Professional Documents

Culture Documents

Lls 5e Chapter 07

Uploaded by

Gabrielle TanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lls 5e Chapter 07

Uploaded by

Gabrielle TanCopyright:

Available Formats

Reporting and

Interpreting

Cost of Goods

Sold and

Inventory

Chapter 7

Copyright 2007 by The McGraw-Hill Companies, Inc. All rights reserved.

7-2

Understanding the Business

Primary

Primary Goals

Goals of

of

Inventory

Inventory

Management

Management

Provide

Provide sufficient

sufficient

quantities

quantities of

of highhighquality

quality inventory.

inventory.

Minimize

Minimize the

the costs

costs of

of

carrying

carrying inventory.

inventory.

7-3

Learning Objectives

Apply

Apply the

the cost

cost principle

principle to

to identify

identify the

the amounts

amounts

that

that should

should be

be included

included in

in inventory

inventory and

and the

the

matching

matching principle

principle to

to determine

determine cost

cost of

of goods

goods

sold

sold for

for typical

typical retailers,

retailers, wholesalers,

wholesalers, and

and

manufacturers.

manufacturers.

7-4

Items Included in Inventory

Inventory

Tangible

Held for Sale

Merchandise Inventory

Raw Materials Inventory

Work in Process Inventory

Finished Goods Inventory

Used to

Produce Goods

or Services

7-5

Costs Included in Inventory Purchases

The cost principle requires that inventory

be recorded at the price paid or the

consideration given.

Invoice

Price

Freight

Inspection

Costs

Preparation

Costs

7-6

Flow of Inventory Costs

Merchandiser

Merchandise

Merchandise

Purchases

Purchases

Manufacturer

Raw

Raw

Materials

Materials

Direct

Direct

Labor

Labor

Factory

Factory

Overhead

Overhead

Merchandise

Merchandise

Inventory

Inventory

Raw

Raw Materials

Materials

Inventory

Inventory

Work

Work in

in Process

Process

Inventory

Inventory

Cost

Cost of

of

Goods

Goods Sold

Sold

Finished

Finished Goods

Goods

Inventory

Inventory

Cost

Cost of

of

Goods

Goods Sold

Sold

7-7

Nature of Cost of Goods Sold

Beginning

Beginning

Inventory

Inventory

Purchases

Purchases

for

for the

the Period

Period

Goods

Goods available

available

for

for Sale

Sale

Ending

Ending Inventory

Inventory

(Balance

(Balance Sheet)

Sheet)

Cost

Cost of

of Goods

Goods Sold

Sold

(Income

(Income Statement)

Statement)

Beginning

Beginning inventory

inventory ++ Purchases

Purchases == Goods

Goods Available

Available for

for Sale

Sale

Goods

Goods Available

Available for

for Sale

Sale Ending

Ending inventory

inventory == Cost

Cost of

of goods

goods sold

sold

7-8

Learning Objectives

Report

Report inventory

inventory and

and cost

cost of

of goods

goods sold

sold using

using

the

the four

four inventory

inventory costing

costing methods.

methods.

7-9

Inventory Costing Methods

Specific

Identification

FIFO

LIFO

Weighted

Average

7-10

Inventory Costing Methods

Total

Total Dollar

Dollar Amount

Amount of

of Goods

Goods

Available

Available for

for Sale

Sale

Inventory

Costing Method

Ending

Ending Inventory

Inventory

Cost

Cost of

of Goods

Goods Sold

Sold

7-11

Specific Identification

When

When units

units are

are

sold,

sold, the

the

specific

specific cost

cost

of

of the

the unit

unit sold

sold

is

is added

added to

to

cost

cost of

of goods

goods

sold.

sold.

7-12

Cost Flow Assumptions

The choice of an inventory

costing method is not based

on the physical flow of goods

on and off the shelves.

7-13

First-In, First-Out Method

Oldest

Oldest Costs

Costs

Cost

Cost of

of

Goods

Goods Sold

Sold

Recent

Recent Costs

Costs

Ending

Ending

Inventory

Inventory

7-14

First-In, First-Out

Date

Beginning

Inventory

Purchases:

Jan. 3

June 20

Sept. 15

Nov. 29

Goods

Available

for Sale

Computers, Inc.

Mouse Pad Inventory

Units

$/Unit

Total

1,000

$ 5.25

$ 5,250.00

500

300

250

200

5.30

5.60

5.80

5.90

2,650.00

1,680.00

1,450.00

1,180.00

2,250

$ 12,210.00

Ending

Inventory

1,200

Cost of

Goods Sold

1,050

Remember:

The costs of

most recent

purchases are

in ending

inventory. Start

with 11/29 and

add units

purchased

until you reach

the number in

ending

inventory.

