Professional Documents

Culture Documents

Master Budgeting and Responsibility Accounting: © 2009 Pearson Prentice Hall. All Rights Reserved

Uploaded by

2mrbunbuns0 ratings0% found this document useful (0 votes)

8 views20 pagespowerpoint

Original Title

costacctg13e_ppt_ch06

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentpowerpoint

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views20 pagesMaster Budgeting and Responsibility Accounting: © 2009 Pearson Prentice Hall. All Rights Reserved

Uploaded by

2mrbunbunspowerpoint

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 20

Master Budgeting

and

Responsibility Accounting

2009 Pearson Prentice Hall. All rights reserved.

Budget defined

The quantitative expression of a proposed

plan of action by management for a specified

period, and

An aid to coordinating what needs to be done

to implement that plan

May include both financial and non-financial

data

2009 Pearson Prentice Hall. All rights reserved.

The Ongoing Budget

Process:

1. Managers and accountants plan the

performance of the company, taking into

account past performance and anticipated

future changes

2. Senior managers distribute a set of goals

against which actual results will be

compared

2009 Pearson Prentice Hall. All rights reserved.

The Ongoing Budget

Process:

3. Accountants help managers investigate

deviations from budget. Corrective action

occurs at this point

4. Managers and accountants assess market

feedback, changed conditions, and their

own experiences as plans are laid for the

next budget period

2009 Pearson Prentice Hall. All rights reserved.

Strategy, Planning and

Budgets, Illustrated

2009 Pearson Prentice Hall. All rights reserved.

Advantages of Budgets

Provides a framework for judging performance

Motivates managers and other employees

Promotes coordination and communication

among subunits within the company

2009 Pearson Prentice Hall. All rights reserved.

Components of Master

Budgets

Operating Budget building blocks leading to

the creation of the Budgeted Income

Statement

Financial Budget building blocks based on

the Operating Budget that lead to the creation

of the Budgeted Balance Sheet and the

Budgeted Statement of Cash Flows

2009 Pearson Prentice Hall. All rights reserved.

Basic Operating Budget

Steps

1. Prepare the Revenues Budget

2. Prepare the Production Budget (in Units)

3. Prepare the Direct Materials Usage Budget

and Direct Materials Purchases Budget

4. Prepare the Direct Manufacturing Labor

Budget

2009 Pearson Prentice Hall. All rights reserved.

Basic Operating Budget

Steps

5. Prepare the Manufacturing Overhead Costs

Budget

6. Prepare the Ending Inventories Budget

7. Prepare the Cost of Goods Sold Budget

8. Prepare the Operating Expense (Period Cost)

Budget

9. Prepare the Budgeted Income Statement

2009 Pearson Prentice Hall. All rights reserved.

Basic Financial Budget Steps

Based on the Operating Budgets:

1. Prepare the Capital Expenditures Budget

2. Prepare the Cash Budget

3. Prepare the Budgeted Balance Sheet

4. Prepare the Budgeted Statement of Cash

Flows

2009 Pearson Prentice Hall. All rights reserved.

Sample

Master

Budget,

Illustrated

2009 Pearson Prentice Hall. All rights reserved.

Other Budgeting Issues

Financial-planning software may be

employed to conduct sensitivity (what-if)

analysis to assist in the budgetary process

Kaizen Budgeting incorporating

continuous improvement factors in the

budgeting process

Activity-Based Budgeting incorporating

Activity-Based Costing in the budgetary

process

2009 Pearson Prentice Hall. All rights reserved.

Kaizen Budgeting, Illustrated

2009 Pearson Prentice Hall. All rights reserved.

Budgeting and the Organization:

