Professional Documents

Culture Documents

RBI

Uploaded by

Apple AhujaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RBI

Uploaded by

Apple AhujaCopyright:

Available Formats

RESERVE BANK OF INDIA

Introduction

RBI is the Central Bank of India Established in 1934

under the RESERVE BANK OF INDIA ACT 1934.

RBI head quarter located in Mumbai (Maharashtra).

The present governor is Duvvuri Subbarao.

RBI has 26 offices out of which four are regional

offices located in metropolitan cities.

Breif History

RBI was set up on the recommendations of the Hilton

Young Commission .

It was started as share-holders bank with a paid up

capital of INR 5 crores.

Initially it was located in Kolkata. It moved to Mumbai

in 1937.

Earlier RBI was privately owned later on in 1949, the

bank was nationalised and is fully owned by the Govt.

of India.

Preamble

The Preamble of the Reserve Bank of India describes

the basic objectives of the Reserve Bank as

"...to regulate the issue of Bank Notes and keeping of

reserves with a view to securing monetary stability

in India and generally to operate the currency and

credit system of the country to its advantage."

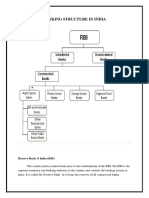

Organization of The RBI

The Reserve Bank's affairs are governed by a central board of

directors and four local boards of directors.

The central board performs the functions of general

superintendence and direction of the banks affairs.

Central board: Appointed/nominated by the GOI for a time period of

four years. It includes the following

Official directors

A. Full-time : Governor and not more than four Deputy Governors

Non-official directors

A. Nominated by Government: Ten Directors from various fields

and two government officials

B. Others: Four directors - one each from four local boards

Organization of The RBI

Local board

Functions : To advise the Central Board on local matters and

to represent territorial and economic interests of local

cooperative and indigenous banks.

One each for the four regions of the country in Mumbai,

Calcutta, Chennai and New Delhi

Membership:

A. consist of five members each

B. appointed by the Central Government

C. for a term of four years

Functions of RBI

Monetary Authority:

A. Formulates, implements and monitors the monetary policy.

B. Objective: maintaining price stability and ensuring adequate

flow of credit to productive sectors.

Regulator and supervisor of the financial system:

A. Prescribes broad parameters of banking operations within

which the country's banking and financial system functions.

B. Objective: maintain public confidence in the system, protect

depositors' interest & provide cost-effective banking services.

Manager of Foreign Exchange

A. Manages the Foreign Exchange Management Act, 1999.

B. Objective: to facilitate external trade and payment and

promote orderly development and maintenance of foreign

exchange market in India.

Functions of RBI

Issuer of currency:

A. Issues and exchanges or destroys currency and coins not fit for

circulation.

B. Objective: to give the public adequate quantity of supplies of

currency notes and coins and in good quality.

Developmental role

A. Performs a wide range of promotional functions to support

national objectives.

Related Functions

A. Banker to the Government: performs merchant banking

function for the central and the state governments; also acts

as their banker.

B. Banker to banks: maintains banking accounts of all scheduled

banks.

Conclusion

RBI has done commendable job as a monetary authority and

regulator of the financial system.

It has adopted the best international practices in the dissemination

of information and rational of policies(i.e., the extent of information

disclosed helps market to make its own projections of interest

rates).

The bank intervened in markets where necessary and allowed the

market participation to build skills and gain maturity to accept the

new system.

It has adopted a consultative and participative approach to

introduce changes.

The RBI has managed foreign exchange resources effectively.

You might also like

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- RBI's Role in India and Pandemic ResponseDocument11 pagesRBI's Role in India and Pandemic ResponseHarish Chandani100% (1)

- Agricultural Finance and Project Management: Reserve Bank of IndiaDocument41 pagesAgricultural Finance and Project Management: Reserve Bank of IndiaPràßhánTh Aɭoŋɘ ɭovɘʀNo ratings yet

- BankingDocument49 pagesBankingRitu BhatiyaNo ratings yet

- RESERVE BANK OF INDIA (Shivam)Document6 pagesRESERVE BANK OF INDIA (Shivam)nishantarya283No ratings yet

