Professional Documents

Culture Documents

International Flow Funds

Uploaded by

pagal larki0 ratings0% found this document useful (0 votes)

125 views13 pagesfor IFM

Original Title

Ch 3 International Flow of Funds

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfor IFM

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

125 views13 pagesInternational Flow Funds

Uploaded by

pagal larkifor IFM

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 13

Chapter # 2

International Flow of Funds

Balance of Payments • The current account represents a

summary of the flow of funds

between one specified country and

• The balance of payments is all other countries due to purchases

a summary of transactions of goods or services, or the provision

between domestic and of income on financial assets.

foreign residents for a

specific country over a • The capital account represents a

specified period of time, summary of the flow of funds

usually a quarter or a year. resulting from the sale of assets

A balance-of-payments is between one specified country and

broken down into current all other countries over a specified

account and the capital period of time

account.

Current Account • Factor Income Payments

• It represents income (interest and

• Current account main components dividend payments) received by

• (1) Merchandise (Goods) And Services, investors on foreign investments in

• (2) Factor Income, And financial assets (securities).

• (3) Transfers.

• Transfer Payments

• Payments for Merchandise and Services • A third component of the current

• IT represent exports and imports account is transfer payments, which

tangible products, services for

customers based in other countries. represent aid, grants, and gifts from

The difference between total exports

and imports is referred to as the one country to another.

balance of trade may be in deficit or in

surplus.

Capital and Financial • Direct Foreign Investment.

Accounts • Direct foreign investment represents the

investment in fixed assets in foreign

countries. Examples a firm’s acquisition,

• The capital account includes construction of a new manufacturing

the value of financial assets

plant etc

transferred across country. It

also includes the value of • Portfolio Investment.

nonproduced nonfinancial • Portfolio investment represents

assets that are transferred

across country borders, such transactions involving long-term financial

as patents and trademarks. assets (such as stocks and bonds)

between countries

• The key components of the

financial account are • Other Capital Investment.

(1) direct foreign investment,

• It represents transactions involving short

(2) portfolio investment, and

(3) other capital investment. term financial assets (such as money

market securities) between countries.

• International Trade Issues

• Events That Increased International Trade

1. Removal of the Berlin Wall. In 1989, Between East Germany &

West Germany.

2. Single European Act. In 1980s, Europe agreed to make uniform

regulations and to remove many taxes on goods traded between

these countries. Example, Best Foods (now part of Unilever)

3. NAFTA. North American Free Trade Agreement (NAFTA) 1993,

trade barriers between the United States and Mexico were

eliminated.

4. GATT (General Agreement on Tariffs and Trade) accord. It called

for the reduction or elimination of trade restrictions on specified

imported goods over a 10-year period across 117 countries. Events

That Increased International Trade

5. Inception of the Euro. In 1999, several European countries

adopted the euro as their currency for business transactions

between these countries.

6. Expansion of the European Union. In 2004, 10 countries were

admitted to the EU, followed by Bulgaria and Romania in 2007.

Nevertheless, their admission into the EU is relevant because

restrictions on their trade with Western Europe are reduced.

• Factors Affecting International Trade

Trade Friction • Inflation

• National income

• Trade Friction It means trade

restrictions on particular • Government policies

products in order to protect their • Exchange rates

local firms. Each country’s

government wants to increase its

exports because more exports 1. Inflation: If a country’s inflation rate

result in a higher level of increases relative to the countries with

production and income and may

create jobs. Following situations which it trades, its current account will be

that commonly occur in trade expected to decrease. Consumers and

friction: corporations in that country will most likely

1. Environmental restrictions (U.S) purchase more goods overseas (due to high

2. Child & labor laws (India, Pakistan) local inflation), while the country’s exports

3. Bribes (Nigeria)

to other countries will decline.

4. Government Subisidies

5. Tax breaks

Factors Affecting

International Trade 4. Exchange Rates:

2. National income: Exchange rates used for currency valuation to

facilitate international trade. As the currency

If a country’s income level strengthens, goods exported by that country

(national income) increases, will become more expensive to the importing

its current account is countries. As a consequence, the demand for

expected to decrease. such goods will decrease.

