Professional Documents

Culture Documents

Risk & Return An Overview of Capital Market Theory

Uploaded by

Vaishnav KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk & Return An Overview of Capital Market Theory

Uploaded by

Vaishnav KumarCopyright:

Available Formats

RISK AND RETURN: AN OVERVIEW

OF CAPITAL MARKET THEORY

By

Vaishnav Kumar

vaishnav@marcbschool.com

LEARNING OBJECTIVES

Discuss the concepts of average and expected rates of

return.

Define and measure risk for individual assets.

Show the steps in the calculation of standard deviation

and variance of returns.

Explain the concept of normal distribution and the

importance of standard deviation.

Compute historical average return of securities and

market premium.

Determine the relationship between risk and return.

Highlight the difference between relevant and

irrelevant risks.

2

Return on a Single Asset

Total return = Dividend + Capital gain

3

( )

1 1 0

1 0 1

1

0 0 0

Rate of return Dividend yield Capital gain yield

DIV

DIV

P P

P P

R

P P P

= +

+

= + =

Return on a Single Asset

21.84

36.99

-6.73

10.81

-16.43

15.65

-27.45

40.94

12.83

2.93

-40

-30

-20

-10

0

10

20

30

40

50

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

Year

T

o

t

a

l

R

e

t

u

r

n

(

%

)

4

Year-to-Year Total Returns on HUL Share

Average Rate of Return

The average rate of return is the sum of the various one-period rates of

return divided by the number of period.

Formula for the average rate of return is as follows:

5

1 2

=1

1 1

= [ ]

n

n t

t

R R R R R

n n

+ + + =

Risk of Rates of Return: Variance and

Standard Deviation

Formulae for calculating variance and standard deviation:

6

Standard deviation = Variance

( )

2

2

1

1

1

n

t

t

Variance R R

n

o

=

= =

7

Investment Worth of Different

Portfolios, 1980-81 to 200708

8

HISTORICAL CAPITAL MARKET RETURNS

Year-by-

Year

Returns

in India:

1981-2008

Averages and Standard Deviations,

198081 to 200708

9

*Relative to 91-Days T-bills.

Historical Risk Premium

The 28-year average return on the stock market is higher

by about 15 per cent in comparison with the average

return on 91-day T-bills.

The 28-year average return on the stock market is higher

by about 12 per cent in comparison with the average

return on the long-term government bonds.

This excess return is a compensation for the higher risk

of the return on the stock market; it is commonly

referred to as risk premium.

10

11

The expected rate of return [E (R)] is the sum of the product of each

outcome (return) and its associated probability:

Expected Return : Incorporating

Probabilities in Estimates

Rates of Returns Under Various Economic Conditions

Returns and Probabilities

Cont

The following formula can be used to calculate the variance of returns:

12

( ) ( ) ( )

( )

2 2 2 2

1 1 2 2

2

1

...

n n

n

i i

i

R E R P R E R P R E R P

R E R P

o

=

( ( (

= + + +

(

=

Example

13

Expected Risk and Preference

A risk-averse investor will choose among investments

with the equal rates of return, the investment with

lowest standard deviation and among investments with

equal risk she would prefer the one with higher return.

A risk-neutral investor does not consider risk, and

would always prefer investments with higher returns.

A risk-seeking investor likes investments with higher

risk irrespective of the rates of return. In reality, most

(if not all) investors are risk-averse.

14

Risk preferences

15

Normal Distribution and Standard Deviation

In explaining the risk-return relationship, we assume that returns are

normally distributed.

The spread of the normal distribution is characterized by the standard

deviation.

Normal distribution is a population-based, theoretical distribution.

16

17

Normal distribution

Properties of a Normal Distribution

The area under the curve sums to1.

The curve reaches its maximum at the expected value

(mean) of the distribution and one-half of the area lies

on either side of the mean.

Approximately 50 per cent of the area lies within

0.67 standard deviations of the expected value; about

68 per cent of the area lies within 1.0 standard

deviations of the expected value; 95 per cent of the

area lies within 1.96 standard deviation of the

expected value and 99 per cent of the area lies within

3.0 standard deviations of the expected value.

18

Probability of Expected Returns

The normal probability table, can be used to

determine the area under the normal curve for various

standard deviations.

The distribution tabulated is a normal distribution with

mean zero and standard deviation of 1. Such a

distribution is known as a standard normal

distribution.

Any normal distribution can be standardised and hence

the table of normal probabilities will serve for any

normal distribution. The formula to standardise is:

S =

19

( ) R E R -

s

Example

An asset has an expected return of 29.32 per cent and the

standard deviation of the possible returns is 13.52 per cent.

