Professional Documents

Culture Documents

633885349917591250

Uploaded by

Chandan Pintu0 ratings0% found this document useful (0 votes)

18 views15 pagesRBI was Established on April 1, 1935 with share capital of Five Crores on recommendation of Hilton young commission. RBI was Nationalised in Year 1949. Central Office was initially established in Calcutta and moved to Mumbai in 1937. RBI Have 20 Directors : The Governor Four Deputy Governor One Govt. Official from Ministry of Finance.

Original Description:

Original Title

239050_633885349917591250

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRBI was Established on April 1, 1935 with share capital of Five Crores on recommendation of Hilton young commission. RBI was Nationalised in Year 1949. Central Office was initially established in Calcutta and moved to Mumbai in 1937. RBI Have 20 Directors : The Governor Four Deputy Governor One Govt. Official from Ministry of Finance.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views15 pages633885349917591250

Uploaded by

Chandan PintuRBI was Established on April 1, 1935 with share capital of Five Crores on recommendation of Hilton young commission. RBI was Nationalised in Year 1949. Central Office was initially established in Calcutta and moved to Mumbai in 1937. RBI Have 20 Directors : The Governor Four Deputy Governor One Govt. Official from Ministry of Finance.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 15

m Established on April 1, 1935 with share capital of Five

Crores on recommendation of Hilton Young

Commission.

m RBI was Nationalised in Year 1949.

m Central Office was initially established in Calcutta and

moved to Mumbai in 1937

m RBI Have 20 Directors :

½ Ôhe Governor

½ Four Deputy Governor

½ One Govt. Official from Ministry of Finance.

½ Ôen Nominate Director, nominated by Govt.

½ Four Directors to represent Headquarters at Mumbai,

Kolkata, Chennai & New Delhi.

m Appointed/ Nominated for period of Four Years.

m Head office in Mumbai.

m 24 Regional offices, most

of them in State Capital.

m ¦ to regulate the issue of Bank Notes and keeping of

reserves with a view to securing monetary stability in India

and generally to operate the currency and credit system

of the country to its advantage."

m Bank of Issue (Under Sec 22)

½ RBI has sole right to issue One Rupees Notes and

small coins in country as agent of Government.

½ RBI has separate Issue Department to issue currency

notes.

½ RBI maintain Minimum Reserve in form of Gold and

Foreign Exchange Reserve of which almost 55%

should be in Gold.

m Banker to Government

½ RBI is banker, agent and advisor of Central Government

and all State Government in India.

½ RBI helps the Government to float new loans and to

manage public debt.

½ RBI makes loans and advances to the States and local

authorities.

m Banker¶s Bank & Lender of Last Resort

½ RBI maintains banking accounts of all schedule

banks.

½ Every schedule bank have to keep cash reserve a fix

percentage of their aggregate deposit liabilities .

½ Banks always expect for help from RBI in time of

banking crisis.

m Controller of Credit

½ RBI holds the cash reserves of all schedule banks.

½ It holds credit operations of banks through quantities

½ RBI has power to ask bank or whole banking system

not to lend particular group or person.

½ Every bank have to get license from RBI for banking

operation. RBI can also cancel this license.

½ Every bank gives weekly return showing assets and

liabilities in details .

m Custodian of Foreign Reserves

½ RBI responsible to maintain official rate of exchange

as according terms of I.M.F.

½ RBI reserves the international currency.

½ RBI observes relationship of Indian Currency with

other International currency.

m Dromotional Functions

½ RBI ask banks and financing agencies to promote rural

and semi-urban areas by financing (funding ).

½ RBI setup directly or indirectly some institutions like :

½ Deposit Insurance Corporation ( 1962 )

½ Industrial Development Bank ( 1964 )

½ Unit Ôrust of India ( 1964 )

½ Industrial Reconstruction Corp. of India ( 1972 )

½ Agricultural Refinance Corporation ( 1963 )

½ RBI promotes villagers for saving and route this money

as short term credit to agriculture.

m Governor

½ Dr. D Subbarao

m Deputy Governors

½ Dr. Rakesh Mohan, Smt. S. Gopinath, Smt. Usha Ôhorat

m Executive Directors

½ Sh. V.K. Sharma, Sh. C. Krishnan, Sh. Anand Sinha,

Sh. V.S. Das, Sh. G. Gopalkrishna, Sh. H.R. Khan,

Sh. D.K. Mohanty

m Reserve Bank of India,

Central Office,

Shaheed Bhagat Singh Road,

Mumbai ± 400 001

Dh.No. 22660868, Web : www.rbi.org.in

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Sample Cross-Complaint For Indemnity For CaliforniaDocument4 pagesSample Cross-Complaint For Indemnity For CaliforniaStan Burman75% (8)

