Professional Documents

Culture Documents

Project Transaction Clearing System

Uploaded by

roxboy230 ratings0% found this document useful (0 votes)

38 views13 pagesEnterprise systems

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEnterprise systems

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

38 views13 pagesProject Transaction Clearing System

Uploaded by

roxboy23Enterprise systems

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 13

Group - 2

Transaction Clearing System and

Market Analysis

Aditya Sood

Harsh Bhardwaj

Kriti Arora

Lokesh Raisinghani

Shantanu

Shiwangi

Vishwesh Prabhu Dessai

Section - A

TRANSACTION CLEARING SYSTEM

Process of settling of payments between card issuing bank and the bank of merchants

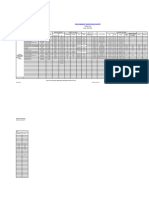

32.90%

19.40%

47.70%

Visa

Mastercard

Others

Types

Closed Loop Payment

Network

Open Loop Payment

Network

Market share in card payments

Issue cards

themselves and

facilitate the

settlement

Do not issue cards,

only facilitate

settlement of

transaction

Visa and MasterCard belong to the Open

Loop Payment Network

Visa and MasterCard Payment Values

TRANSACTION CLEARING PROCESS

1

Cardholder presents the card to the merchant for payment

2

Payment request is forwarded to the acquirer

3

Acquirer contacts the issuer through the VISA network

4

Issuer shares information about balance in cardholders

network

5

The information is routed to the merchant

6

In case of sufficient balance the payment is accepted

7

At the end of month cardholder pays the bills to the issuer

One who uses the card to make payment

Cardholder

Entity to whom the payment is made

Merchant

Bank in which the customer has an account and

which has issued the card to the cardholder

Issuer

The merchants bank

Acquirer

Sequential Steps

BUSINESS MODEL

Business

Model

- Financial Institutions (Issuers and Acquirers)

- Cardholders

- Merchants

- Personnel

- Network and Communications

- Brand Promotion

- Legal Provisions

- Creates value for all stakeholders

- Cardholders get convenience, security and loyalty rewards

- Merchants benefit from improved sales by offering payment method options

- Banks get new revenue streams like card fees, late payment interest

- Multiple revenue streams

- Service revenues from bank for their participation in card programs

- Data processing revenues for transaction processing

- International revenue when cardholder issuer country is different from the merchants country.

COMPETITOR ANALYSIS

TECHNOLOGIES DISRUPTIONS IN THE PAYMENT LANDSCAPE

SmartPhones

Tablets

QR codes

New Business

Models

Cloud computing

Bluetooth

technology

The payments industry is in the early stages of unprecedented innovation and transformation.

In addition, payment preferences have evolved rapidly, as many consumers have switched to electronic

payments in lieu of cheques and now are saying goodbye to cash in favor of plastic cards.

This fast-changing card landscape has provided the opportunity for alternative payment providers to find

a point of entry. Technology has leveled the playing field for non-traditional payment providers and led to

their starring role as a payment disruptor

NFC Driven Mobile

Payments

Near Field Communications,

works by establishing a radio

communication between the

two devices once they are

within a few inches of one

another.

NFC builds upon the RFID

system by allowing two-way

communication between two

NFC-enabled devices

QR code based payment

applications

In a QR code driven system,

a mobile application

generates a QR code, which

the merchant can scan via a

mobile device to process the

payment

The unique code displayed

within the app then links the

credit/debit card account the

consumer has on file within

the app

Example : Starbucks

Plug-in devices to POS

terminals

Plug-in payment devices

turn mobile devices into card

accepting terminals. The

small device, dongle plugs

into the headphone jack

allowing merchants to

accept payments.

The alternative payment

provider charges the

merchant a fee for the

service

CARD OPERATORS

Apart from the traditional clearing systems, card

operators are also making advances in online

payments providing NFC driven mobile

payments, open source platforms and mobile

wallets . Example: Visa

VALUE ADDED SERVICE PROVIDERS

Disruptive players in online and mobile

payments provide wide ranging product

offering ranging from plug-in devices to in-

store payment. Example : PayPal

MOBILE PHONE NETWORKS

Direct connection to the operator billing platform,

which in turn provides an alternative checkout

system where a consumer provides a phone

number to make a purchase. Example : T-MobileIsis

RETAILERS

UK-based supermarkets have

entered the consumer finance

space with commercial banking and

payment offerings. Example: Wal-

Mart

MOBILE APP PLATFORMS

The rise of innovative mobile apps have

forced the introduction of mobile payment

apps. Example: Android Google

BANKS/CARD ISSUERS

In lieu of the advent of technology, banks are

developing in-house app stores to create

mobile applications for open platforms for

further innovating the payments landscape

Example : Deutsche Bank

SEVERAL PLAYERS ARE TRYING TO GAIN A SEAT AT THE PAYMENTS TABLE

MasterCard

PayPass

MasterPass

MasterPass API

and SDK :