Responsibility Accounting

Responsibility Center a part, segment, or

subunit of a organization whose manager is

accountable for a specified set of activities

Responsibility Accounting a system that

measures the plans, budgets, actions and

actual results of each Responsibility Center

2009 Pearson Prentice Hall. All rights reserved.

Types of Responsibility

Centers

1. Cost accountable for costs only

2. Revenue accountable for revenues only

3. Profit accountable for revenues & costs

4. Investment accountable for investments,

revenues, and costs

2009 Pearson Prentice Hall. All rights reserved.

Budgets and Feedback

Budgets offer feedback in the form of

variances: actual results deviate from

budgeted targets

Variances provide managers with

Early warning of problems

A basis for performance evaluation

A basis for strategy evaluation

2009 Pearson Prentice Hall. All rights reserved.

Controllability

Controllability is the degree of influence that a

manager has over costs, revenues, or related

items for which he is being held responsible

Responsibility Accounting focuses on

information sharing, not in laying blame on a

particular manager

2009 Pearson Prentice Hall. All rights reserved.

Budgeting and Human

Behavior

The budgeting process may be abused both

by superiors and subordinates, leading to

negative outcomes

Superiors may dominate the budget process

or hold subordinates accountable for events

they have no control over

Subordinates may build budgetary slack

into their budgets

2009 Pearson Prentice Hall. All rights reserved.

Budgetary Slack

The practice of underestimating budgeted

revenues, or overestimating budgeted

expenses, in an effort to make the resulting

budgeted goals (profits) more easily

attainable

2009 Pearson Prentice Hall. All rights reserved.

2009 Pearson Prentice Hall. All rights reserved.

You might also like

- Flexible Budgets, Direct-Cost Variances, and Management ControlDocument21 pagesFlexible Budgets, Direct-Cost Variances, and Management Control2mrbunbunsNo ratings yet

- Cost12 Xlab03Document7 pagesCost12 Xlab032mrbunbunsNo ratings yet

- Inventory Costing and Capacity Analysis: © 2009 Pearson Prentice Hall. All Rights ReservedDocument22 pagesInventory Costing and Capacity Analysis: © 2009 Pearson Prentice Hall. All Rights Reserved2mrbunbunsNo ratings yet

- Cost12 Xlab02Document4 pagesCost12 Xlab022mrbunbunsNo ratings yet

- Cost-Volume-Profit Analysis: © 2009 Pearson Prentice Hall. All Rights ReservedDocument19 pagesCost-Volume-Profit Analysis: © 2009 Pearson Prentice Hall. All Rights ReservedLea WigiartiNo ratings yet

- Costacctg13e PPT ch08Document19 pagesCostacctg13e PPT ch082mrbunbunsNo ratings yet

- 266404Document24 pages2664042mrbunbunsNo ratings yet

- Cost-Volume-Profit Analysis: © 2009 Pearson Prentice Hall. All Rights ReservedDocument19 pagesCost-Volume-Profit Analysis: © 2009 Pearson Prentice Hall. All Rights ReservedLea WigiartiNo ratings yet

- Flexible Budgets, Direct-Cost Variances, and Management ControlDocument21 pagesFlexible Budgets, Direct-Cost Variances, and Management Control2mrbunbunsNo ratings yet

- Costacctg13e PPT ch02Document30 pagesCostacctg13e PPT ch022mrbunbunsNo ratings yet

- Chapter 04 Job Costing.Document28 pagesChapter 04 Job Costing.Sehon RichardsNo ratings yet

- Management Control Systems, Transfer Pricing, and Multinational Considerations 22Document30 pagesManagement Control Systems, Transfer Pricing, and Multinational Considerations 22Martinus WarsitoNo ratings yet

- JCK 1 SNJKDocument1 pageJCK 1 SNJK2mrbunbunsNo ratings yet

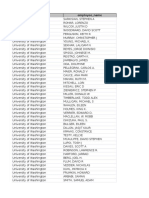

- 2013 UW SalariesDocument2,914 pages2013 UW Salaries2mrbunbunsNo ratings yet

- Chapter 14 Long-Term LiabilitiesDocument16 pagesChapter 14 Long-Term Liabilities2mrbunbunsNo ratings yet

- Fine Cooking - Spring 2017Document100 pagesFine Cooking - Spring 20172mrbunbunsNo ratings yet

- Flex USA - March 2017-P2PDocument232 pagesFlex USA - March 2017-P2P2mrbunbuns100% (3)

- Tr-Avel Le-Isure Sou-Theast Asia - March 2017Document108 pagesTr-Avel Le-Isure Sou-Theast Asia - March 20172mrbunbunsNo ratings yet

- MuscleDocument68 pagesMuscle2mrbunbunsNo ratings yet

- MuscleDocument68 pagesMuscle2mrbunbunsNo ratings yet

- Chapter 21 LeasesDocument26 pagesChapter 21 Leases2mrbunbunsNo ratings yet

- CN09HODocument26 pagesCN09HO2mrbunbunsNo ratings yet

- Chapter 19 Accounting For Income TaxesDocument17 pagesChapter 19 Accounting For Income Taxes2mrbunbunsNo ratings yet

- Mens Fitness UK April 2017Document132 pagesMens Fitness UK April 20172mrbunbunsNo ratings yet

- CN14HODocument28 pagesCN14HO2mrbunbunsNo ratings yet

- Performance Measurement & Compensation: 2009 Foster Business School Cost Accounting L.Ducharme 1Document48 pagesPerformance Measurement & Compensation: 2009 Foster Business School Cost Accounting L.Ducharme 12mrbunbunsNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- LIMRAagentrecruitmentDocument30 pagesLIMRAagentrecruitmentshay68No ratings yet

