Professional Documents

Culture Documents

Chap 005rer

Uploaded by

Abhinav PandeyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 005rer

Uploaded by

Abhinav PandeyCopyright:

Available Formats

1

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

STRATEGY AND

COMPETITIVE

ADVANTAGE

CHAPTER 5

Screen graphics created by:

Jana F. Kuzmicki, PhD, Mississippi University for Women

The essence of strategy lies in

creating tomorrows competitive

advantages faster than competitors

mimic the ones you possess today.

Strategies for taking the hill

wont necessarily hold it.

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Gary Hamel and C.K. Prahalad

Amar Bhide

Quote

3

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Chapter Outline

Five Generic Competitive Strategies

Low-Cost Leadership Strategy

Broad Differentiation Strategies

Best-Cost Provider Strategies

Focused Low-Cost Strategies

Focused Differentiation Strategies

Vertical Integration Strategies

Merger and Acquisition Strategies

Cooperative Strategies

Offensive and Defensive Strategies

First-Mover Advantages and Disadvantages

4

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Strategy and Competitive Advantage

Competitive advantage exists when a firms

strategy gives it an edge in

Defending against competitive forces and

Securing customers

Convince customers firms product / service offers

superior value

Offer buyers a good product at a lower price

Use differentiation to provide a better product

buyers think is worth a premium price

Key to Gaining a Competitive Advantage

5

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

What is Competitive Strategy?

Consists of a companys market

initiatives and business approaches to

Attract and please customers

Withstand competitive pressures

Strengthen market position

Includes offensive and defensive moves to

Counter actions of key rivals

Shift resources to improve long-term market

position

Respond to prevailing market conditions

Narrower in scope than business strategy

6

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Objectives of Competitive Strategy

Build a competitive advantage

Cultivate clientele of loyal customers

Knock the socks off rivals, ethically and

honorably

7

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Figure 5.1: The Five Generic

Competitive Strategies

M

a

r

k

e

t

T

a

r

g

e

t

Type of Advantage Sought

Overall Low-Cost

Provider

Strategy

Broad

Differentiation

Strategy

Focused

Low-Cost

Strategy

Focused

Differentiation

Strategy

Best-Cost

Provider

Strategy

Lower Cost Differentiation

Broad

Range of

Buyers

Narrow

Buyer

Segment

or Niche

Table 5-1: Distinctive

Features of the Five

Generic Competitive

Strategies

Which hat

is unique?

9

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Low-Cost Leadership

Make achievement of low-cost relative to

rivals the theme of firms business strategy

Find ways to drive costs out of business year-

after-year

Low-cost leadership means low

OVERALL costs, not just low

manufacturing or production costs!

Low-cost leadership means low

overall costs, not just low

manufacturing or production costs!

Keys to Success

10

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Options: Achieving a Low-Cost Strategy

Open up a sustainable cost advantage

over rivals, using lower-cost edge to either

Under-price rivals and

reap market share gains

or

Earn higher profit margin

selling at going price

11

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Figure 5.2: Reconfiguring Value Chain

Systems to Lower Costs -- Software Industry

A. Value Chain System of Software Developers Using

Traditional Wholesale-Retail Channels - Highest Cost

Software

development

activities

CD-ROM

production

and

packaging

activities

Marketing

and

promotion of

software

Warehousing

and shipping

of

wholesaler-

retailer

orders

Technical

support

activities

Activities of

software

retailers

Activities of

wholesale

distributors

of software

products

12

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Figure 5.2: Reconfiguring Value Chain

Systems to Lower Costs -- Software Industry

B. Value Chain System of Software Developers

Using Direct Sales and Physical Delivery of CDs

Software

development

activities

CD-ROM

production

and

packaging

activities

Direct and

online

marketing

and

promotion

activities

Ware-

housing and

shipping of

customer

orders

Technical

support and

customer

service

activities

C. Value Chain System of Software Developers

Using Online Sales and Internet Delivery - Lowest Cost

Software

development

activities

Online

marketing

and

promotion

activities

Systems to

accept credit

card

payment and

allow

immediate

download

Technical

support and

customer

service

activities

13

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Approaches to Securing

a Cost Advantage

Do a better job than rivals of

performing value chain activities

efficiently and cost effectively

Approach 1

Revamp value chain to bypass cost-

producing activities that add little

value from the buyers perspective

Approach 2

Control

costs!

By-pass

costs!

