Professional Documents

Culture Documents

Corporate Finance MBA20022013

Uploaded by

Ibrahim Shareef0 ratings0% found this document useful (0 votes)

288 views244 pagesCorporate Finance MBA20022013

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCorporate Finance MBA20022013

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

288 views244 pagesCorporate Finance MBA20022013

Uploaded by

Ibrahim ShareefCorporate Finance MBA20022013

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 244

Corporate Finance

Objectives of the Course

On successful completion of this course, you should be able to:

Identify the purpose and relevance of Corporate Finance;

Explain the use of a variety of advance capital budgeting techniques;

Discuss the importance of risk and return in Corporate Finance;

Discuss the process determining the capital structure and dividend

policy;

Apply financial derivatives in risk management; and

Discuss factors that affect shareholders wealth.

Topic 1: Value and Capital Budgeting

Net Present Value

How to Value Bonds and Stocks

Some Alternative Investment Rules

Net Present Value and Capital Budgeting

Risk Analysis, Options and Capital Budgeting

Topic 2: Risk and Return

Capital Market Theory: An Overview

Return & Risk: The Capital Asset Pricing Model

(CAPM)

An Alternate View of Risk and Return: The Arbitrage

Pricing Theory

Risk, Cost of Capital, and Capital Budgeting

Topic 3: Capital Structure and Dividend Policy

Corporate Financing Decisions and Efficient Capital

Markets

Long-Term Financing: An Introduction

Capital Structure: Basic Concepts

Capital Structure: Limits to the Use of Debt

Valuation and Capital Budgeting for the Levered

Firm

Dividend Policy: Why Does It Matter?

Topic 4&5: Long-Term Financing &

Derivatives

Issuing Securities to the Public

Long-Term Debt

Leasing

Topic 5: Options, Futures, and Corporate

Finance

Options and Corporate Finance: Basic Concepts -

Warrants and Convertibles , Derivatives and Hedging

Risk

Research!

Research is the art of seeing what everyone else has

seen, and doing what no-one else has done.

The Time Value of Money

Which would you rather have -- $1,000 today or

$1,000 in 5 years?

Obviously, $1,000 today.

Money received sooner rather than later allows one

to use the funds for investment or consumption

purposes. This concept is referred to as the TIME

VALUE OF MONEY!!

Why TIME?

NOT having the opportunity to earn interest on

money is called OPPORTUNITY COST

Remember, one CANNOT compare numbers in

different time periods without first adjusting them

using an interest rate.

Compound Interest

When interest is paid on not only the principal

amount invested, but also on any previous interest

earned, this is called compound interest.

FV = Principal + (Principal x Interest)

= 2000 + (2000 x .06)

Future Value

If you invested $2,000 today in an account that pays

6% interest, with interest compounded annually, how

much will be in the account at the end of two years if

there are no withdrawals?

FV

1

= PV (1+i)

n

= $2,000 (1.06)

2

= $2,247.20

FV = future value, a value at some future point in time

PV = present value, a value today which is usually

designated as time 0

i = rate of interest per compounding period

n = number of compounding periods

Future Value Example

John wants to know how large his $5,000 deposit will

become at an annual compound interest rate of 8% at the

end of 5 years.

FV

n

= PV (1+i)

n

FV

5

= $5,000 (1+ 0.08)

5

= $7,346.64

Present Value

Since FV = PV(1 + i)

n.

PV = FV / (1+i)

n.

Discounting is the process of translating a future

value or a set of future cash flows into a present

value.

Present Value Example

Joann needs to know how large of a deposit to make today

so that the money will grow to $2,500 in 5 years. Assume

todays deposit will grow at a compound rate of 4%

annually.

Calculation based on general formula:

PV

0

= FV

n

/ (1+i)

n

PV

0

= $2,500/(1.04)

5

= $2,054.81

Finding n or i when one knows PV and FV

If one invests $2,000 today and has accumulated

$2,676.45 after exactly five years, what rate of

annual compound interest was earned?

Annuities

An Annuity represents a series of equal payments

(or receipts) occurring over a specified number of

equidistant periods.

Examples of Annuities Include:

Student Loan Payments

Car Loan Payments

Insurance Premiums

Mortgage Payments

Retirement Savings

Dividend Policy

Learning Objectives

Important Terms

Mechanics of Dividend Payments

Cash Dividend Payments

M&Ms Dividend Irrelevance Theorem

The Bird in the Hand Argument

Dividend Policy in Practice

Relaxing the M&M Assumptions

Stock Dividends and Stock Splits

Share Repurchases

Summary and Conclusions

Dividend Policy

What is It?

Dividend Policy refers to the explicit or implicit

decision of the Board of Directors regarding the

amount of residual earnings (past or present) that

should be distributed to the shareholders of the

corporation.

This decision is considered a financing decision because the

profits of the corporation are an important source of financing

available to the firm.

Types of Dividends

Dividends are a permanent distribution of residual

earnings/property of the corporation to its owners.

Dividends can be in the form of:

Cash

Additional Shares of Stock (stock dividend)

Property

If a firm is dissolved, at the end of the process, a final dividend of

any residual amount is made to the shareholders this is known

as a liquidating dividend.

Dividends a Financing Decision

In the absence of dividends, corporate earnings accrue to the benefit of

shareholders as retained earnings and are automatically reinvested in the

firm.

When a cash dividend is declared, those funds leave the firm permanently

and irreversibly.

Distribution of earnings as dividends may starve the company of funds

required for growth and expansion, and this may cause the firm to seek

additional external capital.

Corporate Profits After Tax

Retained Earnings

Dividends

Dividends versus Interest Obligations

Interest

Interest is a payment to lenders for the use of their funds for a

given period of time

Timely payment of the required amount of interest is a legal

obligation

Failure to pay interest (and fulfill other contractual

commitments under the bond indenture or loan contract) is an

act of bankruptcy and the lender has recourse through the courts

to seek remedies

Secured lenders (bondholders) have the first claim on the firms

assets in the case of dissolution or in the case of bankruptcy

Dividends

A dividend is a discretionary payment made to shareholders

The decision to distribute dividends is solely the responsibility of

the board of directors

Shareholders are residual claimants of the firm (they have the

last, and residual claim on assets on dissolution and on profits

after all other claims have been fully satisfied)

Dividend Payments

Cash Dividend - Payment of cash by the firm to its

shareholders.

Ex-Dividend Date - Date that determines whether a

stockholder is entitled to a dividend payment; anyone

holding stock before this date is entitled to a dividend.

Record Date - Person who owns stock on this date received

the dividend.

Mechanics of Cash Dividend Payments

Declaration Date

this is the date on which the Board of Directors meet and declare the dividend. In their resolution

the Board will set the date of record, the date of payment and the amount of the dividend for each

share class.

when CARRIED, this resolution makes the dividend a current liability for the firm.

Date of Record

is the date on which the shareholders register is closed after the trading day and all those who are

listed will receive the dividend.

Ex dividend Date

is the date that the value of the firms common shares will reflect the dividend payment (ie. fall in

value)

ex means without.

At the start of trading on the ex-dividend date, the share price will normally open for trading at the

previous days close, less the value of the dividend per share. This reflects the fact that purchasers

of the stock on the ex-dividend date and beyond WILL NOT receive the declared dividend.

Date of Payment

is the date the cheques for the dividend are mailed out to the shareholders.