- LGU Budget CycleDocument3 pagesLGU Budget CycleDelfinNo ratings yet

- Guide To Cashflow 101 TrainingDocument5 pagesGuide To Cashflow 101 TrainingTong Kah Haw100% (2)

- Esso Standard Eastern vs. CommissionerDocument2 pagesEsso Standard Eastern vs. CommissionerlexxNo ratings yet

- TAX NotesDocument45 pagesTAX NotesAlhaji Umaru JallohNo ratings yet

- Drummond Geometry Daily Forecast: Daily Edition For Published On Monday, July 12, 2010Document6 pagesDrummond Geometry Daily Forecast: Daily Edition For Published On Monday, July 12, 2010MKamil34No ratings yet

- Fabm2 Q1Document149 pagesFabm2 Q1Gladys Angela Valdemoro100% (2)

- Nirma Is One of The Most Recognizable Indian BrandsDocument10 pagesNirma Is One of The Most Recognizable Indian BrandsDarshil Shah100% (1)

- Student HandbookDocument26 pagesStudent HandbookNadyusha NavrucNo ratings yet

- Case Study - Krispy Kreme DoughnDocument7 pagesCase Study - Krispy Kreme DoughnKalyan Nanduri67% (3)

- TLE - HO ME EC ON Omics 6: Weekly Home PlanDocument8 pagesTLE - HO ME EC ON Omics 6: Weekly Home PlanJEROME GONDRADA SISONNo ratings yet

- RR No. 2-98 (As Amended by TRAIN Law)Document125 pagesRR No. 2-98 (As Amended by TRAIN Law)Magenic Manila IncNo ratings yet

- Funding Amount (INR)Document8 pagesFunding Amount (INR)Rahul PatelNo ratings yet

- Session 10 Chapter 10 Making Capital InvestmentDecisionDocument35 pagesSession 10 Chapter 10 Making Capital InvestmentDecisionLili YaniNo ratings yet

- ITC Working CapitalDocument72 pagesITC Working Capitaltulasinad12356% (9)

- NCAA Financial Report FY2019-Coastal CarolinaDocument79 pagesNCAA Financial Report FY2019-Coastal CarolinaMatt BrownNo ratings yet

- q2 Long Quiz 002 EntreDocument8 pagesq2 Long Quiz 002 EntreMonn Justine Sabido0% (1)

- Inherent Powers of The State PDFDocument12 pagesInherent Powers of The State PDFGeomari D. BigalbalNo ratings yet

- 3 Floor, Business & Engineering Building, Matina, Davao City Telefax: (082) 300-1496 Phone No.: (082) 244-34-00 Local 137Document13 pages3 Floor, Business & Engineering Building, Matina, Davao City Telefax: (082) 300-1496 Phone No.: (082) 244-34-00 Local 137Abigail Ann PasiliaoNo ratings yet

- 40 - Section 9 of The Indian Income Tax ActDocument18 pages40 - Section 9 of The Indian Income Tax ActDhirendra SinghNo ratings yet

- Chap 04 and 05 (Mini Case)Document18 pagesChap 04 and 05 (Mini Case)ricky setiawan100% (1)

- Minor Project Report On Bajaj Automobiles IndiaDocument55 pagesMinor Project Report On Bajaj Automobiles IndiaAmit Jain71% (7)

- Techna-X Berhad: Incorporated in MalaysiaDocument17 pagesTechna-X Berhad: Incorporated in MalaysiaChoon Wei WongNo ratings yet

- CR-July-Aug-2022Document6 pagesCR-July-Aug-2022banglauserNo ratings yet

- Investopedia ExplainsDocument28 pagesInvestopedia ExplainsPankaj JoshiNo ratings yet

- PTCL Internship Report 2017Document41 pagesPTCL Internship Report 2017shumailasamadyahoocom86% (7)

- Paradise Island Resort A Completed Business PlanDocument30 pagesParadise Island Resort A Completed Business PlanMohdShahrukh100% (2)

- BPI V CIRDocument6 pagesBPI V CIRIan AuroNo ratings yet

- GST 311 Past Question 2016 BashDocument4 pagesGST 311 Past Question 2016 BashYahaya Suleiman AliyuNo ratings yet

- Golden Ribbon Lumber Company V City of ButuanDocument2 pagesGolden Ribbon Lumber Company V City of ButuanGabriel GaspanNo ratings yet