Professional Documents

Culture Documents

CH 17 Inventory Control - HK

Uploaded by

coxshulerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 17 Inventory Control - HK

Uploaded by

coxshulerCopyright:

Available Formats

1

Chapter 17. Inventory Control

Inventory is the stock of any item or resource used in an

organization and can include: raw materials, finished products,

component parts, supplies, and work-in-process

An inventory system is the set of policies and controls that

monitor levels of inventory and determines what levels should

be maintained, when stock should be replenished, and how large

orders should be

Firms invest 25-35 percent of assets in inventory but many do

not manage inventories well

2

Purposes of Inventory

1. To maintain independence of operations

Provide optimal amount of cushion between work centers

Ensure smooth work flow

2. To allow flexibility in production scheduling

3. To meet variation in product demand

4. To provide a safeguard for variation in raw material

or parts delivery time

Protect against supply delivery problems (strikes, weather,

natural disasters, war, etc.)

5. To take advantage of economic purchase-order size

3

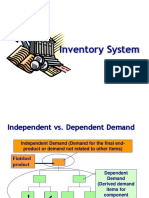

Independent vs. Dependent Demand

Inventory costs

Single-Period Model

Multi-Period Models: Basic Fixed-Order Quantity Models

Event triggered (Example: running out of stock, or dropping below

a reorder point)

EOQ, EOQ with reorder point (ROP) , and with safety stock

Multi-Period Models: Basic Fixed-Time Period Model

EOQ with Quantity Discounts

ABC analysis

Inventory Control (Management)

4

E(1

)

Independent vs. Dependent Demand

Independent Demand (Demand not related to other

items or the final end-product)

Dependent Demand

(Derived demand

items for component

parts,

subassemblies,

raw materials, etc.)

5

Inventory Costs

Holding (or carrying) costs.

Costs for capital, taxes, insurance, etc.

(Dealing with storage and handling)

Setup (or production change) costs. (manufacturing)

Costs for arranging specific equipment setups, etc.

Ordering costs (services & manufacturing)

Costs of someone placing an order, etc.

Shortage (backordering) costs.

Costs of canceling an order, customer goodwill, etc.

6

A Single-Period Model

Sometimes referred to as the newsboy problem

Is used to handle ordering of perishables (fresh seafood, cut

flowers, etc.) and items that have a limited useful life

(newspaper, magazines, high fashion goods, some high tech

components, etc)

The optimal stocking level uses marginal analysis is where the

expected profit (benefit from derived from carrying the next

unit) is less than the expected cost of that unit (minus salvage

value)

C

o

= Cost/unit of overestimated demand (excess demand)

C

o

= Cost per unit salvage value per unit

C

u

= Cost/unit of underestimated demand

C

u

= Price/unit cost/unit + cost of loss of goodwill per unit

Optimal order level is where P <= C

u

/(C

o

+ C

u

)

This model states that we should continue to increase the size of the

inventory so long as the probability of selling the last unit added is

equal to or greater than the ratio of: C

u

/C

o

+C

u

7

Single Period Model Example

UNC Charlotte basketball team is playing in a

tournament game this weekend. Based on our past

experience we sell on average 2,400 shirts with a

standard deviation of 350. We make $10 on every

shirt we sell at the game, but lose $5 on every shirt

not sold. How many shirts should we make for the

game?

1. Determine C

u

= $10 and C

o

= $5 (this time, these were directly given)

2. Compute P $10 / ($10 + $5) = 0.667 66.7%

3. Order up to ~ 66.7% of the demand

4. How do you determine it?

5. Normal distribution, Z transformation,

6. Z

0.667

= 0.432 (use NORMSDIST(.667) or Appendix E)

7. Therefore we need 2,400 +0.432(350) = 2,551 shirts

8

Single Period Model, Marginal Analysis

Marginal analysis approach.

