Professional Documents

Culture Documents

Fcra Provisions 2010 Registration Under Fcra: Presentation at Nirc Meet On Npos, On 11 June 2011

Uploaded by

batool1980Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fcra Provisions 2010 Registration Under Fcra: Presentation at Nirc Meet On Npos, On 11 June 2011

Uploaded by

batool1980Copyright:

Available Formats

Presentation at NIRC meet on NPOs, Le Meridien, New Delhi

on 11 June 2011

on

FCRA Provisions 2010

with focus on

Registration under FCRA

By Subhash Mittal, Director

SMA Management Services (P) Ltd

NIRC seminar on FCRA Provisions with focus on Registration by S. Mittal,

11-6-2011, Le Meridien, New Delhi

Current Effective Status

FCRA 2010

- Bill was tabled in Rajya Sabha in 2006 and passed in

Rajya Sabha on 19

th

August 2010

- Introduced in Lok Sabha on 27

th

Aug 2010 and passed

the same day.

- President assent received on 27

th

September 2010

- It was published in the Gazette on the same day.

- Made effective wef 1-5-2011

Rules

- Draft rules placed on MHA website and comments

invited by 31

st

March 2011

- Final Rules published on 29 April. Effective 1-5-2011

NIRC seminar on FCRA Provisions with focus on Registration by S. Mittal,

11-6-2011, Le Meridien, New Delhi

Background

FCRA legislation background is of late 60s early 70s.

Act was legislated during Emergency

Main objective is to ensure that the foreign funds are not

used to subvert, influence national agenda.

It does not cover foreign monies recd through

commercial transactions.

FCRA Legislation basically does it in three ways:

- prohibits certain persons in sensitive positions (legislature,

political parties, govt. servants, judges, persons from media)

- by monitoring persons (incl. organisations) which wish to receive

such funds / benefits - through requiring persons to obtain prior

permission / registration

- by monitoring subsequent receipt of funds and their usage (by

asking persons receiving such funds to submit necessary

information).

NIRC seminar on FCRA Provisions with focus on Registration by S. Mittal,

11-6-2011, Le Meridien, New Delhi

Important Definitions

Foreign Source (S.2(j))

Foreign govt. or its agency

Any international agency (exceptions UN, World Bank or any other notified by the

Govt.)

Foreign corporations, foreign companies, foreign trade union, foreign non-profit

agencies, foreign citizens

Indian company with more than 50% shareholding held by persons mentioned

above.

Foreign Hospitality (S.2(i))

Any offer, not being a purely casual one, made in cash or kind for providing travel

to / free boarding, etc. in any foreign country or medical treatment.

Foreign Contribution (S.2(h))

Donation, delivery or transfer made by a foreign source or from a person who has

recd it from a foreign source of an article (not being gift for personal use below

specified value), any currency or security.

Includes interest / income earned from such foreign contribution.

Exceptions (S.4)

Salary, Remuneration, Scholarship, Stipend, etc.

Payment in the course of trade or commerce

Fees, in ordinary course of business (incl. educational institutions)

From relatives (however if more than Rs 1 lakh in a financial year recd than

intimate within 30 days)

NIRC seminar on FCRA Provisions with focus on Registration by S. Mittal,

11-6-2011, Le Meridien, New Delhi

NPOs How to receive Foreign Cont.

Prior Permission (S 11(2))

Registration (S 11(1))

NIRC seminar on FCRA Provisions with focus on Registration by S. Mittal,

11-6-2011, Le Meridien, New Delhi

Prior Permission

To be done online Form FC4

A new prior permission application cannot be moved

within 6 months for the same project.

Documents to be attached

Copy of Trust Deed / Memorandum

Activities over last 3 years

3 Years duly audited annual accounts

Latest Commitment letter from the donor

Details of the project to be funded, such as outlays,

detailed budget, etc.

DD / Pay Order of Rs 1000/-

Details of violations / convictions, if any

NIRC seminar on FCRA Provisions with focus on Registration by S. Mittal,

11-6-2011, Le Meridien, New Delhi

Registration

Prior Permission only for a specific project / commitment while

Registration is general in nature and any FC can be deposited without

recourse to the Dept.

For Registration,- Eligibility criteria

Existence for three years.

Minimum of Rs 6 lakh spending during this period.

(No legislative provision /rules but based on practices at the dept.)

Similar requirements as Prior Permission. Online Form FC3, Fees Rs

2000/-.

