Professional Documents

Culture Documents

IFM

Uploaded by

Anil BambuleCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IFM

Uploaded by

Anil BambuleCopyright:

Available Formats

International Monetary System (IMS)

International Trade

Concept

Developed Countries

Developing Countries requirement of funds

Problems in International Trade

Liquidity

Adjustment

Stability

Balance of Payments

Indias BoP Position in 1991

The productivity and efficiency of public sector banks had suffered,

portfolio deteriorated and profitability eroded by 1990 to very low

levels. Customer service was on the lowest ebb and technology

outmoded. Many banks were running at loss or on very low profits.

The entire macro financial system was under severe stress. Indian

Bonds had been rated junk. International credit ratings of the country

were downgraded and as a result, access to external borrowings was

denied. Confidence of International Financial Community had

eroded. The instance of India pledging gold with the Bank of

England and the Bank of France in 1991 for a short-term loan of $

405 million was a testimony of Indias weak Balance of Payments

position and also of the lack of confidence of the international

financial community. There was therefore, no other option for India,

but to act swift to restore and improve upon its economic position and

to redress the imbalances. Various reformatory measures were

therefore, undertaken in the fields of foreign trade, tax system,

industrial policy, financial and other sectors.

Spectacular Improvement in BoP by 2005

With a spectacular come back, India witnessed a

GDP growth rate of 8.5 percent in 2003-04 as

against global GDP growth rate of 5.1 percent,

favourable sentiment in international financial

markets, upgradation of the sovereign rating by

Standard and Poors Rating Services in 2004-05

and recorded the fifth largest accumulated stock

on international reserves in the world (sufficient

to finance about 14 months of imports) by

March, 2005 at $ 141.5 billion, a total reversal of

the sorry state of affairs of the economy in 1991.

Typical BOP Statement

A. Current Accounts

Goods Account

Exports (+)

Imports ()

Balance on Goods Account = A(I)

Services Account

Receipts as interest and dividends, tourism receipts for travel and financial

charges (+) Payments as interest and dividends , tourism payments for

travel and financial charges ()

Balance on Services Account = A(II)

Unilateral Transfers

Gifts, donations, subsidies received from foreigners (+)

Gifts, donations, subsidies made to foreigners ()

Balance on Unilateral Transfers Account = A(III)

Current Account Balance: A(I) + A(II) + A(III)

B. Long-term Capital Account

Foreign Direct Investment (FDI)

Direct investment by foreigners (+)

Direct investment abroad ()

Balance on Direct Foreign Investment = B(I)

Portfolio Investment

Foreigner's investment in the securities of the country (+)

Investment in securities abroad ()

Balance on Portfolio Investment = B(II)

Balance on Long-term Capital Account = B(I) + B(II)

Private Short-term Capital Flows

Foreigners' claim on the country (+)

Short-term claim on foreigners ()

Balance on Short-term Private Capital Account = B(II)

Overall Balance: [A(I) + A(II) + A(III) +[B(I) + B(II) + B(III)

C. Official Reserves Account

Decrease or increase in foreign exchange reserves.

Problem

You are required to find out the overall balance, showing clearly

all the sub-balances from the following data:

1) UC Corporation of the USA invests in India Rs 3,00,000 to modernize its

Indian subsidiary.

2) A tourist from Egypt buys souvenirs worth Rs 3,000 to carry with him.

He also pays hotel and travel bills of Rs 5,000 to Delhi Tourist Agency.

3) The Indian subsidiary of UC Corporation remits, as usual, Rs 5,000 as

dividends to its parent company in the USA.

4) This Indian subsidiary of UC Corporation sells a part of its production in

other Asian countries for Rs 1,00,000.

5) The Indian subsidiary borrows a sum of Rs 2,00,000 (to be paid back in a

year's time) from the German money market to resolve its urgent liquidity

problem.

6) An Indian company buys a machine for Rs 1,00,000 from Japan and 60 per

cent payment is made immediately; the remaining amount is to be paid

after 3 years.

7) An Indian subsidiary of a French Company borrows Rs 50,000 from the

Indian public to invest in its modernization programme.

International Monetary System (IMS) - Evolution

- Gold Standard 1876

- The System of Bretton Woods (1944-71)

- International Monetary Fund

- International Bank for Reconstruction and Development

IBRD (The World Bank)

- Gold Exchange Standard.

