Professional Documents

Culture Documents

DCF

Uploaded by

Piyush SharmaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DCF

Uploaded by

Piyush SharmaCopyright:

Available Formats

CHAPTER FOUR

McGraw-Hill/Irwin

Copyright 2010 by The McGraw-Hill Companies, Inc. All rights reserved.

Cash Accounting,

Accrual Accounting,

and Discounted Cash Flow

Valuation

What you will learn from this Chapter

How the dividend discount model works (or does not work)

What is meant by cash flow from operations

What is meant by cash used in investing activities

What is meant by free cash flow

How discounted cash flow valuation works

Problems that arise in applying cash flow valuation

Why free cash flow may not measure value added in operations

Why free cash flow is a liquidation concept

How discounted cash flow valuation involves cash accounting for operating activities

Why cash flow from operations reported in U.S. financial statements does not measure operating cash flows

correctly

Why cash flows in investing activities reported in U.S. financial statements does not measure cash investment in

operations correctly

How accrual accounting for operations differs from cash accounting for operations

The difference between earnings and cash flow from operations

The difference between earnings and free cash flow

How accruals and the accounting for investment affect the balance sheet as well as the income statement

Why analysts forecast earnings rather than cash flows

How a valuation model is a model of accounting for the future

How reverse engineering works as an analysis tool

What a simple valuation is

4-3

Valuation Models: Going Concerns

CF

1

CF

2

CF

3

CF

4

CF

5

A Firm

1 2 3 4 5

0

d

1

d

2

d

3

d

4

d

5

Dividend

Flow

1 2 3 4 5

0

TV

T

T

d

T

Equity

The terminal value, TV

T

is the price payoff, P

T

when the share is sold

Valuation issues :

The forecast target: dividends, cash flow, earnings?

The time horizon: T = 5, 10, ?

The terminal value

The discount rate

4-4

The Dividend Discount Model: Targeting

Dividends

DDM:

Problems: How far does one project?

Does

provide a good estimate of V

E

0

?

(i) Dividend policy can be arbitrary and not linked to value added.

(ii) The firm can borrow to pay dividends; this does not create value

(iii) Think of a firm that pays no dividends

The dividend irrelevancy concept

The dividend conundrum:

Equity value is based on future dividends, but forecasting dividends

over finite horizons does not give an indication of this value

Conclusion: Focus on creation of wealth rather than distribution of wealth.

3 1 2

0

2 3

E

E E E

d d d

V

3 1 2

0

2 3

E

T

T

E E E E

d d d d

V

4-5

Terminal Values for the DDM

A. Capitalize expected terminal dividends

B. Capitalize expected terminal dividends

with growth

Will it work?

T 1

T T

E

d

TV P

1

T 1

T T

E

d

TV P

g

4-6

Some Math: The Value of a Perpetuity and a

Perpetuity with Growth

The Value of a Perpetuity

A perpetuity is a constant stream that continues without end. The periodic payoff in the stream is sometimes

referred to as an annuity, so a perpetuity is an annuity that continues forever. To value that stream, one capitalizes

the constant amount expected. If the dividend expected next year is expected to be a perpetuity, the value of the

dividend stream is

Value of a perpetual dividend stream =

The Value of a Perpetuity with Growth

If an amount is forecasted to grow at a constant rate, its value can be calculated by capitalizing the amount at the

required return adjusted for the growth rate:

Value of a dividend growing at a constant rate =

1

1

0

E

E

d

V

g

d

V

E

E

1

0

4-7

Dividend Discount Analysis:

Advantages and Disadvantages

Advantages

Easy concept: dividends are

what shareholders get, so

forecast them

Predictability: dividends are

usually fairly stable in the short

run so dividends are easy to

forecast (in the short run)

Disadvantages

Relevance: dividends payout is

not related to value, at least in

the short run; dividend

forecasts ignore the capital

gain component of payoffs.

Forecast horizons: typically

requires forecasts for long

periods; terminal values for

shorter periods are hard to

calculate with any reliability

When I t Works Best

When payout is permanently tied to the value generation in the firm.

