Professional Documents

Culture Documents

Financial Decisions

Uploaded by

Pooja Sheoran0 ratings0% found this document useful (0 votes)

33 views13 pagesFinancial decisions

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinancial decisions

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

33 views13 pagesFinancial Decisions

Uploaded by

Pooja SheoranFinancial decisions

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 13

FINANCIAL DECISIONS

These are decisions concerning financial matters of a business firm.

There aim is to maximize shareholders wealth

Examples :- kinds of assets to be acquired, pattern of capitalization,

distribution of firms

income etc.

Financial decisions are of three types :-

FINANCIAL

DECISIONS

INVESTMENT

DECISIONS

FINANCING

DECISIONS

DIVIDEND

DECISIONS

Relates to determination of

total amount of assets to be held in the firm

composition of these assets

business risk complexions of the firm

Most important financial decision as funds available are limited and need to be

utilized properly

Further classified into two categories :-

Long term investment decision or capital budgeting

Short term investment decision or working capital management

1. CAPITAL BUDGETING :- It is the process of making investment decisions in

capital expenditure, benefits of which are expected over a long period of time

exceeding one year . Investment decision should be evaluated in the terms of

expected profitability, costs involved and the risks associated. This decision is

important for setting new units, expansion of present units, reallocation of funds etc.

2. SHORT TERM INVESTMENT DECISION :- It relates to allocation of funds among

cash and equivalents, receivables and inventories. Such decision is influenced by

trade off between liquidity and profitability. Proper working capital management

policy ensures higher profitability, proper liquidity and sound structural health of

the organization.

Firm must decide best means of financing for new assets and best overall mix of

financing for the firm

Select such sources which will make optimum capital structure

Important to decide the proportion of various sources in the overall capital mix

Debt-equity ratio should be fixed in such a way that it helps in maximizing the

profitability of the concern

More debts will increase the return on equity but will involve fixed interest

liability

More equity will bring permanent funds but the shareholders will expect higher

rates of earnings

Therefore there must be a proper balance between various sources

If capital structure is able to minimize the risk and raise the profitability then the

market prices of the shares will go up maximizing the wealth of shareholders.

Dividend Decisions

Relates to the disbursement of profits back to investors who supplied capital to

the firm.

The term dividend refers to that part of profits of a company which is

distributed by it among its shareholders.

It is the reward of shareholders for investments made by them in the share

capital of the company.

A decision has to be taken whether all the profits are to be distributed, to retain

all the profits in business or to keep a part of profits in the business and

distribute others among shareholders.

The higher rate of dividend may rise the market price of the shares and thus,

maximise the wealth of shareholders.

The firm should also consider the question of dividend stability, shock

dividend (bonus shares) and cash dividend.

All financial decisions have same objective i.e. maximization of

shareholders wealth.

All financial decisions influence one another and are Inter-

dependent.

For example, the decision to invest in some proposal cannot be

taken in isolation without having necessary finance available for the

same.

The financing decision in turn is influenced by and also influences

the dividend decision.

In case the profits are retained for financing of the investment, the

profits available for distribution to the shareholders as dividends are

reduced.

An efficient financial management thus, has to be taken the

optimal joint decision by evaluating each of the decision involved in

relation to its effect on shareholders wealth and by considering the

joint impact of these decisions on the market value of the

companys shares.

INVESTMENT

DECISION

DIVIDEND

DECISION

FINANCING

DECISION

Financial Management

Dividend decision

Wealth Maximisation

To achieve

the goal of

Risk and Return

Relationship

(trade off)

Investment decision Financing decision

Is concerned with

Analysis

FINANCIAL MANAGEMENT PROCESS

It begins with the financial planning and decisions.

While implementing these decisions, firm has to acquire certain risk and return

characteristics.

These characteristics determine the market price of shares and shareholders wealth.

The process must include feedback system to enable to take corrective measures, if required.

Following figure depicts the process of financial management

Feedback

Risk and return

Characteristics of the

firm

Market price of

share P

0

Shareholder

Wealth

W

0

= NP

0

FINANCIAL MANAGEMENT PROCESS

Financial planning

and control

Financial decisions

1. Investment decisions

2. Financing decisions

3. Dividend decisions

There are number of (both external as well as internal ) factors that influence the

financial decisions .