Dividend Policy

Dividends, Shareholders and the Board of Directors

There is no legal obligation for firms to pay dividends to common

shareholders

Shareholders cannot force a Board of Directors to declare a

dividend, and courts will not interfere with the BODs right to

make the dividend decision because:

Board members are jointly and severally liable for any damages they

may cause

Board members are constrained by legal rules affecting dividends

including:

Not paying dividends out of capital

Not paying dividends when that decision could cause the firm to become

insolvent

Not paying dividends in contravention of contractual commitments (such

as debt covenant agreements)

Dividend Reinvestment Plans (DRIPs)

Involve shareholders deciding to use the cash dividend

proceeds to buy more shares of the firm

DRIPs will buy as many shares as the cash dividend allows with the

residual deposited as cash

Leads to shareholders owning odd lots (less than 100 shares)

Firms are able to raise additional common stock capital

continuously at no cost and fosters an on-going relationship

with shareholders.

Dividend Payments

Stock Dividends

Stock dividends simply amount to distribution of

additional shares to existing shareholders

They represent nothing more than recapitalization of

earnings of the company. (that is, the amount of the

stock dividend is transferred from the R/E account to

the common share account.

Because of the capital impairment rule stock

dividends reduce the firms ability to pay dividends in

the future.

Dividend Payments

Stock Dividends

Implications

reduction in the R/E account

reduced capacity to pay future dividends

proportionate share ownership remains unchanged

shareholders wealth (theoretically) is unaffected

Effect on the Company

conserves cash

serves to lower the market value of firms stock modestly

promotes wider distribution of shares to the extent that current owners divest themselves of

shares...because they have more

adjusts the capital accounts

dilutes EPS

Effect on Shareholders

proportion of ownership remains unchanged

total value of holdings remains unchanged

if former DPS is maintained, this really represents an increased dividend payout

Dividend Payments

Stock Dividends

ABC Company

Equity Accounts

as at February xx, 20x9

Common stock (215,000) $5,000,000

Retained earnings 20,000,000

Net Worth $25,000,000

The company, on March 1, 20x9 declares a 10 percent stock dividend

when the current market price for the stock is $40.00 per share.

This stock dividend will increase the number of shares outstanding by 10

percent. This will mean issuing 21,500 shares. The value of the shares

is:

$40.00 (21,500) = $860,000

This stock dividend will result in $860,000 being transferred from the

retained earnings account to the common stock account:

Dividend Payments

Stock Dividends

After the stock dividend:

ABC Company

Equity Accounts

as at March 1, 20x9

Common stock (236,500) $5,860,000

Retained earnings 19,140,000

Net worth $25,000,000

The market price of the stock will be affected by the stock dividend:

New Share Price = Old Price/ (1.1) = $40.00/1.1 = $36.36

The individual shareholders wealth will remain unchanged.

Cash Dividend Payments

The Macro Perspective

Aggregate after-tax profits run at approximately 6% of GDP but are

highly variable

Aggregate dividends are relatively stable when compared to after-tax

profits.

They are sustained in the face of drops in profit during recessions

They are held reasonably constant in the face of peaks in aggregate

profits.

Aggregate Dividends and Profits

Cash Dividend Payments

The Macro Perspective - Question

Why are dividends smoothed and not matched to

profits?

The companies chosen here illustrate the dramatic differences

between companies:

Some pay no dividends

Some pay consistent cash dividends representing substantial

yields on current shares prices

The highest yields are found in the case of Income Trusts and

large stable blue-chip financials and utilities

Cash Dividend Payments

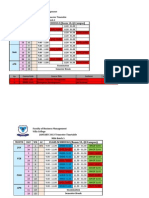

Dividend Yields

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 Average

% % % % % % % % % %

BCE 4.69 3.42 2.52 1.41 1.07 3.15 3.99 4.08 4.29 4.44 3.31

Celestica Inc. 0 0 0 0 0 0 0 0 0 0 0.00

CIBC 3.67 3.07 2.85 3.37 3.17 2.9 3.48 3.28 3.31 3.57 3.27

Cott Corporation 0.23 0.53 0.54 0 0 0 0 0 0 0 0.13

Kinross Gold Corporation 0 0 0 0 0 0 0 0 0 0 0.00

TransAlta Corporation 6.22 5.16 4.52 5.35 5.59 4.06 4.92 5.73 5.88 4.51 5.19

Yellow Pages Income Fund 7.34 7.09 7.22

Table 22-1 S&P/TSX 60 Index Dividend Yields

Modigliani and Millers Dividend Irrelevance Theorem

The value of M&Ms Dividend Irrelevance argument

is that in the end, it shows where value can be

created with dividend policy and why.

M&Ms Dividend Irrelevance Theorem

Assumptions

No Taxes

Perfect capital markets

large number of individual buyers and sellers

costless information

no transaction costs

All firms maximize value

There is no debt

M&Ms Dividend Irrelevance Theorem

Residual Theory of Dividends

The Residual Theory of Dividends suggests that

logically, each year, management should:

Identify free cash flow generated in the previous period

Identify investment projects that have positive NPVs

Invest in all positive NPV projects

If free cash flow is insufficient, then raise external capital in this

case no dividend is paid

If free cash flow exceeds investment requirements, the residual

amount is distributed in the form of cash dividends.

M&Ms Dividend Irrelevance Theorem

Residual Theory of Dividends - Implication

The implication of the Residual Theory of Dividends are:

Investment decisions are independent of the firms dividend

policy

No firm would pass on a positive NPV project because of the lack of

funds, because, by definition the incremental cost of those funds is

less than the IRR of the project, so the value of the firm is maximized

only if the project is undertaken.

If the firm cant make good use of free cash flow (ie. It has no projects

with IRRs > cost of capital) then those funds should be distributed

back to shareholders in the form of dividends for them to invest on

their own.

The firm should operate where Marginal Cost equals Marginal

Revenue as seen in Figure on the following slide:

CHAPTER 22 Dividend Policy

22 - 38

M&Ms Dividend Irrelevance Theorem

Internal Funds, Investment, and Dividends

FIGURE

$11,976

Million

Rate of

Return

WACC

Internal Funds Available

OPTIMAL INVESTMENT

$177,607

Million

MC=MR

The Bird-in-the-Hand Argument

M&Ms Assumptions Relaxed

Risk is a real world factor.

Firms that reinvest free cash flow, put that money at

risk there is no certainty of investment outcome

those forfeit dividends that are reinvestedcould be

lost!

Remember the two-stage DDM?

The Bird-in-the-Hand Argument

M&Ms Assumptions Relaxed

Myron Gordon suggests that dividends are more stable than

capital gains and are therefore more highly valued by investors.

This implies that investors perceive non-dividend paying firms to

be riskier and apply a higher discount rate to value them causing

the share price to fall.

The difference between the M&M and Gordon arguments are

illustrated in Figure 2 on the following slide:

M&M argue that dividends and capital gains are perfect substitutes

CHAPTER 22 Dividend Policy

22 - 41

The Bird-in-the-Hand Argument

M&M versus Gordons Bird in the Hand Theory

0

1

P

D

FIGURE 2

Gordon

OPTIMAL INVESTMENT

M&M

0

0 1

P

P P

The Bird-in-the-Hand Argument

M&M versus Gordons Bird in the Hand Theory

Conclusions:

Firms cannot change underlying operational characteristics by

changing the dividend

The dividend should reflect the firms operations through the

residual value of dividends

Dividend Policy in Practice

Firms smooth their dividends

Firms tend to hold dividends constant, even in the face of

increasing after-tax profit

Firms are very reluctant to cut dividends

Relaxing the M&M Assumptions

Welcome to the Real World!

Dividends and Signalling

Under conditions of information asymmetry, shareholders and the

investing public watch for management signals (actions) about what

management knows.