For example, when a firm has a fixed payout ratio

(dividends/earnings).

4-8

Cash Flows for a Going Concern

Cash flow from operations (inflows)

Cash investment (outflows)

Free cash flow

Time, t

C

1

C

2

C

3

C

4

I

1

I

2

I

3

I

4

C

1

-I

1

C

2

-I

2

C

3

-I

3

C

4

-I

4

C

5

I

5

C

5

-I

5

1 2 4 3 5

Free cash flow is cash flow from operations that results from investments minus cash

used to make investments.

4-9

The Discounted Cash Flow (DCF) Model

Cash flow from

operations (inflows) C

1

C

2

C

3

C

4

C

5

--->

Cash investment I

1

I

2

I

3

I

4

I

5

--->

(outflows)

Free cash flow C

1

I

1

C

2

I

2

C

3

I

3

C

4

I

4

C

5

I

5

--->

________________________________________________ --->

Time, t 1 2 3 4 5

D

0

T

F

T

T

F

T T

3

F

3 3

2

F

2 2

F

1 1 E

0

V

V C I C I C I C I C

V

F

O

V

D

0

F

0

E

0

V V V

4-10

The Continuing Value for the DCF Model

A. Capitalize terminal free cash flow

B. Capitalize terminal free cash flow with growth

Will it work?

1

I C

CV

F

1 T 1 T

T

g

I C

CV

F

1 T 1 T

T

4-11

DCF Valuation: The Coca-Cola Company

In millions of dollars except share and per-share numbers. Required return for the firm is 9%

1999 2000 2001 2002 2003 2004

Cash from operations 3,657 4,097 4,736 5,457 5,929

Cash investments 947 1,187 1,167 906 618

Free cash flow 2,710 2,910 3,569 4,551 5,311

Discount rate (1.09)t 1.09 1.1881 1.2950 1.4116 1.5386

Present value of free cash flows 2,486 2,449 2,756 3,224 3,452

Total present value to 2004 14,367

Continuing value (CV)* 139,414

Present value of CV 90,611

Enterprise value 104,978

Book value of net debt 4,435

Value of equity 100,543

Shares outstanding 2,472

Value per share $40.67

*CV = 5,311 x 1.05 = 139,414

1.09 - 1.05

Present value of CV = 139,414 = 90,611

1.5386

4-12

Steps for a DCF Valuation

Here are the steps to follow for a DCF valuation:

1. Forecast free cash flow to a horizon

2. Discount the free cash flow to present value

3. Calculate a continuing value at the horizon with an estimated

growth rate

4. Discount the continuing value to the present

5. Add 2 and 4

6. Subtract net debt

4-13

Will DCF Valuation Always Work?

A Firm with Negative Free Cash Flows: General Electric Company

In millions of dollars, except per-share amounts.

2000 2001 2002 2003 2004

Cash from operations 30,009 39,398 34,848 36,102 36,484

Cash investments 37,699 40,308 61,227 21,843 38,414

Free cash flow (7,690) (910) (26,379) 14,259 (1,930)

Earnings 12,735 13,684 14,118 15,002 16,593

Earnings per share (eps) 1.29 1.38 1.42 1.50 1.60

Dividends per share (dps) 0.57 0.66 0.73 0.77 0.82

4-14

DCF Valuation and Speculation

Formal valuation aims to reduce our uncertainty about value and

to discipline speculation

The most uncertain (speculative) part of a valuation is the

continuing value. So valuation techniques are preferred if they

result in a smaller amount of the value attributable to the

continuing value

DCF techniques can result in more than 100% of the valuation in

the continuing value: See General Electric.

4-15

Reverse Engineering: What Forecasts are Implied by the

Current Market Price?

million $140,904

shares million 2,472 x 57 P Coke, For

$

o

$4,435 - 1.5386

g - 1.09

g x 311 , 5

5386 . 1

311 , 5

4116 . 1

551 , 4

2950 . 1

569 , 3

1881 . 1

910 , 2

1.09

2,710

million 140,904 $

Reverse engineer as follows:

Can Coke maintain this growth rate?

rate) growth % 6.2 a ( 062 . 1 g

4-16

Simple Valuations

Simple valuations use very short forecasts horizons, and isolate more speculative, long-term

forecasts. Accordingly, they anchor on what we know or are relatively sure about.

