Professional Documents

Culture Documents

ch11 (1) Managerialeconomic

Uploaded by

Arif DarmawanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ch11 (1) Managerialeconomic

Uploaded by

Arif DarmawanCopyright:

Available Formats

Managerial Economics in a

Global Economy

Chapter 11

Pricing Practices

Pricing of Multiple Products

Products with Interrelated Demands

Plant Capacity Utilization and Optimal

Product Pricing

Optimal Pricing of Joint Products

Fixed Proportions

Variable Proportions

Pricing of Multiple Products

Products with Interrelated Demands

For a two-product (A and B) firm, the marginal

revenue functions of the firm are:

A B

A

A A

TR TR

MR

Q Q

A A

= +

A A

B A

B

B

TR TR

MR

QB Q

A A

= +

A A

Pricing of Multiple Products

Plant Capacity Utilization

A multi-product firm using a single plant should produce

quantities where the marginal revenue (MR

i

) from each

of its k products is equal to the marginal cost (MC) of

production.

1 2 k

MR MR MR MC = = = =

Pricing of Multiple Products

Plant Capacity Utilization

Pricing of Multiple Products

Joint Products in Fixed Proportions

Pricing of Multiple Products

Joint Products in Variable Proportions

Price Discrimination

Charging different prices for a

product when the price differences

are not justified by cost differences.

Objective of the firm is to attain

higher profits than would be available

otherwise.

Price Discrimination

1. Firm must be an imperfect

competitor (a price maker)

2. Price elasticity must differ for

units of the product sold at different

prices

3. Firm must be able to segment the

market and prevent resale of units

across market segments

First-Degree

Price Discrimination

Each unit is sold at the highest

possible price

Firm extracts all of the consumers

surplus

Firm maximizes total revenue and

profit from any quantity sold

Second-Degree

Price Discrimination

Charging a uniform price per unit for

a specific quantity, a lower price per

unit for an additional quantity, and so

on

Firm extracts part, but not all, of the

consumers surplus

First- and Second-Degree

Price Discrimination

In the absence of price discrimination, a firm

that charges $2 and sells 40 units will have

total revenue equal to $80.

First- and Second-Degree

Price Discrimination

In the absence of price discrimination, a firm

that charges $2 and sells 40 units will have

total revenue equal to $80.

Consumers will have consumers surplus

equal to $80.

First- and Second-Degree

Price Discrimination

If a firm that practices first-degree price

discrimination charges $2 and sells 40 units,

then total revenue will be equal to $160 and

consumers surplus will be zero.

First- and Second-Degree

Price Discrimination

If a firm that practices second-degree price

discrimination charges $4 per unit for the first

20 units and $2 per unit for the next 20 units,

then total revenue will be equal to $120 and

consumers surplus will be $40.

Third-Degree

Price Discrimination

Charging different prices for the

same product sold in different

markets

Firm maximizes profits by selling a

quantity on each market such that

the marginal revenue on each market

is equal to the marginal cost of

production

Third-Degree

Price Discrimination

Q

1

= 120 - 10 P

1

or P

1

= 12 - 0.1 Q

1

and MR

1

= 12 - 0.2 Q

1

Q

2

= 120 - 20 P

2

or P

2

= 6 - 0.05 Q

2

and MR

2

= 6 - 0.1 Q

2

MR

1

= MC = 2

MR

2

= MC = 2

MR

1

= 12 - 0.2 Q

1

= 2

Q

1

= 50

MR

2

= 6 - 0.1 Q

2

= 2

Q

2

= 40

P

2

= 6 - 0.05 (40) = $4 P

1

= 12 - 0.1 (50) = $7

Third-Degree

Price Discrimination

International

Price Discrimination

Persistent Dumping

Predatory Dumping

Temporary sale at or below cost

Designed to bankrupt competitors

Trade restrictions apply

Sporadic Dumping

Occasional sale of surplus output

Transfer Pricing

Pricing of intermediate products sold

by one division of a firm and

purchased by another division of the

same firm

Made necessary by decentralization

and the creation of semiautonomous

profit centers within firms

Transfer Pricing

No External Market

Transfer Price = P

t

MC of Intermediate Good = MC

p

P

t

= MC

p

Transfer Pricing

Competitive External Market

Transfer Price = P

t

MC of Intermediate Good = MC

p

P

t

= MC

p

Transfer Pricing

Imperfectly Competitive External Market

Transfer Price = P

t

= $4 External Market Price = P

e

= $6

Pricing in Practice

Cost-Plus Pricing

Markup or Full-Cost Pricing

Fully Allocated Average Cost (C)

Average variable cost at normal output

Allocated overhead

Markup on Cost (m) = (P - C)/C

Price = P = C (1 + m)

Pricing in Practice

Optimal Markup

1

1

P

MR P

E

| |

= +

|

\ .

