Professional Documents

Culture Documents

Chapter Twelve: Managing Multinational Cash Flow

Uploaded by

Taz Uddin0 ratings0% found this document useful (0 votes)

14 views23 pagesChapter 12

Original Title

Solution CH4

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentChapter 12

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views23 pagesChapter Twelve: Managing Multinational Cash Flow

Uploaded by

Taz UddinChapter 12

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 23

Chapter Twelve

Managing Multinational Cash

Flow

Mohammed Sohail Mustafa 1

Chapter Outline

12.1 What is Exchange Rate?

12.2 Quotations.

12.3 Exchange Rate Regimes.

12.4 Major Foreign Exchange Instruments/Contracts/Derivatives.

12.5 Factors affecting Exchange Rate.

12.6 Forecasting Exchange Rate Movements.

12.7 Foreign Exchange Exposure.

Mohammed Sohail Mustafa 2

12.1 What is Exchange Rate?

In finance, an exchange rate (also known as a foreign-exchange rate,

forex rate, FX rate or Agio) between two currencies is the rate at which

one currency will be exchanged for another. It is also regarded as the

value of one country’s currency in terms of another currency. For

example, an interbank exchange rate of 91 Japanese yen (JPY, ¥) to the

United States dollar (US$) means that ¥91 will be exchanged for each

US$1 or that US$1 will be exchanged for each ¥91. Exchange rates are

determined in the foreign exchange market, which is open to a wide

range of different types of buyers and sellers where currency trading is

continuous: 24 hours a day except weekends, i.e. trading from 20:15

GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers

to the current exchange rate. The forward exchange rate refers to an

exchange rate that is quoted and traded today but for delivery and

payment on a specific future date.

Mohammed Sohail Mustafa 3

12.2 Quotations.

A currency pair is the quotation of the relative value of a currency unit

against the unit of another currency in the foreign exchange market.

The quotation EUR/USD 1.3533 means that 1 Euro is able to buy

1.3533 US dollar. In other words, this is the price of a unit of Euro in US

dollar. Here, EUR is called the “Fixed currency”, while USD is called the

“Variable currency”.

There is a market convention that determines which is the fixed

currency and which is the variable currency. In most parts of the

world, the order is: EUR – GBP – AUD – NZD – USD – others.

Accordingly, a conversion from EUR to AUD, EUR is the fixed currency,

AUD is the variable currency and the exchange rate indicates how

many Australian dollars would be paid or received for 1 Euro. Cyprus

and Malta which were quoted as the base to the USD and others were

recently removed from this list when they joined the Eurozone.

Mohammed Sohail Mustafa 4

Quotations…….contd.

Quotes using a country’s home currency as the price

currency (for example, EUR 0.735342 = USD 1.00 in the

Eurozone) are known as direct quotation or price

quotation (from that country’s perspective) and are used

by most countries.

Quotes using a country’s home currency as the unit

currency (for example, USD 1.35991 = EUR 1.00 in the

Eurozone) are known as indirect quotation or quantity

quotation and are used in British newspapers and are also

common in Australia, New Zealand and the Eurozone.

Mohammed Sohail Mustafa 5

12.3 Exchange Rate Regimes.

There are a number of methods that can be used to

determine an exchange rate:

1. A flexible or floating exchange rate is where the market

forces of supply and demand determine the exchange rate.

2. A fixed exchange rate is where the government determines

the exchange rate for a period of time based on the value of

another countries currency such as the US dollar.

3. A managed exchange rate is where the government

intervenes in the market to influence the exchange rate or

set the rate for short periods such as a day or week

Mohammed Sohail Mustafa 6

Flexible (or floating) Exchange Rates

Under a flexible or floating exchange rate the value of a

countries currency changes frequently, even by the minute. The

market rate will depend on the demand for, and supply of, that

currency in the forex markets. When there is no intervention in

the free market operations by a government or its’ agency a

“clean float” is said to exist.