Developer Zone

Visa

PayWave

V.Me

Visa API and SDK

: Visa Ready

Partner Program

THE RACE TO CAPTURE ONLINE PAYMENTS

Initially both networks developed the contactless technology to accept their cards with

Visas PayWave and MasterCards PayPass. This was a foundation setting technology

Next digital wallets were released to cature digital payments with Visas V.Me and

MasterCards MasterPass

The most recent move by the networks was to facilitate their platform adoption

through developer tools with Visa Ready Partner Program and MasterCards API

MasterCard Ready

This allows merchants and mobile payment developers tools to increase the

ease of acceptance

Through these platforms, financial institutions are also able to develop their own

mobile wallets with networks technology

This approach has a much greater likelihood of success given it facilitates collaboration and

communication of all stakeholders involved in the process.

THREAT OF MOBILE PAYMENT SYSTEMS

AT&T, Verizon Wireless and T-Mobile are reportedly partnering with Discover Financial Services and Barclays PLC, a global retail banking company, to

challenge the status quo.

These new partners want to allow consumers to complete purchases with a simple wave of their smartphones. Technology observers are calling this

one of the most significant challenges to credit card companies to date.

R

F

I

D

E

m

b

e

d

d

i

n

g

The RFID would act as a

radio version of the

magnetic strip on your

credit card.

S

w

i

p

e

Y

o

u

r

P

h

o

n

e

The Phone's screen acts

as a super-secure

numeric pad for

accessing your PIN

R

e

t

a

i

l

e

r

C

o

m

m

u

n

i

c

a

t

e

s

Retailers can send data

back to your phone, in

the form of adverts or

loyalty card-like reward

points.

THREATS AND OPPORTUNITIES

THREAT OF BITCOIN

Bitcoin, introduced in 2008 by a programmer or group of

programmers under the name Satoshi Nakamoto, has no

central issuing authority and uses a public ledger to verify

transactions that are authenticated by

cryptographic signatures.

Authorities in Russia, China and Israel have sought to restrict

bitcoin, while the U.S. seeks ways to prevent money-

laundering and illicit sales without killing the digital currency.

The threat of regulation and disruptions, including hacker

attacks on online exchanges, have caused bitcoin value

to plummet.

Therefore, Visa and MasterCard are not to worried about

bitcoin emerging as a major competitor.

EMERGING MARKETS

OPPORTUNITY

Globally, 85% of payments are still made with cash.

Consumer spending will drive growth for Visa in the

developed world, but the potential for much greater growth

exists in the developing world as people switch from cash to

card and mobile payments.

To move into this new field, Visa has acquired a South African

company, Fundamo, for $110 million. Fundamo specializes in

providing financial service offerings to mobile phone

operators in developing countries, and with its base in Africa,

it understands regional means of business

PREPAID CARDS OPPORTUNITY

The use of prepaid cards is increasing rapidly as consumers fear using debt

following the recession. Annually, the amount of money put onto prepaid

cards is increasing by 42%, and Visa is a strong player in the market

Visa is using Fundamos technology to introduce prepaid cards to

developing markets where Visas product may be seen as more safe and

reliable than cash

Prepaid cards are not purely issued through banks, so Visa can avoid some of

the increasingly aggressive negotiating process and keep fees higher

FUTURE OF TRANSACTION CLEARING SYSTEM

Near field communication: A cloud payment system where a user can do transactions using a smartphone.

NFC mobile contactless payments can be made at both attended POS locations (such as stores) and unattended

locations (such as vending machines) that use the existing merchant payments infrastructure. To pay, the

consumer simply brings the phone to within a few inches of a contactless payment-capable POS system and the

transaction occurs

Bit coin: Transaction is done through virtual currency. Payments work peer-to-peer without a central repository

and transfers value between Bit coin wallets. It can be installed in a PC or mobile to perform transactions

E-wallet: E-Wallet provides the ability to store multiple credit cards, debit cards and back account information

in a secure environment for making faster payments. You can create up to ten separate profiles for both credit

and debit cards, and up to ten separate profiles for checking and savings accounts. You can edit and delete these

profiles as needed. Using E-wallet, a user can send/receive money anytime to his e-wallet using phone numbers

