Professional Documents

Culture Documents

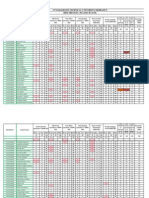

Global Share of Throat & Wallet

Uploaded by

Taylor LeblancCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global Share of Throat & Wallet

Uploaded by

Taylor LeblancCopyright:

Available Formats

Share of the Global Throat and

Wallet

December 2009

Global Throat and Wallet

Euromonitor International

Introduction

Setting the Scene

Dairy in Focus

Last Decade in Focus

Human Need for Fluids

Demographic Dividend in Drinks

Conclusions

Definitions

2

Introduction

Global Throat and Wallet

Euromonitor International

Scope

This briefing on the global market for packaged beverages covers the following products:

Disclaimer

Much of the information in this briefing is of a statistical

nature and, while every attempt has been made to ensure

accuracy and reliability, Euromonitor International cannot be

held responsible for omissions or errors

Figures in tables and analyses are calculated from

unrounded data and may not sum. Analyses found in the

briefings may not totally reflect the companies opinions,

reader discretion is advised

Learn More

To find out more about Euromonitor International's complete

range of business intelligence on industries, countries and

consumers please visit www.euromonitor.com or contact your

local Euromonitor International office:

Introduction

Global Throat and Wallet

Euromonitor International

Objectives of the Drinking Habits Series

This report opens Euromonitor Internationals series of new

global briefings on the worlds drinking habits.

The Drinking Habits series is an attempt to investigate the

importance of branded packaged drinks to humans daily need

for fluid. By taking 2.2 litres a day as a conservative estimate of

the recommended liquid intake, we build up a picture of how

the world drinks, past, present and future. Most importantly, we

track the contribution of branded packaged beverages as a

share of total liquid consumption.

The analysis sheds more light on what, in effect, is the degree

of opportunity for growth in commercialised soft, hot, alcoholic

and dairy drinks, in different regions around the world.

A closer look into the share of throat and wallet reveals

striking regional disparities in the importance of branded

packaged drinks: from highly saturated Western European and

North American markets to the fast maturing regions of Eastern

Europe and Latin America. Crucially, data from the emerging

Asian economies and Middle East and African markets expose

a pool of untapped opportunity.

From questions on What the world drank, drinks and will be

drinking and Where the world buys its drink we move to the

questions of how manufacturers react to evolving consumer

demands and adapt their offerings. We investigate the changes

in leading companies product portfolios, as they develop new

categories, innovative ingredients and packaging.

In short, the Drinking Habits series is a map identifying

opportunity zones in commercialised drinks.

4

Introduction

Global Throat and Wallet

Euromonitor International

Objectives of the Global Share of Throat and Wallet Report

Share of Global Throat and Wallet is the first in the series of briefings on Global Drinking Habits.

With the global financial crisis intensifying competition for the money the world spends on beverages, Euromonitor

International analyses the contribution of branded packaged beverages to total liquid consumption.

As part of the study, consumer profiles for different drinks categories are analysed, in order to understand how

investors might benefit from demographic dividend.

We examine if, in a world with ageing population, adult-profile soft drinks categories will be the safe bet for high

profile strategic investment over the next 10 years.

We also assess if adult-profile categories need to raise their segmentation game to increase their appeal to wider

consumer groups within the adult population and, even more importantly, to reach out to the childrens consumer

group (aged 0-14) which accounts for one in every four people on the planet.

Further to this, Euromonitor International interrogates the disparity between branded packaged drinks consumption

and recommended total intake, and identifies three different geographical zones where branded drinks consumption

has reached different levels of maturity.

Both branded and unbranded balances of consumption are analysed on the global scale over the past decade, at

present and as a key opportunity for new business in the future.

Introduction

Global Throat and Wallet

Euromonitor International

Key Findings

Economy

Human Fluid Need

When Lehman Brothers collapsed in September 2008

Global consumption of packaged branded non-alcoholic

and the Western banking sector slipped into crisis, the

contagion spread quickly to all corners of the world.

Descent into a worsening global economic climate has

been a pivotal force since 2008. Few could have

predicted the depth of the crisis, which had its roots in

the US sub-prime mortgage market.

In this uncertain macro-economic landscape,

competition for beverage share of throat and wallet has

never been more intense.

drinks is equivalent to around 0.5 litres a day in 2009,

against the average humans need for 2.2 litres of liquid,

based on World Health Organization recommendations.

There is, however, significant disparity between regions,

with packaged drinks accounting for two thirds of

required liquid intake in industrialised markets,

compared with around one tenth in the largely untapped

emerging markets of Asia, the Middle East and Africa.

Alcoholic vs Non-Alcoholic vs Dairy

Demographics

Alcoholic and non-alcoholic drinks do not always operate

The ageing of the global population reflects declining

in different competitive playing fields. Beer, for example,

has a quasi soft drinks status in some regions.

Critically, the money channelled into alcoholic drinks has

a direct bearing on disposable income available for soft,

drinks hot drinks and dairy beverages.

Milk drinks are regarded as a staple product and have

shown strong resilience to the effects of the current

economic contraction.

birth rates in key regions, notably Eastern and Western

Europe.

However, although population growth rates are slowing,

there are still a significant number of countries with

youthful populations, such as India and Mexico.

Correctly targeting and then harnessing youthful and

ageing demographics in specific countries is one of the

biggest challenges ahead for all segments of the drinks

industries.

6

Global Throat and Wallet

Euromonitor International

Introduction

Setting the Scene

Dairy in Focus

Last Decade in Focus

Human Need for Fluids

Demographic Dividend in Drinks

Conclusions

Definitions

7

Setting the Scene

Global Throat and Wallet

Euromonitor International

What Does the World Drink in 2009

Globally, some 1.4 trillion litres of commercial packaged beverages were consumed in 2009, including both the on-

trade and off- trade, equivalent to around 4 litres per capita per week.

An unprecedented global financial crisis has intensified competition for the money spent on beverages. Share-ofthroat is now a major cross-industry strategic challenge, as purse strings tighten from London to New York to Sydney.

Global Throat and Wallet

Setting the Scene

Euromonitor International

Global Picture: Throat & Wallet Disparity as 2009 Unfolds

Hot tea accounts for

the largest share of

actual global RTD retail

beverage consumption,

but its share of wallet is

weak.

Hot coffee, for

example, accounts for

double the value of tea,

but only 59% of the

volume.

This is indicative of the

coffee industrys more

effective

premiumisation, fuelled

by strong worldwide

development of caf

culture.

Beer, driven by

standard lager, holds

the largest share of

spending, accounting

for one fifth of global

beverage expenditure.

Collectively, alcoholic

drinks account for a

substantial 45% share.

Note: Shares are part-year estimates.

Setting the Scene

Global Throat and Wallet

Euromonitor International

Tea and Bottled Water Driving New Beverage Business

Development of new business is the key to building a stronger share of throat position, and in 2009 the most

significant rises were generated by bottled water and hot tea. Collectively, these two sectors accounted for more than

three out of every 10 litres of actual beverage volume growth, based on provisional 2009 results.

Hot tea accounted for 17% of actual volume growth in 2009, but drought conditions in India, Kenya and Sri Lanka in

2009, which collectively account for over half the worlds total tea production, are set to push tea prices up, potentially

to an all-time high. There will, therefore, be pressure on demand in the short term.

10

Setting the Scene

Global Throat and Wallet

Euromonitor International

Value Losses Across the Board in 2009

The most striking result of 2009 is the across the board losses in drinks value. In one year, on the back of the global

financial crisis and fluctuations in US$ exchange rates, the drinks businesses lost over US$55 billion in value. All

major categories contributed to this loss in value.

In some categories, like milk, loss in value was also driven by a decline in international commodity prices.

11

Setting the Scene

Global Throat and Wallet

Euromonitor International

Key Drinks Fortunes in Economic Downturn

Beer

Domestic lager has gained consumers from the imported lager category as

consumers trade down, benefiting both volume and value sales. Economy lager also

enjoys the benefit of being largely present in the off-trade.

Wine

With less money to spend, consumers are cutting down on buying champagne, as it

is too expensive and is seen as a luxury. Champagne is the biggest loser in alcoholic

drinks as a result of the recession.

