Professional Documents

Culture Documents

Brief overview of key changes to VAT provisions under TRAIN

Uploaded by

Jung JeonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Brief overview of key changes to VAT provisions under TRAIN

Uploaded by

Jung JeonCopyright:

Available Formats

Briefing on RA 10963: Tax Reform

for Acceleration and Inclusion

(TRAIN) – Value Added Tax

NIRC Provision NIRC TRAIN

Section 106 (A)(2) The following are entitled to VAT zero- The following sales by VAT

Zero-rated Sale of rating: registered persons shall be subject

Goods or Properties to zero percent 0% rate:

1. The sale and actual shipment of

goods from the Philippines to a 1. The sale and actual shipment of

foreign country, irrespective of any goods from the Philippines to a

shipping arrangement that may be foreign country, irrespective of

agreed upon which may influence any shipping arrangement, paid

or determine the transfer of for in acceptable foreign

ownership of the goods so currency or its equivalent in

exported and paid for in goods or services, and

acceptable foreign currency or its accounted for in accordance

equivalent in goods or services, with the rules and regulations of

and accounted for in accordance the Bangko Sentral ng Pilipinas

with the rules and regulations of (BSP).

the Bangko Sentral ng Pilipinas

(BSP).

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 106 (A)(2) 2. Sale and delivery of goods to:

Zero-rated Sale of

Goods or Properties Registered enterprises within a

separate customs territory

Registered enterprises within tourism

enterprise zones

(The above provision was vetoed by

President Duterte because this go against

the principle of limiting the VAT zero-

rating to direct exporters.)

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 106 (A)(2) 2. Sale of raw materials or 3. Sale of raw materials or

Zero-rated Sale of packaging materials to a packaging materials to a

Goods or Properties nonresident buyer for nonresident buyer for delivery to

delivery to a resident local a resident local export-oriented

export-oriented enterprise enterprise to be used in

to be used in manufacturing, processing,

manufacturing, processing, packing or repacking and paid

packing or repacking in the for in acceptable foreign currency

Philippines of the said and accounted for in accordance

buyer's goods and paid for with the rules and regulations of

in acceptable foreign the Bangko Sentral ng Pilipinas

currency and accounted for (BSP).

in accordance with the rules

and regulations of the

Bangko Sentral ng Pilipinas

(BSP).

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 106 (A)(2) 3. Sale of raw materials or 4. Sale of raw materials or

Zero-rated Sale of packaging materials to packaging materials to

Goods or Properties export-oriented enterprise export-oriented enterprise

whose export sales whose export sales exceed

exceed seventy percent seventy percent (70%) of

(70%) of total annual total annual production.

production.

4. Sale of gold to BSP.

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 106 (A)(2) 5. Those considered export 5. Those considered export sales

Zero-rated Sale of sales under Executive under Executive Order No. 226,

Goods or Properties Order NO. 226, otherwise otherwise known as the

known as the “Omnibus “Omnibus Investment Code of

Investment Code of 1987”, 1987”, and other special laws;

and other special laws. and

6. The sale of goods, 6. The sale of goods, supplies,

supplies, equipment and equipment and fuel to persons

fuel to persons engaged in engaged in international shipping

international shipping or or international air transport;

international air transport provided, that the goods,

operations. supplies, equipment and fuel

have been sold and used for

international shipping or air

transport operations.

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 106 (A)(2) Additional provision:

Zero-rated Sale of Items 3, 4, and 5 shall be subject to the 12% VAT

Goods or Properties and no longer be considered export sales subject

to 0% VAT upon satisfaction of the following

conditions:

There is a successful establishment and

implementation of an enhanced VAT refund

system that grants refunds of creditable input

tax within 90 days from the filing of the VAT

refund application with the Bureau.

All pending VAT refund claims as of

December 31, 2017 shall be fully paid in cash

by December 31, 2019.

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 106 (A)(2) The Department of Finance shall establish a VAT

Zero-rated Sale of Refund Center in the BIR and BOC that will handle

Goods or Properties the processing and granting of cash refunds of

creditable input tax.

An amount equivalent to 5% of the total VAT

collection of the BIR and BOC from the immediately

preceding year shall automatically be appropriated

annually and shall be treated as a special account in

the General Fund or as trust receipts for funding VAT

refund claims.