7-15

First-In, First-Out

Given Information

Ending Inventory

Beg. Inv. 1,000 @ $ 5.25

Jan. 3

500 @ 5.30

June 20

300 @ 5.60

Sept. 15

250 @ 5.80

Nov. 29

200 @ 5.90

200 @ $5.90

200 Units

Cost of Goods

Sold

Units

7-16

First-In, First-Out

Given Information

Ending Inventory

Beg. Inv. 1,000 @ $ 5.25

Jan. 3

500 @ 5.30

450 @ $5.30

June 20

300 @ 5.60

300 @ $5.60

Sept. 15

250 @ 5.80

250 @ $5.80

Nov. 29

200 @ 5.90

200 @ $5.90

1,200 Units

Cost of Goods

Sold

Units

$ 6,695 Cost

Now,

Now, we

we have

have allocated

allocated the

the cost

cost to

to all

all

1,200

1,200 units

units in

in ending

ending inventory.

inventory.

7-17

First-In, First-Out

Given Information

Ending Inventory

Beg. Inv. 1,000 @ $ 5.25

Jan. 3

500 @ 5.30

450 @ $5.30

June 20

300 @ 5.60

300 @ $5.60

Sept. 15

250 @ 5.80

250 @ $5.80

Nov. 29

200 @ 5.90

200 @ $5.90

1,200 Units

$ 6,695 Cost

Cost of Goods

Sold

1,000 @ $ 5.25

50 @ 5.30

1,050 Units

$ 5,515 Cost

Now,

Now, we

we have

have allocated

allocated the

the cost

cost to

to all

all

1,050

1,050 units

units sold.

sold.

7-18

First-In, First-Out

Date

Beginning

Inventory

Purchases:

Jan. 3

June 20

Sept. 15

Nov. 29

Goods

Available

for Sale

Computers, Inc.

Mouse Pad Inventory

Units

$/Unit

1,000

500

300

250

200

5.25

5.30

5.60

5.80

5.90

Total

$

5,250.00

2,650.00

1,680.00

1,450.00

1,180.00

2,250

$ 12,210.00

Ending

Inventory

1,200

$ 6,695.00

Cost of

Goods Sold

1,050

$ 5,515.00

Here is the

cost of

ending

inventory

and cost

of goods

sold using

FIFO.

7-19

Last-In, First-Out Method

Oldest

Oldest Costs

Costs

Ending

Ending

Inventory

Inventory

Recent

Recent Costs

Costs

Cost

Cost of

of

Goods

Goods Sold

Sold

7-20

Last-In, First-Out

Date

Beginning

Inventory

Purchases:

Jan. 3

June 20

Sept. 15

Nov. 29

Goods

Available

for Sale

Computers, Inc.

Mouse Pad Inventory

Units

$/Unit

Total

1,000

$ 5.25

$ 5,250.00

500

300

250

200

5.30

5.60

5.80

5.90

2,650.00

1,680.00

1,450.00

1,180.00

2,250

$ 12,210.00

Ending

Inventory

1,200

Cost of

Goods Sold

1,050

Remember:

The costs of the

oldest

purchases are

in ending

inventory. Start

with beginning

inventory and

add units

purchased until

you reach the

number in

ending

inventory.

7-21

Last-In, First-Out

Given Information

Ending Inventory

Beg. Inv. 1,000 @ $ 5.25

1,000 @ $5.25

Jan. 3

500 @ 5.30

June 20

300 @ 5.60

Sept. 15

250 @ 5.80

Nov. 29

200 @ 5.90

1,000 Units

Cost of Goods

Sold

Units

7-22

Last-In, First-Out

Given Information

Ending Inventory

Beg. Inv. 1,000 @ $ 5.25

1,000 @ $5.25

Jan. 3

500 @ 5.30

200 @ 5.30

June 20

300 @ 5.60

Sept. 15

250 @ 5.80

Nov. 29

200 @ 5.90

1,200 Units

Cost of Goods

Sold

Units

$ 6,310 Cost

Now,

Now, we

we have

have allocated

allocated the

the cost

cost to

to all

all

1,200

1,200 units

units in

in ending

ending inventory.

inventory.

7-23

Last-In, First-Out

Given Information

Ending Inventory

Beg. Inv. 1,000 @ $ 5.25

1,000 @ $5.25

Jan. 3

500 @ 5.30

200 @ 5.30

June 20

300 @ 5.60

Sept. 15

250 @ 5.80

Nov. 29

200 @ 5.90

1,200 Units

$ 6,310 Cost

Cost of Goods

Sold

300

300

250

200

1,050

@ $ 5.30

@ 5.60

@ 5.80

@ 5.90

Units

$ 5,900 Cost

Now,

Now, we

we have

have allocated

allocated the

the cost

cost to

to all

all

1,050

1,050 units

units sold.

sold.