Mohammed Sohail Mustafa 7

A Currency Appreciation

Mohammed Sohail Mustafa 8

A Currency Depreciation

Mohammed Sohail Mustafa 9

Fixed Exchange Rates

The World Bank and the IMF were both established in 1944 at a

conference of world leaders in Bretton Woods, New Hampshire

(USA). The aim of the two "Bretton Woods institutions" as they are

sometimes called, was to place the global economy on a sound

footing after World War II. To help reduce the economic instability

that existed the conference favored the use of a fixed exchange

rate system. Under a fixed exchange rate system the value of a

country’s currency is fixed by the government or one of its

agencies, for example the Reserve Bank of Australia (RBA) to

another currency for a specific time period. This method of

determining exchange rates was to dominate until the 1970s.

Mohammed Sohail Mustafa 10

Exchange Rate Determination in a Fixed

Exchange Rate

Mohammed Sohail Mustafa 11

Managed Exchange Rates

A managed exchange rate occurs when there is official intervention

by a government or an agency, such as the RBA to determination

the value of a country’s exchange rate. Through such official

interventions, it is possible to manage both fixed and floating

exchange rates. The Australia dollar was pegged to TWI from

September 1974 to November 1976. Then in November 1976, the

government adopted a “managed flexible peg” or a “crawling peg

system”. Under this new method of determining exchange rates,

the value of the Australian dollar was changed relative to the TWI,

not just relative to a single individual currency. The exchange rate

was announced each morning by the RBA and remained at that rate

until the next morning. This system continued until the Australian

dollar was floated in December 1983.

Mohammed Sohail Mustafa 12

Major Foreign Exchange Instruments

Spot transaction.

Forward transaction.

Options.

Futures.

Swaps.

Mohammed Sohail Mustafa 13

The Spot Market/Spot Rate/Spot Transaction

The duration of the Spot transaction is 2 working

days.

The spot rate will be fixed/remain constant for 2

working days.

The volume of transaction is relatively small.

Usually tourist, overseas students & the dealer are

the main participants of this market

Mohammed Sohail Mustafa 14

The Forward Market/Forward Rate/Forward

Transaction

The duration of the forward transaction is 180 working days.

The seller of the currency determines the forward rate by

analyzing the trend of movements of that currency.

The forward rate will remain constant for maximum 180

working days.

The volume of transaction is relatively large.

Usually importers, exporters & other business peoples & the

dealer are the main participants of this market.

A forward premium is charged at the time of transaction.

Mohammed Sohail Mustafa 15

Options

An option is the right but not the obligation to

buy or sell a foreign currency within a certain

time period or on a specific exchange rate. An

option can be purchased from both the OTC &

ETM. The option provides the company

flexibility, because it can walk away from the

option if the strike price is not a good price.

Mohammed Sohail Mustafa 16

Futures

A foreign currency future resembles a forward

contract insofar as it specifies an exchange rate

sometime in advance of the actual exchange of

currency. However a future is traded on an

ETM, not an OTC. Instead of working with

bankers, company likes to work with the

exchange brokers when purchasing future

contracts.

Mohammed Sohail Mustafa 17

Swaps

A currency swap involves exchanging principal and

fixed rate interest payments on a loan in one currency

for principal and fixed rate interest payments on an

equal loan in another currency. Just like interest rate

swaps, the currency swaps are also motivated by

comparative advantage. Currency swaps entail

swapping both principal and interest between the

parties, with the cash flows in one direction being in a

different currency than those in the opposite

direction. It is also a very crucial uniform pattern in

individuals and customers.