Further, the BIR and BOC shall be required to submit

to the Congressional Oversight Committee on the

CTRP a quarterly report of all pending claims for

refund and any unused fund.

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 106 (A)(2) Deleted provision:

Zero-rated Sale of

Goods or Properties The following shall no longer be subject to 0%

VAT:

1. Sale of gold to BSP

2. Foreign-currency denominated sales

Section 108 (A) Sale or exchange Sale or exchange of services include “sale of

Definition of Sale or of services include electricity by generation companies,

Exchange of Services “sale of electricity transmission by any entity including the National

by generation Grid Corporations of the Philippines [NGCP],

companies, and distribution companies, including electric

transmission, and Cooperatives”.

distribution

companies”

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 108 (B) The following are entitled to VAT The following are entitled to VAT

Zero-rated Sale of zero-rating: zero-rating:

Services

1. Processing, manufacturing or 1. Processing, manufacturing or

repacking goods for other repacking goods for other

persons doing business persons doing business outside

outside the Philippines which the Philippines which goods

goods are subsequently are subsequently exported,

exported, where the services where the services are paid for

are paid for in acceptable in acceptable foreign currency

foreign currency and and accounted for in

accounted for in accordance accordance with the rules and

with the rules and regulations regulations of the Bangko

of the Bangko Sentral ng Sentral ng Pilipinas (BSP).

Pilipinas (BSP).

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC NIRC TRAIN

Provision

Section 108 (B) 2. Services other than those 2. Services other than those

Zero-rated Sale mentioned in the preceding mentioned in the preceding

of Services paragraph, rendered to a person paragraph, rendered to a person

engaged in business conducted engaged in business conducted

outside the Philippines or to a outside the Philippines or to a

nonresident person not nonresident person not engaged

engaged in business who is in business who is outside the

outside the Philippines when the Philippines when the services

services are performed, [51] the are performed, the consideration

consideration for which is paid for which is paid for in acceptable

for in acceptable foreign foreign currency and accounted

currency and accounted for in for in accordance with the rules

accordance with the rules and and regulations of the Bangko

regulations of the Bangko Sentral ng Pilipinas (BSP);

Sentral ng Pilipinas (BSP);

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC NIRC TRAIN

Provision

Section 108 (B) 3. Services rendered to persons or 3. Services rendered to persons or

Zero-rated Sale of entities whose exemption under entities whose exemption under

Services special laws or international special laws or international

agreements to which the agreements to which the Philippines

Philippines is a signatory is a signatory effectively subjects

effectively subjects the supply of the supply of such services to zero

such services to zero percent (0%) percent (0%) rate;

rate;

4. Services rendered to persons 4. Services rendered to persons

engaged in international shipping engaged in international shipping or

or international air transport international air transport

operations, including leases of operations, including leases of

property for use thereof; property for use thereof: provided,

that these services shall be

exclusively for international shipping

or air transport operations;

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC NIRC TRAIN

Provision

Section 108 (B) 5. Services performed by 5. Services performed by

Zero-rated Sale subcontractors and/or subcontractors and/or contractors

of Services contractors in processing, in processing, converting, or

converting, or manufacturing manufacturing goods for an

goods for an enterprise whose enterprise whose export sales

export sales exceed seventy exceed seventy percent (70%) of

percent (70%) of total annual total annual production are no

production; longer entitled to VAT zero-rating.

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC NIRC TRAIN

Provision

Section 108 (B) 6. Transport of passengers and 6. Transport of passengers and

Zero-rated Sale cargo by domestic air or sea cargo by domestic air or sea

of Services vessels from the Philippines to a vessels from the Philippines to a

foreign country. foreign country.

7. Sale of power or fuel generated 7. Sale of power or fuel generated

through renewable sourced of through renewable sourced of

energy such as, but not limited energy such as but not limited to

to, biomass, solar, wind, biomass, solar, wind,

hydropower, geothermal, ocean hydropower, geothermal, ocean

energy, and other emerging energy, and other emerging

energy sources using energy sources using

technologies such as fuel cells technologies such as fuel cells

and hydrogen fuels. and hydrogen fuels.