Spirits

The trading-up trend is weakening, and consumers are trading down to mid-priced

and economy brands. Local spirits such as cachaa in Brazil and soju in South Korea

benefit as lower priced alternatives to international spirits.

Milk

Milks staple status and greater affordability linked to a decline in international

commodity prices allowed sales to grow in volume despite the current economic

recession.

Coffee

Resisting downward pressure from the deteriorating global economic climate, the

category is expected to generate strong sales, even in contracting fresh coffee

markets.

Tea

Black tea looks well positioned to weather the global financial storm. Low unit prices

and multiple brands in the traditional tea markets will see consumption remain stable.

Bottled Water

A backlash against still bottled water in developed markets was in place before the

economic downturn; however, the crisis is accelerating the decline. Functional bottled

water is still niche and therefore still has significant potential.

Concentrates

Low unit price and geographical spread will see concentrate volumes actually

increase globally. This will be driven in two directions: low-sugar/functional ingredients

in developed markets, and emerging market consumption.

12

Setting the Scene

Global Throat and Wallet

Euromonitor International

Emerging Markets are the Lynchpin of Opportunity to 2010

13

Setting the Scene

Global Throat and Wallet

Euromonitor International

Longer Term Trends in the Share of Throat

Performance in first and second tier emerging markets will play an increasingly important role in the development of

the forecast global picture.

14

Global Throat and Wallet

Euromonitor International

Introduction

Setting the Scene

Dairy in Focus

Last Decade in Focus

Human Need for Fluids

Demographic Dividend in Drinks

Conclusions

Definitions

15

Dairy in Focus

Global Throat and Wallet

Euromonitor International

Dairy Sales Growth Slows in 2009

Global retail sales of drinking milk products

declined marginally in retail value in 2009.

This decline was mainly prompted by a

moderate drop in milk prices, as a result of

lower demand and large production stocks.

When milk prices peaked in early 2008,

farmers increased production which, as a

result of weaker demand during the second

half of 2008 and in 2009, prompted a fall in

prices of 3% at global level.

Demand in volume, however, remained

fairly stable, as a result of relatively low

prices and the staple commodity status of

milk in most countries.

In countries like Ukraine, for instance,

chocolate confectionery sales declined by

over 13% in retail volume, as consumers

cut expenditure on non-essential food

products. Demand for milk products, on the

other hand, declined by a mere 1%, as

Ukrainians focused on affordable staple

products consumed on a day-to-day basis.

Private labels share grew by over one

percentage point to reach 23% in 2008, and

is expected to continue to growth

throughout 2009, as price gains increasing

relevance among cash-strapped

consumers.

16

Global Throat and Wallet

Dairy in Focus

Euromonitor International

Crisis Impact on Dairy

Drinking milk products are regarded as a staple

in the diet of many countries. This, along with

milks relatively low price, makes these

products quite resilient to recession, as

consumers tend to cut down on other, nonessential items, such as indulgence products.

Sales of drinking milk products grew by 2% in

retail volume in 2009; slightly faster than in the

previous year. Demand for drinking milk

products is being underpinned by lower global

milk prices, which makes this commodity more

affordable to consumers.

Despite lower commodity prices being only

partly passed on to consumers, there was still

a cost reduction in milk products across

regions.

Demand for health and indulgence continued

to be a recurrent theme in innovation in 2009,

and drove demand in categories such as

flavoured milk drinks and soy beverages, which

grew by 5% and 7%, respectively, in retail

volume in 2009.

Demand for soy beverages continues to grow

in emerging markets, driven by middle class

consumers in urban areas. Retail sales of

these products grew by 12% in China and 14%

in India in 2009, a trend that is likely to

continue in the medium term.

17

Dairy in Focus

Global Throat and Wallet

Euromonitor International

Dairy Retail Volume Growth 2009-2014

18

Dairy in Focus

Global Throat and Wallet

Euromonitor International

Dairy: One Market, One Strategy

Robust growth in the Middle East and Africa and Asia-Pacific

will continue beyond 2009, particularly in markets such as

China and India.

Manufacturers should adapt their long-term strategies

accordingly, prioritising those markets where organic growth

will be strongest.

International manufacturers should therefore adopt a dual

strategy in order to maximise growth at a global level.

On the one hand, they should extend standard priced

packaged milk lines to developing markets, using local inputs,

where possible, to minimise costs and final retail prices.

Manufacturers should not overlook the fact that maintaining

relatively low prices is crucial to allowing middle class

consumers to trade up from fresh to packaged milk in

emerging markets.

Innovation should focus on vitamin enrichment and the

introduction of low-fat lines targeting middle class consumers

in fast growing urban areas.

On the other hand, the industry should enhance the premium

content of brands in more mature markets, through the

addition of additional health properties.

The development of hybrid super-premium brands,

combining indulgence, health, organic and fair trade

properties, will be crucial to expanding the consumer base of

drinking milk products in more mature markets, where health,

social or organic properties are no longer enough to expand

sales when marketed separately.

19

Global Throat and Wallet

Euromonitor International

Introduction

Setting the Scene

Dairy in Focus

Last Decade in Focus

Human Need for Fluids

Demographic Dividend in Drinks

Conclusions

Definitions

20

Last Decade in Focus

Global Throat and Wallet

Euromonitor International

Bottled Water Posts Big Gains Share of Throat

Soft drinks were a stellar growth industry in the

past decade, but significant pressure from the

worldwide financial crisis is set to narrow crossindustry performance disparities over the short to

medium term.

A decade ago, the portfolios of major soft drinks

companies, notably Coca-Cola and PepsiCo,

were heavily loaded with carbonates. This has

changed significantly due to strong development

of a broader spectrum of categories. This is a

strategic revision that is clearly visible in share of

throat, with bottled water, notably, accounting for

16% of global beverage consumption in 2008,

compared with less than 10% in 1998. Fruit juice,

a strong good-for-you category, also made a

significant, albeit more modest gain over the past

decade.

The highest profile share-of-throat loser has been

carbonates, reflecting wider rejection of sugary

drinks, especially in developed markets, as

consumers look to fight obesity and avoid bad-foryou consumption choices.

Beer lost ground in the five years to 2003, but

investment in more effective segmentation,

combined with aggressive pricing, triggered a

return over the following 5-year cycle, and it is the

only alcoholic drinks category gaining share within

the industry.

21

Last Decade in Focus

Global Throat and Wallet

Euromonitor International

Niche Adult and Functional Drinks Hit Rapid Streak of Growth

Significant investment from the major multinational soft drinks companies, especially in the emerging markets, fuelled

the upward surge of bottled water. High yield packages (5+ litres) have been a particularly important spur, the result of

poor potable water availability in key high volume markets, such as Mexico and China, and a corresponding increase

in consumer sophistication and spending power.

Among the new generation of niche, value-enhancing categories, star performers have been RTD tea, energy drinks,

flavoured milk, drinking yoghurt and soy. Each of these is now competing for daily liquid intake. However, recession

across the industrialised markets is likely to put pressure on demand, at least in the short term.

RTDs (premixes) were a dynamic category of alcoholic drinks between 1998 and 2003, but growth slowed to 2008

due, firstly, to growing consumer concern over alcohol content and related consumption by young people and,

secondly, to growth in energy drinks, which signalled a new era of mixability (mainly with vodka), especially in the ontrade.

22

Last Decade in Focus

Global Throat and Wallet

Euromonitor International

Wine and Spirits Losing Share of Wallet

Wine and spirits both registered declines in

their share of wallet, reflecting an increasingly

difficult operating environment for premium

drinks in the worlds richer nations. Beer held

firm over the review period, with strong

segmentation offsetting aggressive pricing.

Despite the global sluggishness of carbonates,

the category saw share of wallet drop by only

one percentage point over the period 19982008, underscoring effective positioning from

industry leaders Coca-Cola and PepsiCo.

Bottled water made big value gains,

accounting for one in every US$14 of drinks

spending in 2008, compared with less than

one in 20 a decade earlier.

Shares of spending in hot tea and coffee are

substantially below volume shares, which

indicates that more effective premiumisation

remains a key challenge for the tea industry in

particular, potentially through stronger

investment in niche formats, such as green

and herbal tea.

