Professional Documents

Culture Documents

NBP

Uploaded by

emran044Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NBP

Uploaded by

emran044Copyright:

Available Formats

92

786

1

National bank of Pakistan

Summary Report

Banking Industry

Danish Ali Zaidi(CEO)

Ateeq-ur-Rehman

Haris Hoorani

Asad Raza

Kamran Malik

Ovais Baig

2

INTRODUCTION

Aims

Enlightenment of students

Outcome:

To introduce the class with the

prospects of NBP strategic

policies and its fallacies.

To give brief overview of the

report that weve submitted to

the honorable teacher

Purpose of

this

presentation

3

Our Agenda

NBP Overview

History

Quick facts

Hierarchy

Vision/mission/goals

SWOT analysis

Matrices

Evaluation

Recommendation

4

NBP Overview

National bank is the oldest bank of

Pakistan

It has the widest spread

I came into bieng in 1949

Caters to all classes of costumers

And even acts as agent of the state

where there is no state bank

5

HISTORY

Established as Government Owned

Bank In 1949

Initial branches were in East Pakistan

This was followed by branches in

Karachi and Lahore.

It is currently the one of the most

established and profitable financial

institute that has been leading the

nation prosperity since its coming

into being

6

Quick Facts

Type Government

KSE: NBP

1,000,000,000 shares of Rs 10 each with 76.6 %

government owned

Founded 1949 Headquarters Principal Office,

Karachi Pakistan Key people

industry = Banking

Capital Markets Products Loans, Credit Cards,

Savings, Consumer Banking etc.

Revenue PKR 50.569 billion (US$ 815.6 million)

(2007)

Net income PKR 19.034 billion (US$ 307 million)

(2007)

Continued.

Domestic Branch 1280 Branches

Islamic Banking 8 Branches

Online Branch 1216 Branch (es)

Overseas Branch 23 Branch (es) 10 Regional /

Representative Office(s)

Swift Branch 13 Branches

6 Customer Facilitation Center(s)

1 international subsidies and 7 Local subsidies

NBP Owned ATMs 125

Outsourced 136

Total ATMs 261

7

Continued

National Bank of Pakistan Awarded Best

Emerging Markets Bank 2011

Awarded By Global Finance Magazine

Bank of the Year awarded for the year 2010 by

the world renowned The Banker magazine

owned by the Financial Times Group, London

Owner(s) Government of Pakistan

Website www.nbp.com.pk

8

Organizational Hierarchy

Chart

9

President

BOD

Member Executive

board

Regional Chief

Zonal Chief

Branch Manager

Vision Statement

To be recognized as a leader and a

brand synonymous with trust,

highest standards of service quality,

international best practices and

social responsibility.

10

Mission Statement

NBP will aspire to the values that make NBP

truly

the Nations Bank, by:

Institutionalizing a merit and performance

culture

Creating a distinctive brand identity by

providing the highest standards of services

Adopting the best international management

practices

Maximizing stakeholders value

Discharging our responsibility as a good

corporate citizen of Pakistan and in countries

where we operate

11

Goals

To enhance profitability

and maximization of

NBP share through

increasing leverage of

existing customer base and

diversified range of

products.

10/4/2014 Confidential 12

13

STRENGTH

Strong financial rating

Alternate duties in SBP absence

Employee Benefits

Healthy environment

Experienced Management

Specialized training for employees

Extensive branch network

Wide range of products

Customer loyalty and trust

WEAKNESSES

Politically influenced HR department

Lack of marketing efforts

inefficient counter services in rush hours

favoritism and nepotism

Lack of standardized performance evaluation and

hiring system

Political pressures because of being a public sector

bank

Limited support for innovation and creativity

Weak customer service

Limited technological advancement

Opportunities

Growing banking industry

Increasing inflation

increasing GDP

Government backing

Increase in economics activities

Expansion of International Coverage

Emerging technologies (e-commerce)

