cost -Build Brand Image -Increase Traffic

√Operating Expenses

-Create Loyalty

√3 Year Financial Plan -Increase Sales

Shortlisting & Select Inventory Control

the right “ Franchise” from Head Office

for sales

1 2 3 4

Setting Up the Shops at

“potential” location

Earns revenue

from Channels Software Setup for

operations

8 7 6 5

Analyze Digital Marketing Advertising & Instore

Performance & and Customer promotion for

replenish shelf Nurturing Discounts

space

“In fact “Showrooming”

The Millennials and “Webrooming” are the

new lexicon of this

Uses smartphone to demography”

68%

compare prices of products

27% Smartphone users spends

3k-10k on shopping

71% uses Digital media

before shopping

21% In-store shopping

influenced by digital media

66% spends more

Due to influence of digital media

66% uses social media before

buying

Retail Landscape Competitive Landscape

Departmental No. of

Stores Stores Other Channel players

Pantaloons 104 Indian Ventures Location Segment

Specialty Stores No. of Stores

Westside 86 Fab Connection Delhi Fashion

Titan Industries

Shoppers Stop 81 - World of Titans 430 Obataimu Mumbai Fashion

Reliance Trends 3300 - Tanishq 174 Pocket Electric Delhi Fashion

- Titan Eyes 336

Hypermarkets No. of Pepperfry Delhi Furniture

Stores Vijay Sales -

Window

Croma - Fenesta Gurgaon

Big Bazaar 512 Maker

HyperCITY 16 E-Zone - Zivame Gurgaon Fashion

Trent Landmark - Addidas India Footwear

Spencer’s Crossword -

Reliance International

Location Segment

Cash & Carry No. of Stores Ventures

Supermarkets No. of

Stores Metro 16 Tommy Hilfiger Europe T-Shirts

Aditya Birla 1735 Reliance 20 Louis Vuitton Europe Fashion

Spencer’s daily 134 REI 6Ten 350 Target USA Fashion

Reliance Fresh 700 Bib Bazaar 512 Walmart Metro 7 USA Fashion

http://www.theweekendleader.com/Culture/1177/pop-up-retail.html

REI 6Ten 350 (Franchisee) MAC USA Cosmetic

Bib Bazaar 512 Source: Company websites, Press Consumer

Apple USA

(Franchisee) Release, TechSci Research Electronic

Revenue Model

Revenue Model Sales of Mens wear at Shops

Pricing Strategy Rs. 995/- to 2595/- per unit

1st Year – 60

Planned Shops 2nd Year - 140 300 Shops

3rd Year - 100

Average Inventory / Shop 1000 Units

Planned Yearly Revenue / Shop 60 - 90 lakhs (Average)

Expected Inventory Turn 10 Turns per year

1st Year – Kerala & Tamil Nadu

Target Geography 2nd Year – Kerala, South Indian & East Indian States

3rd Year – South India, East , West & North Indian States

1. At 10 turns total sales will be 5000 units/year which is negligible

conversion of present footfall.

2. With more than 60 cities , brand popularity, + organized apparel stores

Why we will getting 200 “Hosts” is positive positioning.

achieve it? 3. India is ranked as the most preferred retail destination for international

investors.

4. Organized retail sector is estimated to grow by 400%, in value terms, by

2007-08. Reference www.IBEF.org

Revenue Model

Revenue Model Online Sales of Formal Shirts

Pricing Strategy 995/- to 2500/- per Unit

1st Year – 5% of Total Turnover

Planned Sales 2nd Year – 15% of Total Turnover

3rd Year – 30% of Total Turnover

1st Year – 100 Lakhs Lakhs

Planned Yearly Revenue

3rd Year – 576 Lakhs

Expected Inventory Turn 6 turns per year

1st Year – Entire South India

Target Geography 2nd Year – South & West India

3rd Year – Whole of India

1. India will have 32 Crores online shoppers and fashion is 30% of

total e-tail sales

Why we will achieve it? 2. Share of ecommerce is going to double from present status

3. Organized retailers have 10% of their sales coming from online

channels in 2017, which is bound to increase in future

Growing Urbanisation & Disposable Incomes Driving Retail in India

The latest addition to the Karlsburg range of products is

the Men’s Perfume, which has crossed the Sales Figure

of 10,000 units in the first few months of launching the

product. Today we have crossed 50,000 Units

The advertising of the product is built into the store at

the Airports. The Signage of the Karlsburg Showroom

Boards commands a commercial value of approximately

10 crores every year.

