Professional Documents

Culture Documents

Project and Infrastructure Finance Slides Module6 - Final

Uploaded by

Sourav KamilyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project and Infrastructure Finance Slides Module6 - Final

Uploaded by

Sourav KamilyaCopyright:

Available Formats

R.

Kannan

1

LEASING

MODULE - 6

R.Kannan

2

Leasing

Operating lease:

The lessor maintains equipment

The lease period is shorter than economic life

The asset is returned to lessor at the end of lease period

Financial lease:

The lessor is usually only a financier

Leasee maintains equipment

The primary period covers assets useful life. Further lease at

a nominal price or asset is sold and proceeds split between

the lessor and lessee

First decide whether NPV is positive by discounting

by cost of capital

Then discount alternate financing cash flows by

discounting at cost of borrowing

R.Kannan

3

Leasing

Lease or buy

Select the alternative with the highest NPV

t=n

A) Purchase option (NPV) = - A + X

t

(I-T) + D

t

T + S

n

t=1

(1+K)

t

(1+K)

n

A = Acquisition cost of asset

X

t

= Profit before depreciation, interest and tax

D

t

= Depreciation (WDV)

S

n

= Post-tax salvage value

n = Investment horizon

T = Corporate tax rate

K = Cost of capital

t=n n

B) Leasing (NPV) = X

t

(I-T) + L

t

T - L

t

t=1

(1+K)

t t=1

(1+K)

t

X

t

= Profit before depreciation and tax

L

t

== Lease rental due at the end of year t

R.Kannan

4

Example

a) - Cost of equipment Rs.40 lakhs

- Loan Rs.20 lakhs, interest 14%, repayable in 5 annual equal instalments

- Revenues Rs.30 lakhs, costs other than interest and depreciation Rs.8 lakhs

- Debt to equity ratio 1:1, cost of equity 20%, cost of debt 10%

- Tax rate 30%

- Economic life 8 years, depreciation rate 33.33%

- Investment horizon 5 years; salvage value Rs.4 lakhs

- Primary lease period Rs.70.50 / Rs.1000 / quarter 5 years

- Secondary lease period Rs.3 / Rs.1000 / quarter

- Lease rentals payable in advance

- Lease rentals and purchase price of equipment includes all taxes

Advise the lessee whether to take on lease or buy

b) If the lessor has debt to equity ratio of 4:1 with cost of equity of 20% and cost

of debt at 10%, should he take this business

R.Kannan

5

Cost of capital = 20 x 0.2 + 20 x 0.1 = 0.15

40

Purchase option

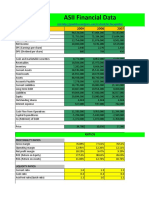

Years 0 1 2 3 4 5

A. Investment (40) -- -- -- -- --

B. Revenues -- 30 30 30 30 30

C. Costs -- (8) (8) (8) (8) (8)

D. Depreciation -- (13.33) (8.89) (5.93) (3.95) (2.63)

E. Profit before interest

and tax -- 8.67 13.11 16.07 18.05 19.37

F. Profit after tax

(tax at 33%) -- 5.77 8.73 10.70 12.02 12.90

G. Net salvage value -- -- -- -- -- 4.00

--------------------------------------------------------------------------

Net cash flow (F + D) (40) 19.10 17.62 16.63 15.97 19.53

Discount factor 15% (40) 0.87 0.756 0.658 0.572 0.497

(40) 16.62 13.32 10.94 9.13 9.71

= 19.72

R.Kannan

6

Lease option

Quarterly lease rentals Rs.2.82 lakhs

Cost of lease rentals

Annual cost 15% = quarterly cost of 3.55%

Present value annuity factor = 14.67

Present vale of cash outflows of leasing = Rs.41.37 lakhs

R.Kannan

7

Cash flows associated with leasing

Years 1 2 3 4 5

Revenues 30 30 30 30 30

Costs other than lease

rentals 8 8 8 8 8

Profit before lease rentals

and tax 22 22 22 22 22

Tax 7.26 7.26 7.26 7.26 7.26

Profit after tax 14.74 14.74 14.74 14.74 14.74

Tax shield on lease rentals

(2.82 X 4 X 0.33) 3.72 3.72 3.72 3.72 3.72

Net cash flow 18.46 18.46 18.46 18.46 18.46

Present value of cash flows = 3.353 X 18.46 = Rs.61.57 lakhs

NPV = (61.57 41.37) = Rs.20.2 lakhs

Since NPV in lease is marginally better, lease option is preferable.

