Professional Documents

Culture Documents

Purva False Commitment

Uploaded by

PraveenKumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Purva False Commitment

Uploaded by

PraveenKumarCopyright:

Available Formats

'You' Philosophy

Why Puravankara?

Project Associated Banks

Banking FAQs

From the beginning, we have always credited our customers

for the success of Puravankara. Our philosophy has always

been to win the trust of our customers by providing them

quality living spaces combined with customer centric services.

From a site visit to bank loan processing, from timely

possession of property to assisting with your interiors, we

have dedicated divisions catering for all your needs and serve

You better. Our passion to surprise and surpass Your

expectations is what fuels our innovation and strategy.

All our endeavours at Puravankara revolve around just one

entity - our customers. It is their needs, demands and ideas

that drive us and they continue to remain at the centre of our

universe.

We call this "The You Philosophy."

Home is where the heart is, is a sentiment associated with many

people investing in a home. Therefore, it is imperative that you

choose the right company to entrust building your dream home.

Each and every project at Puravankara is a result of careful research

and analysis, and our understanding of the current trends and our

customers desire has fueled our passion for innovation. There are

many reasons for one to own a property at Puravankara.

Legacy

Puravankara is one of the oldest organizations with over 38 years of

expertise in real estate domain. Puravankara epitomizes trust and

stability. The company has successfully delivered over 36

residential/commercial projects spanning 7.80 million square feet,

with an additional 29 million square feet of projects under

development. Puravankara has also won many prestigious awards,

which is a testament to the companys reputation of being a real

estate developer of highest standards.

Purva Highland

Axis Bank

Citi Bank

Deutsche Bank

HDFC

SBI

IDBI

India Bulls

ICICI

HSBC

Tata Finance

LIC

Purva Skywood

Axis Bank

Citi Bank

Deutsche Bank

HDFC

SBI

IDBI

India Bulls

ICICI

HSBC

Tata Finance

Purva Atria

Axis Bank

Deutsche Bank

HDFC

India Bulls

ICICI

Purva Atria Platina

HDFC

ICICI

Purva Season

Axis Bank

Citi Bank

Deutsche Bank

HDFC

India Bulls

ICICI

Tata Finance

Purva Venezia

Axis Bank

Citi Bank

Deutsche Bank

HDFC

SBI

IDBI

About the Loan

How will a bank decide my home loan eligibility?

We assess the customer's repayment capacity based on income, age, qualifications, number of

dependents, spouse's income, assets, liabilities, stability and continuity of occupation, and savings history.

What is the repayment tenure?

Repayment tenure is the tenure for the number of year for which the loan gets sanctioned. We offer you a

wide range of options for the tenure of the loan. You can take a home loan for up to 20 years (dependent

on the bank) provided you do not reach the age of 65 years or retire within that period.

How is the loan repaid?

All loan repayments are done via equated monthly installments (EMI).

What is an EMI?

An EMI refers to an equated monthly installment. It is a fixed amount which you pay every month towards

your loan. It comprises of both, principal repayment and interest payment.

When does the repayment start?

EMI payments start from the month following the month in which the full disbursement has been made.

How is the EMI paid?

The EMI is to be paid every month through post-dated cheques (PDCs) or Electronic Clearing System

(ECS)*. If you are opting for PDCs, then you will have to provide 36 PDCs upfront. The PDCs are to be

dated on the 1st of every month.

What if a PDC bounces?

In the case of a bounced cheque or delayed payment, charges and outstanding dues will be charged as

per the prevailing company policy. You can replace old PDCs with new ones within 5 - 7 working days.

Interest Rates,Types and Calculation

How is the interest on my loan calculated?

Interest on a loan is payable on the entire loan balance at any given point of time and the simplest

method of calculating interest is:

Interest = (Principal X Rate X Rime) / 100.

However, different lending institutions have different methods of applying the interest payment received

from the borrower as part of his EMI. This is discussed later in this section.

What are the bases of interest rates calculation?

The interest on most loans is usually calculated on Monthly Reducing or Yearly Reducing Balance. In

Monthly Reducing Balance, as you pay your EMI each month, the principal part of the EMI is adjusted

against the outstanding principal on a monthly basis; However in Yearly Reducing Balance, the principal is

reduced at the end of the year, therefore the borrower pays interest on a certain part of the principal which

has actually been paid back to the bank. This means that the monthly reducing system is a cheaper

means of paying on your loan.

What is the Fixed Rate of Interest?

Fixed rate of interest means that the interest rates remain FIXED for the entire duration the loan and there

is no benefit to the borrower, even if the interest rates in the market drop.

What is a Floating Rate of Interest?

This is the rate of interest that fluctuates according to the market lending rate.

What is a Semi-Fixed Rate of Interest?

