Professional Documents

Culture Documents

Export - Import and Finance

Uploaded by

danozafar0 ratings0% found this document useful (0 votes)

459 views14 pagesThis document discusses import and export procedures and financing in Bangladesh. It lists the members of an import/export group and then outlines various topics related to import and export including import procedures under letter of credit, import and export financing options, and procedures for submitting back-to-back letter of credit applications. Pre-shipment and post-shipment financing options are explained for both imports and exports.

Original Description:

Full procedure of Export and Import business as well as bank's papers submission activities.

Original Title

Export_Import and Finance

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses import and export procedures and financing in Bangladesh. It lists the members of an import/export group and then outlines various topics related to import and export including import procedures under letter of credit, import and export financing options, and procedures for submitting back-to-back letter of credit applications. Pre-shipment and post-shipment financing options are explained for both imports and exports.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

459 views14 pagesExport - Import and Finance

Uploaded by

danozafarThis document discusses import and export procedures and financing in Bangladesh. It lists the members of an import/export group and then outlines various topics related to import and export including import procedures under letter of credit, import and export financing options, and procedures for submitting back-to-back letter of credit applications. Pre-shipment and post-shipment financing options are explained for both imports and exports.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 14

Name ID

Zafar Hossain (Group Leader) 133-066-0-451

Shaheen Shahed 133-063-0-451

Dil Mohammad Roni 133-064-0-451

Md. Niaz Murshed 133-068-0-451

Md. Mohsin Mollah 133-069-0-451

Mahadi Hasan Babu 133-067-0-451

Kamrul Hasan 133-065-0-451

IMPORT AND EXPORT PROCEDURE AND FINANCING OF

RGM

AT A GLANCE OUR ALL TOPICS

IMPORT & EXPORT

IMPORT PROCEDURE UNDER LC

IMPORT FINANCING

PRE SHIPMENT

POST SHIPMENT

EXPORT FINANCING

PRE-SHIPMENT

POST-SHIPMENT

SUBMISSION OF BTB LC APPLICATION

EDF (EXPORT DEVELOPMENT FUND)

IMPORT & EXPORT

An import is a good brought into a jurisdiction, especially across a national

border, from an external source. The party bringing in the good is called an

importer

The term export means shipping the goods and services out of the port of a

country. The seller of such goods and services is referred to as an "exporter"

and is based in the country of export whereas the overseas based buyer is

referred to as an "importer"

Import process

- PRE-ASSESSMENT FOR THE PROPOSED IMPORT FINANCE

- APPROVAL OF LCA FORM

- SUBMISSION OF LC APPLICATION FORM WITH FOLLOWING

REQUIRED PAPERS:

-- LCA FORM DULY SIGNED AND APPROVED

-- PRO FORMA INVOICE DULY SIGNED AND ACCEPTED

-- INSURANCE COVER NOTE

-- IMP FORM DULY SIGNED

3. LIM (Loan against imported merchandise): Its

also a short term loan. The controlling power and

ownership of merchandise goods possess by bank.

4. Cash credit (Hypothetic):

Imported goods control by owner but ownership of

goods hold by bank or financing organization.

5. Cash credit (Pledge):

Imported goods and its ownership both hold by bank or

financing organization

8. Deferred Payment

Its a non-funded credit facility. Bank gives acceptance on

behalf of importer.

PRE-SHIPMENT

1. Letter of credit

L/C by its self is an irrevocable. So no need to take

other authorized permission.

2. Cash Credit (Hypothecation)

Bank Provide Hypothecation Cash Credit to its

customer for day to day need of business. Enough

Insurance is required in favor of Bank. Interest will be

debited on monthly basis on all Cash Credit accounts.

3. Cash Credit (Pledge)

Bank Provide Pledge Cash Credit to its customer for stores their

goods in a warehouse for future trading purpose. Pledge Cash

Credit limit decides as per the valuation of goods stored in

warehouse. Pledge Cash Credit renew every year by the Bank.

4. Packing Credit

Packing credit is nothing but a pre shipment finance given to

exporters with a low interest rate to boost exports. Packing credit

is given by authorized bank by the instruction of Reserve Bank as

a government policy to promote exporters to earn foreign

currency to strengthen financial status of a country.

5. Back to Back L/C

Two letters of credit (LCs) used together to help a seller finance the

purchase of equipment or services from a subcontractor. With the

original LC from the buyer's bank in place, the seller goes to his own

bank and has a second LC issued, with the subcontractor as

beneficiary.

6. LIM

LIM is the short-term loan to the Importer, if he fails to retire the bill

within the stipulated time. In LIM, after releasing the goods from

the Customs authority, the possession of the goods remains with the

Bank

Purpose: To release the imported merchandise from the Customs

authority.