In dairy, weaker participation of milk was partly

offset by the development and premiumisation

of flavoured milk and drinking yoghurt, which

fuelled a collective share of 3% in 2008.

23

Last Decade in Focus

Global Throat and Wallet

Euromonitor International

New Generation of Value-enhancing Categories Raise Profile

The importance of emerging value added niche categories, notably RTD tea, functional drinks, flavoured milk,

drinking yoghurt and soy beverages, is clearly visible from their upbeat retail growth curves over the past decade.

Notwithstanding a tougher operating environment over the short term, these categories will continue to be the target

of significant new investment.

Drinking yoghurts value growth was underpinned by consumers trading up from low-priced standard milk lines with

limited scope for differentiation to premium specialised health-orientated dairy drinks. This trend was particularly

apparent in developed markets.

The hot coffee industry significantly

raised its global game between

2003 and 2008, and much of the

credit lies with Starbucks. The

premiumisation of coffee in the ontrade has filtered positively into the

off-trade. Indeed, while Starbucks

has suffered in its domestic

market, growth continues in the

international arena, particularly in

emerging markets.

In alcoholic drinks, beer has

outperformed wine year-on-year

for over a decade, illustrating a key

shift in consumption culture. The

global disparity would have been

wider had it not been for upbeat

wine growth in key Asian and

Eastern European markets, which

offset declines in Western Europe.

24

Last Decade in Focus

Global Throat and Wallet

Euromonitor International

A Decade of Change for Global Share of Throat 1998-2008

25

Global Throat and Wallet

Euromonitor International

Introduction

Setting the Scene

Dairy in Focus

Last Decade in Focus

Human Need for Fluids

Demographic Dividend in Drinks

Conclusions

Definitions

26

Human Need for Fluids

Global Throat and Wallet

Euromonitor International

Global Picture: The Human Fluid Need

To replace lost fluids, the average human,

according to World Health Organization

recommendations, needs 2.2 litres of nonalcoholic liquid a day, of which water

should ideally be the primary source. Of

course, humans need to modify their liquid

intake depending on activity, climate and

health criteria. 2.2 litres is, therefore, no

more than a rough guideline.

In 2008, global per capita consumption of

commercially produced non-alcoholic

drinks totalled 132 litres, representing

16% of the recommended annual intake.

The implication is that tap water and other

unbranded liquids fuelled a substantial

proportion of the balance.

The disparity between branded

consumption and recommended total

intake sheds some light on the steep rise

of bottled water demand over the past

decade. Crucially, demand has increased

substantially in poorer regions of the world

where potable water infrastructure is

weak.

The unbranded balance of consumption

has narrowed only slightly over the past

decade, and remains a key opportunity for

new business going forward.

27

Global Throat and Wallet

Human Need for Fluids

Euromonitor International

Adding Alcoholic Drinks into the Mix

Alcoholic drinks, which are usually excluded from

Note: Total

calculations when assessing the fulfilment of the

human need for liquid, reduce the noncommercialised drinks consumption even further.

In 2008, global per capita consumption of

commercially produced packaged alcoholic

drinks totalled 35 litres per person per year.

Together with commercialised non-alcoholic

packaged drinks, this reduces the

unbranded/non-commercialised drinks proportion

to below 80%.

Within alcoholic drinks, the share attributed to

beer is increasing steadily, whilst spirits are on

the decline. The shares of wine and other,

smaller categories have been stable over the

years.

Milk and soy drinks are on a slow but steady rise.

Drinking yoghurt and flavoured milk drinks

shares of throat are increasing sharply, whilst

sour milk drinks are steady.

2008 was the year in which the share of

carbonates in global share of throat started to

decline. This is the only major category within

soft drinks seeing a decline.

Every category in hot drinks is still growing in

importance on the global scale.

= 803 litres per person per year

= 2.2 litres per person per day

28

Human Need for Fluids

Global Throat and Wallet

Euromonitor International

Global Picture: Human Fluid Intake, Saturated Zone

In 2008, packaged non-alcoholic drinks accounted

for over 66% of the recommended human fluid

intake in the industrialised markets of North

America, Western Europe and Australasia.

This is indicative of the strength and breadth of

retail consumer culture in the richer nations, and is

a key reason why the beverage arena in those

markets is so competitive.

Saturation of branded beverages means that

growth has increasingly been achieved by

increasing market share.

A key trend is that packaged drinks accounted for

just over 60% of recommended liquid intake in

1998, growing to over 66% a decade later.

However, this share is forecast to contract by 2013.

The end of the growth curve can be explained, first,

by projections of a slow return to recovery in the

macro-economies of the industrialised markets and,

secondly, by a growing propensity toward tap water

due to environmental concerns.

Soft drinks peaked in 2005-2007, and are now

declining, mostly on the back of declines in

carbonates but also in bottled water and

fruit/vegetable juice.

Dairy share of throat contracted slowly but steadily

over the last decade. This trend is likely to continue

in the next five years.

29

Human Need for Fluids

Global Throat and Wallet

Euromonitor International

The Importance of Alcoholic Drinks in Saturated Markets

Adding alcoholic drinks into the mix reduces the

unbranded, unpackaged balance of drink

consumption even further: an average 637 litres

per person per year of commercialised

alcoholic, hot, soft and dairy drinks was

consumed in 2008.

North America tops the charts, with 705 litres of

branded liquid per capita in 2008. Australasia is

second, with 638 litres of commercialised drinks

per person in 2008. Western Europe lags

further behind, with 569 litres.

Over the last decade, an average person in

North America added over 55 litres of

commercialised drinks to their yearly intake. At

the same time, an average person in Western

Europe and Australasia increased their intake

by 42 litres each.

Additional volumes came mostly on the back of

increases in soft drinks consumption.

Dairy was a main casualty in Western Europe

and North America, but not in Australasia.

Alcoholic drinks share is declining in Western

Europe but is still fairly stable in North America

and growing in Australasia.

Hot drinks are performing well in Australasia

and North America, but stagnating in Western

Europe.

30

Human Need for Fluids

Global Throat and Wallet

Euromonitor International

Global Picture: Human Fluid Intake, Maturing Zone

In the emerging markets of Latin

America and Eastern Europe,

packaged non-alcoholic drinks

accounted for around 22% of

recommended liquid intake in 2008,

up from 16% a decade earlier.

This steep rise bears testimony first

to the high level of investment in

the drinks industry since 1998 and,

second, to the strong growth of

retail consumption culture.

Crucially, the region is far from

reaching saturation point. Indeed,

using the industrialised markets as

a benchmark, per capita

consumption of branded nonalcoholic beverages has potential

to increase by upwards of 300

litres.

Forecasts to 2013 indicate growth

of around 24 litres.

The growth potential of these

maturing markets is at the core of

why all major multinational

beverage companies are looking to

strengthen their regional positions,

from Moscow to Mexico City.

31

Human Need for Fluids

Global Throat and Wallet

Euromonitor International

Pick and Mix Categories in Maturing Markets

Adding alcoholic drinks into the mix reduces

the unbranded, unpackaged balance of

drink consumption even further: an average

257 litres per person per year of

commercialised alcoholic, hot, soft and dairy

drinks was consumed in 2008.

Latin America averaged 338 litres of

branded liquid per capita in 2008. Eastern

Europe lags far behind, with only 177 litres.

Over the last decade, an average person in

Latin America added an impressive 83 litres

of commercialised drinks to their yearly

intake. At the same time, an average person

in Eastern Europe increased their intake by

67 litres.

Additional volumes came mostly on the

back of increases in soft drinks consumption

in Latin America, and in alcoholic drinks,

most notably beer, in Eastern Europe.

Soft drinks and alcoholic display the biggest

disparity in drinks consumption in the two

regions. An average person in Latin America

in 2008 consumed 205 litres of soft drinks

and 57 litres of alcoholic drinks. At the same

time, an average consumer in Eastern

Europe drank only 15 litres of soft drinks,

but 102 litres of alcoholic beverages.

32

Human Need for Fluids

Global Throat and Wallet

Euromonitor International

Global Picture: Human Fluid Intake, Untapped Zone

The low impact of packaged non-

alcoholic drinks in Asia-Pacific and

the Middle East/Africa is striking,

with branded products accounting

for little more than one in every 10

litres of recommended liquid intake

in 2008.

