Professional Documents

Culture Documents

Financial Analysis Of Tata Motors Ltd

Uploaded by

Souvik GhoshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Analysis Of Tata Motors Ltd

Uploaded by

Souvik GhoshCopyright:

Available Formats

Financial Analysis Of Tata Motors Ltd.

Asim Bhawsinghka

Gaurav Lal

Karanveer Arora

Karan Sadarangani

Souvik Ghosh

In The Slides

Introduction to the company

Understanding the companys business

Companys Annual and Financial reports

Analysis of Financial reports

Tata Motors Ltd.

Indias largest automobile company

Listed at BSE & NSE; Also listed in NYSE

Commercial Vehicles

Passenger Vehicles

Product Range

C

o

m

m

e

r

c

i

a

l

V

e

h

i

c

l

e

s

Small Commercial

Vehicles

Pickups

Light Commercial

Vehicles

Medium & Heavy

Commercial Vehicles

LCV Passenger

Buses

P

a

s

s

e

n

g

e

r

V

e

h

i

c

l

e

s

Micro Size

Compact Size

Mid Size

Utility Vehicles

Vans

Premium & Luxury

cars

Markets

Asia & Oceania; India, Thailand & S. Korea (Manufacturing Facilities)

North America

Central & South America

Africa; S. Africa & Morocco (Manufacturing Facilities)

Europe; UK & Spain (Manufacturing Facilities); R&D centres

Annual Report 2013-14

AGM on Thursday, July 31, 2014

Chairman Mr. Cyrus P. Mistry

Tata Sons Ltd. holder of 26% shares

Auditors Deloitte Haskins & Sells LLP

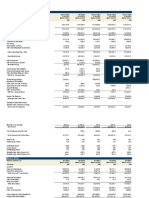

2013 - 2014 2012 - 2013 2011-12

Share Holder's Equity

Share Capital Rs. 643.78 Rs. 638.07 Rs. 634.75

Reserves and Surplus Rs. 18,532.87 Rs. 19,176.65 Rs. 18,496.77 Rs. 19,134.84 Rs. 18,732.91 Rs. 19,367.66

Non Current Liabilities

Long Term Borrowings Rs. 9,746.45 Rs. 8,051.78 Rs. 8,004.50

Deferred Tax Liabilities Rs. 43.11 Rs. 1,963.91 Rs. 2,105.41

Other Long Term Liabilities Rs. 1,155.48 Rs. 1,238.44 Rs. 1,959.63

Long Term Provisisons Rs. 815.20 Rs. 11,760.24 Rs. 691.19 Rs. 11,945.32 Rs. 685.56 Rs. 12,755.10

Current Liabilities

Short Term Borrowings Rs. 4,769.08 Rs. 6,216.91 Rs. 3,007.13

Trade Payables Rs. 9,672.36 Rs. 8,455.02 Rs. 8,705.53

Other Current Liabilities Rs. 2,463.18 Rs. 4,923.10 Rs. 7,470.95

Short Term Provisions Rs. 1,892.91 Rs. 18,797.53 Rs. 1,509.58 Rs. 21,104.61 Rs. 2,954.56 Rs. 22,138.17

Total Liabilities Rs. 30,557.77 Rs. 33,049.93 Rs. 34,893.27

Total Equity + Liabilities Rs. 49,734.42 Rs. 52,184.77 Rs. 54,260.93

Share Holders Equity & Liabilities

Balance Sheet (StandAlone)

Assets..

Balance Sheet

(StandAlone)

2013-14 2012-13 2011-12

Non Current Assets

Fixed Assets

Tangible Assets Rs. 12,133.50 Rs. 12,287.71 Rs. 11,746.47

Intangible Assets Rs. 3,107.07 Rs. 3,168.03 Rs. 3,273.05

Capital Work-In Progress Rs. 1,716.85 Rs. 1,507.84 Rs. 1,910.30

Intangible Assets in Development Rs. 4,638.22 Rs. 21,595.64 Rs. 3,244.96 Rs. 20,208.54 Rs. 2,126.37 Rs. 19,056.19

Non Current Investments Rs. 18,357.57 Rs. 18,171.71 Rs. 17,903.29

Long Term Loans and Advances Rs. 2,918.30 Rs. 3,575.24 Rs. 3,488.11

Other non-current assets Rs. 123.85 Rs. 21,399.72 Rs. 94.32 Rs. 21,841.27 Rs. 100.42 Rs. 21,491.82

