Professional Documents

Culture Documents

Investment 1

Uploaded by

Jessica TerryCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment 1

Uploaded by

Jessica TerryCopyright:

Available Formats

http://www.bized.co.

uk

Investment Appraisal

Copyright 2007 Biz/ed

http://www.bized.co.uk

Investment Appraisal

Copyright 2007 Biz/ed

http://www.bized.co.uk

Investment Appraisal

A means of assessing whether an

investment project is worthwhile or

not

Investment project could be the

purchase of a new PC for a small firm, a

new piece of equipment in a

manufacturing plant, a whole new

factory, etc

Used in both public and private sector

Copyright 2007 Biz/ed

http://www.bized.co.uk

Investment Appraisal

Types of investment

appraisal:

Payback Period

Accounting Rate of

Return (ARR)

Internal Rate of

Return (IRR)

Profitability Index

Net Present Value

(discounted cash

flow)

What factors need to be considered before

investing in equipment such as this?

Copyright: Gergely Erno, stock.xchng

Copyright 2007 Biz/ed

http://www.bized.co.uk

Investment Appraisal

Why do companies invest?

Importance of remembering investment as the

purchase of productive capacity NOT buying stocks

and shares or investing in a bank!

Buy equipment/machinery or build new plant

to:

Increase capacity (amount that can be produced)

which means:

Demand can be met and this generates sales revenue

Increased efficiency and productivity

Copyright 2007 Biz/ed

http://www.bized.co.uk

Investment Appraisal

A fork lift may be an important item but what

does it contribute to overall sales? How long

and how much work would it have to do to

repay its initial cost?

Copyright: Loisjune, stock.xchng

Investment therefore

assumes that the

investment will yield

future income

streams

Investment appraisal

is all about assessing

these income

streams against the

cost of the

investment

Not a precise

science!

Copyright 2007 Biz/ed

http://www.bized.co.uk

Payback Period

Copyright 2007 Biz/ed

http://www.bized.co.uk

Payback Method

The length of time taken to repay

the initial capital cost

Requires information on the returns the

investment generates

e.g. A machine costs 600,000

It produces items that generate a profit

of 5 each on a production run of

60,000 units per year

Payback period will be 2 years

Copyright 2007 Biz/ed

http://www.bized.co.uk

Payback method

Payback could occur during a year

Can take account of this by

reducing the cash inflows from the

investment to days, weeks or

years

Days/Weeks/Months x Initial Investment

Payback = -----------------------------------------Total Cash Received

Copyright 2007 Biz/ed

http://www.bized.co.uk

Payback Method

e.g.

Cost of machine =

600,000

Annual income

streams from

investment =

255,000 per year

Payback = 36 x

600,000/765,000

= 28.23 months

(2 yrs, 6 months)

Income

Year 1

255,000

Year 2

255,000

Year 3

255,000

Copyright 2007 Biz/ed

http://www.bized.co.uk

Accounting Rate of Return

Copyright 2007 Biz/ed

http://www.bized.co.uk

Accounting Rate of Return

A comparison of the profit

generated by the investment with

the cost of the investment

Average annual return or annual profit

ARR = -------------------------------------------Initial cost of investment

Copyright 2007 Biz/ed

http://www.bized.co.uk

Accounting Rate of Return

e.g.

An investment is expected to yield cash flows

of 10,000 annually for the next 5 years

The initial cost of the investment is 20,000

Total profit therefore is: 30,000

Annual profit = 30,000 / 5

= 6,000

ARR = 6,000/20,000 x 100

= 30%

A worthwhile return?

Copyright 2007 Biz/ed

http://www.bized.co.uk

Investment Appraisal

To make a more

informed decision,

more sophisticated

techniques need to

be used.

Importance of timevalue of money

Copyright 2007 Biz/ed

http://www.bized.co.uk

Net Present Value (NPV)

Copyright 2007 Biz/ed

http://www.bized.co.uk

Net Present Value

Takes into account the fact that money values

change with time

How much would you need to invest today to

earn x amount in x years time?