The total visibility of the Karlsburg brand in 42 outlets

in the Indian Airports is estimated at over 100 million

eyeballs / annum and the recognition has enabled a very

healthy conversion rate.

www.karlsburg.org

You might also like

- Koovs.com 2018: India's Emerging ASOS of FashionDocument15 pagesKoovs.com 2018: India's Emerging ASOS of FashionLakshay DhaliaNo ratings yet

- V MART Annual Report 2017-18Document164 pagesV MART Annual Report 2017-18Puneet367No ratings yet

- Footwear Industry AnalysisDocument10 pagesFootwear Industry AnalysisPrakhar Balyan100% (1)

- Final Indian Sportswear NikeDocument12 pagesFinal Indian Sportswear NikeTarannum Aurora 20DM226No ratings yet

- Identifying Opportunities: MirzaDocument156 pagesIdentifying Opportunities: MirzaSusmitha LineNo ratings yet

- VFL Presentation Final Q4-and-FY23Document27 pagesVFL Presentation Final Q4-and-FY23Denish GalaNo ratings yet

- Know Your Company: Aditya Birla Fashion and Retail LimitedDocument7 pagesKnow Your Company: Aditya Birla Fashion and Retail LimitedAnanta JindalNo ratings yet

- Branded Apparel Webinar - FinalDocument35 pagesBranded Apparel Webinar - FinalPriyam ModakNo ratings yet

- Visual Merchandising of PantaloonsDocument81 pagesVisual Merchandising of PantaloonsNeha Singh100% (4)

- Turnover Rs. 2661cr Net Profit Rs. 232crDocument3 pagesTurnover Rs. 2661cr Net Profit Rs. 232crVikas DalviNo ratings yet

- Bata India Limited Annual Report 2017 18Document216 pagesBata India Limited Annual Report 2017 18TotmolNo ratings yet

- Catwalk: Presented ByDocument25 pagesCatwalk: Presented ByShruti ShrivastavaNo ratings yet

- Himanshu Rawat & Rishab Garg Marico ProjectDocument12 pagesHimanshu Rawat & Rishab Garg Marico ProjectHIMANSHU RAWATNo ratings yet

- Indo-French Fashion Retailer, Curating High Street Fashion: Company USP-Market GrowthDocument1 pageIndo-French Fashion Retailer, Curating High Street Fashion: Company USP-Market GrowthRatna KumariNo ratings yet

- Branded Apparel Webinar - FinalDocument35 pagesBranded Apparel Webinar - FinalSaheb KapoorNo ratings yet

- Indian Ethnic Wear Brands Market StudyDocument14 pagesIndian Ethnic Wear Brands Market StudyFaisal Numan100% (3)

- Definition of The Business & Marico CompanyDocument21 pagesDefinition of The Business & Marico CompanyMahantesh mamadapurNo ratings yet

- VC Assignment Entryway 1Document14 pagesVC Assignment Entryway 1elizabthomasNo ratings yet

- Sector Analysis Capstone (Rohan Pandita)Document17 pagesSector Analysis Capstone (Rohan Pandita)Rohan PanditaNo ratings yet

- Marico Limited - Investor Presentation - February 2019Document65 pagesMarico Limited - Investor Presentation - February 2019HIMANSHU RAWATNo ratings yet

- Sourcing MDocument41 pagesSourcing Mzaya sarwarNo ratings yet

- Campus ActivewearDocument25 pagesCampus Activeweargarima52goyalNo ratings yet

- Nykaa BRM Report PDFDocument23 pagesNykaa BRM Report PDFKANIKA SACHANNo ratings yet

- Project Report ON Marico Submitted in Indira School of Business Studies BY Shruti Kumari Roll Number: F-46 PGDMDocument46 pagesProject Report ON Marico Submitted in Indira School of Business Studies BY Shruti Kumari Roll Number: F-46 PGDMShruti KumariNo ratings yet

- Manyavar ProfileDocument14 pagesManyavar ProfileAbhinav SrivastavaNo ratings yet

- High Street Essentials - Information Memorandum: Private and ConfidentialDocument39 pagesHigh Street Essentials - Information Memorandum: Private and ConfidentialcchascashcNo ratings yet

- Textile IndustryDocument14 pagesTextile Industry551VIJAYA ADITYA ERRABATINo ratings yet

- Marico Limited - Investor Presentation - August 2019Document58 pagesMarico Limited - Investor Presentation - August 2019Yaseen AmeenNo ratings yet

- Vedant Fashions: Connecting To The Roots With Style!Document50 pagesVedant Fashions: Connecting To The Roots With Style!amsukdNo ratings yet

