Professional Documents

Culture Documents

1 Bank Lending

Uploaded by

parthasarathi_inCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 Bank Lending

Uploaded by

parthasarathi_inCopyright:

Available Formats

BANK LENDING:

POLICIES AND

PROCEDURES

Paarthasaarathi

Associate Professor

Department of Finance

AICAR BUSINESS SCHOOL, MUMBAI

I. TYPES OF BANK LOANS

Real estate loans: short-term loans for

construction and land development and longerterm loans for the purchase of farmland, homes,

apartments, commercial structures, and foreign

properties.

Financial institution loans: loans to other

banks, insurance companies, finance companies,

and other financial institutions.

Agricultural loans: loans to finance farm and

ranch operations, mainly to assist in planting

and harvesting crops and to support the feeding

and care of livestock.

I. TYPES OF BANK LOANS

4. Commercial and industrial loans: to

businesses to cover expenditures on inventories,

paying taxes, and meeting payrolls.

5. Loans to individuals: credit to finance the

purchase of automobiles, appliances, and other

consumer goods, equity lines for home

improvements, and other personal expenses

6. Bank Leasing to corporate firms on equipment

or vehicles.

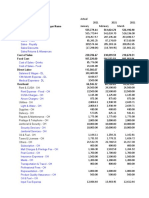

I. TYPES OF BANK LOANS

Loans Outstanding for Commercial Ban

ks

II. Determining the Size

and Mix of Bank Loans

The characteristics of the market it serves:

The demand for loans by local customers

Local economic conditions.

Bank regulation and capital requirements

determines its legal lending limit to a

single borrower and the total loan size.

II. Factors Determining the

Growth and Mix of Bank

Loans

The bank's official loan principal

and

policy: The key factor determining the

composition of a banks loan portfolio.

The loan rates policy by a bank: Borrowers

have

been

shopping

around

for

competitive loans.

III. Regulation of Lending

Regulations on lending limits:

Banks cannot grant real estate loans by

more than the total amount of bank's

capital and surplus or 70 percent of its

total time and savings deposits,

whichever is greater.

A loan to a single customer normally

cannot exceed 15 percent of a national

bank's capital and surplus account.

III. Regulation of Lending

Regulation on Borrowers Protection:

The RBI guidelines require that the household

borrower be quoted the "true cost" of a loan,

as reflected in the annual percentage interest

rate (APR) and all required charges and fees

for obtaining credit, before the loan agreement

is signed.

III. Regulation of Lending

Regulation on Bank Rating: The Uniform Financial

Institutions Rating System would rate each bank

by assigning a numerical rating based on the

quality of its asset portfolio:

1 = strong performance.

2 = satisfactory performance.

3 = fair performance.

4 = marginal performance.

5 = unsatisfactory performance.

The higher a bank's asset-quality rating, the less

frequently it will be subject to review and

examination by RBI.

III. Regulation of Lending

The Uniform Financial Institutions Rating System, numerical

ratings are also assigned based on examiner judgment of

the bank's capital adequacy, management quality, earnings

record, liquidity position, and sensitivity to market risk

exposure. The CAMELS rating:

Capital adequacy.

Asset quality.

Management quality.

Earnings record.

Liquidity position.

Sensitivity to market risk

Banks with an overall rating of 4 or 5-are examined more

frequently than the highest-rated banks, those with ratings

of 1,2, or 3.

IV. Establishing a Loan

Policy

Important elements of a good bank loan

policy as suggested by the RBI

1. A clear mission statement for the

bank's loan portfolio in terms of types,

maturities, sizes, and quality of loans.

2. Specification of the lending authority

given to each loan officer and loan

committee (measuring the maximum

amount and types of loan that each

person and committee can approve and

what signatures are required).

IV. Establishing a Loan

Policy

3. Lines of responsibility in making

assignments and reporting information

within the loan department.

4. Operating procedures for soliciting,

reviewing, evaluating, and making

decisions on customer loan applications.

5. The required documentation that is to

accompany each loan application and

what must be kept in the bank's credit

files (required financial statements,

security agreements, etc.).

IV. Establishing a Loan

Policy

6. Lines of authority within the bank,

detailing who is responsible for maintaining

and reviewing the bank's credit files.

7. Guidelines for taking, evaluating, and

perfecting loan collateral.

8. A presentation of policies and

procedures for setting loan interest rates

and c fees and the terms for repayment of

loans.

9. A statement of quality standards

applicable to all loans.

IV. Establishing a Loan

Policy

10. A statement of the preferred upper

limit for total loans outstanding (i.e., the

maximum ratio of total loans to total

assets allowed).

11. A description of the bank's principal

trade area, from which most loans

should come.

