Professional Documents

Culture Documents

Aqualisa

Uploaded by

Adarsh Kumar DeoriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aqualisa

Uploaded by

Adarsh Kumar DeoriCopyright:

Available Formats

AQUALISA QUARTZ

Group 4, Section D

Situation Analysis

Industry Overview:

40% homes do not have showers (Untapped market)

Key Issues: Water Pressure and Temperature Control

Customer:

73% of the cases the plumber was directly/indirectly involved in the purchase decision (1)

Customers are reluctant to switch brands and 44% of the Sales consists of buying replacement

showers (2)

Developers want customizable products and at prices lower than MRP

Distribution Channels:

Gainsborough product is already present in 70% of DIY outlets

Only high end products are sold in showrooms which are visited by individual shoppers

Aqualisa has presence in 40% trade shops but staff cannot be trained in technology

QUARTZ

High Technology Product involving electronics

Sunk Costs: 5.8 million

In the future Quartz can lead to sister product cannibalism

Sales volume is as low as 30 units/day where expectation is of 200 units/day

Obj: Increase the sales volume of Quartz to 100 units/day in the short run

1: Exhibit 4

2: Exhibit 3

Quartz: Value Proposition

PLUMBERS

Value Proposition

Easy Installation- No need for

Bulky boxes / Excavating the

wall

Installation time reduction:

From 2 to 0.5 days

Push-Fit-Connect technology

General Product Dislikes

Integrated with Electronics

High on Innovation (Plumbers

distrusted too much

innovation)

Perceived notion of

complexity

CONSUMERS

Value Proposition

Water pressure control (12-18

l/min)

Temperature Control (41-45

Celsius)

One touch control

Once set automatic temperature

control

Safe for kids, Easy to use for

elderly

General Product Dislikes

Developers disliked high MRP

products

Why Quartz is not selling?

Plumber Dissatisfaction: Involved in direct/indirect purchase decision

73% of times and are wary of the innovation

High Margin Product:

Non customizable: Cannot capture 20% of the market held by

developers (1)

Customers:

Have low brand awareness

Usually do not switch between types of showers purchased. 44%

go for replacement within the brand used itself(2)

Presence in Premium Product Market

Premium product offered only in the Electric Shower segment

~16% Market share in electric shower segment. Mainly in

Gainsborough brand(3)Electric Showers

Triton

Mira

Gainsborough

Aqualisa

19%

4%

Heatree

3%

Sadia

Masco

Ideal

Standard

44%

Bristan

Hansgrohe

14% Others

16%

Grohe

Strategy to increase sales

volume

Introduce Aqualisa Quartz in DIY Sheds

Rationale: 1. 70% presence in 3,000 outlets in UK

2. Partnership with B&Q could help in product introduction without incurring

advertisements campaign costs

3. Quartz is a better product as compared to Electric Showers. Selling them in the

same shed could give a competitive edge to Quartz

4. DIY sheds are meant for easy to install products. Quartz is easy to install and

takes 0.5 days for installation

5. DIY Shed focus on consumers, Consumer needs are being satisfied by the

Quartzs Value Proposition.

6. Consumers can influence plumbers initial reluctance to use Qurtz

Action Plan: 1. Introduce Quartz at a MSP in the short run in DIY Sheds

2. Increase the stock of Aqualisa Quartz in DIY sheds and keep selling Electric

Showers under Gainsborough brand

3. Increase premium charged in Quartz over a period of time

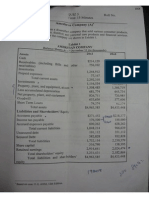

Current Price Structure

Proposed

MRP

Cost

Price

Margi

n

MRP

Cost

Price

Margi

n

Quartz

Standard

85

0

175

675

450

175

275

Quartz

Pumped

10

80

230

850

575

230

345

You might also like

- Aqualisa Quartz:Simply A Better Shower: Ayush Ravi Maaz Ahmad Shivam SahayDocument27 pagesAqualisa Quartz:Simply A Better Shower: Ayush Ravi Maaz Ahmad Shivam SahayAYUSH RAVINo ratings yet

- Aqua QuartzDocument12 pagesAqua QuartzRangan Majumder100% (2)

