Professional Documents

Culture Documents

India GST

Uploaded by

Hardik SharmaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

India GST

Uploaded by

Hardik SharmaCopyright:

Available Formats

Excise duty Paid

on removal of

goods from the

factory

Third Party Third Party

(Factory) Distributers

Sale value = INR 100

Excise Duty = INR12.5

Excise duty charged

either on the sale

value of the goods to

the distributor or on

the maximum retail

price (MRP) minus

abatement

Fig. Excise duty on Manufacturing

VAT Paid in the state of

Karnataka on transfer of

property from the

retailer to the customer

Retailer Customer

(Karnataka) (Karnataka)

Sale value = INR 100

VAT = INR 14.5

VAT charged on the

sale transaction

value / sale value

between the retail

and customer, after

the eligible

discounts

Fig. VAT on within the State Sale of Goods

CST Paid in the state of

Karnataka (origin stat) on

transfer of property from

the manufacturer to the

distributer

Manufacturer Distributor

(Karnataka) (Maharashtra)

Sale value = INR 100

CST = INR 2 or VAT

rate

VAT charged on the

sale transaction

value / sale value

between the retail

and customer, after

the eligible

discounts

Fig. CST on between the States Sale of Goods

Service tax Paid by service

provider (paid by service

recipient in some cases)

on provision of service to

another person

Service Provider Service

(Karnataka) Recipient

Sale value = INR 100 (Maharashtra)

Service Tax = 14% + 0.5%

+ 0.5%

Service tax charged

on the gross value

of the transaction

between the service

provider and the

service recipient

Fig. Service Tax on Provision of Service

Custom duties paid by the

buyer on imported goods

covered under the customs

tariff act and at the rate

Seller Buyer

specified in the act

(USA) Assessable value = INR (India)

100

Custom Duties = INR

29.44

BCD charged on the

assessable value (import

value + certain additions,

if any).CVD charged on

the assessable value or

MRP minus abatement.

SAD charged on

assessable Value + BCD +

CVD

Fig. Custom Duties on Import of Goods into India

Entry tax Paid by

the dealer or the

person causing the

entry of goods into

the state

Dealer Buyer

(Outside State) (In state)

Sale value = INR 100

Entry Tax = Depends on

State

Entry tax charged

on the sale value or

transaction value

(or such value as a

state may

prescribe) of the

goods entering the

state

Fig. Entry on Entry of Goods into a State

Sale of Inputs

INR 100

Excise Duty INR

12.5 Manufacturer

Vendor

(Seller of Inputs) (Producer of Finished

Goods - FG)

Dispatch of FG INR

200

Excise Duty INR 25

Input Excise duty of INR 12.5

paid by manufacturer Wholesaler

allowed as credit against his (Buyer of Finished

output excise duty of INR 25. Goods - FG)

Manufacturer to pay only

INR 12.5 is cash to excise

authorities on dispatch of FG

Fig. Input Excise Duty / Service Tax credit mechanism

Sale of Inputs

INR 100

VAT INR 14.5

Manufacturer

Vendor

(Producer of Finished

(Seller of Inputs)

Goods - FG)

Dispatch of FG INR

200

VAT INR 29

Input VAT of INR 14.5 paid by Wholesaler

manufacturer allowed as

(Buyer of Finished

credit against his output VAT

Goods - FG)

of INR 29. Manufacturer to

pay only INR 14.5 is cash to

VAT authorities on of FG

Fig. Input VAT credit mechanism (same stat transactions)

2000 Setup of EC of finance ministers to design GST for India

Partial Integration of input tax credit mechanism under central

2004 excise and service tax legislations

Introduction of National VAT in a majority of states

2005 All states in India on-board VAT by 2007/2008

The finance Minister announces implementation of GST on April

2007 1, 2010

EC release the first discussion paper on GST with a blueprint for

2009 GST

Introduction of constitution amendment bill in the parliament

2011 and setup of GST network to create IT Framework

Introduction of Negative list based taxation of service and place

2012 of provision of service rules

Re-Introduction of Constitution (One Hundred and Twenty-second

2014 Amendment) Bill, 2014

Re-iteration of Introduction of GST by April 1, 2016 in the Union

2015 Budget Speech of 2015-16

Constitution Amendment Bill, 2014 passed by the Lok Sabha on

2015 May 6, 2015

Fig. GST History of India

Origin State Consumption

A State B

Seller Inter-State Sale Buyer

(Karnataka) (Tamilnadu)

