Professional Documents

Culture Documents

Transfer Pricing

Uploaded by

Shaheen Mahmud0 ratings0% found this document useful (0 votes)

57 views17 pagesTransfer Pricing

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTransfer Pricing

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

57 views17 pagesTransfer Pricing

Uploaded by

Shaheen MahmudTransfer Pricing

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 17

Presented by:

Md. Nazmul Islam, ACMA

Assistant Professor

Department of Accounting & Information

Systems

Faculty of Business Studies

Jagannath University, Dhaka, Bangladesh.

Chapter

Transfer Pricing

Transfer Pricing

L.O. 1 Explain the basic issues associated with transfer pricing.

Transfer price:

The value assigned to the goods or services sold or rented

(transferred) from one unit of an organization to another.

Treatment is the same as a sale to an outside customer.

Revenue to the selling unit

Cost to the buying unit

15 - 2

The Setting

L.O. 2 Explain the general transfer pricing rules and

understand the underlying basis for them.

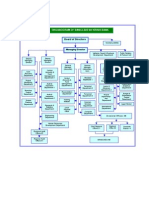

Padre Papers

Wood Division Paper Division

Trees Paper

Wood for

making paper

15 - 3

The Setting

LO2

Padre Papers

Cost and Production Data

Average units produced

Average units sold

Variable manufacturing cost per unit

Variable finishing cost per unit

Fixed divisional cost (unavoidable)

100,000

$ 20

$2,000,000

100,000

$ 30

$4,000,000

Wood Paper

15 - 4

The Setting

LO2

Wood Division

(selling division)

Variable cost = $20

Fixed cost = $2,000,000

Paper Division

(buying division)

Variable wood cost = ?

Variable finishing cost = $30

Fixed cost = $4,000,000

Wood

Transfer

price

Market for paper

(final market

Price = ?

Market for wood

(intermediate market

Price = ?

Padre Papers Resources Flow

15 - 5

Padre Papers Example

LO2

Assume the following data for the wood division:

Capacity in units

Selling price to outside

Variable price per unit

Fixed price per unit (based on capacity)

100,000

$ 60

$ 20

$ 20

15 - 6

Padre Papers Example

LO2

The Paper Division is currently purchasing 100,000

units from an outside supplier for $50, but would

like to purchase units from the Wood Division.

15 - 7

Padre Papers Example

LO2

Transfer

price

Variable

cost (VC)

Lost contribution

margin (CM)

= +

If the Wood Division

has idle capacity:

Transfer

price

$20 $0 = +

If the Wood Division

is working at capacity:

Transfer

price

$20 $40 = +

15 - 8

Optimal Transfer Price

LO2

There is no intermediate market.

In this case, the only outlet for the Wood Division

is the Paper Division and the only source of

supply for the Paper Division is the Wood Division.

The optimal transfer price is the outlay cost for

producing the goods (generally the variable costs).

15 - 9

Perfect Intermediate

Marked-Quality Differences

LO2

Variable manufacturing cost (Wood Division) per unit

Variable finishing cost (Paper Division) per unit

Other data:

Final market (paper) price

Intermediate market (grade A wood) price

Intermediate market (grade B wood) price

$ 20

$ 30

$120

$ 60

$ 50

15 - 10

Quality Difference Example

LO2

Sales:

$ 50 100,000 (transfer)

$120 100,000 (transfer)

Variable costs:

$ 20 100,000

$ 50 100,000 (transfer)

$ 30 100,000 (processing)

Fixed costs

Operating profit

Total company operating profit

$5,000,000

$2,000,000

$2,000,000

$1,000,000

$12,000,000

$ 5,000,000

3,000,000

4,000,000

$ -0-

Wood Paper

$1,000,000

Grade B wood: $50 internal transfer price

15 - 11

Quality Difference Example

LO2

Sales:

$ 60 100,000 (transfer)

$120 100,000 (transfer)

Variable costs:

$ 20 100,000

$ 60 100,000 (transfer)

$ 30 100,000 (processing)

Fixed costs

Operating profit

Total company operating profit

$6,000,000

$2,000,000

$2,000,000

$2,000,000

$12,000,000

$ 6,000,000

3,000,000

4,000,000

$ (1,000,000)

Wood Paper

$1,000,000

Grade A wood: $60 internal transfer price

15 - 12

Managers Goals versus Firms Goals

L.O. 3 Identify the behavioral issues and incentive effects

of negotiated transfer prices, cost-based transfer

prices, and market-based transfer prices.