- Case Analysis-Aqualisa Quartz: Simply A Better Shower: Product Market Share-Aqualisa Market Share-Leader Aqualisa RankDocument4 pagesCase Analysis-Aqualisa Quartz: Simply A Better Shower: Product Market Share-Aqualisa Market Share-Leader Aqualisa RankSiddarth Baliga100% (1)

- Decision Sheet - Aqualisa QuartzDocument1 pageDecision Sheet - Aqualisa QuartzVince Lepcha100% (1)

- AqualisaDocument2 pagesAqualisaSaccharine Jewels100% (1)

- Aqualisa Case - Final v1Document20 pagesAqualisa Case - Final v1donkeytroddler100% (3)

- Aqualisa QuartzDocument6 pagesAqualisa QuartzSiddharth Bahri50% (2)

- Aqualisa Quartz CaseDocument6 pagesAqualisa Quartz CaseSrinivas Kannan100% (2)

- Aqualisa Quartz CaseDocument6 pagesAqualisa Quartz Caseaakash urangapuliNo ratings yet

- Aqualisa CaseDocument6 pagesAqualisa CaseArjun Talwar100% (1)

- Aqualisa Quartz Case RecommendationsDocument5 pagesAqualisa Quartz Case RecommendationsSrinivasa Raghavachar100% (1)

- Aqualisa Case - Final ReportDocument6 pagesAqualisa Case - Final ReportVishnu Menon100% (1)

- Case Memo of Aqualissa - GP KapfererDocument5 pagesCase Memo of Aqualissa - GP KapfererSohini Mo Banerjee100% (1)

- Aqualisa's disappointing Quartz shower salesDocument5 pagesAqualisa's disappointing Quartz shower salesPrateek Dhariwal100% (1)

- Decision Sheet For Aqualisa QuartzDocument1 pageDecision Sheet For Aqualisa QuartzPranav JainNo ratings yet

- AqualisaDocument18 pagesAqualisababeslayerbrit100% (1)

- Aqualisa QuartzDocument3 pagesAqualisa QuartzTatsat Pandey100% (1)

- Aqualisa 3Document4 pagesAqualisa 3blkbnnyc100% (1)

- AQUAliza Quartz CaseDocument29 pagesAQUAliza Quartz Caseshagun100% (1)

- Case Analysis of Aqualisa QuartzDocument6 pagesCase Analysis of Aqualisa QuartzDebarun Sengupta100% (1)

- MBA - GE PI Process FormDocument6 pagesMBA - GE PI Process FormBhaskar MohanNo ratings yet

- Group 10 - Sec F - Aqualisa QuartzDocument5 pagesGroup 10 - Sec F - Aqualisa Quartzanon_816306513100% (1)

- Aqualisa Quartz Sales StrategyDocument2 pagesAqualisa Quartz Sales Strategyverma92100% (1)

- AqualisaDocument19 pagesAqualisaReza Kusuma100% (1)

- Aqualisa Quartz - PPT FinalDocument18 pagesAqualisa Quartz - PPT FinalAshwin Chandrasekar100% (1)

- Aqualisa Quartz Simply A Better Shower SpreadsheetDocument6 pagesAqualisa Quartz Simply A Better Shower SpreadsheetZimam Khasin ArsyadNo ratings yet

- Rohm Hass 2Document5 pagesRohm Hass 2Wei DaiNo ratings yet

- Aqualisa Case Study Final 031009Document5 pagesAqualisa Case Study Final 031009Chihalau Luiza LarisaNo ratings yet

- Quartz Value PropositionDocument6 pagesQuartz Value PropositionchiragNo ratings yet

- Aqualisa Quartz Case SolutionDocument2 pagesAqualisa Quartz Case SolutionAnne SinitraNo ratings yet

- Aqualisa Quartz Case AnalysisDocument6 pagesAqualisa Quartz Case AnalysisBIKASH PANIGRAHI100% (1)

- Aqualisa Quartz Case Anaysis Submitted By: Aayushi Bhandari Pgfa1902Document7 pagesAqualisa Quartz Case Anaysis Submitted By: Aayushi Bhandari Pgfa1902aayushi bhandariNo ratings yet

- Aqualisa Quartz Case Analysis ReportDocument11 pagesAqualisa Quartz Case Analysis ReportJosine Jones100% (2)