R.Kannan

8

Lessors view

Present value of lease rentals

Annual return of 12% = 2.9% quarterly

Net present value of lease rentals = Rs.42.32 lakhs

R.Kannan

9

b) Present value of cash flows (other than lease rentals)

Years 1 2 3 4 5

Depreciation 13.33 8.89 5.93 3.95 2.63

------------------------------------------------------------

A. Tax shield on

depreciation 4.40 2.93 1.95 1.30 0.87

B. Tax on lease rentals (3.72) (3.72) (3.72) (3.72) (3.72)

Net cash flow (A-B) 0.68 (0.79) (1.77) (2.42) (2.85)

Discounting at 12% 0.893 0.797 0.712 0.636 0.567

Net present value at 12% discount (Rs.4.44 lakhs)

Net present value of flows = Rs.42.32 4.44

= Rs.37.88 lakhs

Investment = Rs.40 lakhs

Hence lessor should not enter into this transaction

R.Kannan

10

Other factors to be considered in leasing or purchasing

a) Technology obselence

b) Problems of maintenance

c) Tax systems

d) Access to various methods of financing

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Nudge For Retirement Savings: Neha Narla (PGDMB14046) Sreemathy G (PGDMB14078) Srimathi Sriram (PGDMB14079)Document2 pagesNudge For Retirement Savings: Neha Narla (PGDMB14046) Sreemathy G (PGDMB14078) Srimathi Sriram (PGDMB14079)Sourav KamilyaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Project and Infrastructure Finance Slides Module9 - Ver2Document26 pagesProject and Infrastructure Finance Slides Module9 - Ver2Sourav KamilyaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Group 17 BFDocument1 pageGroup 17 BFSourav KamilyaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Speaker'S Club 4 Meeting: Slot RolesDocument2 pagesSpeaker'S Club 4 Meeting: Slot RolesSourav KamilyaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Project and Infrastructure Finance Slides Module2 - Ver3Document77 pagesProject and Infrastructure Finance Slides Module2 - Ver3Sourav Kamilya100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Introduction To EconomicsDocument19 pagesIntroduction To Economicsshruu92No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- PFM AssumptionDocument1 pagePFM AssumptionSourav KamilyaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- HLLDocument2 pagesHLLSourav KamilyaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Study Plan - Session 8Document1 pageStudy Plan - Session 8Sourav KamilyaNo ratings yet

- Project and Infrastructure Finance Slides Module12 - Ver2Document10 pagesProject and Infrastructure Finance Slides Module12 - Ver2Sourav KamilyaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- FINANCIAL RATIOS REVEAL TROUBLEDocument4 pagesFINANCIAL RATIOS REVEAL TROUBLESourav KamilyaNo ratings yet

- MarketstructureDocument42 pagesMarketstructureSourav KamilyaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Project and Infrastructure Finance Slides Module1 - Ver3Document56 pagesProject and Infrastructure Finance Slides Module1 - Ver3Sourav KamilyaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Consumer Behavior Theory in A NutshellDocument31 pagesConsumer Behavior Theory in A NutshellSourav KamilyaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Poverty in IndiaDocument27 pagesPoverty in IndiaSourav KamilyaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Six Steps For CAT 2011Document2 pagesSix Steps For CAT 2011Sourav KamilyaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Unlicensed-Foreign ExchangeDocument26 pagesUnlicensed-Foreign ExchangeSourav KamilyaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- GCC Vs AlsonsDocument2 pagesGCC Vs AlsonsLindsay MillsNo ratings yet