Current Assets

Current Investments Rs. 100.85 Rs. 1,762.68 Rs. 2,590.26

Inventories Rs. 3,862.53 Rs. 4,455.03 Rs. 4,588.23

Trade Receivables Rs. 1,216.70 Rs. 1,818.04 Rs. 2,708.32

Cash and Bank Balances Rs. 226.15 Rs. 462.86 Rs. 1,840.96

Short-Term Loans and Advances Rs. 1,223.77 Rs. 1,532.09 Rs. 1,871.74

Other Current Assets Rs. 109.06 Rs. 6,739.06 Rs. 104.26 Rs. 10,134.96 Rs. 113.41 Rs. 13,712.92

Total Assets Rs. 49,734.42 Rs. 52,184.77 Rs. 54,260.93

FY13-14 FY12-13 FY11-12

Revenue From Operations Rs. 37,758.00 Rs. 49,319.73 Rs. 59,220.94

Less: Excise Duty Rs. -3,469.89 Rs. -4,554.01 Rs. -4,914.38

Revenue (Net Sales) Rs. 34,288.11 Rs. 44,765.72

Rs. 54,306.56

Other Income Rs. 3,833.03 Rs. 2,088.20 Rs. 574.08

Total Revenue 38,121.14 46,853.92 54,880.64

Expenses

Cost Of Material Consumed (COGS) Rs. 20,492.87 Rs. 27,244.28 Rs. 33,894.82

Purchase Of Product For Sale (COGS) Rs. 5,049.82 Rs. 5,864.45 Rs. 6,433.95

Changes In Inventories Of Finished Goods, Work-In-

Progress, and Product For Sale(COGS)

Rs. 371.72

Rs. 25,914.41

Rs. -143.60 Rs. 32,965.13 Rs. -623.84 Rs. 39,704.93

Gross Profit

Rs. 12,206.73 Rs. 13,888.79

Rs. 15,175.71

Operational Expenses (+ Depreciation + Interest)

Employee Cost Rs. 2,877.69 Rs. 2,837.00 Rs. 2,691.45

Finance Cost(Inc Interest) Rs. 1,337.52 Rs. 1,387.76 Rs. 1,218.62

Depriciation & Ammortization Expense Rs. 2,070.30 Rs. 1,817.62 Rs. 1,606.74

Product Development Expense Rs. 428.74 Rs. 425.76 Rs. 234.25

Other Expenses Rs. 6,987.53 Rs. 7,783.32 Rs. 8,405.51

Expenditure Transferred To Capial & Other Accounts Rs. -1,009.11

Rs. 12,692.67

Rs. -953.80 Rs. 13,297.66 Rs. -907.13 Rs. 13,249.44

Profit Before Exceptional Items, Extra Ordinary Items, & Tax

Rs. -485.94 Rs. 591.13 Rs. 1,926.27

Exceptional Items Rs. 539.86 Rs. 416.20

Rs. 585.24

Profit Before Extra Ordinary Items & Tax Rs. -1,025.80 Rs. 174.93 Rs. 1,341.03

Profit Before Tax Rs. -1,025.80 Rs. 174.93 Rs. 1,341.03

Tax (Credit)/ Expense Rs. -1,360.32 Rs. -126.88 Rs. 98.80

Profit After Tax Rs. 334.52 Rs. 301.81 Rs. 1,242.23

Detailed Analysis BS, PnL

(StandAlone)

Horizontal and Vertical Analysis

Solvency Ratios..

FY14 FY13

Ashok Leyland

FY14

Industry Auto

LCV/HCV

FY14 FY13

Working Capital (in Rs. Crores)

Rs. -12,058.47 Rs. -10,969.65 Rs. -731.167

Current Ratio 19/53 0.36 85/177 0.48 21/25 0.84 0.92 0.96

Liquid Assets (in Rs. Crores)

Rs. 2,767.47 Rs. 5,575.67 Rs. 2495.7869

Liquid Ratio 130/883 0.15 121/458 0.26 27/50 0.54

Ratio of Fixed Assets to Long Term Liabilities

(times) 1.84 1.69 1.55

Debt - Equity Ratio 1.59 1.73 1.88 0.95 0.93

Number of times Interest charges earned (times) 0.25 1.13 0.77 Liquid Ratio(Gone down from FY13)

Decrease in Liquid Assets due to decrease in Current Investment (Redemption of shares of TML

Holdings and sale of MFs) whose cash is used to repay STB

Current Ratio(Gone down from FY13)

Decrease in Liquid Ratio due to decrease in

Solvency Ratios..