Consider solved problem 1, p. 617

1. Determine C

u

= 100-70 = $30 and C

o

= 70-20 = $50

2. Compute P 30/(30+50) 0.375

3. Develop a full marginal analysis table (Excel time!)

4. Assume we purchase 35 units, compute the expected total cost

5. Repeat step 4, for 36,, 40

The optimal order (purchase) size is the no. of units with the minimum expected

total cost

9

Fixed-Order Quantity Models: Assumptions

Demand for the product is constant and uniform throughout the

period.

Inventory holding cost is based on average inventory.

Ordering or setup costs are constant.

All demands for the product will be satisfied. (No back orders

are allowed.)

Lead time (time from ordering to receipt) is constant (later, this

assumption is relaxed with safety stocks).

Price per unit of product is constant.

10

Basic Fixed-Order Quantity Model and Reorder

Point Behavior

R = Reorder point

Q = Economic order quantity

L = Lead time

L

L

Q Q Q

R

Time

Number

of units

on hand

1. You receive an order quantity Q.

2. Your start using

them up over time.

3. When you reach down to

a level of inventory of R,

you place your next Q

sized order.

4. The cycle then repeats.

17-10

11

Cost Minimization Goal

Ordering Costs

Holding

Costs

Q

OPTIMAL

Order Quantity (Q)

C

O

S

T

Annual Cost of

Items (DC)

Total Cost

By adding the item, holding, and ordering costs together, we

determine the total cost curve, which in turn is used to find the

Q

optimal

(a.k.a. EOQ) inventory order point that minimizes total

costs.

12

Basic Fixed-Order Quantity (EOQ) Model

Annual

Holding

Cost

Total Annual Cost =

Annual

Purchase

Cost

Annual

Ordering

Cost

+ +

S

Q

D

H

Q

DC TC

2

A little bit of calculus

H

DS

EOQ

2

L d = ROP

_

A little bit of common sense

L

z L d = ROP

_

ROP with safety stock

TC = Total annual cost

D = Demand

C = Cost per unit

Q = Order quantity

S = Cost of placing an order or setup cost

H = Annual holding and storage cost per unit

of inventory

R or ROP = Reorder point

L = Lead time (constant)

= average (daily, weekly, etc) demand

L

= Standard deviation of demand during lead time

_

d

13

Basic EOQ & ROP Example

Annual Demand = 1,000 units

Days per year considered in average daily demand = 365

Cost to place an order = $10

Holding cost per unit per year = $2.50

Lead time = 7 days

Cost per unit = $15

Given the information below, what are the EOQ, reorder point, and

total annual cost?

EOQ 89.44 89 or 90 units

ROP 2.74*7 19.18 19 or 20 units

14

Another example

Days per year considered in average daily demand = 360

Average daily demand is 3.5 units

Standard deviation of daily demand is 0.95 units

Cost to place an order = $50

Holding cost per unit per year = $7.25

Lead time = 4 days

Compute the EOQ, and ROP is the firm wants to

maintain a 97% service level (probability of not stocking out)

2

d

1

2

constant, is and t independen is day each Since

d L

L

i

d L

L

i

L

z L d = ROP

_

15

Fixed-Time Period Model with Safety Stock

order) on items (includes level inventory current = I

time lead and review over the demand of deviation standard =

y probabilit service specified a for deviations standard of number the = z

demand daily average forecast = d

days in time lead = L

reviews between days of number the = T

ordered be to quantitiy = q

: Where

I - Z + L) + (T d = q

L + T

L + T

q = Average demand + Safety stock Inventory currently on hand

2

d L + T

d

L + T

1 i

2

d L + T

L) + (T =

constant, is and t independen is day each Since

=

i

16

Example of the Fixed-Time Period Model

Average daily demand for a product is 20 units.

The review period is 30 days, and lead time is 10 days.

Management has set a policy of satisfying 96 percent of

demand from items in stock. At the beginning of the

review period there are 200 units in inventory. The daily

demand standard deviation is 4 units.

Given the information below, how many units should be ordered?