12. A discussion of the preferred

procedures for detecting, analyzing, and

working out problem loan situations.

V. Steps in the Lending

Process

1. Loan requests:

often arise from contacts the bank's loan

officers and sales representatives make

as they solicit new accounts from

individuals and firms operating in the

bank's market area.

2. Customers fill out a loan application.

3. An interview with a loan officer.

Interview provides an opportunity for the

bank's loan officer to assess the

customer's character and sincerity of

purpose.

V. Steps in the Lending

Process

4. Site visits:

If a business or mortgage loan is applied for, a site

visit is usually made by an officer of the bank.

5. Credit References:

The loan officer may contact other creditors who

have previously loaned money to this customer for

credit references.

6. Financial Statements and Documentation

needed for Loan Evaluation, including:

complete financial statements and,

board of directors' resolutions authorizing the

negotiation of a loan with the bank.

V. Steps in the Lending

Process

7. Credit Analysis:

The credit analysis is aimed determining whether

the customer has sufficient cash flows and

backup assets to repay the loan.

8. Perfecting the Banks Claims to Collateral:

To ensure that the bank has immediate access to

the collateral or can acquire title to the property

involved if the loan agreement is defaulted.

9. Preparing a Loan Agreement:

Once the loan and the proposed collateral are

satisfied, the note and other documents that

make up a loan agreement are prepared and are

signed by all parties to the agreement.

V. Steps in the Lending

Process

10. Loan Monitoring:

The new agreement must be monitored

continuously to ensure that the terms of

the loan are being followed and that all

required payments of principal and/or

interest are being made as promised.

For larger commercial credits, the loan

officer will visit the customer's business

periodically to check on the firm's

progress and to see what other services

the customer may need.

V. Steps in the Lending

Process

Usually a loan officer or other staff member

places information about a new loan customer

in a computer file known as a bank customer

profile. This file shows what bank services the

customer is currently using and contains other

information required by bank management to

monitor a customer's progress and financialservice needs.

VI. Credit Analysis

Three major questions regarding each

application must be satisfactorily answered:

loan

1. Is the borrower creditworthy ? How do you

know?

2. Can the loan agreement be properly structured

and documented so that the bank and its

depositors are adequately protected and the

customer has a high probability of being able to

service the loan without excessive strain?

3. Can the bank perfect its claim against the assets

or earnings of the customer so that, in the event of

default, bank funds can be recovered rapidly at low

cost and with low risk?

VI. Credit Analysis: The

Five Cs

Character:

The loan officer must be convinced that the

customer has a well-defined purpose for

requesting bank credit and a serious intention

to repay.

Capacity:

The loan officer must be sure that the

customer requesting credit has the authority to

request a loan and the legal standing to sign a

binding loan agreement. This customer

characteristic is known as the capacity to

borrow money.

VI. Credit Analysis: The

Five Cs

Cash.

Three sources of income to repay loans:

(a) cash flows generated from sales or

income,

(b) the sale or liquidation of assets, or

(c) funds raised by issuing debt or equity

securities.

What is cash flow?

Cash flow = Net profits(or total revenue less

all expenses) + Non-cash

expenses

VI. Credit Analysis: The

Five Cs

Another definition used by some accountants and

financial analysts is:

Cash flows = Net profits + Non-cash expenses +

Additions to accounts payable Additions to inventories and

accounts receivable.

This latter definition of cash flow is that it helps to

focus a bank loan officer's attention on those

facets of a customer's business that reflect the

quality and experience of its management and

the strength of the market the customer serves.

VI. Credit Analysis: The

Five Cs

Collateral:

Does the borrower possess adequate net worth

or own enough quality assets to provide

adequate support for the loan? The loan officer

is particularly sensitive to such features as the

age, condition, and degree of specialization of

the borrower's assets.

VI. Credit Analysis: The

Five Cs

Conditions:

The loan officer and credit analyst must

be aware of recent trends in the

borrower's line of work or industry and

how changing economic conditions might

affect the loan. To assess industry and

economic conditions, most banks

maintain files of information-newspaper

clippings, magazine articles, and research

reports-on the industries represented by

their major borrowing customers.

VI. Credit Analysis: Beyond

The Five Cs

Control:

Control centers on such questions as whether

changes in law and regulation could adversely

affect the borrower and whether the loan

request meets the bank's and the regulatory

authorities' standards for loan quality.

VII. Structuring and

Documenting Loans

Structuring a Loan:

Drafting a loan agreement that meets the

borrower's need for funds with a comfortable

repayment schedule.

Anticipating and accommodating of a customer

who may request more or less funds than

requested, over a longer or shorter period.

