Professional Documents

Culture Documents

Monetory and Fiscal Policy

Uploaded by

Avayant Kumar Singh0 ratings0% found this document useful (0 votes)

43 views19 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

43 views19 pagesMonetory and Fiscal Policy

Uploaded by

Avayant Kumar SinghCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 19

Monetory and Fiscal policy

Monetary and fiscal policies

The Monetary and Fiscal policies are two important

instruments employed by the authorities to influence the

behaviour and performance of the financial sector and the

economy in general.

Monetary policy refers to the use of instruments within the

central of the Central Bank (RBI) to influence the level of

aggregate demand for goods and services or to influence the

trend in certain sectors of the economy.

Monetary policy operates through varying the cost and

availability of credit.

Measure of money supply

M1- Currency with public and deposits (demand deposits with

banks and other deposits with RBI)

M2- M1+ Post office savings deposits

M3- M1+ Time deposits with banks.

M4- M3+ Total post office deposits.

Instruments of monetary policy

General- It affects the total quantity of credit and thus

impact the economy generally.

There are 3 general instruments of credit control

Bank Rate- The minimum rate at which the central bank

provides financial accommodation to commercial banks.

Thus an increase in the bank rate means an increase in the

rate of interest charged by the central bank on its advances

to commercial banks, consequently it leads to rise in the

rate of interest charged by commercial banks to their

customers

Open Market operations- The purchase and sales of

foreign exchange, gold, govt securities and even company shares

by central bank is known as open marketing operations.

Through open Market operations, the central bank seeks to

influence the economy either by increasing the money supply or

by decreasing the money supply.

To increase the money supply the central bank buys securities

from commercial banks and public. A sale of securities by the

central bank will have the effect of reducing the money supply.

Variable reserve ratio- Commercial banks have to

maintain a certain percentage of their deposits in the form of

balances with the central bank (RBI) and the variation in the

reserve requirement affect the credit creating capacity of

commercial banks.

Cash Reserve Ratio (CRR)- The minimum amount which

commercial banks are required to keep in form of cash according

to their total time and demand deposits. Variation in the CRR

affects money supply in the economy. Raising of CRR restricts

liquidity in thee system while reduction in CRR increase money

supply.

Statutory Liquidity Ratio (SLR)- A part of cash Reserve ratio

SLR is the minimum amount of liquid asset kept in liquid form;

of the total time and demand liability.

At present SLR is 25%. Thus it ensures that with every increase

in the cash reserve requirements, the overall liquidity obligations

are also raised.

Selective Credit Regulation: Selective Credit controls relate to the

distribution or direction of available credit supplies. It is attained by

giving concessions to priority sectors. Thus it aims to discourage such

activity which are considered to be relatively inessential or less

desirable.

Techniques of selective Credit control

Minimum margins for lending against specific securities.

Ceiling on the amounts of credit for certain purposes

Discriminatory rates of interest charges on certain types of advances.

While imposing selective credit controls, it is ensured that credit fro

production, the movement of commodities and exports in not affected.

Fiscal Policy

Fiscal policy is that part of Government policy which is concerned with

raising revenue through taxation and other means and deciding on the

level and pattern of expenditure. Thus Fiscal policy operates through

the budget

Fiscal policy is seen as the major way of controlling economy. It has two

main roles

a. To remove any severe deflationary and inflationary gaps.

b. To smooth out the fluctuation in the economy associated with the

business cycle.

The first role is to prevent the occurrence of fundamental disequilibrium

in the economy, where as the second role involves reducing govt

expenditure or raising taxes

Union Budget as an Instrument of Growth and its

impact on Business.

The constitution of India provides that

No tax can be levied or collected except by authority of law

No expenditure can be incurred for public funds except in manner

provided in the constitution.

The executive authorities must spend public money in the manner

sanctioned by the parliament.

The Budget

The budget is an estimate of Government expenditure and revenue for the

coming financial year, presented to the Parliament by Finance Minister

on last day of February

It is also known as Annual Financial Statement. All the receipts and

disbursement of the Union Govt are kept under 2 separate headings

Consolidated Fund of India- It includes all revenues received, loans

raised and money received in repayment of loans by the Union Govt.

No money can be withdrawn from this fund except under the authority

of an Act of parliament.

Public Account of India- It comprises of, all other receipts and

disbursements such as deposits, service funds and remittance.

