Professional Documents

Culture Documents

The Statement of Cash Flows

Uploaded by

EthanChiongson0 ratings0% found this document useful (0 votes)

50 views19 pagesReviewer for the statement of cash flows

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentReviewer for the statement of cash flows

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

50 views19 pagesThe Statement of Cash Flows

Uploaded by

EthanChiongsonReviewer for the statement of cash flows

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 19

This statement shows the

cash receipts and cash

payments of the entity

during the period. It shows

where cash came and from

and how it is spent.

A.DIRECT METHOD

B.INDIRECT METHODS

Shows each major class of cash

receipts and cash payments. It

also provides information

which may be useful in

estimating future cash flows.

Net income is adjusted for the

effects of non cash transactions,

change in balances of asset

accounts and items associated

with investing and financing

cash flows.

A.OPERATING

B.INVESTING

C.FINANCING

Are primarily derived from the

principal revenue-producing

activities of the enterprise. They

generally result from the

transactions and other events

that enter into determination of

profit or loss.

Cash receipts from sale of goods

and rendering of services.

Cash receipts from royalties, fees,

commissions and other revenue

Cash payments to supplier of goods

and services

Cash payments to and on behalf of

the employees

Cash receipts and payments of an

insurance enterprise for premiums and

claims, annuities and other policy

benefits

Cash payments or refunds of income

taxes unless they specially indentifies

with financing and investing activities

Cash receipts and payments from

contracts held for dealing or trading

purpose.

Represent the extent to which

expenditures have been made

for resources intended to

generate future income and cash

flows. These affect non trade

assets, most of which are

classified as noncurrent.

Cash payments to acquire

property, plant and equipment,

intangibles and other long-term

assets.

Cash receipts from sale of

property, plant and equipment,

intangibles and other long-term

assets.

Cash advances and loans made to

other parties (other than financial

institution)

Cash receipts from repayment of

advances and loans made to other

parties.

Information arising from

financing activities is useful in

predicting claims on future cash

flows by providers of capital to

the enterprise. These are

transaction with non trade

creditors and shareholders.

Cash receipts from loans

made to a financial institution

Cash repayments of amount

borrowed

Cash received from customers 120,000

Cash paid to suppliers 75,000

Interest received 12,000

Interest paid on bank loans 14,500

Refund for income tax 35,000

Cash paid for rent 35,000

Cash paid for utilities 7,650

Dividends paid 8,700

Payment for 1st installment for bank loan 10,000

Withdrawal of owner 12,540

Proceeds for sale of equipment 6,530

Payment for furnitures purchased 12,550

Payment for equipment purchased 35,460

Additional investment of owner 88,800

Proceeds from bank loan 10,000

WORKBOOK EXERCISES

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Amazon Go ReportDocument3 pagesAmazon Go ReportkatyaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CCP Motivation Letter 2022Document3 pagesCCP Motivation Letter 2022mohammed ahmed0% (1)

- ch14 - Managing ChangeDocument28 pagesch14 - Managing ChangeEthanChiongson100% (2)

- Bookkeeping BasicsDocument19 pagesBookkeeping BasicsAbeer ShennawyNo ratings yet

- Math 12 BESR ABM Q2-Week 6Document13 pagesMath 12 BESR ABM Q2-Week 6Victoria Quebral Carumba100% (2)

- Unit 10 - Accounting For EarningsDocument4 pagesUnit 10 - Accounting For EarningsEthanChiongsonNo ratings yet

- FILE#7 ACCTBA2 Corporation Part 3Document29 pagesFILE#7 ACCTBA2 Corporation Part 3EthanChiongsonNo ratings yet

- Unit 10Document2 pagesUnit 10EthanChiongsonNo ratings yet

- Unit 5 - WB SolutionsDocument2 pagesUnit 5 - WB SolutionsEthanChiongsonNo ratings yet

- Exercise 7 - 1 Review Questions: Solution Manual Unit 7 Treasury SharesDocument7 pagesExercise 7 - 1 Review Questions: Solution Manual Unit 7 Treasury SharesEthanChiongsonNo ratings yet

- UNIT 9 WB SolutionDocument14 pagesUNIT 9 WB SolutionEthanChiongsonNo ratings yet

- Managerial Accounting and The Business Environment: © 2012 Mcgraw-Hill Education (Asia)Document35 pagesManagerial Accounting and The Business Environment: © 2012 Mcgraw-Hill Education (Asia)EthanChiongsonNo ratings yet

- Exercise 6-2 True or False: Solution ManualDocument4 pagesExercise 6-2 True or False: Solution ManualEthanChiongsonNo ratings yet