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC NIRC TRAIN

Provision

Section 108 (B) 8. Services rendered to:

Zero-rated Sale

of Services Registered enterprises within a

separate customs territory

Registered enterprises within

tourism enterprise

(Above provision was votoed by

President Duterte)

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC NIRC TRAIN

Provision

Section 108 (B) Additional provision:

Zero-rated Sale

of Services Items 1 and 5 shall be subject to the 12% VAT

and no longer be considered export sales

subject to 0% VAT upon satisfaction of the

following conditions:

There is a successful establishment and

implementation of an enhanced VAT refund

system that grants refunds of creditable input

tax within 90 days from the filing of the VAT

refund application with the Bureau.

All pending VAT refund claims as of

December 31, 2017 shall be fully paid in cash

by December 31, 2019.

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 108 (B) Additional provision:

Zero-rated Sale of

Goods or properties The Department of Finance shall establish a VAT

and zero-rated sale Refund Center in the BIR and BOC that will handle

of services the processing and granting of cash refunds of

creditable input tax.

To fund claims for VAT refund 5% of the total VAT

collection of the BIR and BOC from the

immediately preceding year shall be:

Automatically appropriated annually.

Treated as a special account in the General

Fund or as trust receipts.

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 108 Additional provision:

Zero-rated Sale of

Goods or Properties The BIR and BOC shall submit to the

and Zero-rated Sale Congressional Oversight Committee on the

of Services Comprehensive Tax Reform Program a quarterly

report of all pending claims for refund and unused

fund.

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC NIRC TRAIN

Provision

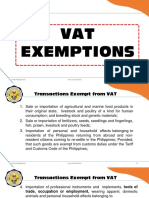

Section 109 The following transactions, among others, The following are the changes on

VAT-exempt are exempt from value-added tax: VAT-exempt transactions:

Transactions (D) Importation of professional instruments (D) Importation of professional

and implements, wearing apparel, domestic instruments and implements, tools of

animals, and personal household effects trade, occupation or employment,

(except any vehicle, vessel, aircraft, wearing apparel, domestic animals,

machinery other goods for use in the and personal and household effects

manufacture and merchandise of any kind in belonging to persons coming to settle

commercial quantity) belonging to persons in the Philippines or Filipinos or their

coming to settle in the Philippines, for their families and descendants who are

own use and not for sale, barter or now residents or citizens of other

exchange, accompanying such persons, or countries, such parties hereinafter

arriving within ninety (90) days before or referred to as overseas Filipinos, in

after their arrival, quantities and of the class suitable to

the profession, rank or position of the

persons importing said items,

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 109 upon the production of for their own use and not for barter or sale,

VAT-exempt evidence satisfactory to the accompanying such persons, or arriving

transactions Commissioner, that such within a reasonable time: Provided, That

persons are actually coming the Bureau of Customs may, upon the

to settle in the Philippines and production of satisfactory evidence that

that the change of residence such persons are actually coming to settle

is bona fide. in the Philippines and that the goods are

brought from their former place of abode,

exempt such goods from payment of

duties and taxes:

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 109 Provided, further, That vehicles, vessels,

VAT-exempt aircrafts, machineries and other similar

Transactions goods for use in manufacture, shall not fall

within this classification and shall therefore

be subject to duties, taxes and other

charges.

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC NIRC TRAIN

Provision

Section 109 Sale of real properties not Sale of real properties not primarily held for sale to

VAT-exempt primarily held for sale to customers or held for lease in the ordinary course

Transactions customers or held for of trade or business or real property utilized for

lease in the ordinary low-cost and socialized housing, residential lot

course of trade or valued at P1,500,000.00 and below; house and lot,

business or real property and other residential dwellings valued at

utilized for low-cost and P2,500,000.00 and below.

socialized housing,

residential lot valued at Beginning January 1, 2021:

P1,919,500.00 and below; The VAT exemption shall not anymore apply to:

house and lot, and other - Sale of low-cast housing

residential dwellings - Sale of residential lot

valued at P3,199,200.00 The threshold selling price amount for sale of

and below. house and lot, and other residential dwellings

shall be P2,000,000.00

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 109 Every 3 years, the threshold Every 3 years, the threshold amount shall

VAT-exempt amount shall be adjusted to be adjusted to its present value using the

Transactions its present value using the Consumer Price Index, as published by the

Consumer Price Index, as Philippine Statistics Authority (PSA).

published by the National

Statistics Office.

Section 109 (Q) Lease of a residential (Q) Lease of a residential unit with a

VAT-exempt unit with a monthly rental monthly rental not exceeding P15,000.00.