VII. Structuring the Loans

Imposing

certain

restrictions

(covenants) on the borrower's activities

to protect the banks when these

activities could threaten the recovery of

bank funds.

Specifying the process of recovering the

bank's funds - when and where the

bank can take action to get its funds

returned.

VIII. Perfecting the

Banks Claim on

Reasons for Taking Collateral:

Collateral

The pledge of collateral gives the lender the

right to seize and sell those assets designated

as loan collateral, using the proceeds of the

sale to cover what the borrower did not pay

back.

Collateralization of a loan gives the lender a

psychological advantage over the borrower.

Because specific assets may be at stake, a

borrower feels more obligated to work hard to

repay his or her loan and avoid losing valuable

assets.

VIII. Perfecting the

Banks Claim on

The goal of a bank taking collateral:

Collateral

To precisely define which borrower assets are

subject to seizure and sale and to document

for all other creditors to see that the bank has

a legal claim to those assets in the event of

nonperformance on a loan.

VIII. Perfecting the

Banks Claim on

Common Types of Loan Collateral:

Collateral

Accounts Receivable.

The bank takes a security interest in the form of

a stated percentage of the face amount of

accounts receivable (sales on credit) shown on a

business borrower's balance sheet.

When the borrower's credit customers send in

cash to retire their debts, these cash payments

are applied to the balance of the borrower's loan.

Two ways to evaluate accounts receivable:

Accounting receivable aging;

Accounting receivable turnover.

VIII. Perfecting the

Banks Claim on

Collateral

Factoring.

A bank can purchase a borrower's

accounts receivable based upon some

percentage of their book value.

The borrower's customers are required to

send their payments to the purchasing

bank.

Usually the borrower promises to set

aside funds in order to cover some or all

of the losses that the bank may suffer

from any unpaid receivables.

VIII. Perfecting the

Banks Claim on

Inventory.

Collateral

A bank will lend only a percentage of the

estimated market value of a borrower's

inventory:

Floating Lien: The inventory pledged may be controlled

completely by the borrower.

Floor planning: The lender takes temporary ownership

of any goods placed in inventory and the borrower

sends payments or sales contracts to the lender as the

goods are sold.

Ways to evaluate inventory:

Resale of inventory;

Inventory turnover;

Inventory converted to accounts receivable.

VIII. Perfecting the

Banks Claim on

Estate Property:

Collateral

Real

Public notice of a mortgage against real

estate is filed with the Registrar in the

place where the property resides.

The bank may also take out title

insurance and insist that the borrower

purchase insurance to cover damage

from floods and other hazards, with the

bank receiving first claim on any

insurance settlement that is made.

VIII. Perfecting the

Banks Claim on

Approaches to the valuation of real estate:

Collateral

The Cost approach: the reproduction

cost of the

building and improvements, deducts estimated

depreciation, and adds the value of the land.

Market Data or direct sales comparison approach:

estimate the value of the subject property based

on the comparable properties selling prices.

The income approach: the discounted value of

the future net operating income streams.

The direct capitalization (cap rate) approach:

calculate the value by dividing an estimate of its

stabilized annual income by a factor called

cap rate.

VIII. Perfecting the

Banks Claim on

Personal Property:

Collateral

Banks take a security interest in automobiles,

furniture, jewelry, securities, and other forms

of personal property owned by a borrower.

A financing statement will be filed publicly in

those cases where the borrower keeps

possession

of

any

personal

property

hypothecated.

A pledge agreement may be prepared if the

bank or its agent holds the pledged property,

giving the bank the right to control that

property until the loan is repaid in full.

VIII. Perfecting the

Banks Claim on

Personal Guarantees:

Collateral

A pledge of the stock, deposits, or other

personal assets held by the major stockholders

or owners of a company may be required as

collateral to secure a business loan.

Guarantees are often sought by banks in

lending to smaller businesses or to firms that

have fallen on difficult times. This gives the

owners an additional reason to want their firm

to prosper and to repay their loan.

VX. Sources of Information

about Loan Customers

Rating Agencies publishes many ratios and group

them by industry and firm size:

Current assets to current liabilities (the current

ratio).

Current assets minus inventories to current

liabilities (the quick ratio).

Sales to accounts receivable.

Cost of sales to inventory (the inventory

turnover ratio).

Earnings before interest and taxes to total

interest payments (the interest coverage

ratio).

VX. Sources of Information

about Loan Customers

Fixed assets to net worth.

Total debt to net worth (the leverage ratio).

Profits before taxes to total assets and tangible

net worth.

Total sales to net fixed assets and to total assets.