Low actual liquid consumption

across much of Africa and some of

the poorest countries of Asia goes

some way to explaining the

weakness, but it is also a reflection

of a widespread culture of

unbranded beverage consumption.

The opportunity for growth of

branded beverages is, by

implication, vast. For example, if

the mature zone is used as a

benchmark, per capita

consumption has potential to

increase by as much as 100 litres

over the medium to long term.

Given the size of the population in

this untapped area, estimated at

some 5 billion people, or 71% of

the world total in 2008, the growth

potential for all beverage sectors is

substantial.

33

Human Need for Fluids

Global Throat and Wallet

Euromonitor International

Only Pockets of Opportunity for Alcoholic Drinks

Unlike in regions with saturated and

maturing commercialised drinks

markets, adding alcoholic drinks into

the mix reduces the unbranded,

unpackaged balance of drink

consumption only marginally: an

average 98 litres per person per year

of commercialised alcoholic, hot, soft

and dairy drinks was consumed in

2008.

The two regions display very similar

share of throat profiles: Asia-Pacific

averaged 100 litres of branded liquid

per capita in 2008, and the Middle East

and Africa 95 litres.

However, Asia-Pacifics

commercialised drinks market was

much more dynamic than the market in

the Middle East and Africa. Over the

last decade, an average person in

Asia-Pacific increased commercialised

drinks consumption by 40 litres a year,

compared with only 15 litres in the

Middle East and Africa.

Additional volumes came mostly on the

back of increases in soft drinks

consumption, but also in alcoholic

drinks and dairy.

34

Global Throat and Wallet

Euromonitor International

Introduction

Setting the Scene

Dairy in Focus

Last Decade in Focus

Human Need for Fluids

Demographic Dividend in Drinks

Conclusions

Definitions

35

Demographic Dividend in Drinks

Global Throat and Wallet

Euromonitor International

Ageing Global Population Is Fuelling a Boom in Adult Drinks

There was a significant global expansion of the adult population over the period 1998-2008, which created a natural

platform of growth for emerging categories, such as RTD tea, RTD coffee, functional drinks and soy beverages. A

large number of new legal drinking age consumers coming into the 20-39 age band also created opportunities for the

alcoholic drinks industry.

Increasing concern for age or rather its effects on health has boosted demand for functional milk and probiotic

drinking yoghurts, a trend that is having a positive impact on dairy drinks sales at a global level.

Critically, the global population is continuing to age, especially in the industrialised markets and Eastern Europe. By

implication, this means there will be a burgeoning 40+ age band over the next 10 years. Harnessing the consumption

demands of this population will be one of the key challenges across the drinks industries.

The worlds key youthful demographics are in Latin America, Asia-Pacific, and the Middle East and Africa. Critically,

although the worlds population is ageing, some of the biggest investment in the short to medium term will be

channelled into emerging markets with a more youthful profile.

Key burgeoning age bands going forward

CSDs, fruit juice,

concentrates, dairy

Bottled water, RTD tea/coffee, functional drinks, beer,

pre-mixes, wine, spirits, hot coffee and tea

36

Demographic Dividend in Drinks

Global Throat and Wallet

Euromonitor International

Youthful Populations Drive Multi-profile Drinks 1998-2008

The decline in global throat participation of adult profile drinks between 1998 and 2008 reflects, firstly, youthful

demographics in key emerging markets of Latin America, Asia and the Middle-East/Africa, and, secondly, a global

surge in bottled water consumption, which has a multi-profile consumer base.

The global development of packaged water, in bulk, family and single-serve sizes, has offset a slowdown in

carbonates. Equally, there has been significant segmentation activity in fruit/vegetable juice, together with new

investment in the niche categories of flavoured milk, drinking yoghurt and soy beverages. Collectively, lunch box

consumption for children has increased across each of these sectors.

Both hot tea and hot coffee, two fundamentally adult profile sectors, have lost share of throat over the past decade.

Indeed, bringing new consumers on stream is a key challenge for the hot beverage industry. In alcoholic drinks, gains

in the share of throat of beer have been countered by slowdowns in wine and spirits. However, as a result of the

recession, in 2008 and 2009, beer has seen its worst performance of the last decade, as Eastern European markets,

such as Russia, which have been driving global beer growth, are seeing declines.

Adult Profile Drinks in Share of Throat Context

Note: Adult profile beverages are broadly defined as Alcoholic drinks, Hot drinks, Functional drinks, RTD coffee and RTD tea.

37

Demographic Dividend in Drinks

Global Throat and Wallet

Euromonitor International

Premiumisation Buoys Spending on Adult Drinks 1998-2008

The drop in share of wallet of adult profile drinks has been less than in throat over the past decade, due in large

measure to the growth of premium adult soft beverage sectors, such as energy drinks, RTD tea and RTD coffee. Adult

profile drinks have also been buoyed by the effective premiumisation of hot coffee, especially since 2003.

In alcoholic drinks, RTD premixes were a niche growth sector until 2003, cannibalising some value from wine, spirits

and beer, above all in the young adult market. However, both the wine and spirits category have enjoyed healthy

value growth over the past few years, due to consumers trading up to premium drinks.

Carbonates remain the dominant value sector in multi-profile beverages. The less precipitous decline in wallet share

versus throat share is indicative of weaker penetration by second tier brands at the global level.

Over the course of the review period, bottled water overtook fruit/vegetable juice to become the second ranked multiprofile sector. Crucially, the good-for-your-family beverage playing field has become more competitive year-on-year

Women are proving to be the most dynamic consumer segment behind the increasing importance of adult

consumption in dairy drinks. They are health-orientated in their choices and happy to try new dairy drink lines offering

properties benefiting the skin and the digestion, driving growth at sector level in more developed markets.

Adult Profile Drinks in Share of Wallet Context

Note: Adult profile beverages are broadly defined as Alcoholic drinks, Hot drinks, Functional drinks, RTD coffee and RTD tea.

38

Demographic Dividend in Drinks

Global Throat and Wallet

Euromonitor International

Children Still Account for One in Four of the Global Population

The global 0-15 age-band contracted by 1% over the 2003-2008 period, against growth of 13% in the over 65 band.

This is a reflection of declining birth rates in key population enclaves across Western and Eastern Europe.

In Russia and Germany, for example, under-15s account for only 14% of the population.

In the major markets of China and the US, populations are also ageing, with the under-15s accounting for little more

than one in every five people. In the case of China, this has led some economists to speculate that the country might

grow old before it grows rich.

The world, of course, is far from homogeneous, and there are a number of major emerging markets where

populations are youthful. Among the most important are India and Mexico, where the under-15 age band accounts for

almost one in every three people. In practical terms, this means that the labour pool is likely to increase by around

one million people a year in both countries between 2010 and 2025.

Key 0-14 populations:

Mexico

India

Saudi Arabia

Philippines

South Africa

Egypt

Indonesia

39

Demographic Dividend in Drinks

Global Throat and Wallet

Euromonitor International

Emerging Markets Are Key to Growth in Child-profile Drinks

The child population in the saturated markets (North America, Western Europe and Australasia) is forecast at 157

million in 2010, less than in Latin America and substantially below totals in the Middle East and Africa, and AsiaPacific. This sheds light on the likely direction of new product development in childrens drinks over the short to

medium term. Globally, children (aged 0-14) account for more than one in every four people on the planet.

The number of children is declining in Asia-Pacific, while growth is flat in Latin America, but both regions are identified

as a key focus for new investment, notably in carbonates, fruit juices, concentrates and liquid dairy. Between 2008

and 2010, carbonates, for example, are forecast to generate 2 billion litres of new consumption in Asia-Pacific and 3

billion litres in Latin America. By contrast, demand is forecast to slide by 3 billion litres in North America.

Until children reach teenage status, it is their parents who make the key consumption choices. However, concern over

sugary drinks tends to be less invasive in the emerging markets, which is why the big cola players will look to shore

up their positions over the next five years.

In the developed markets, there will be stronger promotional and marketing activity behind the nutritional benefits of

child-oriented drinks.