- Aqualisa Quartz Simply A Better ShowerDocument12 pagesAqualisa Quartz Simply A Better ShowerPranjal SinghNo ratings yet

- Aqualisa Quartz-Syndicate 1 NDHIDocument9 pagesAqualisa Quartz-Syndicate 1 NDHIheber100% (1)

- Aqualisa Case QuestionsDocument3 pagesAqualisa Case Questionspunksta18250% (2)

- Aqualisa Quartz Case StudyDocument4 pagesAqualisa Quartz Case Studygoldstar090167% (3)

- Assignment Submission Form: This Will Be The First Page of Your AssignmentDocument3 pagesAssignment Submission Form: This Will Be The First Page of Your AssignmentSaiPraneethNo ratings yet

- Aqualisa Quartz Case Study AnalysisDocument1 pageAqualisa Quartz Case Study AnalysisSumedh Kakde50% (2)

- Marketing-1: Case AnalysisDocument3 pagesMarketing-1: Case AnalysisHimanshuNo ratings yet

- CSTR Notes 1-5 (Gaurav Pansari)Document9 pagesCSTR Notes 1-5 (Gaurav Pansari)Jai KamdarNo ratings yet

- Case Review R&HDocument20 pagesCase Review R&HdebarunsahaNo ratings yet

- Marketing Decision Making ConceptsDocument18 pagesMarketing Decision Making ConceptsAvi JainNo ratings yet

- Cola Wars PresentationDocument13 pagesCola Wars PresentationkvnikhilreddyNo ratings yet

- MC Case - Group 5Document4 pagesMC Case - Group 5Tarun AjwaniNo ratings yet

- Aqualiza ShowerDocument4 pagesAqualiza Showerranjitd07No ratings yet

- Suggested Case Preparation QuestionsDocument2 pagesSuggested Case Preparation QuestionsShaurya MittalNo ratings yet

- Aqualisa Quartz Shower Marketing StrategyDocument3 pagesAqualisa Quartz Shower Marketing StrategyNadya SafarinaNo ratings yet

- HummingbirDocument6 pagesHummingbirUjjwal VasishtNo ratings yet

- BARCO Case AssignmentDocument1 pageBARCO Case AssignmentTanyaNo ratings yet

- Aqualisa - Quartz Case StudyDocument8 pagesAqualisa - Quartz Case StudyNemish KuvadiaNo ratings yet

- Marketing AntidepressantsDocument2 pagesMarketing AntidepressantsAndie HenriquesNo ratings yet

- Case Analysis - Aqualisa QuartzDocument2 pagesCase Analysis - Aqualisa Quartzamitbharadwaj7100% (1)

- Barilla Spa (Hbs 9-694-046) - Case Study Submission: Executive SummaryDocument3 pagesBarilla Spa (Hbs 9-694-046) - Case Study Submission: Executive SummaryRichaNo ratings yet

- This Will Be The First Page of Your AssignmentDocument3 pagesThis Will Be The First Page of Your Assignmentbhanu agarwalNo ratings yet

- Barilla Case CDocument5 pagesBarilla Case CKenneth ChuaNo ratings yet

- Global Wine War 2015: New World Versus Old: Case AnalysisDocument3 pagesGlobal Wine War 2015: New World Versus Old: Case AnalysisAdit ShahNo ratings yet

- UK Shower Market Analysis: How to Boost Sales of Aqualisa's Quartz ShowerDocument34 pagesUK Shower Market Analysis: How to Boost Sales of Aqualisa's Quartz ShowerjockernituNo ratings yet

- G9 - D - AqualisaDocument8 pagesG9 - D - AqualisaMUSKAN MADAN PGP 2021-23 BatchNo ratings yet

- Acqua LisaDocument39 pagesAcqua LisaDeepta GuhaNo ratings yet

- New Server GUI IP ConfigsDocument1 pageNew Server GUI IP ConfigsAdarsh Kumar DeoriNo ratings yet

- SAP ConfigurationDocument1 pageSAP ConfigurationAdarsh Kumar DeoriNo ratings yet

- Bionics Idea Proposals - Assing 3Document6 pagesBionics Idea Proposals - Assing 3Adarsh Kumar DeoriNo ratings yet

- The Story of a 15 Year Old CowDocument5 pagesThe Story of a 15 Year Old CowAdarsh Kumar DeoriNo ratings yet