Hard copy duly signed to be submitted within 30 days (otherwise

application would be deemed to be ceased Rule 1b & 2b)

2

nd

application cannot be moved within 6 months from the date of

cessation.

Separate bank account for receipt of FC.

New Bank accounts for utilisation of FC may be opened. Intimate the

same within 15 days of opening of the account. (Huge Relief)

Pending applications at the time of enactment of New Act will be valid

under New Act provided Fees is submitted.

NIRC seminar on FCRA Provisions with focus on Registration by S. Mittal,

11-6-2011, Le Meridien, New Delhi

Renewal of Registration

All registrations valid for 5 years

File renewal application online (FC-5).

Fees Rs 500/- by DD/Bankers draft

Seems Dept. wishes to re-visit cases to weed out any

blacklisted, proceeded NGOs.

Application to be moved 6 months prior to expiry

In case of NPOs implementing multi-year project to

apply 12 months in advance.

Delay may be condoned but not later than 4 months

after the registration expires. (R. 12 (8))

If renewal not applied than registration ceases after

the expiry period and new application has to be

moved as if its a new registration under Rule 9.

NIRC seminar on FCRA Provisions with focus on Registration by S. Mittal,

11-6-2011, Le Meridien, New Delhi

Registration & its maintenance made

more difficult

Changing of Form Nos. will cause mistakes, headaches

for people required to comply. This could have been

easily avoided.

Need to apply for renewal every 5 years. It is rather

bothersome and is inconsistent with Govt.s line of

thinking.

Now Fee has to be paid for renewal (` 500/-), new

applications (`2000/-; `1000/-).

Hard copy of applications to be submitted within 30

days. If not submitted than application lapses. Next

application cannot be moved for another 6 months.

Earlier Govt. was time bound in responding a maximum

of (90+30) days. However now Govt. will reply within 90

days but can take longer by giving reasons.

NIRC seminar on FCRA Provisions with focus on Registration by S. Mittal,

11-6-2011, Le Meridien, New Delhi

Registration..

Power to cancel the Registration certificate.

(S. 14) Earlier power was not explicit in the

Act (Govt. used blacklisting). However now

no new application can be moved for 3

years once blaclkisted.

Power to suspend Registration certificates

(S.13) upto a maximum of 180 days.

Assets to vest with the Govt wherever

registration cancelled or a registered/

permitted person ceases becomes defunct.

NIRC seminar on FCRA Provisions with focus on Registration by S. Mittal,

11-6-2011, Le Meridien, New Delhi

Increased Bureaucracy

Govt. has sweeping powers under the Act covering

receipt of any FC by notifying. (S. 11(3)).

Govt has given itself similar powers even without

notifying if it considers that FC/FH will prejudicially affect

sovereignty, public interest, etc. (S.9)

If any violation of the Act determined, unutilised/un-

received funds cannot be utilised/received. (S.11(2)).

Earlier only newspapers were covered now even news

channels as well as web channels involved in production

and broadcast of audio/visual news, current affair

programmes. S3(1).

Specific persons involved in such programmes also

covered.

NIRC seminar on FCRA Provisions with focus on Registration by S. Mittal,

11-6-2011, Le Meridien, New Delhi

Increased Bureaucracy

Need to attach bank statements with the Annual Return

(FC6).

Banks are now required to report all receipts of FC within

30 days, wherever a person required to obtain

Registration / Prior Permission but has not obtained it so

far. (Rule 15(1))

If Reg./PP cancelled, then custody of bank funds, assets

vests with the Govt. (S.15, R.14)

NIRC seminar on FCRA Provisions with focus on Registration by S. Mittal,

11-6-2011, Le Meridien, New Delhi

Problem areas

Rules do not define financial limit of article,

earlier `1000/- (S.2(1)h; R.8) seems to be an

error.

For compliance for funds being recd from

Relative not just persons falling within the

scope of FCRA to report but anyone receiving

FC of more than `1 lakh to report. (R. 6 &

S3&4). Even Form FC1 does not clarify this.

Rule 23 (1) requires that for every transfer of

FC to other organisations (incl. registered)

application would need to be made and funds

may be transferred only with Govt permission

(R23(2)).

NIRC seminar on FCRA Provisions with focus on Registration by S. Mittal,

11-6-2011, Le Meridien, New Delhi

Likely to cause Hardships

Renewal of all the existing FCRA registration to expire 5

years after this section of the Act becomes effective.