40

Demographic Dividend in Drinks

Global Throat and Wallet

Euromonitor International

Teenagers a Tough, but Lucrative Consumer Base to Crack

The over-14 teenage market is a key consumer base for energy drinks, sports drinks, carbonates and any beverage

product with a sociable and fun profile. It is, arguably, one of the toughest markets to crack in the beverage industry.

Equally, this population group is estimated to be one of the biggest soft drinks consumers in per capita terms. The

rewards of successful product development are, therefore, very high.

The Middle East and Africa and Latin America are the only regions where the teenage market is growing in size,

indicating that investment in new product activity is likely to be high in the future. Conversely, a sharp drop in Eastern

Europes teenage population is expected, with a related knock-on effect on teenage profile products.

In the richer industrialised regions, the teenage population growth rate is flat, but investment will continue to be high

in energy drinks and fun-profile products. This age band tends to be the least concerned about good-for-you products

because, critically, they are largely making their own consumption choices, unlike the under-15s.

41

Demographic Dividend in Drinks

Global Throat and Wallet

Euromonitor International

Time-rich Retirees are Key Growth Age Band in Europe

The legal drinking age varies between countries and regions, but broadly speaking the over-19 age band is the key

focus for all alcoholic drinks categories. It is increasing in size in all regions of the world, notably in Latin America. In

Mexico, for example, the adult pool is forecast to grow by upwards of one million a year to 2020. Beer, in particular, is

forecast to harness this demographic windfall.

Latin America and Asia-Pacific will also see the largest actual growth in consumption of wine and spirits to 2010.

These sectors are likely to become increasingly competitive, with white spirits, notably vodka, looking to win more

ground on brown spirits among the newest generation of legal drinking age consumers.

It is striking that Western Europe sits second only to Asia-Pacific in the size of its over 65 population, projected at 78

million in 2010, compared, for example, with 40 million in Latin America. This population of retired adults is time-rich,

which equates favourably with multi-occasion drinks, particularly hot tea, hot coffee and hot chocolate. This consumer

segment is also a golden niche for functional innovation in dairy drinks, as older consumers are happy to pay a

premium for products adapted to their specific nutritional needs.

42

Demographic Dividend in Drinks

Global Throat and Wallet

Euromonitor International

Adult Profile Drinks Sustain High Participation

In 2009, financial crisis and demographic pressures have intensified competition for the money spent on beverages.

Three of the top five sectors in terms of share of throat are broadly geared to an adult consumer base, namely hot

tea, hot coffee and beer.

Despite the economic recession, innovations in dairy drinks have continued to target adult consumers with specific

needs. Many adults place even more importance on health during periods of economic contraction, as the pressure to

look good and healthy increases for fear of losing their jobs. New product developments in 2009 have focused on the

introduction of lactose-free properties, cardio-vascular health-friendly soy lines and vitamin-enriched weight-control

dairy drinks.

Bottled water is the main multi-profile sector, but has come under pressure in the developed markets due to concern

over throwaway plastic bottles and their impact on the environment. This negative lobbying has also gained limited

momentum in emerging markets.

Carbonates, despite strong pressure, look like sustaining a significant share of both wallet and throat, with children

and young adults remaining the key consumer base.

Further, the adult categories of wine and spirits, which have lower shares of throat, continue to be key drivers of

spending.

43

Global Throat and Wallet

Euromonitor International

Introduction

Setting the Scene

Dairy in Focus

Last Decade in Focus

Human Need for Fluids

Demographic Dividend in Drinks

Conclusions

Definitions

44

Conclusions

Global Throat and Wallet

Euromonitor International

Key Industry Drivers

Segmentation

Health and Wellness

Segmentation within categories has become increasingly

Growing consumer awareness of health issues has been

important to share-of-throat gains.

In beer, for example, there has been highly effective

development of economy, standard and premium

segments. In times of boom and bust, this has enabled

consumers to cross-trade, depending on their available

disposable income.

Targeting women, children and older consumers is

becoming a norm, especially in saturated markets, not

only in terms of marketing but also packaging,

ingredients and colours.

a major determinant of share-of-throat over the past

decade, illustrated by significant upturns in categories

with a better-for-you image, such as bottled water, RTD

tea, soy beverages and low-calorie drinks.

Milk, historically a beneficiary of health consumption, has

been hit by the latest growth trends, firstly, because

there is greater beverage competition, and secondly,

because concern over cholesterol levels has weakened

demand.

Comfort consumption

Premiumisation

Consumer confidence globally is running at its lowest

Reduced milk demand over the past decade has been

ebb in years, and this is impacting marketing strategies.

Coca-Colas Open Happiness campaign, for example,

is a move to tap into desire for optimism at a time of

bleak macro-economic conditions. Also, the introduction

by Starbucks of a new range of hot tea is a bid to

capture the same type of stress-free aspiration.

In alcoholic drinks, there is also a related trend towards

escapist consumption as macro economies deteriorate.

offset in the dairy industry by successful development of

the value-added products flavoured milk and drinking

yoghurt. Both categories have become strong

competitors for good-for-you and functional soft drinks.

Premiumisation has also been important in the coffee

industry, driven by the on-trade.

This has raised the competitive stakes for hot tea, which

has so far been slow to develop a successful premium

tier at a global level.

45

Global Throat and Wallet

Conclusions

Euromonitor International

Diversity in Share Of Throat & Wallet

Portfolio Diversity

Portfolio diversity has become increasingly important

Saturated Zone

In the worlds developed markets of Western Europe,

across the drinks industries. Coca-Cola and PepsiCo, for

North America and Australasia, packaged non-alcoholic

example, used to be heavily weighted towards

drinks accounted for around 66% of recommended

carbonates, but both have moved aggressively into a

human fluid intake in 2009, up from just under 60% a

much broader range of categories over the past decade.

decade earlier.

This has radically changed the share-of-throat picture,

The upward curve has, however, hit a brick wall,

with bottled water and functional beverages becoming

indicating saturation. This means that brand growth will

increasingly high profile. This has raised the competitive

increasingly be driven by market share, in turn raising

bar for hot drinks, dairy drinks and mainstream soft

the share-of-throat competitive stakes to 2010 and

drinks.

beyond.

Maturing Zone

Untapped Zone

In the maturing markets of Latin America and Eastern

In the comparatively untapped zones of the Middle East

Europe, the packaged drinks industries are far from

saturation.

Branded products accounted for around 22% of

recommended liquid intake at the close of the review

period, up from 16% a decade earlier. A commensurate

rise in share is possible over the next 10-year period,

driven by high levels of investment from the major

multinationals.

and Africa, and Asia, branded products still account for

only one in every 10 litres of recommended liquid intake.

The growth potential of this region, with a combined

population of some 5 billion people, is vast. Crucially, this

region, more than any other, is likely to be the target of

stronger positions by multinationals across the beverage

industries.

46

Global Throat and Wallet

Euromonitor International

Introduction

Setting the Scene

Dairy in Focus

Last Decade in Focus

Human Need for Fluids

Demographic Dividend in Drinks

Conclusions

Definitions

47

Definitions

Global Throat and Wallet

Euromonitor International

General Definitions

All values expressed in this report are in US dollar terms, using a fixed exchange rate (2008, unless otherwise

stated).

2009 figures are based on Q2-Q3 2009 research and are, therefore, part-year estimates.

2009-2014 figures for Hot Drinks and Soft Drinks are based on preliminary research findings as of Q3 2009. Final

2009-2014 figures for Hot Drinks and Soft Drinks will be published by Euromonitor International in December 2009.

All forecast data are expressed in constant terms; inflationary effects are discounted. Conversely, all historical data

are expressed in current terms; inflationary effects are taken into account.

All volumes expressed in this report are in million litres and ready-to-drink (RTD) million litres.

Share of Throat volume sales of beverages.

Share of Wallet value sales of beverages.