3. Government policies: Example: A tennis racket that sells in the United

Policies having major States for $100 will require a payment of C$125

effect on balance of trade by the Canadian importer if the Canadian dollar

• Subsidizing exporters, is valued at C$1 $.80. If C$1 $.70, it would

• Restrictions on imports, require a payment of C$143, which might

through tariff & quota. discourage the Canadian demand for U.S. tennis

• Lack of enforcement on rackets. A strong local currency is expected to

piracy (CDs of windows etc) reduce the current account balance

International Capital Factors Affecting DFI

Flows • Changes in Restrictions. Penetration of U.S.-based

Common type of international capital flow is MNCs, Colgate-Palmolive, General Electric, etc in India,

direct foreign investment which helps MNCs China due to removal of government barriers.

to reach additional consumers or can rely on • Privatization. Several national governments have

low-cost labor. In 2006, the total FDI all over recently engaged in privatization, or the selling of some

the world was about $1.2 trillion. of their operations to corporations and other investors.

• Potential Economic Growth. Countries that have greater

potential for economic growth are more likely to attract

DFI.

• Tax Rates. Countries that impose relatively low tax rates

on corporate earnings are more likely to attract DFI.

• Exchange Rates. Firms typically prefer to pursue DFI in

countries where the local currency is expected to

strengthen against their own currently relatively cheap

(weak). Then, earnings from the new operations can

periodically be converted back to the firm’s currency at

a more favorable exchange rate.

Factors Affecting Agencies That Facilitate International Flows

International • International Monetary Fund International Monetary

Portfolio Investment Fund (IMF) was formed in July 1944. The major

objectives of the IMF are to promote cooperation

Portfolio investment to a specific country is among countries on international monetary issues,

influenced by the following factors. promote stability in exchange rates, provide temporary

Tax Rates on Interest or Dividends. funds to 185 member countries when needed to

Investors normally prefer to invest in a correct imbalances of international payments, promote

country where the taxes on interest or free trade.

dividend income from investments are

relatively low.

Interest Rates. Money tends to flow to • World Bank The International Bank for Reconstruction

countries with high interest rates, as long and Development (IBRD), also referred to as the World

as the local currencies are not expected to Bank, was established in 1944. Its primary objective is

weaken. to make loans to countries to enhance economic

Exchange Rates. When investors invest in a development. Its main source of funds is the sale of

security in a foreign country, their return is bonds and other debt instruments to private investors

affected by (1) the change in the value of and governments. Its loans are not subsidized but are

the security and (2) the change in the value extended at market rates to governments (and their

of the currency in which the security is agencies) that are likely to repay them.

denominated.

Agencies That Facilitate • International Development Association The

International Development Association (IDA) was

International Flows created in 1960. Its loan policy is for less prosperous

nations. The IDA extends loans at low interest rates to

poor nations that cannot qualify for loans from the

• World Trade Organization The

World Bank.

World Trade Organization (WTO)

was created in 1993. This

organization was established to • Bank for International Settlements The Bank for

provide a forum for multilateral International Settlements (BIS) or central bank (“lender

trade negotiations and to settle of last resort”) attempts to facilitate cooperation

trade disputes related to the GATT among countries with regard to international

accord between 81 member transactions or assist to countries in financial crisis

countries, and more countries have specially in Latin American and Eastern European

joined since then. Member countries.

countries are given voting rights

that are used to make judgments

about trade disputes and other • Regional Development Agencies Several other agencies

issues. have more regional objectives relating to economic

development. These include, for example, the Inter-

American Development Bank, the Asian Development

Bank, South Asian Association for Regional Cooperation

(SAARC) etc.