Likely to cause huge bottlenecks. (S. 11)

Detailed rule relating to Administrative Expenses likely to

cause endless interpretations. Instead Govt should have

given overriding principles with the help of ICAI. (R. 5)

Applications pending when the Act becomes applicable

would need to deposit fee. This will cause unavoidable

hardships. (R. 9(5)). Cases would be rejected if persons

not aware of the same. Applications cannot be revived

for 6 months.

Banks to report receipt of FC of `1 crore or more singly or in

aggregate within 30 days for all persons, including unregistered.

(S 17(2);R 15)

Thank You.

You might also like

- RA-11032 PadillaDocument13 pagesRA-11032 PadillaMax Ellison OconNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- 1 EODB Law-BOSS CARAVANDocument16 pages1 EODB Law-BOSS CARAVANgulp_burpNo ratings yet

- PM Ra 11032 Written Report by John Carlo CapawaDocument16 pagesPM Ra 11032 Written Report by John Carlo CapawaJohn Carlo JoCapNo ratings yet

- Foreign Contribution Regulation Act - 1976: ObjectiveDocument26 pagesForeign Contribution Regulation Act - 1976: ObjectiveSachin RaikarNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- PDF 1 20190207153559208uhjc1Document4 pagesPDF 1 20190207153559208uhjc1dgpmNo ratings yet

- Fcra 2010Document18 pagesFcra 2010Chandra SeelaNo ratings yet

- RA 11032 - Group 3Document91 pagesRA 11032 - Group 3Hilo MethodNo ratings yet

- CSC Roles On EODB EGSD Act of 2018 PDFDocument43 pagesCSC Roles On EODB EGSD Act of 2018 PDFarciblue100% (1)

- Bmbe CompleteDocument61 pagesBmbe Completedarla1008No ratings yet

- Union Budget 2023 For NGOsDocument7 pagesUnion Budget 2023 For NGOsGOODS AND SERVICES TAXNo ratings yet

- Ease of Doing BusinessDocument5 pagesEase of Doing BusinessAndrew GallardoNo ratings yet

- Myanmar Financial Instiqution Law For Foreign BanksDocument2 pagesMyanmar Financial Instiqution Law For Foreign BanksYamin Kyaw (Lin Lin)No ratings yet

- Muthoot Finance NCD Application Form Dec 2011 - Jan 2012Document8 pagesMuthoot Finance NCD Application Form Dec 2011 - Jan 2012Prajna CapitalNo ratings yet

- Interim Order in The Matter of Mass Infra Realty LimitedDocument17 pagesInterim Order in The Matter of Mass Infra Realty LimitedShyam Sunder0% (1)

- EODB Presentation With MC 2019-177Document20 pagesEODB Presentation With MC 2019-177Lorjezza SiaoNo ratings yet

- Republic Act 11032 or EODBEGSDDocument9 pagesRepublic Act 11032 or EODBEGSDRandy AvilesNo ratings yet

- Procedure For Setting Up A Commercial BaDocument7 pagesProcedure For Setting Up A Commercial Bajosephm2901No ratings yet

- Presentation RA11032 Digital TransformationDocument43 pagesPresentation RA11032 Digital TransformationHalila SudagarNo ratings yet

- EODBDocument4 pagesEODBDan RadaNo ratings yet

- Checklist CSR IADocument3 pagesChecklist CSR IAdeepanshudlh1984No ratings yet

- Gopal: Income of The TrustDocument23 pagesGopal: Income of The TrustAshish ShahNo ratings yet

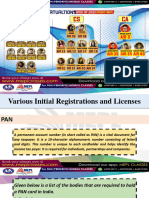

- Various Initial Registrations and LicensesDocument34 pagesVarious Initial Registrations and LicensesshrividhulaaNo ratings yet

- 2019-11-28 NITI Aayog ArbitrationDocument2 pages2019-11-28 NITI Aayog ArbitrationRaja MahilangeNo ratings yet

- Ease of Doing FinalDocument15 pagesEase of Doing FinalMark RenlyNo ratings yet

- Interim Order in The Matter of Neesa Technologies LimitedDocument14 pagesInterim Order in The Matter of Neesa Technologies LimitedShyam SunderNo ratings yet

- LNT Bond FormDocument8 pagesLNT Bond FormsunajbaniNo ratings yet

- L&T Long Term Infrastructure Bond Tranche 1 Application FormDocument8 pagesL&T Long Term Infrastructure Bond Tranche 1 Application FormPrajna CapitalNo ratings yet