- Unit 8 WB SolutionDocument11 pagesUnit 8 WB SolutionEthanChiongson0% (2)

- Managerial Accounting and Cost Concepts: Mgt. FunctionsDocument42 pagesManagerial Accounting and Cost Concepts: Mgt. FunctionsEthanChiongsonNo ratings yet

- ch05 - MotivationDocument54 pagesch05 - MotivationEthanChiongsonNo ratings yet

- TREDONE Review Questions For The Final Oral ExamDocument5 pagesTREDONE Review Questions For The Final Oral ExamEthanChiongsonNo ratings yet

- ch05 - MotivationDocument54 pagesch05 - MotivationEthanChiongsonNo ratings yet

- ch06 - Reward and AppraisalDocument48 pagesch06 - Reward and AppraisalEthanChiongsonNo ratings yet

- ch07 - LeadershipDocument49 pagesch07 - LeadershipEthanChiongsonNo ratings yet

- The Earliest Hospitals EstablishedDocument3 pagesThe Earliest Hospitals EstablishedJonnessa Marie MangilaNo ratings yet

- Chap 0023Document26 pagesChap 0023yousef olabiNo ratings yet

- What Is Ecocroticism - GlotfeltyDocument3 pagesWhat Is Ecocroticism - GlotfeltyUmut AlıntaşNo ratings yet

- Questionnaire DellDocument15 pagesQuestionnaire Dellkumarrohit352100% (2)

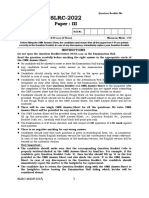

- SLRC InstPage Paper IIIDocument5 pagesSLRC InstPage Paper IIIgoviNo ratings yet

- AcadinfoDocument10 pagesAcadinfoYumi LingNo ratings yet

- How To Survive Economic CollapseDocument4 pagesHow To Survive Economic CollapseZub AleandruNo ratings yet

- What Is GlobalizationDocument19 pagesWhat Is GlobalizationGiovanni Pierro C Malitao JrNo ratings yet

- First Aid Is The Provision of Initial Care For An Illness or InjuryDocument2 pagesFirst Aid Is The Provision of Initial Care For An Illness or InjuryBasaroden Dumarpa Ambor100% (2)

- Kelly Wright hw499 ResumeDocument2 pagesKelly Wright hw499 Resumeapi-526258935No ratings yet

- The Game of KevukDocument8 pagesThe Game of KevukTselin NyaiNo ratings yet

- Process Recording Template 1Document5 pagesProcess Recording Template 1api-584340241No ratings yet

- Auditing Unit - 5 by Anitha RDocument16 pagesAuditing Unit - 5 by Anitha RAnitha RNo ratings yet

- Strategic Management AnswerDocument7 pagesStrategic Management AnswerJuna Majistad CrismundoNo ratings yet

- Causes of UnemploymentDocument7 pagesCauses of UnemploymentBishwaranjan RoyNo ratings yet

- Marking Guide For MUNsDocument2 pagesMarking Guide For MUNsNirav PandeyNo ratings yet

- Islamic StudyDocument80 pagesIslamic StudyWasim khan100% (1)

- Affidavit of GC - Reject PlaintDocument9 pagesAffidavit of GC - Reject PlaintVishnu R. VenkatramanNo ratings yet

- Professionals and Practitioners in Counselling: 1. Roles, Functions, and Competencies of CounselorsDocument70 pagesProfessionals and Practitioners in Counselling: 1. Roles, Functions, and Competencies of CounselorsShyra PapaNo ratings yet

- M.V AFFLATUS & WEN YUE Collision Report by China MSADocument23 pagesM.V AFFLATUS & WEN YUE Collision Report by China MSAJasper AngNo ratings yet

- Criticism On Commonly Studied Novels PDFDocument412 pagesCriticism On Commonly Studied Novels PDFIosif SandoruNo ratings yet

- Journal Jul Dec14 Art4Document16 pagesJournal Jul Dec14 Art4paromita bhattacharjeeNo ratings yet

- CM - Mapeh 8 MusicDocument5 pagesCM - Mapeh 8 MusicAmirah HannahNo ratings yet

- Near Miss ReportingDocument14 pagesNear Miss ReportingMuflihMuhammadNo ratings yet

- 雅思口语常用高效表达句型 PDFDocument3 pages雅思口语常用高效表达句型 PDFJing AnneNo ratings yet

- Application For DiggingDocument3 pagesApplication For DiggingDhathri. vNo ratings yet