Liquid Ratio(Gone down from FY13)

Decrease in Liquid Assets due to decrease in Current Investment (Redemption of shares of TML Holdings

and sale of MFs) whose cash is used to repay STB

Current Ratio(Gone down from FY13)

Decrease in Liquid Ratio due to decrease in

TurnOver Ratios..

FY14 FY13

Ashok

Leyland

FY14

Industry

Auto

LCV/HCV

Accounts Receivable turnover ratio (times) 22.60 19.78

7.31

13.59

Number of days' sales in receivables (in days) 11.60 13.27

47.68

26.49

Inventory turnover ratio (times) 6.23 7.29

4.92

7.29

Number of days' sales in inventory (in days) 57.77 49.38 73.17 49.38

Profitability Ratios..

FY14 FY13

Ashok Leyland

FY14

Ratio of Net Sales to Assets (times) 1.05 1.27 0.94

Rate Earned on Total Assets 3% 3% 3%

Rate Earned on Stock Holders Equity 52% 47% 1%

Profit after tax (in Rs. Crores) 334.52 301.81

The weighted average number of Ordinary shares for Basic EPS Nos. 2732346381.00 2706014707.00

The weighted average number of A Ordinary shares for Basic EPS Nos. 481962228.00 481958717.00

Share of profit for Ordinary shares for Basic EPS in crores 280.26 252.09

Share of profit for A Ordinary shares for Basic EPS in crores 54.26 49.72

EPS (Ordinary shares , Basic) (in Rs.) 1.03 0.93

0.11

EPS ('A' Ordinary shares , Basic) (in Rs.) 1.13 1.03

Market Standing Ratios..

FY14 FY13

Ashok Leyland

FY14

Eicher Motors

FY14

PE Ratio (Ordinary Share; NSE , Sep1) (times) 506.97 351.36

PE Ratio (A Ordinary Share; NSE , Sep4) (times) 335.76

Total Dividends (In Rs. Crores) 648.56 645.2

15964.06

(lakhs)

Weight for Ordinary Shares 543.27 540.45 2660676634.00

Weight for A Ordinary shares 105.29 104.75

The weighted average number of Ordinary shares for Basic EPS

Nos. 2732346381 2706014707

The weighted average number of A Ordinary shares for Basic

EPS Nos. 481962228 481958717

Dividends per Share (Ordinary) (in Rs.) 1.99 1.99 0.6 (FY13)

Dividends per Share (A Ordinary) (in Rs.) 2.18 2.17

Dividend Payout Ratio (Ordinary Share) 194% 215% 36.80

Dividend Payout Ratio (A Ordinary Share) 194%

Dividend Yield on Common Stock (Ordinary Share) 0.38

Dividend Yield on Common Stock (A Ordinary Share) 0.53

Face Value

Tata Motors = 2

AshokLeyland =1

Eicher Motors = 10

Thank You.

You might also like

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Balance Sheet of Reliance IndustriesDocument5 pagesBalance Sheet of Reliance IndustriessampadaNo ratings yet

- Financial StatementsDocument14 pagesFinancial Statementsthenal kulandaianNo ratings yet

- in Rs. Cr.Document19 pagesin Rs. Cr.Ashish Kumar SharmaNo ratings yet

- Consumer Behaviour-Ramanuj MajumdarDocument407 pagesConsumer Behaviour-Ramanuj MajumdarSandeep Pandit50% (4)

- Hotel Industry - Portfolia AnalysisDocument26 pagesHotel Industry - Portfolia Analysisroguemba87% (15)

- CAPE 2003 AccountingDocument13 pagesCAPE 2003 AccountingStephen WhiteKnight BuchananNo ratings yet

- Financial Analysis (HDFC BANK)Document136 pagesFinancial Analysis (HDFC BANK)palmeet73% (62)

- 33 SITXFIN003 Student Version AnswersDocument62 pages33 SITXFIN003 Student Version AnswersShopee Lazada0% (2)

- Kolitz, David L. - Financial Accounting - A Concepts-Based Introduction-Routledge - Taylor & Francis Group (2017)Document631 pagesKolitz, David L. - Financial Accounting - A Concepts-Based Introduction-Routledge - Taylor & Francis Group (2017)murtadho75% (4)

- Colgate - 10 Year DataDocument10 pagesColgate - 10 Year DataAmal RoyNo ratings yet