Transfer price higher than market:

Buying division will not buy

Transfer price lower than market:

Selling division will not sell

15 - 13

Centrally Established

Transfer Price Policies

LO3

Market price-based:

Sets the transfer price at the market price or

at a small discount from the market price

Cost-based:

Outlay cost to selling division plus forgone

contribution to company projects

Negotiated transfer:

The managers of the buying and selling

divisions agree on a price.

15 - 14

Multinational Transfer Pricing

L.O. 4 Explain the economic consequences

of multinational transfer prices.

International (or interstate) transfer pricing

can affect tax liabilities, royalties, and other

payments due to different laws in different

countries or states.

Company incentive:

Increase profit in low-tax country

Decrease profit in high-tax country

15 - 15

Segment Reporting

L.O. 5 Describe the role of transfer prices in segment reporting.

The FASB requires companies to report certain

information about segments in order to provide

a measure of performance for those segments

that are significant to the company as a whole.

15 - 16

End of Chapter 15

Copyright 2011 by The McGraw-Hill Companies, I nc. All rights reserved. McGraw-Hill/I rwin

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 8098 pt1Document385 pages8098 pt1Hotib PerwiraNo ratings yet

- DocDocument1 pageDocShaheen MahmudNo ratings yet

- Statistical InformationDocument1 pageStatistical InformationShaheen MahmudNo ratings yet

- AssumptionsDocument3 pagesAssumptionsShaheen MahmudNo ratings yet

- Report For SirDocument57 pagesReport For SirMostafizur RahmanNo ratings yet

- Succession Planning Ensures Optimum ProductivityDocument12 pagesSuccession Planning Ensures Optimum ProductivityShaheen MahmudNo ratings yet

- HRMDocument57 pagesHRMShaheen MahmudNo ratings yet

- Guide EngDocument219 pagesGuide EngShaheen MahmudNo ratings yet

- Group 7 Section BDocument25 pagesGroup 7 Section BShaheen MahmudNo ratings yet

- Bank Credit Trends in BangladeshDocument259 pagesBank Credit Trends in BangladeshShaheen MahmudNo ratings yet

- Accrual PrincipleDocument3 pagesAccrual PrincipleShaheen MahmudNo ratings yet

- Final ReportDocument210 pagesFinal ReportShaheen MahmudNo ratings yet

- CSR in Bangladesh BankingDocument3 pagesCSR in Bangladesh BankingShaheen MahmudNo ratings yet

- Phrase and IdiomsDocument14 pagesPhrase and IdiomsShaheen MahmudNo ratings yet

- Report For SirDocument57 pagesReport For SirMostafizur RahmanNo ratings yet

- Last Four Years Activities of BKBDocument4 pagesLast Four Years Activities of BKBShaheen MahmudNo ratings yet

- OrganogramDocument1 pageOrganogramShaheen MahmudNo ratings yet

- Job Circular of Different OrganizationDocument1 pageJob Circular of Different OrganizationShaheen MahmudNo ratings yet

- Android Tutorial PDFDocument34 pagesAndroid Tutorial PDFThế AnhNo ratings yet

- OMDocument8 pagesOMShaheen MahmudNo ratings yet

- Operations ManagementDocument175 pagesOperations ManagementAnurag Saikia100% (2)

- Managerial AssaignmentDocument20 pagesManagerial AssaignmentShaheen MahmudNo ratings yet

- Slide of ProductivityDocument15 pagesSlide of ProductivityShaheen MahmudNo ratings yet

- Bank Head Office AddressesDocument6 pagesBank Head Office AddressesShaheen MahmudNo ratings yet

- Responsibility AccountingDocument39 pagesResponsibility AccountingShaheen MahmudNo ratings yet

- College LevelDocument42 pagesCollege LevelShaheen MahmudNo ratings yet

- Annual Report ComparisonDocument7 pagesAnnual Report ComparisonShaheen MahmudNo ratings yet

- MBA SyllabusDocument18 pagesMBA SyllabusShaheen MahmudNo ratings yet

- Target Market Segmentation and Positioning StrategiesDocument5 pagesTarget Market Segmentation and Positioning StrategiesShaheen MahmudNo ratings yet