Transactions not exceeding P12,800.00.

(U) Importation of fuel, (U) Additional provision:

goods and supplies by

persons engaged in Xxx Provided, That the fuel, goods, and

international shipping or air supplies shall be used for international

transport operations. shipping or air transport operations.

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 109 Additional exempt transactions:

VAT-exempt

Transactions (W) Sale or lease of goods and services to

senior citizens and person with

disabilities.

(X) Transfer of property in merger or

consolidation [under Section 40(C)(2) of

the NIRC/tax-free exchange].

(Y) Association dues, membership fees,

and other assessments and charges

collected by homeowners associations

and condominium corporations.

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 109 (W) Sale or lease of goods (Z) Sale of gold to the BSP.

VAT-exempt or properties or the

Transactions performance of services (AA) Sale of drugs and medicines

other than the transactions prescribed for diabetes, high cholesterol,

specifically mentioned as and hypertension beginning January 1,

VAT-exempt, the gross 2019.

annual sales and/or

receipts do not exceed the Now (BB) Sale or lease of goods or

amount of P1,919,500.00 properties or the performance of services

(as amended). other than the transactions mentioned in the

preceding paragraphs, the gross annual

sales and/or receipts do not exceed the

amount of P3,000,000.

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 110 The input tax on the Amortization of input VAT shall only

(A)(2)(b) purchase of capital allowed until December 31, 2021.

Amortization of goods with a cost

Input VAT from exceeding After such date, taxpayers with

Purchases of P1,000,000.00 shall be unutilized input VAT on capital goods

Capital Goods amortized based on its purchased or imported shall be

useful life or 60 months, allowed to apply the same as

whichever is shorter. scheduled until fully utilized.

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 112 The Commissioner shall The period of granting by the

Refunds or Tax grant a refund or issue a Commissioner of refunds is decreased to

Credit of Input VAT tax credit certificate for 90 days (from 120 days) from the date of

creditable input taxes submission of complete documents in

within 120 days from the support of the application.

date of submission of

complete documents. The granting of tax credit instead of refund

is removed.

Additional provision:

Should the Commissioner find that the grant of

refund is not proper, the Commissioner must

sate in writing the legal and factual basis for

denial.

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 112 Failure on the part of the The deemed denial of failure to act on the

Refunds or Tax Commissioner to act on application is removed.

Credit of Input VAT the application within the

period prescribed shall Additional provision:

be deemed a denial of

the application. Failure on the part of any official, agent, or

employee of the BIR to act on the application

within the ninety (90) – day period shall be

punishable under Section 269 of the Tax Code

(administrative fine and imprisonment).

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 114 (A) VAT taxpayers shall file Beginning January 1, 2023, the filing and

Return and Payment quarterly return within 25 payment shall be done within 25 days

of VAT days following the close following the close of each taxable quarter.

of each taxable quarter,

while payment of the VAT

shall be made on a

monthly basis upon filing

of monthly VAT

declaration.

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 114 (B) Government or any of its Additional provision:

Withholding of VAT political subdivisions,

instrumentalities or agencies, Beginning January 1, 2021, the VAT

including government-owned withholding system shall shift from final

or -controlled corporations to a creditable system.

(GOCCs) shall, before

making payment on account Payments for purchases of goods and

of each purchase of goods services arising from projects funded by

and services which are Official Development Assistance (ODA)

subject to the value-added tax shall not be subject to the final

shall deduct and withhold a withholding tax system.

final value-added tax at the

rate of five percent (5%) of

the gross payment thereof.

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC NIRC TRAIN

Provision

Section 116 Cooperatives are exempt from Additional exemption:

3% gross receipts the 3% gross receipts tax

tax of persons Beginning January 1, 2019, self-

exempt from the employed and professionals with total

VAT annual gross sales and/or gross

receipts not exceeding P500,000 shall

be exempt from the 3% gross receipts

(The above provision was vetoed by

President Duterte because the

proposed exemption will result in

unnecessary erosion of revenues and

would lead to abuse and leakages.)

TRAIN Briefing – VAT

VER 1.0 – January 2018

NIRC NIRC TRAIN

Provision

Section 127 Sale, barter or exchange of shares The rate of the stock transaction

Stock transaction of stock listed and traded through tax is increased to 6/10 of 1%

tax the local stock exchange shall be

subject to a tax of ½ of 1% of the

gross selling price or gross value in

money of the shares of stock sold,

bartered, exchanged or otherwise

disposed

Section 269 Additional provision:

Violations

committed by “(j) Deliberate failure to act on the

government application for refunds within the

enforcement prescribed period provided under

officers Section 112 of this Act.”