1

P

p

E

P MR

E

| |

=

|

|

+

\ .

MR C =

1

P

p

E

P C

E

| |

=

|

|

+

\ .

Pricing in Practice

Optimal Markup

1

P

p

E

P C

E

| |

=

|

|

+

\ .

(1 ) P C m = +

(1 )

1

P

p

E

C m C

E

| |

+ =

|

|

+

\ .

1

1

P

P

E

m

E

=

+

Pricing in Practice

Incremental Analysis

A firm should take an action if the

incremental increase in revenue from

the action exceeds the incremental

increase in cost from the action.

Pricing in Practice

Two-Part Tariff

Tying

Bundling

Prestige Pricing

Price Lining

Skimming

Value Pricing

You might also like

- Ekonomi Manajerial: Dalam Perekonomian GlobalDocument30 pagesEkonomi Manajerial: Dalam Perekonomian GlobalMaryam BurhanuddinNo ratings yet

- Pricing PractiseDocument40 pagesPricing PractiseridwanNo ratings yet

- Lesson MarketDocument60 pagesLesson MarketAGRAWAL UTKARSHNo ratings yet

- ME11 - Ch. 15Document17 pagesME11 - Ch. 15Mohit GuptaNo ratings yet

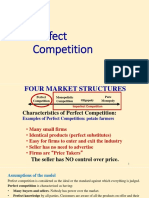

- Lecture 16 Market Structures-Perfect CompetitionDocument41 pagesLecture 16 Market Structures-Perfect CompetitionDevyansh GuptaNo ratings yet

- Monopolistic CompetitionDocument9 pagesMonopolistic Competitionpriyanka2303100% (2)

- Pricing, Competition and Market Structure BUSI 7130 / 7136Document41 pagesPricing, Competition and Market Structure BUSI 7130 / 7136palashdon6No ratings yet

- PRICING TACTICS LECTUREDocument24 pagesPRICING TACTICS LECTUREAgnes Meilina SinagaNo ratings yet

- The Second P: PRICEDocument22 pagesThe Second P: PRICEJudy Ann PrincipeNo ratings yet

- Market StructureDocument101 pagesMarket StructureManu C PillaiNo ratings yet

- Market and Pricing - Perfect Competition and MonopolyDocument35 pagesMarket and Pricing - Perfect Competition and Monopolychandel08No ratings yet

- Pricing Strategies and TacticsDocument33 pagesPricing Strategies and Tacticssathvik RekapalliNo ratings yet

- Perfect CompetitionDocument37 pagesPerfect CompetitionAastha JainNo ratings yet

- 5 MarketsDocument79 pages5 Marketsbilal12941100% (1)

- Pure CompetitionDocument9 pagesPure Competitioncindycanlas_07No ratings yet

- Perfect competition market structure analysisDocument31 pagesPerfect competition market structure analysisAnand ShindeNo ratings yet

- Chapter 10 Stud VerDocument27 pagesChapter 10 Stud VerSurya PanwarNo ratings yet

- Market PerfectDocument35 pagesMarket PerfectLoretta D'SouzaNo ratings yet

- Monopoly Oligopoly Monopolistic Competition Perfect CompetitionDocument8 pagesMonopoly Oligopoly Monopolistic Competition Perfect CompetitionDerry Mipa SalamNo ratings yet

- Perfect Competition Market StructureDocument22 pagesPerfect Competition Market StructureApurvAdarshNo ratings yet

- Lecture 11 - Price-Setting in B2B MarketsDocument36 pagesLecture 11 - Price-Setting in B2B MarketsMihaela Popazova100% (1)

- BIE201 Handout09Document11 pagesBIE201 Handout09andersonmapfirakupaNo ratings yet

- Pricing Policy of FirmsDocument11 pagesPricing Policy of FirmsNikhil RoyNo ratings yet

- MONOPOLY Market Spring 2022Document50 pagesMONOPOLY Market Spring 2022Abid SunnyNo ratings yet

- Chapter 5 - Market StructureDocument19 pagesChapter 5 - Market Structurejosephyoseph97No ratings yet