A semi-fixed rate of interest is a combination of fixed and floating rates. The rate remains unchanged for

the first one to three years (varies from lender to lender). Post this period, the rate of interest becomes

floating.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Basic Sales TrainingDocument36 pagesBasic Sales TrainingManraj Singh100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Liability Insurance.Document62 pagesLiability Insurance.pankajgupta80% (5)

- CBSE Class 11 Accountancy Study Material PDFDocument148 pagesCBSE Class 11 Accountancy Study Material PDFKaushik SenguptaNo ratings yet

- Letter of CreditDocument7 pagesLetter of CreditprasadbpotdarNo ratings yet

- List of Registered Independent Sales OrganizationsDocument53 pagesList of Registered Independent Sales Organizationscdill70100% (1)

- Bni PT Bangun Jun22Document3 pagesBni PT Bangun Jun22Yehezkiel AdhiNo ratings yet

- Marketing Head Mumbai 4567Document8 pagesMarketing Head Mumbai 4567Wilfred Dsouza0% (1)

- Financial Institutions AssignmentDocument22 pagesFinancial Institutions AssignmentProbortok Somaj80% (5)

- Sanjeev Ghei 3Document23 pagesSanjeev Ghei 3PraveenKumarNo ratings yet

- Sanjeev Ghai, Sanjeev GheiDocument15 pagesSanjeev Ghai, Sanjeev GheiPraveenKumarNo ratings yet

- Eschol Tech SolutionsDocument11 pagesEschol Tech SolutionsPraveenKumarNo ratings yet

- Olumide Adeola PidanDocument12 pagesOlumide Adeola PidanPraveenKumarNo ratings yet

- Olumide Adeola PidanDocument12 pagesOlumide Adeola PidanPraveenKumarNo ratings yet

- Purva Bluemont False CommitmentDocument7 pagesPurva Bluemont False CommitmentPraveenKumarNo ratings yet

- Olumide Adeola PidanDocument9 pagesOlumide Adeola PidanPraveenKumarNo ratings yet

- Implied Authority of A Partner: A Comparative Study: Assistant Professor of LawDocument20 pagesImplied Authority of A Partner: A Comparative Study: Assistant Professor of LawHimanshuNo ratings yet

- Statement MAR2022 760347549Document60 pagesStatement MAR2022 760347549Nehal JajuNo ratings yet

- NCR Amea News August 2012Document7 pagesNCR Amea News August 2012vietnbNo ratings yet

- List of Circle Wise Branches: State Bank of India: RFP For Procurement of AEC KitDocument116 pagesList of Circle Wise Branches: State Bank of India: RFP For Procurement of AEC KitKamal SharmaNo ratings yet

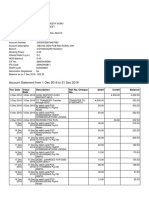

- Account Statement From 1 Dec 2016 To 31 Dec 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Dec 2016 To 31 Dec 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceENDLURI DEEPAK KUMARNo ratings yet

- Functions and Roles of RbiDocument3 pagesFunctions and Roles of RbiMOHITNo ratings yet

- Ghana CHRAJ Investigation Report On MP Car LoansDocument26 pagesGhana CHRAJ Investigation Report On MP Car LoansKwakuazarNo ratings yet

- Fdd-1q-Deposit Kyckyc Final PrintDocument11 pagesFdd-1q-Deposit Kyckyc Final PrintBablu PrasadNo ratings yet

- IRS Questions Pakistan Fiscal TaxesDocument7 pagesIRS Questions Pakistan Fiscal TaxesIbrahimGorgageNo ratings yet

- The Reasons of This Question: 2. Levels of Career GoalsDocument17 pagesThe Reasons of This Question: 2. Levels of Career GoalsRaviraj ZalaNo ratings yet

- Clearing Code and Branch Code (21 Jan 2015) With Tel NoDocument318 pagesClearing Code and Branch Code (21 Jan 2015) With Tel NoArdisonNo ratings yet

- HDFC Bank Summer Internship Report on Segmentation and Penetration StrategiesDocument66 pagesHDFC Bank Summer Internship Report on Segmentation and Penetration StrategiesrupaliNo ratings yet

- From Import Import From Import From Import Try From Import Except PassDocument2 pagesFrom Import Import From Import From Import Try From Import Except PassriteshNo ratings yet

- IRCTC travel insurance coverDocument3 pagesIRCTC travel insurance coverAbhinav TayadeNo ratings yet

- Fleet Bank HistoryDocument24 pagesFleet Bank HistoryScutty StarkNo ratings yet

- Sep 2018 PDFDocument40 pagesSep 2018 PDFrah7ulNo ratings yet

- Kiosk Banking Solution KBSDocument2 pagesKiosk Banking Solution KBSMANISHNo ratings yet

- The History and Evolution of Credit and Debit CardsDocument33 pagesThe History and Evolution of Credit and Debit CardsDeepali Jain87% (15)

- C. Independent Financial Statements AuditDocument5 pagesC. Independent Financial Statements Auditahmed arfanNo ratings yet

- Checklist Distribution Agreement SPLDocument3 pagesChecklist Distribution Agreement SPLLitaNo ratings yet

- Banking Case DigestDocument6 pagesBanking Case DigestIsaac David GatchalianNo ratings yet

- Proposal For ThesisDocument8 pagesProposal For ThesisDestiny Tuition Centre50% (2)