A list of the important external as well as internal factors influencing the decisions as

given below:

A. External factors:

State of economy

Structure of capital and money markets

Government policy

Taxation policy

Lending policy of financial institutions

B. Internal factors:

nature and size of business

Expected return, cost and risk

Composition of assets

Structure of ownership

Trend of earnings

Liquidity position

Working capital requirements

Conditions of debt agreements.

Profit earning is the main aim of every economic activity.

It is the measure of efficiency of a business enterprise.

It also serve as a protection against risks

Accumulated profits enable a business to face risks like fall in prices,competition from

other units adverse government policies.

Arguments in favour of profit maximization as the objective of business :-

a) When profit - earning is the aim of business then profit maximization should be the

obvious objective.

b) Profitability is a barometer for efficiency and economic prosperity of a business

enterprise , thus , profit maximization is justified o the grounds of rationality.

c) Business should aim at maximization of profits for enabling its growth and development.

d) A firm by pursuing the objective of profit maximization socio-economic welfare.

e) A business will be able to survive under unfavourable situation, only if it has some past

earnings to rely upon. Therefore a business to try to earn more and more when situation

is favorable.

Profit maximization as an objective of financial management has been considered

inadequate. Even as an operational criterion for maximizing owners economic welfare,

profit maximization has been rejected because of the following drawbacks :-

a) The term profit is vague and it cannot be precisely defined. It means different things

for different people. Even if, we take the meaning of profits as earnings per share and

maximize the earnings per share, it does not necessarily mean increase in the market

value of the shares and the owners economic welfare.

b) It ignores the time value of money and does not consider the magnitude and timings

of earnings. It treats all earnings as equal though they occur in different periods.

c) It does not take into consideration the risk of the prospective earnings stream.

d) The effect of dividend policy on the market price of the shares is also not considered in

this objective.

The following elements are involved in profit maximization.

Increase in revenues all efforts should be made to increase the sales which will

increase the revenue receipts. Profits can be increased either by raising the price of

products or by increasing the volume of sales.

Controlling costs another way of increasing profit is to control or reduce costs.

This will increase the margin of profit per unit. The costs may be controlled by

controlling material wastages,increasing labour efficiency etc.

WEALTH MAXIMIZATION

When the firm maximises the stockholders wealth, the individual stockholder can use this

wealth to maximize his individual utility. It means that by maximizing the stockholders

wealth the firm is operating consistently towards maximizing stockholders utility.

STOCKHOLDERS CURRENT NUMBER OF SHARES * CURRENT STOCK PRICE

WEALTH IN A FIRM = OWNED PER SHARE

MAXIMUM UTILITY MAXIMUM STOCKHOLDERS WEALTH MAXIMUM CURRENT STOCK PRICE PER SHARE

Implications of wealth maximization it serves the interest of suppliers of loaned

capital,employes ,management and society. It not only serves shareholders interests but

insures security to lenders also. Productivity and efficiency of employees is the primary

consideration in raising companys wealth. The efficient allocation of productive resources

will be essential for raising the wealth of the company. The economic interest of the

society are served if various resources are put to economical and efficient use.

CRITICISM OF WEALTH

MAXIMIZATION

It is a prescriptive idea

It is not necessarily socially desirable

There is controversy whether the objective is to maximize stockholders

wealth or wealth of the firm

It may face difficulties when ownership and management are seperated.