- ECO101 Perfect Competitive MarketDocument14 pagesECO101 Perfect Competitive Marketxawad13No ratings yet

- Microeconomics: Lecture 10: Profit Maximization and Competitive SupplyDocument42 pagesMicroeconomics: Lecture 10: Profit Maximization and Competitive Supplyblackhawk31No ratings yet

- 2.2. MonopolyDocument52 pages2.2. Monopolyapi-3696178100% (2)

- Chapter 9 SUMMARY SECTION CDocument4 pagesChapter 9 SUMMARY SECTION ClalesyeuxNo ratings yet

- Competition & Pure MonopolyDocument36 pagesCompetition & Pure MonopolyChadi AboukrrroumNo ratings yet

- Chapter Four: Price and Out Put Determination Under Perfect CompetitionDocument49 pagesChapter Four: Price and Out Put Determination Under Perfect Competitioneyob yohannesNo ratings yet

- Pricing PracticesDocument43 pagesPricing PracticesLeiza FroyaldeNo ratings yet

- Chap 09Document8 pagesChap 09Thabo MojavaNo ratings yet

- Maximizing Profits in Perfectly Competitive MarketsDocument4 pagesMaximizing Profits in Perfectly Competitive MarketsRodney Meg Fitz Balagtas100% (1)

- Chapter-9 Imperfect CompetitionDocument23 pagesChapter-9 Imperfect Competitiongr8_amaraNo ratings yet

- CH 12Document45 pagesCH 12billa jiNo ratings yet

- Perfect CompetitionDocument12 pagesPerfect CompetitionMikail Lee BelloNo ratings yet

- Economic Principles I: Profit Maximisation in Conditions of Perfect CompetitionDocument13 pagesEconomic Principles I: Profit Maximisation in Conditions of Perfect CompetitiondpsmafiaNo ratings yet

- ME OligopolyDocument11 pagesME OligopolyLinh PhamNo ratings yet

- Demand as Seen by a Purely Competitive SellerDocument7 pagesDemand as Seen by a Purely Competitive SellerMaria Emarla Grace CanozaNo ratings yet

- Firms in Perfectly Competitive Markets: Chapter Summary and Learning ObjectivesDocument33 pagesFirms in Perfectly Competitive Markets: Chapter Summary and Learning ObjectivesseriosulyawksomNo ratings yet

- Tutorial 8 - SchemeDocument7 pagesTutorial 8 - SchemeTeo ShengNo ratings yet

- Perfect Competition ADocument67 pagesPerfect Competition APeter MastersNo ratings yet

- Chap 6.1 (1)Document17 pagesChap 6.1 (1)Annie DuolingoNo ratings yet

- Chapter FiveDocument30 pagesChapter FiveetNo ratings yet

- Monopolistic Competition and Basic Oligopoly Models ExplainedDocument19 pagesMonopolistic Competition and Basic Oligopoly Models ExplainedCeline YapNo ratings yet

- "You Don't Sell Through Price. You Sell The Price" Price Is The Marketing-Mix Element That Produces Revenue The Others Produce CostDocument22 pages"You Don't Sell Through Price. You Sell The Price" Price Is The Marketing-Mix Element That Produces Revenue The Others Produce Cost200eduNo ratings yet

- Pure Competition in Short Run - NotesDocument6 pagesPure Competition in Short Run - Notessouhad.abouzakiNo ratings yet

- Competitive Markets and Firm BehaviorDocument13 pagesCompetitive Markets and Firm BehaviorqwertyNo ratings yet

- CHAPTER 6 - Managing in Competitive, Monopolistic, and Monopolistically Competitive Markets Learning ObjectivesDocument13 pagesCHAPTER 6 - Managing in Competitive, Monopolistic, and Monopolistically Competitive Markets Learning ObjectivesJericho James Madrigal CorpuzNo ratings yet

- How Much Must Advertising Change to Keep Sales ConstantDocument28 pagesHow Much Must Advertising Change to Keep Sales ConstantSs ArNo ratings yet

- Econ Chapter 5Document30 pagesEcon Chapter 5nunutsehaynuNo ratings yet

- Cost-Volume-Profit (CVP) Analysis: Understanding Break-Even Point, Margin of Safety and Operating LeverageDocument40 pagesCost-Volume-Profit (CVP) Analysis: Understanding Break-Even Point, Margin of Safety and Operating LeverageJeejohn Sodusta0% (1)