Rating Agencies also calculates common-size

balance sheets (with all major asset and liability

items expressed as a percentage of total assets)

and common-size income statements (with profits

and operating expense items expressed as a

percentage of total sales) for different size groups

of firms within an industry.

VX. Sources of Information

about Loan Customers

Rating Agencys Industry Surveys provides

information for analyzing loan applications

from business borrowers.

They provide a detailed analysis of recent trends in

the borrower's industry and that industry's future

outlook. Analysts working for Standard & Poor's

examine the prospects for each industry's future

sales growth and profitability, the expected impact

of technological changes, trends in industry

organizational structure and competition, what' s

happening to the prices of industry goods and

services, and new product developments within each

major industrial group where banks make loans.

VX. Sources of Information

about Loan Customers

Dun & Bradstreet Credit Services:

This agency collects information on approximately 3

million firms in 800 different business lines. D&B

prepares detailed financial reports on individual

borrowing companies for its subscribers. For each

firm reviewed, the D&B Business Information

Reports provide a credit rating, a brief financial and

management history of the firm, a summary of

recent balance sheet and income and expense

statement trends, a listing of any major loans

known to be still outstanding against the firm, its

terms of trade, the names of its key managers, and

the location and condition of the firm's facilities.

X. Parts of a Typical Loan

Agreement

Collateral. Secured loan agreements

include a section describing any assets

that are pledged as collateral, along with

an explanation of how and when the bank

can take possession of the collateral in

order to recover its funds.

Covenants. Most formal loan agreements

also contain restrictive covenants,

which are usually one of two types:

affirmative or negative.

X. Parts of a Typical Loan

Agreement

1. Affirmative covenants require the borrower to

take certain actions, such as periodically filing

financial statements with the bank, maintaining

insurance coverage on the loan and on any

collateral pledged, and maintaining specified

levels of liquidity and equity.

2. Negative covenants restrict the borrower from

doing certain things without the bank's approval,

such as taking on new debt, acquiring additional

fixed assets, participating in mergers, selling

assets, or paying excessive dividends to

stockholders.

X. Parts of a Typical Loan

Agreement

Borrower Guaranties or Warranties.

In most loan agreements, the borrower

specifically guarantees or warranties that

the information supplied in the loan

application is true and correct. The borrower

may also be required to pledge personal

assets behind a business loan or against a

loan that is cosigned by a third party.

Whether collateral is posted or not, the loan

agreement must identify who or what

institution is responsible for the loan and

obligated to make payment.

X. Parts of a Typical Loan

Agreement

Events of Default.

Finally, most loans

contain a section listing events of default,

specifying what actions or inactions by the

borrower would represent a significant

violation of the terms of the loan agreement

and what actions the bank is legally

authorized to take in order to secure the

recovery of its funds. The events-of-default

section also clarifies who is responsible for

collection costs, court costs, and attorney's

fees that may arise from litigation of the

loan agreement.

XI. Loan Review

1. Reviewing all types of loans on a periodic

basis - every 30, 60, or 90 days on the

largest loans, along with a random sample

of smaller loans.

2. Detailed the loan review process

carefully to include:

a. The record of borrower payments, to

ensure that the customer is not falling

behind the planned repayment schedule.

b. The quality and condition of any

collateral pledged behind the loan.

XI. Loan Review

c. The completeness of loan documentation, to

make sure the bank has access to any collateral

pledged and possesses the full legal authority

to take action against the borrower in the

courts if necessary.

d. An evaluation of whether the borrower's

financial condition and forecasts have changed,

which may have increased or decreased the

borrower's need for bank credit.

e. An assessment of whether the loan conforms

to the bank's lending policies and to the

standards applied to its loan portfolio by

examiners from the regulatory agencies.

XI. Loan Review

3. Reviewing most frequently the largest loans,

because default on these credit agreements could

seriously affect the bank's own financial

condition.

4. Conducting more frequent reviews of troubled

loans, with the frequency of review increasing as

the problems surrounding any particular loan

increase.

5. Accelerating the loan review schedule if the

economy slows down or if the industries in which

the bank has made a substantial portion of its

loans develop significant problems.

XII. Handling Problem Loan

Situations

Common features to problem loans:

1. Unusual or unexplained delays in receiving

promised financial reports and payments or in

communicating with bank personnel.

2. Sudden changes in methods used by the

borrowing firm to account for depreciation, make

pension plan contributions, value inventories,

account for taxes, or recognize income.

3. For business loans, restructuring outstanding

debt or eliminating dividends, or experiencing a

change in the customer's credit rating.

XII. Handling Problem Loan

Situations

4. Adverse changes in the price of a borrowing

customer's stock.

5. Net earnings losses in one or more years,

especially as measured by returns on the

borrower's assets (ROA), or equity capital (ROE),

or earnings before interest and taxes (EBIT).