8. LATR

LTR is Post Shipment Import Trade finance given by the

Bank to the Importer. Difference is, in Lim, the possession of

the released goods remains under banks control but in LTR,

the Goods remains with the Importer.

Securities: 1. The Letter of Trust Receipt.

2. Other sufficient Securities.

In the Trust Letter the importer acknowledges that the

goods are held by him in trust for the Bank and agrees to

make over the sale proceeds to the Bank.

POST-SHIPMENT

Negotiation of Export Bills.

Time Loan.

Loan against Cash Incentive.

Loan against Duty Draw Back.

SUBMISSION OF BTB LC APPLICATION

LCA form duly signed and approved

Proforma invoice duly signed and accepted

Insurance cover note

IMP form duly signed

Master LC / contract (export order)

THANK YOU

You might also like

- Interntinal BankingDocument6 pagesInterntinal BankingKazi Saif HiraNo ratings yet

- INTERNATIONAL TRADE FINANCE GUIDEDocument2 pagesINTERNATIONAL TRADE FINANCE GUIDEAnonymous FfhgFHHftXNo ratings yet

- Financing Foreign Trade PDFDocument16 pagesFinancing Foreign Trade PDFHemanth Kumar89% (9)

- Pre & Post Shipment Finance in Export TradeDocument7 pagesPre & Post Shipment Finance in Export TradevinmbaftNo ratings yet

- Export FinanceDocument6 pagesExport FinanceMallikarjun RaoNo ratings yet

- Export finance and Letter of CreditDocument16 pagesExport finance and Letter of Creditabhijeet186299No ratings yet

- Pre ShipmentDocument8 pagesPre ShipmentRajesh ShahNo ratings yet

- Types of Export Finance ExplainedDocument14 pagesTypes of Export Finance Explainedsamy7541No ratings yet

- Methods of Financing ExportersDocument35 pagesMethods of Financing Exportersmilee_2009No ratings yet

- Ibo-04 2020-21Document16 pagesIbo-04 2020-21arun1974No ratings yet

- Pre & Post Shipment Finance in Export TradeDocument6 pagesPre & Post Shipment Finance in Export TradeVodafone dbNo ratings yet

- Foreign Exchange NoteDocument37 pagesForeign Exchange NoteAtia IbnatNo ratings yet

- Export Finance (Case Study Need To Be Added)Document62 pagesExport Finance (Case Study Need To Be Added)rupalNo ratings yet

- International Trade & Trade FinanceDocument19 pagesInternational Trade & Trade Financemesba_17No ratings yet

- Roll No-D018, SAP ID - 80101190221Document9 pagesRoll No-D018, SAP ID - 80101190221Harsh GandhiNo ratings yet

- Export Finance and Payment Presented by Sri Jintu Borthakur Sri Dipranjal KeotDocument45 pagesExport Finance and Payment Presented by Sri Jintu Borthakur Sri Dipranjal Keotjunet123123No ratings yet

- Post Shipment FinanceDocument4 pagesPost Shipment FinanceambrosialnectarNo ratings yet

- International Finance Pre Shipments FinanceDocument14 pagesInternational Finance Pre Shipments FinanceKiran AwasthiNo ratings yet

- AniketDocument5 pagesAniketAjay PrajapatiNo ratings yet

- Pre-shipment Finance GuideDocument6 pagesPre-shipment Finance GuidePrashant JainNo ratings yet

- Export Pre Shipment and Post Shipment FinanceDocument10 pagesExport Pre Shipment and Post Shipment FinancembmmanishNo ratings yet

- Purpose of FinanceDocument10 pagesPurpose of FinanceManjith BoloorNo ratings yet

- Buyers CreditDocument8 pagesBuyers Creditsudhir.kochhar3530No ratings yet

- Chapter - 1: MeaningDocument84 pagesChapter - 1: MeaningManoj KumarNo ratings yet

- C Packing CreditDocument6 pagesC Packing CreditKapil KumarNo ratings yet

- Export Finance PreshipmentDocument11 pagesExport Finance PreshipmentIftekhar Ahmed100% (1)

- Export FinanceDocument29 pagesExport FinanceAishu KrishnanNo ratings yet

- International Banking and Foreign ExchangeDocument11 pagesInternational Banking and Foreign ExchangePrateek JainNo ratings yet

- Foreign Exchange BASIC INFODocument27 pagesForeign Exchange BASIC INFOasifmahmud20diuNo ratings yet

- Export Packing CreditDocument3 pagesExport Packing CreditshashidharrajuNo ratings yet