A simple DCF for Coca-Cola, 2000

Debt Net

g

I C

V

E

E

O

1 1

315 , 63 $

05 . 1 09 . 1

710 , 2

$4,435

4-17

Reverse Engineering a Simple Valuation: Coca-Cola

435 , 4 $ $

0

g - 1.09

2,710

140,904 P

Applying the simple model to reverse engineer Cokes stock price,

%) 7.13 is rate (growth g 0713 . 1

4-18

The DCF Model:

Will it work for Wal-Mart Stores?

Wal-Mart Stores, Inc.

(Fiscal years ending January 31. Amounts in millions of dollars.)

1988 1989 1990 1991 1992 1993 1994 1995 1996

Cash from operations 536 828 968 1,422 1,553 1,540 2,573 3,410 2,993

Cash investments 627 541 894 1,526 2,150 3,506 4,486 3,792 3,332

Free cash flow (91) 287 74 (104) (597) (1,966) (1,913) (382) (339)

Dividends per share 0.03 0.04 0.06 0.07 0.09 0.11 0.13 0.17 0.20

Price per share 6 8 10 16 27 32 26 25 24

4-19

Why Free Cash Flow is not a Value-Added Concept

Cash flow from operations (value added) is reduced by

investments (which also add value): investments are

treated as value losses

Value received is not matched against value surrendered

to generate value

A firm reduces free cash flow by investing and increases

free cash flow by reducing investments:

free cash flow is partially a liquidation concept

Note: analysts forecast earnings, not cash flows

4-20

Discounted Cash Flow Analysis:

Advantages and Disadvantages

Advantages

Easy concept: cash

flows are real and

easy to think about;

they are not affected

by accounting rules

Familiarity: is a

straight application of

familiar net present

value techniques

Disadvantages

Suspect concept:

free cash flow does not measure value added in the short run;

value gained is not matched with value given up.

free cash flow fails to recognize value generated that does not

involve cash flows

investment is treated as a loss of value

free cash flow is partly a liquidation concept; firms increase free

cash flow by cutting back on investments.

Forecast horizons: typically requires forecasts for long

periods; terminal values for shorter periods are hard to

calculate with any reliability

Validation: it is hard to validate free cash flow forecasts

Not aligned with what people forecast: analysts forecast

earnings, not free cash flow; adjusting earnings forecasts

to free cash forecasts requires further forecasting of

accruals.

When I t Works Best

When the investment pattern is such as to produce constant free cash

flow or free cash flow growing at a constant rate.

4-21

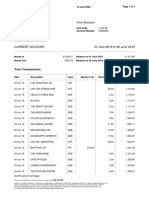

Partial Statement

of Cash Flows:

Dell Inc., 2008

4-22

Reported Cash Flow from Operations

Reported cash flows from operations in U.S. cash flow

statements is after interest:

Cash Flow from Operations =

Reported Cash Flow from Operations + After-tax Net Interest

Payments

After-tax Net Interest = Net Interest x (1 - tax rate)

Net interest = Interest payments Interest receipts

Reported cash flow from operations is sometimes referred

to as levered cash flow from operations

4-23

Reported Cash Flow in Investing Activities

Reported cash investments include net investments in

interest bearing financial assets (excess cash):

Cash investment in operations =

Reported cash flow from investing

- Net investment in interest-bearing securities

4-24

Calculating Free Cash Flow from the Cash Flow

Statement: Dell Inc., 2008

Reported cash flow from operations 3,949

Interest payments 54

Interest income* (387)

Net interest payments (333)

Taxes (35%) 117

Net interest payments after tax (65%) (216)

Cash flow from operations 3,733

Reported cash used in investing activities 1,763

Purchases of interesting-bearing securities 2,394

Sales of interest-bearing securities (3,679) 1,285

Cash investment in operations 3,048

Free cash flow 685

*Interest payments are given as supplemental data to the statement of cash flows, but interest receipts usually are not.

