Professional Documents

Culture Documents

Lesson 2.1 Foreign Exchange Market

Uploaded by

ashu1286Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lesson 2.1 Foreign Exchange Market

Uploaded by

ashu1286Copyright:

Available Formats

MBA (Finance specialisation)

&

MBA Banking and Finance

(Trimester)

Term VI

Module : International Financial Management

Unit II: Foreign Exchange Markets

Lesson 2.1

(Introduction to Foreign Exchange Markets- Functions, quotations, etc.)

Foreign Exchange Market

A foreign exchange market is the one where one

currency (foreign currency) is bought and sold

against another currency (domestic or home

currency). This market has been developed to

facilitate international trade, foreign investment

and borrowing from or / lending to foreigners. In

order to pay for imports or receive payments for

exports, companies/individuals residing in one

country have to acquire or dispose off the

currency of another country. Foreign exchange

markets provide the facility of exchanging

different currencies.

Foreign Exchange Market

The price of one currency in terms of another

is known as exchange rate. Exchange dealers

do the job of the exchange of currencies. The

transactions in the foreign exchange market

can be either to exchange cash or to buy/sell

some other instruments. The major

instruments are currency forward, currency

futures, currency options and currency

swaps.

Foreign Exchange Market

Various kinds of transactions conducted in the foreign exchange

market are briefly given below:

Spot transactions refers to the transaction involving sale and

purchase of currencies for immediate delivery.

Currency forward contracts are settled on a future date even

though the forward rate are quoted at present moment (today).

They are quoted like spot rate but actual delivery of currencies

takes place much later.

Currency options are the instruments that give the choice to

their holder to buy or sell a foreign currency on or up to date ( also

called maturity date) at a specified exchange rate ( also called

strike rate).

Swaps are the instrument that enable two parties to exchange

the stream of cashflows in two different currencies.

Foreign Exchange Market

Exchange rate quotations

Exchange rate means the price of one unit of a

currency in terms of some units of another country.

For example , Rs 45/US$ means that an amount of Rs

45 is needed to buy one US dollar or Rs 45 will be

received for selling one US dollar. When there is no

difference between buying and selling rate , the rate is

unified. But in practice, it is rarely so. A dealer, who is

willing to buy and sell the same currency against

another, does not quote an identical price for buying

as well as selling. Buying rate is also called bid rate

while selling rate is also known as offer rate or ask

rate.

Foreign Exchange Market

Spread

The dealer keeps a difference between buying and selling price. This

difference is known as spread and constitute his profit. Look at the

example given below

Now consider the rupee/dollar rate. The dealer will buy dollar for Rs

62.50 where he will sell a dollar for Rs 62.80. The difference between

buying rate and selling rate ( 62.80 -62.50 = 0.30) is spread. This is the

profit of the dealer. The amount of spread or the profit of the dealer

depends on the volume of transactions. The currencies which are

frequently traded have smaller spread whereas the currencies which are

not very frequently traded have larger spread.

Currency Pair Buying rate Selling rate

Rupee/US $ 62.50 62.80

Rupee/Swiss Franc 35.40 35.90

Foreign Exchange Market

Spread can be expressed in absolute figures or in terms of percentage.

In absolute terms, Spread = Selling rate Buying rate

Spread in percentage can be expressed either with reference to buying

rate or with reference to selling rate.

When buying rate is taken as reference, the denominator is buying rate .

Thus,

Spread ( in percentage) = [( Selling rate Buying rate)/ Buying rate] x 100

When selling rate is taken as reference, the denominator is selling rate .

Thus,

Spread ( in percentage) = [( Selling rate Buying rate)/ Selling rate] x 100

Foreign Exchange Market

Direct and Indirect quotations

When one unit of FOREIGN currency (i.e. dollar) is quoted in terms

of some number of HOME currency (i.e. rupees), it is a direct

quotation. For example , Rs 60/US $.

When one unit of HOME currency (i.e. rupees) is quoted in terms

of some number of FOREIGN currency (i.e. dollar), it is a indirect

quotation. For example , $0.0166/rupee.

Cross Rates

An exchange rate between two currencies that is derived from the

exchange rates of those currencies with a third currency is known

as a cross rate of exchange. For example, exchange rate may be

given between a pair, A and B and another pair, A and C. Then the

rate between B and C derived from the given rates of the two pairs

( A and B, and , A and C) is called cross rate.