TRAIN Briefing – VAT

VER 1.0 – January 2018

You might also like

- Brief overview of key changes to VAT provisions under TRAINDocument32 pagesBrief overview of key changes to VAT provisions under TRAINRob BankyNo ratings yet

- Bir Train Vat 20180418Document54 pagesBir Train Vat 20180418DanaNo ratings yet

- Business Tax Title IV Value-Added Tax Imposition of TaxDocument56 pagesBusiness Tax Title IV Value-Added Tax Imposition of TaxCath LimNo ratings yet

- Tax Feb 17Document103 pagesTax Feb 17Lolit CarlosNo ratings yet

- TRAIN Value Added TaxDocument32 pagesTRAIN Value Added TaxMickey MouseyNo ratings yet

- Revenue Regulations No. 13-18: CD Technologies Asia, Inc. © 2019Document17 pagesRevenue Regulations No. 13-18: CD Technologies Asia, Inc. © 2019Lance MorilloNo ratings yet

- 04 Value - Added TaxDocument8 pages04 Value - Added TaxfelixacctNo ratings yet

- RR No. 13-2018 (VAT Refund)Document23 pagesRR No. 13-2018 (VAT Refund)Hailin QuintosNo ratings yet

- Secret Files For TXDocument118 pagesSecret Files For TXGrace EnriquezNo ratings yet

- 1) 7.22.19 VAT DiscussionsDocument30 pages1) 7.22.19 VAT DiscussionsJanarie Bosco OrofilNo ratings yet

- VAT Regulations AmendedDocument20 pagesVAT Regulations AmendedNikka Bianca Remulla-IcallaNo ratings yet

- RR No. 13-2018 CorrectedDocument20 pagesRR No. 13-2018 CorrectedRap BaguioNo ratings yet

- VAT ModuleDocument50 pagesVAT ModuleRovi Anne IgoyNo ratings yet

- Reviewer BTTDocument14 pagesReviewer BTTAlthea Frances VasalloNo ratings yet

- TRAIN (Changes) ???? Pages 11, 13, 14Document3 pagesTRAIN (Changes) ???? Pages 11, 13, 14blackmail1No ratings yet

- Value Added TaxDocument11 pagesValue Added TaxYvette Pauline JovenNo ratings yet

- VAT ReviewerDocument72 pagesVAT ReviewerJohn Kenneth AcostaNo ratings yet

- Title IvDocument9 pagesTitle IvErica Mae GuzmanNo ratings yet

- Value Added Tax 3Document8 pagesValue Added Tax 3Nerish PlazaNo ratings yet

- 08 Chap 17 18 Mamalateo 2019 Tax BookDocument35 pages08 Chap 17 18 Mamalateo 2019 Tax BookJeremias CusayNo ratings yet

- Title Iv Value-Added Tax Imposition of TaxDocument4 pagesTitle Iv Value-Added Tax Imposition of TaxCat SabioNo ratings yet

- Feb 23 Class VATDocument58 pagesFeb 23 Class VATybun100% (1)

- Chapter I - Imposition of Tax: Title Iv Value-Added TaxDocument8 pagesChapter I - Imposition of Tax: Title Iv Value-Added TaxCher TantiadoNo ratings yet

- Title Iv Value-Added Tax Chapter I - Imposition of Tax Section 105. Persons Liable. - Any Person Who, in The Course of Trade orDocument9 pagesTitle Iv Value-Added Tax Chapter I - Imposition of Tax Section 105. Persons Liable. - Any Person Who, in The Course of Trade orporeoticsarmyNo ratings yet

- B. Taxable TransactionsDocument8 pagesB. Taxable TransactionsJessa Mary Ann CedeñoNo ratings yet

- Digest RR 13-2018Document9 pagesDigest RR 13-2018Maria Rose Ann BacilloteNo ratings yet

- Tax 2 Prefinals FinalDocument45 pagesTax 2 Prefinals FinalHanna Mae MataNo ratings yet