Product coverage:

Alcoholic Drinks

Hot Drinks

Liquid Dairy

Soft Drinks

48

Definitions

Global Throat and Wallet

Euromonitor International

Alcoholic Drinks Definitions

Alcoholic Drinks coverage:

Beer: An alcoholic drink usually brewed from malt, sugar, hops and water and fermented with yeast. Some beers are

made by fermenting a cereal, especially barley, and therefore not flavoured by hops. Alcohol content for beer varies

as much as 14% abv (alcohol by volume), although 3.5-5% is most common. Beer is often loosely classified by the

nature in which it is made: Top fermented (ie ales, bitters, wheat beers, stouts, porters etc) Bottom fermented (ie all

lagers). Note: pre-mixed beers such as beer/lemonade, beer/whisky or beer/tequila mixtures are excluded from the

data. These are included in flavoured alcoholic beverages (FABs). Beer is the aggregation of lager, dark beer, stout

and LABs/NABs.

Cider/perry: Cider is made from fermented apple juice, while perry is made from fermented pear juice. Both artisanal

and industrial cider/perry are included.

RTDs/High-strength premixes: This the combination of RTD and high-strength premixes. RTD stands for ready-todrink. Other terms which may used for these products are FABs, alcopops and premixes. The RTDs sector is the

aggregation of malt-, wine-, spirit-based and other types of premixed drinks. These drinks usually have an alcohol

content of around 5%, but it can be as high as 10% abv. Premixes containing a high percentage of alcohol of around

15%+ combined with juice or any other soft drink are included here. These are usually marketed as a product to be

drunk neat with ice, to mix with an energy drink and/or to make cocktails. Fruit-flavoured, vodka-based spirits with an

alcohol content of between 16-21% are classified here. Examples: Aliz, Ursus Roter, Berentzen Fruchtige, Kleiner

Feigling.

Wine: This is the aggregation of still and sparkling light grape wines, fortified wine and vermouth and non-grape wine.

In terms of alcohol content, light wine usually falls into the 8-14% abv bracket, while fortified wine ranges from 14% to

23% abv. For this study, low- and non-alcoholic wine is also included in the data (attributed to each sector as

appropriate).

Spirits: This is the aggregation of whisk(e)y, brandy and cognac, white spirits, rum, tequila, liqueurs and other spirits.

49

Definitions

Global Throat and Wallet

Euromonitor International

Hot Drinks Definitions

Hot Drinks coverage:

Coffee: The aggregation of fresh and instant coffee.

Tea: Tea types and consumption habits differ greatly as a result, Western countries will focus more upon black tea,

whereas Asian countries (mainly Japan, China and South Korea, but also India, Thailand, Vietnam, Malaysia and

Indonesia) will focus more upon green and flavoured varieties. The three main categories of tea are black, green,

and oolong. Within each of these categories there are many varieties. Green teas, black teas and oolong teas come

from the same tea plant species, the difference being the processing of tea. Black tea undergoes several hours of

oxidation during preparation (accelerated by heat and humidity) whereas oolong tea is partially fermented and green

tea is steamed to stop oxidation.

Other hot drinks: Only malt- or plant-based powders, granules, blocks or tablets mixed with milk or water are

included. The packaging usually recommends either milk or water, but consumers do not always follow this for

different reasons, for example cultural reasons, and dietary or cultural requirements. These products can be

consumed hot or cold. The packaging often has serving recommendations.

Note: Flavoured powder milk drinks are excluded to avoid double-counting, as such powdered drinks are usually

mixed with milk.

50

Definitions

Global Throat and Wallet

Euromonitor International

Liquid Dairy Definitions

Liquid Dairy coverage:

Milk: This is the aggregation of fresh/pasteurised, long-life/UHT and goat milk. Note: Powdered milk (dehydrated)

used in place of fresh or long life milk or goat milk and infant milk formula is excluded.

Flavoured milk drinks: This is the aggregation of dairy-only flavoured milk drinks and flavoured milk drinks with fruit

juice. Note: Flavoured powder milk drinks are excluded.

Soy beverages: This is the aggregation of soy milk and soy drinks. Note: Only RTD liquid products are included. Soy

powder is excluded.

Drinking yoghurt: This is the aggregation of regular drinking and functional drinking yoghurt.

Sour milk drinks: Includes kefir, lassi as well as buttermilk and whey drinks. Kefir is significant in Eastern Europe. A

cultured-milk beverage, kefir has a creamy consistency and slightly sour taste. Kefir is prepared by culturing fresh

milk with kefir grains/ granules which are a natural mother-culture. Traditionally, butter milk is the slightly sour,

residual liquid which remains after butter is churned, ie milk from the butter or buttermilk. It is usually flecked with tiny

spots of sweet, creamy butter. The flavour of buttermilk is similar to yoghurt. Commercial buttermilk is nowadays

made by adding a lactic acid bacteria culture to pasteurised sweet milk, and it may or may not have added butter

flecks. The milk is later left to ferment. Low/reduced fat sour milk drinks are also included here.

Note: Coffee whiteners, condensed/evaporated milk, flavoured, functional condensed milk and cream are excluded.

51

Definitions

Global Throat and Wallet

Euromonitor International

Soft Drinks Definitions

Soft Drinks coverage:

Carbonates: Euromonitor International defines carbonates as all non-alcoholic drinks into which carbon dioxide gas

has been dissolved, and therefore the drink is carbonated. Carbonates are an aggregation of cola carbonates and

non-cola carbonates, whether regular or low-calorie.

Fruit/vegetable juice: This sector only includes still drinks. Carbonated varieties are included in the non-cola

carbonates subsector. Juice flavoured milk drinks and fruit shakes are excluded. However, fruit/vegetable drinks that

contain a minimum amount of milk are included within this sector. This sector is the aggregation of 100% juice,

nectars (25-99% juice content), juice drinks (up to 24% juice content) and fruit-flavoured drinks.

Bottled water: This sector includes sparkling water, spring water and purified/table water. This is the aggregation of

still bottled water, carbonated bottled water, flavoured bottled water and functional bottled water.

Functional drinks: This is the aggregation of sports drinks, energy drinks and elixirs. Health and meal replacement

drinks, such as Slim Fast and Pedialyte, are not included. Powder energy drinks are excluded and are included within

the powder concentrates subsector.

Concentrates: This is the aggregation of liquid concentrates and powder concentrates. RTD concentrates volumes

are calculated by applying an average conversion ratio for each country to as sold liquid and powder volumes. The

conversion ratios for liquid and for powder are specific to each country and can be viewed alongside as sold

volumes in the appendix of each country report.

RTD tea: This is the aggregation of still RTD tea and carbonated RTD tea.

RTD coffee: Includes packaged ready-to-drink coffee. This sector does not include coffee flavoured milk drinks.

Leading brands in off-trade volume include Georgia, Nescaf and Suntory Boss.

Asian speciality drinks: Asian speciality drinks are traditional drinks or national specialities commonly found in Asia.

This is the aggregation of Asian cereal-pulse based drinks, Asian juice drinks and other Asian speciality drinks.

52

Global Throat and Wallet

Euromonitor International

Experience more...

This research from Euromonitor International is part of a global strategic intelligence

system which offers a complete picture of the commercial environment . Also available

from Euromonitor International:

Global Briefings

Global Company Profiles

Country Market Insight Reports

The state of the market globally

and regionally, emerging trends

and pressing industry issues:

timely, relevant insight published

every month.

The competitive positioning and

strategic direction of the leading

companies including uniquely

sector-specific sales and share

data.

The key drivers influencing the

industry in each country;

comprehensive coverage of

supply-side and demand trends

and how they shape the future

outlook.

Interactive Statistical Database

Strategy Briefings

Learn More

Market sizes, market shares,

distribution channels and

forecasts; the complete market

analysed at levels of category

detail beyond any other source.

Executive debate on the global

trends changing the consumer

markets of the future.