- IMS since 1971

- Fixed Exchange Rates

- An Eclectic Currency Arrangement The Birth of the Euro

The Design of the Gold Exchange System

(1934)

Foreign Exchange Markets

Concepts

Foreign Exchange Market

Requirement of foreign currency

Equilibrium and Disequilibrium in FEM

Balancing of Disequilibrium

Participants in FEM

Quotation in FEM (as on 21

st

Nov. 2012)

Direct ` 55.10 =US$ 1(in India)

US $1.59 = 1(in US)

Indirect $ 1 = 0.6289

` 1 =$ 0.018

` 1 = 0.011

Two Way Quote

Buying (Bid price) and Selling (Ask price)

$1 = ` 55.10 ` 56.25

Spread = Ask price - Bid price

Percent spread =

100

price ask

price bid price ask

Cross Currency Rates

Is the direct relationship between two non-home

currencies in a foreign exchange market.

Ex: US $1.59 = 1(in US)

conversion to Indian Currency

$ 1 = ` 55.10

1 = ` 55.10 x 1.59 = ` 87.60

OR ` 55.10x 1.59 = 1

` 1 = 1 / 87.6= 0.01141

Settlements

Business Day is a day on which both banks are open for

business / settlement.

Contract Date Date of agreed deal over telephone.

Premium and Discount on a Currency.

Cash Rate or Ready Rate Exchange of currencies on the

date of the deal - Telegraphic transfer or cash or value-day

deal.

Tom Rate Exchange of currencies on next working day

(also called Tomorrow Rate).

Spot Rate(SR) Exchange of currencies on second

working day

Forward Rate(FR) Exchange of currencies after a certain

period from the date of the deal (more than two days).

Calculation of Spread

(as on 21-11-2012)

Cross

Currency

Spot 1 month 3 months 6 -months

` / $ 55.10 / 25 36 / 49 92 / 56.04 56.67 / 79

Calculation of Premium or Discount

Premium or discount of a currency in the forward

market on the spot rate (SR) is calculated as follows:

Premium or Discount (Per Cent)

= [FR SR) / SR] x (12/n)x 100*

Where n is the number of months forward

If FR > SR, it implies premium

< SR, it signals discount

Arbitrage in Case of Forward Market

(or Covered Interest Arbitrage)

If the Interest rate differential is

greater than the premium or

discount, place the money in the

currency that has higher rate of

interest or vice-versa.

Illustrative Problem

Spot Rate : `. 55.10 = $ 1

6 month forward rate: Rs. `.56.67 = $ 1

Annualised interest rate on 6 month rupee : 6%

Annualised interest rate on 6 month dollar : 3%

Calculate the arbitrage possibilities

Steps for Calculation of Arbitrage Possibility

1. Calculate the annualised discount / premium

2. Calculate the interest rate differential

3. Compare 1 and 2

4. Apply the following formula

If the Interest rate differential is greater than the premium or discount,

place the money in the currency that has higher rate of interest or vice-

versa.

5. Borrow Currency A (at interest) for a required period.

6. Convert Currency A to Currency B at spot rate.

7. Place Currency B in the money market for the required the period.

8. Enter into a forward contract.

9. Sell Currency B with interest for the specified period in the forward

market.

10. Convert the proceeds of B in to currency A.

11. Repay the Debt taken at 5 above with interest.

12. Calculate the gain.

American Depositary Receipts

Fluctuation in Exchange Rates

Rate of

inflation in

the

country A

higher

than that

in the

country B

Imports of

the

country A

increase

while its

exports

decrease

Trade

balance of

the

country A

tends to be

in deficit

Currency

of the

country A

tends to

depreciate

INTERNATIONAL CASH MANAGEMENT

Teltrexs Interaffiliate Cash Receipts and Disbursements Matrix ($000)

a

Net denotes the difference between total receipts and total disbursements for each affiliate

Teltrexs Interaffiliate Foreign Exchange Transactions without Netting ($000)

Bilateral Netting of Teltrexs Interaffiliate

Foreign Exchange Transactions ($000)

Multilateral Netting of Teltrexs Interaffiliate

Foreign Exchange Transactions ($000)

Flow of Teltrex's Net Cash Receipts from Transactions

with External Parties with a Centralized Depository ($000)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Claim Age Pension FormDocument25 pagesClaim Age Pension FormMark LordNo ratings yet