Interest income (from the income statement) is used instead; this includes accruals but is usually close to the cash

interest received.

Dells statutory tax rate (for federal and state taxes) is 35 percent, as indicated in the financial statement footnotes.

4-25

From Earnings to Free Cash Flows

It is difficult to forecast free cash flows without forecasting

earnings. First forecast earnings and then make adjustments

to convert earnings to cash flow from operations. Follow

the following steps:

i. Forecast earnings available to common

ii. Forecast accruals (the difference between earnings and cash

flow from operations in the cash flow statement)

iii. Calculate levered cash flow from operations (Step (i) - Step

(ii))

iv. Calculate unlevered cash flow from operations by adding

after-tax net interest

v. Forecast cash investments in operations

vi. Calculate forecasted free cash flow, C - I (Step (iv) - Step (v))

4-26

Converting Earnings to Free Cash Flow:

Dell Inc., 2008

4-27

A Common Approximation

4-28

Features of the Income Statement

1. Dividends dont affect income

2. Investment doesnt affect income

3. There is a matching of

Value added (revenues)

Value lost (expenses)

Net value added (net income)

4. Accruals adjust cash flows

Accruals

Value added that

is not cash flow

Adjustments to cash inflows

that are not value added

4-29

The Income Statement:

Dell Inc.

4-30

The Revenue Calculation

Revenue = Cash receipts from sales

+ New sales on credit

Cash received for previous periods' sales

Estimated sales returns and rebates

Deferred revenue for cash received in advance of sale

+ Revenue previously deferred

4-31

The Expense Calculation

Expense = Cash paid for expenses

+ Amounts incurred in generating revenue but not yet paid

Cash paid for generating revenues in future periods

+ Amounts paid in the past for generating revenues in the current period

4-32

Earnings and Cash Flows

Earnings = [C - I] - i + I + accruals

= C - i + accruals

The earnings calculation adds back investments

and puts them back in the balance sheet. It also

adds accruals.

4-33

Earnings and Cash Flows:

Wal-Mart Stores

____________________________________________________________________________

Wal-Mart Stores, Inc.

1988 1989 1990 1991 1992 1993 1994 1995 1996

Cash from operations 536 828 968 1,422 1,553 1,540 2,573 3,410 2,993

Cash investments 627 541 894 1,526 2,150 3,506 4,486 3,792 3,332

Free cash flow ( 91) 287 74 (104) (597) (1,966) (1,913) (382) (339)

Net income 628 837 1,076 1,291 1,608 1,995 2,333 2,681 2,740

Eps .28 .37 .48 .57 .70 .87 1.02 1.17 1.19

4-34

Accruals, Investments and the Balance Sheet

Accruals and investments are put in the balance sheet

Shareholders equity = Cash + Other Assets - Liabilities

Earnings

Cash from Operations

Accruals

Free cash flow

Cash from Operations

Investments

4-35

The Balance Sheet:

Dell Inc.

4-36

The articulation of the financial statements

through the recording of cash flows and accruals

Investment and disinvestment by owners

Earnings

Net change in owners equity

S St ta at te em me en nt t o of f S Sh ha ar re eh ho ol ld de er rs s E Eq qu ui it ty y

y ye ea ar r 1 1

Cash from operations

+ Accruals

Net income

I In nc co om me e S St ta at te em me en nt t y ye ea ar r 1 1

Cash from operations

Cash from investing

Debt financing

Net change in cash

C Ca as sh h F Fl lo ow w S St ta at te em me en nt t y ye ea ar r 1 1

Cash0

+ Other Assets0

Total Assets0

- Liabilities0

Owners equity0

Cash1

+ Other Assets1

Total Assets1

- Liabilities1

Owners equity1

E En nd di in ng g B Ba al la an nc ce e S Sh he ee et t

y ye ea ar r 1 1

Beginning stocks Flows Ending stocks

E En nd di in ng g B Ba al la an nc ce e S Sh he ee et t

y ye ea ar r 0 0

Equity financing

Net cash flows from all activities increases cash in the balance sheet

Cash from operations increases net income and shareholders equity

Cash investments increase other assets

Cash from debt financing increases liabilities

Cash from equity financing increases shareholders equity

Accruals increase net income, shareholders equity, assets and liabilities

4-37

You might also like

- Cash Accounting, Accrual Accounting, and Discounted Cash Flow ValuationDocument32 pagesCash Accounting, Accrual Accounting, and Discounted Cash Flow ValuationHanh Mai TranNo ratings yet

