Professional Documents

Culture Documents

Share Capital Maintenance

Uploaded by

Azhari AhmadOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Share Capital Maintenance

Uploaded by

Azhari AhmadCopyright:

Available Formats

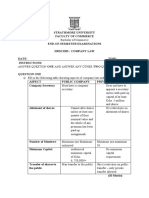

SHARE CAPITAL & ITS

MAINTENANCE

MUHAMMAD UMAR BIN ABDUL RAZAK

FACULTY OF LAW

UITM

Specially Crafted by | TAQIUDDIN HAMZAH 1

OUTLINE

ICON 1) MEANING OF SHARE

CAPITAL

What will you learn under this

topic? ICON 2) MAINTENANCE OF SHARE

CAPITAL DOCTRINE

ICON

Basically on the need to ensure the 3 ) PROHIBITIONS

company maintain its share capital

ICON

in order to protect 2 parties:- 4) CONCLUSION

a) Shareholders

b) Creditors

Specially Crafted by | TAQIUDDIN HAMZAH 2

1) MEANING OF A capital which come from

SHARE CAPITAL shares, when companies issues

shares, the companies will

Specially Crafted by

TAQIUDDIN HAMZAH

obtain the capital contributed by

those who subscribe the shares.

Section 14(3) The application

for incorporation shall include a

statement by every person who

desire to form a company.....the

details of class and number of

shares to be taken by a member.

Specially Crafted by | TAQIUDDIN HAMZAH 3

AUTHORISED CAPITAL

ISSUED CAPITAL

TYPE OF PAID-UP CAPITAL

SHARE CALLED-UP CAPITAL

CAPITAL UNPAID CAPITAL

Specially Crafted by | TAQIUDDIN HAMZAH 4

AUTHORISED CAPITAL ISSUED CAPITAL PAID-UP CAPITAL

500,000 SHARES TO BE

1,000,000 SHARES A & B PAID HALF FROM

ISSUED TO 2

THE ISSUED= 250,000

OF RM1 EACH MEMBERS EQUALLY (A

SHARES

& B)

TYPE OF SHARE CAPITAL

CALLED-UP UNPAID CAPITAL

THE CO DEMANDED A & B HOWEVER, THE MEMBERS

TO PAY FOR THE ONLY PAID 10% OF THE CALLED

REMAINING BALANCE OF UP CAPITAL I.E. 25,000 OF RM1

UNPAID CAPITAL EACH

Specially Crafted by | TAQIUDDIN HAMZAH 5

CREDITORS

2) IMPORTANT FOR CREDITORS BECAUSE IT

CONSTITUTE THE SOURCE OF FUND FROM

MAINTENANCE

WHICH THE CREDITORS CLAIM CAN BE

MET

OF SHARE

CAPITAL SHAREHOLDERS

UPON WINDING UP, MEMBERS ARE

ENTITLED TO RETURN OF CAPITAL

AFTER ALL DEBTS HAVE BEEN PAID.

Specially Crafted by | TAQIUDDIN HAMZAH 6

PAID UP CAPITAL MAY BE DIMINISHED OR LOST

IN THE COURSE OF THE COMPANYS TRADING;

THAT IS THE RESULT WHICH NO LEGISLATION

TREVOR V CAN PREVENT BUT PERSONS WHO DEAL WITH,

AND GIVE CREDIT TO A LIMITED COMPANY,

NATURALLY RELY UPON THE FACT THAT THE

WHITWORH COMPANY IS TRADING WITH A CERTAIN AMOUNT

OF CAPITAL ALREADY PAID, AS WELL AS UPON

THE RESPONSIBILITY OF ITS MEMBERS FOR

(1887) 12 APPS THE CAPITAL REMAINING AT CALL; AND THEY

ARE ENTITLED TO ASSUME THAT NO PART OF

CAS 409

THE CAPITAL WHICH HAS BEEN PAID INTO THE

COFFERS OF THE COMPANY HAS BEEN PAID

OUT, EXCEPT IN THE LEGITIMATE COURSE OF

ITS BUSINESS (PD 423-423, AS PER LORD

WATSON)

Specially Crafted by | TAQIUDDIN HAMZAH 7

COMPANIES

ACT 1965

VS

COMPANIES

ACT 2016

Specially Crafted by | TAQIUDDIN HAMZAH 8

PROVISIONS

WHICH

UNDERWRITING COMMISSIONS UNDER SECTION 58

THE COMPANY PAID ANOTHER PERSON TO SUBSCRIBE ITS

PREVENT

SHARES UPON LISTING ON BURSA. IN RETURN, THE

PERSON WILL BE PAID WITH CERTAIN COMMISSION.