Central Sales Tax(CST)

CST payable in the

State of Karnataka

(Origin state from

which the goods

start the movement

collects CST)

Fig. Indirect Tax Regime Origin Based

Origin State Consumption

A State B

Seller Inter-State Supply Buyer

(Karnataka) (Tamilnadu)

Goods & Service Tax(CST)

CST (IGST) on

supply of goods

payable in State B

(consumption state)

where the goods

are consumed

Fig. GST Regime Consumption Based

Indirect Tax

Regime

GST

Manufacture of

goods

Supply of

Sale of goods

Goods and

Import of goods

services

Provision of

Service

Entry of goods

Fig. Taxable Events Indirect Tax vs. GST

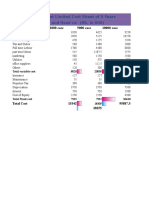

Existing Central Existing State Taxes under

Taxes Taxes GST Regime

Excise

Duty

Service VAT

CGST

Tax + Entry Tax = SGST

BCD* Luxury Tax

IGST

CVD Ent. Tax

SAD

CST

Fig. Existing Indirect Taxes to be subsumed under the GST regime

Supply of Inputs

INR 100

CGST INR 1, CGST Manufacturer

Vendor* INR 10 (Producer of Finished

(Seller of Inputs) Goods - FG)

State A State A

Supply of FG INR 200

CGST INR 20, CGST INR

20

The manufacturer will be

eligible to use the Input Wholesaler

CGST of INR 10 against the (Buyer of Finished

output CGST of INR Goods - FG)

20.Similarly, Input SGST of State A

INR 10 can be used against

the output SGST of TNR 20.

* Vender, manufacturer and the wholesaler are based in different states

Fig. Sale of goods within the State (Intra-state)

Supply of Inputs

Vendor* Manufacturer

INR 100 IGST INR

(Seller of Inputs) (Producer of Finished

10

State A Goods - FG)

State A

Supply of FG INR

200

IGST INR

40

The manufacturer will be Wholesaler

eligible to use the Input (Buyer of Finished

CGST of INR 20 paid on Goods - FG)

inputs against the output State A

IGST of INR 40 on supply of

FG

* Vender, manufacturer and the wholesaler are based in different states

Fig. Sale of goods between the States (Inter-state)

Goods Services

Zero Rate

0% Zero Rate

Special Rate 0%

1% Base Rate

Base Rate 12% Higher

12% Higher Rate 20%

Rate 20%

The GST rate are still under discussion. Decision

pending on the actual GST rates and number of GST

rates

Fig. Possible GST Rates??

India USA

Export of Goods or

Seller Services Buyer

Value of Supply INR

100

GST INR 0

Export would be

zero rated under

GST, but the seller

would be eligible for

input tax credit /

refund of the input

GSTs

Fig. Exports to be zero rated under the GST regime

Existing

Proposed

Indirect Tax

GST Regime

Regime

BCD

IGST

BCD instead of

CVD CVD and

SAD SAD

CESS and

CESS

other duties

included in

GST

Fig. Import Duties Indirect tax regime vs GST regime

Possible reduction

in tax cost

Possible

Reduced cheaper

resources, cost

To the Governments

Expansion of goods and

To the Consumers

Tax base time services

To the Business

Increase in Reduction in Improved

Revenue litigation services

levels

Streamlining of Efficient

tax structuring of Access to

administration operations more goods

and services

Self-Assessment

Fig. Benefits of GST

Conceptualizati Implementation

on and Management

Stage Stage

Minimum of 4 different

taxes under GST

Transactional

Probability of high Provisions

rate of GST

IT Infrastructure

Complexity of taxing

inter-state transactions GST Administration

Difficulty of framing Accounting Standards

the place of Supply

rules

Fig. GST Challenges

Knowledge of GST concepts, acts and rules

GST impact analysis on business operations and tax cost

Plan for business restricting / supply chain restricting,

if required

Changes to IT Instructure / Information Systems

Resource management for in house tax teams

Fig. GST Preparedness for Businesses

Power to both central & stat governments to levy GST on

transactions in goods and services

Introduction to definition of GST in the Constitution

Provision for formulation of GST council

Additional 1% tax on inter-stat supply of goods

Compensation to the Stat governments for loss of CST

Fig. Key changes in the Constitution Amendment Bill

The term Supply is not defined along with the

definition of GST in the constitution amendment bill

The GST council as a recommendatory body

1% additional duty on inter-state supply of goods

Exceptions made for specific sectors & taxes under GST

Fig. Key Drawbacks in the GST Bill

Continuously evolving legislation with new world focus

Technology drive and fully automated

Self-assessment with zero intervention by govts.