How International Trade

Affects an MNC’s Value

• Higher inflation Rate

• Higher National Income

• Country trade agreements

• Tariffs or other trade barriers

Thank You

• Strong or Weak Home

Currency

You might also like

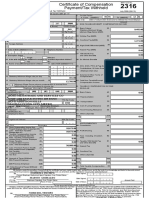

- BIR Form 2316 Roselie FortusDocument1 pageBIR Form 2316 Roselie FortusJayvee BarbaNo ratings yet

- Loan and Security Agreement (Sample)Document53 pagesLoan and Security Agreement (Sample)Raymond AlhambraNo ratings yet

- Lesson 11 International Aspects of Corporate FinanceDocument17 pagesLesson 11 International Aspects of Corporate Financeman ibe0% (1)

- Grimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesGrimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldFranc Anthony GalaoNo ratings yet

- Yogesh BDADocument7 pagesYogesh BDAATIF HASANNo ratings yet

- Module 1 Financial ManagementDocument7 pagesModule 1 Financial Managementfranz mallariNo ratings yet

- Tax II Course Outline 2Document15 pagesTax II Course Outline 2Queenie Querubin100% (1)

- Professional Personal ChefDocument225 pagesProfessional Personal ChefPaulo Castelhano100% (10)

- FM Syllabus for Financial ManagementDocument3 pagesFM Syllabus for Financial ManagementRio DhaniNo ratings yet

- Comparative Matrix of The Salient Features of SSS, Gsis, and Ecsif g07 Group 4Document18 pagesComparative Matrix of The Salient Features of SSS, Gsis, and Ecsif g07 Group 4Ruby Santillana50% (2)

- Functions of Financial Management ExplainedDocument13 pagesFunctions of Financial Management ExplainedmhikeedelantarNo ratings yet

- Introduction to Corporate Governance PrinciplesDocument9 pagesIntroduction to Corporate Governance PrinciplesJanet T. CometaNo ratings yet

- FM 8 Module 2 Multinational Financial ManagementDocument35 pagesFM 8 Module 2 Multinational Financial ManagementJasper Mortos VillanuevaNo ratings yet

- Financial Manamegent Prelim ModuleDocument52 pagesFinancial Manamegent Prelim ModuleExequiel Adrada100% (1)

- Pando v. Gimenez AntichresisDocument1 pagePando v. Gimenez AntichresisMariel QuinesNo ratings yet

- Monitoring of Credit and Collection FundsDocument24 pagesMonitoring of Credit and Collection FundsADALIA BEATRIZ ONGNo ratings yet

- Social ScienceDocument39 pagesSocial ScienceCarlo Sablaon CallosNo ratings yet

- CBP Oversteps Authority in Imposing Stabilization TaxDocument3 pagesCBP Oversteps Authority in Imposing Stabilization TaxAiken Alagban LadinesNo ratings yet

- Equity Securities MarketDocument23 pagesEquity Securities MarketILOVE MATURED FANSNo ratings yet

- Financial Reporting EssentialsDocument20 pagesFinancial Reporting EssentialsAnastasha Grey100% (1)

- Chapter4 WORLD ECONOMIESDocument26 pagesChapter4 WORLD ECONOMIESJeane Mae BooNo ratings yet

- Entrepreneurial Finance GuideDocument13 pagesEntrepreneurial Finance GuideDr. Meghna DangiNo ratings yet

- Final Examination INVESTMENT AND PORTFOLIO MANAGEMENTDocument2 pagesFinal Examination INVESTMENT AND PORTFOLIO MANAGEMENTRemar Allen Bautista100% (1)

- Lesson: 7 Cost of CapitalDocument22 pagesLesson: 7 Cost of CapitalEshaan ChadhaNo ratings yet

- M03 Gitman50803X 14 MF C03Document65 pagesM03 Gitman50803X 14 MF C03layan123456No ratings yet

- Personal FinanceDocument21 pagesPersonal FinanceBench AndayaNo ratings yet

- An Overview of Financial ManagementDocument8 pagesAn Overview of Financial ManagementCHARRYSAH TABAOSARESNo ratings yet

- Computing Mean Historical ReturnsDocument2 pagesComputing Mean Historical Returnsmubarek oumerNo ratings yet

- Review of Literature on Inventory Management SystemsDocument4 pagesReview of Literature on Inventory Management SystemscyraNo ratings yet

- Lesson 1 (Mutual Funds)Document14 pagesLesson 1 (Mutual Funds)JINKY MARIELLA VERGARANo ratings yet

- DocumentDocument1 pageDocumentRicky LavillaNo ratings yet

- ECON13B Managerial EconomicsDocument3 pagesECON13B Managerial EconomicsTin Portuzuela100% (1)