Management is therefore very cautious about dividend changesthey

dont want to create high expectations (this is the reason for extra or

special dividends) that will lead to disappointment, and they dont

want to have investors over react to negative earnings surprises (the

sticky dividend phenomenon)

(The Signalling Model is explained in Figure 3 found on the next slide.)

Relaxing the M&M Assumptions

The Signalling Model

FIGURE 3

e

t

$

1 2 3 Time

e

t

*

d

t

*

d

t

Relaxing the M&M Assumptions

Welcome to the Real World!

Agency Theory

Investors are wary of senior management so they seek to put controls

in place.

There is a fear that managers may waste corporate resources by over-

investing in low or poor NPV projects.

Gordon Donaldson argued this is the reason for the pecking order

managements tend to use when raising capital

Shareholders would prefer to receive a dividend and then have

management file a prospectus, justifying investment in projects and the

need to raise the capital that was just distributed as a dividend.

Shareholders are prepared to pay those additional underwriting costs as

an agency cost incurred to monitor and assess management.

Relaxing the M&M Assumptions

Welcome to the Real World!

Taxes and the Clientele Effect

Table (on the following slide) illustrates that different classes of

investors face different tax brackets

Preference for dividends versus capital gains income depends on the

province of residence and taxable income level leading to tax

clienteles.

High income earners tend to prefer capital gains (there is an additional

tax incentive for such individuals in that they can choose the timing of the

sale of their investmentremember only realized capital gains are

subject to tax

Low income earners tend to prefer dividends

Conclusion firms should not change dividend policy drastically since

it upsets the existing ownership base.

Relaxing the M&M Assumptions

Taxes

Income Level

$25,000 $50,000 $75,000 $100,000

British Columbia Dividends 2.52 6.19 15.69 20.04

Capital gains 12.45 15.58 18.85 20.35

Alberta Dividends 3.63 8.03 13.83 13.83

Capital gains 12.63 16.00 18.00 18.00

Ontario Dividends 0.00 8.24 20.74 20.74

Capital gains 10.65 15.58 21.71 21.71

Quebec Dividends 5.95 15.42 26.06 26.06

Capital gains 14.37 19.19 22.86 22.86

Nova Scotia Dividends 0.00 8.75 17.05 19.06

Capital gains 12.02 18.48 21.34 22.63

Table 22-3 Individual Tax Rates (%) on Dividends and Capital Gains

Share Repurchases

Simply another form of payout policy.

An alternative to cash dividend where the objective is

to increase the price per share rather than paying a

dividend.

Since there are rules against improper accumulation

of funds, firms adopt a policy of large infrequent

share repurchase programs.

Share Repurchases

reasons for use:

Offsetting the exercise of executive stock options

Leveraged recapitalizations

Information or signalling effects

Repurchase dissident shares

Removing cash without generating expectations for future

distributions

Take the firm private.

Disadvantages of Share Repurchases

they are usually done on an irregular basis, so a

shareholder cannot depend on income from this

source.

if regular repurchases are made, there is a good

chance that Revenue Canada will rule that the

repurchases were simply a tax avoidance scheme

(to avoid tax on dividends) and will assess tax

there may be some agency problems - if managers

have inside information, they are purchasing from

shareholders at a price less than the intrinsic

value of the shares.

Methods of Share Repurchases

tender offer:

this is a formal offer to purchase a given number of shares at a given

price over current market price.

open market purchase:

the purchase of shares through an investment dealer like any other

investor

this is not designed for large block purchases.

private negotiation with major shareholders

In any repurchase program, the securities commission requires

disclosure of the event as well as all other material information

through a prospectus.

Repurchase Example

Current EPS

= [total earnings] / [# of shares] = $4.4 m / 1.1 m =

$4.00

Current P/E ratio

= $20 / $4 = 5X

EPS after repurchase of 100,000 shares

= $4.4 m / 1.0 = $4.40

Expected market price after repurchase:

= [p/e][EPS

new

] = [5][$4.40] = $22.00 per share

Effects of A Share Repurchase

EPS should increase following the repurchase if

earnings after-tax remains the same

a higher market price per outstanding share of

common stock should result

stockholders not selling their shares back to the firm

will enjoy a capital gain if the repurchase increases

the stock price.

Advantages of Share Repurchases

signal positive information about the firms future

cash flows

used to effect a large-scale change in the firms capital

structure

increase investors return without creating an

expectation of higher future cash dividends

reduce future cash dividend requirements or increase

cash dividends per share on the remaining shares,

without creating a continuing incremental cash drain

capital gains treated more favourably than cash

dividends for tax purposes.

Disadvantages of Share Repurchases

signal negative information about the firms future

growth and investment opportunities

the provincial securities commission may raise

questions about the intention

share repurchase may not qualify the investor for a

capital gain

Borrowing to Pay Dividends

Is this legal? is it possible to do?

Yes

the firm must have the ability and capacity to borrow

the firm must have sufficient retained earnings to allow it to

pay the dividend

the firm must have sufficient cash on hand to pay the cash

dividend

the firm must NOT have agreed to any limitations on the

payment of dividends under the bond indenture.

Why?

A possible answer is to signal to the market that the board is

confident about the firms ability to sustain cash dividends into

the future.

CHAPTER 22 Dividend Policy

22 - 59

Assets: Liabilities:

Cash 10 Long-term Debt 0

Fixed Assets 140 Common Stock 50

Retained Earnings 100

Total Assets $150 Total Claims $150

After Borrowingbefore cash dividend:

Assets: Liabilities:

Cash 60 Long-term Debt 50

Fixed Assets 140 Common Stock 50

Retained Earnings 100

Total Assets $200 Total Claims $200

Before Borrowing:

0% Debt

25% Debt

Borrowing to Pay Dividends

An Example

CHAPTER 22 Dividend Policy

22 - 60

Assets: Liabilities:

Cash 60 Current liabilities 50

Fixed Assets 140 Long-term Debt 50

Common Shares 50

Retained earnings 50

Total Assets $200 Total Claims $200

After Cash Dividend payment of $50

Assets: Liabilities:

Cash 10 Long-term Debt 50

Fixed Assets 140 Common Stock 50

Retained earnings 50

Total Assets $150 Total Claims $150

After Dividend Declarationbefore date of payment.

50% Debt

33% Debt

Borrowing to Pay Dividends

An Example

The foregoing example illustrates:

it is possible for a firm with borrowing capacity to borrow funds

to pay cash dividends.

this is not possible if the lenders insist on restrictive covenants that

limit or prevent this from occurring.

the cash for the dividend must be present in the cash account.

payment of dividends reduces both the cash account on the asset

side of the balance sheet as well as the retained earnings account

on the claims side of the balance sheet.

in the absence of restrictions, it is possible to transfer wealth from

the bondholders to the stockholders. (Bondholders in this example

may have thought their firm would have only a 25% debt ratio.after the

dividend the debt ratio rose to 33% and the equity cusion dropped from

75% to 66%.)

Borrowing to Pay Dividends

An Example

Summary and Conclusions

In this chapter you have learned:

About the different types of dividends including, regular and special

cash dividends, stock dividends, and share repurchases.

M&Ms dividend irrelevance argument and the real world factors

such as transactions costs, taxes, clientele effects and signalling tend

to favour real-world dividend relevance

Tax motives and other reasons explain why firms might want to

repurchase their shares.

Concept Review Questions

Define four important dates that arise with

respect to dividend payments.

Past year Qs

Leasing

Types of Leases

The Basics

A lease is a contractual agreement between a lessee and

lessor.

