Professional Documents

Culture Documents

Chapter 7 - Current Asset Management

Uploaded by

hendraxyzxyzOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 7 - Current Asset Management

Uploaded by

hendraxyzxyzCopyright:

Available Formats

CURRENT ASSET

MANAGEMENT

CHAPTER SEVEN

1

INTRODUCTION

Financial manager must carefully allocate

resources among the current assets of the firm,

such as cash, marketable securities, accounts

receivable and inventory.

In managing cash and marketable securities,

the primary concern should be for safety and

liquidity.

While for accounts receivable and inventory,

attention should pay on maximization

profitability.

2

CASH MANAGEMENT

Minimizing cash balances as well as having

accurate knowledge of when cash moves into

and out of the company can improve overall

corporate profitability.

There are several reasons for holding cash:

Transaction balances involves the use of cash to

pay for planned corporate expenses such as

supplies, payrolls and taxes.

Compensate bank for services provided.

Precautionary needs it assume management

wants cash for emergency purposes when cash

inflows are less than projected.

3

CASH MANAGEMENT:

CASH FLOW CYCLE

The primary consideration in managing cash flow

cycle is to ensure that inflows and outflows of cash

are properly matched for transaction purposes.

A simple cash flow cycle where the sale of finished

goods or services produces either a cash sale or

account receivable for future collection.

The accounts receivable will eventually collected and

become cash which is used to buy and produce

inventory that is then sold.

Therefore, the cash-generating process is continuous

even though the cash flow may be unpredictable and

uneven.

4

CASH MANAGEMENT:

CASH FLOW CYCLE

Other activities in the firm also can affect cash

inflows and outflows.

The expanded cash flow cycle in Figure 7.2

(pg.177):

Cash inflows are mainly from sales.

But is influenced by the type of customers,

geographical location, the product sold and the

industry.

5

CASH MANAGEMENT:

CASH FLOW CYCLE

The expanded cash flow cycle in Figure 7.2

(cont):

When an account receivable is collected cash

balances increase and the firm uses cash to pay:

Interest to lenders

Dividends to stockholders

Taxes to the government

Accounts payable to suppliers

Wages to workers

Replace inventory

6

CASH MANAGEMENT:

CASH FLOW CYCLE

The expanded cash flow cycle in Figure 7.2

(cont):

When the firm have excess cash, it will invest in

marketable securities.

When it need cash for current assets, it will either

sell marketable securities or borrow fund from

short-term lenders.

7

COLLECTIONS & DISBURSEMENTS:

FLOAT

Managing the cash inflows and payments is a

function of many variables.

There are actually two cash balances of

importance:

The firms recorded amount

The amount credited to the firm by the bank.

The difference between the two is called float.

Float arises as a result of time delays in

mailing, processing and clearing checks

through the banking system.

8

COLLECTIONS & DISBURSEMENTS:

FLOAT

When checks is received in the mail and a

deposit is made, the deposited funds are not

available for use until the check has cleared

the banking system and been credited to the

firm bank account.

This would happened to those checks payment

to suppliers and checks received from

customers.

9

COLLECTIONS & DISBURSEMENTS:

FLOAT

Example: A firm has deposited $1,000,000

checks received from customers during the

week, and has issued $900,000 checks to

suppliers.

Assume that $800,000 of checks from

customer have cleared and debited while only

$400,000 of firms checks being claimed. The

initial cash balance is $100,000.

What will the firm and bank records show?

10

COLLECTIONS & DISBURSEMENTS:

FLOAT

With the example given, we compute the float:

The above shows that float provide us with

$300,000 extra in available short-term funds.

11

Firm books Bank books (amount cleared)

Initial amount 100,000 100,000

Deposits (+) 1,000,000 800,000

Checks issue (-) (900,000) (400,000)

Balance 200,000 500,000

COLLECTIONS & DISBURSEMENTS:

IMPROVING COLLECTIONS

Collection and check-clearing process through

a number of strategies.

First, is to utilize variety of collection centers

through out the marketing area.

E.g. an insurance company with headquarters in

Chicago may have 75 collection offices disbursed

throughout the country with each performing a

billing and collection-deposit function.

The company can use a local bank as the collection

offices thus clearing the checks in shorter time.

12

COLLECTIONS & DISBURSEMENTS:

IMPROVING COLLECTIONS

First, is to utilize variety of collection centers

through out the marketing area.