- Manyavar - AR Summary 2022Document3 pagesManyavar - AR Summary 2022abhishekbasumallickNo ratings yet

- SCM Pantaloons Project Report Group 11Document19 pagesSCM Pantaloons Project Report Group 11GunjeshJha100% (1)

- Nuvama On Cantabil Retail India Visit Note High Growth at An AffordableDocument18 pagesNuvama On Cantabil Retail India Visit Note High Growth at An Affordabletakemederato1No ratings yet

- Earnings Presentation For December 31, 2016 (Company Update)Document14 pagesEarnings Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Sapm Company AnalysisDocument6 pagesSapm Company AnalysisShrishti GoyalNo ratings yet

- Evaluation of Marketing Strategies & Assessment of Consumer Preferences of Bata India Ltd.Document76 pagesEvaluation of Marketing Strategies & Assessment of Consumer Preferences of Bata India Ltd.jainadi32No ratings yet

- Bata 2017Document221 pagesBata 2017Jupe JonesNo ratings yet

- Aquisition of Flipkart Group by Walmart Inc.Document13 pagesAquisition of Flipkart Group by Walmart Inc.aniket kalyankarNo ratings yet

- Arvind Mills: Presented By:-Group No-5Document15 pagesArvind Mills: Presented By:-Group No-5Pravin KumarNo ratings yet

- Initiating Coverage by MOSL February 2014Document46 pagesInitiating Coverage by MOSL February 2014Parul ChaudharyNo ratings yet

- Final PresentationDocument34 pagesFinal PresentationniharNo ratings yet

- Cross-Border Ecommerce Opportunities and Challenges by EunimartDocument10 pagesCross-Border Ecommerce Opportunities and Challenges by EunimartAnonymous 6ir71kNo ratings yet

- Vivel Itc AssignmentDocument24 pagesVivel Itc AssignmentMayank LalwaniNo ratings yet

- A Industrial Tour - Marico ProductsDocument60 pagesA Industrial Tour - Marico Productsabin tijo100% (3)

- Stylol Jeans CompanyyDocument59 pagesStylol Jeans CompanyyPriyanka_Verma_103No ratings yet

- CavinKare and CotyDocument16 pagesCavinKare and Cotyraaj_shrawan_1499444No ratings yet

- New Product Development ProcessDocument56 pagesNew Product Development ProcessEAT HEALTHYNo ratings yet

- Aditya Birla Fashion and Retail LTD - Initiating Coverage - ACMIIL IE - 121118Document24 pagesAditya Birla Fashion and Retail LTD - Initiating Coverage - ACMIIL IE - 121118Siva KumarNo ratings yet

- Big Basket: Big Basket Is India's Largest Online Food and GroceryDocument10 pagesBig Basket: Big Basket Is India's Largest Online Food and GroceryGautam'sTubeNo ratings yet

- 11111MNC MericoDocument24 pages11111MNC MericoMehedi Hasan ShakilNo ratings yet

- Sensory Branding-Oreo in Indian ContextDocument10 pagesSensory Branding-Oreo in Indian ContextRaffay MaqboolNo ratings yet

- Nykaa: Consumer BehaviourDocument32 pagesNykaa: Consumer Behaviouryashvi bansal50% (2)

- India's Domestic Fashion Market Trends and Business OpportunitiesDocument19 pagesIndia's Domestic Fashion Market Trends and Business OpportunitiesTanu GuptaNo ratings yet

- Boat PresentationDocument16 pagesBoat PresentationKushal100% (1)

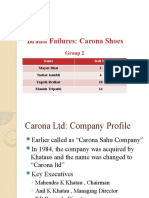

- Brand Failures: Carona Shoes: Group 2Document27 pagesBrand Failures: Carona Shoes: Group 2tushargkambliNo ratings yet

- VIP Investment Thesis - Aug 2020Document8 pagesVIP Investment Thesis - Aug 2020Rohit KadamNo ratings yet

- 2017 International Comparison Program for Asia and the Pacific: Purchasing Power Parities and Real Expenditures—Results and MethodologyFrom Everand2017 International Comparison Program for Asia and the Pacific: Purchasing Power Parities and Real Expenditures—Results and MethodologyNo ratings yet

- Strategic Digital Marketing: Top Digital Experts Share the Formula for Tangible Returns on Your Marketing InvestmentFrom EverandStrategic Digital Marketing: Top Digital Experts Share the Formula for Tangible Returns on Your Marketing InvestmentNo ratings yet

- Aid for Trade in Asia and the Pacific: Promoting Economic Diversification and EmpowermentFrom EverandAid for Trade in Asia and the Pacific: Promoting Economic Diversification and EmpowermentNo ratings yet