6. Adverse changes in the borrower's capital

structure (equity/debt ratio), liquidity (current

ratio), or activity levels (e.g., the ratio of sales to

inventory).

XII. Handling Problem Loan

Situations

7. Deviations of actual sales or cash flow

from those projected when the loan was

requested.

8. Sudden, unexpected, and unexplained

changes in deposit balances maintained by

the customer.

XII. Handling Problem Loan

Situations

What should a banker do when a loan is in

trouble?

1. Always keep the goal of loan workouts firmly in

mind: to maximize the bank's chances for the full

recovery of its funds.

2. The rapid detection and reporting of any

problems with a loan are essential; delay often

worsens a problem loan situation.

3. Keep the loan workout responsibility separate

from the lending function to avoid possible

conflicts of interest for the loan officer.

XII. Handling Problem Loan

Situations

4. Bank workout specialists should confer with the

troubled customer quickly on possible options,

especially for cutting expenses, increasing cash

flow, and improving management control.

Precede this meeting with a preliminary

analysis of the problem and its possible causes,

noting any special workout problems.

Develop a preliminary plan of action after

determining the banks risk exposure and the

sufficient of loan documents (especially any

claims against the customers collateral other

than that held by the bank.)

XII. Handling Problem Loan

Situations

5. Estimate what resources are available to

collect the troubled loan (including the estimated

liquidation values of assets and deposits).

6. Loan workout personnel should conduct a tax

and litigation search to see if the borrower has

other unpaid obligations.

7. For business borrowers, bank loan personnel

must evaluate the quality, competence, and

integrity of current management and visit the site

to assess the borrower's property and operations.

XII. Handling Problem Loan

Situations

8. Bank workout professionals must consider all

reasonable alternatives cleaning up the troubled

loan, including making a new, temporary

agreement if loan problems appear to be shortterm in nature or finding a way to help the

customer strengthen cash flow (such as reducing

expenses or entering new markets) or to infuse

new capital into the business. Other possibilities

include finding additional collateral, securing

endorsements or guarantees, reorganizing,

merging or liquidating the firm, or filing a

bankruptcy petition.

Thank you.

Copyright by t.r. paarthasaarathi

All rights reserved. This material may not be reproduced, displayed, modified or distributed without the express prior

written permission of the author

56

You might also like

- Loan Policy 1Document13 pagesLoan Policy 1Vijay GangwaniNo ratings yet

- Credit Mgt. - WEBILT - DeckDocument287 pagesCredit Mgt. - WEBILT - Decksimran kaur100% (1)

- UNIT3Document37 pagesUNIT3lokesh palNo ratings yet

- Ch2 Principles of Credit ManagementDocument18 pagesCh2 Principles of Credit ManagementSandeep Kumar SuranaNo ratings yet

- Bank Lending and Credit A DministrationDocument5 pagesBank Lending and Credit A Dministrationolikagu patrickNo ratings yet

- Process of Retail LendingDocument26 pagesProcess of Retail Lendingkaren sunil100% (1)

- Credit Appraisal Process GRP 10Document18 pagesCredit Appraisal Process GRP 10Priya JagtapNo ratings yet

- Capital: Owner About Their Stake Hence More Safeguard Will Be The Borrowed FundsDocument28 pagesCapital: Owner About Their Stake Hence More Safeguard Will Be The Borrowed FundsMdramjanaliNo ratings yet

- A Study On Credit Management at District CoDocument86 pagesA Study On Credit Management at District CoIMAM JAVOOR100% (2)

- 2.international FinanceDocument81 pages2.international FinanceDhawal RajNo ratings yet

- Sanction, Documentation and Disbursement of CreditDocument32 pagesSanction, Documentation and Disbursement of Creditrajin_rammstein100% (1)

- Note On Bank Loans-SummaryDocument7 pagesNote On Bank Loans-Summaryscbihari1186No ratings yet

- Unit-6: Commercial & Industrial LendingDocument28 pagesUnit-6: Commercial & Industrial LendingRaaz Key Run ChhatkuliNo ratings yet

- Credit Appraisal Process & Financial ParametersDocument35 pagesCredit Appraisal Process & Financial ParametersAbhishek Barman100% (1)

- Principles of LendingDocument37 pagesPrinciples of LendingRohit BaralNo ratings yet

- Credit AwarenessDocument62 pagesCredit AwarenessHimanshu Mishra100% (1)

- Credit Appraisal Means An InvestigationDocument3 pagesCredit Appraisal Means An InvestigationSoumava Paul100% (1)