- Valuation of FirmDocument13 pagesValuation of FirmLalitNo ratings yet

- Chapter 02 Investment AppraisalDocument3 pagesChapter 02 Investment AppraisalMarzuka Akter KhanNo ratings yet

- Stock Pitch GuideDocument25 pagesStock Pitch GuideXie NiyunNo ratings yet

- What Are Valuation MultiplesDocument20 pagesWhat Are Valuation MultiplesDhruv GNo ratings yet

- Equity Research and Valuation B Kemp Dolliver-0935015213Document69 pagesEquity Research and Valuation B Kemp Dolliver-0935015213rockkey76No ratings yet

- Sample Deal Discussions: Sell-Side Divestiture Discussion & AnalysisDocument11 pagesSample Deal Discussions: Sell-Side Divestiture Discussion & AnalysisAnonymous 45z6m4eE7pNo ratings yet

- Valuation Methods GuideDocument82 pagesValuation Methods GuideSourabh Dhawan100% (1)

- Formulas #1: Future Value of A Single Cash FlowDocument4 pagesFormulas #1: Future Value of A Single Cash FlowVikram Sathish AsokanNo ratings yet

- Cash ManagementDocument30 pagesCash ManagementankitaNo ratings yet

- Capital StructureDocument59 pagesCapital StructureRajendra MeenaNo ratings yet

- Equity Valuation ModelsDocument58 pagesEquity Valuation ModelsSarang GuptaNo ratings yet

- ValComp Tutorial 2014 (Unlocked)Document36 pagesValComp Tutorial 2014 (Unlocked)Harsh ChandaliyaNo ratings yet

- Financial Ratios of Keppel Corp 2008-1Document3 pagesFinancial Ratios of Keppel Corp 2008-1Kon Yikun KellyNo ratings yet

- Framework For Business AnalysisDocument10 pagesFramework For Business AnalysismkhanmajlisNo ratings yet

- The Partnering ToolbookDocument45 pagesThe Partnering ToolbooklenaNo ratings yet

- Mergers: Principles of Corporate FinanceDocument35 pagesMergers: Principles of Corporate FinancechooisinNo ratings yet

- Financial Modeling in ExcelDocument32 pagesFinancial Modeling in ExcelMd AtifNo ratings yet

- Reliance Petroleum's Triple Option Convertible Bonds IssueDocument2 pagesReliance Petroleum's Triple Option Convertible Bonds IssueNavin KumarNo ratings yet

- Chapter 10: Equity Valuation & AnalysisDocument22 pagesChapter 10: Equity Valuation & AnalysisMumbo JumboNo ratings yet

- Valuation of BusinessDocument44 pagesValuation of Businessnaren75No ratings yet

- An Intro to Valuation MethodsDocument15 pagesAn Intro to Valuation Methodsdeeps0705No ratings yet

- Cheat Sheet For Valuation (2) - 1Document2 pagesCheat Sheet For Valuation (2) - 1RISHAV BAIDNo ratings yet

- Corporate Finance Case StudyDocument26 pagesCorporate Finance Case StudyJimy ArangoNo ratings yet

- The Business Cycle Approach To Investing - Fidelity InvestmentsDocument8 pagesThe Business Cycle Approach To Investing - Fidelity InvestmentsKitti WongtuntakornNo ratings yet

- Red Flags - ShenanigansDocument6 pagesRed Flags - Shenanigansclmu00011No ratings yet

- Cash Flow Analysis, Target Cost, Variable CostDocument29 pagesCash Flow Analysis, Target Cost, Variable CostitsmenatoyNo ratings yet