- Super Sample Accounting Transactions: Must Equal The Total Amount of The CreditDocument3 pagesSuper Sample Accounting Transactions: Must Equal The Total Amount of The CreditjpgamasNo ratings yet

- Limiting Factor AnalysisDocument5 pagesLimiting Factor AnalysisFaizan MotiwalaNo ratings yet

- Lec 01Document22 pagesLec 01Hamid KhurshidNo ratings yet

- Rishabh Gupta PDFDocument3 pagesRishabh Gupta PDFrishabhNo ratings yet

- Rasio Sheet v1.0Document10 pagesRasio Sheet v1.0Yulianita AdrimaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Five Ess IndicatorsDocument22 pagesFive Ess IndicatorsSri VathsanNo ratings yet

- Financial Management Term PaperDocument29 pagesFinancial Management Term PaperOmar Faruk100% (1)

- ActDocument436 pagesActRoshan KaharNo ratings yet

- Deutsche Bank - Sipchem Sukuk Offering CircularDocument209 pagesDeutsche Bank - Sipchem Sukuk Offering CircularcheejustinNo ratings yet

- Day1 Session3 ColeDocument36 pagesDay1 Session3 ColeLameuneNo ratings yet

- Cbse Sample Papers For Class 12 Accountancy With Solution PDFDocument24 pagesCbse Sample Papers For Class 12 Accountancy With Solution PDFVicky PawarNo ratings yet

- Introduction To Tom Demark Indicators and StudiesDocument8 pagesIntroduction To Tom Demark Indicators and Studiesfabiotorralvo_174743No ratings yet

- Firm Financil Performance and Human Resource Accounting Disclosure in NigeriaDocument9 pagesFirm Financil Performance and Human Resource Accounting Disclosure in NigeriadinawrdnaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- NCFM Commodity Derivatives Mock TestDocument12 pagesNCFM Commodity Derivatives Mock TestsimplypaisaNo ratings yet

- AL Meezan Investment Management Limited: Fund Managers' ReportDocument11 pagesAL Meezan Investment Management Limited: Fund Managers' ReportSalman ArshadNo ratings yet

- Audit Tips for Analyzing Trading Securities ProblemsDocument6 pagesAudit Tips for Analyzing Trading Securities ProblemsJazzy100% (3)

- A Project ReportDocument93 pagesA Project ReportRasik GhayalNo ratings yet

- AdrDocument10 pagesAdrvahid100% (1)

- Ifrs vs. GaapDocument18 pagesIfrs vs. GaapRidwan Al MahmudNo ratings yet

- Mini CaseDocument15 pagesMini CaseSammir Malhotra0% (1)

- Guide to Fair Value Measurement under IFRS 13Document3 pagesGuide to Fair Value Measurement under IFRS 13Annie JuliaNo ratings yet

- Branca's Secret LetterDocument2 pagesBranca's Secret LetterThe Wrap100% (2)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Financial Analysis: Reliance Industries LimitedDocument18 pagesFinancial Analysis: Reliance Industries LimitedRohan ChandnaNo ratings yet

- Basic: Problem SetsDocument4 pagesBasic: Problem SetspinoNo ratings yet

- HedgingDocument15 pagesHedgingAnupam G. RatheeNo ratings yet

- Organization and Formation of A CorporationDocument41 pagesOrganization and Formation of A CorporationDennis Udani100% (1)

- Ubs Europe EtfDocument44 pagesUbs Europe Etfaklank_218105No ratings yet

- Nitin Fire Protection Industries LTD.: Management Interaction Note September 16, 2011Document13 pagesNitin Fire Protection Industries LTD.: Management Interaction Note September 16, 2011Educational VideosNo ratings yet

- BWFF 2033 Financial Management: Dr. Muhammad Airil Syafiq Bin Mohd KhalidDocument8 pagesBWFF 2033 Financial Management: Dr. Muhammad Airil Syafiq Bin Mohd KhalidezwanNo ratings yet