- Vat HandoutsDocument7 pagesVat HandoutsjulsNo ratings yet

- Business Taxation 3Document47 pagesBusiness Taxation 3Prince Isaiah JacobNo ratings yet

- Lesson 5 BtaxDocument6 pagesLesson 5 Btaxdin matanguihanNo ratings yet

- VatDocument7 pagesVatCharla SuanNo ratings yet

- VAT Zero Rated Transactions PhilippinesDocument8 pagesVAT Zero Rated Transactions PhilippineskmoNo ratings yet

- Value Added TaxDocument13 pagesValue Added TaxRyan AgcaoiliNo ratings yet

- Imposition of TaxDocument12 pagesImposition of TaxchriskhoNo ratings yet

- Philippines Tax Services BIR Issues Rules TRAIN Law VAT ProvisionsDocument6 pagesPhilippines Tax Services BIR Issues Rules TRAIN Law VAT ProvisionsWilmar AbriolNo ratings yet

- Application For VAT Zero RatingDocument9 pagesApplication For VAT Zero RatingHanabishi RekkaNo ratings yet

- Zero-Rated Sales PDFDocument24 pagesZero-Rated Sales PDFNEstandaNo ratings yet

- 2019 BAR Exam Tax Supplement by R.G. Manabat & CoDocument48 pages2019 BAR Exam Tax Supplement by R.G. Manabat & CoQueenie ValleNo ratings yet

- Value-Added TaxDocument30 pagesValue-Added TaxmeriiNo ratings yet

- Fort Bonifacio v. CIRDocument17 pagesFort Bonifacio v. CIRPaul Joshua SubaNo ratings yet

- Taxation Law Review: VAT on Phil-Air's ReceiptsDocument15 pagesTaxation Law Review: VAT on Phil-Air's ReceiptsSij Da realNo ratings yet

- Value Added Tax - Module ExercisesDocument8 pagesValue Added Tax - Module ExercisesChiarra ArceoNo ratings yet

- Title Iv Value-Added Tax: Chapter I - Imposition of TaxDocument3 pagesTitle Iv Value-Added Tax: Chapter I - Imposition of TaxNickNo ratings yet

- VAT rules for domestic, foreign, and deemed salesDocument8 pagesVAT rules for domestic, foreign, and deemed salesKenneth MatabanNo ratings yet

- TRAIN (Changes) ???? Pages 12, 14, 16, 17Document4 pagesTRAIN (Changes) ???? Pages 12, 14, 16, 17blackmail1No ratings yet

- Tax Particulars National Internal Revenue Code of 1997 R. A. No. 10963Document5 pagesTax Particulars National Internal Revenue Code of 1997 R. A. No. 10963blackmail1No ratings yet

- RR No. 28-2020Document4 pagesRR No. 28-2020Jayvee OlayresNo ratings yet

- Bir - Train Tot - Transfer TaxesDocument14 pagesBir - Train Tot - Transfer TaxesGlo GanzonNo ratings yet

- BUSTAX-REVIEWER (2)Document7 pagesBUSTAX-REVIEWER (2)Jeremy JimenezNo ratings yet

- Askdmakldma Ksdmalkd MLDocument4 pagesAskdmakldma Ksdmalkd MLSteven OrtizNo ratings yet

- REVENUE REGULATIONS NO. 9-2021 Issued On June 11, 2021 Amends CertainDocument3 pagesREVENUE REGULATIONS NO. 9-2021 Issued On June 11, 2021 Amends CertainLady Paul SyNo ratings yet

- 5.-BIR TRAIN Briefing Transfer-TaxesDocument14 pages5.-BIR TRAIN Briefing Transfer-TaxesMaria Luisa RafaelNo ratings yet

- Value Added TaxDocument4 pagesValue Added TaxJune Romeo ObiasNo ratings yet

- VALUE Added TaxDocument20 pagesVALUE Added TaxMadz Rj MangorobongNo ratings yet

- 4 VAT ExemptionsDocument28 pages4 VAT ExemptionsMobile LegendsNo ratings yet

- Part 4 - Value-Added Tax Title VI, NIRC I. Nature and Characteristics of VatDocument7 pagesPart 4 - Value-Added Tax Title VI, NIRC I. Nature and Characteristics of VatCelyn PalacolNo ratings yet

- DomondonDocument40 pagesDomondonCharles TamNo ratings yet

- Integration Management Advisory Services Standards and Variance AnalysisDocument6 pagesIntegration Management Advisory Services Standards and Variance AnalysisJung JeonNo ratings yet