The company also can adopt lockbox system to

replace the collection offices.

Under the lockbox system, customers are requested

to forward their checks to a post office box and a

local bank picks up the checks.

The bank can then process the local checks through

the local clearing house for rapid collection.

13

COLLECTIONS & DISBURSEMENTS:

EXTENDING DISBURSEMENT

A slowdown pattern more appropriately to

describe the payment procedures.

For instance, a multimillion-dollar corporation

with its headquarters located in the most

exclusive office space in Manhattan, but with

its primary payment center in North Dakota.

Their objective is to extended disbursement

float so that they hold their cash balances as

long as possible.

14

COLLECTIONS & DISBURSEMENTS:

COST-BENEFIT ANALYSIS

An efficiently maintained cash management

program can be expensive operation.

The use of remote collection and disbursement

center discussed earlier involves additional

costs and bank might require the firm maintain

adequate deposit balances or pay sufficient

fees for the services.

Therefore, these expenses must be compared

to the benefits that may accrue through the use

of cost-benefit analysis.

15

COLLECTIONS & DISBURSEMENTS:

COST-BENEFIT ANALYSIS

Example, if a firm has an average daily

payment of $2 million, through stretching the

disbursement schedule by one day, the $2

million will become available for alternate

uses.

16

COLLECTIONS & DISBURSEMENTS:

ELECTRONIC FUNDS TRANSFER

This is a system in which funds are moved

between the computer terminals without the

use of a check.

E.g. through the use of terminal

communication between the supermarket and

the bank, your payment is automatically

charged against your account before you leave

the supermarket.

17

COLLECTIONS & DISBURSEMENTS:

ELECTRONIC FUNDS TRANSFER

Automated clearinghouses (ACH) are an

important element in electronic funds

transfers.

An ACH transfers information between one

financial institution and another and from

account to account via computer tape.

Refer to Figure 7-4 for the ACH network, it

shows the flow of funds.

18

COLLECTIONS & DISBURSEMENTS:

ELECTRONIC FUNDS TRANSFER

Figure 7-4:

The originator (individual or corporation) forwards

the credit or debit transaction data to an Originating

Depository Financial Institution (ODFI).

ODFI then sort and transmits the file to an

automated clearinghouse operator.

The ACH then distributes the file to the receiving

depository financial institution (RDFI) which then

makes the funds available receivers account

(individual or corporation).

19

THANK YOU

20

TUTORIAL QUESTIONS

1. In the management of cash and marketable

securities, why should the primary concern

be for safely and liquidity rather than

maximization of profit?

2. Briefly explain how a corporation may use

float to its advantage.

3. Why does float exist and what effect do

electronic funds transfer systems have on

float?

21

TUTORIAL QUESTIONS

4. Explain the similarities and differences of

lockbox systems and regional collection

offices.

5. Why would a financial manager wan to slow

down disbursement?

22

You might also like

- Objective Questions On Capital BudgetingDocument3 pagesObjective Questions On Capital Budgetingthorat82No ratings yet

- Acctg201 ProcessCostingLectureNotesDocument24 pagesAcctg201 ProcessCostingLectureNotesSophia Marie Eredia FerolinoNo ratings yet

- Reorganization and Troubled Debt Restructuring - 2Document32 pagesReorganization and Troubled Debt Restructuring - 2Marie GarpiaNo ratings yet

- Absorption and Variable Costing - Ch. 2 PGDM New FinalDocument24 pagesAbsorption and Variable Costing - Ch. 2 PGDM New FinalBhuvan ThakurNo ratings yet

- Current Asset ManagementDocument17 pagesCurrent Asset ManagementKurt HendiveNo ratings yet

- ADV I Chapter 3 2009Document17 pagesADV I Chapter 3 2009temedebere100% (1)

- Transfer PricingDocument35 pagesTransfer PricingsivaNo ratings yet

- Break-Even Point and Cost-Volume-Profit Analysis: QuestionsDocument39 pagesBreak-Even Point and Cost-Volume-Profit Analysis: QuestionsElijah MontefalcoNo ratings yet

- Module 3 Financial Ratios Practice ProblemsDocument2 pagesModule 3 Financial Ratios Practice ProblemsMeg CruzNo ratings yet

- Simulation & Learning CurveDocument25 pagesSimulation & Learning Curveaadi1811No ratings yet