To find the probability that the return of the asset will be zero or

less, we can divide the difference between zero and the expected

value of the return by standard deviation of possible net present

value as follows:

S = = 2.17

The probability of being less than 2.17 standard deviations from

the expected value, according to the normal probability

distribution table is 0.015. This means that there is 0.015 or 1.5%

probability that the return of the asset will be zero or less.

20

0 29.32

13.52

-

You might also like

- Principles of ReconciliationDocument4 pagesPrinciples of ReconciliationFrank KaufmannNo ratings yet

- Reflection For Preparation ProcessDocument2 pagesReflection For Preparation Processapi-286606031No ratings yet

- ActivityDocument3 pagesActivityUnamadable UnleomarableNo ratings yet

- Descriptive EssayDocument3 pagesDescriptive EssayslightlyasleepNo ratings yet

- Lab ReportDocument5 pagesLab ReportSamantha SpalittaNo ratings yet

- Biol Activity 5 Word2003Document16 pagesBiol Activity 5 Word2003Faith Jessica ParanNo ratings yet

- Accounting PrinciplesDocument12 pagesAccounting Principlesneotrinity13No ratings yet

- Decision AnalysisDocument5 pagesDecision AnalysisKamran AhmedNo ratings yet

- Diffusion LabDocument11 pagesDiffusion Labapi-319818745No ratings yet

- Introduction To CreditDocument3 pagesIntroduction To Creditapi-254111572No ratings yet

- Importance of Good GovernanceDocument3 pagesImportance of Good Governanceedgar_moratinNo ratings yet

- 2nd Year Reviewer Midterms (Compatibility)Document11 pages2nd Year Reviewer Midterms (Compatibility)Louie De La Torre0% (1)

- Working Capital Adjustments Under Transfer PricingDocument9 pagesWorking Capital Adjustments Under Transfer PricingTaxpert Professionals Private LimitedNo ratings yet

- Exchange Rate RiskDocument30 pagesExchange Rate RiskPallabi DowarahNo ratings yet

- Investment and Portfolio Chapter 4Document48 pagesInvestment and Portfolio Chapter 4MarjonNo ratings yet

- Risk and Return and Capm: Mba 2 Lecturer SeriesDocument32 pagesRisk and Return and Capm: Mba 2 Lecturer SeriesOKELLONo ratings yet

- Prelim - GGSR.Document2 pagesPrelim - GGSR.Mark RevarezNo ratings yet

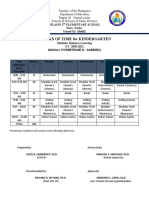

- Blocks of Time Kindergarten - CorinthianDocument1 pageBlocks of Time Kindergarten - CorinthiancorinthianNo ratings yet

- Concept of RiskDocument40 pagesConcept of Riskemba2015No ratings yet

- Financial Accounting and Reporting 1 SyllabusDocument10 pagesFinancial Accounting and Reporting 1 Syllabusshelou_domantayNo ratings yet

- Accounting Problems and SolutionsDocument3 pagesAccounting Problems and SolutionsKavitha Ragupathy100% (1)

- Financial ForecastingDocument15 pagesFinancial ForecastingjugnuNo ratings yet

- Bonds CH08Document16 pagesBonds CH08Hendrickson Cruz SaludNo ratings yet

- 03-IAS 8 Accounting Policies, Changes in Estimates and Correction of ErrorsDocument20 pages03-IAS 8 Accounting Policies, Changes in Estimates and Correction of Errorsrfhunxaie100% (2)

- Name: Hazylle Raven Rose M. Pinto Course and Section: BS PSYCH 1-1Document3 pagesName: Hazylle Raven Rose M. Pinto Course and Section: BS PSYCH 1-1Jasmine TagubaNo ratings yet

- Consumption Function: "Consumption Is The Sole End and Purpose of All Production." Adam SmithDocument28 pagesConsumption Function: "Consumption Is The Sole End and Purpose of All Production." Adam SmithPooja SheoranNo ratings yet

- Bicol State College of Applied Sciences and Technology: Republic of The Philippines City of NagaDocument15 pagesBicol State College of Applied Sciences and Technology: Republic of The Philippines City of NagaMaryknoll NituraNo ratings yet

- Payroll 2005Document20 pagesPayroll 2005api-3740993No ratings yet

- Decision Tree Analysis for Business DecisionsDocument16 pagesDecision Tree Analysis for Business DecisionsAndri GintingNo ratings yet

- Engineering Economy-Cost Break Even and Present Economy StudiesDocument33 pagesEngineering Economy-Cost Break Even and Present Economy StudiesOğulcan Aytaç0% (1)

- True/False: Chapter 11 The Cost of Capital 181Document44 pagesTrue/False: Chapter 11 The Cost of Capital 181Rudford GectoNo ratings yet