- BankingDocument110 pagesBankingNarcity UzumakiNo ratings yet

- Assignment of Management of Working Capital: TopicDocument13 pagesAssignment of Management of Working Capital: TopicDavinder Singh BanssNo ratings yet

- Assignment of Management of Working Capital: TopicDocument13 pagesAssignment of Management of Working Capital: TopicDavinder Singh Banss0% (1)

- Credit Appraisal ProcessDocument19 pagesCredit Appraisal ProcessVaishnavi khot100% (1)

- Introduction To Lending - Topic 1Document78 pagesIntroduction To Lending - Topic 1SAMSONI lucasNo ratings yet

- Principles of Sound Lending, Credit PolicyDocument54 pagesPrinciples of Sound Lending, Credit Policyrajin_rammsteinNo ratings yet

- Credit RatingDocument10 pagesCredit Ratingnguyentrinh.03032003No ratings yet

- Principles of Credit ManagementDocument26 pagesPrinciples of Credit ManagementPALLAVI KAMBLENo ratings yet

- Unit 8Document8 pagesUnit 8rtrsujaladhikariNo ratings yet

- Activity Sheet In: Business FinanceDocument7 pagesActivity Sheet In: Business FinanceCatherine LarceNo ratings yet

- Credit Management Overview and Principles of LendingDocument55 pagesCredit Management Overview and Principles of LendingShilpa Grover100% (4)

- Credit PolicyDocument3 pagesCredit PolicySuvro AvroNo ratings yet

- Report On Working Capital Loan (Prime Bank)Document29 pagesReport On Working Capital Loan (Prime Bank)rrashadatt100% (3)

- Bank Strengthening Manual: USAID - Iraq Economic Governance IIDocument54 pagesBank Strengthening Manual: USAID - Iraq Economic Governance IIshailaja74No ratings yet

- Credit Administration and Documentation StandardsDocument7 pagesCredit Administration and Documentation StandardsEINSTEIN2DNo ratings yet

- Eco 306 MB BankDocument11 pagesEco 306 MB BankKhánh Mai Lê NguyễnNo ratings yet

- Credit Report On MCBDocument16 pagesCredit Report On MCBuzmabhatti34No ratings yet

- Uses of Bank Funds: The Lending FunctionDocument21 pagesUses of Bank Funds: The Lending FunctionAKSHAY BHADAURIANo ratings yet

- Credit Portfolio ManagementDocument6 pagesCredit Portfolio ManagementSachin PreetiNo ratings yet

- Credit ManagementDocument29 pagesCredit ManagementDipesh KaushalNo ratings yet

- Week 3a-Consumer LendingDocument22 pagesWeek 3a-Consumer LendingSenuri AlmeidaNo ratings yet

- Bank Lending: Policies & Procedures: M. Morshed 1Document26 pagesBank Lending: Policies & Procedures: M. Morshed 1musansuNo ratings yet

- Credit C7Document14 pagesCredit C7Chantelle Ishi Macatangay AquinoNo ratings yet

- Credit ManagementDocument46 pagesCredit Managementshuklashish79% (24)

- Principles of LendingDocument19 pagesPrinciples of LendingAkshay JainNo ratings yet

- Q1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsDocument24 pagesQ1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsJusie ApiladoNo ratings yet

- Credit Analysis and Distress Prediction Credit Analysis and Distress PredictionDocument10 pagesCredit Analysis and Distress Prediction Credit Analysis and Distress PredictionEster Oshin AritonangNo ratings yet

- Chap 4 - Credit Risk AssessmentDocument14 pagesChap 4 - Credit Risk Assessmentcharlie simoNo ratings yet

- Dashka Zulfiqar 18910 Fasiha Sagheer 18911Document5 pagesDashka Zulfiqar 18910 Fasiha Sagheer 18911samreenNo ratings yet

- CHAP - 3 - Lending Policies and ProceduresDocument74 pagesCHAP - 3 - Lending Policies and Procedureskhanhlmao25252No ratings yet

- Credit AppraisalDocument6 pagesCredit AppraisalAnjali Angel ThakurNo ratings yet

- Case Study: Presented by Neha.G - 31 Neha .M - 32Document10 pagesCase Study: Presented by Neha.G - 31 Neha .M - 32cuteneha_1989No ratings yet

- Pamantasan NG Lungsod NG Maynila PLM Business School A.Y. 2020 - 2021 First Semester Fin 3104: Credit Management and Collection PoliciesDocument29 pagesPamantasan NG Lungsod NG Maynila PLM Business School A.Y. 2020 - 2021 First Semester Fin 3104: Credit Management and Collection PoliciesHarlene BulaongNo ratings yet

- Overview - Corporate BankingDocument10 pagesOverview - Corporate BankingKavviya VenkatNo ratings yet