14

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Approach 1: Controlling the Cost Drivers

Capture scale economies; avoid scale diseconomies

Capture learning and experience curve effects

Manage costs of key resource inputs

Consider linkages with other activities in value chain

Find sharing opportunities with other business units

Compare vertical integration vs. outsourcing

Assess first-mover advantages vs. disadvantages

Control percentage of capacity utilization

Make prudent strategic choices related to operations

15

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Approach 2: Revamping the Value Chain

Abandon traditional business methods and shift to e-

business technologies and use of Internet

Use direct-to-end-user sales/marketing methods

Simplify product design

Offer basic, no-frills product/service

Shift to a simpler, less capital-intensive, or more

flexible technological process

Find ways to bypass use of high-cost raw materials

Relocate facilities closer to suppliers or customers

Drop something for everyone approach and focus on

a limited product/service

Reengineer core business processes

16

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Keys to Success in Achieving

Low-Cost Leadership

Scrutinize each cost-creating activity, identifying

cost drivers

Use knowledge about cost drivers to manage

costs of each activity down year after year

Find ways to reengineer how activities are

performed and coordinatedeliminate the costs

of unnecessary work steps

Be creative in cutting low value-added activities

out of value chain systemre-invent the

industry value chain

17

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Characteristics of a

Low-Cost Provider

Cost conscious corporate culture

Employee participation in cost-control efforts

Ongoing efforts to benchmark costs

Intensive scrutiny of budget requests

Programs promoting continuous cost

improvement

Low-cost producers champion

FRUGALITY while aggressively

INVESTING in cost-saving improvements!

Successful low-cost producers champion

frugality but wisely and aggressively

invest in cost-saving improvements !

18

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

When Does a Low-Cost

Strategy Work Best?

Price competition is vigorous

Product is standardized or readily available

from many suppliers

There are few ways to achieve

differentiation that have value to buyers

Most buyers use product in same ways

Buyers incur low switching costs

Buyers are large and have

significant bargaining power

Industry newcomers use introductory low prices to

attract buyers and build customer base

19

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Pitfalls of Low-Cost Strategies

Being overly aggressive in cutting price

Low cost methods are easily imitated by rivals

Becoming too fixated on reducing costs

and ignoring

Buyer interest in additional features

Declining buyer sensitivity to price

Changes in how the product is used

Technological breakthroughs open up cost

reductions for rivals

20

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Differentiation Strategies

Incorporate differentiating features that cause

buyers to prefer firms product or service over

brands of rivals

Find ways to differentiate that create value for

buyers and that are not easily matched or

cheaply copied by rivals

Not spending more to achieve differentiation than

the price premium that can be charged

Keys to Success

Objective

21

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Appeal of Differentiation Strategies

A powerful competitive approach when

uniqueness can be achieved in ways that

Buyers perceive as valuable and are

willing to pay for

Rivals find hard to match or copy

Can be incorporated

at a cost well below

the price premium

that buyers will pay

Which hat

is unique?

22

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Benefits of Successful Differentiation

A product / service with unique and

appealing attributes allows a firm to

Command a premium price and/or

Increase unit sales and/or

Build brand loyalty

= Competitive Advantage

23

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Types of Differentiation Themes

Unique taste -- Dr. Pepper

Multiple features -- Microsoft Windows and Office

Wide selection and one-stop shopping -- Home

Depot and Amazon.com

Superior service -- FedEx, Ritz-Carlton

Spare parts availability -- Caterpillar

More for your money -- McDonalds, Wal-Mart

Prestige -- Rolex

Quality manufacture -- Honda, Toyota

Technological leadership -- 3M Corporation, Intel

Top-of-the-line image -- Ralph Lauren, Chanel

24

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Sustaining Differentiation: The Key to

Competitive Advantage

Most appealing approaches to differentiation

Those hardest for rivals to match or imitate

Those buyers will find most appealing

Best choices for gaining a longer-lasting, more

profitable competitive edge

New product innovation

Technical superiority

Product quality and reliability

Comprehensive customer service

Unique competitive capabilities

25

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Where to Find Differentiation

Opportunities in the Value Chain

Purchasing and procurement activities

Product R&D and product design activities

Production process / technology-related activities

Manufacturing / production activities

Distribution-related activities

Marketing, sales, and customer service activities

Internally

Performed

Activities,

Costs, &

Margins

Activities,

Costs, &

Margins of

Suppliers

Buyer/User

Value

Chains

Activities, Costs,

& Margins of

Forward Channel

Allies &

Strategic Partners

26

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

How to Achieve a

Differentiation-Based Advantage

Incorporate product features/attributes that lower

buyers overall costs of using product

Approach 1

Incorporate features/attributes that raise the

performance a buyer gets out of the

product

Approach 2

Incorporate features/attributes that enhance buyer

satisfaction in non-economic or intangible ways

Approach 3

Compete on the basis of superior capabilities

Approach 4

27

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Signaling Value as Well as

Delivering Value

Buyers seldom pay for value that is not

perceived

Signals of value may be as important

as actual value when

Nature of differentiation is hard to

quantify

Buyers are making first-time

purchases

Repurchase is infrequent

Buyers are unsophisticated

28

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

When Does a Differentiation

Strategy Work Best?