- CA FINAL SFM DERIVATIVES Futures SUMMARYDocument9 pagesCA FINAL SFM DERIVATIVES Futures SUMMARYsujeet mauryaNo ratings yet

- Exercises on FRA’s and SWAPS valuationDocument5 pagesExercises on FRA’s and SWAPS valuationrandomcuriNo ratings yet

- Formulae Sheets: Ps It Orp S It 1 1Document3 pagesFormulae Sheets: Ps It Orp S It 1 1Mengdi ZhangNo ratings yet

- Fcffsimpleginzu ITCDocument62 pagesFcffsimpleginzu ITCPravin AwalkondeNo ratings yet

- A Note On Valuation in Entrepreneurial SettingsDocument4 pagesA Note On Valuation in Entrepreneurial SettingsUsmanNo ratings yet

- Measuring Value for M&ADocument18 pagesMeasuring Value for M&Arishit_93No ratings yet

- Ch5 - Financial Statement AnalysisDocument39 pagesCh5 - Financial Statement AnalysisLaura TurbatuNo ratings yet

- Financial Shenanigans CashflowsDocument19 pagesFinancial Shenanigans CashflowsAdarsh ChhajedNo ratings yet

- CFA Industry Analysis PharmaceuticalDocument58 pagesCFA Industry Analysis Pharmaceuticalgioro_miNo ratings yet

- Exam 1 Study Guide S15Document1 pageExam 1 Study Guide S15Jack JacintoNo ratings yet

- Think Equity Think QGLP Contest 2019: Application FormDocument20 pagesThink Equity Think QGLP Contest 2019: Application Formvishakha100% (1)

- 300 - PEI - Jun 2019 - DigiDocument24 pages300 - PEI - Jun 2019 - Digimick ryanNo ratings yet

- Ubs Investor Guide 5.27Document44 pagesUbs Investor Guide 5.27shayanjalali44No ratings yet

- How To Analyze Bank Stocks - PDFDocument22 pagesHow To Analyze Bank Stocks - PDFRamasamyShenbagarajNo ratings yet

- Ê, in Finance, Is AnDocument11 pagesÊ, in Finance, Is AnJome MathewNo ratings yet

- Security Analysis: Chapter - 1Document47 pagesSecurity Analysis: Chapter - 1Harsh GuptaNo ratings yet

- Weeks 1 To 4 Fundamental AnalysisDocument166 pagesWeeks 1 To 4 Fundamental Analysismuller1234No ratings yet

- Rajagopal Deloitte Business ValuationDocument85 pagesRajagopal Deloitte Business Valuationanalyst_anil14No ratings yet

- Financial Statement Analysis RatiosDocument3 pagesFinancial Statement Analysis RatiosshahbazsiddikieNo ratings yet

- Dabur Healthcare valuation reportDocument58 pagesDabur Healthcare valuation reportUmangNo ratings yet

- Cost of CapitalDocument55 pagesCost of CapitalSaritasaruNo ratings yet

- KKR - Consolidated Research ReportsDocument60 pagesKKR - Consolidated Research Reportscs.ankur7010No ratings yet

- Valuation Practices Survey 2013 v3Document36 pagesValuation Practices Survey 2013 v3Deagle_zeroNo ratings yet

- Restructuring Debt and EquityDocument20 pagesRestructuring Debt and EquityErick SumarlinNo ratings yet

- P/B Ratio Explained for Valuing StocksDocument18 pagesP/B Ratio Explained for Valuing StocksVicknesan AyapanNo ratings yet

- Corporate RestructuringDocument18 pagesCorporate Restructuring160286sanjeevjha50% (6)

- Financial Markets: Dr. P.R .KulkarniDocument66 pagesFinancial Markets: Dr. P.R .KulkarnihrshtkatwalaNo ratings yet

- How To Choose Between Growth and ROICDocument5 pagesHow To Choose Between Growth and ROICFDRbardNo ratings yet

- WACC Capital StructureDocument68 pagesWACC Capital StructuremileticmarkoNo ratings yet

- Exam Prep for:: Business Analysis and Valuation Using Financial Statements, Text and CasesFrom EverandExam Prep for:: Business Analysis and Valuation Using Financial Statements, Text and CasesNo ratings yet