- DILG Joint Circulars 20100813 JMCNo01 Seriesof2010Document21 pagesDILG Joint Circulars 20100813 JMCNo01 Seriesof2010mackoypogiNo ratings yet

- Companies Act, 2013: An Insight Into Latest AmendmentsDocument10 pagesCompanies Act, 2013: An Insight Into Latest Amendmentsvipul tutejaNo ratings yet

- Analysis of CBDT Circular On Condonation of Delay in Filing Refund Claim and Claim of Carry Forward of Losses - Taxguru - inDocument2 pagesAnalysis of CBDT Circular On Condonation of Delay in Filing Refund Claim and Claim of Carry Forward of Losses - Taxguru - inShyam Lal MandhyanNo ratings yet

- Tax Law Assignment, Brahm Sareen - 01716503820Document8 pagesTax Law Assignment, Brahm Sareen - 01716503820Brahm SareenNo ratings yet

- Interim Order in The Matter of Neesa Technologies LimitedDocument14 pagesInterim Order in The Matter of Neesa Technologies LimitedShyam SunderNo ratings yet

- One Has To Follow The Following Guidelines While Filing 1st Appeal Under Right To Information Act 2005Document44 pagesOne Has To Follow The Following Guidelines While Filing 1st Appeal Under Right To Information Act 2005Hori LalNo ratings yet

- IDFC Long Term Infrastructure Bond Tranche 2 Application Form 2012Document8 pagesIDFC Long Term Infrastructure Bond Tranche 2 Application Form 2012Prajna CapitalNo ratings yet

- Salient Features of Ra 11032: "Responsibilities of Lgus and Ngas"Document29 pagesSalient Features of Ra 11032: "Responsibilities of Lgus and Ngas"Mike MikeNo ratings yet

- An Act Promoting Ease of Doing Business and Efficient Government Service Delivery Act of 2018Document42 pagesAn Act Promoting Ease of Doing Business and Efficient Government Service Delivery Act of 2018Barangay MintalNo ratings yet

- Missive Volume IV - July 2011: Transaction AdvisorsDocument11 pagesMissive Volume IV - July 2011: Transaction AdvisorsAkhil BansalNo ratings yet

- Chapter-6: Right To Information Act, 2005Document7 pagesChapter-6: Right To Information Act, 2005Krishna GNo ratings yet

- The Law Directed Government Agencies To Create A Citizen's CharterDocument4 pagesThe Law Directed Government Agencies To Create A Citizen's Chartertikki0219No ratings yet

- Ch8. RIGHT TO INFORMATION ACT, 2005Document5 pagesCh8. RIGHT TO INFORMATION ACT, 2005sks.in109No ratings yet

- Briefer On R.A. No. 11032Document28 pagesBriefer On R.A. No. 11032RoseNo ratings yet

- Interim Order Cum Show Cause Notice in The Matter of Real Sunshine Corp LimitedDocument11 pagesInterim Order Cum Show Cause Notice in The Matter of Real Sunshine Corp LimitedShyam SunderNo ratings yet

- Ease of Doing BusinessDocument16 pagesEase of Doing BusinessNathaniel100% (1)

- Micro Finance Section 8 Company in IndiaDocument3 pagesMicro Finance Section 8 Company in Indiacogent payrollNo ratings yet

- L&T Long Term Infrastructure Bond Tranche 2 Application Form 2012Document8 pagesL&T Long Term Infrastructure Bond Tranche 2 Application Form 2012Prajna CapitalNo ratings yet

- RamgyanDocument8 pagesRamgyanRamgyan PrajapatiNo ratings yet

- Investment 2Document4 pagesInvestment 2muskaan gargNo ratings yet

- Patent Amendment Rules 2024Document5 pagesPatent Amendment Rules 2024Raghavendra SinghNo ratings yet

- Muthoot Finance NCD Application Form Mar 2012Document8 pagesMuthoot Finance NCD Application Form Mar 2012Prajna CapitalNo ratings yet

- Ease of Doing Business Act: (ARTA)Document8 pagesEase of Doing Business Act: (ARTA)Sam OneNo ratings yet

- Sarfaesi Act 2002Document4 pagesSarfaesi Act 2002Prashant ChaudharyNo ratings yet

- Secretary: Department of Trade and IndustryDocument7 pagesSecretary: Department of Trade and IndustryHalmen ValdezNo ratings yet