There are many ways to differentiate a

product that have value and please

customers

Buyer needs and uses are diverse

Few rivals are following a similar

differentiation approach

Technological change and product

innovation are fast-paced

29

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Pitfalls of Differentiation Strategies

Trying to differentiate on a feature buyers do

not perceive as lowering their cost or enhancing

their well-being

Over-differentiating such that product

features exceed buyers needs

Charging a price premium that

buyers perceive is too high

Failing to signal value

Not understanding what buyers want or prefer

and differentiating on the wrong things

30

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Competitive Strategy Principle

A low-cost producer strategy can

defeat a differentiation strategy

when buyers are satisfied with a

standard product and do not see

extra attributes as worth paying

additional money to obtain!

A low-cost provider strategy can

defeat a differentiation strategy

when buyers are satisfied with

a standard product and do not

see extra differentiating

attributes as worth

paying for!

31

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Best Cost Provider Strategies

Combine a strategic emphasis on low-cost with a

strategic emphasis on differentiation

Make an upscale product at a lower cost

Give customers more value for the money

Deliver superior value by meeting or exceeding

buyer expectations on product attributes and

beating their price expectations

Be the low-cost provider of a product with good-to-

excellent product attributes, then use cost

advantage to underprice comparable brands

Objectives

32

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

How a Best-Cost Strategy

Differs from a Low-Cost Strategy

Aim of a low-cost strategy--Achieve lower costs

than any other competitor in the industry

Intent of a best-cost strategy--Make a more

upscale product at lower costs than the makers

of other brands with comparable features and

attributes

A best-cost provider cannot be the industrys

absolute low-cost leader because of the added

costs of incorporating the additional upscale

features and attributes

that the low-cost leaders

product doesnt have

33

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Competitive Strength of a

Best-Cost Provider Strategy

A best-cost providers competitive advantage

comes from matching close rivals on key product

attributes and beating them on price

Success depends on having the skills and

capabilities to provide attractive performance

and features at a lower cost than rivals

A best-cost producer can often out-compete both

a low-cost provider and a differentiator when

Standardized features/attributes wont meet the

diverse needs of buyers

Many buyers are price and value sensitive

34

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Risk of a Best-Cost Provider Strategy

Risk A best-cost provider may get

squeezed between strategies of firms using

low-cost and differentiation strategies

Low-cost leaders may be able to siphon

customers away with a lower price

High-end differentiators may be able to steal

customers away with better product

attributes

35

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Focus / Niche Strategies

Involve concentrated attention on a narrow

piece of the total market

Serve niche buyers better than rivals

Choose a market niche where buyers have

distinctive preferences, special requirements, or

unique needs

Develop unique capabilities to serve needs of

target buyer segment

Objective

Keys to Success

36

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Focus / Niche Strategies

and Competitive Advantage

Achieve lower costs than

rivals in serving the segment --

A low-cost strategy

Offer niche buyers something

different from rivals --

A differentiation strategy

Approach 1

Approach 2

Which hat

is unique?

37

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Examples of Focus Strategies

eBay

Online auctions

Porsche

Sports cars

Horizon and Comair (commuter airlines)

Link major airports with small cities

Jiffy Lube International

Maintenance for motor vehicles

Bandag

Specialist in truck tire recapping

38

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

What Makes a Niche

Attractive for Focusing?

Big enough to be profitable and offers good

growth potential

Not crucial to success of industry leaders

Costly or difficult for multi-segment competitors to

meet specialized needs of niche members

Focuser has resources and capabilities to

effectively serve an attractive niche

Few other rivals are specializing in same niche

Focuser can defend against challengers via

superior ability to serve niche members

39

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Risks of a Focus Strategy

Competitors find effective ways to match a

focusers capabilities in serving niche

Niche buyers preferences shift towards

product attributes desired by majority of

buyers - niche becomes part of

overall market

Segment becomes so attractive

it becomes crowded with rivals,

causing segment profits to

be splintered

40

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Cooperative Strategies

Companies sometimes use strategic

alliances or collaborative partnerships to

complement their own strategic initiatives

and strengthen their competitiveness. Such

cooperative strategies go beyond normal

company-to-company dealings but fall short

of merger or formal joint venture.