The agreement establishes that the lessee has the right to use

an asset and in return must make periodic payments to the

lessor.

The lessor is either the assets manufacturer or an

independent leasing company.

Operating Leases

Usually not fully amortized. This means that the

payments required under the terms of the lease are not

enough to recover the full cost of the asset for the

lessor.

Usually require the lessor to maintain and insure the

asset.

Lessee enjoys a cancellation option. This option gives

the lessee the right to cancel the lease contract before

the expiration date.

Financial Leases

The exact opposite of an operating lease.

1. Do not provide for maintenance or service by the lessor.

2. Financial leases are fully amortized.

3. The lessee usually has a right to renew the lease at expiry.

4. Generally, financial leases cannot be cancelled, i.e., the

lessee must make all payments or face the risk of

bankruptcy.

Sale and Lease-Back

A particular type of financial lease.

Occurs when a company sells an asset it already owns

to another firm and immediately leases it from them.

Two sets of cash flows occur:

The lessee receives cash today from the sale.

The lessee agrees to make periodic lease payments, thereby

retaining the use of the asset.

Leveraged Leases

A leveraged lease is another type of financial lease.

A three-sided arrangement between the lessee, the

lessor, and lenders.

The lessor owns the asset and for a fee allows the lessee to

use the asset.

The lessor borrows to partially finance the asset.

The lenders typically use a nonrecourse loan. This means that

the lessor is not obligated to the lender in case of a default by

the lessee.

Accounting and Leasing

In the old days, leases led to off-balance-sheet

financing.

In 1979, the Canadian Institute of Chartered

Accountants implemented new rules for lease

accounting according to which financial leases must be

capitalized.

Capital leases appear on the balance sheetthe present

value of the lease payments appears on both sides.

Accounting and Leasing

Balance Sheet

Truck is purchased with debt

Truck $100,000 Debt $100,000

Land $100,000 Equity $100,000

Total Assets $200,000 Total Debt & Equity $200,000

Operating Lease

Truck Debt

Land $100,000 Equity $100,000

Total Assets $100,000 Total Debt & Equity $100,000

Capital Lease

Assets leased $100,000 Obligations under capital lease $100,000

Land $100,000 Equity $100,000

Total Assets $200,000 Total Debt & Equity $200,000

Capital Lease

A lease must be capitalized if any one of the following is met:

The present value of the lease payments is at least 90-percent

of the fair market value of the asset at the start of the lease.

The lease transfers ownership of the property to the lessee by

the end of the term of the lease.

The lease term is 75-percent or more of the estimated

economic life of the asset.

The lessee can buy the asset at a bargain price at expiry.

Taxes and Leases

The principal benefit of long-term leasing is tax reduction.

Leasing allows the transfer of tax benefits from those who need

equipment but cannot take full advantage of the tax benefits of

ownership to a party who can.

If the CCRA (Canada Customs and Revenue Agency) detects

one or more of the following, the lease will be disallowed.

1. The lessee automatically acquires title to the property after

payment of a specified amount in the form of rentals.

2. The lessee is required to buy the property from the lessor.

3. The lessee has the right during the lease to acquire the property

at a price less than fair market value.

The Cash Flows of Leasing

Consider a firm, ClumZee Movers, that wishes to acquire

a delivery truck.

The truck is expected to reduce costs by $4,500 per year.

The truck costs $25,000 and has a useful life of five years.

If the firm buys the truck, they will depreciate it straight-

line to zero.

They can lease it for five years from Tiger Leasing with

an annual lease payment of $6,250.

21-74

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

The Cash Flows of Leasing

Cash Flows: Buy

Year 0 Years 1-5

Cost of truck $25,000

After-tax savings 4,500(1-.34) = $2,970

Depreciation Tax Shield 5,000(.34) = $1,700

$25,000 $4,670

Cash Flows: Lease

Year 0 Years 1-5

Lease Payments 6,250(1-.34) = $4,125

After-tax savings 4,500(1-.34) = $2,970

$1,155

Cash Flows: Leasing Instead of Buying

Year 0 Years 1-5

$25,000 $1,155 $4,670 = $5,825

21-75

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

The Cash Flows of Leasing

Cash Flows: Leasing Instead of Buying

Year 0 Years 1-5

$25,000 $1,155 $4,670 = $5,825

Cash Flows: Buying Instead of Leasing

Year 0 Years 1-5

$25,000 $4,670 $1,155 = $5,825

However we wish to conceptualize this, we need to

have an interest rate at which to discount the future

cash flows.

That rate is the after-tax rate on the firms secured

debt.

NPV Analysis of the Lease-vs.-Buy Decision

A lease payment is like the debt service on a secured bond

issued by the lessee.

In the real world, many companies discount both the

depreciation tax shields and the lease payments at the after-tax

interest rate on secured debt issued by the lessee.

The various tax shields could be riskier than lease payments for

two reasons:

1. The value of the CCA tax benefits depends on the firms ability

to generate enough taxable income.

2. The corporate tax rate may change.

21-77

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

NPV Analysis of the Lease-vs.-Buy Decision

20 . 219 $

) 05 . 1 (

825 , 5 $

000 , 25 $

5

1

t

t

NPV

20 . 219 $

) 05 . 1 (

825 , 5 $

000 , 25 $

5

1

t

t

NPV

NPV Buying Instead of Leasing

Year 0 Years 1-5

-$25,000 $4,670 $1,155 = $5,825

There is a simple method for evaluating leases: discount

all cash flows at the after-tax interest rate on secured debt

issued by the lessee. Suppose that rate is 5-percent.

NPV Leasing Instead of Buying

Year 0 Years 1-5

$25,000 $1,155 $4,670 = -$5,825

Reasons for Leasing

Good Reasons

Taxes may be reduced by leasing.

The lease contract may reduce certain types of uncertainty.

Transactions costs can be higher for buying an asset and

financing it with debt or equity than for leasing the asset.

Bad Reasons

Leasing and accounting income

100% financing

Summary and Conclusions

There are three ways to value a lease.

1. Use the real-world convention of discounting the

incremental after-tax cash flows at the lessors after-tax rate

on secured debt.

2. Calculate the increase in debt capacity by discounting the

difference between the cash flows of the purchase and the

cash flows of the lease by the after-tax interest rate. The

increase in debt capacity from a purchase is compared to the

extra outflow at year 0 from a purchase.

3. Use APV (presented in the appendix to this chapter).

They all yield the same answer.

The easiest way is the least intuitive.

Capital Structure

capital structure refers to the way a corporation finances its assets

through some combination of equity, debt, or hybrid securities.

A firm's capital structure is then the composition or 'structure' of its

liabilities.

In reality, capital structure may be highly complex and include

dozens of sources.

An optimal capital structure: maximizes the value of the firm.

The impact of capital structure on value depends upon the effect of

debt on:

WACC

FCF

Modigliani-Miller theorem,

The theorem states that, in a perfect market, how a

firm is financed is irrelevant to its value.

perfect capital market;

-no transaction or bankruptcy costs;

-perfect information

- firms and individuals can borrow at the same

interest rate;

-no taxes;

-and investment decisions are not affected by

financing decisions.

Capital structure in the real world

The theories below try to address some of these

imperfections, by relaxing assumptions made in the

M&M model.

1. Trade-off theory - bankruptcy cost Vs. Tax benefit but it

(doesn't explain differences within the same industry).

2. Pecking order theory -companies prioritize their sources

of financing (from internal financing to equity) / costs of

asymmetric information

3. Agency Costs - Underinvestment problem / Free cash

flow management issues

Capital structure Ratios

Capital structure ratios compare a company's debt and

its equity.