- Banking Structure in IndiaDocument49 pagesBanking Structure in IndiaAjay RapelliNo ratings yet

- RBI Roles and FunctionsDocument23 pagesRBI Roles and Functionsdp1988No ratings yet

- Bank of Maharashtra: A History of Service and GrowthDocument51 pagesBank of Maharashtra: A History of Service and GrowthSantosh BarikNo ratings yet

- Npa Management SbiDocument104 pagesNpa Management Sbiparth jani100% (1)

- Changing Scenario of the Indian Banking SectorDocument14 pagesChanging Scenario of the Indian Banking Sectorrupeshdahake8586100% (2)

- State Bank of India: India's Largest BankDocument12 pagesState Bank of India: India's Largest BankpreetighNo ratings yet

- Format of Project For 6th SemesterDocument4 pagesFormat of Project For 6th SemesterShahjahanNo ratings yet

- Case StudyDocument22 pagesCase StudyKUNAL GUPTA0% (1)

- HUMAN RESOURCE STRATEGIES AT SBIDocument26 pagesHUMAN RESOURCE STRATEGIES AT SBIAmul KapoorNo ratings yet

- Evolution of Reserve Bank of IndiaDocument6 pagesEvolution of Reserve Bank of IndiamotherfuckermonsterNo ratings yet

- Role of RBI in Economic and Social Development PDFDocument88 pagesRole of RBI in Economic and Social Development PDFKaruna LadeNo ratings yet

- Project Role of RBI Word Doc.3Document66 pagesProject Role of RBI Word Doc.3nilesh dhivreNo ratings yet

- Commercial Application ProjectDocument12 pagesCommercial Application ProjectMridul MoolchandaniNo ratings yet

- Presentation Report On Loans and AdvancesDocument20 pagesPresentation Report On Loans and AdvancesHawk AujlaNo ratings yet

- A Project Report of Indian Financial System On Role of Rbi in Indian EconomyDocument14 pagesA Project Report of Indian Financial System On Role of Rbi in Indian EconomyAjay Gupta67% (3)

- Reserve Bank of IndiaDocument10 pagesReserve Bank of Indiatejaskamble45No ratings yet

- 50 Years of Bank NationalisationDocument16 pages50 Years of Bank NationalisationIshita DongreNo ratings yet

- Project Report On Indian Banking SystemDocument23 pagesProject Report On Indian Banking Systemsaif aliNo ratings yet

- Evolution and Organizational Structure of SBIDocument6 pagesEvolution and Organizational Structure of SBIpandisivaNo ratings yet

- Study of NPA in UCO BankDocument63 pagesStudy of NPA in UCO BankSunil Shekhar Nayak0% (1)

- Comparative Study Between Private Sectors Bank and Public Sector BanksDocument36 pagesComparative Study Between Private Sectors Bank and Public Sector BanksjudeNo ratings yet

- Reserve Bank of IndiaDocument11 pagesReserve Bank of IndiaHarshSuryavanshiNo ratings yet

- Bank of BarodaDocument75 pagesBank of BarodaVicky SinghNo ratings yet

- Indian Banks' Battle Against Rising NPAsDocument15 pagesIndian Banks' Battle Against Rising NPAsREVA UniversityNo ratings yet

- Economics Project Format: TitleDocument18 pagesEconomics Project Format: TitleKisha OswalNo ratings yet

- Corporate Finance ProjectDocument14 pagesCorporate Finance ProjectAspiring StudentNo ratings yet

- Non-Performing Asset of Public and Private Sector Banks in India A Descriptive Study SUSHENDRA KUMAR MISRADocument5 pagesNon-Performing Asset of Public and Private Sector Banks in India A Descriptive Study SUSHENDRA KUMAR MISRAharshita khadayteNo ratings yet

- Managing Assets and Liabilities of Urban Co-op BanksDocument70 pagesManaging Assets and Liabilities of Urban Co-op BanksAbhiroop Bhattacharjee100% (1)

- Financial Analysis PNBDocument32 pagesFinancial Analysis PNBTarandeepNo ratings yet

- RBI Functions List: Traditional, Developmental, SupervisoryDocument25 pagesRBI Functions List: Traditional, Developmental, Supervisorygeethark12100% (1)