41

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Why Cooperative Strategies Are Integral

to a Firms Competitiveness

Collaborative arrangements can help a company lower its

costs or gain access to needed expertise and capabilities

Firms often lack the resources and competitive skills to be

successful in very demanding competitive races

Allies can be useful in helping a company establish a

stronger presence in global markets and helping it win

the race for global market leadership

Allies with competitively useful technological know-how

or expertise can greatly aid a company racing against

rivals for leadership in the industries of the future now

being created by todays technological and information

age revolution

Collaborative arrangements with foreign partners can be

very helpful in pursuing opportunities in unfamiliar national

markets

42

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Competitive Value of

Strategic Alliances to the Partners

Capacity of partners to defuse organizational

frictions

Ability to collaborate effectively over time and work

through challenges

Technological and competitive surprises

New market developments

Changes in their own priorities

and competitive circumstances

Competitive advantage emerges when a company

acquires valuable capabilities via alliances it could

not obtain on its own, providing an edge over rivals

43

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Why are Strategic Alliances Formed?

To collaborate on technology development or

new product development

To fill gaps in technical or manufacturing

expertise

To acquire new competencies

To improve supply chain efficiency

To gain economies of scale in production and/or

marketing

To acquire or improve market access via joint

marketing agreements

44

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Potential Benefits of Alliances to Achieve

Global and Industry Leadership

Get into critical country markets quickly to accelerate

process of building a global presence

Gain inside knowledge about unfamiliar markets and

cultures

Access valuable skills and competencies concentrated

in particular geographic locations

Establish a beachead for participating in target industry

Master new technologies and build new expertise

faster than would be possible internally

Open up expanded opportunities in target industry by

combining firms capabilities with resources of partners

45

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Why Alliances Fail

Ability of an alliance to endure depends on

How well partners work together

Success of partners in responding

and adapting to changing conditions

Willingness of partners to renegotiate the bargain

Reasons for alliance failure include

Diverging objectives and priorities of partners

Inability of partners to work well together

Emergence of more attractive technological paths

Marketplace rivalry between one or more allies

46

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Merger - Combination and pooling of equals, with

newly created firm often taking on a new name

Acquisition - One firm, the acquirer, purchases

and absorbs operations of another, the acquired

Merger-acquisition

Much-used strategic option

Especially suited for situations where

alliances do not provide a firm with needed

capabilities or cost-reducing opportunities

Ownership allows for tightly integrated operations,

creating more control and autonomy than alliances

Merger and Acquisition Strategies

47

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Benefits of Mergers and Acquisitions

Combining operations may result in

More or better competitive capabilities

More attractive line-up of products / services

Wider geographic coverage

Greater financial resources to invest

in R&D, add capacity, or expand

Cost-saving opportunities

Filling in of resource or technological gaps

Stronger technological skills

Greater ability to launch next-wave products /

services

48

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Pitfalls of Mergers and Acquisitions

Combining operations may result in

Resistance from rank-and-file employees

Hard-to-resolve conflicts in management styles and

corporate cultures

Tough problems in combining and

integrating the operations of the

once-different companies

Greater-than-anticipated difficulties in

Achieving expected cost-savings

Sharing of expertise

Achieving enhanced competitive capabilities

49

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Vertical Integration Strategies

Vertical integration extends a firms

competitive scope within same industry

Backward into sources of supply

Forward toward end-users of final

product

Can aim at either full or partial integration

Internally

Performed

Activities,

Costs, &

Margins

Activities,

Costs, &

Margins of

Suppliers

Buyer/User

Value

Chains

Activities, Costs,

& Margins of

Forward Channel

Allies &

Strategic Partners

50

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Competitive Strategy Principle

A vertical integration strategy

has appeal only if it

significantly strengthens a

firms competitive position!