Debt and equity are the two methods companies acquire

capital. Debt refers to money borrowed, while equity

refers to money invested or earned.

Financial ratios that measure capital structure include

the debt-to-equity ratio

the ratio of fixed assets to long-term liabilities.

Gearing ratio

EPS and PE ratio

Capital gearing ratio = (Capital Bearing Risk) : (Capital

not bearing risk)

Factors to be considered

Debt ratios of other firms in the industry.

Pro forma coverage ratios at different capital

structures under different economic scenarios.

Lender and rating agency attitudes

(impact on bond ratings).

Reserve borrowing capacity.

Effects on control.

Type of assets: Are they tangible, and hence suitable

as collateral?

Tax rates.

why investors

should establish

portfolios

This is neatly captured

in the old saying dont

put all your eggs in one

basket.

The logic

The logic is that an investor who puts all of their

funds into one investment risks everything on the

performance of that individual investment. A wiser

policy would be to spread the funds over several

investments (establish a portfolio) so that the

unexpected losses from one investment maybe offset

to some extent by the unexpected gains from

another.

EXPECTED RETURN

Investors receive their returns from shares in the

form of dividends and capital gains/ losses.

formula

The formula for calculating the annual return on a

share is:

Annual return = D 1 + (P1 - P 0)/P0

where:

D1 = dividend per share

P1 = share price at the end of a year

P0 = share price at the start of a year.

Example

Suppose that a dividend of 5p per share was paid

during the year on a share whose value was 100p at

the start of the year and 117p at the end of the year:

Annual return =

5 + (117 - 100)/100 100 = 22%

dividend yield and capital gain

The total return is made up of a 5% dividend yield and a

17% capital gain. We have just calculated a historical return,

on the basis that the dividend income and the price at the

end of year one is known .

The future expected return

Calculating the future expected return is a lot more

difficult because we will need to estimate both next

year s dividend and the share price in one year s

time. Analysts normally consider the different

possible returns in alternate market conditions and

try and assign a probability to each.

Example 1 shows the calculation of the

expected return for A plc.

The current share price of A plc is 100p and the

estimated returns for next year are shown .

The investment in A plc is risky.

Risk refers to the possibility of the actual return

varying from the expected return, ie the actual return

may be 30% or 10% as opposed to the expected

return of 20%.

Required return

The required return consists of two elements,

which are:

Required return = Risk-free return + Risk premium

Risk-free return

The risk-free return is the return required by

investors to compensate them for investing in a risk-

free investment.

The risk-free return compensates investors for

inflation and consumption preference, ie the fact

that they are deprived from using their funds while

tied up in the investment.

The return on treasury bills is often used as a

surrogate for the risk-free rate.

Risk premium

Risk simply means that the future actual return may

vary from the expected return.

If an investor undertakes a risky investment he

needs to receive a return greater than the risk-free

rate in order to compensate him.

The more risky the investment the greater the

compensation required.

This is not surprising and it is what we would expect

from risk averse investors.

The Barclay Capital Equity Gilt Study 2003

The Barclay Capital Study calculated the average

return on treasury bills in the UK from 1900 to 2002

as approximately 6%.

It also calculated that the average return on the UK

stock market over this period was 11%.

Thus if an investor had invested in shares that had

the same level of risk as the market, he would have to

receive an extra 5% of return to compensate for the

market risk.

Thus 5% is the historical average risk in the UK.

The required return calculation

Suppose that Joe, the investor believes that the

shares in A plc are twice as risky as the market and

that the use of long-term averages are valid.

Calculate the required return

The required return may be calculated as follows:

Required return of A plc = Risk free + Risk premium

16% = 6% + (5% 2)

Thus 16% is the return that Joe requires to

compensate for the perceived level of risk in A plc,

i.e. it is the discount rate that he will use to appraise

an investment in A plc.

THE NPV CALCULATION

Suppose that Joe is considering investing 100 in A

plc with the intention of selling the shares at the end

of the first year.

Assume that the expected return will be 20% at the

end of the first year.

Given that Joe requires a return of 16% should he

invest?

THE NPV CALCULATION

Cash flows year 0 (100), year end 120

Discount factor 16%, year 0 = 1, year 1= 0.862

(100) 103

NPV=3

Decision criteria:

accept if the NPV is zero or positive.

The NPV is positive, thus Joe should invest.

A positive NPV opportunity is where the expected return

more than compensates the investor for the perceived

level of risk, i.e. the expected return of 20% is greater

than the required return of 16%.

An NPV calculation compares the expected and required

returns in absolute terms.

Calculation of the risk premium

Calculating the risk premium is the essential

component of the discount rate.

This in turn makes the NPV calculation possible.

To calculate the risk premium, we need to be able to

define and measure risk.

THE STUDY OF RISK

The definition of risk that is often used in finance

literature is based on the variability of the actual

return from the expected return.

Statistical measures of variability are the variance

and the standard deviation (the square root of the

variance).

The variance and standard deviation of the returns.

Example 1 - A plc,

Market conditions [Actual return Probability expected return]2

Boom [30 - 20]2 0.1 10

Normal [20 - 20]2 0.8 0

Recession [10 - 20]2 0.1 10

Variance 2 20

Standard deviation = 4.47

The variance

The variance of return is the weighted sum of

squared deviations from the expected return.

The reason for squaring the deviations is to ensure

that both positive and negative deviations contribute

equally to the measure of variability.

Thus the variance represents rates of return

squared.

The standard deviation

Standard deviation is the square root of the variance,

its units are in rates of return.

As it is easier to discuss risk as a percentage rate of

return, the standard deviation is more commonly

used to measure risk.

A choice of investing in either A plc or Z plc,

Shares in Z plc have the following returns and

associated probabilities:

Probability Return %

0.1 35

0.8 20

0.1 5

A choice of investing in either A plc or Z plc,

Let us then assume that there is a choice of investing

in either A plc or Z plc, which one should we choose?

To compare A plc and Z plc, the expected return and

the standard deviation of the returns for Z plc will

have to be calculated.

Calculation

The expected return is: (0.1) (35%) + (0.8)(20%) +

(0.1) (5%) = 20%

The variance is: = 2, z = (0.1) (35% - 20%)2 + (0.8)

(20% - 20%)2 + (0.1) (5% - 20%)2 = 45%

The standard deviation is: = z = 6.71%

Summary table

Investment Expected return Standard deviation

A plc 20% 4.47%

Z plc 20% 6.71%

Given that the expected return is the same for both

companies, investors will opt for the one that has the

lowest risk, ie A plc.

The decision

The decision is equally clear where an investment gives

the highest expected return for a given level of risk.

However, these only relate to specific instances where the

investments being compared either have the same

expected return or the same standard deviation.

Where investments have increasing levels of return

accompanied by increasing levels of standard deviation,

then the choice between investments will be a subjective

decision based on the investor s attitude to risk.

RISK AND RETURN ON TWO-ASSET

PORTFOLIOS

So far we have confined our choice to a single

investment. Let us now assume investments

The risk-return relationship will now be measured

in terms of the portfolios expected return and the

portfolios standard deviation.

Information about four investments: A plc, B plc, C

plc, and D plc.

Assumption

Assume that our investor, Joe has decided to

construct a two-asset portfolio and that he has

already decided to invest 50% of the funds in A plc.

He is currently trying to decide which one of the

other three investments into which he will invest the

remaining 50% of his funds.

The expected return of a two-asset portfolio

The expected return of a portfolio (Rport) is simply

a weighted average of the expected returns of

the individual investments.