- DocumentDocument1 pageDocumentShaheen MahmudNo ratings yet

- EXL ServiceDocument2 pagesEXL ServiceMohit MishraNo ratings yet

- ICAO EDTO Course - Basic Concepts ModuleDocument63 pagesICAO EDTO Course - Basic Concepts ModuleLbrito01100% (1)

- Network Marketing - Money and Reward BrochureDocument24 pagesNetwork Marketing - Money and Reward BrochureMunkhbold ShagdarNo ratings yet

- World-Systems Analysis An Introduction B PDFDocument64 pagesWorld-Systems Analysis An Introduction B PDFJan AudreyNo ratings yet

- PLAI 10 Point AgendaDocument24 pagesPLAI 10 Point Agendaapacedera689100% (2)

- LTD NotesDocument2 pagesLTD NotesDenis Andrew T. FloresNo ratings yet

- BusLaw Chapter 1Document4 pagesBusLaw Chapter 1ElleNo ratings yet

- Russian Revolution History Grade 9 NotesDocument6 pagesRussian Revolution History Grade 9 NotesYesha ShahNo ratings yet

- URP - Questionnaire SampleDocument8 pagesURP - Questionnaire SampleFardinNo ratings yet

- Rights of Accused in Libuit v. PeopleDocument3 pagesRights of Accused in Libuit v. PeopleCheska BorjaNo ratings yet

- An Analysis of Gram Nyayalaya Act, 2008 FDRDocument15 pagesAn Analysis of Gram Nyayalaya Act, 2008 FDRPrakash Kumar0% (1)

- BGAS-CSWIP 10 Year Re-Certification Form (Overseas) No LogbookDocument7 pagesBGAS-CSWIP 10 Year Re-Certification Form (Overseas) No LogbookMedel Cay De CastroNo ratings yet

- Anthony VixayoDocument2 pagesAnthony Vixayoapi-533975078No ratings yet

- Medtech LawsDocument19 pagesMedtech LawsJon Nicole DublinNo ratings yet

- Soviet Middle Game Technique Excerpt ChessDocument12 pagesSoviet Middle Game Technique Excerpt ChessPower Power100% (1)

- Dua' - Study Circle 1Document12 pagesDua' - Study Circle 1Dini Ika NordinNo ratings yet

- Cruise LetterDocument23 pagesCruise LetterSimon AlvarezNo ratings yet

- Unique and Interactive EffectsDocument14 pagesUnique and Interactive EffectsbinepaNo ratings yet

- CRPC 1973 PDFDocument5 pagesCRPC 1973 PDFAditi SinghNo ratings yet

- IPR and Outer Spaces Activities FinalDocument25 pagesIPR and Outer Spaces Activities FinalKarthickNo ratings yet

- Vdkte: LA-9869P Schematic REV 1.0Document52 pagesVdkte: LA-9869P Schematic REV 1.0Analia Madeled Tovar JimenezNo ratings yet

- George Orwell (Pseudonym of Eric Arthur Blair) (1903-1950)Document10 pagesGeorge Orwell (Pseudonym of Eric Arthur Blair) (1903-1950)Isha TrakruNo ratings yet

- People of The Philippines vs. OrsalDocument17 pagesPeople of The Philippines vs. OrsalKTNo ratings yet

- 20% DEVELOPMENT UTILIZATION FOR FY 2021Document2 pages20% DEVELOPMENT UTILIZATION FOR FY 2021edvince mickael bagunas sinonNo ratings yet

- Chapter 3-Hedging Strategies Using Futures-29.01.2014Document26 pagesChapter 3-Hedging Strategies Using Futures-29.01.2014abaig2011No ratings yet

- Airport Solutions Brochure Web 20170303Document6 pagesAirport Solutions Brochure Web 20170303zhreniNo ratings yet

- Dilg MC 2013-61Document14 pagesDilg MC 2013-61florianjuniorNo ratings yet

- How a Dwarf Archers' Cunning Saved the KingdomDocument3 pagesHow a Dwarf Archers' Cunning Saved the KingdomKamlakar DhulekarNo ratings yet

- Cristina Gallardo CV - English - WebDocument2 pagesCristina Gallardo CV - English - Webcgallardo88No ratings yet