51

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Strategic Advantages of

Backward Integration

Generates cost savings only if volume needed is

big enough to capture efficiencies of suppliers

Potential to reduce costs exists when

Suppliers have sizable profit margins

Item supplied is a major cost component

Resource requirements are easily met

Can produce a differentiation-based competitive

advantage when it results in a better quality part

Reduces risk of depending on suppliers of crucial

raw materials / parts / components

52

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Strategic Advantages of

Forward Integration

Advantageous for a firm to establish its own

distribution network if

Undependable distribution channels undermine

steady production operations

Lacking a broad enough product line to justify

integrating forward into stand-alone distributorships

or retail outlets, a firm may sell directly to end users

Direct sales and Internet retailing may

Lower distribution costs

Produce a relative cost advantage over rivals

Enable lower selling prices to end users

53

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Strategic Disadvantages of

Vertical Integration

Boosts resource requirements

Locks firm deeper into same industry

Results in fixed sources of supply

and less flexibility in accommodating

buyer demands for product variety

Poses problems of balancing capacity at each

stage of value chain

May require radically different skills / capabilities

Reduces manufacturing flexibility, lengthening

design time and ability to introduce new products

54

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Pros and Cons of

Integration vs. De-Integration

Whether vertical integration is a viable or attractive

strategy depends on

How much it can lower cost, build expertise, increase

differentiation, or otherwise enhance performance of

strategy-critical activities

Its impact on investment cost, flexibility,

and administrative overhead

The contribution it makes to strengthening

a company market position or helping it

create competitive advantage

Many companies are finding that de-integrating,

unbundling, and out-sourcing value chain activities are a

better strategic option when it comes to lowering cost,

improving their competitiveness, or gaining added operating

flexibility

55

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Unbundling and Outsourcing Strategies

De-Integration or unbundling involves narrowing

the scope of the firms operations, focusing on

performing certain core value chain activities and

relying on outsiders to perform the remaining

value chain activities

Concept

Internally

Performed

Activities

Suppliers

Support

Services

Functional

Activities

Distributors

or Retailers

56

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

When Does Outsourcing

Make Strategic Sense?

Activity can be performed better or more cheaply by outside

specialists

Activity is not crucial to achieve a sustainable competitive

advantage

Risk exposure to changing technology and/or changing

buyer preferences is reduced

Operations are streamlined to

Cut cycle time

Speed decision-making

Reduce coordination costs

Firm can concentrate on doing those core value

chain activities that best suit its resource strengths

and capabilities

57

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Strategic Advantages of Outsourcing

Improves firms ability to obtain high quality and/or

cheaper components or services

Improves firms ability to innovate by interacting

with best-in-world suppliers

Enhances firms flexibility should customer needs

and market conditions suddenly shift

Increases firms ability to assemble diverse kinds of

expertise speedily and efficiently

Allows firm to concentrate its resources on

performing those activities internally which it can

perform better than outsiders

58

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Pitfalls of Outsourcing

Farming out too many or the wrong

activities, thus

Hollowing out its capabilities

Losing touch with activities and

expertise that determine its overall long-

term success

59

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Offensive and Defensive Strategies

Used to build new or stronger

market position and/or create

competitive advantage

Offensive Strategies

Used to protect competitive

advantage (rarely are they the

basis for creating advantage)

Defensive Strategies

60

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Figure 5.3: The Building and Eroding

of Competitive Advantage

S

i

z

e

o

f

C

o

m

p

e

t

i

t

i

v

e

A

d

v

a

n

t

a

g

e

Benefit Period Erosion Period Buildup Period

Strategic

moves

produce

competitive

advantage

Moves by

rivals

erode

competitive

advantage

Size of

competitive

advantage

achieved

Time

61

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Competitive Strategy Principle

Any competitive advantage

currently held will eventually be

eroded by the actions of

competent, resourceful

competitors !

62

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Options for Mounting Strategic Offensives

1. Initiatives to match or exceed competitor

strengths

2. Initiatives to capitalize on competitor

weaknesses

3. Simultaneous initiatives on many fronts

4. End-run offensives

5. Guerrilla warfare tactics

6. Preemptive strikes

63

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Objectives

Attacking Competitor Strengths

Whittle away at a rivals

competitive advantage

Gain market share by out-matching

strengths of weaker rivals

Challenging strong competitors with a

lower price is foolhardy unless the

aggressor has a cost advantage or

advantage of greater financial strength!