Value of money is affected by interest rates

NPV helps to take these factors into

consideration

Shows you what your investment would have

earned in an alternative investment regime

Copyright 2007 Biz/ed

http://www.bized.co.uk

Net Present Value

e.g.

Project A costs 1,000,000

After 5 years the cash returns =

100,000 (10%)

If you had invested the 1 million into a

bank offering interest at 12% the

returns would be greater

You might be better off re-considering

your investment!

Copyright 2007 Biz/ed

http://www.bized.co.uk

Net Present Value

The principle:

How much would you have to invest now to

earn 100 in one years time if the interest

rate was 5%?

The amount invested would need to be:

95.24

Allows comparison of an investment by valuing

cash payments on the project and cash

receipts expected to be earned over the

lifetime of the investment at the same point in

time, i.e the present.

Copyright 2007 Biz/ed

http://www.bized.co.uk

Net Present Value

Future Value

PV = ----------------(1 + i)n

Where i = interest rate

n = number of years

The PV of 1 @ 10% in 1 years time is 0.9090

If you invested 0.9090p today and the interest

rate was 10% you would have 1 in a years

time

Process referred to as:

Discounting Cash Flow

Copyright 2007 Biz/ed

http://www.bized.co.uk

Net Present Value

Cash flow x discount factor = present

value

e.g. PV of 500 in 10 years time at a rate

of interest of 4.25% = 500 x .6595373 =

329.77

329.77 is what you would have to

invest today at a rate of interest of

4.25% to earn 500 in 10 years time

PVs can be found through valuation

tables (e.g. Parrys Valuation Tables)

Copyright 2007 Biz/ed

http://www.bized.co.uk

Cash Flows

Copyright 2007 Biz/ed

http://www.bized.co.uk

Discounted Cash Flow

An example:

A firm is deciding on investing in an

energy efficiency system. Two possible

systems are under investigation

One yields quicker results in terms of

energy savings than the other but the

second may be more efficient later

Which should the firm invest in?

Copyright 2007 Biz/ed

http://www.bized.co.uk

Discounted Cash Flow System A

Year

Cash Flow ()

Discount Factor

(4.75%)

Present Value

()

(CF x DF)

- 600,000

1.00

-600,000

+75,000

0.9546539

71,599.04

+100,000

0.9113641

91,136.41

+150,000

0.8700374

130,505.61

+200,000

0.8305846

166,116.92

+210,000

0.7929209

166,513.39

+150,000

0.7569650

113,544.75

Total

285,000

NPV

=139,416

Copyright 2007 Biz/ed

http://www.bized.co.uk

Discounted Cash Flow System B

Year

Cash Flow ()

Discount Factor

(4.75%)

Present Value ()

(CF x DF)

- 600,000

1.00

-600,000

+25,000

0.9546539

23,866.35

+75,000

0.9113641

68,352.31

+85,000

0.8700374

73,953.18

+100,000

0.8305846

83,058.46

+150,000

0.7929209

118,938.10

+450,000

0.7569650

340,634.30

Total

285,000

NPV =108,802.70

Copyright 2007 Biz/ed

http://www.bized.co.uk

Discounted Cash Flow

System A represents the better

investment

System B yields the same return after

six years but the returns of System A

occur faster and are worth more to the

firm than returns occurring in future

years even though those returns are

greater

Copyright 2007 Biz/ed

http://www.bized.co.uk

Internal Rate of Return (IRR)

Copyright 2007 Biz/ed

http://www.bized.co.uk

Internal Rate of Return

Allows the risk associated with an investment project to

be assessed

The IRR is the rate of interest (or discount rate)

that makes the net present value = to zero

Helps measure the worth of an investment

Allows the firm to assess whether an investment in

the machine, etc. would yield a better return based

on internal standards of return

Allows comparison of projects with different initial

outlays

Set the cash flows to different discount rates

Software or simple graphing allows the IRR to be

found

Copyright 2007 Biz/ed

http://www.bized.co.uk

Profitability Index

Copyright 2007 Biz/ed

http://www.bized.co.uk

Profitability Index

Allows a comparison of the costs

and benefits of different projects

to be assessed and thus allow

decision making to be carried out

Net Present Value

Profitability Index = --------------------Initial Capital Cost

Copyright 2007 Biz/ed

http://www.bized.co.uk

Investment Appraisal

Key considerations for firms in

considering use:

Ease of use/degree of simplicity required

Degree of accuracy required

Extent to which future cash flows can be

measured accurately

Extent to which future interest rate

movements can be factored in and

predicted

Necessity of factoring in effects of inflation

Copyright 2007 Biz/ed

You might also like

- Concept of Capital Budgeting: Capital Budgeting Is A Process of Planning That Is Used To AscertainDocument11 pagesConcept of Capital Budgeting: Capital Budgeting Is A Process of Planning That Is Used To AscertainLeena SachdevaNo ratings yet

- VI. Capital Budgeting Under Certainty: Professors Simon Pak and John ZdanowiczDocument56 pagesVI. Capital Budgeting Under Certainty: Professors Simon Pak and John ZdanowiczSonal Power UnlimitdNo ratings yet

- Working With Financial StatementsDocument27 pagesWorking With Financial StatementsYannah HidalgoNo ratings yet

- The Value of Control: Stern School of BusinessDocument38 pagesThe Value of Control: Stern School of Businessavinashtiwari201745No ratings yet

- Cap BudgetDocument74 pagesCap BudgetBhutada_Sumeet_8280No ratings yet

- Investment Appraisal MethodsDocument31 pagesInvestment Appraisal MethodsDELGADO ZEVALLOS ANGIE MELISSANo ratings yet

- Chap 04 - DDM and DCFDocument33 pagesChap 04 - DDM and DCFhelloNo ratings yet

- M&As (Class4)Document51 pagesM&As (Class4)Salman SalluNo ratings yet

- Pod SpeDocument10 pagesPod SpeBayuu KakandazesNo ratings yet

- Valuation Methods Used in Mergers & Acquisition: Roshankumar S PimpalkarDocument6 pagesValuation Methods Used in Mergers & Acquisition: Roshankumar S PimpalkarSharad KumarNo ratings yet

- Subject: Corporate Financial Accounting: Nes Ratnam College of Arts, Science and CommerceDocument64 pagesSubject: Corporate Financial Accounting: Nes Ratnam College of Arts, Science and Commercejaya ranguNo ratings yet

- FinalDocument22 pagesFinalgaurav PrajapatiNo ratings yet

- M&ADocument30 pagesM&AMira AbdrakhmanovaNo ratings yet

- 600 019 Advanced Petroleum Economics 600.019 Advanced Petroleum EconomicsDocument46 pages600 019 Advanced Petroleum Economics 600.019 Advanced Petroleum EconomicsRoberto MendozaNo ratings yet

- M&A Rough DraftDocument71 pagesM&A Rough DraftsokajiNo ratings yet

- By: Ashish RazdanDocument11 pagesBy: Ashish RazdanVishal GiradkarNo ratings yet

- Sharing - Session - Petroleum Economic - 1 Page Back To BackDocument34 pagesSharing - Session - Petroleum Economic - 1 Page Back To BacksidNo ratings yet

- Driver Selection For Large Offshore Production Facilities: An Important Early Project DecisionDocument22 pagesDriver Selection For Large Offshore Production Facilities: An Important Early Project DecisionzsmithNo ratings yet

- Petroleum Project Economics 03Document34 pagesPetroleum Project Economics 03ediwskiNo ratings yet

- Oil and Gas Incremental Project AnalysisDocument16 pagesOil and Gas Incremental Project AnalysisediwskiNo ratings yet

- Cash Flow AnalysisDocument108 pagesCash Flow AnalysisTote FrotyNo ratings yet

- Workshop On Mergers & Acquisitions: Mohit SarafDocument46 pagesWorkshop On Mergers & Acquisitions: Mohit SarafKamal ChughNo ratings yet

- Oil and Gas Economic EvaluationDocument4 pagesOil and Gas Economic EvaluationTemitope BelloNo ratings yet