- Operations Due Diligence: An M&A Guide for Investors and BusinessFrom EverandOperations Due Diligence: An M&A Guide for Investors and BusinessNo ratings yet

- Report of BecgDocument15 pagesReport of BecgPiyush SharmaNo ratings yet

- Ethics and Delivering Customer Value Across Global MarketsDocument30 pagesEthics and Delivering Customer Value Across Global MarketsPiyush SharmaNo ratings yet

- MarketingDocument12 pagesMarketingNikunj KamalNo ratings yet

- Nimisha Singh (PGFB1328) Paridhi Bathwal (PGFB1329) Piyush Sharma (PGFB1330) Pooja Saraf (PGFB1331) Pratyush Sahu (PGFB1332)Document36 pagesNimisha Singh (PGFB1328) Paridhi Bathwal (PGFB1329) Piyush Sharma (PGFB1330) Pooja Saraf (PGFB1331) Pratyush Sahu (PGFB1332)Piyush SharmaNo ratings yet

- Business Communication2Document9 pagesBusiness Communication2Piyush SharmaNo ratings yet

- Managing Brand EquityDocument22 pagesManaging Brand EquityPiyush SharmaNo ratings yet

- Introduction To Strategic Brand ManagementDocument28 pagesIntroduction To Strategic Brand ManagementPiyush SharmaNo ratings yet

- 10 Nadiri TumerDocument13 pages10 Nadiri TumerPiyush SharmaNo ratings yet

- 6.Post-Merger and Acquisition Short-Run Financial Performance - Yayati 11Document12 pages6.Post-Merger and Acquisition Short-Run Financial Performance - Yayati 11Piyush SharmaNo ratings yet

- Credit RiskDocument3 pagesCredit RiskPiyush SharmaNo ratings yet

- SRRFFDocument32 pagesSRRFFPiyush SharmaNo ratings yet

- Internal Factor Evaluation MatrixDocument1 pageInternal Factor Evaluation MatrixPiyush SharmaNo ratings yet

- Analysis of Adoption Pattern of An Innovation ofDocument10 pagesAnalysis of Adoption Pattern of An Innovation ofPiyush SharmaNo ratings yet

- Ing Vysya Bank ProjectDocument89 pagesIng Vysya Bank Projectniteshniki100% (3)

- Final ReportDocument45 pagesFinal ReportPiyush SharmaNo ratings yet

- Get All Pair of City Values Such That Supplier 89 in The First City Supplies Project89 in The Second CityDocument7 pagesGet All Pair of City Values Such That Supplier 89 in The First City Supplies Project89 in The Second CityPiyush SharmaNo ratings yet

- Ing Vysya Bank ProjectDocument89 pagesIng Vysya Bank Projectniteshniki100% (3)

- Final ReportDocument45 pagesFinal ReportPiyush SharmaNo ratings yet

- Introduction to Production and Operations Management in 40 CharactersDocument3 pagesIntroduction to Production and Operations Management in 40 CharactersPiyush SharmaNo ratings yet

- Steve Jobs Group 4Document3 pagesSteve Jobs Group 4Piyush SharmaNo ratings yet

- CASE STUDY - Staffing A Call CenterDocument2 pagesCASE STUDY - Staffing A Call CenterPiyush Sharma50% (2)

- Portfolio ProblemDocument4 pagesPortfolio ProblemPiyush SharmaNo ratings yet

- of KhyatiDocument7 pagesof KhyatiPiyush SharmaNo ratings yet

- Definition of Business PolicyDocument3 pagesDefinition of Business PolicyPiyush Sharma100% (3)

- StrengthsDocument4 pagesStrengthsPiyush SharmaNo ratings yet

- Icci BankDocument23 pagesIcci BankPhateh Krishna AgrawalNo ratings yet

- EJMCM Volume 7 Issue 4 Pages 999-1009Document11 pagesEJMCM Volume 7 Issue 4 Pages 999-1009Reem Alaa AldinNo ratings yet

- Operating System of ICB Unit FundDocument58 pagesOperating System of ICB Unit FundShahriar Zaman HridoyNo ratings yet