Mohammed Sohail Mustafa 18

Foreign-Exchange Convertibility

Hard currencies are those that governments allow both residents and

nonresidents to purchase in unlimited amounts, i.e., currencies freely

traded and accepted in international business. Hard currencies are fully

convertible, relatively stable and tend to be comparatively strong. Soft

(weak) currencies are not fully convertible and tend to be the currencies

of developing countries. To conserve scarce foreign exchange,

governments may impose exchange restrictions on individuals and/or

companies. Under a multiple exchange-rate system the government sets

different rates for different types of transactions. If the government

imposes an advance import deposit, importers will be required to make

a deposit with the central bank, often for as long as one year, to cover the

full price of the products being sourced from abroad. With quantity

controls, the government limits the amount of foreign currency that can

be used for a given transaction. Such currency controls significantly add to

the cost of doing business and can serve as serious impediments to trade.

Mohammed Sohail Mustafa 19

12.5 Factors Affecting Exchange Rates.

1. Inflation,

2. Interest Rates,

3. Speculation,

4. Change in Competitiveness,

5. Relative strength of other currencies,

6. Balance of Payments,

7. Government Debt,

8. Government intervention, &

9. Economic growth/recession.

Mohammed Sohail Mustafa 20

Example Fall in Value of Sterling 2007 – Jan 2009

During this period, the value of Sterling fell over 20%. This was due to:

1. Restoring UK’s lost competitiveness. UK had large current account deficit in 2007

2. Bank of England cut interest rates to 0.5% in 2008.

3. Recession hit UK economy hard. Markets expected interest rates in UK to stay low

for a considerable time.

4. Bank of England pursued quantitative easing (increasing money supply). This

raised prospect of future inflation, making UK bonds less attractive.

Mohammed Sohail Mustafa 21

12.6 Forecasting Exchange Rate Movements.

Purchasing Power Parity (PPP)

Relative Economic Strength Approach

Econometric Models

Time Series Model

Mohammed Sohail Mustafa 22

12.7 Foreign Exchange Exposure.

When a company has cash flows that are denominated in a

foreign currency, it becomes exposed to foreign exchange

risk, or in other words, has foreign exchange exposure.

Foreign exchange exposure can also arise when a firm has

assets denominated in a foreign currency, because the

value of those assets will fluctuate with the exchange rate.

Four types of exposure are:

1. Transaction exposure,

2. Economic exposure,

3. Translation exposure, &

4. Contingent exposure.

Mohammed Sohail Mustafa 23

You might also like

- Currency.': in Simple Words, Exchange Rate Is The Price of A Nation's Currency in Terms of AnotherDocument6 pagesCurrency.': in Simple Words, Exchange Rate Is The Price of A Nation's Currency in Terms of AnotherNeel NarsinghaniNo ratings yet

- International Monetary System Facilitates Global TradeDocument23 pagesInternational Monetary System Facilitates Global TradeDipankar BhattacharjeeNo ratings yet

- Non Deliverable ForwardDocument17 pagesNon Deliverable ForwardManish GuptaNo ratings yet

- Forex Hedging Project Summer Internship Training At: Stuti Jain, MBA (G) of Batch 2020-2019Document9 pagesForex Hedging Project Summer Internship Training At: Stuti Jain, MBA (G) of Batch 2020-2019Stuti JainNo ratings yet

- Role of RBI in FOREX MarketDocument14 pagesRole of RBI in FOREX Marketlagfdf88No ratings yet

- New Central Bank Act (R.A. 7653) : Establishment and Organization of The Bangko Sentral NG PilipinasDocument17 pagesNew Central Bank Act (R.A. 7653) : Establishment and Organization of The Bangko Sentral NG PilipinasDominic Romero75% (4)

- Marc Faber - The Performance of Gold During Inflation and Deflation (2005.04.20)Document20 pagesMarc Faber - The Performance of Gold During Inflation and Deflation (2005.04.20)contulmmivNo ratings yet

- Foreign Exchange MarketDocument40 pagesForeign Exchange MarketSayaliRewaleNo ratings yet

- Basler Transformer Protection Application Guide PDFDocument33 pagesBasler Transformer Protection Application Guide PDFAbrakain69No ratings yet