Return on investments (%)

Market conditions Probability A plc B plc C plc D plc

Boom 0.1 30 30 10 10

Normal 0.8 20 20 20 22.5

Recession 0.1 10 10 30 10

Expected return 20 20 20 20

Standard deviation 4.47 4.47 4.47 4.47

E.g. 3 - Return on investments (%)

Market Conditions A plc B plc Portfolio A + B

Boom 30 30 30

Normal 20 20 20

Recession 10 10 10

Portfolio Expected Return calculation

Rpor t = x.RA + (1 - x).RB

x = the proportion of funds invested in A

(1 - x) = the proportion of funds invested in B

RA + B = 0.5 20 + 0.5 20 = 20

RA + C = 0.5 20 + 0.5 20 = 20

RA + D = 0.5 20 + 0.5 20 = 20

Portfolio Expected Return

Given that the expected return is the same for all the

portfolios, Joe will opt for the portfolio that has the

lowest risk as measured by the portfolios standard

deviation.

The standard deviation of a two-asset portfolio

We can see that the standard deviation of all the

individual investments is 4.47%.

Intuitively, we probably feel that it does not matter

which portfolio Joe chooses, as the standard

deviation of the portfolios should be the same

(because the standard deviations of the individual

investments are all the same).

The standard deviation of a two-asset portfolio

However, the above analysis is flawed, as the

standard deviation of a portfolio is not simply the

weighted average of the standard deviation of

returns of the individual investments but is generally

less than the weighted average.

So what causes this reduction of risk?

What is the missing factor?

The missing factor is how the returns of the two

investments co-relate or co-vary, i.e. move up or

down together. There are two ways to measure co

variability.

The first method is called the covariance and the second

method is called the correlation coefficient.

Before we perform these calculations let us review the

basic logic behind the idea that risk may be reduced

depending on how the returns on two investments co-

vary.

Portfolio A+B perfect positive correlation

The returns of A and B move in perfect lock step,

(when the return on A goes up to 30%, the return on

B also goes up to 30%, when the return on A goes

down to 10%, the return on B also goes down to

10%), ie they move in the same direction and by the

same degree.

Example 3.

This is the most basic possible example of perfect

positive correlation , where the forecast of the actual

returns are the same in all market conditions for

both investments and thus for the portfolio (as the

portfolio return is simply a weighted average).

Example 3.

Hence there is no reduction of risk. The portfolios

standard deviation under this theoretical extreme of

perfect positive correlation is a simple weighted

average of the standard deviations of the individual

investments:

por t (A,B) = 4.47 0.5 + 4.47 0.5

= 4.47

Portfolio A+C perfect negative correlation

The returns of A and C move in equal but opposite

ways (when the return on A goes up to 30%, the

return on C goes down to 10%,

when the return on A goes down to 10%, the return

on C goes up to 30%). See Example 4.

EXAMPLE 4-Return on investments (%)

Market Conditions A plc C plc Portfolio A + C

Boom 30 10 20

Normal 20 20 20

Recession 10 30 20

Portfolio A+C perfect negative correlation

This is the utopian position, i.e. where the

unexpected returns cancel out against each other

resulting in the expected return. If the forecast actual

return is the same as the expected return under all

market conditions, then the risk of the portfolio has

been reduced to zero.

This is the only situation where the portfolios

standard deviation can be calculated as follows:

port (A,C) = 4.47 0.5 - 4.47 0.5 = 0

EXAMPLE 5

Market Conditions A plc D plc Portfolio A + D

Boom 30 10 20

Normal 20 22.5 21.25

Recession 10 10 10

Market conditions

The forecast actual return is the same as the

expected return under normal market conditions and

almost the same under boom market conditions (20

v 21.25).

Therefore, we can say that the forecast actual and

expected returns are almost the same in two out of

the three conditions.

Market conditions

This compares with only one condition when there is

perfect positive correlation (no reduction of risk) and

all three conditions when there is perfect negative

correlation (where risk may be eliminated).

Therefore, when there is no correlation between the

returns on investments this results in the partial

reduction of risk.

Measuring co-variability

Co-variability can be measured in absolute terms by

the covariance or in relative terms by the correlation

coefficient.

The covariance

A positive covariance indicates that the returns move

in the same directions as in A and B.

A negative covariance indicates that the returns

move in opposite directions as in A and C.

A zero covariance indicates that the returns are

independent of each other as in A and D.

The correlation coefficient

Using the covariance formula, we can easily

determine the formula for the correlation coefficient.

A,B = Cov a,b/ab

The correlation coefficient as a relative measure of

co-variability expresses the strength of the

relationship between the returns on two

investments.

It is strictly limited to a range from -1 to +1. See

Example 6.

Reality

In reality, the correlation coefficient between returns

on investments tends to lie between 0 and +1.

It is the norm in a two-asset portfolio to achieve a

partial reduction of risk (the standard deviation of a

two-asset portfolio is less than the weighted average

of the standard deviation of the individual

investments).

Reality

Therefore, we will need a new formula to calculate

the risk (standard deviation of returns) on a two -

asset portfolio. The formula will obviously take into

account the risk (standard deviation of returns) of

both investments but will also need to incorporate a

measure of co-variability as this influences the level

of risk reduction .

The formulae for the standard deviation of

returns of a two-asset portfolio

Version 1

Version 2

Summary table

Investment Expected return (%) Standard deviation (%)

Port A + B 20 4.47

Port A + C 20 0.00

Port A + D 20 3.16

Summary

A + C is the most efficient portfolio as it has the

lowest level of risk for a given level of return.

Perfect negative correlation does not occur between

the returns on two investments in the real world, ie

risk cannot be eliminated, although it is useful to

know the theoretical extremes.

However, as already stated, in reality the correlation

coefficients between returns on investments tend to

lie between 0 and +1.

Investments in different industries

Indeed, the returns on investments in the same

industry tend to have a high positive correlation of

approximately 0.9, while the returns on investments

in different industries tend to have a low positive

correlation of approximately 0.2.

Thus investors have a preference to invest in

different industries thus aiming to create well

diversified portfolio, ensuring that the maximum risk

reduction effect is obtained.

Initial understanding

Based on our initial understanding of the risk-return

relationship, if investors wish to reduce their risk

they will have to accept a reduced return. However,

portfolio theory shows us that it is possible to

reduce risk without having a consequential

reduction in return.

Initial understanding

This can be proved quite easily, as a portfolios

expected return is equal to the weighted average of

the expected returns on the individual investments,

whereas a portfolios risk is less than the weighted

average of the risk of the individual investments due

to the risk reduction effect of diversification caused

by the correlation coefficient being less than +1.

By investing in just two investments we

can reduce the risk

We can see from Portfolio A + D above where the

correlation coefficient was zero, that by investing in

just two investments we can reduce the risk from

4.47% to just 3.16% (a reduction of 1.31 percentage

points).

Imagine how much risk we could have diversified

away, had we created a large portfolio of say 500

different investments or indeed 5,000 different

investments.

10 KEY POINTS TO REMEMBER

1 The expected return on a share consists of a dividend

yield and a capital gain/loss in percentage terms.

2 The required return on a risky investment consists of

the risk-free rate (which includes inflation) and a

risk premium.

3 Total risk is normally measured by the standard

deviation of returns ().

KEY POINTS TO REMEMBER

4 Portfolio theory demonstrates that it is possible to

reduce risk without having a consequential reduction

in return, i.e. the portfolios expected return is equal

to the weighted average of the expected returns on

the individual investments, while the portfolio risk is

normally less than the weighted average of the risk of

the individual investments.