- Structure and Mechanism of Corporate Governance in The Indian Banking SectorDocument7 pagesStructure and Mechanism of Corporate Governance in The Indian Banking SectorIJAR JOURNALNo ratings yet

- Attachments 71b8d55c 2019 June Statement PDFDocument5 pagesAttachments 71b8d55c 2019 June Statement PDFMarianaNo ratings yet

- Assignment June 2022Document3 pagesAssignment June 2022AirForce ManNo ratings yet

- Internship Report: Janata Bank Limited and Its General Banking ActivitiesDocument54 pagesInternship Report: Janata Bank Limited and Its General Banking ActivitiesMehedi HasanNo ratings yet

- Non-Current Liabilities Cheat SheetDocument1 pageNon-Current Liabilities Cheat SheetSarah SafiraNo ratings yet

- Retail Banking Industry Growth Potential Despite ChallengesDocument26 pagesRetail Banking Industry Growth Potential Despite Challengesshukhi89No ratings yet

- Financial - Regulations Part-2 PDFDocument426 pagesFinancial - Regulations Part-2 PDFafe782480% (30)

- FixedDepositsDocument1 pageFixedDepositsTiso Blackstar GroupNo ratings yet

- Wildcat Capital InvestorsDocument18 pagesWildcat Capital Investorsokta hutahaeanNo ratings yet

- New profit sharing ratiosDocument9 pagesNew profit sharing ratiosAman KakkarNo ratings yet

- Barclays Shiller White PaperDocument36 pagesBarclays Shiller White PaperRyan LeggioNo ratings yet

- Financial Management 1 Risk and Return AnalysisDocument12 pagesFinancial Management 1 Risk and Return AnalysisANKITA M SHARMANo ratings yet

- Accounts.31.12.17.FinalDocument7 pagesAccounts.31.12.17.FinalMileticoNo ratings yet

- CA - FOUNDATION LT (APRIL BATCH) NOV'23WE-4 QP-keyDocument4 pagesCA - FOUNDATION LT (APRIL BATCH) NOV'23WE-4 QP-keyDhruv AgarwalNo ratings yet

- Deloitte Au Tax Insight Deconstructing Chevron Transfer Pricing Case 041115 PDFDocument8 pagesDeloitte Au Tax Insight Deconstructing Chevron Transfer Pricing Case 041115 PDFCA.Srikant Parthasarathy ParthasarathyNo ratings yet

- Audit Property Plant EquipmentDocument5 pagesAudit Property Plant EquipmentMonica GarciaNo ratings yet

- Form OC-10 Appl 4 FRNDocument51 pagesForm OC-10 Appl 4 FRNBenne James100% (4)

- Accountancy & Auditing Paper - 1-2015Document3 pagesAccountancy & Auditing Paper - 1-2015Qasim IbrarNo ratings yet

- Basis Trading BasicsDocument51 pagesBasis Trading BasicsTajinder SinghNo ratings yet

- STDSMT Funds MT MX MapDocument120 pagesSTDSMT Funds MT MX MapDnyaneshwar PatilNo ratings yet

- This Spreadsheet Supports Analysis of The Case, "Coleco Industries Inc." (Case 60)Document6 pagesThis Spreadsheet Supports Analysis of The Case, "Coleco Industries Inc." (Case 60)kashanr82No ratings yet

- Account Opening DisclosuresDocument7 pagesAccount Opening DisclosuresMarcus Wilson100% (1)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument12 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balanceamool rokadeNo ratings yet

- WM Unit 8 Retirement Planning 6th Jan 2022Document32 pagesWM Unit 8 Retirement Planning 6th Jan 2022Aarti GuptaNo ratings yet

- Corporate Financial Management IntroDocument17 pagesCorporate Financial Management IntroADEYANJU AKEEMNo ratings yet

- About IndustryDocument36 pagesAbout IndustryHardik AgarwalNo ratings yet

- PNB v. CA and Ramon LopezDocument2 pagesPNB v. CA and Ramon LopezRebecca ChanNo ratings yet