- Financial Analysis of Nestle LTDDocument43 pagesFinancial Analysis of Nestle LTDShahbaz AliNo ratings yet

- Reliance Industries LTD.: Assignment 2Document27 pagesReliance Industries LTD.: Assignment 2Vishal RajNo ratings yet

- Balance Sheet of State Bank of IndiaDocument8 pagesBalance Sheet of State Bank of IndiaJyoti VijayNo ratings yet

- Enginee Rs India: Previous YearsDocument9 pagesEnginee Rs India: Previous YearsArun KanadeNo ratings yet

- Information On Dena BankDocument17 pagesInformation On Dena BankPradip VishwakarmaNo ratings yet

- HCL Technologies: Balance Sheet - in Rs. Cr.Document20 pagesHCL Technologies: Balance Sheet - in Rs. Cr.Kuldeep SinghNo ratings yet

- Ashok LeylandDocument13 pagesAshok LeylandNeha GuptaNo ratings yet

- Balance Sheet of Reliance IndustriesDocument5 pagesBalance Sheet of Reliance IndustriesMukesh bariNo ratings yet

- Indian Oil Corporation Project 2Document30 pagesIndian Oil Corporation Project 2Rishika GoelNo ratings yet

- Accounts AssignmentDocument7 pagesAccounts AssignmentHari PrasaadhNo ratings yet

- Master of Business Administration: Accounting For ManagerDocument19 pagesMaster of Business Administration: Accounting For ManagerDeep saliyaNo ratings yet

- Bibliography and Ane KumaranDocument6 pagesBibliography and Ane KumaranG.KISHORE KUMARNo ratings yet

- Revenue: Revenue & Net Profit/ (Loss) - 9 Months Ended 31st DecemberDocument2 pagesRevenue: Revenue & Net Profit/ (Loss) - 9 Months Ended 31st DecemberMihiri de SilvaNo ratings yet

- FM Project 700120043Document26 pagesFM Project 700120043Adnan SharifNo ratings yet

- Hindalco Industries FY19-20 Financial ReportDocument14 pagesHindalco Industries FY19-20 Financial ReportJaydeep SolankiNo ratings yet

- Onsolidated Balance Sheet of Jet Airways - in Rs. Cr.Document11 pagesOnsolidated Balance Sheet of Jet Airways - in Rs. Cr.Anuj SharmaNo ratings yet

- Ratio Analysis of TVS Motor CompanyDocument16 pagesRatio Analysis of TVS Motor CompanyRahul BabbarNo ratings yet

- JUL'Sep'12 Jul-Sep'11 Rupees RupeesDocument8 pagesJUL'Sep'12 Jul-Sep'11 Rupees RupeesMansoor AliNo ratings yet

- HUL Stand Alone StatementsDocument50 pagesHUL Stand Alone StatementsdilipthosarNo ratings yet

- Balance Sheet JSWDocument3 pagesBalance Sheet JSWTejas ArgulewarNo ratings yet

- Introduction of MTM: StatementDocument23 pagesIntroduction of MTM: StatementALI SHER HaidriNo ratings yet

- Profit and Loss and Balance Sheet of Idbi BankDocument11 pagesProfit and Loss and Balance Sheet of Idbi BankHarjeet KaurNo ratings yet

- HPCL profit and loss analysis for FY20 and FY19Document10 pagesHPCL profit and loss analysis for FY20 and FY19riyaNo ratings yet

- Tata Motors DCFDocument11 pagesTata Motors DCFChirag SharmaNo ratings yet

- Balance Sheet of Adora Products Pvt. LTD: Equities and LiabilitiesDocument4 pagesBalance Sheet of Adora Products Pvt. LTD: Equities and LiabilitiesPariniti GuptaNo ratings yet

- W16494 XLS EngDocument36 pagesW16494 XLS EngAmanNo ratings yet

- BST PROJECT FileDocument5 pagesBST PROJECT FileAR MASTERRNo ratings yet

- A Comparative Study On ITC PVT LTD and HUL PVT LTDDocument18 pagesA Comparative Study On ITC PVT LTD and HUL PVT LTDVishal RoyNo ratings yet

- Engineers India: Previous YearsDocument30 pagesEngineers India: Previous YearsArun KanadeNo ratings yet

- DR Umesh SolankiDocument29 pagesDR Umesh Solankivivek guptaNo ratings yet

- Assignments Semester IDocument13 pagesAssignments Semester Idriger43No ratings yet