- Chapter 5Document53 pagesChapter 5abdi geremewNo ratings yet

- Market Structure Original Unit 3Document32 pagesMarket Structure Original Unit 3snehapriyaramamoorthyNo ratings yet

- Managerial Economics - Lecture 3Document25 pagesManagerial Economics - Lecture 3Yasser RamadanNo ratings yet

- By: Muhammad Shahid IqbalDocument24 pagesBy: Muhammad Shahid Iqbaljamshed20No ratings yet

- Pricing PracticesDocument10 pagesPricing Practicesvarunreddy.sims100% (1)

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Suyanto, BEP Consept - 30 Mei 2013Document13 pagesSuyanto, BEP Consept - 30 Mei 2013Arif DarmawanNo ratings yet

- Aviation Safety Oleh Capt Novianto HerupratomoDocument31 pagesAviation Safety Oleh Capt Novianto HerupratomoArif DarmawanNo ratings yet

- Managerial Economics in A Global Economy: Long-Run Investment Decisions: Capital BudgetingDocument16 pagesManagerial Economics in A Global Economy: Long-Run Investment Decisions: Capital BudgetingArif DarmawanNo ratings yet

- Managerial Economics in A Global Economy: Linear ProgrammingDocument18 pagesManagerial Economics in A Global Economy: Linear ProgrammingArif DarmawanNo ratings yet

- Managerial Economics in A Global Economy: Oligopoly and Strategic BehaviorDocument53 pagesManagerial Economics in A Global Economy: Oligopoly and Strategic BehaviorArif DarmawanNo ratings yet

- Managerial Economics in A Global Economy: Risk AnalysisDocument31 pagesManagerial Economics in A Global Economy: Risk AnalysisArif DarmawanNo ratings yet

- Managerial Economics in A Global Economy: Regulation and Antitrust: The Role of Government in The EconomyDocument22 pagesManagerial Economics in A Global Economy: Regulation and Antitrust: The Role of Government in The EconomyArif DarmawanNo ratings yet

- Managerial Economics in A Global Economy: Market Structure: Perfect Competition, Monopoly and Monopolistic CompetitionDocument24 pagesManagerial Economics in A Global Economy: Market Structure: Perfect Competition, Monopoly and Monopolistic CompetitionArif DarmawanNo ratings yet

- Managerial Economics in A Global Economy: Demand TheoryDocument21 pagesManagerial Economics in A Global Economy: Demand TheoryArif DarmawanNo ratings yet

- Managerial Economics in A Global Economy: Demand ForecastingDocument13 pagesManagerial Economics in A Global Economy: Demand ForecastingArif DarmawanNo ratings yet

- Managerial Economics in A Global Economy: Production Theory and EstimationDocument25 pagesManagerial Economics in A Global Economy: Production Theory and EstimationArif DarmawanNo ratings yet

- Managerial Economics in A Global Economy: Optimization Techniques and New Management ToolsDocument11 pagesManagerial Economics in A Global Economy: Optimization Techniques and New Management ToolsArif DarmawanNo ratings yet

- Managerial Economics in A Global EconomyDocument26 pagesManagerial Economics in A Global EconomyArif DarmawanNo ratings yet

- Managerial Economics in A Global Economy: Cost Theory and EstimationDocument23 pagesManagerial Economics in A Global Economy: Cost Theory and EstimationArif DarmawanNo ratings yet

- EkmanDocument11 pagesEkmanAyu Kusuma WardhaniNo ratings yet

- Ekonomi Manajerial Pada Ekonomi Global: Bab 7 Teori Dan Perkiraan HargaDocument20 pagesEkonomi Manajerial Pada Ekonomi Global: Bab 7 Teori Dan Perkiraan HargaArif DarmawanNo ratings yet

- Railway SignalingDocument10 pagesRailway SignalingArif DarmawanNo ratings yet

- OverviewDocument1 pageOverviewArif DarmawanNo ratings yet

- Ekonomi Manajerial Pada Ekonomi GlobalDocument26 pagesEkonomi Manajerial Pada Ekonomi GlobalArif DarmawanNo ratings yet

- Ekonomi Manajerial Pada Ekonomi GlobalDocument26 pagesEkonomi Manajerial Pada Ekonomi GlobalArif DarmawanNo ratings yet

- 8051 Tutorial by (Craig Steiner)Document29 pages8051 Tutorial by (Craig Steiner)Kaumudi TunuguntlaNo ratings yet