- International Financial Management 13 Edition: by Jeff MaduraDocument33 pagesInternational Financial Management 13 Edition: by Jeff MaduraAbdulaziz Al-amroNo ratings yet

- Foreign Exchange Market: Dr. Amit Kumar SinhaDocument67 pagesForeign Exchange Market: Dr. Amit Kumar SinhaAmit SinhaNo ratings yet

- Foreign Exchange and Risk Management StudyDocument7 pagesForeign Exchange and Risk Management StudyMallikarjun Rao100% (2)

- Electronic Engines Support 05 2017Document320 pagesElectronic Engines Support 05 2017Anonymous Qca07FTr100% (1)

- Electronic Engines Support 05 2017Document320 pagesElectronic Engines Support 05 2017Anonymous Qca07FTr100% (1)

- International Finance Manual PDFDocument213 pagesInternational Finance Manual PDFAnonymous 4gOYyVfdf100% (3)

- Project Report On Currency MarketDocument54 pagesProject Report On Currency MarketSurbhi Aery63% (8)

- 17 Currency MarketDocument26 pages17 Currency MarketGarv JainNo ratings yet

- Part ofDocument5 pagesPart ofdagimNo ratings yet

- Introduction To Currency Markets: Basic Foreign Exchange DefinitionsDocument20 pagesIntroduction To Currency Markets: Basic Foreign Exchange DefinitionsSrinath KurelliNo ratings yet

- Treasury MAnagement in NepalDocument4 pagesTreasury MAnagement in NepalAntovna GyawaliNo ratings yet

- Foreign Exchange Market FunctionsDocument12 pagesForeign Exchange Market FunctionsmurthyNo ratings yet

- Foreign Exchange RateDocument10 pagesForeign Exchange RateanbalaganmaheshNo ratings yet

- Finmark ActivityDocument4 pagesFinmark ActivityKoo KooNo ratings yet

- Module 2 RMDocument12 pagesModule 2 RMksheerodshriNo ratings yet

- Mechanics of Currency Dealing and Exchange Rate QuotationsDocument6 pagesMechanics of Currency Dealing and Exchange Rate Quotationsvijayadarshini vNo ratings yet

- Introduction To Foreign ExchangeDocument36 pagesIntroduction To Foreign Exchangedhruv_jagtap100% (1)

- Forex Currency Forex Market Liquid Market Trillions of DollarsDocument5 pagesForex Currency Forex Market Liquid Market Trillions of DollarsTimothy 328No ratings yet

- Gbe Unit 4-2Document9 pagesGbe Unit 4-2mojnkuNo ratings yet

- Chapter 16 - Foreign Exchange MarketsDocument19 pagesChapter 16 - Foreign Exchange MarketsLevi Emmanuel Veloso BravoNo ratings yet

- Name: Shariq Altaf ROLL NO: MBA-18-13 Q1. Fixed Exchange Rate Is The Rate Which Is Officially Fixed by The Government orDocument5 pagesName: Shariq Altaf ROLL NO: MBA-18-13 Q1. Fixed Exchange Rate Is The Rate Which Is Officially Fixed by The Government orShariq AltafNo ratings yet

- FOREX-Rates Explained: Key Features and Types of Exchange RatesDocument9 pagesFOREX-Rates Explained: Key Features and Types of Exchange RatesAshish MhatreNo ratings yet

- Module 3 Lesson 3Document15 pagesModule 3 Lesson 3Marivic TolinNo ratings yet

- Assignment Foreign, Exchange ReportDocument7 pagesAssignment Foreign, Exchange ReportEdna MartinezNo ratings yet

- The Exchange Rates and International Monetary EnvironmentDocument22 pagesThe Exchange Rates and International Monetary EnvironmentishaqNo ratings yet

- FEMA (Foreing Exchange Management Act)Document4 pagesFEMA (Foreing Exchange Management Act)mahbobullah rahmaniNo ratings yet