25.298 = 4 10 + 30 = L) + (T =

2 2

d L + T

q = 20(30+10) + 1.75(25.30) 200 644.27 units

17

A special purpose model

Price-Break Model (Quantity discounts)

Based on the same assumptions as the EOQ model, the price-

break model has a similar EOQ (Q

opt

) formula:

Annual holding cost, H, is calculated using H = iC where

i = percentage of unit cost attributed to carrying inventory

C = cost per unit

Since C changes for each price-break, the formula above

must be applied to each price-break cost value.

Determine the total cost for each price break

The lowest total cost suggests the optimal order size (EOQ)

Cost Holding Annual

Cost) Setup or der Demand)(Or 2(Annual

=

iC

2DS

= Q

OPT

18

Price-Break Example

A company has a chance to reduce their inventory ordering costs by

placing larger quantity orders using the price-break order quantity

schedule below. What should their optimal order quantity be if this

company purchases this single inventory item with an e-mail ordering

cost of $4, a carrying cost rate of 2% of the inventory cost of the item,

and an annual demand of 10,000 units?

Order Quantity(units) Price/unit($)

0 to 2,499 $1.20

2,500 to 3,999 $1.00

4,000 or more $0.98

Re-do the example with an order cost of $25 and an inventory carrying cost rate of 45%.

19

0 1826 2500 4000 Order Quantity

20

ABC Classification System

Items kept in inventory are not of equal importance in terms of:

dollars invested

profit potential

sales or usage volume

stock-out penalties

So, identify inventory items based on percentage of total dollar value,

where A items are roughly top 15 %, B items as next 35 %, and the

lower 65% are the C items

0

30

60

30

60

A

B

C

% of

$ Value

% of

Use

21

Inventory Accuracy and Cycle Counting

Inventory accuracy refers to how well the inventory

records agree with physical count

Lock the storeroom

Hire the right personnel for as storeroom manager or

employees

Cycle Counting is a physical inventory-taking technique in

which inventory is counted on a frequent basis rather than

1-2 times a year

Easier to conduct when inventories are low

Randomly (minimize predictability)

Pay more attention to A items, then B, etc.

Suggested problems: 3, 6, 12, 14, 17, 18, 21, 24

Case: Hewlett-Packard

You might also like

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- CH 15 Inventory ManagementDocument21 pagesCH 15 Inventory ManagementAshwin MishraNo ratings yet

- Chap015 Inventory ControlDocument43 pagesChap015 Inventory ControlKhushbu ChandnaniNo ratings yet

- Chap 015Document43 pagesChap 015Ponkiya AnkitNo ratings yet

- Notes On Inventory Management & ControlDocument8 pagesNotes On Inventory Management & ControlKaniz FatimaNo ratings yet

- Inventory Control: Operations ManagementDocument43 pagesInventory Control: Operations ManagementRahul KhannaNo ratings yet

- Inventory ControlDocument26 pagesInventory ControlhajarawNo ratings yet

- Understanding Inventory Management ConceptsDocument8 pagesUnderstanding Inventory Management ConceptsNirav PatelNo ratings yet

- Inventory Management - Lecture 15.04.2015Document56 pagesInventory Management - Lecture 15.04.2015Asia Oleśków SzłapkaNo ratings yet

- Traditional Inventory Models For Independent Demand: Lecture By: DrarsinghDocument37 pagesTraditional Inventory Models For Independent Demand: Lecture By: DrarsinghGADHANo ratings yet

- Lesson 122014 ShortDocument20 pagesLesson 122014 ShortAbel PachecoNo ratings yet

- Invtemp 140909235749 Phpapp01Document92 pagesInvtemp 140909235749 Phpapp01Amit VermaNo ratings yet

- Inventory Management: Bus Adm 370 - CHP 12 Inventory MGMTDocument7 pagesInventory Management: Bus Adm 370 - CHP 12 Inventory MGMTSidharth GoyalNo ratings yet

- Ch08 - InventoryDocument111 pagesCh08 - InventoryelakkiyaNo ratings yet

- Lecture OutlineDocument55 pagesLecture OutlineShweta ChaudharyNo ratings yet

- 8 Inventory SystemsDocument48 pages8 Inventory SystemsAngeline Nicole RegaladoNo ratings yet