Trends in housing, shopping, careers, business

Religious acceptance of banks

THREATS

Increase in no. of banks

Online Banking

international investment in private sectors

increased banking hours

Modern type of banking

Highly skilled people and management required

The whole structure change

Government policy

imf Policies

SWOT

14

EFE matrix

Sr No Oppourtunities Weight Rating W. score

1 Growing banking industry 0.08 4 0.32

2 Increasing inflation 0.05 3 0.15

3 increaing GDP 0.07 3 0.21

4 Government backing 0.085 4 0.34

5 Increase in economics activities 0.02 4 0.08

6 Expansion of International Coverage 0.06 3 0.18

7 Emerging technologies (e-commerce) 0.09 3 0.27

8 Trends in housing, shopping, careers, business 0.1 4 0.4

9 Religious acceptance of banks 0.015 3 0.045

External Threats

10 Increase in no. of banks 0.05 3 0.15

11 Online Banking 0.06 2 0.12

12 intrernational investment in private sectors 0.01 3 0.03

13 increased banking hours 0.05 3 0.15

14 Modren type of banking 0.025 2 0.05

15 Highly skilled people and management required 0.03 2 0.06

16 The whole structure change 0.025 2 0.05

17 Government policy 0.08 2 0.16

18 imf Policies 0.1 4 0.4

Total 1 3.165

15

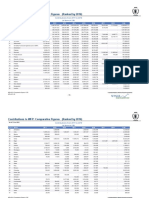

IFE matrix

Sr.No Internal Strength Weight Rating

Weighted

Score

1 Strong financial rating 0.08 4 0.32

2 Alternate duties in SBP absence 0.08 4 0.32

3 Employee Benefits 0.06 3 0.18

4 Healthy environment 0.04 3 0.12

5 Experienced Management 0.1 4 0.4

6 Specialized training for employees 0.05 3 0.15

7 Extensive domestic and overseas branch network 0.1 4 0.4

8 Wide range of products and services 0.05 3 0.15

9 Customer loyalty and trust 0.07 4 0.28

Internal weakness

10 Politically influenced HR department 0.05 1 0.05

11 Lack of marketing efforts 0.02 2 0.04

12 inefficient counter services in rush hours 0.06 1 0.06

13 favoritism and nepotism 0.05 2 0.1

14 Lack of standardized performance evaluation and hiring system 0.05 2 0.1

15 Political pressures because of being a public sector bank 0.05 2 0.1

16 Limited support for innovation and creativity 0.02 2 0.04

17 Weak customer service 0.02 2 0.04

18 Limited technological advancement 0.05 2 0.1

Total 1 2.95

10/4/2014 Confidential 16

CPM

HBL MCB

Sr # Critical Success Factor weight Rating W. Score Rating W. Score

1 Market share 0.15 4 0.6 3 0.45

2 Total Asset 0.1 3 0.3 2 0.2

3 Financial Rating 0.09 3 0.27 3 0.27

4 Product Quality 0.08 2 0.16 3 0.24

5 Customer Loyalty 0.05 2 0.1 3 0.15

6 Expansion 0.08 1 0.08 2 0.16

7 organizational Structure 0.05 3 0.15 3 0.15

8 E- Commerce 0.05 2 0.1 3 0.15

9 Online Branches 0.2 4 0.8 3 0.6

10 Management Experience 0.05 3 0.15 2 0.1

11 Costumer Services 0.1 2 0.2 3 0.3

Total 1 2.91 2.77

17

fds

Government TDRs

I SLAMI C BANKI NG

CASH CARD NBP I NVESTOR

CASH N Gold ADNAVCE

PAK REMI TT

AMDANI PROTECTI ON

PREMI UM SAVER SHEI LD

KI SAN TAQAT SAI BAAN

KI SAN DOST ADV. SALARY

18

Evaluation

IFE score of 2.95 shows that

strategies made by Bank Officials are

implemented and giving the results as

management desire.

This score shows that with some

weakness, bank has to make some

advancement, especially in

technology sector.

NBP AAA rating in medium and long

term banking

19

Continued

Political influence in bank is a big

set back

Govt. support is there for NBP but

too much interest of Govt. is

unethical

Bank should grow more because

there is still huge vacant space in

banking sector that can be utilized

by bank, increasing market share

and render its services to the public.

20

In order to grow in the market relative or

unrelated highly skilled management is required

that can plan and able to implement that plan

efficiently and effectively.

In order to lead in this environment IMF policies

should not be follow. And the whole structure

should be change.

The Bank has intensely undergone market

penetration strategy and are spread far and

wide across the nation.

The bank due to lack of intensity lately has

been undergoing huge impairment losses

21

The Bank has a weakly following product

development strategies which they need to work

harder on

The Bank has undergone related diversification

by launching Islamic banking counter.

The Bank has extremely low Cost of fund of

7.18 %that is a very positive.

The Bank has a huge NPL percentage of approx

35% that should be addressed.