- IBE AssignmentDocument5 pagesIBE AssignmentMilind KarkareNo ratings yet

- New Microsoft Word DocumentDocument17 pagesNew Microsoft Word Documentmahesh_zorrick8907No ratings yet

- Foreign Exchange Derivative MarketsDocument28 pagesForeign Exchange Derivative MarketsAIRES VILLASURDANo ratings yet

- Foreign Exchange Derivative MarketsDocument16 pagesForeign Exchange Derivative MarketsAIRES VILLASURDANo ratings yet

- DVK BOOK Currency FuturesDocument68 pagesDVK BOOK Currency FuturesSaubhagya SuriNo ratings yet

- Om 5Document8 pagesOm 5AIRES VILLASURDANo ratings yet

- Presidents of European Bank For Reconstruction and Development (EBRD)Document12 pagesPresidents of European Bank For Reconstruction and Development (EBRD)kath_ahyenNo ratings yet

- Exchange Rates and Forex BusinessDocument26 pagesExchange Rates and Forex BusinessJanakiraman SanthoshNo ratings yet

- Foreign ExchangeDocument16 pagesForeign ExchangeRica AgubaNo ratings yet

- Eco FinalDocument39 pagesEco FinalNimiNo ratings yet

- Fixed vs Floating Exchange Rates: A GuideDocument6 pagesFixed vs Floating Exchange Rates: A GuideThinaThinaNo ratings yet

- Module 3 (FINE-6)Document4 pagesModule 3 (FINE-6)John Mark GabrielNo ratings yet

- Trichy Full PaperDocument13 pagesTrichy Full PaperSwetha Sree RajagopalNo ratings yet

- International Business Assignment: BY: Neetika Jalan 08D1678 Bba "B"Document17 pagesInternational Business Assignment: BY: Neetika Jalan 08D1678 Bba "B"jayesh611No ratings yet

- FIN542 Group Assignment 1Document5 pagesFIN542 Group Assignment 1Syukri SalimNo ratings yet

- Summary Multinational Financial ManagementDocument5 pagesSummary Multinational Financial ManagementShafa ENo ratings yet

- Module 8 Open Economy PDFDocument60 pagesModule 8 Open Economy PDFjay gargNo ratings yet

- Lala Lajpatrai College of Commerce & EconomicsDocument26 pagesLala Lajpatrai College of Commerce & EconomicsvorachiragNo ratings yet

- Forex TradingDocument64 pagesForex Tradingankurdeswal93No ratings yet

- The Foreign Exchange MarketDocument3 pagesThe Foreign Exchange MarketDavina AzaliaNo ratings yet

- The International Monetary SystemDocument4 pagesThe International Monetary SystemAnalou LopezNo ratings yet

- Topic: Foreign Exchange Markets Review Questions: Pls. Answer BrieflyDocument3 pagesTopic: Foreign Exchange Markets Review Questions: Pls. Answer BrieflyFiz AbdulrakmanNo ratings yet

- Introduction To Foreign ExchangeDocument27 pagesIntroduction To Foreign Exchangemandy_t06No ratings yet

- Full Convertibility of The Indian RupeeDocument18 pagesFull Convertibility of The Indian RupeeZaina ParveenNo ratings yet

- A Assignment On:: Submitted To: Submitted byDocument31 pagesA Assignment On:: Submitted To: Submitted byatul1157No ratings yet

- Big Picture C UlocDocument5 pagesBig Picture C UlocAnvi Rose CuyosNo ratings yet

- FOREX MARKET DEFINITIONDocument12 pagesFOREX MARKET DEFINITIONSiva Naga Aswini BNo ratings yet

- International Monetary SystemsDocument23 pagesInternational Monetary SystemsTharshiNo ratings yet