- 03 LasherIM Ch03Document47 pages03 LasherIM Ch03Maryam Bano100% (5)

- Materiality and Audit RiskDocument13 pagesMateriality and Audit RiskJibran SheikhNo ratings yet

- Certification Below 300Document1 pageCertification Below 300Boy Omar Garangan DatudaculaNo ratings yet

- Rehabilitaion of CorporationDocument14 pagesRehabilitaion of CorporationSarah Jane-Shae O. SemblanteNo ratings yet

- Chapter 16 "How Well Am I Doing?" - Financial Statement AnalysisDocument134 pagesChapter 16 "How Well Am I Doing?" - Financial Statement AnalysisTyra Joyce RevadaviaNo ratings yet

- Quantitative Techniques (OK Na!)Document9 pagesQuantitative Techniques (OK Na!)AANo ratings yet

- 2.8 Substantive Tests - AR and SalesDocument2 pages2.8 Substantive Tests - AR and SalesBrian Jeric MorilloNo ratings yet

- Accountancy - Chapter 4 & 5Document5 pagesAccountancy - Chapter 4 & 5maricarNo ratings yet

- Financial Management (Chapter 4: Financial Analysis-Sizing Up Firm Performance)Document24 pagesFinancial Management (Chapter 4: Financial Analysis-Sizing Up Firm Performance)Steven consueloNo ratings yet

- Module 6 FINP1 Financial ManagementDocument28 pagesModule 6 FINP1 Financial ManagementChristine Jane LumocsoNo ratings yet

- Bond Stock ValuationDocument38 pagesBond Stock ValuationRichard Artajo RoxasNo ratings yet

- Chapter 1Document8 pagesChapter 1John Christopher CadiaoNo ratings yet

- Govbusman Midterms HandoutDocument43 pagesGovbusman Midterms HandoutAnn SantosNo ratings yet

- Quizz Chapter 21Document9 pagesQuizz Chapter 21Rachel EnokouNo ratings yet

- ACCT 1A&B: Fundamentals of Accounting BCSV Fundamentals of Accounting Part I Accounting For Merchandising BusinessDocument13 pagesACCT 1A&B: Fundamentals of Accounting BCSV Fundamentals of Accounting Part I Accounting For Merchandising BusinessJerric CristobalNo ratings yet

- Case 2Document4 pagesCase 2Chris WongNo ratings yet

- Cost Behavior and CVP Analysis PDFDocument22 pagesCost Behavior and CVP Analysis PDFJohn Carlo D. EngayNo ratings yet

- Chapter 4 SolutionsDocument85 pagesChapter 4 SolutionssevtenNo ratings yet

- Cost - Volume - ProfitDocument52 pagesCost - Volume - ProfitsueernNo ratings yet

- Inventory List SubmissionDocument2 pagesInventory List SubmissionLevi Lazareno EugenioNo ratings yet

- #22 Revaluation & Impairment (Notes For 6206)Document5 pages#22 Revaluation & Impairment (Notes For 6206)Claudine DuhapaNo ratings yet

- Foreign Currency TransactionsDocument19 pagesForeign Currency Transactionsmicaella pasionNo ratings yet

- 8 Rizal Surety & Insurance Co. vs. CADocument12 pages8 Rizal Surety & Insurance Co. vs. CAMichelle Montenegro - AraujoNo ratings yet

- Chapter 9: FOREX MARKET Key PointsDocument6 pagesChapter 9: FOREX MARKET Key PointsDanica AbelardoNo ratings yet

- Cabrera Chapter 01 - AnswerDocument3 pagesCabrera Chapter 01 - AnswerAlyssa100% (1)

- Assignment Bill FrenchDocument5 pagesAssignment Bill Frenchrahulchohan2108No ratings yet

- Prelims Ms1Document6 pagesPrelims Ms1ALMA MORENANo ratings yet

- Mas 06Document9 pagesMas 06Einstein Salcedo100% (1)

- Acct1a&b Chapter 1 ReviewerDocument3 pagesAcct1a&b Chapter 1 ReviewerKathleen Louise VarillaNo ratings yet

- Accounting ReviewerDocument22 pagesAccounting ReviewerAira TantoyNo ratings yet

- The Auditorx27s Responsibilitydocx PDF FreeDocument9 pagesThe Auditorx27s Responsibilitydocx PDF FreeGONZALES CamilleNo ratings yet