- Adjudication Order in Respect of in Respect of Mipco Seamless Rings (Gujarat) Ltd.Document7 pagesAdjudication Order in Respect of in Respect of Mipco Seamless Rings (Gujarat) Ltd.Shyam SunderNo ratings yet

- Regulatory Roles of Goverment of IndiaDocument27 pagesRegulatory Roles of Goverment of IndiaShivangi Misra0% (1)

- Perjanjian Kerjasama ESPAY Payment Gateway (Indo - Eng Version) With Newest ChannelDocument23 pagesPerjanjian Kerjasama ESPAY Payment Gateway (Indo - Eng Version) With Newest ChannelZaynull Abideen NoahNo ratings yet

- Kotak Mahindra Bank Gets RBI Approval To Open Its First Overseas Branch in Dubai International Financial Centre (Company Update)Document3 pagesKotak Mahindra Bank Gets RBI Approval To Open Its First Overseas Branch in Dubai International Financial Centre (Company Update)Shyam SunderNo ratings yet

- EcomDocument125 pagesEcomSriniwaas Kumar SkjNo ratings yet

- The Illuminati and The House of RothschildDocument14 pagesThe Illuminati and The House of RothschildJason Whittington100% (3)

- SMC vs. KhanDocument19 pagesSMC vs. KhanGuiller MagsumbolNo ratings yet

- Ucp 21 - Financial Accounting Unit-1 - Branch Accounts: Type: 80% Theory - 20% Problem Question & AnswersDocument59 pagesUcp 21 - Financial Accounting Unit-1 - Branch Accounts: Type: 80% Theory - 20% Problem Question & AnswersrhadityaNo ratings yet

- Recent Trends and Development of Banking System in IndiaDocument5 pagesRecent Trends and Development of Banking System in Indiavishnu priya v 149No ratings yet

- S&P CriteriaDocument57 pagesS&P CriteriaCairo AnubissNo ratings yet

- Circular No 201-2014Document22 pagesCircular No 201-2014ctnorlizaNo ratings yet

- Role of RbiDocument4 pagesRole of Rbitejas1989No ratings yet

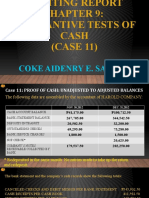

- Auditing Report CASE11Document18 pagesAuditing Report CASE11Coke Aidenry Saludo0% (1)

- Banking Sector in CambodiaDocument44 pagesBanking Sector in CambodiaChanrithy Sok100% (1)

- Jayshree Project ReportDocument86 pagesJayshree Project Reportmustkeem_qureshi7089No ratings yet

- History of Philippine Money XXDocument7 pagesHistory of Philippine Money XXBlezelle CalpitoNo ratings yet

- Digital Wallet Platform in Europe PDFDocument2 pagesDigital Wallet Platform in Europe PDFAnand KrishnaNo ratings yet

- Google Pixel Select Stores TnCsDocument96 pagesGoogle Pixel Select Stores TnCsRahul AhujaNo ratings yet

- Erste Bank Research Euro 2012Document10 pagesErste Bank Research Euro 2012Wito NadaszkiewiczNo ratings yet

- Picpa Ancon 2019Document2 pagesPicpa Ancon 2019sanglay99No ratings yet

- Ebanking History in MalaysiaDocument2 pagesEbanking History in MalaysiaNur Hanisah InaniNo ratings yet

- Internship Report PPCBL Aon PDFDocument58 pagesInternship Report PPCBL Aon PDFaon waqasNo ratings yet

- Snap Statement: Pt. Bank Rakyat Indonesia (Persero), TBKDocument1 pageSnap Statement: Pt. Bank Rakyat Indonesia (Persero), TBKners fatmaNo ratings yet

- Monetary Policy and CB Module-7Document18 pagesMonetary Policy and CB Module-7Eleine Taroma AlvarezNo ratings yet

- Base24 zOSDocument198 pagesBase24 zOSaksmsaidNo ratings yet

- How To File A 1096 and 1099 and 1099oid To Pay Utility BillsDocument10 pagesHow To File A 1096 and 1099 and 1099oid To Pay Utility BillsTitle IV-D Man with a plan99% (87)

- Fa2 Mock Test 2Document7 pagesFa2 Mock Test 2Sayed Zain ShahNo ratings yet

- Goibibo Doc 2 PDFDocument4 pagesGoibibo Doc 2 PDFAashutosh SinghalNo ratings yet