7-24

Last-In, First-Out

Date

Beginning

Inventory

Purchases:

Jan. 3

June 20

Sept. 15

Nov. 29

Goods

Available

for Sale

Computers, Inc.

Mouse Pad Inventory

Units

$/Unit

1,000

500

300

250

200

5.25

Total

$

5.30

5.60

5.80

5.90

5,250.00

2,650.00

1,680.00

1,450.00

1,180.00

2,250

$ 12,210.00

Ending

Inventory

1,200

6,310.00

Cost of

Goods Sold

1,050

5,900.00

Here is the

cost of

ending

inventory

and cost of

goods sold

using LIFO.

7-25

Average Cost Method

When

When aa unit

unit is

is sold,

sold, the

the

average

average cost

cost of

of each

each unit

unit in

in

inventory

inventory is

is assigned

assigned to

to cost

cost

of

of goods

goods sold.

sold.

Cost of Goods

Available for

Sale

Number of

Units

Available for

Sale

7-26

Average Cost Method

Date

Beginning

Inventory

Purchases:

Jan. 3

June 20

Sept. 15

Nov. 29

Goods

Available

for Sale

Computers, Inc.

Mouse Pad Inventory

Units

$/Unit

1,000

500

300

250

200

5.25

5.30

5.60

5.80

5.90

Total

$

5,250.00

2,650.00

1,680.00

1,450.00

1,180.00

Weighted Average Cost

2,250

Ending

Inventory

1,200

Cost of

Goods Sold

1,050

$ 12,210.00

$ 12,210

= $5.42667

2,250

7-27

Average Cost Method

Date

Beginning

Inventory

Purchases:

Jan. 3

June 20

Sept. 15

Nov. 29

Goods

Available

for Sale

Computers, Inc.

Mouse Pad Inventory

Units

$/Unit

1,000

500

300

250

200

5.25

Total

$

5.30

5.60

5.80

5.90

5,250.00

2,650.00

1,680.00

1,450.00

1,180.00

Weighted Average Cost

$ 12,210

= $5.42667

2,250

2,250

$ 12,210.00

Ending

Inventory

1,200

6,512.00

1,200 $ 5.42667

Cost of

Goods Sold

1,050

5,698.00

1,050 $ 5.42667

7-28

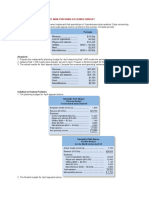

Comparison of Methods

Computers, Inc.

Income Statement

For Year Ended December 31, 2006

Net sales

Cost of goods sold:

Merchandise inventory, beginning

Net purchases

Goods available for sale

Merchandise inventory, ending

Cost of goods sold

Gross profit

Operating expenses

Income before taxes

Income taxes expense (30%)*

Net income

FIFO

$ 25,000

LIFO

$ 25,000

Weighted

Average

$ 25,000

$

$

$

$

$

* Tax expense amounts were rounded.

5,250

6,960

12,210

6,695

5,515

19,485

750

18,735

5,621

13,114

$

$

$

$

$

5,250

6,960

12,210

6,310

5,900

19,100

750

18,350

5,505

12,845

$

$

$

$

$

5,250

6,960

12,210

6,512

5,698

19,302

750

18,552

5,566

12,986

7-29

Financial Statement Effects of Costing

Methods

Advantages

Advantages of

of Methods

Methods

First-In,

First-Out

Last-In,

First-Out

Weighted

Average

Ending

Ending inventory

inventory

approximates

approximates

current

current

replacement

replacement cost.

cost.

Better

Better matches

matches

current

current costs

costs in

in cost

cost

of

of goods

goods sold

sold with

with

revenues.

revenues.

Smoothes

Smoothes out

out

price

price changes.

changes.

7-30

Learning Objectives

Decide

Decide when

when the

the use

use of

of different

different inventory

inventory

costing

costing methods

methods is

is beneficial

beneficial to

to aa company.

company.

7-31

Managers Choice of Inventory Methods

Net

Net Income

Income Effects

Effects

Managers

Managers prefer

prefer to

to report

report

higher

higher earnings

earnings for

for their

their

companies.

companies.

Income

Income Tax

Tax Effects

Effects

Managers

Managers prefer

prefer to

to pay

pay

the

the least

least amount

amount of

of taxes

taxes

allowed

allowed by

by law

law as

as late

late as

as

possible.

possible.

7-32

Choosing Inventory Costing Methods

If . . .

LIFO for

taxes

LIFO

Conformity

Rule

Then . . .

LIFO for

books

7-33

Learning Objectives

Report

Report inventory

inventory at

at the

the lower

lower of

of cost

cost or

or market

market

(LCM).

(LCM).

7-34

Valuation at Lower of Cost or Market

Ending

Ending inventory

inventory is

is reported

reported at

at the

the

lower

lower of

of cost

cost or

or market

market (LCM)

(LCM)..