- Class 19Document35 pagesClass 19chinmay manjrekarNo ratings yet

- Ibt Rev PDFDocument4 pagesIbt Rev PDFRose Vanessa BurceNo ratings yet

- Multinational Financial Management Exchange RatesDocument21 pagesMultinational Financial Management Exchange RatesShahbaz QureshiNo ratings yet

- Elevated Neutral-To-Earth Voltage in Distribution Systems IncludiDocument35 pagesElevated Neutral-To-Earth Voltage in Distribution Systems IncludiTaz UddinNo ratings yet

- Substation Grounding Tutorial: Joe Gravelle, P.E. Eduardo Ramirez-Bettoni, P.EDocument104 pagesSubstation Grounding Tutorial: Joe Gravelle, P.E. Eduardo Ramirez-Bettoni, P.EAhmed AwadenNo ratings yet

- Motor Start TheoryDocument30 pagesMotor Start TheoryMIBALINo ratings yet

- Sample Reflection Paper SNKDocument1 pageSample Reflection Paper SNKTaz UddinNo ratings yet

- KeyDocument1 pageKeyTaz UddinNo ratings yet

- Bangladesh National Building CodeDocument1,870 pagesBangladesh National Building CodeTaz UddinNo ratings yet

- 900-0545 I3iWatch100Document87 pages900-0545 I3iWatch100thegr8t1No ratings yet

- Nox Removal System by SCR ProcessDocument4 pagesNox Removal System by SCR ProcessTaz UddinNo ratings yet

- Robin HoodDocument36 pagesRobin HoodTaz UddinNo ratings yet

- Elevated Neutral-to-Earth Voltage in Distribution Systems Includi PDFDocument187 pagesElevated Neutral-to-Earth Voltage in Distribution Systems Includi PDFTaz UddinNo ratings yet

- A001064 07e PDFDocument114 pagesA001064 07e PDFTaz UddinNo ratings yet

- GU - Cabine MT BT (EN) - 1VCP000591 1511Document88 pagesGU - Cabine MT BT (EN) - 1VCP000591 1511Fatmir JashariNo ratings yet

- Managing - Change & Transition - Harvard Business Review PressDocument113 pagesManaging - Change & Transition - Harvard Business Review PressTaz UddinNo ratings yet

- Alternate Delivery Service Enrollment Form - V.1.0 PDFDocument4 pagesAlternate Delivery Service Enrollment Form - V.1.0 PDFTaz UddinNo ratings yet

- Robin Hood: Case 23Document2 pagesRobin Hood: Case 23Taz UddinNo ratings yet

- 056-091 Equipotential Earth BondingDocument2 pages056-091 Equipotential Earth BondingJaime GanozaNo ratings yet

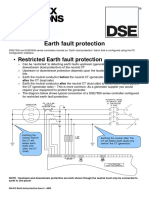

- 056-019 Earth Fault Protection PDFDocument2 pages056-019 Earth Fault Protection PDFmigas_migue2856No ratings yet

- 056-057 SW1andSW2Document2 pages056-057 SW1andSW2Jesus IzaguirreNo ratings yet

- Robin Hood: Case 23Document2 pagesRobin Hood: Case 23Taz UddinNo ratings yet

- Alternate Delivery Service Enrollment Form - V.1.0 PDFDocument4 pagesAlternate Delivery Service Enrollment Form - V.1.0 PDFTaz UddinNo ratings yet

- 2000 Report CompanyDocument113 pages2000 Report CompanyЂорђе МалешевићNo ratings yet

- Nox Removal System by SCR ProcessDocument4 pagesNox Removal System by SCR ProcessTaz UddinNo ratings yet

- Nyse Dis 2017Document110 pagesNyse Dis 2017Ngọc Trâm ĐặngNo ratings yet

- Nyse Dis 2017Document110 pagesNyse Dis 2017Ngọc Trâm ĐặngNo ratings yet

- Chapter 4 SolutionsDocument13 pagesChapter 4 SolutionsAhmed FahmyNo ratings yet