WASTE OF ISSUE OF SHARES AT DISCOUNT UNDER SECTION 59

SHARE CAPITAL ISSUE SHARES BELOW PAR VALUE I.E. 0.50

SEN.

UNDER THE

COMPANIES ISSUE OF SHARES AT PREMIUM UNDER SECTION 60

ISSUANCE OF SHARES ABOVE PAR VALUE

ACT 1965 DUE TO THE GOOD PERFORMANCE IN THE

PREVIOUS YEARS. VALUE INCREASES.

Specially Crafted by | TAQIUDDIN HAMZAH 9

SHARES TO BE ISSUED

WITHOUT PAR VALUE

SHARES WILL BE ISSUED AT A

PRICE

SHARE PREMIUM ACCOUNT

NO PAR VALUE AND THE CONCEPT OF

AUTHORISED CAPITAL WILL NO

REGIME LONGER BE APPLICABLE

TRANSITIONAL PERIOD OF 24

MONTHS WILL BE GIVEN FOR

THE COMPANY TO UTILISE THE

AMOUNT IN THE COMPANYS

SHARE PREMIUM ACCOUNT

Specially Crafted by | TAQIUDDIN HAMZAH 10

NOMINAL OF PAR VALUE IS

ONLY APPLICABLE AT THE

POINT OF ISSUANCE OF

RATIONALE SHARES. THE ACTUAL VALUE

OF THE COMPANY WILL

FOR THE VARY IN ACCORDANCE WITH

THE CURRENT SITUTATION

MIGRATION : OF THE COMPANY.

THE ISSUED PRICE OF

SHARES WILL BE

DETERMINED BY THE

CURRENT VALUE OF THE

COMPANY.

Specially Crafted by | TAQIUDDIN HAMZAH 11

3) PROHIBITIONS

PURCHASE ITS OWN

GIVING FINANCIAL ASSISTANCE

SHARES )

PROHIBITION

PAYING DIVIDEND OUT OF S REDUCING SHARE CAPITAL

CAPITAL

Specially Crafted by | TAQIUDDIN HAMZAH 12

1) PROHIBITION ON COMPANY

PURCHASING ITS OWN SHARES

The prohibition on a company purchasing its own shares was first expressed in the

case of Trevor v Whitworth.

In this case, the executor of Whitworth, a deceased shareholder of the company

(James Schafield & Son Ltd), sold his shares in the company to it. Payment is to be

made by two installments. Prior to the payment of second installment, the company

went into liquidation. The executor claimed the balance from the companys

liquidator, Trevor. The companys MOA did not authorize the company to purchase

its own shares but the AOA did. The court held that a company had no power to

purchase its own shares even if its AOA permits

Specially Crafted by | TAQIUDDIN HAMZAH 13

The rule in Trevor v Whitworth has been

adopted by Section 127 of CA 2016.

3 conditions: the company is solvent at the date

of the purchase, the purchase is made at the

stock exchange & made in good faith and the

best interest of the company 127 (2) CA 2016

Specially Crafted by | TAQIUDDIN HAMZAH 14

Usually, a company buy back its shares

because it has an excess of capital that

WHY DO it cannot effectively (or profitably) use in

its business.

COMPANIES Companies that are active in managing

their capital position may find at

BUY BACK particular time may find they may have

too much equity capital and not enough

THEIR debt capital to produce optimum returns

for shareholders.

SHARES? As a result, the share values do not

reflect the true nature of the companys

financial standing.

Specially Crafted by | TAQIUDDIN HAMZAH 15

16 Specially Crafted by | TAQIUDDIN HAMZAH

BURSA

MAKING REQUISITE ANNOUCEMENT OF MEETINGS OUTCOME

APPROVAL BY ORDINARY RESOLUTION

GM

AUTHORISATION VALID FOR CERTAIN PERIOD (CHAPTER 12 OF BURSA

LISTING REQUIREMENTS)

CO ANNOUNCE TO BURSA ABOUT THE SHARE BUY BACK Bursa

DRAFT CIRCULAR TO BE SENT TO ALL SHAREHOLDERS

RESOLUTION TO BUY BACK BOD

MAKE SOLVENCY STATEMENT UNDER SEC 112

WHAT HAPPEN TO THE SHARES?

the purchased shares will be cancelled; or

It will be referred as a treasury shares; or

To retain part of the shares so purchased as treasury shares and cancel the remainder

of shares.