64

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Options for Attacking

a Competitors Strengths

Offer equally good product at a lower price

Develop low-cost edge, then use it to under-price

rivals

Leapfrog into next-generation technologies

Add appealing new features

Run comparison ads

Construct new plant capacity ahead of the rival

or in the rivals market strongholds

Offer a wider product line

Develop better customer service capabilities

65

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Attacking Competitor Weaknesses

Concentrate company strengths and resources

directly against a rivals weaknesses

Weaknesses to Attack

Go after

Those customers a rival has that it is

least equipped to serve

Rivals providing sub-par customer service

Rivals with weaker marketing skills

Geographic regions where rival is weak

Segments rival is neglecting

Objective

66

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Launching Simultaneous Offensives

on Many Fronts

Launch several major initiatives to

Throw rivals off-balance

Splinter their attention

Force them to use substantial

resources to defend their position

A challenger with superior resources can overpower

weaker rivals by out-competing them across-the-

board long enough to become a market leader.

Objective

Appeal

67

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

End-Run Offensives

Dodge head-to-head confrontations that

escalate competitive intensity or risk cutthroat

competition

Attempt to maneuver around strong

competitorsconcentrate on areas of market

where competition is weakest

Objectives

68

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Optional Approaches for

End-Run Offensives

Introduce new products that redefine market

and terms of competition

Build presence in geographic areas where rivals

have little presence

Create new segments by introducing products

with different features to better

meet buyer needs

Introduce next-generation

technologies to leapfrog rivals

69

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Guerrilla Offenses

Use principles of surprise and hit-and-run to

attack in locations and at times where

conditions are most favorable to initiator

Appeal

Well-suited to small challengers

with limited resources and

market visibility

Approach

70

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Options for Guerrilla Offenses

Make random, scattered raids on leaders

customers

Occasional low-balling on price

Intense bursts of promotional activity

Special campaigns to attract buyers

from rivals plagued with a strike or having

problems meeting delivery schedules

Challenge rivals encountering problems with

quality, meeting delivery times, or providing

adequate technical support

File legal actions charging antitrust violations,

patent infringements, or unfair advertising

71

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Preemptive Strikes

Involves moving first to secure an advantageous

position that rivals

are foreclosed or discouraged

from duplicating!

Approach

72

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Preemptive Strike Options

Acquire firm which has exclusive control of a valuable

technology

Secure exclusive/dominant access to best distributors

Tie up best or most sources of essential raw materials

Secure best geographic locations

Obtain business of prestigious customers

Expand capacity ahead of demand in hopes

of discouraging rivals from following suit

Build an image in buyers minds that is unique

or hard to copy

73

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Choosing Who to Attack

Four types of firms can be the target of an

fresh offensive

Market leaders

Runner-up firms

Struggling rivals on verge

of going under

Small local or regional

firms not doing a good job

for their customers

74

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Offensive Strategy and

Competitive Advantage

Strategic offensive offering strongest basis for

competitive advantage usually entail

Developing lower-cost product design

Making changes in production operations that

lower costs or enhance differentiation

Developing product features that deliver superior

performance or lower users costs

Giving more responsive customer service

Escalating marketing effort

Pioneering a new distribution

channel

Selling direct to end-users

75

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Offensive Strategy Principle

The chances for a successful

offensive initiative are improved

when it is based on a companys

resource strengths and strongest

competencies and capabilities!

76

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Defensive Strategy

Fortify firms present position

Help sustain any competitive

advantage held

Lessen risk of being attacked

Blunt impact of any attack that occurs

Influence challengers to aim attacks at

other rivals

Objectives

77

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Defensive Strategies: Approaches

Block avenues open

to challengers

Approach 1

Approach 2

Signal challengers that

vigorous retaliation

is likely

78

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Block Avenues Open to Challengers

Participate in alternative technologies

Introduce new features, add new models, or broaden

product line to close gaps rivals may pursue

Maintain economy-priced models

Increase warranty coverage

Offer free training and support services

Reduce delivery times for spare parts

Make early announcements about new

products or price changes

Challenge quality or safety of rivals products

using legal tactics

Sign exclusive agreements with distributors

79

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Signal Challengers Retaliation Is Likely

Publicly announce managements strong

commitment to maintain present market share

Publicly announce plans to put adequate capacity

in place to meet forecasted demand

Give out advance information about new products,

technological breakthroughs, and other moves

Publicly commit firm to policy of matching prices

and terms offered by rivals

Maintain war chest of cash reserves

Make occasional counter-response to moves of

weaker rivals

80

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

First-Mover Advantages

When to make a strategic move is often as

crucial as what move to make

First-mover advantages arise when

Pioneering helps build firms image and

reputation

Early commitments to new technologies,

new-style components, and distribution

channels can produce cost advantage

Loyalty of first time buyers is high

Moving first can be a preemptive strike

81

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

First-Mover Disadvantages

Moving early can be a disadvantage (or fail

to produce an advantage) when

Costs of pioneering are sizable and loyalty of

first time buyers is weak

Innovators products are

primitive, not living up to

buyer expectations

Rapid technological change

allows followers to leapfrog pioneers

82

2001 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin Copyright

Timing and Competitive Advantage

Being a first-mover holds potential for competitive

advantage in some cases but not in others

Principle 1

Being a fast follower can sometimes yield

as good a result as being a first mover

Principle 2

Being a late-mover may or may not be fatal --

it varies with the situation

Principle 3

You might also like

- Leadership and Leadership StylesDocument17 pagesLeadership and Leadership StylesMaru RokzsNo ratings yet