You might also like

- Exchange Rate Theories ExplainedDocument19 pagesExchange Rate Theories ExplainedPooja SheoranNo ratings yet

- Indian Insurance Industry On A Newer OrbitDocument35 pagesIndian Insurance Industry On A Newer OrbitPooja SheoranNo ratings yet

- Returns To EducationDocument22 pagesReturns To EducationPooja SheoranNo ratings yet

- Blocks To Creativity & Conducing Factors To CreativityDocument17 pagesBlocks To Creativity & Conducing Factors To CreativityPooja SheoranNo ratings yet

- Chap 1 - Updated Research MeaningDocument35 pagesChap 1 - Updated Research MeaningPooja SheoranNo ratings yet

- Quality of EducationDocument9 pagesQuality of EducationPooja SheoranNo ratings yet

- International Monetary SystemDocument35 pagesInternational Monetary SystemAki CreusNo ratings yet

- Dynamics That Underlie Creative ThinkingDocument20 pagesDynamics That Underlie Creative ThinkingPooja SheoranNo ratings yet

- DeflationDocument7 pagesDeflationPooja SheoranNo ratings yet

- Dynamics That Underlie Creative ThinkingDocument20 pagesDynamics That Underlie Creative ThinkingPooja SheoranNo ratings yet

- Role of Creativity and Innovation in An OrganizationDocument14 pagesRole of Creativity and Innovation in An OrganizationPooja SheoranNo ratings yet

- 01 PresentationDocument51 pages01 PresentationPooja SheoranNo ratings yet

- 3M (Corporation Story Success)Document12 pages3M (Corporation Story Success)Pooja SheoranNo ratings yet

- Lateral Thinking - What Is A Problem (Document15 pagesLateral Thinking - What Is A Problem (Pooja SheoranNo ratings yet

- Suspended Judgement and Six Thinking HatsDocument43 pagesSuspended Judgement and Six Thinking HatsPooja SheoranNo ratings yet

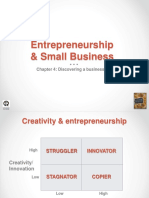

- Entrepreneurship & Small Business: Chapter 4: Discovering A Business IdeaDocument42 pagesEntrepreneurship & Small Business: Chapter 4: Discovering A Business IdeaPooja SheoranNo ratings yet

- Suspended Judgement and Six Thinking HatsDocument43 pagesSuspended Judgement and Six Thinking HatsPooja SheoranNo ratings yet

- Consumption Function: "Consumption Is The Sole End and Purpose of All Production." Adam SmithDocument28 pagesConsumption Function: "Consumption Is The Sole End and Purpose of All Production." Adam SmithPooja SheoranNo ratings yet

- Consumption Function: "Consumption Is The Sole End and Purpose of All Production." Adam SmithDocument28 pagesConsumption Function: "Consumption Is The Sole End and Purpose of All Production." Adam SmithPooja SheoranNo ratings yet

- Mission Statement vs. Vision Statement: Compare AnythingDocument6 pagesMission Statement vs. Vision Statement: Compare AnythingPooja SheoranNo ratings yet

- Corporate Governance Best Practices: ( Exception - Private Company)Document3 pagesCorporate Governance Best Practices: ( Exception - Private Company)Pooja SheoranNo ratings yet

- Chapter-8 Money MarketDocument14 pagesChapter-8 Money MarketPooja SheoranNo ratings yet

- Accounting - Finance InterfaceDocument25 pagesAccounting - Finance InterfacePooja SheoranNo ratings yet

- Vision and MissionDocument2 pagesVision and MissionPooja SheoranNo ratings yet

- CH 3Document33 pagesCH 3Pooja SheoranNo ratings yet

- CH 2Document21 pagesCH 2Pooja SheoranNo ratings yet

- Interface of Accounting and Finance With MarketingDocument10 pagesInterface of Accounting and Finance With MarketingPooja SheoranNo ratings yet

- Role Play CasesDocument4 pagesRole Play CasesPooja SheoranNo ratings yet

- Value Added StatementDocument6 pagesValue Added StatementPooja SheoranNo ratings yet

- TQM and Six SigmaDocument33 pagesTQM and Six SigmaPooja Sheoran100% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Galway Music Officer RoleDocument20 pagesGalway Music Officer RoleJohanna KennyNo ratings yet

- Contract Law 17Document1 pageContract Law 17lorraineNo ratings yet

- Gel Electrophoresis Lab ReportDocument10 pagesGel Electrophoresis Lab Reportapi-31150900783% (6)