- Accounting Implications of Foreign Currency Transactions Translation and HedgingDocument16 pagesAccounting Implications of Foreign Currency Transactions Translation and Hedgingmharb said12No ratings yet

- 2021 National Budget Highlights ZimbabweDocument14 pages2021 National Budget Highlights ZimbabwenyashaNo ratings yet

- Binyenya NdaluDocument168 pagesBinyenya NdaluAkuku SamNo ratings yet

- Dior's Socio-Cultural Forces and StrategiesDocument6 pagesDior's Socio-Cultural Forces and StrategiesMma 777No ratings yet

- How Exchange Rate Influence A Countrys Import and ExportDocument9 pagesHow Exchange Rate Influence A Countrys Import and ExportdidiNo ratings yet

- IIF Capital Flows Report 10 15Document38 pagesIIF Capital Flows Report 10 15ed_nycNo ratings yet

- Shocks and Policy Responses in The Open Economy: (This Is A Draft Chapter of A New Book - Carlin & Soskice (200x) )Document25 pagesShocks and Policy Responses in The Open Economy: (This Is A Draft Chapter of A New Book - Carlin & Soskice (200x) )Martiniano MajoralNo ratings yet

- Lesson 15 The Eurocurrency MarketDocument7 pagesLesson 15 The Eurocurrency Marketjitinwadhwani0% (1)

- Chapter 4Document17 pagesChapter 4Proveedor Iptv EspañaNo ratings yet

- Burberry Annual Report 2015-16Document188 pagesBurberry Annual Report 2015-16Siddharth Shekhar100% (1)

- Australian Exporter Currency Exchange Loss CalculationDocument9 pagesAustralian Exporter Currency Exchange Loss CalculationleieparanoicoNo ratings yet

- Chapter 6 Slides - Orange Coloured Slides Slide 1Document7 pagesChapter 6 Slides - Orange Coloured Slides Slide 1MartinNo ratings yet

- International Macroeconomics: Slides For Chapter 8: International Capital Market IntegrationDocument54 pagesInternational Macroeconomics: Slides For Chapter 8: International Capital Market IntegrationM Kaderi KibriaNo ratings yet

- 2016 AnswersDocument11 pages2016 AnswersumeshNo ratings yet

- Chapter 4 - The Balance of Payments - BlackboardDocument28 pagesChapter 4 - The Balance of Payments - BlackboardCarlosNo ratings yet

- FX Fluctuations, Intervention, and InterdependenceDocument9 pagesFX Fluctuations, Intervention, and InterdependenceRamagurubaran VenkatNo ratings yet

- The Determinants of Budget Deficit in EthiopiaDocument56 pagesThe Determinants of Budget Deficit in Ethiopiaasamino mulugeta90% (20)

- Module 9 Quiz FX Risk ManagementDocument2 pagesModule 9 Quiz FX Risk ManagementAira Denise TecuicoNo ratings yet

- Types of Exchange RateDocument15 pagesTypes of Exchange RateAnu KumariNo ratings yet

- EBOOK Etextbook PDF For Global Banking 3Rd Edition by Roy C Smith Download Full Chapter PDF Docx KindleDocument61 pagesEBOOK Etextbook PDF For Global Banking 3Rd Edition by Roy C Smith Download Full Chapter PDF Docx Kindlecarol.miles887100% (36)

- Industry: January 2003Document31 pagesIndustry: January 2003Ian AbellaNo ratings yet

- BST CHAP 11 Cbse Class 11 Rajat ArroraDocument29 pagesBST CHAP 11 Cbse Class 11 Rajat Arrorasb132205100% (1)

- Chapter 5: Managing Investment RiskDocument13 pagesChapter 5: Managing Investment RiskMayank GuptaNo ratings yet

- Tif 1Document7 pagesTif 1James BurdenNo ratings yet

- SFM - Forex - QuestionsDocument23 pagesSFM - Forex - QuestionsVishal SutarNo ratings yet