- Bank Supervision and Examination: Laws, Controls, and PurposeDocument56 pagesBank Supervision and Examination: Laws, Controls, and PurposeKhaizar Moi OlaldeNo ratings yet

- CH 9 - Completing The Cycle - MerchandisingDocument38 pagesCH 9 - Completing The Cycle - MerchandisingJem Bobiles100% (1)

- Chapter 8: Money Market and Capital MarketDocument4 pagesChapter 8: Money Market and Capital MarketJenilyn PepitoNo ratings yet

- Module 3 Topic 2 in Cooperative ManagementDocument24 pagesModule 3 Topic 2 in Cooperative Managementharon franciscoNo ratings yet

- (GEMATMW) InvestagramsDocument3 pages(GEMATMW) InvestagramsCourtney TulioNo ratings yet

- Understanding Formal Institutions - Politics, Laws and EconomicsDocument4 pagesUnderstanding Formal Institutions - Politics, Laws and EconomicsLeoncio BocoNo ratings yet

- Ch01 McGuiganDocument31 pagesCh01 McGuiganJonathan WatersNo ratings yet

- Bureau of Plant IndustryDocument6 pagesBureau of Plant IndustryJohn Zoren HugoNo ratings yet

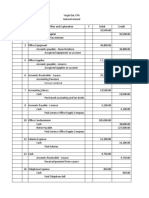

- Projected FinancialsDocument42 pagesProjected FinancialsAries Gonzales CaraganNo ratings yet

- Economic Aspect of Public DebtDocument22 pagesEconomic Aspect of Public DebtHazel Valdez CasaldonNo ratings yet

- CASE StudyDocument26 pagesCASE Studyjerah may100% (1)

- Quiz. For Ten (10) Points Each, Answer The Following Questions BrieflyDocument2 pagesQuiz. For Ten (10) Points Each, Answer The Following Questions BrieflyJohn Phil PecadizoNo ratings yet

- Good Gov 7-9 With Q&ADocument74 pagesGood Gov 7-9 With Q&AJoshua JunsayNo ratings yet

- Features common to all forecasts and elements of a good forecastDocument2 pagesFeatures common to all forecasts and elements of a good forecastRJ DAVE DURUHA100% (1)

- Economic Dev. Chapter 4Document66 pagesEconomic Dev. Chapter 4oliiiiiveeeNo ratings yet

- 4.1 Debt and Equity FinancingDocument13 pages4.1 Debt and Equity FinancingAliza UrtalNo ratings yet

- Direct Exporting Recommended for Taiho Plastics' US Market EntryDocument31 pagesDirect Exporting Recommended for Taiho Plastics' US Market EntryShannon Faye S Tarife80% (5)

- An Introduction To Security Valuation: Dr. Amir RafiqueDocument51 pagesAn Introduction To Security Valuation: Dr. Amir RafiqueUmar AliNo ratings yet

- Challenges of Sole Proprietorship BusinessesDocument20 pagesChallenges of Sole Proprietorship BusinessesIvy CoronelNo ratings yet

- History of TQMDocument23 pagesHistory of TQMVarsha PandeyNo ratings yet

- Evolution To Global MarketingDocument6 pagesEvolution To Global Marketingmohittiwarimahi100% (2)

- Guiding Principles of Monetary Administration by The Bangko SentralDocument8 pagesGuiding Principles of Monetary Administration by The Bangko SentralEuphoria BTSNo ratings yet

- College of Management: Capiz State UniversityDocument4 pagesCollege of Management: Capiz State UniversityDave IsoyNo ratings yet

- Group 5 Case AnalyzationDocument13 pagesGroup 5 Case AnalyzationChristine DiazNo ratings yet

- Activity 03 Strategies in Action TemplateDocument4 pagesActivity 03 Strategies in Action TemplateErnest S. Yriarte Jr.No ratings yet

- 1 - Nature of StraMaDocument77 pages1 - Nature of StraMaJonathan RemorozaNo ratings yet

- FM101 Group Assignment QuestionDocument2 pagesFM101 Group Assignment QuestionReenal100% (1)