- Autoridad Myles Munroe Poder de La El Proposito y PDF Autoridad Myles MunroeDocument5 pagesAutoridad Myles Munroe Poder de La El Proposito y PDF Autoridad Myles MunroeMaricarmen MorenoNo ratings yet

- Promoting Gusaling Museo Through ModernizationDocument15 pagesPromoting Gusaling Museo Through Modernizationdesiree choi100% (1)

- FMS 1Document27 pagesFMS 1bishal dattaNo ratings yet

- Land, Soil, Water, Natural Vegetation& Wildlife ResourcesDocument26 pagesLand, Soil, Water, Natural Vegetation& Wildlife ResourcesKritika VermaNo ratings yet

- Jyothy Fabricare Services Ltd. - Word)Document64 pagesJyothy Fabricare Services Ltd. - Word)sree02nair88100% (1)

- CH06 Binding MaterialsDocument114 pagesCH06 Binding MaterialsAbass AwalehNo ratings yet

- Differential Scanning CalorimetryDocument60 pagesDifferential Scanning CalorimetryMariyam100% (2)

- Sense Organs Lesson PlanDocument16 pagesSense Organs Lesson PlanBernard DayotNo ratings yet

- 53 Midas-Xr Analysis enDocument33 pages53 Midas-Xr Analysis encristiNo ratings yet

- Laplace Transform solved problems explainedDocument41 pagesLaplace Transform solved problems explainedduchesschloeNo ratings yet

- Financial Modeling Interview Questions AnsweredDocument6 pagesFinancial Modeling Interview Questions AnsweredBHAVEN ASHOK SINGHNo ratings yet

- Useful List of Responsive Navigation and Menu Patterns - UI Patterns - GibbonDocument16 pagesUseful List of Responsive Navigation and Menu Patterns - UI Patterns - Gibbonevandrix0% (1)

- Alchemical Psychology Uniform Edition o - HillmanDocument207 pagesAlchemical Psychology Uniform Edition o - HillmanElsy Arana95% (22)

- Eight Directions Feng ShuiDocument6 pagesEight Directions Feng Shuifree_scribdNo ratings yet

- INDIAMART 25012022003631 Investor Presentation Q3FY2021-22Document84 pagesINDIAMART 25012022003631 Investor Presentation Q3FY2021-22geethvazNo ratings yet

- Manual Lift Release System: Parts List and DiagramsDocument4 pagesManual Lift Release System: Parts List and DiagramsPartagon PowNo ratings yet

- Should A Christian Believer Wear An ANKH?: Luxury Art By: Ketu'Rah GloreDocument4 pagesShould A Christian Believer Wear An ANKH?: Luxury Art By: Ketu'Rah GloreMyk Twentytwenty NBeyondNo ratings yet

- Sample Management Representation Letter Type II SAS 70 AuditDocument2 pagesSample Management Representation Letter Type II SAS 70 Auditaaldawi0% (1)

- Three Laws of RoboticsDocument2 pagesThree Laws of RoboticsBav VAansoqnuaetzNo ratings yet

- VR 2200 CatalogueDocument4 pagesVR 2200 Catalogueh.torabyNo ratings yet

- AA Practice Problems on Amino Acids and Peptides (less than 40 charsDocument20 pagesAA Practice Problems on Amino Acids and Peptides (less than 40 charsNurlaeli NaelulmunaMajdiyahNo ratings yet

- Blasting 001 Abb WarehouseDocument2 pagesBlasting 001 Abb WarehouseferielvpkNo ratings yet

- Unitized Curtain Wall SystemDocument38 pagesUnitized Curtain Wall Systems.senthil nathan100% (1)

- Climate Change ReactionDocument2 pagesClimate Change ReactionAngelika CotejoNo ratings yet

- Justification: Justification: Doctrine of Council of TrentDocument4 pagesJustification: Justification: Doctrine of Council of TrentMihai SarbuNo ratings yet

- Galen and The Antonine Plague - Littman (1973)Document14 pagesGalen and The Antonine Plague - Littman (1973)Jörgen Zackborg100% (1)

- History of PTCLDocument4 pagesHistory of PTCLswealumair86No ratings yet