Replacement

Replacement Cost

Cost

The

The current

current purchase

purchase price

price

for

for identical

identical goods.

goods.

The company will recognize a holding loss in the

current period rather than the period in which the

item is sold.

This practice is conservative.

7-35

Valuation at Lower of Cost or Market

Item

Pentium chips

Disk drives

Quantity

1,000

400

Cost

$ 250

100

Replacement

Cost

$

200

110

LCM

$ 200

100

Total LCM

$ 200,000

40,000

7-36

Learning Objectives

Evaluate

Evaluate inventory

inventory management

management using

using the

the

inventory

inventory turnover

turnover ratio

ratio and

and the

the effects

effects of

of

inventory

inventory on

on cash

cash flows.

flows.

7-37

Inventory Turnover

Inventory

=

Turnover

Cost of Goods Sold

Average Inventory

Average

Average Inventory

Inventory is

is .. .. ..

(Beginning

(Beginning Inventory

Inventory ++ Ending

Ending Inventory)

Inventory) 22

This

This ratio

ratio reflects

reflects how

how many

many times

times

average

average inventory

inventory was

was produced

produced and

and

sold

sold during

during the

the period.

period. A

A higher

higher ratio

ratio

indicates

indicates that

that inventory

inventory moves

moves more

more

quickly

quickly thus

thus reducing

reducing storage

storage and

and

obsolescence

obsolescence costs.

costs.

7-38

Inventory and Cash Flows

Add Increase in Inventory

Decrease in Accounts

Payable

Cost of

Goods

Sold

Cash

Payment to

Suppliers

Decrease in Inventory

Increase in Accounts

Subtract

Payable

7-39

Learning Objectives

Compare

Compare companies

companies that

that use

use different

different

inventory

inventory costing

costing methods.

methods.

7-40

Inventory Methods and Financial Statement

Analysis

U.S. public companies using LIFO also report beginning

and ending inventory on a FIFO basis if the FIFO values

are materially different.

Beginning

Beginning inventory

inventoryFIFO

FIFO

-- Beginning

Beginning inventory

inventoryLIFO

LIFO

Beginning

Beginning LIFO

LIFO Reserve

Reserve

(Excess

(Excess of

of FIFO

FIFO over

over LIFO)

LIFO)

Ending

Ending inventory

inventoryFIFO

FIFO

-- Ending

Ending inventory

inventoryLIFO

LIFO

Ending

Ending LIFO

LIFO Reserve

Reserve

(Excess

(Excess of

of FIFO

FIFO over

over LIFO)

LIFO)

7-41

LIFO and International Comparisons

LIFO Permitted?

No

Yes

Singapore

China

Canada

Australia

Great Britain

7-42

Learning Objectives

Understand

Understand methods

methods for

for controlling

controlling and

and

keeping

keeping track

track of

of inventory

inventory and

and analyze

analyze the

the

effects

effects of

of inventory

inventory errors

errors on

on financial

financial

statements.

statements.

7-43

Internal Control of Inventory

Separation of inventory

accounting and physical

handling of inventory.

Storage in a manner that

protects from theft and

damage.

Limiting access to

authorized employees.

Maintaining perpetual

inventory records.

Comparing perpetual

records to periodic

physical counts.

7-44

Perpetual and Periodic Inventory Systems

Provides

Provides up-to-date

up-to-date

inventory

inventory records.

records.

Perpetual

Perpetual

System

System

Provides

Provides up-to-date

up-to-date

cost

cost of

of sales

sales records.

records.

In a periodic inventory system, ending inventory and cost of

goods sold are determined at the end of the accounting

period based on a physical count.

7-45

Perpetual and Periodic Inventory Systems

Inventory System

Periodic System

Carried over

Beginning Inventory

from prior period

Accumulated in

Add: Purchases

the Purchases

account

Measured at end

of period by

Less: Ending Inventory

physical

inventory count

Computed as a

residual amount

Cost of Goods Sold

at end of period

Item

Perpetual System

Carried over from

prior period

Accumulated in

the Inventory

account

Perpetual record

updated at every

sale

Measured at

every sale based

on perpetual

record

7-46

Errors in Measuring Ending Inventory

Errors in Measuring Inventory

Ending Inventory

Beginning Inventory

Overstated Understated Overstated Understated

Effect on Current Period's Balance Sheet

Ending Inventory

Retained Earnings

+

+

N/A

N/A

N/A

N/A

+

+

+

-

+

+

-

+

+

Effect on n Current Period's Income Statement

Goods Available for Sale

Cost of Goods Sold

Gross Profit

Net Income

7-47

Chapter Supplement A

LIFO

LIFO Liquidations

Liquidations

7-48

LIFO Liquidations

When a LIFO company sells more inventory than it

purchases or manufactures, items from beginning

inventory become part of cost of goods sold. This is

called a LIFO liquidation.