- STFC Ar 13 14Document215 pagesSTFC Ar 13 14Anil BambuleNo ratings yet

- Basel II Pillar 3 Disclosure Q3 2012Document3 pagesBasel II Pillar 3 Disclosure Q3 2012Anil BambuleNo ratings yet

- A Report On Fundamentals of Economic Value AddedDocument39 pagesA Report On Fundamentals of Economic Value AddedKishan TankNo ratings yet

- Single Investment ULIP For HNI SHNIDocument1 pageSingle Investment ULIP For HNI SHNIAnil BambuleNo ratings yet

- Magic of EquityDocument6 pagesMagic of EquityNitin Govind BhujbalNo ratings yet

- Mutual Fund Distribution ModelDocument387 pagesMutual Fund Distribution ModelAnil BambuleNo ratings yet

- Nissanrenaultmerger 12724042133265 Phpapp02Document17 pagesNissanrenaultmerger 12724042133265 Phpapp02Anil BambuleNo ratings yet

- CD-37-Budget and Budgetary ControlDocument89 pagesCD-37-Budget and Budgetary ControlAnil BambuleNo ratings yet

- ICRA's Credit Rating Methodology For Non-Banking Finance CompaniesDocument6 pagesICRA's Credit Rating Methodology For Non-Banking Finance CompaniesAnil BambuleNo ratings yet

- Investment Analysis and Portfolio ManagementDocument102 pagesInvestment Analysis and Portfolio ManagementPankaj Bhasin88% (8)

- NCFM BsmeDocument96 pagesNCFM BsmeAstha Shiv100% (1)

- Credit Risk ManagementDocument64 pagesCredit Risk Managementcherry_nu100% (12)

- Credit Management & Appraisal SystemDocument60 pagesCredit Management & Appraisal SystemAnil BambuleNo ratings yet

- Shriram Transport Finance Company LTD, MeghanDocument26 pagesShriram Transport Finance Company LTD, MeghanAnil Bambule100% (1)

- BusinessLaw 2012Document170 pagesBusinessLaw 2012rommel_007100% (1)

- DNB - co.in-BFSI Sector in IndiaDocument9 pagesDNB - co.in-BFSI Sector in IndiaAnil BambuleNo ratings yet

- Ethics in Business: Insider Trading CaseDocument4 pagesEthics in Business: Insider Trading CaseAnil BambuleNo ratings yet

- Log in ActionDocument85 pagesLog in ActionAnil BambuleNo ratings yet

- Triangular ArbitrageDocument5 pagesTriangular ArbitrageAnil BambuleNo ratings yet

- Foreign Exchange Risks ExplainedDocument24 pagesForeign Exchange Risks ExplainedWisDomRaazNo ratings yet

- Investment Management Is The Professional Management of Various SecuritiesDocument7 pagesInvestment Management Is The Professional Management of Various SecuritiesAnil BambuleNo ratings yet

- Ccra Level 1 ContentsDocument6 pagesCcra Level 1 ContentsAnil BambuleNo ratings yet

- Corporate Social ResponsibilityDocument115 pagesCorporate Social ResponsibilityAkshat KaulNo ratings yet

- ICRA's Credit Rating Methodology For Non-Banking Finance CompaniesDocument6 pagesICRA's Credit Rating Methodology For Non-Banking Finance CompaniesAnil BambuleNo ratings yet

- BY: Anil M Bambule MBA1201003 Anildvhimsr3@gmail - Co.inDocument9 pagesBY: Anil M Bambule MBA1201003 Anildvhimsr3@gmail - Co.inAnil BambuleNo ratings yet

- India Yamaha Motor Pvt. LTD: Presented byDocument10 pagesIndia Yamaha Motor Pvt. LTD: Presented byAnil BambuleNo ratings yet

- Investment Analysis and Portfolio ManagementDocument102 pagesInvestment Analysis and Portfolio ManagementPankaj Bhasin88% (8)

- CaptilDocument183 pagesCaptilAnil BambuleNo ratings yet

- NCFM BsmeDocument96 pagesNCFM BsmeAstha Shiv100% (1)

- 201183-B-00-20 Part ListDocument19 pages201183-B-00-20 Part ListMohamed IsmailNo ratings yet