Foreign Exchange Market

Exchange rate quotations in Forward market

In case of forward market, the exchange of currencies takes

place after some period from the date of the deal. The

exchange rates are quoted for maturity of one month , two

months, three months, etc. using swap points as shown

below:

Currency pair Spot One month

forward

Two month

forward

Three month

forward

$/euro 1.2000/50 30/40 60/85 100/140

Foreign Exchange Market

The interpretation of swap points is as follows:

Here spot rate is 1.2000/50 which implies spot buying rate is $ 1.2000 per euro and spot

selling rate is $1.2050 per euro since the last two digits of buying rate are replaced by 50.

In order to determine , the forward rate , we shall see the relationship between

numerator and denominator of the forward period.

Like , in the case of one month forward, numerator (30) is smaller than denominator

(40) , then these points are to be added to the respective figures of spot buying and

selling rates. So, one month forward buying rate becomes 1.2030 (1.2000 + 0.0030) and

one month selling rate becomes 1.2090 (1.2050 + 00.40). Here the forward rate figures

are greater than spot rate figures therefore we may say forward rate is at premium vis-

-vis spot rate.

Similarly , second month rate would be ( 1.2000+0.0060 = 1.2060 and 1.2050+ 0.0085 =

1.2135) and third month rates would be (1.2000+0.0100 = 1.2100 and 1.2050+ 0.0140 =

1.2190).

Foreign Exchange Market

In case numerator is larger than denominator, than these swap points are to be subtracted from the

respective figures of spot buying and selling rates. Consider the example given below:

In case of one month forward, numerator (50) is greater than denominator (40) , therefore , these

swap point will be deducted from the spot rate to arrive at outright rate of one month forward.

Buying rate of one month forward will be 1.7100 0.0050 = 1.7050

Selling rate of one month forward will be 1.7250 0.0040 = 1.7210

Here the forward rate figures are smaller than spot rate figures therefore we may say forward rate

is at discount vis--vis spot rate.

Currency pair Spot One month

forward

Two month

forward

Three month

forward

$/euro 1.7100/250 50/40 100/85 155/125

Foreign Exchange Market

Similarly, In case of two month forward, numerator (100) is greater than

denominator (85) , therefore , these swap point will be deducted from

the spot rate to arrive at outright rate of one month forward.

Buying rate of one month forward will be 1.7100 0.0100 = 1.7000

Selling rate of one month forward will be 1.7250 0.0085 = 1.7165

In case of three month forward, numerator (155) is greater than

denominator (125) , therefore , these swap point will be deducted from

the spot rate to arrive at outright rate of one month forward.

Buying rate of one month forward will be 1.7100 0.0155 = 1.6945

Selling rate of one month forward will be 1.7250 0.0125 = 1.7125

Foreign Exchange Market

Example : A foreign exchange trader gives the following quotes for

the Euro vs. dollar spot, one month, three months and six months

to a US based treasurer.

Calculate the outright quotes for one, three and six month forward.

Also calculate spread at these periods.

currency pair Spot 1 Month 3 Months 6 Months

Euro vs dollar $0.02368/70 4/5 8/7 14/12

Foreign Exchange Market

Solution

Maturity Remarks Bid (buy) Ask (sell) Spread = Difference

between ask and bid

Spot $0.02368 $0.02370 .00002

1 Month Since numerator (4)

is less than

denominator (5),

points are added to

the spot rate

$0.02372 $0.02375 .00003

3 Months Since numerator (8)

is more than

denominator (7),

points are subtracted

from the spot rate

$0.02360 $0.02363 .00003

6 Months Since numerator (14)

is more than

denominator (12),

points are subtracted

from the spot rate

$0.02354 $0.02358 .00004

Exercise

Problem 1: A foreign exchange trader gives the following quotes for

the Rs vs. dollar spot, one month, three months and six months to a

US based treasurer

Calculate the outright quotes for one, two and three month forward.

Also calculate spread and spread percentage ( based on selling as

well as buying price) at these periods.

Spot rate (Rs/$) 62.32 62.53

One month forward 0.05 0.09

Two month forward 0.07 0.03

Three month forward 0.08 0.06

Exercise

Problem 2: A foreign exchange trader gives the following quotes for

the Rs vs. dollar spot, one month, three months and six months to a

US based treasurer

Calculate the outright quotes for one, two and three month forward.