A big liquidity ratio means the bank has great

opportunity to exploit interbank lending

10/4/2014 Confidential 22

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- IGCSE MCQ ChecklistDocument8 pagesIGCSE MCQ ChecklistDhrisha GadaNo ratings yet

- Number SeriesDocument77 pagesNumber Seriessp450001No ratings yet

- WM Insurance Sums 1Document4 pagesWM Insurance Sums 1Rohit GhaiNo ratings yet

- American Dream Fades as Inequality RisesDocument4 pagesAmerican Dream Fades as Inequality RisesAriel seligmanNo ratings yet

- Remsa Brake Pads Commercial Presentation 2013Document13 pagesRemsa Brake Pads Commercial Presentation 2013Brandon Fowler100% (1)

- Drying Processing and Storage of Corn Seed in Tropical and Sub-TDocument29 pagesDrying Processing and Storage of Corn Seed in Tropical and Sub-Ttaufiq hidNo ratings yet

- Republic of The Philippines Municipality of Bulan SorsogonDocument8 pagesRepublic of The Philippines Municipality of Bulan SorsogonBonifacio GepigaNo ratings yet

- BA101 Chapter1Document18 pagesBA101 Chapter1Brian DevlinNo ratings yet

- Netsuite Electronic Payments: Securely Automate EFT Payments and Collections With A Single Global SolutionDocument5 pagesNetsuite Electronic Payments: Securely Automate EFT Payments and Collections With A Single Global SolutionJawad HaiderNo ratings yet

- Davao City hosts anti-drug summitDocument56 pagesDavao City hosts anti-drug summitSheryll Ann Santos OcolNo ratings yet

- Contributions To WFPDocument6 pagesContributions To WFPMarian ChavezNo ratings yet

- Renewable Energy. Wind Resource AssessmentDocument21 pagesRenewable Energy. Wind Resource AssessmentMathias MichaelNo ratings yet

- Dynamic Pricing in TelecomDocument15 pagesDynamic Pricing in TelecomMichael Bryan Larico BarzolaNo ratings yet

- Internship Report on Sustainable Financial Inclusion and Poverty Alleviation through Smart Banking at Bank AsiaDocument70 pagesInternship Report on Sustainable Financial Inclusion and Poverty Alleviation through Smart Banking at Bank AsiashopnoNo ratings yet

- Margins Take Center StageDocument6 pagesMargins Take Center StageCognizantNo ratings yet

- Adoption of MOA & AOA Under Companies Act, 2013 PDFDocument12 pagesAdoption of MOA & AOA Under Companies Act, 2013 PDFVivek PandeyNo ratings yet

- Case Digests: Arts. 1262 - 1304Document2 pagesCase Digests: Arts. 1262 - 1304Manny Carl ClarionNo ratings yet

- Fundraising Letter CampaignDocument2 pagesFundraising Letter Campaignapi-83415991No ratings yet

- Is an Oscar award worth $20,000 assessable for income taxDocument9 pagesIs an Oscar award worth $20,000 assessable for income taxNawalRamayNo ratings yet

- Final Report The Purse Project PDFDocument115 pagesFinal Report The Purse Project PDFTata RaminathaNo ratings yet

- ECO529 NotesDocument177 pagesECO529 Notesviola fabiantoNo ratings yet

- CS KhushiDocument1 pageCS Khushimzplus chikhliNo ratings yet

- WAPCOS LimitedCentre For Planning and DevelopmentDocument3 pagesWAPCOS LimitedCentre For Planning and DevelopmentRafikul RahemanNo ratings yet

- Gorive CelijeDocument3 pagesGorive CelijeMilana Guteša BožoNo ratings yet

- (Sales) Medina V Collector of Internal RevenueDocument2 pages(Sales) Medina V Collector of Internal RevenueKristel Angeline Rose P. NacionNo ratings yet

- Soal Latihan Akuntansi Mutual HoldingDocument9 pagesSoal Latihan Akuntansi Mutual HoldingFlavita VindiNo ratings yet

- Orban Co-Operative BankDocument27 pagesOrban Co-Operative BankYaadrahulkumar MoharanaNo ratings yet

- Prepare The Cash BookDocument4 pagesPrepare The Cash BookShaloom TV100% (1)

- FlightDocument2 pagesFlightwordscriptNo ratings yet

- History of Public Fiscal AdministrationDocument13 pagesHistory of Public Fiscal AdministrationRonna Faith Monzon100% (1)