- New VLSIDocument2 pagesNew VLSIRanjit KumarNo ratings yet

- Median FilteringDocument30 pagesMedian FilteringK.R.RaguramNo ratings yet

- South West Mining LTD - Combined CFO & HWA - VerDocument8 pagesSouth West Mining LTD - Combined CFO & HWA - Verapi-3809359No ratings yet

- Application Letters To Apply For A Job - OdtDocument2 pagesApplication Letters To Apply For A Job - OdtRita NourNo ratings yet

- Evaluation of Performance of Container Terminals T PDFDocument10 pagesEvaluation of Performance of Container Terminals T PDFjohnNo ratings yet

- Pavement Design - (Rigid Flexible) DPWHDocument25 pagesPavement Design - (Rigid Flexible) DPWHrekcah ehtNo ratings yet

- Hood Design Using NX Cad: HOOD: The Hood Is The Cover of The Engine in The Vehicles With An Engine at Its FrontDocument3 pagesHood Design Using NX Cad: HOOD: The Hood Is The Cover of The Engine in The Vehicles With An Engine at Its FrontHari TejNo ratings yet

- VKC Group of Companies Industry ProfileDocument5 pagesVKC Group of Companies Industry ProfilePavithraPramodNo ratings yet

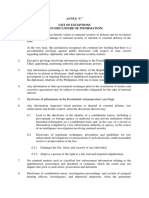

- ANNEX C LIST OF EXCEPTIONS (Non-Disslosure of Information)Document3 pagesANNEX C LIST OF EXCEPTIONS (Non-Disslosure of Information)ryujinxxcastorNo ratings yet

- Ex 6 Duo - 2021 Open-Macroeconomics Basic Concepts: Part 1: Multple ChoicesDocument6 pagesEx 6 Duo - 2021 Open-Macroeconomics Basic Concepts: Part 1: Multple ChoicesTuyền Lý Thị LamNo ratings yet

- WS-250 4BB 60 Cells 40mm DatasheetDocument2 pagesWS-250 4BB 60 Cells 40mm DatasheetTejash NaikNo ratings yet

- Aircraft MaintenanceDocument32 pagesAircraft MaintenanceTateNo ratings yet

- Guide To Networking Essentials Fifth Edition: Making Networks WorkDocument33 pagesGuide To Networking Essentials Fifth Edition: Making Networks WorkKhamis SeifNo ratings yet

- Dorks List For Sql2019 PDFDocument50 pagesDorks List For Sql2019 PDFVittorio De RosaNo ratings yet

- Important Terms in ObliconDocument4 pagesImportant Terms in ObliconAriana Cristelle L. Pagdanganan100% (1)

- 25 - Marketing Channels - Value Networks.Document2 pages25 - Marketing Channels - Value Networks.zakavision100% (1)

- Mittal Corp LTD 22ND November 2022Document4 pagesMittal Corp LTD 22ND November 2022Etrans 9No ratings yet

- CIVREV!!!!Document5 pagesCIVREV!!!!aypod100% (1)

- AW-NB037H-SPEC - Pegatron Lucid V1.3 - BT3.0+HS Control Pin Separated - PIN5 - Pin20Document8 pagesAW-NB037H-SPEC - Pegatron Lucid V1.3 - BT3.0+HS Control Pin Separated - PIN5 - Pin20eldi_yeNo ratings yet

- Kudla Vs PolandDocument4 pagesKudla Vs PolandTony TopacioNo ratings yet

- Sample Pilots ChecklistDocument2 pagesSample Pilots ChecklistKin kei MannNo ratings yet

- Course Syllabus: Ecommerce & Internet MarketingDocument23 pagesCourse Syllabus: Ecommerce & Internet MarketingMady RamosNo ratings yet

- Southport Minerals CombinedDocument20 pagesSouthport Minerals CombinedEshesh GuptaNo ratings yet

- 7MWTW1710YM0Document8 pages7MWTW1710YM0Izack-Dy JimZitNo ratings yet

- Siemens C321 Smart LockDocument2 pagesSiemens C321 Smart LockBapharosNo ratings yet

- OMS - Kangaroo Mother CareDocument54 pagesOMS - Kangaroo Mother CareocrissNo ratings yet

- Digest of Ganila Vs CADocument1 pageDigest of Ganila Vs CAJohn Lester LantinNo ratings yet

- PRI SSC TutorialDocument44 pagesPRI SSC TutorialSantosh NarayanNo ratings yet