- Review of The Literature: Chapter - IIIDocument10 pagesReview of The Literature: Chapter - IIIVįňäý Ğøwđã VįñîNo ratings yet

- Union Bank of IndiaDocument43 pagesUnion Bank of IndiaBalaji GajendranNo ratings yet

- Banking - Banking Sector in IndiaDocument65 pagesBanking - Banking Sector in Indiapraveen_rautela100% (1)

- Sbi Merger PDFDocument6 pagesSbi Merger PDFVijit SachdevaNo ratings yet

- Banking Sector in IndiaDocument29 pagesBanking Sector in Indiahahire0% (1)

- University of Mumbai: "75 Years of Reserve Bank of India"Document109 pagesUniversity of Mumbai: "75 Years of Reserve Bank of India"Harshal Chavan100% (1)

- State Bank of IndiaDocument25 pagesState Bank of IndiabsragaNo ratings yet

- PNB's Financial InsightDocument43 pagesPNB's Financial InsightBritneyJonesNo ratings yet

- Adoption of Open Banking in the PhilippinesDocument21 pagesAdoption of Open Banking in the PhilippinesWendelynn Giannina AngNo ratings yet

- Role of Rbi in Indian Banking System 2022Document22 pagesRole of Rbi in Indian Banking System 2022ayushNo ratings yet

- Presentation On Bank of BarodaDocument14 pagesPresentation On Bank of BarodaPunit JainNo ratings yet

- Conflicting Roles of RBI as Debt Manager and Bank SupervisorDocument17 pagesConflicting Roles of RBI as Debt Manager and Bank SupervisorArunav Guha RoyNo ratings yet

- Challlenges of Internet BankingDocument12 pagesChalllenges of Internet BankingeldhoseNo ratings yet

- Credit Risk Management of Nepalese BanksDocument121 pagesCredit Risk Management of Nepalese BanksPrem YadavNo ratings yet

- A Descriptive Study On Growth of Mobile Banking & Insurance in India During Covid-19Document69 pagesA Descriptive Study On Growth of Mobile Banking & Insurance in India During Covid-19UPENDRA NISHADNo ratings yet

- Industry Analysis: Desk Research Banking IndustryDocument66 pagesIndustry Analysis: Desk Research Banking IndustryAniket MankarNo ratings yet

- E-banking in India: A Guide to Its Evolution, Features and TypesDocument43 pagesE-banking in India: A Guide to Its Evolution, Features and Typeskpalanivel123No ratings yet

- Rbi ThesisDocument51 pagesRbi ThesisAnil Anayath100% (8)

- Indian Banking Industry Growth and NPAsDocument85 pagesIndian Banking Industry Growth and NPAsAbhijit MohantyNo ratings yet

- Reserve Bank of India: Vidur Ahuja Amardeep Shokeen 13BSP0911 13BSP1500Document10 pagesReserve Bank of India: Vidur Ahuja Amardeep Shokeen 13BSP0911 13BSP1500Apple AhujaNo ratings yet

- Working of RBI: Supervised By: DR - Anjana AttriDocument25 pagesWorking of RBI: Supervised By: DR - Anjana AttriKajal ChaudharyNo ratings yet

- Reserve Bank of India EstablishmentDocument3 pagesReserve Bank of India EstablishmentBhaskar SinghNo ratings yet

- Reserve Bank of IndiaDocument12 pagesReserve Bank of IndiaKaushik ParmarNo ratings yet

- Functions of RBIDocument11 pagesFunctions of RBIAbhi JainNo ratings yet

- RBI (Basic Info.)Document4 pagesRBI (Basic Info.)Gowher MajidNo ratings yet

- Ambuja Cement FinalDocument30 pagesAmbuja Cement FinalApple Ahuja0% (1)

- As-Is Error in Voter Id-Card - SDRDocument1 pageAs-Is Error in Voter Id-Card - SDRApple AhujaNo ratings yet

- Instruments of Monetary PolicyDocument12 pagesInstruments of Monetary PolicyApple AhujaNo ratings yet

- Reserve Bank of India: Vidur Ahuja Amardeep Shokeen 13BSP0911 13BSP1500Document10 pagesReserve Bank of India: Vidur Ahuja Amardeep Shokeen 13BSP0911 13BSP1500Apple AhujaNo ratings yet