The treasury shares will be held a securities account. It can be used as share dividend,

resell the shares or transfer the shares under the employees share scheme.

Specially Crafted by | TAQIUDDIN HAMZAH 17

2) PROHIBITION TO GIVE

FINANCIAL ASSISTANCE TO ANY

PERSON TO PURCHASE ITS

SHARES SEC 123 CA 2016

Specially Crafted by | TAQIUDDIN HAMZAH 18

1997 SEC 67A OF CA 1965

Allow public company to buy back its

shares & to give financial assistance for

HISTORY 1998

shares buy back.

SECTION 67A WAS AMENDED

Only public company can undertake

shares buy back

2016 SECTION 126 CA 2016

Not prohibited but allowed

under this section

solvency statement

Specially Crafted by | TAQIUDDIN HAMZAH 19

SECTION 123(1)

This section prohibits the company from

GIVING FINANCIAL ASSISTANCE,

whether directly or indirectly either by

loan, guarantee, or security, to any to

person to purchase its own shares.

SECTION 123 SUBSIDIARY CO

Also, if the company is a subsidiary, any shares in its holding

company

Specially Crafted by | TAQIUDDIN HAMZAH 20

WHY THE LAW PROHIBITS IT?

Has the same detrimental effect on the companys financial

position of self acquisition and can infringe the capital

maintenance doctrine.

To prevent the wastage of capital. To protect the

creditors

The company is not prevented from recovering the loss from

the offender as stated in Section 123(4) CA 2016.

Specially Crafted by | TAQIUDDIN HAMZAH 21

Section 125

Lending money by the company

is in the ordinary course of its

EXCEPTIONS business

In accordance to the scheme

TO SEC 123 for the benefit of the employees

Bona fide in the employment of

the company

Specially Crafted by | TAQIUDDIN HAMZAH 22

WHAT AMOUNT TO FINANCIAL

ASSISTANCE?

Belmont Finance v Williams Furniture (a company making a

gift to a person, which is used to acquire shares)

Chung Kiaw Bank v Hotel Rasa Sayang (a company

guaranteeing a loan by a third party to a person to acquire

shares in the company)

EH Dey Pty Ltd v Dey (reducing liability of a person in

connection with the acquisition of the companys shares)

Specially Crafted by | TAQIUDDIN HAMZAH 23

BELMONT FINANCE V WILLIAMS

FURNITURE (NO 2) [1980] 1 ALL ER

393

Grosscurth wanted to acquire shares in BF. He controlled a company

called Maximum. He sold his shares in Maximum to BF.

The funds he obtained were used to finance the acquisition of BF.

Held: There was a financial assistance by BF to Grosscurth.

Specially Crafted by | TAQIUDDIN HAMZAH 24

CHUNG KIAW BANK V HOTEL RASA

SAYA NG [1990] 1 MLJ 356

Plf gave loan to a company named Syarikat Johor Tenggara. The company

used the fund to purchase shares in Defendant. The loan was secured by D,

by creating a charge over its property and assets.

When the company defaulted in payment, P wanted to enforce the security.

Held: There was a financial assistance. However, P could not enforce the

security because before 1992 amendment, Section 67(6) did not allow any

person other than the company to recover loan or any amount given in

contravention of that section.

Specially Crafted by | TAQIUDDIN HAMZAH 25

EH DEY PTY LTD V DEY [1996] VR

464

Dey was a shareholder of Eh Dey Pty Ltd. He owed a sum of money to

the company for the shares he had taken but not fully paid.

Mr. and Mrs paul wanted to buy these shares.

P passed a resolution reducing the amount owed by D to the company.

Mr. and Mrs Paul then acquired shares at a lower price.

Held: This was financial assistance because the reduction of the

amount owed was in connection with the share transfer between D and

Mr. & Mrs Paul.

Specially Crafted by | TAQIUDDIN HAMZAH 26

LORI (M) SDN BHD V ARAB

MALAYSIA

MARA offered to sell its shares in Lori to Technivest (T). T obtained

loan from bank, security was several guarantees and a charge over

land belonging to Lori.