When inventory costs are rising,

these lower cost items in

beginning inventory produce a

higher gross profit, higher

taxable income, and higher

taxes when they are sold.

7-49

LIFO Liquidations

Companies must disclose the effects of LIFO

liquidations in the notes when they are material.

Many companies avoid LIFO

liquidations and the accompanying

increase in tax expense by

purchasing sufficient quantities of

inventory at year-end to ensure that

ending inventory quantities are

greater than or equal to beginning

inventory quantities.

7-50

Chapter Supplement B

Additional

Additional Issues

Issues in

in Measuring

Measuring

Purchases

Purchases

7-51

Purchase Returns and Allowances

Purchase returns and allowances are a reduction in

the cost of purchases associated with unsatisfactory

goods.

Returned goods require a

reduction in the cost of

inventory purchases and the

recording of a cash refund or a

reduction in the liability to the

vendor.

7-52

Purchase Discounts

A purchase discount is a cash discount received for

prompt payment of an account.

Terms

Time

Due

Discount Period

Credit Period

Full amount

less discount

Full amount due

Purchase or Sale

7-53

Purchase Discounts

2/10,n/30

Discount

Discount

Percent

Percent

Number

Number of

of

Days

Days

Discount

Discount Is

Is

Available

Available

Otherwise,

Otherwise,

Net

Net (or

(or All)

All)

Is

Is Due

Due

Credit

Credit

Period

Period

7-54

Purchase Discounts

Purchases paid for

within the discount

period reduce the

Inventory account for

the amount of the cash

discount received.

7-55

Chapter Supplement C

Comparison of Perpetual and

Periodic Inventory Systems

7-56

Perpetual Inventory System

Jan. 1

Apr. 14

Nov. 30

Dec. 31

Had beginning inventory of 800 units at a unit cost of

$50.

Purchased 1,100 units at a unit cost of $50.

Inventory

55,000

Accounts payable

55,000

Sold 1,300 units at a sales price of $83.

Accounts receivable

107,900

Sales revenue

107,900

Cost of goods sold

65,000

Inventory

65,000

Use cost of goods sold and inventory amounts.

7-57

Periodic Inventory System

7-58

End of Chapter 7

You might also like

- Reporting and Interpreting Cost of Goods Sold and InventoryDocument40 pagesReporting and Interpreting Cost of Goods Sold and InventoryPedroNo ratings yet

- Training On Inventory ValuationDocument54 pagesTraining On Inventory ValuationBifle OrganizationNo ratings yet

- Inventory Valuation MADocument3 pagesInventory Valuation MAmohitNo ratings yet

- Notes On Inventory ValuationDocument7 pagesNotes On Inventory ValuationNouman Mujahid100% (2)

- ACC 557 Week 4 Chapter 6 E6 1 E6 10 E6 14 P6 3ADocument7 pagesACC 557 Week 4 Chapter 6 E6 1 E6 10 E6 14 P6 3Atswag2014No ratings yet

- PA (Test 2)Document6 pagesPA (Test 2)ANH PHẠM QUỲNHNo ratings yet

- Inventories and The Cost of Goods SoldDocument27 pagesInventories and The Cost of Goods SoldEzgi ÇebiNo ratings yet

- Beginning Inventory Cost of Goods SoldDocument8 pagesBeginning Inventory Cost of Goods SoldAndres BorreroNo ratings yet

- Total Factory/Manuf. Cost Cogm Cogm: Manufacturing Overhead Budget DefinitionDocument44 pagesTotal Factory/Manuf. Cost Cogm Cogm: Manufacturing Overhead Budget DefinitionChinh Lê Đình100% (1)

- Day 3Document33 pagesDay 3Leo ApilanNo ratings yet

- Review Problem 1: Variance Analysis Using A Flexible Budget: RequiredDocument12 pagesReview Problem 1: Variance Analysis Using A Flexible Budget: RequiredGraieszian LyraNo ratings yet

- CH 09 SolDocument54 pagesCH 09 Solawilliams023No ratings yet

- Managerial Accounting-Fundamental Concepts and Costing Systems For Cost Analysis Module 2Document44 pagesManagerial Accounting-Fundamental Concepts and Costing Systems For Cost Analysis Module 2Uzma KhanNo ratings yet

- 1.1. Inventory Costing Methods Under A Periodic SystemDocument6 pages1.1. Inventory Costing Methods Under A Periodic Systembeth elNo ratings yet

- ACCT 306 PowerpointDocument30 pagesACCT 306 PowerpointKayla SheltonNo ratings yet

- Inventory Practice ProblemsDocument14 pagesInventory Practice ProblemsmikeNo ratings yet

- Variable and Absorption CostingDocument13 pagesVariable and Absorption CostingJerome LauderbaughNo ratings yet