- BilledStatements 4806 16-10-22 18.18Document2 pagesBilledStatements 4806 16-10-22 18.18Harsh NawariaNo ratings yet

- Second Semester Accounting Paper 1Document8 pagesSecond Semester Accounting Paper 1egi.academicinfoNo ratings yet

- IMFDocument33 pagesIMFShaheen KhanNo ratings yet

- HSBCDocument2 pagesHSBCВлад АнгелNo ratings yet

- Son of Hamas: A Gripping Account of Terror, Betrayal, Political Intrigue, and Unthinkable ChoicesFrom EverandSon of Hamas: A Gripping Account of Terror, Betrayal, Political Intrigue, and Unthinkable ChoicesRating: 4.5 out of 5 stars4.5/5 (501)

- For Love of Country: Leave the Democrat Party BehindFrom EverandFor Love of Country: Leave the Democrat Party BehindRating: 4.5 out of 5 stars4.5/5 (3)

- An Unfinished Love Story: A Personal History of the 1960sFrom EverandAn Unfinished Love Story: A Personal History of the 1960sRating: 5 out of 5 stars5/5 (3)

- Pagan America: The Decline of Christianity and the Dark Age to ComeFrom EverandPagan America: The Decline of Christianity and the Dark Age to ComeRating: 5 out of 5 stars5/5 (2)

- The War after the War: A New History of ReconstructionFrom EverandThe War after the War: A New History of ReconstructionRating: 5 out of 5 stars5/5 (2)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Age of Revolutions: Progress and Backlash from 1600 to the PresentFrom EverandAge of Revolutions: Progress and Backlash from 1600 to the PresentRating: 4.5 out of 5 stars4.5/5 (8)

- Prisoners of Geography: Ten Maps That Explain Everything About the WorldFrom EverandPrisoners of Geography: Ten Maps That Explain Everything About the WorldRating: 4.5 out of 5 stars4.5/5 (1145)

- Thomas Jefferson: Author of AmericaFrom EverandThomas Jefferson: Author of AmericaRating: 4 out of 5 stars4/5 (107)

- Franklin & Washington: The Founding PartnershipFrom EverandFranklin & Washington: The Founding PartnershipRating: 3.5 out of 5 stars3.5/5 (14)

- How States Think: The Rationality of Foreign PolicyFrom EverandHow States Think: The Rationality of Foreign PolicyRating: 5 out of 5 stars5/5 (7)

- Broken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterFrom EverandBroken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterRating: 5 out of 5 stars5/5 (3)

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpFrom EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpRating: 4.5 out of 5 stars4.5/5 (11)

- How to Destroy America in Three Easy StepsFrom EverandHow to Destroy America in Three Easy StepsRating: 4.5 out of 5 stars4.5/5 (21)

- Heretic: Why Islam Needs a Reformation NowFrom EverandHeretic: Why Islam Needs a Reformation NowRating: 4 out of 5 stars4/5 (57)

- Compromised: Counterintelligence and the Threat of Donald J. TrumpFrom EverandCompromised: Counterintelligence and the Threat of Donald J. TrumpRating: 4 out of 5 stars4/5 (18)

- Darkest Hour: How Churchill Brought England Back from the BrinkFrom EverandDarkest Hour: How Churchill Brought England Back from the BrinkRating: 4 out of 5 stars4/5 (31)

- The Exvangelicals: Loving, Living, and Leaving the White Evangelical ChurchFrom EverandThe Exvangelicals: Loving, Living, and Leaving the White Evangelical ChurchRating: 4.5 out of 5 stars4.5/5 (13)

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteFrom EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteRating: 4.5 out of 5 stars4.5/5 (16)

- The Return of George Washington: Uniting the States, 1783–1789From EverandThe Return of George Washington: Uniting the States, 1783–1789Rating: 4 out of 5 stars4/5 (22)

- Bind, Torture, Kill: The Inside Story of BTK, the Serial Killer Next DoorFrom EverandBind, Torture, Kill: The Inside Story of BTK, the Serial Killer Next DoorRating: 3.5 out of 5 stars3.5/5 (77)

- The Franklin Scandal: A Story of Powerbrokers, Child Abuse & BetrayalFrom EverandThe Franklin Scandal: A Story of Powerbrokers, Child Abuse & BetrayalRating: 4.5 out of 5 stars4.5/5 (45)

- The Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaFrom EverandThe Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaRating: 4.5 out of 5 stars4.5/5 (12)