- Education System in IndiaDocument1 pageEducation System in IndiaAbhinav PandeyNo ratings yet

- Marketing Management MCQDocument2 pagesMarketing Management MCQAbhinav Pandey100% (1)

- Education System in IndiaDocument1 pageEducation System in IndiaAbhinav PandeyNo ratings yet

- The A / An N: Practice 1Document4 pagesThe A / An N: Practice 1Abhinav PandeyNo ratings yet

- A Topic Needs No Introduction in Itself When Mere Mentioning of It Raises Eyebrows All Across The CountryDocument2 pagesA Topic Needs No Introduction in Itself When Mere Mentioning of It Raises Eyebrows All Across The CountryAbhinav PandeyNo ratings yet

- Answers WorksheetDocument2 pagesAnswers WorksheetAbhinav PandeyNo ratings yet

- Clearing GD'S Like A Champion: 1) Increase Your Pool of Knowledge: Make A Habit of "READING" andDocument3 pagesClearing GD'S Like A Champion: 1) Increase Your Pool of Knowledge: Make A Habit of "READING" andAbhinav PandeyNo ratings yet

- Berman Rm10 PPT 08Document24 pagesBerman Rm10 PPT 08sunn2526No ratings yet

- AdvertisingDocument28 pagesAdvertisingAbhinav PandeyNo ratings yet

- Current Affairs e Book 2014Document24 pagesCurrent Affairs e Book 2014Abhinav PandeyNo ratings yet

- Emerging Retail Trends in India Indian JournalDocument23 pagesEmerging Retail Trends in India Indian JournalAbhinav PandeyNo ratings yet

- Strategic ManagementDocument49 pagesStrategic Managementnoorkalif89% (18)

- Ethical DilemmaDocument5 pagesEthical DilemmaAbhinav PandeyNo ratings yet

- Research Paper "Document43 pagesResearch Paper "Pooja Rana75% (4)

- Cet 12 M Bares 090312Document134 pagesCet 12 M Bares 090312Abhinav PandeyNo ratings yet

- Ethical and Legal Issues in RetailingDocument14 pagesEthical and Legal Issues in RetailingPoonam SharmaNo ratings yet

- Group Decision Support SystemDocument25 pagesGroup Decision Support SystemAbhinav PandeyNo ratings yet

- Unit 3: Corporate Social ResponsibilityDocument14 pagesUnit 3: Corporate Social ResponsibilityAbhinav PandeyNo ratings yet

- 4.01 Ethics and AdvertisingDocument14 pages4.01 Ethics and AdvertisingAbhinav PandeyNo ratings yet

- Unit 3: Corporate Social ResponsibilityDocument14 pagesUnit 3: Corporate Social ResponsibilityAbhinav PandeyNo ratings yet

- The Application of Data Mining Techniques and Multiple Classifiers To Marketing DecisionDocument10 pagesThe Application of Data Mining Techniques and Multiple Classifiers To Marketing DecisionAbhinav PandeyNo ratings yet

- Octaware SystemsDocument2 pagesOctaware SystemsTanmoy ChakrabortyNo ratings yet

- An Entropy-Based Adaptive Genetic Algorithm For Learning Classification RulesDocument8 pagesAn Entropy-Based Adaptive Genetic Algorithm For Learning Classification RulesAbhinav PandeyNo ratings yet

- IshamDocument13 pagesIshamPriyanka SinghNo ratings yet

- Data Mining Tutorial: D. A. DickeyDocument109 pagesData Mining Tutorial: D. A. DickeyAbhinav PandeyNo ratings yet

- Team Building in Organizations Assignment Submitted By: Abhinav Pandey Enrollment No: 08861203912 MBA-4 SEMDocument6 pagesTeam Building in Organizations Assignment Submitted By: Abhinav Pandey Enrollment No: 08861203912 MBA-4 SEMAbhinav PandeyNo ratings yet