- Quesionaire 222Document3 pagesQuesionaire 222awaishaneefNo ratings yet

- Banking in The Philippines: Avec M. John Darrel Rillo EconomicsDocument30 pagesBanking in The Philippines: Avec M. John Darrel Rillo EconomicsGian CPANo ratings yet

- Mixed Income EarnersDocument6 pagesMixed Income EarnersEzi AngelesNo ratings yet

- Journal EntriesDocument2 pagesJournal EntriesMelody Lim DayagNo ratings yet

- Financial Statements Analysis - ComprehensiveDocument60 pagesFinancial Statements Analysis - ComprehensiveGonzalo Jr. RualesNo ratings yet

- Business Communication Chapter # 3Document53 pagesBusiness Communication Chapter # 3Mesbahuddin SeddiqNo ratings yet

- Ch5-Credit and Collection PolicyDocument59 pagesCh5-Credit and Collection PolicyWilsonNo ratings yet

- Quick Guide Book On Operations Management With Analytics v2023Document197 pagesQuick Guide Book On Operations Management With Analytics v2023cristiancelerianNo ratings yet

- Relationship Between Educational Attainment and Economic StatusDocument16 pagesRelationship Between Educational Attainment and Economic StatusAngela CantigaNo ratings yet

- BEC 420 International EconomicsDocument21 pagesBEC 420 International EconomicsPresley SaviyeNo ratings yet

- TCS AnniversaryDocument5 pagesTCS AnniversaryVitlesh PanditaNo ratings yet

- FABM 2 MIDTERM AutoRecoveredDocument15 pagesFABM 2 MIDTERM AutoRecoveredMerdwindelle AllagonesNo ratings yet

- Church Quiet Title 2 PDFDocument126 pagesChurch Quiet Title 2 PDFjerry mcleodNo ratings yet

- CIR Vs PAL Feb 22 2017Document2 pagesCIR Vs PAL Feb 22 2017Jea CoNo ratings yet

- Solved Phyllis Sued Martin S Estate and Won A 65 000 SettlementDocument1 pageSolved Phyllis Sued Martin S Estate and Won A 65 000 SettlementAnbu jaromiaNo ratings yet

- Form 16 DetailsDocument5 pagesForm 16 DetailsAshish KNo ratings yet

- Vihaan Direct Selling (India) PVT LTD - RegistrationDocument4 pagesVihaan Direct Selling (India) PVT LTD - RegistrationKisi Ka Dar NahiNo ratings yet

- Chrome It Inc Manufactures Special Chromed Parts Made To TheDocument3 pagesChrome It Inc Manufactures Special Chromed Parts Made To Thetrilocksp SinghNo ratings yet

- Principles of Sound Tax SystemDocument3 pagesPrinciples of Sound Tax Systemkate trishaNo ratings yet

- Optimal Fiscal Policy and Capital Taxation in Overlapping Generations ModelsDocument25 pagesOptimal Fiscal Policy and Capital Taxation in Overlapping Generations ModelsFranzar VicliviaNo ratings yet

- CompensationDocument15 pagesCompensationeieipayadNo ratings yet

- PRUlife-partner Eng PDFDocument12 pagesPRUlife-partner Eng PDFAmirul IzzadNo ratings yet

- Taxation LawDocument40 pagesTaxation Lawnelzahumiwat0No ratings yet

- Creative AccountingDocument8 pagesCreative AccountingKaiwenNo ratings yet

- A Guide To Mining Taxation in ZambiaDocument44 pagesA Guide To Mining Taxation in ZambiaChola MukangaNo ratings yet

- EY Tax Alert: Malaysian DevelopmentsDocument10 pagesEY Tax Alert: Malaysian DevelopmentsSirius StarNo ratings yet

- Ra 9442Document5 pagesRa 9442kreistil weeNo ratings yet

- S20 TX ZWE Sample AnswersDocument9 pagesS20 TX ZWE Sample AnswersKAH MENG KAMNo ratings yet

- SOC SCI 104 - Pre and Post Test ExamDocument1 pageSOC SCI 104 - Pre and Post Test ExamarciblueNo ratings yet

- Chevron vs CIR; PAL Excise Tax RefundDocument4 pagesChevron vs CIR; PAL Excise Tax RefundcharmainejalaNo ratings yet