3 months later, bank obtained confirmation from T that the shares

which T purchased had been transferred and fully paid up prior to the

giving of loan and the creation of security.

T defaulted payment and the bank applied to court to enforce the

security.

Held: The transaction did not amount to financial assistance as this

was a bona fide commercial transaction. Bank had been given

undertaking that transfer of shares was concluded when they gave

loan and obtained security.

Specially Crafted by | TAQIUDDIN HAMZAH 27

3) PROHIBITION ON COMPANIES

PAYING DIVIDEND OUT OF

CAPITAL

Specially Crafted by | TAQIUDDIN HAMZAH 28

Section 131(1) CA 2016

expressly stated that dividends

must be declared only out of

profits if the company is

SOLVENT.

Therefore, directors of

company cannot declare

DIVIDENDS dividends out of capital.

This provision is designed to

prevent a reduction of capital

being disbursed as payment of

dividends out of a companys

issued capital.

Specially Crafted by | TAQIUDDIN HAMZAH 29

There is no necessity for there to be available

profits when the dividend is actually paid;

what is more important is that there were

available profits when the dividend was

declared (Marra Development Ltd v BW Rofe

(1977) 3 ACLR 185

Source of profits must derive from the

MEANING OF company itself which declares and pays

dividend Industrial Equity Ltd v Blackburn -

profits belonging to the subsidiary cannot be

PROFITS? applied to pay dividend of its holding company

because it is a natural consequences of

doctrine of separate legal entity.

Dividends must not be declared in anticipation

of earnings Re Given Estate

Specially Crafted by | TAQIUDDIN HAMZAH 30

A company which has lost part of its capital

A company which has lost part of its capital

can lawfully declare or pay dividends without

can lawfully declare or pay dividends without

first making good the capital which has been

first making good the capital which has been

lost Verner v General and Commercial

lost Verner v General and Commercial

Investment Trust

Investment Trust

A company is at liberty to pay dividend even if

A company is at liberty to pay dividend even if

the available profit at the time of declaring the

the available profit at the time of declaring the

dividend is not equivalent to its nominal or

dividend is not equivalent to its nominal or

share capital, unless the articles say

share capital, unless the articles say otherwise

otherwise - Lee v Neuchatel Asphalte

- Lee v Neuchatel Asphalte

Profits available for dividend mean the profits

Profits available for dividend mean the profits

which the directors consider should be

which the directors consider should be

distributed after making provision for past

distributed after making provision for past

losses, for reserves or for other purposes.

losses, for reserves or for other purposes

Specially Crafted by | TAQIUDDIN HAMZAH 31

A company which has lost part of its capital can lawfully declare

or pay dividends without first making good the capital which has

been lost Verner v General and Commercial Investment Trust

A company is at liberty to pay dividend even if the available

profit at the time of declaring the dividend is not equivalent to its

nominal or share capital, unless the articles say otherwise - Lee

v Neuchatel Asphalte

Profits available for dividend mean the profits which the

directors consider should be distributed after making provision

for past losses, for reserves or for other purposes

Specially Crafted by | TAQIUDDIN HAMZAH 32

4) PROHIBITION TO REDUCE

THE SHARE CAPITAL- SEC 115

Specially Crafted by | TAQIUDDIN HAMZAH 33

Generally, company is not allowed to reduce its share capital except

in accordance with the Companies Act 2016

The rationale behind this is that reduction of capital is treated as

return of assets to the shareholders and the effect would be to

reduce assets that are available for distribution to creditors should

the company goes into liquidation.

The provision in relation to reduction of share capital is mentioned

in Section 115 where company may reduce its share capital in 2

ways.

Specially Crafted by | TAQIUDDIN HAMZAH 34

MERCHANT CREDIT PTY LTD V

INDUSTRIAL & COMMERCIAL

REALTY CO LTD

MC was set up as a joint venture between Industrial

The project was abandoned because

Commercial Bank (ICB) and Arthur Lipper the planning permission could not be

International Ltd (ALI). obtained.

It was agreed that ICB and ALI would take 47.5% of

ICR then commenced proceeding

MCs share capital each.

claiming the return of 332, 500 together

MC proposed to develop an ice skating complex and with interest.

the costs of the project was over $1million.

The court held that ICR were not entitled

ICB agreed to subscribe 332, 500 shares which were

taken up by ICR, a wholly-owned subsidiary of ICB.

to have their money back as the money

was paid for shares and not as loan.