- Export Financing And Letter Of Credit Options In IndiaDocument8 pagesExport Financing And Letter Of Credit Options In IndiaRohit AggarwalNo ratings yet

- Post ShipmentDocument3 pagesPost ShipmentBhanu MehraNo ratings yet

- Export and Import Finance GuideDocument61 pagesExport and Import Finance GuidekanikaNo ratings yet

- Pre Shipment Finance Is Issued by A Financial Institution When The Seller Want The Payment of The Goods Before ShipmentDocument5 pagesPre Shipment Finance Is Issued by A Financial Institution When The Seller Want The Payment of The Goods Before ShipmentBhanu MehraNo ratings yet

- Banking Project NewDocument77 pagesBanking Project NewMohit PaleshaNo ratings yet

- Legal EnvironmentDocument12 pagesLegal EnvironmentJasleen ChawlaNo ratings yet

- EIF BBA NOTES 3 and 4 UnitDocument17 pagesEIF BBA NOTES 3 and 4 UnitMOHAMMAD ZUBERNo ratings yet

- Itab RevieweerDocument13 pagesItab RevieweerAra PanganibanNo ratings yet

- International Trade Payment MethodsDocument19 pagesInternational Trade Payment Methodsfarhadcse30No ratings yet

- Cridit Managment: MBA Banking & Finance 3 TermDocument28 pagesCridit Managment: MBA Banking & Finance 3 Term✬ SHANZA MALIK ✬100% (2)

- Export Financing: Helping You Take Your Products and Business GlobalDocument8 pagesExport Financing: Helping You Take Your Products and Business GlobalrajivdindigulNo ratings yet

- Credit Analysis: DR C SitharamayyaDocument21 pagesCredit Analysis: DR C SitharamayyaVvs Ramaraju0% (1)

- Project On International Payment System: J. Watumull Sadhubella Girls CollegeDocument22 pagesProject On International Payment System: J. Watumull Sadhubella Girls CollegeAngel JhamnaniNo ratings yet

- Chapter 8 Foreign Trade Procedure and FinancingDocument22 pagesChapter 8 Foreign Trade Procedure and FinancingsajjadNo ratings yet

- Export Finance: Group 5Document31 pagesExport Finance: Group 5sidpunjNo ratings yet

- Export Import Finance Unit 1 Terms of PaymentDocument21 pagesExport Import Finance Unit 1 Terms of PaymentMohit kumar sahuNo ratings yet

- LC Letter of CreditsDocument8 pagesLC Letter of CreditsTehniat HamzaNo ratings yet

- Export Procedures and Letters of CreditDocument9 pagesExport Procedures and Letters of CreditIndeevar SarkarNo ratings yet

- Cha 11Document19 pagesCha 11Balaji KalyanNo ratings yet

- Online Tuition Pakistan - Types of Letters of CreditDocument8 pagesOnline Tuition Pakistan - Types of Letters of CreditUsman RazaNo ratings yet

- Exporter Financing: Pre-Shipment and Post-Shipment CreditsDocument21 pagesExporter Financing: Pre-Shipment and Post-Shipment CreditsVineeth Kunnath100% (4)

- Export Finance Guide for BanksDocument17 pagesExport Finance Guide for BanksRohit GuptaNo ratings yet

- Session 23-25 Financing of Foreign TradeDocument28 pagesSession 23-25 Financing of Foreign TradeLagishetty AbhiramNo ratings yet

- Foreign Exchange TransactionsDocument12 pagesForeign Exchange TransactionsRajib DattaNo ratings yet

- CORPORATE FINANCE-2 UnitDocument11 pagesCORPORATE FINANCE-2 UnitAnubala SureshNo ratings yet

- Chapter 4-1Document18 pagesChapter 4-1syahiir syauqiiNo ratings yet

- Fundamentals of Trade FinanceDocument9 pagesFundamentals of Trade FinanceMohammed SuhaleNo ratings yet

- Packing Credit: Report SubtitleDocument5 pagesPacking Credit: Report SubtitleSaikumar BommaNo ratings yet

- CBM AssignmentDocument6 pagesCBM AssignmentNimit BhatiaNo ratings yet

- RESUME of Md. Istiaque HossainDocument2 pagesRESUME of Md. Istiaque HossaindanozafarNo ratings yet

- Bio-Data - English2Document79 pagesBio-Data - English2danozafar100% (1)

- Factors Influencing Views on Selection and Gradation in English for Today Class 5Document4 pagesFactors Influencing Views on Selection and Gradation in English for Today Class 5danozafarNo ratings yet