- Unit 3 Non-Banking Financial ServicesDocument29 pagesUnit 3 Non-Banking Financial ServicesAllwynThomasNo ratings yet

- Unit III MBF22408T Credit Risk and Recovery ManagementDocument22 pagesUnit III MBF22408T Credit Risk and Recovery ManagementSheetal DwevediNo ratings yet

- Mastering Trade Lines "A Guide to Building Credit and Financial Success"From EverandMastering Trade Lines "A Guide to Building Credit and Financial Success"No ratings yet

- Repair Your Credit Score: The Ultimate Personal Finance Guide. Learn Effective Credit Repair Strategies, Fix Bad Debt and Improve Your Score.From EverandRepair Your Credit Score: The Ultimate Personal Finance Guide. Learn Effective Credit Repair Strategies, Fix Bad Debt and Improve Your Score.No ratings yet

- Portfolio Credit Risk - Random Correlation MatrixDocument20 pagesPortfolio Credit Risk - Random Correlation Matrixparthasarathi_inNo ratings yet

- Capital Adequacy and Profit Planning. Module DDocument47 pagesCapital Adequacy and Profit Planning. Module Dparthasarathi_inNo ratings yet

- Naayanam Soundaravadivu-Aru Ramanathan (1958)Document124 pagesNaayanam Soundaravadivu-Aru Ramanathan (1958)parthasarathi_in100% (1)

- 17 Vol 2 No 2Document10 pages17 Vol 2 No 2goyal_khushbu88No ratings yet

- Case Studies On Non-Fund Based LimitsDocument2 pagesCase Studies On Non-Fund Based Limitsparthasarathi_inNo ratings yet

- 2-Order Stamp. 7 June 2008 - 1amnestyDocument5 pages2-Order Stamp. 7 June 2008 - 1amnestyparthasarathi_inNo ratings yet

- Treasury ManagementDocument48 pagesTreasury Managementparthasarathi_inNo ratings yet

- Capital Adequacy and Profit Planning. Module DDocument47 pagesCapital Adequacy and Profit Planning. Module Dparthasarathi_inNo ratings yet

- Multiple Choice Questions On TreasuryDocument8 pagesMultiple Choice Questions On Treasuryparthasarathi_in100% (1)

- Caiib-Intl (1) BKGDocument45 pagesCaiib-Intl (1) BKGparthasarathi_inNo ratings yet

- Emotional Intelligence QuestionnaireDocument5 pagesEmotional Intelligence Questionnaireparthasarathi_in83% (12)

- Pontoon PLC A Case StudyDocument6 pagesPontoon PLC A Case Studyparthasarathi_inNo ratings yet

- Case Studies On Non-Fund Based LimitsDocument2 pagesCase Studies On Non-Fund Based Limitsparthasarathi_inNo ratings yet

- Lehman Forex ManualDocument130 pagesLehman Forex Manualed_nycNo ratings yet

- BR ActDocument40 pagesBR Actparthasarathi_in0% (1)

- MCQ On International BankingDocument7 pagesMCQ On International Bankingparthasarathi_in100% (3)

- RTI Application Format For CTS Nos and Building ApprovalsDocument1 pageRTI Application Format For CTS Nos and Building Approvalsparthasarathi_inNo ratings yet

- Pepsi WC CaseDocument2 pagesPepsi WC Caseparthasarathi_inNo ratings yet

- Anatomic Therapy Tamil PDF BookDocument320 pagesAnatomic Therapy Tamil PDF BookAthimoolam SubramaniyamNo ratings yet

- Inhouse TrainingDocument85 pagesInhouse Trainingparthasarathi_inNo ratings yet

- WEEKLY FX Review-23rd June2013-30th June 2013Document3 pagesWEEKLY FX Review-23rd June2013-30th June 2013parthasarathi_inNo ratings yet

- Pepsi WC CaseDocument2 pagesPepsi WC Caseparthasarathi_inNo ratings yet

- Forex Programme HandoutsDocument78 pagesForex Programme Handoutsparthasarathi_inNo ratings yet

- A Guide To RBIs Weekly Statistical Supplement - Part IIDocument11 pagesA Guide To RBIs Weekly Statistical Supplement - Part IIparthasarathi_inNo ratings yet

- Banking MCQUESTIONSDocument43 pagesBanking MCQUESTIONSparthasarathi_inNo ratings yet

- Institute For Technology & Management PGDMFM 2012-2014 (1st Year)Document3 pagesInstitute For Technology & Management PGDMFM 2012-2014 (1st Year)parthasarathi_inNo ratings yet