Payment was made to MC, the balance to fund for the

project was advanced by ALI.

MC have no power to return the money

without reduction of capital which could

Issue of shares was deferred until the project got

approval.

only be affected by leave of court.

Specially Crafted by | TAQIUDDIN HAMZAH 35

WAYS TO REDUCE SHARE CAPITAL

COURT SANCTIONS PROCEDURE - SOLVENCY STATEMENT

Sec 117 CA 2017

Sec 115 CA 2016. Private and public company may

2 conditions to satisfy: undertake this exercise without

Special resolution resorting to court sanction

approving the process.

reduction; and Only need to provide a solvency

Court must confirm the statement as required under this

reduction section

Specially Crafted by | TAQIUDDIN HAMZAH 36

CONCLUSION

Specially Crafted by | TAQIUDDIN HAMZAH 37

TASK FOR THE STUDENTS

To find out what is solvency test ?

What are the remedies for the breaches ?

How do the creditors and shareholders are being

protected under CA 2016

Specially Crafted by | TAQIUDDIN HAMZAH 38

THANK YOU

Specially Crafted by | TAQIUDDIN HAMZAH 39

You might also like

- Raising Venture Capital for the Serious EntrepreneurFrom EverandRaising Venture Capital for the Serious EntrepreneurRating: 3 out of 5 stars3/5 (4)

- SHARE CAPITAL.1pptDocument68 pagesSHARE CAPITAL.1pptIreneNo ratings yet

- (11-20) Topic 2 Share Capital & Its Maintenance v2Document19 pages(11-20) Topic 2 Share Capital & Its Maintenance v2AtiraNo ratings yet

- Share Capital and Its MaintenanceDocument78 pagesShare Capital and Its MaintenanceAtiraNo ratings yet

- SHARE CAPITAL & ITS MAINTENANCE v2Document23 pagesSHARE CAPITAL & ITS MAINTENANCE v2AtiraNo ratings yet

- Topic 5 - Company Borrowing Ca2016Document16 pagesTopic 5 - Company Borrowing Ca2016Sivaneeshwary MuruganNo ratings yet

- Issue of Shares Theory NotesDocument7 pagesIssue of Shares Theory Notesjnzqvsxtf4No ratings yet

- Company Law: Meaning and Nature of CompanyDocument8 pagesCompany Law: Meaning and Nature of CompanyAnubhav GuptaNo ratings yet

- CBSE Class 12 Accountancy Company Accounts Share Capital WorksheetDocument13 pagesCBSE Class 12 Accountancy Company Accounts Share Capital WorksheetJenneil CarmichaelNo ratings yet

- 67187bos54090 Cp10u2Document45 pages67187bos54090 Cp10u2Ashutosh PandeyNo ratings yet

- Partnership 1Document64 pagesPartnership 1jayasandhya mNo ratings yet

- ACCOUNTING FOR SHARE CAPITAL AND DEBENTURESDocument22 pagesACCOUNTING FOR SHARE CAPITAL AND DEBENTURESAnonymous 3yqNzCxtTzNo ratings yet

- Corporaterestructuringcrpresentation26 08 08 100126234632 Phpapp01Document21 pagesCorporaterestructuringcrpresentation26 08 08 100126234632 Phpapp01rsrtsNo ratings yet

- 19UD57 Financial ManagementDocument19 pages19UD57 Financial Management19UD57 Vijay Ananth PNo ratings yet

- CH 92 Company Accounts 2Document58 pagesCH 92 Company Accounts 2tasleemfcaNo ratings yet

- Corporate AccountingDocument16 pagesCorporate AccountingshakuttiNo ratings yet

- Week 6 - Parties in TakafulDocument28 pagesWeek 6 - Parties in TakafullegallymoonNo ratings yet

- Module - 3capital GainsDocument38 pagesModule - 3capital Gainsyash131997No ratings yet

- Accountancy Theory ExtraDocument2 pagesAccountancy Theory Extrajimmyadamskl69No ratings yet

- New Islamic Modes of Finance1Document69 pagesNew Islamic Modes of Finance1Abdul MaroofNo ratings yet

- Corporate Business LawDocument11 pagesCorporate Business Lawsameer rahimNo ratings yet

- Islamic Private Debt Securities (IPDS) RulesDocument37 pagesIslamic Private Debt Securities (IPDS) RulesSara IbrahimNo ratings yet