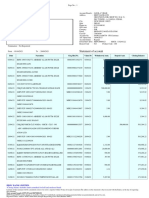

The Structure of the budget

Vertically Budget is divided into Revenue (receipts) and

Expenditure (disbursements). However, horizontally it is

divided into Revenue account and Capital account. This

led to further subcategorizing revenue side into Revenue

Receipts and Revenue Expenditure and Expenditure side

into Capital Receipt and Capital Expenditure

Revenue Expenditure- All the current expenditure of the

Govt on administration,

Capital Expenditure- All the Capital transaction of the

Govt

Revenue Receipts- Revenue from taxes.

Capital Receipts- Market loans, external aid, income

from repayment

Importance of the Budget

The budget strive to give maximum support to forces that can

move the country forward on the path of growth with stability

and social justice with stability & social justice. The budget

should set the stage fro the achievement of economic and

social goals.

Certain sectors or industries get significantly impacted by the

Budget proposal like tax proposals or budgetary allocations.

1. Accelerate the pace of economic development by mobilizing

resources for the public sector and their optimal allocation.

2. To bring about improvement in production in the private

sector in accordance with the national priorities.

3. To bring about improvement in income distribution

4. To promote exports and encourage import substitution.

5. To achieve economic stabilization.

You might also like

- LetterDocument1 pageLetterAvayant Kumar SinghNo ratings yet

- HR PracticesDocument14 pagesHR PracticesAvayant Kumar SinghNo ratings yet

- Leadership NotesDocument14 pagesLeadership NotesAvayant Kumar Singh100% (1)

- Thought of The Day: Live Everyday As If It Were Your Last Day, and Then Someday You Will Be RightDocument28 pagesThought of The Day: Live Everyday As If It Were Your Last Day, and Then Someday You Will Be RightAvayant Kumar SinghNo ratings yet

- Ehics in AdvertisingDocument7 pagesEhics in AdvertisingAvayant Kumar SinghNo ratings yet

- Inventory ManagementDocument7 pagesInventory ManagementAvayant Kumar Singh100% (1)

- Real EstateDocument35 pagesReal EstateAvayant Kumar Singh100% (1)

- Thoughts of The DaysDocument12 pagesThoughts of The DaysAvayant Kumar SinghNo ratings yet

- Marketing Research in MISDocument9 pagesMarketing Research in MISAvayant Kumar SinghNo ratings yet

- RelationshipsDocument21 pagesRelationshipsAvayant Kumar SinghNo ratings yet

- GloblizationDocument22 pagesGloblizationAvayant Kumar SinghNo ratings yet

- You Can Not Judge A Person's Intelligence Only by His Answers But by Questions AlsoDocument23 pagesYou Can Not Judge A Person's Intelligence Only by His Answers But by Questions AlsoAvayant Kumar SinghNo ratings yet

- AdvertisngDocument11 pagesAdvertisngAvayant Kumar SinghNo ratings yet

- Customer Competitor AnalysisDocument11 pagesCustomer Competitor AnalysisAvayant Kumar SinghNo ratings yet

- Thought of The Day: Knowledge Is A Power That Never Leaves YouDocument10 pagesThought of The Day: Knowledge Is A Power That Never Leaves YouAvayant Kumar SinghNo ratings yet

- Security Analysis and InvestmentDocument37 pagesSecurity Analysis and InvestmentAvayant Kumar SinghNo ratings yet

- Diffusion of InnovationDocument12 pagesDiffusion of InnovationAvayant Kumar SinghNo ratings yet

- Labor LegislationDocument28 pagesLabor LegislationAvayant Kumar SinghNo ratings yet

- International Capital Budgeting or Evaluation of International ProjectDocument18 pagesInternational Capital Budgeting or Evaluation of International ProjectAvayant Kumar SinghNo ratings yet

- Thought of The Day: "Life Consists Not in Holding Good Cards But in Playing Those You Hold Well."Document18 pagesThought of The Day: "Life Consists Not in Holding Good Cards But in Playing Those You Hold Well."Avayant Kumar SinghNo ratings yet

- Currency Risk ManagementDocument14 pagesCurrency Risk ManagementAvayant Kumar SinghNo ratings yet

- To Live A Creative Life, One Must Loose The Fear of Being WrongDocument10 pagesTo Live A Creative Life, One Must Loose The Fear of Being WrongAvayant Kumar SinghNo ratings yet

- Foreign Investment: Benefit & RiskDocument23 pagesForeign Investment: Benefit & RiskAvayant Kumar SinghNo ratings yet

- Social Responsibility of BusinessDocument11 pagesSocial Responsibility of BusinessAvayant Kumar Singh100% (1)

- Country Risk ManagementDocument9 pagesCountry Risk ManagementAvayant Kumar SinghNo ratings yet

