Professional Documents

Culture Documents

FM MMS

Uploaded by

mrchavan1430 ratings0% found this document useful (0 votes)

11 views9 pagesFM-MMS-

Original Title

FM-MMS-

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFM-MMS-

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views9 pagesFM MMS

Uploaded by

mrchavan143FM-MMS-

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 9

Financial Management

-Prof Dimple Pandey

Objective of Financial Management

Objective- To understand the need and importance of FM. Importance of time

value of money

earning outcome- !tudents "no# the reason to study FM

Objective of Financial Management

Introduction to subject

$elevance

$elation of finance #ith economics and accounting

%hy this subject is there after studying economics and accounting

&oal of firms-caselet

Importance of time value of money

'ompounding( discounting

Objective of Financial Management

FINANCE THEORY RESTS ON THE PREMISE THAT MANAGERS

SHOULD MANAGE THEIR FIRMs RESOURCES WITH THE

OBJECTIVE OF ENHANCING THE FIRMs MARKET VALUE.

SHAREHOLDER ORIENTATION IN INDIA

In the !"e #$ %&'e(!%&)!t&#n* +%#'!%&)!t&#n* !n, &nst&t-t&#n!%&)!t&#n #$ the

.!/&t!% 0!("et* the(e &s ! +(e!te( &n.ent&1e t# $#.-s #n .(e!t&n+ 1!%-e $#(

sh!(eh#%,e(s. The $#%%#&n+ #'se(1!t&#ns !(e .%e!( &n,&.!t&#ns.

Dh&(-'!& A0'!n& 2 In e1e(3th&n+ th!t e ,#* e h!1e #n%3 #ne s-/(e0e

+#!%* th!t &s t# 0!4&0&)e 3#-( e!%th !s In,&!5s %!(+est &n1est#( $!0&%3.

An!n, M!h&n,(! 2 A%% #$ -s !(e 'e+&nn&n+ t# %##" !t .#0/!n&es !s #ne,

'3 sh!(eh#%,e(s. The "e3 &s t# (!&se sh!(eh#%,e( (et-(ns

Objective of Financial Management

RELATIONSHIP OF FINANCE TO ECONOMICS

M!.(#e.#n#0&. en1&(#n0ent ,e$&nes the sett&n+ &th&n h&.h the $&(0

#/e(!tes. GDP +(#th (!te* &nte(est (!tes* &n$%!t&#n (!te* e4.h!n+e (!tes* t!4

(!tes* !n, s# #n h!1e !n &0/!.t #n the $&(0

M&.(#e.#n#0&.s ,e!%s &th the e.#n#0&. ,e.&s&#ns #$ &n,&1&,-!% $&(0s !n,

!&0s !t /(#$&t 0!4&0&s!t&#n.

F&n!n.e* &n essen.e* &s !//%&e, 0&.(#e.#n#0&.s

Objective of Financial Management

RELATIONSHIP OF FINANCE TO ACCOUNTING

A..#-nt&n+ &s .#n.e(ne, &th s.#(e "ee/&n+* he(e!s $&n!n.e &s !&0e, !t

1!%-e 0!4&0&)&n+.

The !..#-nt!nt /(e/!(es the !..#-nt&n+ (e/#(ts '!se, #n the !..(-!%

0eth#,. The $#.-s #$ the $&n!n.&!% 0!n!+e( &s #n .!sh $%#s.

A..#-nt&n+ ,e!%s /(&0!(&%3 &th the /!st. F&n!n.e &s .#n.e(ne, 0!&n%3

&th the $-t-(e.

Objective of Financial Management

THE FUNDAMENTAL PRINCIPLE OF FINANCE

A '-s&ness /(#/#s!%6(e+!(,%ess #$ hethe( &t &s ! ne &n1est0ent #(

!.7-&s&t&#n #$ !n#the( .#0/!n3 #( ! (est(-.t-(&n+ &n&t&!t&1e 8(!&ses the

1!%-e #$ the $&(0 #n%3 &$ the /(esent 1!%-e #$ the $-t-(e st(e!0 #$ net .!sh

'ene$&ts e4/e.te, $(#0 the /(#/#s!% &s +(e!te( th!n the &n&t&!% .!sh #-t%!3

(e7-&(e, t# &0/%e0ent the /(#/#s!%.

In1est#(s /(#1&,e the &n&t&!% .!sh (e7-&(e, t# $&n!n.e the '-s&ness /(#/#s!%

The /(#/#s!% +ene(!tes .!sh (et-(ns t# &n1est#(s

Time value of money

Objective- To "no# the importance of time value of money. Introduction to

compunding and discounting techni)ues and their applications using numericals.

earning outcome- !tudent should be able to understand the importance of time

value of money( be able to calculate present and future values of investment.