- Cost of Capital and Capital StructureDocument40 pagesCost of Capital and Capital StructureJames NgonyaniNo ratings yet

- Petroleum Project Economics 06Document15 pagesPetroleum Project Economics 06ediwskiNo ratings yet

- Option Valuation - DamodaranDocument82 pagesOption Valuation - DamodaranIA M.No ratings yet

- Project Finance: Aditya Agarwal Sandeep KaulDocument96 pagesProject Finance: Aditya Agarwal Sandeep Kaulsguha123No ratings yet

- Chapter 9 Project Cash FlowsDocument28 pagesChapter 9 Project Cash FlowsGovinda AgrawalNo ratings yet

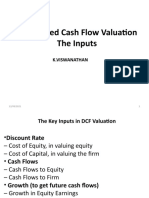

- Discounted Cash Flow Valuation The Inputs: K.ViswanathanDocument47 pagesDiscounted Cash Flow Valuation The Inputs: K.ViswanathanHardik VibhakarNo ratings yet

- Presented By:-Pankaj Smit Ojas Sayali Ishaan Dattaji Ashutosh Omkar MaheshDocument11 pagesPresented By:-Pankaj Smit Ojas Sayali Ishaan Dattaji Ashutosh Omkar MaheshOjas LeoNo ratings yet

- Cash Flow Estimation and Risk AnalysisDocument24 pagesCash Flow Estimation and Risk AnalysisSahil GuptaNo ratings yet

- M&a Masterclass Presentation SlidesDocument52 pagesM&a Masterclass Presentation SlidesnebonlineNo ratings yet

- Cost Estimation Total Product Cost: Malavika M R 2015-09-013Document32 pagesCost Estimation Total Product Cost: Malavika M R 2015-09-013Roman BarboNo ratings yet

- Short-Term Decision Making in Foundry Unit - A Case Study PDFDocument6 pagesShort-Term Decision Making in Foundry Unit - A Case Study PDFDevendra TaradNo ratings yet

- Tax Treatment For Gross Split Production Sharing Contracts in Indonesian Oil and Gas Sector - SSEK Corporate - Commercial Indonesian Law FirmDocument6 pagesTax Treatment For Gross Split Production Sharing Contracts in Indonesian Oil and Gas Sector - SSEK Corporate - Commercial Indonesian Law FirmDewa Gede Praharyan JayadiputraNo ratings yet

- Free Cash Flow (FCF) Explained: Formula, Types & SignificanceDocument31 pagesFree Cash Flow (FCF) Explained: Formula, Types & SignificanceKaranvir GuptaNo ratings yet

- Capital Budgeting DecisionsDocument28 pagesCapital Budgeting DecisionsMoshmi MazumdarNo ratings yet

- OIL and GAS ASSIGNMENTDocument3 pagesOIL and GAS ASSIGNMENTSourabha DehadraiNo ratings yet

- Manual For Discounting Oil and Gas IncomeDocument9 pagesManual For Discounting Oil and Gas IncomeCarlota BellésNo ratings yet

- Risk Management: Session - 14 Risk Analysis in BusinessDocument39 pagesRisk Management: Session - 14 Risk Analysis in BusinessahmedNo ratings yet

- Cash Accounting, Accrual Accounting, and Discounted Cash Flow ValuationDocument32 pagesCash Accounting, Accrual Accounting, and Discounted Cash Flow ValuationHanh Mai TranNo ratings yet

- Cost of CapitalDocument55 pagesCost of CapitalSaritasaruNo ratings yet

- Upstream Petroleum EconomicsDocument17 pagesUpstream Petroleum Economicsjhon berez223344No ratings yet

- Capital Investment Decisions: NPV, IRR & Payback PeriodDocument46 pagesCapital Investment Decisions: NPV, IRR & Payback Periodkundayi shavaNo ratings yet

- L-9. Risk Analysis in Capital Investment DecisionsDocument10 pagesL-9. Risk Analysis in Capital Investment DecisionsHimanshu Tulshyan100% (1)

- PTRL3025 Lecture NotesDocument7 pagesPTRL3025 Lecture NotesericpenhNo ratings yet