- Ginger Final Report FIGTF 02Document80 pagesGinger Final Report FIGTF 02Nihmathullah Kalanther Lebbe100% (2)

- Building A Pentesting Lab For Wireless Networks - Sample ChapterDocument29 pagesBuilding A Pentesting Lab For Wireless Networks - Sample ChapterPackt PublishingNo ratings yet

- Broiler ProductionDocument13 pagesBroiler ProductionAlexa Khrystal Eve Gorgod100% (1)

- CDR Writing: Components of The CDRDocument5 pagesCDR Writing: Components of The CDRindikuma100% (3)

- Biblical Foundations For Baptist Churches A Contemporary Ecclesiology by John S. Hammett PDFDocument400 pagesBiblical Foundations For Baptist Churches A Contemporary Ecclesiology by John S. Hammett PDFSourav SircarNo ratings yet

- Conveyor Control Using Programmable Logic ControllerDocument7 pagesConveyor Control Using Programmable Logic ControllerWann RexroNo ratings yet

- Mitsubishi FanDocument2 pagesMitsubishi FanKyaw ZawNo ratings yet

- Hindi ShivpuranDocument40 pagesHindi ShivpuranAbrar MojeebNo ratings yet

- Assignment 3Document2 pagesAssignment 3Debopam RayNo ratings yet

- 21st CENTURY TECHNOLOGIES - PROMISES AND PERILS OF A DYNAMIC FUTUREDocument170 pages21st CENTURY TECHNOLOGIES - PROMISES AND PERILS OF A DYNAMIC FUTUREpragya89No ratings yet

- LS01 ServiceDocument53 pagesLS01 ServicehutandreiNo ratings yet

- ISO - 21.060.10 - Bolts, Screws, Studs (List of Codes)Document9 pagesISO - 21.060.10 - Bolts, Screws, Studs (List of Codes)duraisingh.me6602No ratings yet

- The Grass Rink Summer Final 2019Document9 pagesThe Grass Rink Summer Final 2019api-241553699No ratings yet

- Oracle SOA Suite 11g:buildDocument372 pagesOracle SOA Suite 11g:buildMohsen Tavakkoli100% (1)

- Course Projects PDFDocument1 pageCourse Projects PDFsanjog kshetriNo ratings yet

- Catálogo MK 2011/2013Document243 pagesCatálogo MK 2011/2013Grupo PriluxNo ratings yet

- Journal of Atmospheric Science Research - Vol.5, Iss.4 October 2022Document54 pagesJournal of Atmospheric Science Research - Vol.5, Iss.4 October 2022Bilingual PublishingNo ratings yet

- De DusterDocument6 pagesDe DusterArstNo ratings yet

- Intervensi Terapi Pada Sepsis PDFDocument28 pagesIntervensi Terapi Pada Sepsis PDFifan zulfantriNo ratings yet

- Avid Final ProjectDocument2 pagesAvid Final Projectapi-286463817No ratings yet

- Chap9 PDFDocument144 pagesChap9 PDFSwe Zin Zaw MyintNo ratings yet

- Research On Export Trade in BangladeshDocument7 pagesResearch On Export Trade in BangladeshFarjana AnwarNo ratings yet

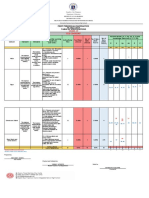

- Revised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10Document6 pagesRevised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10May Ann GuintoNo ratings yet

- Dehn Brian Intonation SolutionsDocument76 pagesDehn Brian Intonation SolutionsEthan NealNo ratings yet

- Paramount Healthcare Management Private Limited: First Reminder Letter Without PrejudiceDocument1 pageParamount Healthcare Management Private Limited: First Reminder Letter Without PrejudiceSwapnil TiwariNo ratings yet

- Building For The Environment 1Document3 pagesBuilding For The Environment 1api-133774200No ratings yet

- Minuets of The Second SCTVE MeetingDocument11 pagesMinuets of The Second SCTVE MeetingLokuliyanaNNo ratings yet

- Onset Hobo Trade T Cdi 5200 5400 User ManualDocument3 pagesOnset Hobo Trade T Cdi 5200 5400 User Manualpaull20020% (1)

- WinCC Control CenterDocument300 pagesWinCC Control Centerwww.otomasyonegitimi.comNo ratings yet