- Ekonomi Manajerial Pada Ekonomi Global: Bab 3a: Tambahan Dibalik Kurva Permintaan Pasar Teori Memilih KonsumenDocument6 pagesEkonomi Manajerial Pada Ekonomi Global: Bab 3a: Tambahan Dibalik Kurva Permintaan Pasar Teori Memilih KonsumenArif DarmawanNo ratings yet

- Ekonomi Manajerial Dalam Ekonomi Global: Bab 2 Teknik Optimalisasi Dan Perangkat Manajemen BaruDocument16 pagesEkonomi Manajerial Dalam Ekonomi Global: Bab 2 Teknik Optimalisasi Dan Perangkat Manajemen BaruArif DarmawanNo ratings yet

- Ekonomi Manajerial Pada Ekonomi GlobalDocument26 pagesEkonomi Manajerial Pada Ekonomi GlobalArif DarmawanNo ratings yet

- Leadership Workshop Report On Leadership in CrisisDocument3 pagesLeadership Workshop Report On Leadership in CrisisxyzNo ratings yet

- Brand India from Local to Global: Patanjali's Growth StrategyDocument30 pagesBrand India from Local to Global: Patanjali's Growth StrategyJay FalduNo ratings yet

- CaseDocument31 pagesCaseRamya GopinathNo ratings yet

- Fedach Global Service Orig ManualDocument64 pagesFedach Global Service Orig ManualMario ManciaNo ratings yet

- Significance of Operations Management IBS CDCDocument5 pagesSignificance of Operations Management IBS CDCManoja Anusha PatneediNo ratings yet

- The External Environment Affecting A British AirwaysDocument13 pagesThe External Environment Affecting A British Airwayskunal ladNo ratings yet

- Tata Ace AssignmentDocument5 pagesTata Ace AssignmentSatish Kumar KarnaNo ratings yet

- 5 Key Differentiators That Set Elite Companies ApartDocument24 pages5 Key Differentiators That Set Elite Companies ApartAbraham OluwatuyiNo ratings yet

- Yueyue Wang ResumeDocument2 pagesYueyue Wang Resumeapi-489269412No ratings yet

- Tabel Penelitian TerdahuluDocument3 pagesTabel Penelitian TerdahuluFachrurozie AlwieNo ratings yet

- Consumer Handbook PDFDocument69 pagesConsumer Handbook PDFGursharan SinghNo ratings yet

- Calvin KlienDocument5 pagesCalvin KlienVarun MehrotraNo ratings yet

- Siemens CaseDocument4 pagesSiemens Casespaw1108No ratings yet

- 4914 - Case Study - 1 - RPGDocument3 pages4914 - Case Study - 1 - RPGSambit Mishra100% (1)

- Kotler Krasher 2018 PDFDocument98 pagesKotler Krasher 2018 PDFRitvik YadavNo ratings yet

- Lean Manufacturing, SummaryDocument5 pagesLean Manufacturing, Summaryleonard241531No ratings yet

- Industrial Growth Pattern in IndiaDocument9 pagesIndustrial Growth Pattern in IndiaDevashree Mansukh100% (1)

- Loan approval process assessmentDocument3 pagesLoan approval process assessmentshahidjappaNo ratings yet

- Accenture Returns RepairsDocument7 pagesAccenture Returns RepairsBhairav MehtaNo ratings yet

- Supply Chain Study of Orange in JaipurDocument21 pagesSupply Chain Study of Orange in JaipurNarinder GautamNo ratings yet

- Honda Supply TeamDocument7 pagesHonda Supply TeamGermán MariacaNo ratings yet

- ExamplesDocument5 pagesExamplesAstraea KimNo ratings yet

- Pershing Square LowesDocument23 pagesPershing Square Lowesnothanks213No ratings yet

- MKT243 Tutorial Chapter 3Document3 pagesMKT243 Tutorial Chapter 3muhammad nurNo ratings yet

- MilmaDocument28 pagesMilmaaks16_201467% (3)

- Nike Air Force 1 Creative BriefDocument13 pagesNike Air Force 1 Creative BriefMisho MusaNo ratings yet

- Kroger Vendor General Parcel Air LTL TL Routing InstructionsDocument4 pagesKroger Vendor General Parcel Air LTL TL Routing InstructionsReetika ChoudharyNo ratings yet

- Case Study NJMDocument6 pagesCase Study NJMdevrahul11No ratings yet

- K ElectricsDocument17 pagesK ElectricsMahaAqeel100% (1)

- Marketing For Engineers CH 2Document80 pagesMarketing For Engineers CH 2karim kobeissiNo ratings yet