Also calculate spread and spread percentage ( based on selling as

well as buying price) at these periods.

Spot rate (Rs/$) 61.45 61.6

One month forward 0.06 0.08

Two month forward 0.05 0.03

Three month forward 0.07 0.05

Forward Premium or Discount

If forward rate of a currency is greater than the its spot rate, it is said to be

at a forward premium. On the other hand ,if its forward rate is smaller than

its spot rate, it is at forward discount. For example, Rs/$ spot rate is Rs 60/$

and three month forward rate is Rs 61/$. This shows that dollar is at

forward premium. The premium or discount is calculated using equation

given below :

Forward premium/discount = [ (F S)/ S ] x (12/N) x 100

where

N is the number of months forward,

F = Forward rate

S = Spot rate

Foreign Exchange Market

Example : From the data given below calculate forward premium or

discount as the case may be

Solution

Forward Premium (using bid price)

= [(44.7000 44.5000)/ 44.5000] x (12/3) x 100 = 1.18 percent per annum

[Dollar is at premium]

Forward Premium (using ask price)

= [(44.9990 44.7050)/ 44.7050] x (12/3) x 100 = 2.63 percent per annum

[Dollar is at premium]

Particular Spot 3-month forward

Rs/$ 44.5000/7050 44.7000/9990

Foreign Exchange Market

Example : From the data given below calculate forward

premium or discount (on annualized basis) as the case may be

Solution

Forward Premium/ discount

= [(62.50 62.15)/ 62.15] x (12/3) x 100 = 2.252 percent per annum

[Dollar is at premium]

Particular Spot 3-month forward

Rs/$ 62.15 62.50

You might also like

- Winning Binary Options Trading Strategy: Simple Secret of Making Money From Binary Options TradingFrom EverandWinning Binary Options Trading Strategy: Simple Secret of Making Money From Binary Options TradingRating: 4.5 out of 5 stars4.5/5 (22)

- #1 Forex Trading CourseDocument63 pages#1 Forex Trading Courseitsrijo100% (1)

- Lesson 1.1 International Finance ManagementDocument15 pagesLesson 1.1 International Finance Managementashu1286No ratings yet

- Demo - Nism 8 - Equity Derivatives ModuleDocument7 pagesDemo - Nism 8 - Equity Derivatives ModuleBhupat1270% (1)

- Upload Portfolio Positions to BloombergDocument30 pagesUpload Portfolio Positions to BloombergAlex LimNo ratings yet

- Meet The Real 'Wolf of Wall Street' in Forbes' Original Takedown of Jordan BelfortDocument4 pagesMeet The Real 'Wolf of Wall Street' in Forbes' Original Takedown of Jordan BelfortJay SayNo ratings yet

- CAPM AssignmentDocument1 pageCAPM Assignmentshreyansh jainNo ratings yet

- 10 Forex Quotes IB. Sess 16Document10 pages10 Forex Quotes IB. Sess 16Kapil PrabhuNo ratings yet

- 1 Foreign Exchange Markets - IDocument8 pages1 Foreign Exchange Markets - INaomi LyngdohNo ratings yet

- Forex ProblemsDocument38 pagesForex Problemsnehali Madhukar AherNo ratings yet

- An Introduction To The Foreign Exchange Market Moorad ChoudhryDocument6 pagesAn Introduction To The Foreign Exchange Market Moorad ChoudhryVipin Kumar CNo ratings yet

- Exchange Rate Calculation Types Spot ForwardDocument6 pagesExchange Rate Calculation Types Spot ForwardRohit AggarwalNo ratings yet

- BCCM International Finance Module Provides Insight into Foreign Exchange MarketsDocument83 pagesBCCM International Finance Module Provides Insight into Foreign Exchange MarketsSingmay MoralNo ratings yet

- SPT, Cross, ForwardDocument38 pagesSPT, Cross, Forwardseagul_1183822No ratings yet

- Forex For CAIIBDocument6 pagesForex For CAIIBkushalnadekarNo ratings yet

- (A& F) - IfM-Foreign Exchange MarketsDocument24 pages(A& F) - IfM-Foreign Exchange Marketsudayraju2007No ratings yet