- 1 EconomicDocument16 pages1 EconomicAhmed JassimNo ratings yet

- Petroleum Economics NotesDocument16 pagesPetroleum Economics Noteshouda debdiNo ratings yet

- MBA Financial Management Core Course 2013-15Document36 pagesMBA Financial Management Core Course 2013-15Devansh DoshiNo ratings yet

- Petroleum Economics and Risk AnalysisDocument2 pagesPetroleum Economics and Risk AnalysisnuzululNo ratings yet

- ValComp Tutorial 2014 (Unlocked)Document36 pagesValComp Tutorial 2014 (Unlocked)Harsh ChandaliyaNo ratings yet

- Petroleum Economics-Basic ConceptDocument51 pagesPetroleum Economics-Basic ConceptDajev100% (1)

- Petroleum Exploration MethodsDocument23 pagesPetroleum Exploration MethodsAngsuman PhukanNo ratings yet

- Risk and Return Analysis of Automobile and Oil & Gas SectorsDocument30 pagesRisk and Return Analysis of Automobile and Oil & Gas SectorssaravmbaNo ratings yet

- Investment 1Document30 pagesInvestment 1meelas123No ratings yet

- Investment AppraisalDocument30 pagesInvestment Appraisallinda zyongweNo ratings yet

- Whitman College Salary Advance Request FormDocument2 pagesWhitman College Salary Advance Request FormJessica TerryNo ratings yet

- Mohamed Abdulla. P,: Yours TrulyDocument4 pagesMohamed Abdulla. P,: Yours TrulyJessica TerryNo ratings yet

- Electrical Engineer Seeks Maintenance RoleDocument4 pagesElectrical Engineer Seeks Maintenance RoleJessica TerryNo ratings yet

- Saravana Kumar.P PhotoDocument3 pagesSaravana Kumar.P PhotoJessica TerryNo ratings yet

- Manikandan GDocument3 pagesManikandan GJessica TerryNo ratings yet

- 4158 9 2012 09 19931282Document4 pages4158 9 2012 09 19931282Jessica TerryNo ratings yet

- Mohamed Abdulla. P,: Yours TrulyDocument4 pagesMohamed Abdulla. P,: Yours TrulyJessica TerryNo ratings yet

- Anishkumar S Resume Mechanical EngineerDocument2 pagesAnishkumar S Resume Mechanical EngineerJessica TerryNo ratings yet

- Sample HR Manual 280Document53 pagesSample HR Manual 280Devendra MohbansiNo ratings yet

- Unit Iv Fund Based Financial Services: Basic Concepts in LeasingDocument13 pagesUnit Iv Fund Based Financial Services: Basic Concepts in LeasingJessica TerryNo ratings yet

- Engineering Economics and Financial Accounting PrinciplesDocument14 pagesEngineering Economics and Financial Accounting PrinciplesBharath Sankar0% (1)

- Stress ManagementDocument4 pagesStress ManagementnidhidarklordNo ratings yet

- Industrial Relations and Labour WelfareDocument56 pagesIndustrial Relations and Labour WelfaresanjaysalveNo ratings yet

- (WWW - Entrance-Exam - Net) - Kurukshetra University IT 6th Sem Management Information System Sample Paper 3Document1 page(WWW - Entrance-Exam - Net) - Kurukshetra University IT 6th Sem Management Information System Sample Paper 3Jessica TerryNo ratings yet

- Legal Aspects of Business Master NotesDocument44 pagesLegal Aspects of Business Master NotesJessica Terry75% (4)

- Acne Treatment Strategies and TherapiesDocument32 pagesAcne Treatment Strategies and TherapiesdokterasadNo ratings yet

- Level 3 Repair PBA Parts LayoutDocument32 pagesLevel 3 Repair PBA Parts LayoutabivecueNo ratings yet

- Book Networks An Introduction by Mark NewmanDocument394 pagesBook Networks An Introduction by Mark NewmanKhondokar Al MominNo ratings yet