- Taking Back Retail: Transforming Traditional Retailers Into Digital RetailersFrom EverandTaking Back Retail: Transforming Traditional Retailers Into Digital RetailersNo ratings yet

- Beyond Borders, Beyond Competition: VRIN Strategies for Global Branding: Business Strategy, #2From EverandBeyond Borders, Beyond Competition: VRIN Strategies for Global Branding: Business Strategy, #2No ratings yet

- Examen Parcial de InglesDocument3 pagesExamen Parcial de InglesTara BallNo ratings yet

- Retail Question BankDocument4 pagesRetail Question BankDeepak SonarNo ratings yet

- Different Types of Dyeing ProcessDocument12 pagesDifferent Types of Dyeing ProcessNguyễn Huy CườngNo ratings yet

- IKEA's Global Marketing StrategyDocument3 pagesIKEA's Global Marketing StrategyJacky Nguyen0% (1)

- RosannaSS2014 LowResNoPriceDocument23 pagesRosannaSS2014 LowResNoPriceRosanna BowlesNo ratings yet

- MR ManualDocument76 pagesMR Manualamulya00428No ratings yet

- Mangerial EconomicsDocument55 pagesMangerial EconomicsSandeep GhatuaryNo ratings yet

- 2019 Gildan USA CatalogDocument104 pages2019 Gildan USA CatalogKoet Ji CesNo ratings yet

- DLL TLE Week3Document6 pagesDLL TLE Week3Jepoy Macasaet100% (1)

- Countable and Uncountable NounsDocument2 pagesCountable and Uncountable Nounsapi-30443225967% (12)

- HEB Construction HS BookletDocument31 pagesHEB Construction HS Bookletkanakarao1No ratings yet

- BAIN 2011 Luxury Market StudyDocument35 pagesBAIN 2011 Luxury Market StudyMichelleMNFNo ratings yet

- #2795 - ENGLISH Women's Zippered Jacket or HoodieDocument4 pages#2795 - ENGLISH Women's Zippered Jacket or HoodieRezeal Textile100% (1)

- Virgin Water Supply Chain OverviewDocument36 pagesVirgin Water Supply Chain OverviewDeepak PathaniaNo ratings yet

- Billy Bob 2018 BDocument58 pagesBilly Bob 2018 Bcs2k2000No ratings yet

- Factor of Fashion PDFDocument11 pagesFactor of Fashion PDFGashaw Fikir AdugnaNo ratings yet

- MRC-107T Tadiran RADIO PALLET TMDocument74 pagesMRC-107T Tadiran RADIO PALLET TMΒΕΗΣ ΣΤΕΛΙΟΣ Veis Stelios0% (1)

- Big Blue 500D Big Blue 600 X: (Deutz-Powered)Document108 pagesBig Blue 500D Big Blue 600 X: (Deutz-Powered)andrés florentin pizarro lazarte100% (1)

- Whole Garment Production SystemDocument61 pagesWhole Garment Production SystemKriti Singh50% (4)

- Amazon's Global Expansion of Amazon Go StoresDocument76 pagesAmazon's Global Expansion of Amazon Go StoresAbinaya Santhakumar100% (1)

- Final Project On Aadhar by GaganDocument91 pagesFinal Project On Aadhar by GaganEr Bikramjit Singh100% (2)

- Filleting A Monkfish TailDocument1 pageFilleting A Monkfish Tailmohamed.mauroofNo ratings yet

- Glossary of Leather Terms - ALCADocument33 pagesGlossary of Leather Terms - ALCAAnik AlamNo ratings yet

- ZARA's IT-Powered Fast Fashion SuccessDocument2 pagesZARA's IT-Powered Fast Fashion Successamit kumarNo ratings yet

- Draping of FabricDocument25 pagesDraping of FabricAswathy Unnikrishnan100% (6)

- Brosura Chic & EthicDocument20 pagesBrosura Chic & EthicAna-Maria PaladusNo ratings yet

- A Project Report On A COMPARATIVE MARKET PDFDocument49 pagesA Project Report On A COMPARATIVE MARKET PDFdiksha palNo ratings yet

- Yarn Classification & TerminologyDocument82 pagesYarn Classification & TerminologyRAHUL16398No ratings yet

- Blood Circulation:: KnittingDocument5 pagesBlood Circulation:: KnittingISSONNo ratings yet

- Case Studies in Strategy (Catalogue III)Document130 pagesCase Studies in Strategy (Catalogue III)TahseenRanaNo ratings yet