- Handout 2 Audit IntegDocument6 pagesHandout 2 Audit IntegJung JeonNo ratings yet

- RFBT Law On SalesDocument44 pagesRFBT Law On SalesTricia Mae De Ocera100% (3)

- That Time I Got Reincarnated As A Slime, Vol. 3Document284 pagesThat Time I Got Reincarnated As A Slime, Vol. 3Plamen Stoilov100% (4)

- Chapter 20 AnsDocument3 pagesChapter 20 AnsDave ManaloNo ratings yet

- That Time I Got Reincarnated As A Slime, Vol. 3Document284 pagesThat Time I Got Reincarnated As A Slime, Vol. 3Plamen Stoilov100% (4)

- 1 General Principles of TaxationDocument6 pages1 General Principles of TaxationJung JeonNo ratings yet

- TOA 2012 Mock ExamDocument8 pagesTOA 2012 Mock ExamCharry RamosNo ratings yet

- 01 Quiz Bee - P1 and TOA (Easy) PDFDocument4 pages01 Quiz Bee - P1 and TOA (Easy) PDFSamNo ratings yet

- PSA 700 (Revised) - CleanDocument41 pagesPSA 700 (Revised) - CleanMa Karla Denise IlovinoNo ratings yet

- PFRS Adopted by SEC As of December 31, 2011 PDFDocument27 pagesPFRS Adopted by SEC As of December 31, 2011 PDFJennybabe PetaNo ratings yet

- Pas 1: Presentation of Financial StatementsDocument9 pagesPas 1: Presentation of Financial StatementsJung Jeon0% (1)

- CPAR Auditing TheoryDocument62 pagesCPAR Auditing TheoryKeannu Lewis Vidallo96% (46)

- ACOSTA (PHI 104) RevisedDocument6 pagesACOSTA (PHI 104) RevisedJung JeonNo ratings yet

- Chapter 20 AnsDocument3 pagesChapter 20 AnsDave ManaloNo ratings yet

- Acosta, Cathleen Joy C. PHI104 Bsa 4A Tue 1Pm-4Pm I.What Is PhilosophyDocument8 pagesAcosta, Cathleen Joy C. PHI104 Bsa 4A Tue 1Pm-4Pm I.What Is PhilosophyJung JeonNo ratings yet

- DefinitonofphilosophyphilosophyDocument7 pagesDefinitonofphilosophyphilosophyJung JeonNo ratings yet

- The Computer EnvironmentDocument12 pagesThe Computer EnvironmentJung jeonNo ratings yet

- Topic01 Proplogic PDFDocument18 pagesTopic01 Proplogic PDFJung JeonNo ratings yet

- Topic01 Proplogic PDFDocument18 pagesTopic01 Proplogic PDFJung JeonNo ratings yet

- The Computer EnvironmentDocument12 pagesThe Computer EnvironmentJung jeonNo ratings yet

- The Computer EnvironmentDocument12 pagesThe Computer EnvironmentJung jeonNo ratings yet

- The Proposition: Abad, Joshua F. Acosta, Cathleen Joy CDocument50 pagesThe Proposition: Abad, Joshua F. Acosta, Cathleen Joy CJung JeonNo ratings yet

- Topic01 Proplogic PDFDocument18 pagesTopic01 Proplogic PDFJung JeonNo ratings yet

- ACOSTA (PHI 104) RevisedDocument6 pagesACOSTA (PHI 104) RevisedJung JeonNo ratings yet

- ACOSTA (PHI 104) RevisedDocument6 pagesACOSTA (PHI 104) RevisedJung JeonNo ratings yet

- Brief overview of key changes to VAT provisions under TRAINDocument32 pagesBrief overview of key changes to VAT provisions under TRAINJung JeonNo ratings yet

- DefinitonofphilosophyphilosophyDocument7 pagesDefinitonofphilosophyphilosophyJung JeonNo ratings yet

- Electricity Technology RoadmapDocument176 pagesElectricity Technology RoadmapYasir HamidNo ratings yet

- 03 Task Performance 1 - ARG (Reinald Zach Ramos)Document1 page03 Task Performance 1 - ARG (Reinald Zach Ramos)Dan DalandanNo ratings yet