- 8 Inventory SystemDocument48 pages8 Inventory SystemPollyNo ratings yet

- InventoryDocument38 pagesInventoryNamita DeyNo ratings yet

- INVENTORY MANAGEMENT GUIDEDocument7 pagesINVENTORY MANAGEMENT GUIDEkunjanNo ratings yet

- InventoryDocument46 pagesInventorySoumitra ChakrabortyNo ratings yet

- Managing Service Inventory: Replenishment Order Replenishment Order Replenishment Order Customer OrderDocument38 pagesManaging Service Inventory: Replenishment Order Replenishment Order Replenishment Order Customer OrderNitesh RanjanNo ratings yet

- Pom Ii: Independent Demand InventoryDocument44 pagesPom Ii: Independent Demand InventoryAshokNo ratings yet

- The Basic Economic Order Quantity ModelDocument13 pagesThe Basic Economic Order Quantity ModelRichardson HolderNo ratings yet

- Unit-3 (Industrial Management)Document48 pagesUnit-3 (Industrial Management)Ankur Agrawal0% (1)

- Lecturing 5 Eoq and RopDocument8 pagesLecturing 5 Eoq and RopJohn StephensNo ratings yet

- IE305 CH 4 Inventory and Economic Order QuantityDocument52 pagesIE305 CH 4 Inventory and Economic Order Quantitymuhendis_8900100% (1)

- ch05 PPTDocument23 pagesch05 PPThusnainttsNo ratings yet

- Inventory ControlDocument30 pagesInventory Controlchintu_thakkar9No ratings yet

- Material de Inventarios1Document13 pagesMaterial de Inventarios1wam30959No ratings yet

- Cycle InventoryDocument13 pagesCycle InventoryUmang ZehenNo ratings yet

- Inventory ControlDocument17 pagesInventory ControlL'ingénieur Mohamed AlsaghierNo ratings yet

- Inventory Management: Presented By: Apple MagpantayDocument31 pagesInventory Management: Presented By: Apple MagpantayRuth Ann DimalaluanNo ratings yet

- MSE - UNIT - 3 (1) .PPTMDocument23 pagesMSE - UNIT - 3 (1) .PPTMJoel ChittiproluNo ratings yet

- Supply Chain Inventory ManagementDocument36 pagesSupply Chain Inventory ManagementPreeti AroraNo ratings yet

- Ch08 - InventoryDocument111 pagesCh08 - InventoryjosephdevaraajNo ratings yet

- Dr. Abe Feinberg's Inventory NotesDocument5 pagesDr. Abe Feinberg's Inventory NotesBeautyfull Naina MehtaNo ratings yet

- Chap.4 - Inventory Management Edited PDFDocument60 pagesChap.4 - Inventory Management Edited PDFadmasuNo ratings yet

- Inven MNGTDocument32 pagesInven MNGTMahal KitaNo ratings yet

- InventoryDocument36 pagesInventorynidhi_friend1020032748No ratings yet

- Gestión de compras y proveedores: análisis ABC, EOQ y Lote ÓptimoDocument49 pagesGestión de compras y proveedores: análisis ABC, EOQ y Lote ÓptimoJavier Holgado RiveraNo ratings yet

- Inventory ManagementDocument47 pagesInventory ManagementDhivaakar KrishnanNo ratings yet

- Optimize Inventory Management with EOQ ModelDocument68 pagesOptimize Inventory Management with EOQ ModelSubhronil BoseNo ratings yet

- Inventory ControlDocument36 pagesInventory ControlAnkur YashNo ratings yet

- Inventory Planning: Nazmun NaharDocument29 pagesInventory Planning: Nazmun NaharKamrulHassanNo ratings yet

- Manage inventory with EOQ and order pointsDocument32 pagesManage inventory with EOQ and order pointsdukegcNo ratings yet