- tAX FINALSDocument8 pagestAX FINALSAmie Jane MirandaNo ratings yet

- Relevant Costing - HandoutDocument10 pagesRelevant Costing - HandoutUsra Jamil SiddiquiNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document20 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- CHAPTER 8 - DepreciationDocument12 pagesCHAPTER 8 - DepreciationMuhammad AdibNo ratings yet

- Explanation: Inherent Limitations of The AuditDocument4 pagesExplanation: Inherent Limitations of The AuditRiz WanNo ratings yet

- Cost Volume Profit Analysis Review NotesDocument17 pagesCost Volume Profit Analysis Review NotesAlexis Kaye DayagNo ratings yet

- Philippine Framework For Assurance EngagementsDocument15 pagesPhilippine Framework For Assurance EngagementsAnonymous LC5kFdtcNo ratings yet

- Risk ResponseDocument4 pagesRisk ResponseLevi AckermannNo ratings yet

- Presentation On Variable and Absorption CostingDocument24 pagesPresentation On Variable and Absorption Costingsmurtazaali84No ratings yet

- Management Advisory ServicesDocument14 pagesManagement Advisory ServicesChrizzele Quiohilag Sonsing100% (1)

- Accounting For Foreign Currency Transactions PDFDocument49 pagesAccounting For Foreign Currency Transactions PDFDaniel DakaNo ratings yet

- Responsibility and Segment Accounting CRDocument24 pagesResponsibility and Segment Accounting CRAshy LeeNo ratings yet

- Cash Management TechniquesDocument39 pagesCash Management TechniquesDharmendra ThakurNo ratings yet

- Chapter 18 - AnswerDocument9 pagesChapter 18 - Answerwynellamae0% (2)

- Cash and Marketable Securities ManagementDocument12 pagesCash and Marketable Securities ManagementAlexandra TagleNo ratings yet

- Balance Cash Holding Teaching MaterialDocument18 pagesBalance Cash Holding Teaching MaterialAbdi Mucee TubeNo ratings yet

- 310 Balance Cash HoldingsDocument21 pages310 Balance Cash Holdingsdawit TerefeNo ratings yet

- Cash and Marketable Securities ManagementDocument53 pagesCash and Marketable Securities ManagementRaza SamiNo ratings yet

- Shimp8e - Chap08 Note CHPT 07 N 12 Not ExistDocument30 pagesShimp8e - Chap08 Note CHPT 07 N 12 Not ExisthendraxyzxyzNo ratings yet

- Shimp8e Chap03Document33 pagesShimp8e Chap03hendraxyzxyzNo ratings yet

- Shimp8e Chap06Document25 pagesShimp8e Chap06hendraxyzxyzNo ratings yet

- Shimp8e Chap01Document24 pagesShimp8e Chap01hendraxyzxyz0% (1)

- Shimp8e Chap02Document29 pagesShimp8e Chap02hendraxyzxyzNo ratings yet

- A Comprehensive Model of E-Loyalty: The Mediational Role of Customer SatisfactionDocument32 pagesA Comprehensive Model of E-Loyalty: The Mediational Role of Customer SatisfactionhendraxyzxyzNo ratings yet

- 2016 Trends in Higher Education Marketing, Enrollment, and TechnologyDocument36 pages2016 Trends in Higher Education Marketing, Enrollment, and TechnologyhendraxyzxyzNo ratings yet

- Sistem Pemasaran: Lingkungan Makro Ekstern Lingkungan Mikro Ekstern Marketing MixDocument61 pagesSistem Pemasaran: Lingkungan Makro Ekstern Lingkungan Mikro Ekstern Marketing MixhendraxyzxyzNo ratings yet

- Solomon cb09 PPT 06Document40 pagesSolomon cb09 PPT 06hendraxyzxyzNo ratings yet

- Mkt420 Consumer Behavior-131107Document11 pagesMkt420 Consumer Behavior-131107hendraxyzxyzNo ratings yet

- Chapter 7 (II) - Current Asset ManagementDocument23 pagesChapter 7 (II) - Current Asset ManagementhendraxyzxyzNo ratings yet

- Chinese-English Precepts Ebook For Buddhist Five PreceptsDocument0 pagesChinese-English Precepts Ebook For Buddhist Five PreceptshendraxyzxyzNo ratings yet

- Endogenous Growth Theories and New Strategies For DevelopmentDocument8 pagesEndogenous Growth Theories and New Strategies For DevelopmenthendraxyzxyzNo ratings yet