- RP - CF1 - Financial Analysis and PlanningDocument22 pagesRP - CF1 - Financial Analysis and PlanningSamyu KNo ratings yet

- Bharat PetrolDocument10 pagesBharat Petroljhanvi tandonNo ratings yet

- UBL Financial Statement AnalysisDocument17 pagesUBL Financial Statement AnalysisJamal GillNo ratings yet

- Balance Sheet of Havells IndiaDocument5 pagesBalance Sheet of Havells IndiaMalarNo ratings yet

- A&F Assignment 2Document4 pagesA&F Assignment 2Tech PerusalNo ratings yet

- Punjab and Sind BankDocument13 pagesPunjab and Sind Banksimran jeetNo ratings yet

- FA Ratios AssignmentDocument61 pagesFA Ratios AssignmentShambhavi SinhaNo ratings yet

- ONGC Financial AnalysisDocument13 pagesONGC Financial Analysisdipshi92No ratings yet

- 96th Annual Report Ingersoll RandDocument122 pages96th Annual Report Ingersoll Randanon_587007360No ratings yet

- Income Statement and Balance Sheet Analysis of 5 YearsDocument26 pagesIncome Statement and Balance Sheet Analysis of 5 YearsNikhil BhatiaNo ratings yet

- Budgetary Control as a Tool for Cost ManagementDocument8 pagesBudgetary Control as a Tool for Cost ManagementDileepkumar K DiliNo ratings yet

- Quarterly Results in BriefDocument7 pagesQuarterly Results in BriefNaveenSharmaNo ratings yet

- Balance Sheet (Crore)Document10 pagesBalance Sheet (Crore)MOHAMMED ARBAZ ABBASNo ratings yet

- Annual Report 2018 Min - FINALDocument152 pagesAnnual Report 2018 Min - FINALraghavNo ratings yet

- JFHFFDocument18 pagesJFHFFUjjwal SharmaNo ratings yet

- Stock PitchDocument8 pagesStock PitchRaksha ShettyNo ratings yet

- Lecture Common Size and Comparative AnalysisDocument28 pagesLecture Common Size and Comparative AnalysissumitsgagreelNo ratings yet

- Financial Analysis Ratios Guide (FIN 1101Document21 pagesFinancial Analysis Ratios Guide (FIN 1101YASH BATRANo ratings yet

- Tata SteelDocument10 pagesTata SteelSakshi ShahNo ratings yet

- Comman Size Analysis of Income StatementDocument11 pagesComman Size Analysis of Income Statement4 7No ratings yet

- Bajaj Auto Fundamental Analysis: BY Sagir Kazi Submitted To:-Prof - Nitin TikkeDocument25 pagesBajaj Auto Fundamental Analysis: BY Sagir Kazi Submitted To:-Prof - Nitin TikkeRohan NimkarNo ratings yet

- Previous Years: Larse N and Toubr o - in Rs. Cr.Document12 pagesPrevious Years: Larse N and Toubr o - in Rs. Cr.Parveen BabuNo ratings yet

- Sapm Assignment: Piramal Enterprises LTDDocument23 pagesSapm Assignment: Piramal Enterprises LTDAjeet TripathiNo ratings yet

- SAPM Technical and Fundamental AnalysisDocument23 pagesSAPM Technical and Fundamental AnalysisVarghese JoseNo ratings yet

- Negotiation FinalDocument10 pagesNegotiation FinalSouvik GhoshNo ratings yet

- Marketing Decision-Product & PromotionDocument30 pagesMarketing Decision-Product & PromotionSouvik Ghosh100% (1)

- Introduction To Integrated Marketing CommunicationsDocument15 pagesIntroduction To Integrated Marketing CommunicationsSouvik GhoshNo ratings yet

- The Telescopic Contact Lens - FinalDocument12 pagesThe Telescopic Contact Lens - FinalSouvik GhoshNo ratings yet

- Allen Thomas KannattuDocument37 pagesAllen Thomas KannattuSouvik GhoshNo ratings yet

- 3 ProbabilityDocument54 pages3 ProbabilitySouvik Ghosh100% (1)

- 274 830 1 PBDocument8 pages274 830 1 PBSouvik GhoshNo ratings yet

- 4sampling and Sampling DistributionsDocument44 pages4sampling and Sampling DistributionsSouvik GhoshNo ratings yet

- AnshitaLalwani DivA DeloitteDocument18 pagesAnshitaLalwani DivA DeloitteSouvik GhoshNo ratings yet