Reduction in tax evasion

Selective / Exceptional audit and investigation

Reduced corruption

Fig. Future of Indirect Taxes in India

You might also like

- IDocument2 pagesIHardik SharmaNo ratings yet

- Job Compatibility QuestionnaireDocument4 pagesJob Compatibility QuestionnaireHardik Sharma0% (1)

- MBA Cridit System SyllabusDocument48 pagesMBA Cridit System SyllabussujithsamuelNo ratings yet

- The Need For Security: Our Bad Neighbor Makes Us Early Stirrers, Which Is Both Healthful and Good HusbandryDocument56 pagesThe Need For Security: Our Bad Neighbor Makes Us Early Stirrers, Which Is Both Healthful and Good HusbandryArockiaruby RubyNo ratings yet

- Working CapitalDocument9 pagesWorking CapitalHardik SharmaNo ratings yet

- ProjectDocument4 pagesProjectHardik SharmaNo ratings yet

- Engineering Graphics 2004Document3 pagesEngineering Graphics 2004Hardik SharmaNo ratings yet

- Engineering Graphics 2002Document2 pagesEngineering Graphics 2002Hardik SharmaNo ratings yet

- Basic Mechanical Engineering 2003Document2 pagesBasic Mechanical Engineering 2003Hardik SharmaNo ratings yet

- Engineering Drawing Exam ReviewDocument4 pagesEngineering Drawing Exam ReviewHardik SharmaNo ratings yet

- Block Diagram of ComputerDocument1 pageBlock Diagram of ComputerHardik SharmaNo ratings yet

- Engineering Graphics 2002 PDFDocument2 pagesEngineering Graphics 2002 PDFHardik SharmaNo ratings yet

- Financial ManagementDocument48 pagesFinancial ManagementHardik SharmaNo ratings yet

- Working CapitalDocument9 pagesWorking CapitalHardik SharmaNo ratings yet

- Term Loan ProcedureDocument5 pagesTerm Loan ProcedureHardik Sharma100% (1)

- MAX WEBER's ContributonDocument8 pagesMAX WEBER's ContributonHardik SharmaNo ratings yet

- Ashank Winery Cost Sheet and BEP AnalysisDocument4 pagesAshank Winery Cost Sheet and BEP AnalysisHardik SharmaNo ratings yet

- 12.make or BuyDocument6 pages12.make or BuyHardik SharmaNo ratings yet

- Financial ManagementDocument48 pagesFinancial ManagementHardik SharmaNo ratings yet

- The Control FunctionDocument20 pagesThe Control FunctionHardik SharmaNo ratings yet

- French BenifitsDocument63 pagesFrench BenifitsHardik SharmaNo ratings yet

- Mechanics of A-B-C AnalysisDocument4 pagesMechanics of A-B-C AnalysisHardik SharmaNo ratings yet

- Research MethodologyDocument41 pagesResearch MethodologyRomit Machado83% (6)

- Prototypin G: Gattani Neha Brijmohan ROLL NO.14081 MBA-1Document11 pagesPrototypin G: Gattani Neha Brijmohan ROLL NO.14081 MBA-1Hardik SharmaNo ratings yet

- Data Collection and Analysis Sem II 2014Document35 pagesData Collection and Analysis Sem II 2014Hardik SharmaNo ratings yet

- Inventory Software: Application Software On Inventory of Textile Trading CompanyDocument9 pagesInventory Software: Application Software On Inventory of Textile Trading CompanyHardik SharmaNo ratings yet

- The Control FunctionDocument20 pagesThe Control FunctionHardik SharmaNo ratings yet

- FatherDocument19 pagesFatherprowednesNo ratings yet

- Essence of LifeDocument12 pagesEssence of LifeHardik SharmaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CAPISTRANO vs. LIMCUANDODocument1 pageCAPISTRANO vs. LIMCUANDOElaine Grace R. AntenorNo ratings yet

- Quotation for 15KW solar system installationDocument3 pagesQuotation for 15KW solar system installationfatima naveedNo ratings yet