To find out more about Euromonitor

International's complete range of

business intelligence on industries,

countries and consumers please visit

www.euromonitor.com or contact your

local Euromonitor International office:

London + 44 (0)20 7251 8024

Chicago +1 312 922 1115

Singapore +65 6429 0590

Shanghai +86 21 63726288

Vilnius +370 5 243 1577

Dubai +971 4 609 1340

53

You might also like

- American Wine Economics: An Exploration of the U.S. Wine IndustryFrom EverandAmerican Wine Economics: An Exploration of the U.S. Wine IndustryNo ratings yet

- My Favorite City CartagenaDocument1 pageMy Favorite City Cartagenalaura gutierrezNo ratings yet

- The Financial Crisis and the Global South: A Development PerspectiveFrom EverandThe Financial Crisis and the Global South: A Development PerspectiveNo ratings yet

- Mission Impossible? Fixing Nasa'S Financial Management: HearingDocument82 pagesMission Impossible? Fixing Nasa'S Financial Management: HearingScribd Government DocsNo ratings yet

- The Global Alcohol Industry: Daniel O'Leary - 1469525Document16 pagesThe Global Alcohol Industry: Daniel O'Leary - 1469525doleary1109No ratings yet

- Report Description: Chapter 1 IntroductionDocument28 pagesReport Description: Chapter 1 Introductionsidhujassi91No ratings yet

- 1Document6 pages1khansiNo ratings yet

- Alcoholic Beverage Eg MRDocument8 pagesAlcoholic Beverage Eg MRPSYCHO RockstarNo ratings yet

- Wine PestleDocument5 pagesWine PestleRaunaq Kulkarni0% (1)

- Alcoholic Beverages Industry in India: An Exploratory StudyDocument7 pagesAlcoholic Beverages Industry in India: An Exploratory StudyWayne GonsalvesNo ratings yet

- Case SM1 Updated v1Document15 pagesCase SM1 Updated v1Divya ChaudharyNo ratings yet

- Drinking To The Future Trends in The Spirits IndustryDocument48 pagesDrinking To The Future Trends in The Spirits Industryapi-237456292No ratings yet

- Chapter - 1 Industry Profile: Growth PotentialDocument33 pagesChapter - 1 Industry Profile: Growth PotentialPabitra BarikNo ratings yet

- Alcohol Industry in IndiaDocument9 pagesAlcohol Industry in IndiaashurebelNo ratings yet

- Alcoholic Beverage EGMRDocument8 pagesAlcoholic Beverage EGMRsherin sajanNo ratings yet

- Pulse Report Drinks Q2-2014Document20 pagesPulse Report Drinks Q2-2014IRIworldwideNo ratings yet

- Emerging Markets List: Morgan Stanley Capital International Emerging Market IndexDocument5 pagesEmerging Markets List: Morgan Stanley Capital International Emerging Market IndexMarietoni FernandezNo ratings yet

- Newb483 462c 8d11 D8417514ca97Document3 pagesNewb483 462c 8d11 D8417514ca97she2007No ratings yet

- Beverage Industrial AnalysisDocument15 pagesBeverage Industrial Analysisniveditha krishnaNo ratings yet

- Future Success Strategies For Carbonated Soft Drinks (CSDS) 2010 EditionDocument14 pagesFuture Success Strategies For Carbonated Soft Drinks (CSDS) 2010 EditionHrushikesh ReddyNo ratings yet

- Non Commercial AlcoholDocument9 pagesNon Commercial AlcoholKi Ageng Pangrekso BuwonoNo ratings yet

- 2011 Soft Drinks Report - UKDocument24 pages2011 Soft Drinks Report - UKSuraj RathiNo ratings yet

- Part I: Analysis of Case 5Document18 pagesPart I: Analysis of Case 5zigert51No ratings yet

- Part I: Analysis of Case 5Document10 pagesPart I: Analysis of Case 5Nguyễn Trung HiếuNo ratings yet

- Wine China TaxesDocument59 pagesWine China TaxesMarceloInversorNo ratings yet

- The Alcohol Industry - An OverviewDocument26 pagesThe Alcohol Industry - An OverviewPRINCE ABSON NSUNDWANE NSUNDWANENo ratings yet

- Customer Satisfaction Coca ColaDocument44 pagesCustomer Satisfaction Coca Colafm9490% (1)

- Fruit Juice SampleDocument22 pagesFruit Juice SampleVishnu SreekanthanNo ratings yet

- Report On Indian Beverage IndustryDocument19 pagesReport On Indian Beverage IndustryAvinash BulaniNo ratings yet

- TR 08 08 Whatshotaroundtheglobe-BeveragesDocument25 pagesTR 08 08 Whatshotaroundtheglobe-Beveragesapi-248965729No ratings yet

- Business CootDocument38 pagesBusiness CootOrfani Valencia MenaNo ratings yet

- Quilmes Marketing PlanDocument32 pagesQuilmes Marketing PlanMateo Herrera VanegasNo ratings yet

- DPR Bererages IndustryDocument2 pagesDPR Bererages Industrysamir sahagalNo ratings yet

- CP - 2 FinalDocument64 pagesCP - 2 FinalAashu SolankiNo ratings yet

- Presentation in EconomicsDocument7 pagesPresentation in EconomicsNorman Christopher LopezNo ratings yet

- Estudio Del Sector Soft DrinksDocument5 pagesEstudio Del Sector Soft Drinksjorge olayaNo ratings yet

- Araki LastDocument31 pagesAraki LastmelkamuNo ratings yet

- Coca Cola Case Study AnswerDocument2 pagesCoca Cola Case Study AnsweryeabinNo ratings yet

- Opportunities and Threats in 2008Document5 pagesOpportunities and Threats in 2008Tushar SharmaNo ratings yet

- Global Crisis eDocument4 pagesGlobal Crisis eAnonymous 6OPLC9UNo ratings yet

- Australian Wine IndexDocument22 pagesAustralian Wine IndexAustralian Wine Index100% (2)

- Competition in Energy Drinks. Sports Drinks. and Vitamin-Enhanced BeveragesDocument20 pagesCompetition in Energy Drinks. Sports Drinks. and Vitamin-Enhanced BeveragesTiiWiiNo ratings yet

- To The CustomersDocument31 pagesTo The CustomersSaranyaelangovan MargaretNo ratings yet

- Brand Book FinalDocument37 pagesBrand Book FinalDami Odumosu0% (1)

- CaseDocument5 pagesCaseHassan SheikhNo ratings yet

- The Bacardi LimitedDocument25 pagesThe Bacardi LimitedJefree SarkerNo ratings yet

- 1.external Environment: 1.1.current Situation in UK MarketDocument11 pages1.external Environment: 1.1.current Situation in UK MarketOana StanNo ratings yet

- Carbonated Soft Drinks Market Coca ColaDocument8 pagesCarbonated Soft Drinks Market Coca ColaRaja SufianNo ratings yet

- 04.10.11 Saad Salahuddin Managing Strategy AssignmentDocument6 pages04.10.11 Saad Salahuddin Managing Strategy Assignmentss242No ratings yet

- White Paper - Soft DrinksDocument18 pagesWhite Paper - Soft Drinksfahmeed786100% (1)

- An Analysis of Soft Drink Consumption TR-1 PDFDocument27 pagesAn Analysis of Soft Drink Consumption TR-1 PDFIoana VivisencoNo ratings yet

- Wine Distribution How Online Is Changing The Off-Trade WorldDocument38 pagesWine Distribution How Online Is Changing The Off-Trade WorldcrazychocoNo ratings yet

- Coca-Cola Case StudyDocument20 pagesCoca-Cola Case StudyFathi Salem Mohammed Abdullah86% (28)

- Cola Wars ContinueDocument6 pagesCola Wars Continueakusmarty123No ratings yet

- Final Report On ChacoDocument66 pagesFinal Report On ChacoSachidanand MauryaNo ratings yet

- Report On Hungarian Mineral Water MarketDocument15 pagesReport On Hungarian Mineral Water MarketyogeshibNo ratings yet

- Market InformationDocument2 pagesMarket InformationGustavoNo ratings yet

- Drinking Out of The Home - UK - July 2014 - Executive SummaryDocument5 pagesDrinking Out of The Home - UK - July 2014 - Executive SummaryjoanapjordaoNo ratings yet

- Project Title Consumer Behavior On Wines AT Winemo Inc: Page NoDocument54 pagesProject Title Consumer Behavior On Wines AT Winemo Inc: Page Nosreddy68No ratings yet

- 29 Psychological Tricks To Make You Buy MoreDocument14 pages29 Psychological Tricks To Make You Buy MoreDragosnicNo ratings yet

- Cocktail Reciepe KihmDocument11 pagesCocktail Reciepe KihmTaylor LeblancNo ratings yet