- Independent Demand Inventory Management: by 2 Edition © Wiley 2005 Powerpoint Presentation by R.B. Clough - UnhDocument38 pagesIndependent Demand Inventory Management: by 2 Edition © Wiley 2005 Powerpoint Presentation by R.B. Clough - Unhnaveed_nawabNo ratings yet

- Chapter 14 Inventory Management TechniquesDocument36 pagesChapter 14 Inventory Management TechniquesKhurramSadiqNo ratings yet

- Economic Order QuantityDocument7 pagesEconomic Order QuantityShuvro RahmanNo ratings yet

- INVENTORY PLANNINGDocument7 pagesINVENTORY PLANNINGandov9No ratings yet

- Distribution Inventory Systems: Dr. Everette S. Gardner, JRDocument46 pagesDistribution Inventory Systems: Dr. Everette S. Gardner, JRahmedmaeNo ratings yet

- ConsolidationsDocument6 pagesConsolidationsEvarist Lema MemberNo ratings yet

- IM 322 Inventory Management: Chapter 3 Economic Order Quantity Model (EOQ)Document24 pagesIM 322 Inventory Management: Chapter 3 Economic Order Quantity Model (EOQ)es_sajiNo ratings yet

- Materials Management EssentialsDocument46 pagesMaterials Management Essentialstemesgen yohannesNo ratings yet

- Constant and Time Varying Demand EOQ ModelsDocument49 pagesConstant and Time Varying Demand EOQ ModelsminhduyNo ratings yet

- Economic Order QuantityDocument18 pagesEconomic Order Quantitytgm21031983No ratings yet

- 306 CH 12Document38 pages306 CH 12Mahendra ThengNo ratings yet

- Operations ManagementDocument80 pagesOperations ManagementgopalsakalaNo ratings yet

- SCM Inventory Part - IIDocument75 pagesSCM Inventory Part - IIKushal Kapoor100% (1)

- Extension of TimeDocument1 pageExtension of TimeHassan SalamaNo ratings yet

- Sample-B O QDocument39 pagesSample-B O QKeyur Gajjar50% (2)

- B02-Prepare Cost EstimateDocument128 pagesB02-Prepare Cost Estimateyo5208100% (1)

- Overtime (Ot) Claim Form: Employee Name: Work Area/Department: Month/YearDocument1 pageOvertime (Ot) Claim Form: Employee Name: Work Area/Department: Month/YearHassan SalamaNo ratings yet

- Overtime Claim Form: Mon Tues Weds Thurs Fri Sat SunDocument2 pagesOvertime Claim Form: Mon Tues Weds Thurs Fri Sat SunHassan SalamaNo ratings yet

- (Company Name) Project Parameters Company Confidential: (Date)Document7 pages(Company Name) Project Parameters Company Confidential: (Date)Hassan SalamaNo ratings yet

- Sample Cost Estimate Worksheets TemplateDocument5 pagesSample Cost Estimate Worksheets TemplateSiddhiraj AgarwalNo ratings yet

- Vocabulary ArabicDocument48 pagesVocabulary ArabicAbdo ChamméNo ratings yet

- Project Scheduling: Construction ManagementDocument28 pagesProject Scheduling: Construction ManagementHassan SalamaNo ratings yet

- F2 Chapter 18Document0 pagesF2 Chapter 18Swaita SahaNo ratings yet

- Project Time ManagementDocument13 pagesProject Time ManagementHassan SalamaNo ratings yet

- Time ReductionDocument19 pagesTime ReductionHassan SalamaNo ratings yet

- Project PlanningDocument30 pagesProject PlanningHassan SalamaNo ratings yet

- The Concept of Risk - An IntroductionDocument14 pagesThe Concept of Risk - An IntroductionHassan SalamaNo ratings yet

- IntroDocument3 pagesIntroHassan SalamaNo ratings yet

- Time ManagementDocument16 pagesTime ManagementSaud Khan WazirNo ratings yet

- Time ManagementDocument16 pagesTime ManagementSaud Khan WazirNo ratings yet