RuPay: A payment gateway launched in India, which will work on ATMs/merchant outlets and help in reducing

cash transactions. A variant of pre-paid RuPay card would shortly be launched by IRCTC, which will help in

booking railway tickets

References

http://www.portal.euromonitor.com/Portal/Handlers/accessPDF.ashx/Alternative_Payment_Provi

ders_Starring_as_Payment_Disruptors.pdf

http://www.euromonitor.com/mastercard-international-inc-in-consumer-finance/report

http://www.livemint.com/Money/tz1Pjm3WnRJvcfrisif66L/Indias-own-payment-gateway-RuPay-

launched.html

http://www.pcadvisor.co.uk/how-to/mobile-phone/3472879/what-is-nfc-how-nfc-works-what-it-

does/

Thank You

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Project UPS - PDF P04234Document44 pagesProject UPS - PDF P04234Tareq AzizNo ratings yet

- Yusra Hanif: Lecturer Computer Science Concordia College SahiwalDocument13 pagesYusra Hanif: Lecturer Computer Science Concordia College SahiwalYusraNo ratings yet

- Beauty Parlour Manangement SystemDocument47 pagesBeauty Parlour Manangement SystemShivani GajNo ratings yet

- CP2105Document24 pagesCP2105acechoeNo ratings yet

- Human Resource Management (By: Warsame I. Ahmed)Document69 pagesHuman Resource Management (By: Warsame I. Ahmed)bakaal12390% (10)

- Mettler Toledo LinxsDocument36 pagesMettler Toledo LinxsSandro MunizNo ratings yet

- Manual SWGR BloksetDocument5 pagesManual SWGR BloksetibrahimNo ratings yet

- Procurement Monitoring Report JuneDocument2 pagesProcurement Monitoring Report JuneKaJong JaclaNo ratings yet

- Formula SAE Michigan 2014 ProgramDocument80 pagesFormula SAE Michigan 2014 ProgramcbratliffNo ratings yet

- Paper Arduino Based Gas Detection Using SensorsDocument6 pagesPaper Arduino Based Gas Detection Using SensorsAbhishek MishraNo ratings yet

- Hec Boq SubconDocument25 pagesHec Boq SubconSHRIYA POWERNo ratings yet

- Sepam 100 LaDocument12 pagesSepam 100 LaHung Cuong PhamNo ratings yet

- Evolution of Traditional To New MediaDocument54 pagesEvolution of Traditional To New MediaLino CornejaNo ratings yet

- PM400DVA060: Mitsubishi Intelligent Power ModulesDocument6 pagesPM400DVA060: Mitsubishi Intelligent Power ModulesDiego GrisalesNo ratings yet

- Social Media CompetencyDocument2 pagesSocial Media CompetencyNoah OkitoiNo ratings yet

- Category ID Product Quantity Unit Price TotalDocument2 pagesCategory ID Product Quantity Unit Price TotalMohammad RumanNo ratings yet

- Warning Chime System: SectionDocument63 pagesWarning Chime System: SectionChang ChangNo ratings yet

- Blazing Text Navigating The Dimensional LabyrinthDocument91 pagesBlazing Text Navigating The Dimensional LabyrinthsurendersaraNo ratings yet

- Soal Sastra Inggris Mid GenapDocument4 pagesSoal Sastra Inggris Mid Genapsaiful faizinNo ratings yet

- Ug895 Vivado System Level Design Entry PDFDocument131 pagesUg895 Vivado System Level Design Entry PDFsambashivaNo ratings yet

- Building A Computer: Electronic Numerical Integrator and Computer (ENIAC)Document31 pagesBuilding A Computer: Electronic Numerical Integrator and Computer (ENIAC)Anonymous HsoXPyNo ratings yet

- Predatory JournalsDocument9 pagesPredatory JournalsNabeel MuhammadNo ratings yet

- Intergrative Programming and Technology 1 QUIZ 2Document10 pagesIntergrative Programming and Technology 1 QUIZ 2julius obregonNo ratings yet

- Caterpillar C15 Engine SpecsDocument5 pagesCaterpillar C15 Engine SpecsDesta 77No ratings yet

- Online CommunicationDocument14 pagesOnline CommunicationClarin FleminNo ratings yet

- The Product & UX Design Roadmap 2023Document16 pagesThe Product & UX Design Roadmap 2023shreya kaleNo ratings yet

- IIT Bombay Spoken Tutorials For ICT Training in Schools: Value To The SchoolDocument2 pagesIIT Bombay Spoken Tutorials For ICT Training in Schools: Value To The SchoolmanaliNo ratings yet

- CRM in Russia and U.S. - Case Study From American Financial Service IndustryDocument40 pagesCRM in Russia and U.S. - Case Study From American Financial Service IndustryebabjiNo ratings yet

- IR MPA II Installation Requirements enDocument6 pagesIR MPA II Installation Requirements enMohammed BouazzaNo ratings yet

- Hardware Reference Guide: Small Form Factor Models Compaq Evo Desktop FamilyDocument63 pagesHardware Reference Guide: Small Form Factor Models Compaq Evo Desktop FamilySébastien MunozNo ratings yet