- Principles of Accounting, Volume 2: Managerial AccountingDocument59 pagesPrinciples of Accounting, Volume 2: Managerial AccountingVo VeraNo ratings yet

- Lecture 3 - Budgeting 1Document35 pagesLecture 3 - Budgeting 1Tgrh TgrhNo ratings yet

- Absorption & Marginal Costing MA ACCADocument23 pagesAbsorption & Marginal Costing MA ACCAsimranNo ratings yet

- Production BudgetDocument25 pagesProduction BudgetfitriawasilatulastifahNo ratings yet

- CH 3Document17 pagesCH 3trishanjaliNo ratings yet

- AQIB Break Even AnalysisDocument22 pagesAQIB Break Even AnalysisArmaghan BhattiNo ratings yet

- Lecture 4b Cost Volume Profit EditedDocument24 pagesLecture 4b Cost Volume Profit EditedJinnie QuebrarNo ratings yet

- Agenda:: A Little More Vocabulary C-V-P Analysis Thursday's Class Group Problem SolvingDocument33 pagesAgenda:: A Little More Vocabulary C-V-P Analysis Thursday's Class Group Problem SolvingApoorvNo ratings yet

- Break Even: Engineering Economics - Session 9 Last SessionDocument23 pagesBreak Even: Engineering Economics - Session 9 Last Sessionmark floresNo ratings yet

- MANACC01Document4 pagesMANACC01Justine Paul Pangasi-anNo ratings yet

- Break Even: IS4103 - Module 4Document22 pagesBreak Even: IS4103 - Module 4Aliah HadjirulNo ratings yet

- Lifo Fifo Exercise - SolutionDocument12 pagesLifo Fifo Exercise - Solutionrikita_17No ratings yet

- Nif C-4Document6 pagesNif C-4andrey PabloNo ratings yet

- Advanced Finance Applied PowerPoint ChapterDocument47 pagesAdvanced Finance Applied PowerPoint ChapterasdfasfasdfasdfasdfsdafNo ratings yet

- Ch7 Variable CostingDocument20 pagesCh7 Variable CostingHechy HoopNo ratings yet

- Engineering Economics Lecture Sheet - 4 CVPDocument41 pagesEngineering Economics Lecture Sheet - 4 CVPebrahimbutexNo ratings yet

- MA Session 6Document46 pagesMA Session 6Sameer FaisalNo ratings yet

- Cost ManagementDocument9 pagesCost ManagementVikkuNo ratings yet

- PersediaanDocument31 pagesPersediaanabdul robby farhanNo ratings yet

- Prelim Quiz 2Document16 pagesPrelim Quiz 2Rynette FloresNo ratings yet

- 3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Document2 pages3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Jonathan Altamirano Burgos0% (1)

- 2 Product Costing Systems Concepts and Design Issues Compatibility ModeDocument73 pages2 Product Costing Systems Concepts and Design Issues Compatibility ModeIamRuzehl VillaverNo ratings yet

- Pertemuan 11 Chap007-008 Hilton - EditDocument58 pagesPertemuan 11 Chap007-008 Hilton - Editferly12No ratings yet

- Additional Topics in Variance Analysis: Mcgraw-Hill/IrwinDocument17 pagesAdditional Topics in Variance Analysis: Mcgraw-Hill/Irwinimran_chaudhryNo ratings yet

- Joint CostingDocument38 pagesJoint CostingHassan MohiuddinNo ratings yet

- Accounting For Manufacturing BusinessDocument81 pagesAccounting For Manufacturing BusinessAdrian Faminiano100% (1)

- Managerial Accounting Discussion Set 2 (Answers)Document16 pagesManagerial Accounting Discussion Set 2 (Answers)julsmlarkNo ratings yet

- Chapter 4Document22 pagesChapter 4Korubel Asegdew YimenuNo ratings yet

- Cost Sheet: Meaning and Its ImportanceDocument15 pagesCost Sheet: Meaning and Its ImportanceDevanshi ShahNo ratings yet

- Institucion Universitaria Politecnico GrancolombianoDocument6 pagesInstitucion Universitaria Politecnico GrancolombianoYenny MartinezNo ratings yet

- Entrep 2Document44 pagesEntrep 2JONESSA GAMBITONo ratings yet

- Financial Management - Merchandise InventoryDocument45 pagesFinancial Management - Merchandise InventoryWaqas Ul HaqueNo ratings yet

- Since All The Data Needed To Construct An Income Statement Are AvailableDocument3 pagesSince All The Data Needed To Construct An Income Statement Are AvailableShay MortonNo ratings yet

- Operations Management - AssignmentDocument10 pagesOperations Management - AssignmentAkshatNo ratings yet

- Managerial Accounting Final ExamDocument14 pagesManagerial Accounting Final ExamatifNo ratings yet