- World Monetary System and Exchange RatesDocument16 pagesWorld Monetary System and Exchange RatesRishabh SehrawatNo ratings yet

- Balance of Payment 20Document79 pagesBalance of Payment 20Anshul SinhaNo ratings yet

- Cross Rate and Merchant RateDocument26 pagesCross Rate and Merchant RateDivya NadarajanNo ratings yet

- Foreign Exchange Markets: Prof Mahesh Kumar Amity Business SchoolDocument47 pagesForeign Exchange Markets: Prof Mahesh Kumar Amity Business SchoolasifanisNo ratings yet

- 35 Summary ForexDocument15 pages35 Summary ForexRevati GalgaliNo ratings yet

- Introduction To International Financial ManagementDocument37 pagesIntroduction To International Financial ManagementhappyNo ratings yet

- Foreign Exchange Rates CalculationsDocument14 pagesForeign Exchange Rates Calculationsnenu_1000% (1)

- Lecture 7: The Forward Exchange MarketDocument35 pagesLecture 7: The Forward Exchange MarketkarthickgamblerNo ratings yet

- Direct Quotations Can Be Converted Into Indirect Quotations and Vice VersaDocument6 pagesDirect Quotations Can Be Converted Into Indirect Quotations and Vice VersaLeo the BulldogNo ratings yet

- Afu 08504 - International Finance - The Economics of Foreign Exchange MarketDocument10 pagesAfu 08504 - International Finance - The Economics of Foreign Exchange MarketWilliam MuhomiNo ratings yet

- Chapter 15: Foreign Exchange (FX) MarketsDocument32 pagesChapter 15: Foreign Exchange (FX) MarketsjoannamanngoNo ratings yet

- CURRENCY DERIVATIVES MARKET OVERVIEWDocument39 pagesCURRENCY DERIVATIVES MARKET OVERVIEWNandita ShahNo ratings yet

- Illustrations For PracticeDocument3 pagesIllustrations For PracticeDhruvi AgarwalNo ratings yet

- Introduction To Interest Rate Trading: Andrew WilkinsonDocument44 pagesIntroduction To Interest Rate Trading: Andrew WilkinsonLee Jia QingNo ratings yet

- Accounting For Foreign Currency TransactionsDocument8 pagesAccounting For Foreign Currency TransactionsHussen AbdulkadirNo ratings yet

- Forex Trading CourseDocument69 pagesForex Trading Courseapi-3703868No ratings yet

- Study International Finance Markets and CurrenciesDocument14 pagesStudy International Finance Markets and CurrenciesNoopur SrivastavaNo ratings yet

- Evolution and Future of ForexDocument44 pagesEvolution and Future of Forexsushant1903No ratings yet

- R21 Currency Exchange Rates IFT NotesDocument35 pagesR21 Currency Exchange Rates IFT NotesMohammad Jubayer AhmedNo ratings yet

- Exchange Rate Quotations, Balance of Payments, Prices, Parities and Interest RatesDocument22 pagesExchange Rate Quotations, Balance of Payments, Prices, Parities and Interest RatesSourav PaulNo ratings yet

- Foreign Exchange Market: Dr. Amit Kumar SinhaDocument67 pagesForeign Exchange Market: Dr. Amit Kumar SinhaAmit SinhaNo ratings yet

- ABC of Foreign ExchangeDocument8 pagesABC of Foreign Exchangesulabhpathak1987No ratings yet

- Currency Future and OptionsDocument60 pagesCurrency Future and Optionspanicker_maheshNo ratings yet

- Echange Rate Mechanism: 1. Direct Quote 2. Indirect QuoteDocument4 pagesEchange Rate Mechanism: 1. Direct Quote 2. Indirect QuoteanjankumarNo ratings yet

- Foreign Exchange MarketDocument29 pagesForeign Exchange MarketRavi SistaNo ratings yet

- FX 102 - FX Rates and ArbitrageDocument32 pagesFX 102 - FX Rates and Arbitragetesting1997No ratings yet

- 08 - MM FuturesDocument9 pages08 - MM FuturesildaNo ratings yet

- Unit 2Document15 pagesUnit 2Aryan RajNo ratings yet

- International Business FinanceDocument14 pagesInternational Business FinanceKshitij ShahNo ratings yet