- Ethics in Organizational Communication: Muhammad Alfikri, S.Sos, M.SiDocument6 pagesEthics in Organizational Communication: Muhammad Alfikri, S.Sos, M.SixrivaldyxNo ratings yet

- Anti-Communist Myths DebunkedDocument168 pagesAnti-Communist Myths DebunkedSouthern Futurist100% (1)

- Consti II NotesDocument108 pagesConsti II NotesVicky LlasosNo ratings yet

- Tanveer SethiDocument13 pagesTanveer SethiRoshni SethiNo ratings yet

- Zambia HIV/AIDS Data IntegrityDocument1 pageZambia HIV/AIDS Data IntegrityReal KezeeNo ratings yet

- Chemistry Presentation Week2Document17 pagesChemistry Presentation Week2Mohammad SaadNo ratings yet

- On Moral and Non-Moral StandardsDocument11 pagesOn Moral and Non-Moral Standardsryan bhinogNo ratings yet

- Order Dated - 18-08-2020Document5 pagesOrder Dated - 18-08-2020Gaurav LavaniaNo ratings yet

- Final Sociology Project - Dowry SystemDocument18 pagesFinal Sociology Project - Dowry Systemrajpurohit_dhruv1142% (12)

- Family Law Dissertation TopicsDocument5 pagesFamily Law Dissertation TopicsWriteMyEnglishPaperForMeSterlingHeights100% (1)

- DENR V DENR Region 12 EmployeesDocument2 pagesDENR V DENR Region 12 EmployeesKara RichardsonNo ratings yet

- CAlAMBA AND SANTIAGO - TUGOTDocument2 pagesCAlAMBA AND SANTIAGO - TUGOTAndrea Tugot100% (1)

- Ptu Question PapersDocument2 pagesPtu Question PapersChandan Kumar BanerjeeNo ratings yet

- The Revolt of 1857: Causes, Nature, Importance and OutcomesDocument8 pagesThe Revolt of 1857: Causes, Nature, Importance and OutcomesMaaz AlamNo ratings yet

- Gorgeous Babe Skyy Black Enjoys Hardcore Outdoor Sex Big Black CockDocument1 pageGorgeous Babe Skyy Black Enjoys Hardcore Outdoor Sex Big Black CockLorena Sanchez 3No ratings yet

- Legal Ethics Oral Examination 2018Document13 pagesLegal Ethics Oral Examination 2018Telle MarieNo ratings yet

- Classification of CorruptionDocument3 pagesClassification of CorruptionMohammad Shahjahan SiddiquiNo ratings yet

- Armstrong BCE3 Install 507120-01Document18 pagesArmstrong BCE3 Install 507120-01manchuricoNo ratings yet

- Grant Thornton - Co-Op 3Document7 pagesGrant Thornton - Co-Op 3ConnieLowNo ratings yet

- Guide Internal Control Over Financial Reporting 2019-05Document24 pagesGuide Internal Control Over Financial Reporting 2019-05hanafi prasentiantoNo ratings yet

- IRR of BP 33, Amended by PD 1865Document14 pagesIRR of BP 33, Amended by PD 1865rajNo ratings yet

- BMW Immo EmulatorDocument12 pagesBMW Immo EmulatorAnonymous wpUyixsjNo ratings yet

- CB 4 Letter To Gov. Cuomo Re Congestion PricingDocument3 pagesCB 4 Letter To Gov. Cuomo Re Congestion PricingGersh KuntzmanNo ratings yet

- Islamic Mangement Vs Conventional ManagementDocument18 pagesIslamic Mangement Vs Conventional Managementlick100% (1)

- CW: Union Victory at Gettysburg & VicksburgDocument9 pagesCW: Union Victory at Gettysburg & VicksburgPi LoverNo ratings yet

- Pieterson v. INS, 364 F.3d 38, 1st Cir. (2004)Document9 pagesPieterson v. INS, 364 F.3d 38, 1st Cir. (2004)Scribd Government DocsNo ratings yet

- Introduction To Ultrasound: Sahana KrishnanDocument3 pagesIntroduction To Ultrasound: Sahana Krishnankundu.banhimitraNo ratings yet

- Hydrochloric Acid MSDS: 1. Product and Company IdentificationDocument7 pagesHydrochloric Acid MSDS: 1. Product and Company IdentificationdeaNo ratings yet