- OF Ministry Road Transport Highways (Road Safety Cell) : TH THDocument3 pagesOF Ministry Road Transport Highways (Road Safety Cell) : TH THAryann Gupta100% (1)

- Situation AnalysisDocument94 pagesSituation Analysisamirafateha100% (2)

- BLUEBOOK CITATION GUIDEDocument12 pagesBLUEBOOK CITATION GUIDEMichaela PortarcosNo ratings yet

- 02-Procedures & DocumentationDocument29 pages02-Procedures & DocumentationIYAMUREMYE EMMANUELNo ratings yet

- Mar 2021Document2 pagesMar 2021TanNo ratings yet

- Performance Requirements For Organic Coatings Applied To Under Hood and Chassis ComponentsDocument31 pagesPerformance Requirements For Organic Coatings Applied To Under Hood and Chassis ComponentsIBR100% (2)

- Evoe Spring Spa Targeting Climbers with Affordable WellnessDocument7 pagesEvoe Spring Spa Targeting Climbers with Affordable WellnessKenny AlphaNo ratings yet

- KNJN Fpga Pluto-P BoardDocument15 pagesKNJN Fpga Pluto-P Boardgandalf1024No ratings yet

- Hi Tracy: Total Due Here's Your Bill For JanuaryDocument6 pagesHi Tracy: Total Due Here's Your Bill For JanuaryalexNo ratings yet

- Geller (LonginusRhetoric'sCure)Document27 pagesGeller (LonginusRhetoric'sCure)Miguel AntónioNo ratings yet

- Fish Culture Y4Document136 pagesFish Culture Y4KèlǐsītǎnKǎPáng100% (1)

- U1 Presantation-MAK 032021Document15 pagesU1 Presantation-MAK 032021MD ANAYET ALI KHANNo ratings yet

- PSP, Modern Technologies and Large Scale PDFDocument11 pagesPSP, Modern Technologies and Large Scale PDFDeepak GehlotNo ratings yet

- Oral READING BlankDocument2 pagesOral READING Blanknilda aleraNo ratings yet

- 5528 L1 L2 Business Admin Unit Pack v4Document199 pages5528 L1 L2 Business Admin Unit Pack v4Yousef OlabiNo ratings yet

- ControllingDocument8 pagesControllingAnjo Pasiolco Canicosa100% (2)

- PDFDocument2 pagesPDFJahi100% (3)

- Concept of Intestate SuccessionDocument9 pagesConcept of Intestate SuccessionBodhiratan BartheNo ratings yet

- 51 JointventureDocument82 pages51 JointventureCavinti LagunaNo ratings yet

- 4 5895601813654079927 PDFDocument249 pages4 5895601813654079927 PDFqabsNo ratings yet

- E GCOct 2013 NsDocument0 pagesE GCOct 2013 Nsvae2797No ratings yet

- Promotion From Associate Professor To ProfessorDocument21 pagesPromotion From Associate Professor To ProfessorKamal KishoreNo ratings yet

- Plusnet Cancellation FormDocument2 pagesPlusnet Cancellation FormJoJo GunnellNo ratings yet

- Court Rules on Debt Collection Case and Abuse of Rights ClaimDocument3 pagesCourt Rules on Debt Collection Case and Abuse of Rights ClaimCesar CoNo ratings yet

- Isha Hatha Yoga - Program Registration FormDocument2 pagesIsha Hatha Yoga - Program Registration FormKeyur GadaNo ratings yet

- Module 1: Overview of Implementation of The NSTP (Activities)Document3 pagesModule 1: Overview of Implementation of The NSTP (Activities)RonnelNo ratings yet

- Orbit BioscientificDocument2 pagesOrbit BioscientificSales Nandi PrintsNo ratings yet

- International Waiver Attestation FormDocument1 pageInternational Waiver Attestation FormJiabao ZhengNo ratings yet

- Ra 1425 Rizal LawDocument7 pagesRa 1425 Rizal LawJulie-Mar Valleramos LabacladoNo ratings yet

- 2009 WORD White Paper TemplateDocument4 pages2009 WORD White Paper Templateomegalpha777No ratings yet