- INTERNATIONAL BANKING MANAGEMENTDocument39 pagesINTERNATIONAL BANKING MANAGEMENTaabha06021984No ratings yet

- INTERNATIONAL FINANCE MODULES AND EVALUATIONDocument30 pagesINTERNATIONAL FINANCE MODULES AND EVALUATIONSaurav GoyalNo ratings yet

- Lecture 10-Foreign Exchange MarketDocument42 pagesLecture 10-Foreign Exchange MarketfarahNo ratings yet

- Forex Trading Course - Turn $1,260 Into $12,300 in 30 Days by David CDocument74 pagesForex Trading Course - Turn $1,260 Into $12,300 in 30 Days by David Capi-3748231No ratings yet

- Foreign Exchange MarketDocument27 pagesForeign Exchange MarketMD SHUJAATULLAH SADIQNo ratings yet

- Assignment 1stDocument3 pagesAssignment 1stAmmar ButtNo ratings yet

- Foreign Exchange Rate MarketDocument92 pagesForeign Exchange Rate Marketamubine100% (1)

- Euro EconomyDocument26 pagesEuro EconomyJinal ShahNo ratings yet

- Foreign Exchange MarketDocument73 pagesForeign Exchange MarketAmit Sinha100% (1)

- International Financial ManagementDocument38 pagesInternational Financial Managementhaidersyed06No ratings yet

- Forex Markets: International Finance - Group 3 Roll No-11, 16, 30, 45, 47, 58Document34 pagesForex Markets: International Finance - Group 3 Roll No-11, 16, 30, 45, 47, 58Pradyumna SwainNo ratings yet

- What Is The Spot Market?Document2 pagesWhat Is The Spot Market?chinmayaNo ratings yet

- INTERNATIONAL FINANCIAL SYLLABUSDocument90 pagesINTERNATIONAL FINANCIAL SYLLABUSTarini MohantyNo ratings yet

- Unit 17 Exchange RatesDocument15 pagesUnit 17 Exchange Ratesujjwal kumar 2106No ratings yet

- Forex Trading for Beginners: The Ultimate Trading Guide. Learn Successful Strategies to Buy and Sell in the Right Moment in the Foreign Exchange Market and Master the Right Mindset.From EverandForex Trading for Beginners: The Ultimate Trading Guide. Learn Successful Strategies to Buy and Sell in the Right Moment in the Foreign Exchange Market and Master the Right Mindset.No ratings yet

- Lesson - 4.1 (1) International Finance ManagementDocument14 pagesLesson - 4.1 (1) International Finance Managementashu1286No ratings yet

- IFM SyllabusDocument4 pagesIFM Syllabusashu1286No ratings yet

- Lesson - 4.2 International Finance ManagementDocument19 pagesLesson - 4.2 International Finance Managementashu1286No ratings yet

- Lesson - 2.2 International Finance ManagementDocument10 pagesLesson - 2.2 International Finance Managementashu1286No ratings yet

- Lesson - 3.3 International Finance ManagementDocument11 pagesLesson - 3.3 International Finance Managementashu1286No ratings yet

- International Finance ManagementDocument38 pagesInternational Finance Managementashu1286No ratings yet

- Lesson - 5.2 International Finance ManagementDocument12 pagesLesson - 5.2 International Finance Managementashu1286No ratings yet

- Lesson - 5.2 International Finance ManagementDocument37 pagesLesson - 5.2 International Finance Managementashu1286No ratings yet

- Lesson - 5.1 International Finance ManagementDocument31 pagesLesson - 5.1 International Finance Managementashu1286No ratings yet

- Lesson 2.3 Revised International Finance ManagementDocument12 pagesLesson 2.3 Revised International Finance Managementashu1286No ratings yet

- Lesson 2.4 International Finance ManagementDocument18 pagesLesson 2.4 International Finance Managementashu1286No ratings yet

- Lesson 1.2 BOP International Finance ManagementDocument16 pagesLesson 1.2 BOP International Finance Managementashu1286No ratings yet

- Lesson 3.2 International Finance ManagementDocument26 pagesLesson 3.2 International Finance Managementashu1286No ratings yet

- Lesson 3.1 International Finance ManagementDocument24 pagesLesson 3.1 International Finance Managementashu1286No ratings yet