- A 73 CreativityDocument18 pagesA 73 CreativityDeepika PhakkeNo ratings yet

- Principles of Banking: Sample Questions and AnswersDocument15 pagesPrinciples of Banking: Sample Questions and Answersmaninder_6No ratings yet

- Banking MCQUESTIONSDocument43 pagesBanking MCQUESTIONSparthasarathi_inNo ratings yet

- The Standard For Program Management: PMI Heartland ChapterDocument43 pagesThe Standard For Program Management: PMI Heartland ChapterAldo Roger Bringas GarayNo ratings yet

- bài tập tổng hợp 1Document10 pagesbài tập tổng hợp 1Hoàng Bảo TrâmNo ratings yet

- Strategic Management (MGMT 2301) : The Cost Leadership StrategyDocument8 pagesStrategic Management (MGMT 2301) : The Cost Leadership StrategyDusmahomedNo ratings yet

- Export Controlled or Sanctioned Countries, Entities and Persons - DoResearchDocument1 pageExport Controlled or Sanctioned Countries, Entities and Persons - DoResearchAgung WijanarkoNo ratings yet

- Faisal WorksheetDocument5 pagesFaisal WorksheetAbdul MateenNo ratings yet

- Formal Negotiating: Some Questions Answered in This Chapter AreDocument24 pagesFormal Negotiating: Some Questions Answered in This Chapter AreNguyễn Phi YếnNo ratings yet

- FranchiseDocument4 pagesFranchiseJane DizonNo ratings yet

- RocheDocument5 pagesRochePrattouNo ratings yet

- The Social Function of BusinessDocument10 pagesThe Social Function of BusinessJupiter WhitesideNo ratings yet

- SECC - Software Testing Service: Hossam Osman, PH.D R & D Unit ManagerDocument12 pagesSECC - Software Testing Service: Hossam Osman, PH.D R & D Unit ManagerAmany ShoushaNo ratings yet

- Case Study #4:: Defining Standard Projects at Global Green Books PublishingDocument3 pagesCase Study #4:: Defining Standard Projects at Global Green Books PublishingHarsha ReddyNo ratings yet

- LM Grade 9 HORTICULTURE PDFDocument113 pagesLM Grade 9 HORTICULTURE PDFNenia J O. Sienes86% (21)

- Project Report For Computer CenterDocument11 pagesProject Report For Computer Centernaveen krishnaNo ratings yet

- Felix Amante Senior High School San Pablo, Laguna: The Purple Bowl PHDocument8 pagesFelix Amante Senior High School San Pablo, Laguna: The Purple Bowl PHcyrel ocfemiaNo ratings yet

- Advanced Level Test Automation EngineerDocument3 pagesAdvanced Level Test Automation EngineerImprovindo MajuNo ratings yet

- 0106XXXXXX8428-01-04-21 - 31-03-2022Document27 pages0106XXXXXX8428-01-04-21 - 31-03-2022SabyasachiBanerjeeNo ratings yet

- Afar 2 Module CH 13Document12 pagesAfar 2 Module CH 13Ella Mae TuratoNo ratings yet

- RR No. 03-98Document18 pagesRR No. 03-98fatmaaleahNo ratings yet

- Sales GST 31Document1 pageSales GST 31ashish.asati1No ratings yet

- Jim Arnold PhotographyDocument2 pagesJim Arnold Photographylaale djaan67% (3)

- Pan African Resources: Exceeding Expectations (As Usual)Document11 pagesPan African Resources: Exceeding Expectations (As Usual)Owm Close CorporationNo ratings yet

- Ias 2Document5 pagesIas 2FarrukhsgNo ratings yet

- Case Study Project Income Statement BudgetingDocument186 pagesCase Study Project Income Statement BudgetingKate ChuaNo ratings yet

- MIF Pre-Course Acc Exam - SolDocument6 pagesMIF Pre-Course Acc Exam - SolpantolaNo ratings yet

- Section - 6 API Spec Q1 Ninth Edition Requirement (Clause: 1-4)Document21 pagesSection - 6 API Spec Q1 Ninth Edition Requirement (Clause: 1-4)JohnNo ratings yet

- 0001 UCPL - SAP - FICO - S4 - HANA - SyllabusDocument14 pages0001 UCPL - SAP - FICO - S4 - HANA - SyllabusRajesh Kumar100% (1)

- Britannia Final StageDocument167 pagesBritannia Final Stagenbane2121No ratings yet

- MGT 210Document19 pagesMGT 210FAYAZ AHMEDNo ratings yet

- POM Unit 3Document84 pagesPOM Unit 3Megha Ahuja 21BC712No ratings yet

- Asian Paints PLDocument2 pagesAsian Paints PLPriyalNo ratings yet