Time value of money

It is the value of money at different time intervals as the value of money

changes over a period of time.

*alue of money received today is more than its value received at a later date.

Methods of calculating time value of money+

'ompounding- Future value

Doubling period

$ule of ,-

$ule of ./

Future value of an 0nnuity-periodic flo#s of e)ual amounts

!in"ing fund- Fi1ed payments each period to accumulate to a future sum after

specified period.

Discounting- Present value

Present value of perpetuity- 0nnuity for an infinite time period

'apital recovery factor- amount of installment

You might also like

- Explore Nature at Sunshine ResortDocument36 pagesExplore Nature at Sunshine Resortmrchavan143No ratings yet

- Fact FofeitDocument34 pagesFact Fofeitmrchavan143No ratings yet

- Factoring Vs ForfeitingDocument27 pagesFactoring Vs ForfeitingShruti AshokNo ratings yet

- Just in TimeDocument13 pagesJust in Timemrchavan143100% (1)

- Khidki VadaDocument2 pagesKhidki Vadamrchavan143No ratings yet

- Final PresentationDocument16 pagesFinal Presentationmrchavan143No ratings yet

- FACTORINGDocument17 pagesFACTORINGmrchavan143No ratings yet

- Group Members: Jayshree Varsha Melanie Abhishek Priyanka Rekha HardikDocument27 pagesGroup Members: Jayshree Varsha Melanie Abhishek Priyanka Rekha Hardikmrchavan143No ratings yet

- Introduction to Marketing Services in the Insurance IndustryDocument68 pagesIntroduction to Marketing Services in the Insurance Industrymrchavan143No ratings yet

- Acquisition: of Bank of Rajasthan by ICICI BankDocument12 pagesAcquisition: of Bank of Rajasthan by ICICI Bankmrchavan143No ratings yet

- Topmutual FundsDocument35 pagesTopmutual Fundsmrchavan143No ratings yet

- Our VisionDocument1 pageOur Visionmrchavan143No ratings yet

- SEO (Disambiguation) : Internet MarketingDocument8 pagesSEO (Disambiguation) : Internet Marketingmrchavan143No ratings yet

- Unique Identity ProjectDocument17 pagesUnique Identity Projectmrchavan143No ratings yet

- MahindraDocument29 pagesMahindramrchavan143No ratings yet

- Khidki VadaDocument2 pagesKhidki Vadamrchavan143No ratings yet

- Khidki VadaDocument2 pagesKhidki Vadamrchavan143No ratings yet

- Case - 6 page-93-Dr.B.Rathan ReddyDocument1 pageCase - 6 page-93-Dr.B.Rathan Reddymrchavan143No ratings yet

- BCG HulDocument1 pageBCG Hulmrchavan143No ratings yet

- Maruti PPT On Labour UnrestDocument5 pagesMaruti PPT On Labour Unrestaki001No ratings yet

- Law of ContractsDocument102 pagesLaw of Contractsrajjuneja100% (5)

- Maruti Suzuki's Manesar plant faces lockout as violence halts productionDocument2 pagesMaruti Suzuki's Manesar plant faces lockout as violence halts productionmrchavan143No ratings yet

- Impact of Information Technology On Business: Presented By: Samrudhi GadveDocument11 pagesImpact of Information Technology On Business: Presented By: Samrudhi Gadvemrchavan143No ratings yet

- Retail BanksDocument52 pagesRetail Banksmrchavan143No ratings yet

- Grind Well Norton LimitedDocument79 pagesGrind Well Norton Limitedbhaskar.jain20021814No ratings yet

- Management and Its EvolutionDocument14 pagesManagement and Its Evolutionmrchavan143No ratings yet

- CodificationDocument15 pagesCodificationVarsha Anil NairNo ratings yet

- EntrepreneurshipDocument98 pagesEntrepreneurshipmrchavan143100% (1)

- Executive Summary of KraftDocument4 pagesExecutive Summary of Kraftmrchavan143No ratings yet

- 10 Tips To Feng Shui Your OfficeDocument4 pages10 Tips To Feng Shui Your Officemrchavan143No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- AI Capstone Project Report for Image Captioning and Digital AssistantDocument28 pagesAI Capstone Project Report for Image Captioning and Digital Assistantakg29950% (2)