- Format Excel time ranges as half-hour intervalsDocument1 pageFormat Excel time ranges as half-hour intervalsAdarsh Kumar DeoriNo ratings yet

- Practice Problems Ans KeyDocument5 pagesPractice Problems Ans KeyAdarsh Kumar DeoriNo ratings yet

- Do More in Boy-Video Series Happy and Safe HoliDocument1 pageDo More in Boy-Video Series Happy and Safe HoliAdarsh Kumar DeoriNo ratings yet

- New Sandbox 172.29.152.32 05 SEP New Production 172.29.150.55 01 SEPDocument1 pageNew Sandbox 172.29.152.32 05 SEP New Production 172.29.150.55 01 SEPAdarsh Kumar DeoriNo ratings yet

- Canvas Character Plot Emotion Conflict/resolution/ Transformation (Why)Document1 pageCanvas Character Plot Emotion Conflict/resolution/ Transformation (Why)Adarsh Kumar DeoriNo ratings yet

- Presentation of Reducing Noice Using BionicsDocument5 pagesPresentation of Reducing Noice Using BionicsAdarsh Kumar DeoriNo ratings yet

- Innovation Through DiversityDocument20 pagesInnovation Through DiversitykasyapNo ratings yet

- Q5 (CashFlow)Document2 pagesQ5 (CashFlow)Adarsh Kumar DeoriNo ratings yet

- Ford Fiesta: RFM - Recency Frequency Monetary Product Life CycleDocument1 pageFord Fiesta: RFM - Recency Frequency Monetary Product Life CycleAdarsh Kumar DeoriNo ratings yet

- Clean Edge Razor - Grp04Document3 pagesClean Edge Razor - Grp04Adarsh Kumar DeoriNo ratings yet

- DM DPDSDocument7 pagesDM DPDSAdarsh Kumar DeoriNo ratings yet

- Group D2: Amod Sardesai Amrita Dokania Mora Shreyyanth Chari Shasikala Shishir Arya Srishti KhilnaniDocument8 pagesGroup D2: Amod Sardesai Amrita Dokania Mora Shreyyanth Chari Shasikala Shishir Arya Srishti KhilnaniAdarsh Kumar DeoriNo ratings yet

- DM QuestionsDocument10 pagesDM QuestionsAdarsh Kumar DeoriNo ratings yet

- Pccbs QuizDocument14 pagesPccbs QuizAdarsh Kumar DeoriNo ratings yet

- Hewlett-Packard Imaging Systems DivisionDocument5 pagesHewlett-Packard Imaging Systems DivisionAdarsh Kumar DeoriNo ratings yet

- ICICI MKT PresentationDocument8 pagesICICI MKT PresentationAdarsh Kumar DeoriNo ratings yet

- Practice Problems Ans KeyDocument5 pagesPractice Problems Ans KeyAdarsh Kumar DeoriNo ratings yet

- Enron - Dahbol Power ProjectDocument9 pagesEnron - Dahbol Power ProjectAdarsh Kumar DeoriNo ratings yet

- DS DominionDocument1 pageDS DominionAdarsh Kumar DeoriNo ratings yet

- DepreciationDocument85 pagesDepreciationAdarsh Kumar DeoriNo ratings yet

- Decision Sheet - Nirmal RayonsDocument1 pageDecision Sheet - Nirmal RayonsAdarsh Kumar DeoriNo ratings yet

- Session 3Document28 pagesSession 3Adarsh Kumar DeoriNo ratings yet

- PS 1 Slot I Exam Solution KS-1Document17 pagesPS 1 Slot I Exam Solution KS-1Adarsh Kumar DeoriNo ratings yet

- PressedDocument16 pagesPressedAdarsh Kumar DeoriNo ratings yet

- Consumption Investment Government Closed Economy FinalDocument8 pagesConsumption Investment Government Closed Economy FinalAdarsh Kumar DeoriNo ratings yet

- CASTME-Evaluating Bread QualityDocument6 pagesCASTME-Evaluating Bread QualityKunwar Apoorv Singh PariharNo ratings yet

- Contractor Safety Stand Down 2016Document25 pagesContractor Safety Stand Down 2016ekoimampNo ratings yet

- Intel Corporation International Marketing FinalDocument9 pagesIntel Corporation International Marketing FinalSõúmëñ AdhikaryNo ratings yet