- Initiating The Industrialization ProcessDocument11 pagesInitiating The Industrialization ProcesshendraxyzxyzNo ratings yet

- Marketing AgreementDocument6 pagesMarketing AgreementdcdavisNo ratings yet

- Associated Bank V CADocument6 pagesAssociated Bank V CArgtan3No ratings yet

- Sharpe Index Model: Portfolio Expected Return E (R) oDocument2 pagesSharpe Index Model: Portfolio Expected Return E (R) oAlissa BarnesNo ratings yet

- World Insurance Report - 2019Document36 pagesWorld Insurance Report - 2019mNo ratings yet

- Analysis of Revenue and Expenditure at Citi (Monica Alex Fernandes)Document69 pagesAnalysis of Revenue and Expenditure at Citi (Monica Alex Fernandes)Monica FernandesNo ratings yet

- Lafcu Employerbrochure 0714Document2 pagesLafcu Employerbrochure 0714api-239798923No ratings yet

- Visa Money Transfer Clients Short Version 13 April 2010Document21 pagesVisa Money Transfer Clients Short Version 13 April 2010rwilson66100% (1)

- Audit of The Inventory and Warehousing Cycle: Chapter 2DDocument34 pagesAudit of The Inventory and Warehousing Cycle: Chapter 2DCyndi SyifaaNo ratings yet

- Lazard InternshipDocument1 pageLazard InternshipMike LeNo ratings yet

- JPM - 021914 - 123336 Bloomberg Report (Luxottica Group)Document6 pagesJPM - 021914 - 123336 Bloomberg Report (Luxottica Group)reginetalucodNo ratings yet

- Nse & BseDocument120 pagesNse & BseArjun PatelNo ratings yet

- Indigo IPODocument592 pagesIndigo IPOTarun SinghNo ratings yet

- IIBFDocument3 pagesIIBFRauShan RajPutNo ratings yet

- Notes For Shippign Week 3Document31 pagesNotes For Shippign Week 3Tay Min SiNo ratings yet

- Checkout and SettlementDocument12 pagesCheckout and SettlementAshishDJoseph100% (2)

- Priority Sector AdvDocument33 pagesPriority Sector AdvShibashish GiriNo ratings yet

- HDFC LifeDocument1 pageHDFC LifefacebookorkutNo ratings yet

- Karwa Letter 5Document19 pagesKarwa Letter 5Samyak DahaleNo ratings yet

- Types of Software Used in BanksDocument3 pagesTypes of Software Used in BanksMussadaq JavedNo ratings yet

- G 065 19 Sales Brochure LIC S Jeevan Amar Plan Proof 10Document2 pagesG 065 19 Sales Brochure LIC S Jeevan Amar Plan Proof 10chat windowNo ratings yet

- Basic AccountsDocument51 pagesBasic AccountsNilesh Indikar100% (1)

- PNB Ze Lo Mastercard - App Form OnePager - Jan2020 1Document9 pagesPNB Ze Lo Mastercard - App Form OnePager - Jan2020 1Crypto ManiacNo ratings yet

- 2.2 Pending Litigation: Criteria Compliance Requirements DocumentsDocument3 pages2.2 Pending Litigation: Criteria Compliance Requirements DocumentstanujaayerNo ratings yet

- Dabistan-e-Ijtihaad - 99 Names of Holy Prophet Muhammad (Saw)Document2 pagesDabistan-e-Ijtihaad - 99 Names of Holy Prophet Muhammad (Saw)Salman MirzaNo ratings yet

- Credit Rating AgenciesDocument19 pagesCredit Rating AgenciesParth MahajanNo ratings yet

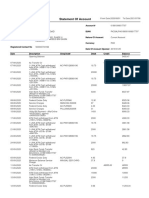

- 'Account StatementDocument11 pages'Account StatementSikander Qazi100% (2)

- 91 ClubDocument1 page91 Clubgouravbhatti0112200491% (11)

- Please Accept Any Appropriate Answer Not Mentioned in This KeyDocument3 pagesPlease Accept Any Appropriate Answer Not Mentioned in This KeyayouzyouftnNo ratings yet

- Rogue TraderDocument4 pagesRogue TraderbijayrNo ratings yet

- SMS BillDocument2 pagesSMS BillamitsbhatiNo ratings yet