- MBA Third Semester Model Question Paper - 2009: Management and Organization Development-MU0002 (2 Credits)Document11 pagesMBA Third Semester Model Question Paper - 2009: Management and Organization Development-MU0002 (2 Credits)ManindersuriNo ratings yet

- Settlement of Piled Foundations Using Equivalent Raft ApproachDocument17 pagesSettlement of Piled Foundations Using Equivalent Raft ApproachSebastian DraghiciNo ratings yet

- FM Stereo FM-AM Tuner: ST-SE500 ST-SE700Document64 pagesFM Stereo FM-AM Tuner: ST-SE500 ST-SE700al80al80100% (4)

- Jaap Rousseau: Master ExtraodinaireDocument4 pagesJaap Rousseau: Master ExtraodinaireKeithBeavonNo ratings yet

- GDJMDocument1 pageGDJMRenato Alexander GarciaNo ratings yet

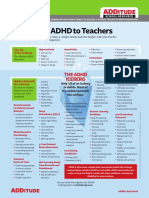

- Explaining ADHD To TeachersDocument1 pageExplaining ADHD To TeachersChris100% (2)

- GASB 34 Governmental Funds vs Government-Wide StatementsDocument22 pagesGASB 34 Governmental Funds vs Government-Wide StatementsLisa Cooley100% (1)

- Tax Q and A 1Document2 pagesTax Q and A 1Marivie UyNo ratings yet

- Codilla Vs MartinezDocument3 pagesCodilla Vs MartinezMaria Recheille Banac KinazoNo ratings yet

- Role of Rahu and Ketu at The Time of DeathDocument7 pagesRole of Rahu and Ketu at The Time of DeathAnton Duda HerediaNo ratings yet

- ACS Tech Manual Rev9 Vol1-TACTICS PDFDocument186 pagesACS Tech Manual Rev9 Vol1-TACTICS PDFMihaela PecaNo ratings yet

- The Insanity DefenseDocument3 pagesThe Insanity DefenseDr. Celeste Fabrie100% (2)

- The Steriotypes: Cultural StereotypeDocument8 pagesThe Steriotypes: Cultural StereotypeRosbeyli Mazara ReyesNo ratings yet

- Bianchi Size Chart for Mountain BikesDocument1 pageBianchi Size Chart for Mountain BikesSyafiq IshakNo ratings yet

- February / March 2010Document16 pagesFebruary / March 2010Instrulife OostkampNo ratings yet

- Classification of Boreal Forest Ecosystem Goods and Services in FinlandDocument197 pagesClassification of Boreal Forest Ecosystem Goods and Services in FinlandSivamani SelvarajuNo ratings yet

- 4AD15ME053Document25 pages4AD15ME053Yàshánk GøwdàNo ratings yet

- College Wise Form Fillup Approved Status 2019Document4 pagesCollege Wise Form Fillup Approved Status 2019Dinesh PradhanNo ratings yet

- Should Animals Be Banned From Circuses.Document2 pagesShould Animals Be Banned From Circuses.Minh Nguyệt TrịnhNo ratings yet

- 12.1 MagazineDocument44 pages12.1 Magazineabdelhamed aliNo ratings yet

- Microsoft Word - G10 Workbook - Docx 7Document88 pagesMicrosoft Word - G10 Workbook - Docx 7Pax TonNo ratings yet

- Online Statement of Marks For: B.A. (CBCS) PART 1 SEM 1 (Semester - 1) Examination: Oct-2020Document1 pageOnline Statement of Marks For: B.A. (CBCS) PART 1 SEM 1 (Semester - 1) Examination: Oct-2020Omkar ShewaleNo ratings yet

- What Blockchain Could Mean For MarketingDocument2 pagesWhat Blockchain Could Mean For MarketingRitika JhaNo ratings yet

- Notes Socialism in Europe and RussianDocument11 pagesNotes Socialism in Europe and RussianAyaan ImamNo ratings yet

- Battery Genset Usage 06-08pelj0910Document4 pagesBattery Genset Usage 06-08pelj0910b400013No ratings yet

- The Highest Form of Yoga - Sant Kirpal SinghDocument9 pagesThe Highest Form of Yoga - Sant Kirpal SinghKirpal Singh Disciple100% (2)

- Technical Contract for 0.5-4X1300 Slitting LineDocument12 pagesTechnical Contract for 0.5-4X1300 Slitting LineTjNo ratings yet

- 2013 Gerber CatalogDocument84 pages2013 Gerber CatalogMario LopezNo ratings yet

- Prac Research Module 2Document12 pagesPrac Research Module 2Dennis Jade Gascon NumeronNo ratings yet