- Mtle - Hema 1Document50 pagesMtle - Hema 1Leogene Earl FranciaNo ratings yet

- Data Sheet: Experiment 5: Factors Affecting Reaction RateDocument4 pagesData Sheet: Experiment 5: Factors Affecting Reaction Ratesmuyet lêNo ratings yet

- SEG Newsletter 65 2006 AprilDocument48 pagesSEG Newsletter 65 2006 AprilMilton Agustin GonzagaNo ratings yet

- Complete Guide To Sports Training PDFDocument105 pagesComplete Guide To Sports Training PDFShahana ShahNo ratings yet

- AFNOR IPTDS BrochureDocument1 pageAFNOR IPTDS Brochurebdiaconu20048672No ratings yet

- Towards A Human Resource Development Ontology Combining Competence Management and Technology-Enhanced Workplace LearningDocument21 pagesTowards A Human Resource Development Ontology Combining Competence Management and Technology-Enhanced Workplace LearningTommy SiddiqNo ratings yet

- Decision Maths 1 AlgorithmsDocument7 pagesDecision Maths 1 AlgorithmsNurul HafiqahNo ratings yet

- 3 - Performance Measurement of Mining Equipments by Utilizing OEEDocument8 pages3 - Performance Measurement of Mining Equipments by Utilizing OEEGonzalo GarciaNo ratings yet

- Origins and Rise of the Elite Janissary CorpsDocument11 pagesOrigins and Rise of the Elite Janissary CorpsScottie GreenNo ratings yet

- ISO 9001:2015 Explained, Fourth Edition GuideDocument3 pagesISO 9001:2015 Explained, Fourth Edition GuideiresendizNo ratings yet

- Merchandising Calender: By: Harsha Siddham Sanghamitra Kalita Sayantani SahaDocument29 pagesMerchandising Calender: By: Harsha Siddham Sanghamitra Kalita Sayantani SahaSanghamitra KalitaNo ratings yet

- Water Jet CuttingDocument15 pagesWater Jet CuttingDevendar YadavNo ratings yet

- Cold Rolled Steel Sections - Specification: Kenya StandardDocument21 pagesCold Rolled Steel Sections - Specification: Kenya StandardPEng. Tech. Alvince KoreroNo ratings yet

- Conv VersationDocument4 pagesConv VersationCharmane Barte-MatalaNo ratings yet

- GlastonburyDocument4 pagesGlastonburyfatimazahrarahmani02No ratings yet

- Chennai Metro Rail BoQ for Tunnel WorksDocument6 pagesChennai Metro Rail BoQ for Tunnel WorksDEBASIS BARMANNo ratings yet

- Important Instructions To Examiners:: Calculate The Number of Address Lines Required To Access 16 KB ROMDocument17 pagesImportant Instructions To Examiners:: Calculate The Number of Address Lines Required To Access 16 KB ROMC052 Diksha PawarNo ratings yet

- Service and Maintenance Manual: Models 600A 600AJDocument342 pagesService and Maintenance Manual: Models 600A 600AJHari Hara SuthanNo ratings yet

- ESA Knowlage Sharing - Update (Autosaved)Document20 pagesESA Knowlage Sharing - Update (Autosaved)yared BerhanuNo ratings yet

- FX15Document32 pagesFX15Jeferson MarceloNo ratings yet

- Google Dorks For PentestingDocument11 pagesGoogle Dorks For PentestingClara Elizabeth Ochoa VicenteNo ratings yet

- 4 Wheel ThunderDocument9 pages4 Wheel ThunderOlga Lucia Zapata SavaresseNo ratings yet

- Personalised MedicineDocument25 pagesPersonalised MedicineRevanti MukherjeeNo ratings yet

- Iso 9001 CRMDocument6 pagesIso 9001 CRMleovenceNo ratings yet

- Web Api PDFDocument164 pagesWeb Api PDFnazishNo ratings yet

- Rohit Patil Black BookDocument19 pagesRohit Patil Black BookNaresh KhutikarNo ratings yet

- Requesting A Query in Zemanta Using PHPDocument10 pagesRequesting A Query in Zemanta Using PHPAther SajjadNo ratings yet