KEY POINTS TO REMEMBER

5 The extent of the risk reduction is influenced by the

way the returns on the investments co-vary. Co-

variability is normally measured in the exams by the

correlation coefficient.

6 In reality, the correlation coefficient between returns

on investments tend to lie between 0 and +1. Thus

total risk can only be partially reduced, not

eliminated.

KEY POINTS TO REMEMBER

7 A portfolios total risk consists of unsystematic and

systematic risk.

However, a well-diversified portfolio only suffers

from systematic risk, as the unsystematic risk has

been diversified away.

8 An investor who holds a well-diversified portfolio

will only require a return for systematic risk. Thus

their required return consists of the risk-free rate

plus a systematic risk premium.

KEY POINTS TO REMEMBER

9 Investors who have well-diversified portfolios

dominate the market.

Thus the market only gives a return for systematic

risk.

10 The preparation of a summary table and the

identification of the most efficient portfolio (if

possible) is an essential exam skill.

Revision Investment analysis

Explain the usefulness of financial

derivatives to business organization?

What is the difference between money

market and capital market?

What is meant by market portfolio?

Define Security Market Line (SML)?

What is the advantage of using margin

facility in share trading to an investor?

Revision Exam style questions

Which security is an example of a hybrid

security?

A. Ordinary share

B. Commercial paper

C. Bond

D. Convertible share

Revision Investment analysis

The share of Medex Ltd. is currently trading at

$3.35. You expect the share price to go up to

$3.80 in the next few days.

What type of order would you give to your broker

to purchase the shares now?

A. Margin order

B. Market order

C. Stop-loss order

D. Limit order

Revision Investment analysis

Which is the definition for an optimal

portfolio?

A. The portfolio that has the lowest risk.

B. The portfolio that gives the best set of

returns.

C. The portfolio that has the best set of

returns within its specific risk level.

D. The portfolio that comprises of assets that

are risk-free.

Revision Investment analysis

Assuming a portfolio has 3 assets. How many

variances and co-variances need to be calculated

to compute the portfolio risk?

A. The number of variance is 3 and the number

of covariance is also 3.

B. The number of variance is 6 and the number

of covariance is 3.

C. The number of variance is 3 and the number of

covariance is 6.

D. The number of variance is 6 and the number

of covariance is also 6.

Revision Investment analysis

A share has a beta of 1.1. The risk-free rate is 2.5%

and the return on the market is 12%. The estimated

return for the share is 14%.

Based on the Capital Asset Pricing Model (CAPM),

what should an investor do?

A. Sell the share because the required return is

9.95%.

B. Sell the share because the required return is

16.5%.

C. Buy the share because the required return is 11.5%.

D. Buy the share because the required return is

12.95%.

Revision Investment analysis

On 13 October 2010, Mr. Aik bought 2,000

shares of Zee Ltd. (Zee) at $3 per share. He

receives a dividend of $0.06 per share on 15

December 2010 and later sold the shares for

$3.30 per share on 29 December 2010.

Based on this information, how much is the

dividend yield and capital gain of Zees

shares?

Revision Investment analysis

You have a portfolio consisting of 30% of

Share Ae and the balance in Share Be. The

beta coefficient of Share Ae and Share Be are

0.7 and 1.5 respectively. The risk-free rate is

4% and the expected market return is 12%.

What is your portfolios expected return?

Revision Investment analysis

Mr. Kasim, an investor wishes to construct a

portfolio consisting of 40% index share and

60% risk-free asset. The return on the risk-

free asset is 2% and the expected return on

the index share is 10%. If the standard

deviation of returns on the index share is 8%,

what is the expected standard deviation of

the portfolio?

VALUATION PROCESS

There are two approaches to evaluate security. They

are:

(a) Top to Bottom Approach

(b) Bottom Up Approach

Two approaches

In the Top to Bottom Approach, we begin by

analysing the economy followed by the industry and

then proceed to the firms in the industry.

In the Bottom Up Approach, analysts will try to

identify firms that are undervalued. These firms were

chosen without taking into account the economic

situation and environment.

The basic valuation model

In the basic valuation model, we will look at:

(a) the Discounted Dividend Model

(b) the Constant Growth Model

(c) the Relationship between Share Price and Growth

(d) Multistage Growth

Discounted Dividend Model

In the Discounted Dividend Model, the share price is

calculated by finding the present value of the

predicted dividend and the predicted selling price of

the share.

Constant Growth Model

If there is a rise in the dividend, the Discounted

Dividend Model (formula 5.6) will have to be

adjusted. For example, lets assume the dividend of

the company rise at a rate of 5% per year. So, if we

take 3 years ahead, the dividend will be:

D1 = 0.50(1.05) = 0.525

D2 = 0.525(1.05) = 0.55125 or 0.05(1.05)2

D3 = 0.55125 (1.05) = 0.579 or 0.05(1.05)3

Constant Growth Model

Generally, the situation above is the same as:

D1 = D0(1+g)

D2 = D1(1+g) or D0 (1+g)2

D3= D2(1+g) or D1(1+g)3

Note: g is the growth rate.

PRICE EARNING (PE) RATIO MODEL

This model is also known as the earnings multiplier

model. This is because the PE ratio is also known as

the earning multiplier

ECONOMIC ANALYSIS

The prospect and future of a firm depends on the

economic situation and business environment where

the firm operates. Sometimes, the environment plays

a great role on the performance of a firm.

In the evaluation of share prices, we have to evaluate

the following economic and industrial situations:

(a) World Environment

(b) Domestic Economy

(c) Government Policy

INDUSTRY ANALYSIS

A simple definition of industry would be where a

group of firms run the same business.

The purpose of industrial analysis is to understand

the characteristics and structure of an industry.

There is a relationship between the character and

structure of the industry with earnings that can be

generated by firms in the industry.

In addition, a good firm usually is in a healthy and

growing industry.

Sales Level and Industry Life Cycle

Competitive Structure in Industry

We can complete the industry analysis by examining

the competitive structure of an industry.

The competitive structure can give insight into the

earning of firms in the industry. The tighter the

competition, the harder it will be for firms to get or

maintain high profit.

Michael Porter, 5 forces model

COMPANY ANALYSIS

The objective of company analysis is to examine the

nature and characteristics of a company.

SWOT analysis

It also involves examining the financial affairs of that

company and determining the quality of its earnings.

Company analysis - 3 main financial statements

There are 3 main financial statements. They are:

(a) Balance Sheet which is a statement of the

companys assets, liabilities and stockholders equity.

(b) Income Statement which provide a summary of

operating results.

(c) Statement of Cash Flows which provide a summary

of cash flow and events that caused the cash position

to change.

Financial statements

To increase earnings

There are two main strategies that a company can use

in order to increase earnings.

They are:

(a) Low Cost Strategy

(b) Differentiation Strategy

Low Cost Strategy

Through this strategy the company endeavors to

increase earnings by controlling costs.

This is only done when there is no opportunity to

increase the price of the product.

Through this strategy the company will maintain its

pricing policy, being confident that customers will

not stop buying its products as it is perceived to be

different and maybe of high quality.

Differentiation Strategy

Porters Generic Strategies

Fixed Income Security

A bond is a fixed income security which promises the

investor a fixed stream of income for a specific time

period.

CHARACTERISTICS OF BONDS

Maturity Period

Maturity Value

Coupon Rates

Floating Rate

Zero-coupon Bonds

Embedded Options

A floating rate indicates that the coupon rate may

change according to the current interest rate. This

current interest rate is dependent on the state of the

economy.