- Janine Patterson: Personal StatementDocument3 pagesJanine Patterson: Personal StatementdanozafarNo ratings yet

- A.K Traders route sales reportDocument73 pagesA.K Traders route sales reportdanozafarNo ratings yet

- Notice of Intent To LienDocument2 pagesNotice of Intent To LienDemetrius BeyNo ratings yet

- Growth Lending Guide BOOST and Co Apr19Document31 pagesGrowth Lending Guide BOOST and Co Apr19Ilya HoffmanNo ratings yet

- Credit DigestDocument7 pagesCredit Digestmudblood_princessNo ratings yet

- 01 MeetingDocument113 pages01 MeetingslumbaNo ratings yet

- Industrial Development Bank of India (IDBI)Document10 pagesIndustrial Development Bank of India (IDBI)Tejpratap VishwakarmaNo ratings yet

- Chapter 8. Sale by A Non-Owner or by One Having Voidable TitleDocument13 pagesChapter 8. Sale by A Non-Owner or by One Having Voidable TitleRache GutierrezNo ratings yet

- 52 Formats of Power of AttorneyDocument2 pages52 Formats of Power of AttorneyJit100% (2)

- DBP v. Arcilla Ruling on Loan Disclosure ComplianceDocument3 pagesDBP v. Arcilla Ruling on Loan Disclosure ComplianceKarenliambrycejego RagragioNo ratings yet

- A Study On Home Loans (Rajni) (Mba-3rd Sem - Finance) (Col-Rdias) DelhiDocument133 pagesA Study On Home Loans (Rajni) (Mba-3rd Sem - Finance) (Col-Rdias) Delhi*8984% (231)

- Letter of Complaint GarbageDocument3 pagesLetter of Complaint GarbagemaineNo ratings yet

- Chapter 8: Loan Approval and ClosingDocument27 pagesChapter 8: Loan Approval and ClosingJustice WilliamsNo ratings yet

- Review of Literature: Chapter-2Document5 pagesReview of Literature: Chapter-2Juan JacksonNo ratings yet

- KBC Trial BalanceDocument9 pagesKBC Trial Balanceapi-2486948440% (1)

- Uday Garudachar's Election Nomination AffidavitDocument9 pagesUday Garudachar's Election Nomination AffidavitewsejipuraNo ratings yet

- 04 22 15Document28 pages04 22 15grapevineNo ratings yet

- Teal Motor Vs Orient InsuranceDocument2 pagesTeal Motor Vs Orient InsuranceShiena Lou B. Amodia-RabacalNo ratings yet

- Memorandum of AgreementDocument4 pagesMemorandum of Agreementcocongpogs working at pizza placeNo ratings yet

- Teil - 17 - Foreclosure FraudDocument151 pagesTeil - 17 - Foreclosure FraudNathan BeamNo ratings yet

- Banking products and services overviewDocument21 pagesBanking products and services overviewtanyaNo ratings yet

- Court upholds validity of mortgage on disputed propertyDocument3 pagesCourt upholds validity of mortgage on disputed propertyShiela PilarNo ratings yet

- Development Bank of The Philippines vs. Arcilla: Truth in Lending ActDocument4 pagesDevelopment Bank of The Philippines vs. Arcilla: Truth in Lending ActJosiebethAzueloNo ratings yet

- Jan Marasek V., 3rd Cir. (2013)Document3 pagesJan Marasek V., 3rd Cir. (2013)Scribd Government DocsNo ratings yet

- Ust Civil Q and A 2013 To 2015Document55 pagesUst Civil Q and A 2013 To 2015twenty19 lawNo ratings yet

- Balance Sheet Valix C1ValixDocument14 pagesBalance Sheet Valix C1Valixmaryqueenramos79% (24)

- Statcon DigestDocument1 pageStatcon DigestMaria JicaNo ratings yet

- The Battle for Steel Corp ControlDocument23 pagesThe Battle for Steel Corp ControlKevin Barrion EspinosaNo ratings yet

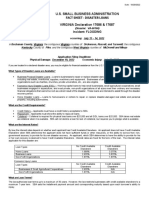

- U.S. Small Business Administration Fact Sheet - Disaster LoansDocument2 pagesU.S. Small Business Administration Fact Sheet - Disaster LoansNews 5 WCYBNo ratings yet

- Judicial Admissions Doctrine ExplainedDocument2 pagesJudicial Admissions Doctrine Explaineddoraemoan100% (1)

- Chapter 7 AnswerDocument16 pagesChapter 7 AnswerKathy WongNo ratings yet

- CIMA F3 SyllabusDocument8 pagesCIMA F3 SyllabusShah KamalNo ratings yet