- History of EVs and Role of BatteriesDocument48 pagesHistory of EVs and Role of BatteriesJuan José Gálvez BordonabeNo ratings yet

- PPA Status List 066-067 18 OCTDocument8 pagesPPA Status List 066-067 18 OCTPradeepNo ratings yet

- Design and Implementation of A Domestic Solar-Wind Hybrid Energy SystemDocument6 pagesDesign and Implementation of A Domestic Solar-Wind Hybrid Energy SystemOm ShivshankarNo ratings yet

- Renewable Energy Sources L T P C 3003Document2 pagesRenewable Energy Sources L T P C 3003Ashok RNo ratings yet

- Guide+Solar+Power+Non Residential+Consumers+Sep+18Document20 pagesGuide+Solar+Power+Non Residential+Consumers+Sep+18Shaiful ShazwanNo ratings yet

- Gas Power Plants AlstomDocument28 pagesGas Power Plants AlstomNo Pi100% (2)

- Hydrogen Electrolyser Study WP3 Report Final 23Document21 pagesHydrogen Electrolyser Study WP3 Report Final 2310evenwoodcloseNo ratings yet

- Abdirahman Et Al 2014 PDFDocument12 pagesAbdirahman Et Al 2014 PDFAbdirahmanNo ratings yet

- Review Article-Renewable EnergiesDocument10 pagesReview Article-Renewable EnergiesKenalexisNo ratings yet

- Law On Electricity of The Federation of BihDocument38 pagesLaw On Electricity of The Federation of BihmamijatoNo ratings yet

- Modeling Instruction - Power of Our FutureDocument99 pagesModeling Instruction - Power of Our Futurejrangel218No ratings yet

- Floating Solar Power PlantDocument18 pagesFloating Solar Power PlantPavani MudhirajNo ratings yet

- Environmental Studies AssignmentDocument26 pagesEnvironmental Studies Assignment21029412 NATRI BAIDNo ratings yet

- 400w Mono Half Cut Cell Solar PanelDocument2 pages400w Mono Half Cut Cell Solar Panelssrkm guptaNo ratings yet

- HrvatskaDocument239 pagesHrvatskaAlmir SedićNo ratings yet

- Section 4 Elements and SystemsDocument34 pagesSection 4 Elements and SystemsUniversal DesignNo ratings yet

- Using Knowledge of Text Structure To Glean InformationDocument38 pagesUsing Knowledge of Text Structure To Glean InformationDiane SantosNo ratings yet

- Case Study On Solar Lamp: Implementation at Kurukshetra Hostel in PEC ChandigarhDocument7 pagesCase Study On Solar Lamp: Implementation at Kurukshetra Hostel in PEC ChandigarhBhaskarAdhikariNo ratings yet

- Dokumen - Tips New and Renewable Energy Development Corporation 2019-04-10 New and RenewableDocument48 pagesDokumen - Tips New and Renewable Energy Development Corporation 2019-04-10 New and RenewableITZMERZSNo ratings yet

- Q3 2021 Board ReportDocument45 pagesQ3 2021 Board Reportaplicabil ro websiteNo ratings yet

- AEDB - RFP - Solar Projects - EPA SCH 4Document2 pagesAEDB - RFP - Solar Projects - EPA SCH 4Usman KhawajaNo ratings yet

- Horizon Fuel Cells CatalogDocument8 pagesHorizon Fuel Cells CatalogsapietiatuaNo ratings yet

- Maritime Forecast TO 2050: Energy Transition Outlook 2022Document84 pagesMaritime Forecast TO 2050: Energy Transition Outlook 2022Ricards SaulevicsNo ratings yet

- HelioscopeDocument2 pagesHelioscopeHarun Cahyo Utomo DanteNo ratings yet

- GHG Reductions Through Performance Contacting Under CPPDocument379 pagesGHG Reductions Through Performance Contacting Under CPPkshahyd05No ratings yet

- 4.wheeling Agreement Third Party SaleDocument11 pages4.wheeling Agreement Third Party SaleNITIN MISHRANo ratings yet

- HUMANITIES Semester Sustainable EngineeringDocument43 pagesHUMANITIES Semester Sustainable EngineeringkavithaNo ratings yet

- LDK 220P 230P 235P 240P Datasheet ENDocument2 pagesLDK 220P 230P 235P 240P Datasheet ENHugo FonteNo ratings yet