- Retail SITEDocument31 pagesRetail SITEAvayant Kumar SinghNo ratings yet

- International Working Capital ManagementDocument28 pagesInternational Working Capital ManagementAvayant Kumar Singh100% (2)

- Process of Delivering The ServiceDocument11 pagesProcess of Delivering The ServiceAvayant Kumar SinghNo ratings yet

- Security AnalysisDocument25 pagesSecurity AnalysisAvayant Kumar SinghNo ratings yet

- Payment of Wages Act, 1936Document8 pagesPayment of Wages Act, 1936Avayant Kumar SinghNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Lecture-11 Compound Interest)Document2 pagesLecture-11 Compound Interest)Aditya SahaNo ratings yet

- 6c Deposit Totals Are Balanced With Internal RecordsDocument2 pages6c Deposit Totals Are Balanced With Internal Recordsapi-279228567No ratings yet

- Rekkor Singgih (May Bank)Document2 pagesRekkor Singgih (May Bank)Ayu ShafiraNo ratings yet

- Federal Deposit Insurance Corporation Washington, D.CDocument15 pagesFederal Deposit Insurance Corporation Washington, D.CNye LavalleNo ratings yet

- Evolution and Future of Indian Banking IndustryDocument19 pagesEvolution and Future of Indian Banking IndustrySindhu PoyyeriNo ratings yet

- The Federal Reserve System - An EncyclopediaDocument486 pagesThe Federal Reserve System - An EncyclopediaBenjamin SpahićNo ratings yet

- Brismo Analytics Loan Vintage AnalysisDocument2 pagesBrismo Analytics Loan Vintage AnalysisVanderghastNo ratings yet

- Tools For Recovering NpaDocument4 pagesTools For Recovering Npanchaudhari_2100% (2)

- CH 14Document42 pagesCH 14maxhaakeNo ratings yet

- Author Insights Julie PrattenDocument9 pagesAuthor Insights Julie PrattenEmily JamesNo ratings yet

- Islamic BankingDocument10 pagesIslamic BankingAin IsmailNo ratings yet

- Internship Report On Foreign Exchange ManagementDocument28 pagesInternship Report On Foreign Exchange ManagementSkyknight Rana25% (4)

- Document PDFDocument7 pagesDocument PDFPeña MotorNo ratings yet

- Nanyang Business School AB1201 Financial Management Seminar Questions Set 2: Time Value of Money (Common Questions)Document7 pagesNanyang Business School AB1201 Financial Management Seminar Questions Set 2: Time Value of Money (Common Questions)cccqNo ratings yet

- Role of NABARD in Rural DevelopmentDocument6 pagesRole of NABARD in Rural Developmentvenkata siva kumarNo ratings yet

- Questionnaire On E-BankingDocument3 pagesQuestionnaire On E-Bankingdevngri75% (24)

- MCQ Receivable ManagementDocument2 pagesMCQ Receivable Management15Deepak yadav100% (1)

- Revised AMLC Transaction CodesDocument25 pagesRevised AMLC Transaction CodesGuevarraWellrhoNo ratings yet

- 1000 11.12.07Document72 pages1000 11.12.07Disha MehtaNo ratings yet

- Bank Negara Malaysia's Role in Malaysia's Financial SystemDocument16 pagesBank Negara Malaysia's Role in Malaysia's Financial SystemhanimudaNo ratings yet

- IST 2021 Fee ChallanDocument1 pageIST 2021 Fee ChallanMuhammadNo ratings yet

- 2006 PDFDocument2 pages2006 PDFVigneshwaraLingamNo ratings yet

- Npa Management SbiDocument104 pagesNpa Management Sbiparth jani100% (1)

- RMC No 9-2016 - Clarification On Taxability of NSSLA For Income Tax, GRT and DSTDocument3 pagesRMC No 9-2016 - Clarification On Taxability of NSSLA For Income Tax, GRT and DSTdignaNo ratings yet

- P21,600Document86 pagesP21,600Andrei Mark CalmaNo ratings yet

- FIN081 P3 Quiz2 Short-Term-Financing AnswerDocument4 pagesFIN081 P3 Quiz2 Short-Term-Financing AnswerMary Lyn DatuinNo ratings yet

- Controller and Treasurer DifferencesDocument1 pageController and Treasurer DifferencesRechelle PerezNo ratings yet

- ATM Broucher HitachiDocument10 pagesATM Broucher HitachiVv DhasNo ratings yet

- Capitulo 11Document26 pagesCapitulo 11Daniel Adrián Avilés VélezNo ratings yet

- HDFC Bank statement for Javed AliDocument3 pagesHDFC Bank statement for Javed AliNew NewNo ratings yet