- Classification of Companies IIDocument14 pagesClassification of Companies IINeeraj VNo ratings yet

- Mudarabah and Musharakah - : Participatory Modes of FinancingDocument45 pagesMudarabah and Musharakah - : Participatory Modes of FinancingKhurram MaqboolNo ratings yet

- Islamic Banking GuideDocument31 pagesIslamic Banking GuideRizwan Bin RafiqNo ratings yet

- Company Law Ii Maintenance of CapitalDocument4 pagesCompany Law Ii Maintenance of CapitalIntanNo ratings yet

- Corporate Accounting Notes - FinalDocument211 pagesCorporate Accounting Notes - Finalvik jainNo ratings yet

- Accounting 53Document15 pagesAccounting 53GrishmaNo ratings yet

- UnderwritingDocument16 pagesUnderwritingChienny HocosolNo ratings yet

- Cralaw Virtua1aw LibraryDocument143 pagesCralaw Virtua1aw LibraryJon SnowNo ratings yet

- Chapter 3 Fa5Document22 pagesChapter 3 Fa5Noriani Binti SambriNo ratings yet

- Chapter 6 Loan and DebenturesDocument9 pagesChapter 6 Loan and DebenturesranunNo ratings yet

- A Beginner Stock MarketDocument15 pagesA Beginner Stock MarketRam IyerNo ratings yet

- CH 1 - Issue of SharesDocument44 pagesCH 1 - Issue of Shares21BCO097 ChelsiANo ratings yet

- Corporate AccountingDocument40 pagesCorporate Accountingsawan yadavNo ratings yet

- Company Law Short Revision Notes by Vinit Mishra SirDocument103 pagesCompany Law Short Revision Notes by Vinit Mishra SirChinmay GokhaleNo ratings yet

- Answer Paper 5Document17 pagesAnswer Paper 5SomeoneNo ratings yet

- Chap 06 - Musharaka PartnershipDocument26 pagesChap 06 - Musharaka Partnershipomair.jawaid60No ratings yet

- LawDocument11 pagesLawnwanguiNo ratings yet

- Bajaj Notes On M&ADocument8 pagesBajaj Notes On M&Ark1510No ratings yet

- Share Capital - Meaning, Types and Classes - CompanyDocument10 pagesShare Capital - Meaning, Types and Classes - CompanyZAKA ULLAHNo ratings yet

- Slides - Accounting For Mudharabah FinancingDocument25 pagesSlides - Accounting For Mudharabah FinancingMasni Najib Kaaybee100% (1)

- Week 6 Islamic Financing InstrumentDocument30 pagesWeek 6 Islamic Financing Instrument2 Ashlih Al TsabatNo ratings yet

- 28908cpt Fa SM cp9 Part3 PDFDocument31 pages28908cpt Fa SM cp9 Part3 PDFBaking passionsNo ratings yet

- Topic 4 Shares Capital NotesDocument16 pagesTopic 4 Shares Capital NotesDanica DivyaNo ratings yet

- Accounts of Joint Stock Company - Issue of Shares & Debentures, & Schedule ViDocument13 pagesAccounts of Joint Stock Company - Issue of Shares & Debentures, & Schedule VibasithrahmanNo ratings yet

- Slides 1Document8 pagesSlides 1mimihassanNo ratings yet

- Wint Wealth - Invoice DiscountingDocument12 pagesWint Wealth - Invoice DiscountingSmkeynote SmkeynoteNo ratings yet

- Buy Back of SharesDocument17 pagesBuy Back of SharesTayyeb RangwalaNo ratings yet

- Kinds of CompaniesDocument24 pagesKinds of CompaniesDr. Seema H. KadamNo ratings yet

- 3 Underwriting of SharesDocument6 pages3 Underwriting of Sharesvaibhav agarwalNo ratings yet

- DIMINISHING-MUSHARIKA-14112021-072718pmDocument24 pagesDIMINISHING-MUSHARIKA-14112021-072718pmAwn AqdasNo ratings yet

- Company Law Marathon (For Dec 2020 and Onwards) Class FileDocument35 pagesCompany Law Marathon (For Dec 2020 and Onwards) Class Filepittujb2002No ratings yet

- Company accounts underwriting shares debenturesDocument7 pagesCompany accounts underwriting shares debenturesSakshi chauhanNo ratings yet

- Accounting For Share CapitalDocument38 pagesAccounting For Share CapitalAadi PunjabiNo ratings yet