- Topic2 Risk and ReturnDocument21 pagesTopic2 Risk and ReturnMirza VejzagicNo ratings yet

- CPA Review Financial AccountingDocument5 pagesCPA Review Financial AccountingSharmaine Diane N. CalvaNo ratings yet

- All Subj Board Exam Picpa Ee PDF FreeDocument9 pagesAll Subj Board Exam Picpa Ee PDF FreeannyeongchinguNo ratings yet

- Unit 3 Accounting For Division of Profits & LossesDocument8 pagesUnit 3 Accounting For Division of Profits & LossesIsha Aguilar100% (1)

- Financial ManagementDocument85 pagesFinancial ManagementRajesh MgNo ratings yet

- Cap BudDocument29 pagesCap BudJorelyn Joy Balbaloza CandoyNo ratings yet

- Security Analysis - IntroductionDocument20 pagesSecurity Analysis - IntroductionAnanya Ghosh100% (1)

- Activity 8 Financial Market Is LM GarcesleeyasonDocument14 pagesActivity 8 Financial Market Is LM GarcesleeyasonCheska Lee100% (1)

- NSTP-CWTS Lesson 1Document83 pagesNSTP-CWTS Lesson 1Rose le Folloso0% (1)

- F.M Chapter 1 PDFDocument10 pagesF.M Chapter 1 PDFpettgreentteaNo ratings yet

- Chap 3 Fixed Income SecuritiesDocument45 pagesChap 3 Fixed Income SecuritiesHABTAMU TULU0% (1)

- Role of Managerial Accounting in ManagementDocument4 pagesRole of Managerial Accounting in ManagementKhairul AslamNo ratings yet

- What Is A Shareholder's EquityDocument4 pagesWhat Is A Shareholder's EquityblezylNo ratings yet

- 12 x10 Financial Statement AnalysisDocument19 pages12 x10 Financial Statement AnalysisGS DmpsNo ratings yet

- Shareholders EquityDocument51 pagesShareholders EquityIsmail Hossain100% (2)

- GGSR PrelimDocument102 pagesGGSR PrelimTintin Ruiz0% (2)

- Capital Structure Theories and Their AssumptionsDocument24 pagesCapital Structure Theories and Their AssumptionsSiddharth GautamNo ratings yet

- Government Spending Theories Lecture NotesDocument6 pagesGovernment Spending Theories Lecture NotesrichelNo ratings yet

- Chapter 8Document18 pagesChapter 8Marie Sheaneth BalitangNo ratings yet

- The Financial System OverviewDocument11 pagesThe Financial System OverviewDipika TambeNo ratings yet

- Functions of Financial Management ExplainedDocument13 pagesFunctions of Financial Management ExplainedmhikeedelantarNo ratings yet

- Interest Rates and Bond ValuationDocument75 pagesInterest Rates and Bond ValuationOday Ru100% (1)

- Chapter # 06 - Cost of CapitalDocument36 pagesChapter # 06 - Cost of CapitalshakilhmNo ratings yet

- History AssignmentDocument1 pageHistory AssignmentJinky SanturiasNo ratings yet

- Overview of Valuation Concepts and MethodsDocument7 pagesOverview of Valuation Concepts and Methodsprincess mae colinaNo ratings yet

- Financial ManagementDocument4 pagesFinancial ManagementAnurag Sharma100% (10)

- What Is FinanceDocument8 pagesWhat Is FinanceGULBAZ MAHMOODNo ratings yet

- Methods of DepreciationDocument12 pagesMethods of Depreciationamun din100% (1)

- CH 04 RevisedDocument20 pagesCH 04 RevisedPrakash PandeyNo ratings yet

- Peter Drucker's Influence on Modern ManagementDocument12 pagesPeter Drucker's Influence on Modern ManagementVaishnav Kumar0% (1)

- RBI PresentationDocument21 pagesRBI PresentationVaishnav KumarNo ratings yet

- Potential For Entrepreneurship in Rural IndiaDocument12 pagesPotential For Entrepreneurship in Rural IndiaVaishnav KumarNo ratings yet

- Valuation of Bonds and SharesDocument79 pagesValuation of Bonds and SharesVaishnav KumarNo ratings yet

- Risk and Return: by Vaishnav KumarDocument67 pagesRisk and Return: by Vaishnav KumarVaishnav KumarNo ratings yet

- Concepts of Value and ReturnDocument38 pagesConcepts of Value and ReturnVaishnav KumarNo ratings yet

- Nature of Financial ManagementDocument30 pagesNature of Financial ManagementVaishnav KumarNo ratings yet