- Cathedral Stars: Designed by Donna Jordan For Jordan Fabrics Finished Size 70 X 70"Document5 pagesCathedral Stars: Designed by Donna Jordan For Jordan Fabrics Finished Size 70 X 70"Carlos Sebastian Moreira100% (1)

- Furnishings of Medieval Peasant HousesDocument10 pagesFurnishings of Medieval Peasant HousesBianca IuliaNo ratings yet

- Inta212rp p01 W2a2 Harley-Bishop BDocument43 pagesInta212rp p01 W2a2 Harley-Bishop BBarbaraNo ratings yet

- 0:: G Z S 0 0 0 8 G S G 0 Zs 8 G E S:: S G Z G G G G Z 8 043 G:: 0Document20 pages0:: G Z S 0 0 0 8 G S G 0 Zs 8 G E S:: S G Z G G G G Z 8 043 G:: 0Maxsta 04No ratings yet

- HM 1C Kitchen Essentials Laboratory Exercise ActivityDocument13 pagesHM 1C Kitchen Essentials Laboratory Exercise ActivityWang Amora Prince KenwachiNo ratings yet

- Nielsen Final PowerpointDocument31 pagesNielsen Final Powerpointapi-325689771No ratings yet

- Definition of TermsDocument8 pagesDefinition of TermsJace EstrellaNo ratings yet

- The Launch of A New Biscuit BrandDocument2 pagesThe Launch of A New Biscuit BrandDharshana Muthtettugoda100% (2)

- Types of Pockets T: Ypes of Facing and InterfacingDocument22 pagesTypes of Pockets T: Ypes of Facing and Interfacinggrascia2010No ratings yet

- Bir RMC 55-2013Document8 pagesBir RMC 55-2013Coolbuster.NetNo ratings yet

- Leather Business PlanDocument7 pagesLeather Business PlanAmit KumarNo ratings yet

- Windflower Embroidery Stitching Guide PDFDocument25 pagesWindflower Embroidery Stitching Guide PDFVerdeamor100% (2)

- Knowing About The Concept of Nokia Outlets Through Audit and Observing Behaviour of Sales PramoterDocument29 pagesKnowing About The Concept of Nokia Outlets Through Audit and Observing Behaviour of Sales PramoterSulagna DharNo ratings yet

- Weaving Types & Looms ExplainedDocument17 pagesWeaving Types & Looms Explainedliza100% (2)

- Bread and PastryDocument8 pagesBread and PastrySuShi-sunIñigoNo ratings yet

- Observation ResultDocument4 pagesObservation Resultapi-257610307No ratings yet

- A Project Report On A COMPARATIVE MARKET PDFDocument49 pagesA Project Report On A COMPARATIVE MARKET PDFdiksha palNo ratings yet

- User Manual 2750Document10 pagesUser Manual 2750Len BenschopNo ratings yet

- Eligin National Watch Company - Case StudyDocument8 pagesEligin National Watch Company - Case StudypankajrikhyNo ratings yet

- Hapter: CRS Questions & AnswersDocument21 pagesHapter: CRS Questions & AnswersKJ MarquezNo ratings yet

- Commercial 95 340 - Product Profile - Rev. 13 Gale - May 2013Document1 pageCommercial 95 340 - Product Profile - Rev. 13 Gale - May 2013Aqil GhaffarNo ratings yet

- Zara India Case Study OriginalDocument1 pageZara India Case Study OriginalNarendra PatilNo ratings yet

- Blood Circulation:: KnittingDocument5 pagesBlood Circulation:: KnittingISSONNo ratings yet

- Vangibath Powder Recipe - Homemade Vangi Bath Masala Recipe - Cook With SmileDocument7 pagesVangibath Powder Recipe - Homemade Vangi Bath Masala Recipe - Cook With Smilecastingforge4875No ratings yet

- Finishing ChemicalsDocument8 pagesFinishing ChemicalsL.N.CHEMICAL INDUSTRYNo ratings yet

- Types of Seams and Seam Finishes ExplainedDocument2 pagesTypes of Seams and Seam Finishes ExplainedtoniiannNo ratings yet

- I Like Your Batman UnderwearDocument209 pagesI Like Your Batman UnderwearJv ChiuNo ratings yet