- Factoring: Presented By:-Dhairya Roll No - 03 Mba (Final) Sec-ADocument13 pagesFactoring: Presented By:-Dhairya Roll No - 03 Mba (Final) Sec-ADhairyaa BhardwajNo ratings yet

- Corporate RestructuringDocument54 pagesCorporate RestructuringRita SinghNo ratings yet

- CIR v. ManningDocument18 pagesCIR v. Manningmceline19No ratings yet

- Suggested Answers of Company Law June 2019 Old Syl-Executive-RevisionDocument15 pagesSuggested Answers of Company Law June 2019 Old Syl-Executive-RevisionjesurajajosephNo ratings yet

- Shariah Compliant Funds Rising and Shariah Compliant SecuritizationDocument40 pagesShariah Compliant Funds Rising and Shariah Compliant SecuritizationZahra GüzelNo ratings yet

- Absence Letter SampleDocument1 pageAbsence Letter SampleAzhari Ahmad0% (2)

- ICJ rules it lacks jurisdiction over Yugoslavia's use of force cases due to applicant's UN membership statusDocument19 pagesICJ rules it lacks jurisdiction over Yugoslavia's use of force cases due to applicant's UN membership statusAzhari AhmadNo ratings yet

- Act 177 (2016)Document577 pagesAct 177 (2016)Nerissa ZahirNo ratings yet

- bp1111 FoakesDocument16 pagesbp1111 FoakesAzhari AhmadNo ratings yet

- 17th NovemberDocument20 pages17th NovemberAzhari AhmadNo ratings yet

- Law of Treaties: Formation, Requirements & Governing PrinciplesDocument3 pagesLaw of Treaties: Formation, Requirements & Governing PrinciplesAzhari AhmadNo ratings yet

- Act 177 (2016)Document577 pagesAct 177 (2016)Nerissa ZahirNo ratings yet

- 17th NovemberDocument20 pages17th NovemberAzhari AhmadNo ratings yet

- PromotersDocument6 pagesPromotersAzhari AhmadNo ratings yet

- BetrothalDocument27 pagesBetrothalAzhari AhmadNo ratings yet

- Student's Guideline To Submission of PPDocument15 pagesStudent's Guideline To Submission of PPAzhari AhmadNo ratings yet

- The Cost of The State Is Far Too Great To Sustain Universal Free University Education PointDocument4 pagesThe Cost of The State Is Far Too Great To Sustain Universal Free University Education PointAzhari AhmadNo ratings yet

- Def HT by AcademiciansDocument2 pagesDef HT by AcademiciansAzhari AhmadNo ratings yet

- Final ProposalDocument11 pagesFinal ProposalAzhari AhmadNo ratings yet

- LAW605 Scheme of Work - Sept 2014Document2 pagesLAW605 Scheme of Work - Sept 2014Azhari AhmadNo ratings yet

- FypDocument8 pagesFypAzhari AhmadNo ratings yet

- Written Submission FinalDocument10 pagesWritten Submission FinalAzhari AhmadNo ratings yet

- Presentation 1Document16 pagesPresentation 1Azhari AhmadNo ratings yet

- Reproductive Medicine and Assisted Reproductive Technologies (A.R.T.)Document23 pagesReproductive Medicine and Assisted Reproductive Technologies (A.R.T.)Azhari AhmadNo ratings yet

- Jeremy BenthamDocument12 pagesJeremy BenthamNuraniNo ratings yet

- Ibrahim V AbdullahDocument2 pagesIbrahim V AbdullahAzhari AhmadNo ratings yet

- 2 - Culpable HomicideDocument5 pages2 - Culpable HomicideAzhari AhmadNo ratings yet

- A Kanapathy Pillay V Joseph ChongDocument3 pagesA Kanapathy Pillay V Joseph ChongAzhari AhmadNo ratings yet

- 1 - MurderDocument3 pages1 - MurderAzhari AhmadNo ratings yet

- Abdul Hamid B Saad V Aliyasak B IsmailDocument4 pagesAbdul Hamid B Saad V Aliyasak B IsmailAzhari AhmadNo ratings yet

- Equity NotesDocument10 pagesEquity NotesAzhari AhmadNo ratings yet

- HJ Abdul Rahman V HassanDocument5 pagesHJ Abdul Rahman V HassanAzhari AhmadNo ratings yet