- RBI PresentationDocument21 pagesRBI PresentationVaishnav KumarNo ratings yet

- RBI PresentationDocument21 pagesRBI PresentationVaishnav KumarNo ratings yet

- Conquering Greater HeightsDocument2 pagesConquering Greater HeightspifaapNo ratings yet

- Shreve S.E. Stochastic Calculus For Finance I.. The Binomial Asset Pricing ModelDocument203 pagesShreve S.E. Stochastic Calculus For Finance I.. The Binomial Asset Pricing ModelBill100% (1)

- Vix CollectionDocument49 pagesVix Collectionfordaveb100% (1)

- Reliance Super Invest Assure Plan-V1Document24 pagesReliance Super Invest Assure Plan-V1samvats1No ratings yet

- Ma-ao Sugar Central Co. shareholders sue over alleged corporate fund misuseDocument23 pagesMa-ao Sugar Central Co. shareholders sue over alleged corporate fund misuseinno KalNo ratings yet

- Fibonacci SecretsDocument15 pagesFibonacci SecretsAlbert Mao100% (1)

- Chapter 12 Suggestions For Case Analysis: Strategic Management and Business Policy, 13e (Wheelen) - PIVDocument21 pagesChapter 12 Suggestions For Case Analysis: Strategic Management and Business Policy, 13e (Wheelen) - PIVMema SlimamNo ratings yet

- Reason For Outbound Call Manual HumanaticDocument6 pagesReason For Outbound Call Manual HumanaticJose Richard Giray100% (1)

- Secretarial Practical March 2019 STD 12th Commerce HSC Maharashtra Board Question PaperDocument2 pagesSecretarial Practical March 2019 STD 12th Commerce HSC Maharashtra Board Question PaperPratik TekawadeNo ratings yet

- 02 Accounting Study NotesDocument4 pages02 Accounting Study NotesJonas Scheck100% (2)

- 06-TRADE - CONFIRMATION-016007451-Anggita Dwihanum-20190923 PDFDocument1 page06-TRADE - CONFIRMATION-016007451-Anggita Dwihanum-20190923 PDFanggitaNo ratings yet

- Research Paper On FCIDocument12 pagesResearch Paper On FCIAnkit RastogiNo ratings yet

- TVM, Valuation, Risk and ReturnDocument23 pagesTVM, Valuation, Risk and ReturnSreenivasan PadmanabanNo ratings yet

- Walt Disney Fa Sem3Document29 pagesWalt Disney Fa Sem3Ami PatelNo ratings yet

- Banking Questions For IBPS Gr8AmbitionZDocument25 pagesBanking Questions For IBPS Gr8AmbitionZshahenaaz3No ratings yet

- Market Efficiency HypothesisDocument60 pagesMarket Efficiency HypothesiscrazydownloaderNo ratings yet

- Fast's Stock Market BluffDocument16 pagesFast's Stock Market Blufferickschonfeld100% (4)

- Forex 101Document18 pagesForex 101Geoffrey Castillon RamirezNo ratings yet

- Benefits of FDI diversification across countriesDocument8 pagesBenefits of FDI diversification across countriesALI SHER HaidriNo ratings yet

- Hlurb Buyers GuideDocument10 pagesHlurb Buyers GuideAxl PagdangananNo ratings yet

- Accelerapro CPD coursesDocument2 pagesAccelerapro CPD coursesMiecoMoralesNo ratings yet

- Mahindra Susten Private Limited Signed OffDocument53 pagesMahindra Susten Private Limited Signed OffI am whoNo ratings yet

- FAR Notes CH1: Income Statement & Balance Sheet & Discontinued Operations 1.0 (Becker 2017)Document7 pagesFAR Notes CH1: Income Statement & Balance Sheet & Discontinued Operations 1.0 (Becker 2017)charles100% (1)

- Deloitte - IFRS in Real EstateDocument13 pagesDeloitte - IFRS in Real EstateRD100% (1)

- The Following Securities Are in Pascual Company S Portfolio of L PDFDocument1 pageThe Following Securities Are in Pascual Company S Portfolio of L PDFAnbu jaromiaNo ratings yet

- Accounting For InvestmentDocument29 pagesAccounting For InvestmentSyahrul AmirulNo ratings yet

- BASELpap 52Document402 pagesBASELpap 52sdhakal89No ratings yet

- 2019 Caribbean Hospitality Financing Survey FinalDocument12 pages2019 Caribbean Hospitality Financing Survey FinalBernewsAdminNo ratings yet

- Thomas Bjork ProblemsDocument22 pagesThomas Bjork ProblemsAniruddha DuttaNo ratings yet

- Cryptocurrency Micro-Investing Platform Cred Partners With Komodo PlatformDocument3 pagesCryptocurrency Micro-Investing Platform Cred Partners With Komodo PlatformPR.comNo ratings yet