Floating Rate

Embedded Options

Embedded options are specific characteristics

stipulated in the bond indentures. These

characteristics may include the option to call the

bond at an earlier date before maturity.

Another type of option is when bonds can be

converted to equity.

The latter is known as convertible bonds.

RISKS ASSOCIATED WITH BONDS

Interest Rate Risks

Reinvestment Risks

Redemption Risks (or Risk of a Call)

Default Risks

Inflation Risks

Liquidity Risks

BOND PRICING

The price/value of a bond is the present value of the

expected cash flow from the bond.

The expected cash flows are the coupon payments

and the face value.

These cash flows are then discounted at the required

rate of return. This rate of return is normally called

the yield of the bond.

Yield

This yield will depend vastly on the present market

interest rate.

The present market interest rate will consider the

risk-free rate of return and compensate its investor

for the expected inflation.

Depending on the risk structure of the bond, the

investor will also be compensated for additional risks

faced throughout the life of the bond.

These risks may include liquidity, default or call risk

which are normally specific to the security and firms.

Example

For example, a three-year RM1,000 bond with 10%

coupon rate with a yield of 8% will have a value of:

Calculate

Bond value = Present value of coupons + Present

value of face value

Yield to Maturity

The rate of return earned from investing in bonds

until the bond matures is termed as yield to

maturity. Yield to maturity is also viewed as the

promised rate of return accruing to investors.

However, investors can only expect the promised

return only if:

-the probability of the issuer defaulting in payment is

zero; and

-the bond cannot be called before maturity.

Current Yield and Holding period return

The current yield of a bond is just the coupon

payment divided by the price.

The holding period return equals income earned over

a period (including capital gains or losses) as a

percentage of the bond price at the start of the

period.

The return can be calculated for any holding period

based on the income generated over that period.

VOLATILITY IN BOND PRICES

The most important factor that influences the value

of the bond is the market interest rate, which directly

influences the yield that an investor is looking for.

Changes in this interest rate will affect the changes in

the prices of bonds referred to as the volatility of

bond prices.

Bond Prices Move Inversely with Interest

Rates

Generally, the price of bonds will move counter

cyclical to the movements in interest rates. In other

words, if the price of bonds has a tendency to fall,

then it may be due to the upward movements of

interest rates in the market.

Go through the exmple.

Volatility of Bond Prices for Longer Term

Maturity Bonds

Bonds with longer maturity periods, experience a

more volatile price movement.

Table 7.1 shows that the rate of change in price is

higher for a ten-year bond compared to a one-year

bond.

Observe also that the rate of change in price reduces

at a decreasing rate as the maturity period increases

given the same level of interest rate.

Modified Duration

Modified duration is used to estimate the sensitivity

of bond price as a result of a change in interest rates.

It is calculated as:

Use the formula

Where D* is the Macaulay Duration, i is the yield and

n is the number of times the coupon rate is paid in a

year.

If a bond is sold at RM1,000, and has Macaulay Duration

of 5 years with a yield of 8% and pays the coupon twice in

a year.

Calculate the modified duration.

Macaulay duration, named for Frederick Macaulay who

introduced the concept, is the weighted average maturity

of a bond

Modified Duration = Macaulay Duration /( 1 + y/n),

where y = yield to maturity and n = number of

discounting periods in year ( 2 for semi - ann pay bonds )

BOND PORTFOLIO MANAGEMENT

Investors can put their money in more than one

bond to create a bond portfolio.

There are two types of management strategies

namely the passive and active.

a) Passive Strategy;

-Buy and Hold Strategy

-Index Strategy

b) Active Strategy

Active Strategy

There are 4 sources of active management strategies

namely:

i) Interest Rates Forecasting

ii) Choosing a Sector

iii) Movements Between Sector

iv) Choosing a Wrongly Priced Bond

Active Bond Management

In an active bond portfolio management, there is

always a need to change the portfolio of bonds. A

bond manager may have to switch from one sector to

another, or from one bond to another. Sometimes

there is no need to actually buy and sell bonds.

Instead the manager can just enter a swap.

A swap is an exchange between one bond with

another.

Go through the examples of swap

Liability Funding Strategy

Apart from maximising profits given a specific level

of risk, investments in bonds provide a buffer against

contingent claims.

An insurance company for example, receiving

premiums must be able to pay its customers claims

at the end of the life of the insurance. This does not

include any unexpected claims made by the clients.

Derivatives

This topic explains derivative securities: forward contracts,

futures, and both call and put options.

Among the most innovative and most rapidly growing

markets to be developed in recent years are the markets for

financial futures and options. This is known as Derivative

market.

Futures and options trading are designed to protect the

investor against interest rate risks, exchange rate risks and

price risks.

A derivative security is a financial contract written on an

underlying asset.

The underlying asset

The underlying asset may be a share, Treasury Bill,

foreign currency or even another derivative security.

Go through the examples

Two types of derivative security, futures and options

are actively traded on organized exchanges.

These contracts are standardized with regard to

description of the underlying asset, the right of the

owner, and the maturity date.

Not standardized contracts

Forward contracts, on the other hand, are not

standardized; each contract is customized to its

owner, and they are traded in what is called the

inter-bank market.

Options can be found embedded in other securities,

convertible bonds and extendible bonds being two

such examples.

A convertible bond contains a provision that gives an

option to convert the security into common share. As

extendible bond contains a provision that gives an

option to extend the maturity of the bond.

A forward contract and A futures contract

A forward contract is an agreement to buy or sell a

specified quantity of asset at a specified price, with

delivery at a specified time and place.

A futures contract is an agreement to buy or sell a

specified quantity of an asset at a specified price, and

at a specified time and place.

This part of the definition of a futures contract is

identical to that of a forward contract. But futures

contracts differ from forward contracts in four

important ways.

The differences are

(a) Futures contracts allow participants to realise

gains or losses on a daily basis, while forward

contracts are cash settled only at delivery.

(b) Futures contracts are standardised with respect

to the quality and the quantity of the asset

underlying the contract, the delivery date or period,

and the delivery place if there is physical delivery. In

contrast, forward contracts are customised on all

these dimensions to meet the needs of the two

counterparties.

The differences are

Futures contracts are settled through a clearing

house. The clearing house acts as a middleman. This

minimises credit risk as the second party to a futures

contract is always the clearing house.

Futures markets are regulated, while forward

contracts are unregulated.

Now lets look at an example of a futures contract.

Clearing House

This intervention of the clearing house means that

the futures market has no counterparty risk.

If A plans to buy futures and B plans to sell futures,

both parties will refer to the clearing house to fulfil

their intentions. The clearing house is thus the

counter party to every contract.

In this case, B is not the counter party to A.

Settlement Price

A futures contract is marked-to-market each day.

When each trading is closed, the exchange will

establish the closing price, which is the settlement

price.

This settlement price is used to compute the

investors position, whether a loss or a gain

compared to the initial settlement price agreed upon

at the inception of the contract.

Daily Margin

When a person enters into a futures contract, the

individual is required to deposit funds in an account with

the broker.

This account is called the margin account.

The exchange sets the minimum amount of margin

required, but brokers can increase the margin if they feel

that the risk of the investors default is increased.

This margin account may earn interest or may not earn

interest.

The economic role of the margin account is to act as

collateral to minimise the risk of default by either party

in the futures contract.

Basis

The difference between the futures price and the spot

price is known as the basis.

Basis t = F(t, T) -S(t).

Basis with respect to maturity

Using Futures for Hedging

Futures are usually used to hedge our investment or

lock the price of the underlying asset.

Thus with hedging, we can construct a portfolio