- Project Finance and Management Post-Completion Audit Abandonment AnalysisDocument8 pagesProject Finance and Management Post-Completion Audit Abandonment Analysisashu1286No ratings yet

- Iifm AssignmentDocument3 pagesIifm Assignmentashu1286No ratings yet

- Test of IfmDocument3 pagesTest of Ifmashu1286No ratings yet

- Assignment 1 International Financial MangtDocument5 pagesAssignment 1 International Financial Mangtashu1286No ratings yet

- Graham & Doddsville Issue: Fall 2019Document48 pagesGraham & Doddsville Issue: Fall 2019marketfolly.comNo ratings yet

- Chapter 5 FinanceDocument18 pagesChapter 5 FinancePia Eriksson0% (1)

- Order in The Matter of M/s Sunshine Global Agro LimitedDocument16 pagesOrder in The Matter of M/s Sunshine Global Agro LimitedShyam SunderNo ratings yet

- Balance of Payments AccountingDocument20 pagesBalance of Payments AccountingWilly AndersonNo ratings yet

- DNL Use of Proceeds Annual Progress As of 12.31.14Document6 pagesDNL Use of Proceeds Annual Progress As of 12.31.14WrLw7pcufeGUNo ratings yet

- Self Trading Prevention Functionality v100Document25 pagesSelf Trading Prevention Functionality v100Leonardo GiglioNo ratings yet

- Company Conformed Name: Morgan Stanley Central IndexDocument169 pagesCompany Conformed Name: Morgan Stanley Central IndexgggfickaNo ratings yet

- F9D2Document30 pagesF9D2mysticsoulNo ratings yet

- Day Trading StrategiesDocument4 pagesDay Trading Strategiesthushantha50% (2)

- Terms and Conditions EToroDocument42 pagesTerms and Conditions EToroZhess BugNo ratings yet

- SBI's Organizational StructureDocument1 pageSBI's Organizational StructureKautuk Popli100% (1)

- Case Study - Harshad MehtaDocument5 pagesCase Study - Harshad MehtaMudit AgarwalNo ratings yet

- Select Banking and Finance AbbreviationsDocument5 pagesSelect Banking and Finance AbbreviationsAnmol JainNo ratings yet

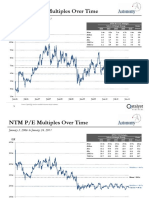

- NTM Revenue Multiples Over Time: Mean 6.8x, 75th Perc 7.6xDocument3 pagesNTM Revenue Multiples Over Time: Mean 6.8x, 75th Perc 7.6xmittleNo ratings yet

- Research Methodology on Major Stock Market ScamsDocument35 pagesResearch Methodology on Major Stock Market ScamsSameer VelaniNo ratings yet

- Law and Practice of BankingDocument151 pagesLaw and Practice of BankingAshok KumarNo ratings yet

- Session 2 International FinanceDocument3 pagesSession 2 International FinanceTumbleweedNo ratings yet

- Trade Capture Report MessagesDocument25 pagesTrade Capture Report Messagesjatipatel5719No ratings yet

- ReportDocument3 pagesReportumaganNo ratings yet

- Binus Financial Analyst Academy CFA Program Level 1 Semester 2 Batch 34 2018 V4fDocument5 pagesBinus Financial Analyst Academy CFA Program Level 1 Semester 2 Batch 34 2018 V4fBudiman SnowieNo ratings yet

- Risk and Return: Past and PrologueDocument39 pagesRisk and Return: Past and ProloguerrNo ratings yet

- Prudential Regulations For Corporate / Commercial BankingDocument73 pagesPrudential Regulations For Corporate / Commercial BankingAsma ShoaibNo ratings yet

- Investment:: Process of Estimating Return and Risk of A Security Is Known As Security AnalysisDocument76 pagesInvestment:: Process of Estimating Return and Risk of A Security Is Known As Security AnalysisDowlathAhmedNo ratings yet

- Premier Cement 16Document177 pagesPremier Cement 16Leanna R. Braxton100% (1)

- 99th AGM AR WEB 16 07 2018 PDFDocument184 pages99th AGM AR WEB 16 07 2018 PDFpks009No ratings yet

- AEA: Simultaneous Determination of Spot and Futures PricesDocument15 pagesAEA: Simultaneous Determination of Spot and Futures PricesGeorge máximoNo ratings yet