- CSR Assignment A.1: Approach Initiatives Key Facts and FiguresDocument3 pagesCSR Assignment A.1: Approach Initiatives Key Facts and FiguresAbhinav PandeyNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- SSC Mains (Maths) Mock Test-10Document16 pagesSSC Mains (Maths) Mock Test-10Ravinder SinghNo ratings yet

- Shareholders Loan AgreementDocument29 pagesShareholders Loan Agreementjcarpen33100% (1)

- Ipo RHP IndigoDocument404 pagesIpo RHP IndigoKuperajahNo ratings yet

- Appendix 74 - Instructions - IIRUPDocument2 pagesAppendix 74 - Instructions - IIRUPLian Blakely Cousin100% (2)

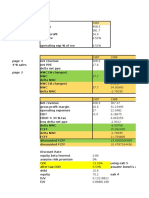

- Income Statement: Alladin Travel Inc. Statement of Profit and Loss As of April 30, 2018Document2 pagesIncome Statement: Alladin Travel Inc. Statement of Profit and Loss As of April 30, 2018Jasmine ActaNo ratings yet

- Investment Banking Cover Letter TemplateDocument2 pagesInvestment Banking Cover Letter TemplateMihnea CraciunescuNo ratings yet

- Chapter 5: Intercompany Profit Transactions - InventoriesDocument38 pagesChapter 5: Intercompany Profit Transactions - InventoriesRizki BayuNo ratings yet

- ICICI Pru Signature Online Brochure 230331 150752Document30 pagesICICI Pru Signature Online Brochure 230331 150752Tamil PokkishamNo ratings yet

- F650 CaseDocument44 pagesF650 CaseRohan SinghNo ratings yet

- 17,605.40 Tumbled The: Hapter QueryDocument10 pages17,605.40 Tumbled The: Hapter QueryAashish mishraNo ratings yet

- Business English WordsDocument10 pagesBusiness English WordsAnna EgriNo ratings yet

- FurnitureDocument72 pagesFurnitureSamuel Davis100% (3)

- Sec RequirementsDocument11 pagesSec RequirementsAngelica M. CodillaNo ratings yet

- Real Estate PresentationDocument23 pagesReal Estate PresentationTarun AnandNo ratings yet

- Balaji Teleflims Ltd.Document76 pagesBalaji Teleflims Ltd.rocking_vidhi8100% (1)

- Affidavit IndigencyDocument6 pagesAffidavit IndigencylizinsarasotaNo ratings yet

- Forex Market - 2Document18 pagesForex Market - 2Emad TabassamNo ratings yet

- Solutions To Recommended Questions - Chapter 1Document16 pagesSolutions To Recommended Questions - Chapter 1David Terran TangNo ratings yet

- Chapter 6: Government Influence On Exchange Rate Exchange Rate System Fixed Exchange Rate SystemDocument5 pagesChapter 6: Government Influence On Exchange Rate Exchange Rate System Fixed Exchange Rate SystemMayliya Alfi NurritaNo ratings yet

- FE Review Engineering EconomicsDocument54 pagesFE Review Engineering EconomicsJERRISON BRUCENo ratings yet

- Lehman Examiner's Report, Vol. 5Document683 pagesLehman Examiner's Report, Vol. 5DealBookNo ratings yet

- Legal Issues For Start Up Businesses: Students To Startups: Be Your Own BossDocument23 pagesLegal Issues For Start Up Businesses: Students To Startups: Be Your Own BossSsewa AhmedNo ratings yet

- 113.ammonium ChlorideDocument19 pages113.ammonium ChloridetadiyosNo ratings yet

- Be Free! By:mary Elizabeth CroftDocument90 pagesBe Free! By:mary Elizabeth Croft1 watchman100% (2)

- Reviewer MathDocument261 pagesReviewer MathMac Jayson DiazNo ratings yet

- Advanced Bond ConceptsDocument32 pagesAdvanced Bond ConceptsJohn SmithNo ratings yet

- Pinkerton ADocument14 pagesPinkerton AGandhi Jenny Rakeshkumar BD20029No ratings yet

- Term Paper: HartalegaDocument18 pagesTerm Paper: HartalegafalinaNo ratings yet

- Indicator Library: How To Win in The Stock MarketDocument11 pagesIndicator Library: How To Win in The Stock MarketPeter FrankNo ratings yet

- To Valuation Methods: (GROUP 1)Document21 pagesTo Valuation Methods: (GROUP 1)PAA KAMAYNo ratings yet