- LAND LAW II (Jual Janji-July 10)Document19 pagesLAND LAW II (Jual Janji-July 10)Azhari AhmadNo ratings yet

- Land LawDocument2 pagesLand LawAzhari AhmadNo ratings yet

- Principles of Option PricingDocument30 pagesPrinciples of Option PricingVaidyanathan Ravichandran100% (1)

- JSW SteelDocument34 pagesJSW SteelShashank PatelNo ratings yet

- R. A. Podar College of Commerce and Economics:, (Autonomous)Document45 pagesR. A. Podar College of Commerce and Economics:, (Autonomous)Rashi thiNo ratings yet

- Trade AcronymsDocument5 pagesTrade AcronymsAnderson FernandesNo ratings yet

- PR - Order in The Matter of M/s Wasankar Wealth Management Limited, Wasankar Investments and OthersDocument1 pagePR - Order in The Matter of M/s Wasankar Wealth Management Limited, Wasankar Investments and OthersShyam SunderNo ratings yet

- Financial ManagementDocument31 pagesFinancial ManagementShashikant MishraNo ratings yet

- Calculate Value at Risk (VaR) for a diversified portfolioDocument11 pagesCalculate Value at Risk (VaR) for a diversified portfolioRashmiroja SahuNo ratings yet

- Bulkowski's Day Trading Setup - Reader ViewDocument3 pagesBulkowski's Day Trading Setup - Reader ViewPaulo AzevedoNo ratings yet

- Manch 4.0 Project List: For Internal Use OnlyDocument8 pagesManch 4.0 Project List: For Internal Use OnlyHimanshu KumarNo ratings yet

- Multiple Choice Questions: Answer: B. Wealth MaximisationDocument20 pagesMultiple Choice Questions: Answer: B. Wealth MaximisationArchana Neppolian100% (1)

- Arbitrage CalculatorDocument10 pagesArbitrage CalculatornasirNo ratings yet

- FV FV: ExplanationDocument54 pagesFV FV: Explanationenergizerabby83% (6)

- Fortune Wealth ManagementDocument27 pagesFortune Wealth Managementjagadeesh0907No ratings yet

- Asian PaintsDocument10 pagesAsian PaintsAyaad SiddiquiNo ratings yet

- Marmore Industry Report: Policy Reforms Hold KeyDocument7 pagesMarmore Industry Report: Policy Reforms Hold KeyAdeel ShaikhNo ratings yet

- Modified UCA Cash Flow FormatDocument48 pagesModified UCA Cash Flow FormatJohan100% (1)

- DIF I - Regulatory IssuesDocument133 pagesDIF I - Regulatory Issuesparvez ansariNo ratings yet

- Week 09 - Inventory EstimationsDocument3 pagesWeek 09 - Inventory EstimationsPj ManezNo ratings yet

- Balance sheet and income statement analysisDocument8 pagesBalance sheet and income statement analysisAnindya BasuNo ratings yet

- Corpo Voting TableDocument6 pagesCorpo Voting TableLuna Faustino-LopezNo ratings yet

- Project Selection and Portfolio ManagementDocument28 pagesProject Selection and Portfolio Management胡莉沙No ratings yet

- Chapter 2 Financial AnalysisDocument76 pagesChapter 2 Financial AnalysisAhmad Ridhuwan Abdullah100% (1)

- 2010-10-26 233008 SmayerDocument6 pages2010-10-26 233008 Smayernicemann21No ratings yet

- Making Capital Structure Support StrategyDocument8 pagesMaking Capital Structure Support StrategyOwm Close CorporationNo ratings yet

- Unit 14: The Foreign Exchange Market New WordsDocument3 pagesUnit 14: The Foreign Exchange Market New WordsKún KuteNo ratings yet

- Capital Budgeting Techniques: NPV, IRR, PaybackDocument2 pagesCapital Budgeting Techniques: NPV, IRR, PaybackSanjit SinhaNo ratings yet

- Entrepreneurship: Dr. Akshita JainDocument137 pagesEntrepreneurship: Dr. Akshita JainSALONI JAINNo ratings yet

- Pre BoardDocument16 pagesPre BoardPatrick WaltersNo ratings yet

- Amk 1Document4 pagesAmk 1rykaNo ratings yet

- MTM of Overnight Index SwapsDocument7 pagesMTM of Overnight Index SwapsAjanavit PrasadNo ratings yet