- ProductCosting Material Ledger1Document129 pagesProductCosting Material Ledger1Iván Andrés Marchant NúñezNo ratings yet

- Job and Batch Costing II COMPLETEDocument34 pagesJob and Batch Costing II COMPLETEwakemeup143No ratings yet

- Soal Asistensi Akuntansi Manajemen 1-6Document26 pagesSoal Asistensi Akuntansi Manajemen 1-6Lilik Adik KurniawanNo ratings yet

- Latihan UAS Manacc TUTORKU (Answered)Document10 pagesLatihan UAS Manacc TUTORKU (Answered)Della BianchiNo ratings yet

- Chap1 Marginal Costing & Decision MakingDocument31 pagesChap1 Marginal Costing & Decision Makingrajsingh15No ratings yet

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDocument55 pagesBasic Cost Management Concepts and Accounting For Mass Customization OperationsBelajar MembacaNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Symphony No. 5 in C Minor: Allegro Con BrioDocument13 pagesSymphony No. 5 in C Minor: Allegro Con BrioannalisaNo ratings yet

- Nara Trip (One Day) From OsakaDocument4 pagesNara Trip (One Day) From OsakaGabrielle TanNo ratings yet

- Whilst Every Possible Care Has Been Taken in Preparing Our Gluten Free Food, Contact With Gluten May Still Occur As Equipment Is SharedDocument2 pagesWhilst Every Possible Care Has Been Taken in Preparing Our Gluten Free Food, Contact With Gluten May Still Occur As Equipment Is SharedGabrielle TanNo ratings yet

- Book Partituras - Richard Clayderman 3 - Piano Solo Best Collection PDFDocument49 pagesBook Partituras - Richard Clayderman 3 - Piano Solo Best Collection PDFMadirley Pimenta100% (1)

- 2015 16 TimetableDocument2 pages2015 16 TimetableGabrielle TanNo ratings yet

- Assessment Information GroupProjectPresentationDocument4 pagesAssessment Information GroupProjectPresentationGabrielle TanNo ratings yet

- ANZ KiwiSaver Scheme AR 2015 WebDocument15 pagesANZ KiwiSaver Scheme AR 2015 WebGabrielle TanNo ratings yet

- Japan JR Pass ComparisonDocument3 pagesJapan JR Pass ComparisonGabrielle TanNo ratings yet

- Retracted: The Leadership QuarterlyDocument14 pagesRetracted: The Leadership QuarterlyGabrielle TanNo ratings yet

- Sheppard Industries LTD V Specialized Bicycle Components Inc Coa Ca805 2010 26 July 2011Document23 pagesSheppard Industries LTD V Specialized Bicycle Components Inc Coa Ca805 2010 26 July 2011Gabrielle TanNo ratings yet

- Still in Love With YouDocument4 pagesStill in Love With YouErvina WijayaNo ratings yet

- Japan JR Pass ComparisonDocument3 pagesJapan JR Pass ComparisonGabrielle TanNo ratings yet

- VMware Secures Patent To Take Mobile Devices Back To The Dark AgesDocument1 pageVMware Secures Patent To Take Mobile Devices Back To The Dark AgesGabrielle TanNo ratings yet

- Japan Plan 4.0 (Overnight Bus Plan)Document11 pagesJapan Plan 4.0 (Overnight Bus Plan)Gabrielle TanNo ratings yet

- Beam Deflection FormulaeDocument2 pagesBeam Deflection Formulae7575757575100% (6)

- Wave Systems 2012solDocument6 pagesWave Systems 2012solGabrielle TanNo ratings yet

- Mastering EES Themechangers - Blogspot.inDocument608 pagesMastering EES Themechangers - Blogspot.inGabrielle Tan100% (2)

- Les Miserables - I Dreamed A Dream (Joyce)Document7 pagesLes Miserables - I Dreamed A Dream (Joyce)Gabrielle TanNo ratings yet

- Renderer InfoDocument1 pageRenderer Infomarwo6No ratings yet

- Still in Love With YouDocument4 pagesStill in Love With YouErvina WijayaNo ratings yet

- LicenseDocument1 pageLicenseLudwig TapiaNo ratings yet

- Beam Deflection FormulaeDocument2 pagesBeam Deflection Formulae7575757575100% (6)

- HW1 (28.2.2012 Due)Document2 pagesHW1 (28.2.2012 Due)Gabrielle TanNo ratings yet

- Guidelines Prac WK 2011Document6 pagesGuidelines Prac WK 2011Gabrielle TanNo ratings yet

- Tutorial 4Document1 pageTutorial 4Gabrielle TanNo ratings yet

- Guidelines Prac WK 2011Document6 pagesGuidelines Prac WK 2011Gabrielle TanNo ratings yet

- Tutorial 1Document2 pagesTutorial 1Gabrielle TanNo ratings yet

- Oreo Cheesecake (NO BAKE) RecipeDocument1 pageOreo Cheesecake (NO BAKE) RecipeGabrielle TanNo ratings yet