- Accenture Service PVT - LTD - Priyanka DcostaDocument22 pagesAccenture Service PVT - LTD - Priyanka DcostaSouvik GhoshNo ratings yet

- T Test SolutionsDocument5 pagesT Test SolutionsSouvik GhoshNo ratings yet

- Estimation SolutionsDocument8 pagesEstimation SolutionsSouvik GhoshNo ratings yet

- Royal Orchid 13-14 PDFDocument99 pagesRoyal Orchid 13-14 PDFSouvik GhoshNo ratings yet

- Project ReportDocument37 pagesProject ReportSouvik GhoshNo ratings yet

- Business Combination HO Questions1Document8 pagesBusiness Combination HO Questions1Nicole Gole CruzNo ratings yet

- Financial Statement Analysis of KKR InfotechDocument32 pagesFinancial Statement Analysis of KKR InfotechDhanya vijeeshNo ratings yet

- Account balances as of Nov 2015Document4 pagesAccount balances as of Nov 2015Afrili Setio BoedionoNo ratings yet

- GSK Vs AciDocument20 pagesGSK Vs AciKanij FatemaNo ratings yet

- Accounting TerminologyDocument20 pagesAccounting TerminologyVenumadhav BandiNo ratings yet

- Annual Report 2007Document168 pagesAnnual Report 2007anithaasriiNo ratings yet

- CMA FormatDocument21 pagesCMA Formatapi-377123878% (9)

- Sbi Balance SheetDocument5 pagesSbi Balance SheetNirmal BhagatNo ratings yet

- Tutor Statement Cash FlowDocument3 pagesTutor Statement Cash Flowlavie nroseNo ratings yet

- Conceptual Framework & Accounting StandardsDocument30 pagesConceptual Framework & Accounting StandardsAndrea Nicole De Leon100% (1)

- LeverageDocument7 pagesLeverageKomal ThakurNo ratings yet

- Fs AnalysisDocument34 pagesFs Analysisbawangb21No ratings yet

- Soal Asistensi Akm 3 Pertemuan 4 Cash FlowDocument2 pagesSoal Asistensi Akm 3 Pertemuan 4 Cash Flowaldo sinagaNo ratings yet

- Ayush MittalDocument92 pagesAyush Mittaldeepti singhalNo ratings yet

- Inventories ExercisesDocument11 pagesInventories ExercisesVincrsp BogukNo ratings yet

- Kieso - Inter - ch10 - Ifrs Psak Ppe RevDocument59 pagesKieso - Inter - ch10 - Ifrs Psak Ppe RevJhoNo ratings yet

- Soal Teori:: Petunjuk: Kerjakan SOAL TEORI Dan SOAL PRAKTIKA Pada Kolom Jawaban Yang Tersedia !!Document6 pagesSoal Teori:: Petunjuk: Kerjakan SOAL TEORI Dan SOAL PRAKTIKA Pada Kolom Jawaban Yang Tersedia !!irma purnama ningrumNo ratings yet

- Corporation ExercisesDocument2 pagesCorporation ExercisesLily RonshakuNo ratings yet

- Momshies Counter StatementDocument3 pagesMomshies Counter StatementKarl Jason Dolar CominNo ratings yet

- Namma Kalvi 12th Accountancy Unit 5 Sura English Medium Guide PDFDocument15 pagesNamma Kalvi 12th Accountancy Unit 5 Sura English Medium Guide PDFAakaash C.K.No ratings yet

- Accountancy Project Ratio AnalysisDocument21 pagesAccountancy Project Ratio AnalysisTanmay ChaitanyaNo ratings yet

- Financial Statement Analysis ExplainedDocument36 pagesFinancial Statement Analysis ExplainedFiriehiwot BirhanieNo ratings yet

- FABIZ I FA S2 Non Current Assets Part 4Document18 pagesFABIZ I FA S2 Non Current Assets Part 4Andreea Cristina DiaconuNo ratings yet

- Actg 431 Quiz Week 3 Theory of Accounts (Part III) Intangible Assets QuizDocument7 pagesActg 431 Quiz Week 3 Theory of Accounts (Part III) Intangible Assets QuizMarilou Arcillas PanisalesNo ratings yet

- Tybms Sem5 Fa Nov19Document6 pagesTybms Sem5 Fa Nov19Hola GamerNo ratings yet

- Unit 8 Regulatory Framework of AccountingDocument16 pagesUnit 8 Regulatory Framework of AccountingerrolbrandfordNo ratings yet