- 2023-11-04 09 - 55 - 54.725Document1 page2023-11-04 09 - 55 - 54.725Taylor LeblancNo ratings yet

- Uttarakhand Open University, Haldwani (Nainital)Document1 pageUttarakhand Open University, Haldwani (Nainital)Taylor LeblancNo ratings yet

- BHM 5th Sem (C Batch)Document24 pagesBHM 5th Sem (C Batch)Taylor LeblancNo ratings yet

- Tourism Quiz - 2013 List of Participants BHMCT 3 SEMDocument2 pagesTourism Quiz - 2013 List of Participants BHMCT 3 SEMTaylor LeblancNo ratings yet

- Monthly ExpenseDocument4 pagesMonthly ExpenseTaylor LeblancNo ratings yet

- Sl. No. Name of Teacher Mon Tue Wed Thu Fri Current Work LoadDocument2 pagesSl. No. Name of Teacher Mon Tue Wed Thu Fri Current Work LoadTaylor LeblancNo ratings yet

- Invigilation July 2013Document2 pagesInvigilation July 2013Taylor LeblancNo ratings yet

- Types of MealsDocument38 pagesTypes of MealsTaylor LeblancNo ratings yet

- Packing Unit: Pcs Pcs Pcs Pcs Pcs PcsDocument10 pagesPacking Unit: Pcs Pcs Pcs Pcs Pcs PcsTaylor LeblancNo ratings yet

- Sl. No. Name of Teacher Mon Tue Wed Thu Fri Current Work LoadDocument2 pagesSl. No. Name of Teacher Mon Tue Wed Thu Fri Current Work LoadTaylor LeblancNo ratings yet

- Accounts Accounts Accounts Accounts Accounts AccountsDocument2 pagesAccounts Accounts Accounts Accounts Accounts AccountsTaylor LeblancNo ratings yet

- BHM 5th Sem (Presentations)Document23 pagesBHM 5th Sem (Presentations)Taylor LeblancNo ratings yet

- Beer QuizDocument4 pagesBeer QuizTaylor LeblancNo ratings yet

- Sl. No. Name of Teacher Mon Tue Wed Thu Fri Current Work LoadDocument2 pagesSl. No. Name of Teacher Mon Tue Wed Thu Fri Current Work LoadTaylor LeblancNo ratings yet

- Gueridon Service Reference BookletDocument54 pagesGueridon Service Reference BookletTaylor Leblanc100% (2)

- Beer QuizDocument4 pagesBeer QuizTaylor LeblancNo ratings yet

- TypesofmealsDocument21 pagesTypesofmealsTaylor LeblancNo ratings yet

- Push :: Description: Here STACK Is An Array With MAX Locations. TOP Points To The Top Most Element and ITEM IsDocument1 pagePush :: Description: Here STACK Is An Array With MAX Locations. TOP Points To The Top Most Element and ITEM IsTaylor LeblancNo ratings yet

- BeerDocument9 pagesBeerTaylor LeblancNo ratings yet

- BHM 1ST SEM (2012-15 BATCH) : Name of Institute: Kukreja Institute of Management & Technology, DehradunDocument54 pagesBHM 1ST SEM (2012-15 BATCH) : Name of Institute: Kukreja Institute of Management & Technology, DehradunTaylor LeblancNo ratings yet

- Champak Aug (First) 09Document84 pagesChampak Aug (First) 09indianebooks100% (2)

- WinesDocument55 pagesWinesTaylor Leblanc100% (1)

- Tequila NotesDocument2 pagesTequila NotesTaylor Leblanc100% (1)

- Champak Aug (First) 09Document84 pagesChampak Aug (First) 09indianebooks100% (2)

- Beta Vulgaris - Chemical Composition - IndiaDocument6 pagesBeta Vulgaris - Chemical Composition - IndiaReni WulansariNo ratings yet

- Business Price IndexesDocument9 pagesBusiness Price IndexesSemitala TimothyNo ratings yet

- Cooking Equipment: 2. Open ElementDocument4 pagesCooking Equipment: 2. Open ElementleijuliaNo ratings yet

- Palak Malai Kofta in Mughlai GravyDocument5 pagesPalak Malai Kofta in Mughlai GravyTaoshobuddhaNo ratings yet

- LKPD 9 Procedure TextDocument4 pagesLKPD 9 Procedure TextDebby OktavianiNo ratings yet

- 2017 EIBN Sector Report Food and BeverageDocument47 pages2017 EIBN Sector Report Food and BeverageRizky PriantamaNo ratings yet

- Masala TeaDocument1 pageMasala TeamalarvkNo ratings yet

- Not Another Vegan Cookbook - Recipe BookDocument132 pagesNot Another Vegan Cookbook - Recipe BookMohit AshokNo ratings yet

- Mock Board Exam On Nutritional Biochemistry and Clinical Dietetics1Document25 pagesMock Board Exam On Nutritional Biochemistry and Clinical Dietetics1JermeLou Bao100% (14)

- GowardhanDocument11 pagesGowardhanBaiju SivaramanNo ratings yet

- Intermediate1 Unit 1 SB PDFDocument14 pagesIntermediate1 Unit 1 SB PDFJavier PercilesNo ratings yet

- PHV Food DefenseDocument49 pagesPHV Food DefenseJapsja JaNo ratings yet

- 10 Easy Diabetic Desserts (Low-Carb)Document12 pages10 Easy Diabetic Desserts (Low-Carb)jhjhghghgghNo ratings yet

- GPP 2022-2023 PPT EditedDocument215 pagesGPP 2022-2023 PPT EditedEdimar RingorNo ratings yet

- 02 Handout 2Document5 pages02 Handout 2Claire RosquitesNo ratings yet

- Goan CuisneDocument3 pagesGoan CuisneSunil KumarNo ratings yet

- Devendra (Division Agriculture, Nutrition Sciences International Development Research Centre Tanglin SingaporeDocument34 pagesDevendra (Division Agriculture, Nutrition Sciences International Development Research Centre Tanglin SingaporeMarisa PaysaNo ratings yet

- Price List - SengkoeloenDocument5 pagesPrice List - SengkoeloenhendryhotmaNo ratings yet

- NARRATIVE REPORT ON HEALTH CARE SEMINAR AND FEEDING PROGRAM AT MALVAR & History of BAKINGDocument4 pagesNARRATIVE REPORT ON HEALTH CARE SEMINAR AND FEEDING PROGRAM AT MALVAR & History of BAKINGMary Grace LopezNo ratings yet

- Nutrition: Dra - Esperanza Jean Ferrer-JimenezDocument56 pagesNutrition: Dra - Esperanza Jean Ferrer-JimenezDan FabrosNo ratings yet

- GIAE L1B Listening U1Document1 pageGIAE L1B Listening U1Aron GarateNo ratings yet

- Devondale Farmers Cookbook - Ebook 1.08.16Document39 pagesDevondale Farmers Cookbook - Ebook 1.08.16Anonymous 1ToVe0hNo ratings yet

- Foggy Bottom Hours + Location Circa BistrosDocument1 pageFoggy Bottom Hours + Location Circa BistrosSage BarnesNo ratings yet

- 442 Performace Guide Week2 0Document1 page442 Performace Guide Week2 0AlexNo ratings yet

- Vanaspati Ghee: Look For The Trans Fat Level While BuyingDocument6 pagesVanaspati Ghee: Look For The Trans Fat Level While BuyingSurya AgarwalNo ratings yet

- The Indian Summer Yoga Retreat in Salento BrochureDocument17 pagesThe Indian Summer Yoga Retreat in Salento BrochureJulie Chereath MeoNo ratings yet

- Too Much Information!: 1 GRAMMAR QuantifiersDocument3 pagesToo Much Information!: 1 GRAMMAR Quantifiersjhon kevinNo ratings yet

- How To Start Fish Farming in ZambiaDocument23 pagesHow To Start Fish Farming in ZambiaSte VenNo ratings yet

- Common Ingredients in Korean CusineDocument4 pagesCommon Ingredients in Korean CusineLorry Angela SalvatierraNo ratings yet

- Sitxfsa002: Participate in Safe Food Handling PracticesDocument23 pagesSitxfsa002: Participate in Safe Food Handling PracticesPitaram Panthi100% (1)