- A Study On Responsibility Accounts On StakeholdersDocument6 pagesA Study On Responsibility Accounts On StakeholdersresearchparksNo ratings yet

- CA Final SA Concept by Siddharth AgarwalDocument54 pagesCA Final SA Concept by Siddharth Agarwalvishnuverma100% (1)

- 2015 CFE Honour Roll EnglishDocument1 page2015 CFE Honour Roll Englishsanjay_k87No ratings yet

- Group Reporting in SAP S4HANADocument43 pagesGroup Reporting in SAP S4HANAShimaa Ibrahim Mohamed100% (2)

- Bengal Chemicals & Pharmaceuticals LTD - 11920231113659Document16 pagesBengal Chemicals & Pharmaceuticals LTD - 11920231113659shafaquesameen2001No ratings yet

- Second PreboardDocument3 pagesSecond PreboardPrankyJellyNo ratings yet

- PO Setup and Defaulting of Accounts in A Purchasing EnvironmentDocument5 pagesPO Setup and Defaulting of Accounts in A Purchasing EnvironmentharishNo ratings yet

- Name: Esha Reddy Class: TY BCOM Div: B Roll No: 7772 Subject: Cost Accounting Semester: VI Submitted To: Dr. Kiran DeshmukhDocument20 pagesName: Esha Reddy Class: TY BCOM Div: B Roll No: 7772 Subject: Cost Accounting Semester: VI Submitted To: Dr. Kiran Deshmukhriya thakurNo ratings yet

- A Study On Fixed Asset ManagementDocument8 pagesA Study On Fixed Asset ManagementShrid GuptaNo ratings yet

- Annex 3 (Finrep)Document50 pagesAnnex 3 (Finrep)Cynical GuyNo ratings yet

- CH4Document49 pagesCH4星喬No ratings yet

- Analysis and Interpretation of Financial StatementsDocument76 pagesAnalysis and Interpretation of Financial StatementsSufyan Sadiq60% (5)

- ASE20104 Examiner Report - March 2018Document20 pagesASE20104 Examiner Report - March 2018Aung Zaw HtweNo ratings yet

- Principles of Accounting Lecture 1Document9 pagesPrinciples of Accounting Lecture 1Masum HossainNo ratings yet

- Aacctg For Bus CombDocument8 pagesAacctg For Bus CombMaurice AgbayaniNo ratings yet

- Hilton 7 eDocument37 pagesHilton 7 eBlackBunny103No ratings yet

- NEW SAMPLE 2023 External Penetration Test Engagement Report FINALDocument30 pagesNEW SAMPLE 2023 External Penetration Test Engagement Report FINALvlatko.lazarevskiNo ratings yet

- Chapter 21 FinalDocument16 pagesChapter 21 FinalMichael HuNo ratings yet

- Week 9 Impairment of Non-Current Assets (MFRS 136) For StudentsDocument32 pagesWeek 9 Impairment of Non-Current Assets (MFRS 136) For StudentsAnselmNo ratings yet

- Solution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsDocument7 pagesSolution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsIsyraf Hatim Mohd TamizamNo ratings yet

- SZABIST Karachi University Course Catalog 2019Document329 pagesSZABIST Karachi University Course Catalog 2019Fazli AzeemNo ratings yet

- CFA 1 Financial Reporting & AccountingDocument92 pagesCFA 1 Financial Reporting & AccountingAspanwz Spanwz100% (1)

- IFA Week 3 Tutorial Solutions Brockville SolutionsDocument9 pagesIFA Week 3 Tutorial Solutions Brockville SolutionskajsdkjqwelNo ratings yet

- BUS707 Assessment 3 Structured Literature Review - Aasi - EditedDocument9 pagesBUS707 Assessment 3 Structured Literature Review - Aasi - EditedFarheen AhmedNo ratings yet

- Bajaj Finance AnalysisDocument37 pagesBajaj Finance AnalysisUjwal KhandokarNo ratings yet

- Sec Reportorial RequirementsDocument2 pagesSec Reportorial RequirementsAnonymous qDb8S3koENo ratings yet

- Fall 2023-2024 - Introduction To Business - Final Assignment - Main BodyDocument12 pagesFall 2023-2024 - Introduction To Business - Final Assignment - Main Bodywww.kazimarzanjsbmsc570No ratings yet

- SAP ReportsDocument4 pagesSAP Reportsbalaji.amubanNo ratings yet

- Specacc ReviewerDocument11 pagesSpecacc ReviewerKianna Jhade MoralesNo ratings yet

- Director Finance Controller in Boston MA Resume Gregory MurphyDocument2 pagesDirector Finance Controller in Boston MA Resume Gregory MurphyGregoryMurphyNo ratings yet