Professional Documents

Culture Documents

Sanjay Buch2013

Uploaded by

Amit GuptaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sanjay Buch2013

Uploaded by

Amit GuptaCopyright:

Available Formats

CASE STUDY

By: Sanjay Buch, Partner Crawford Bayley & Co. Advocates & Solicitors

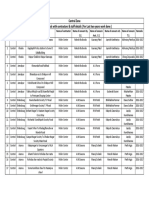

One listed and an unlisted company are considering coming together by (1) Merger, (2) Takeover of shares/control (3) sale of Business/ Assets.

(1) MERGER Implications: Stamp Duty 1. stamp duty on instruments, and not on transactions. 2. Li Taka Pharmaceuticals Ltd. vs State of Maharashtra And Other AIR (1997) Bom 7.

Listed Co.

Unlisted Co.

3. Hindustan Lever & Anr vs State of Maharashtra & Anr AIR (2004) SC 326 ,

4. Delhi Towers Limited vs GNCT of Delhi 2009,

1937 Notification, Article 23 and 62 of Indian Stamp Act, Maharashtra, Gujarat, Karnataka, Rajasthan, MP, WB state amendments;

One listed and an unlisted company are considering coming together by Merger Conti..

MERGER Implications: Companies Act, 2013

Section 230: Disclose Reduction of share capital of the Company if included in the compromise of arrangement; Details of any scheme of corporate debt restructuring (CDR) consented to by not less than seventy-five percent of the secured creditors in value including funds required post-implementation of the CDR; Attach valuation report on shares and all of the assets of the Company, disclose in the Notice explaining its effect on creditors, Key Managerial Personnel, Promoter and Non-Promoter and debenture holders and the effect of the compromise or arrangement on any material interests of the Directors; Notice of any meeting send to Central Government, Income-tax authorities, RBI, SEBI, Stock exchange, Registrar, Official Liquidator, CCI (if necessary) and any other regulator likely to be affected; Representations by them within 30 days otherwise deemed approval. Optional Postal ballot Voting allowed.

One listed and an unlisted company are considering coming together by Merger Conti..

Objection in relation to a Scheme can be raised only by persons holding not less than 10% of the shareholding; or having outstanding debt amounting to not less than 5% of the total outstanding debt as per the last audited financial statement. Treasury Shares has been done away with under the proviso to sub-section (3)(b) wherein holding of shares by the company in its own name or in trust as a result of the Scheme. Fast track merger between- holding company and its wholly owned subsidiary and two or more small companies. No approval of the Tribunal is required. (Small company= Paid-up Cap not more than 50 lakhs or Turnover not more than 2 Crore); Section 236: Exit option to Minority shareholders allowed : Majority shareholders (holding at least 90% of equity share capital) can buy at a price by Registered valuer Listed and unlisted companies all covered. Section 232 merger of listed transferor company and unlisted transferee company, the transferee company shall continue to be an unlisted company. Exit option to be given to the shareholders of the transferor company if they decide to opt out of the transferee company, wherein the exit price to be not less than the price under any SEBI regulation.

One listed and an unlisted company are considering coming together by Merger Conti..

Implications: Takeover Code/ Listing Agreement

SEBI Circular No. CIR/CFD/DIL/8/2013 dated 21st May, 2013 to clarify and relax certain issues in reference to its Circular CIR/CFD/DIL/5/2013 dated February 4, 2013 dealing with its observations on M&A Schemes; Applies where no exemption from Rule 19(2)(b) of Securities Contracts (Regulation) Rules, 1957 for listing is sought; Compliance with 24(f) and (g) of the BSE Listing Agreement; Valuation Report from an Independent Chartered Accountant' is not required in cases where there is no change in the shareholding pattern of the listed company / resultant company; (example: WOS into Parent) Otherwise Valuation Report required in all cases. SEBI to provide its comments on the Draft Scheme to the stock exchanges within 30 days from Date of receipt of copy of in-principle approval for listing of equity shares of the company seeking exemption from Rule 19(2)(b) of Securities Contracts (Regulation) Rules, 1957 on designated stock exchange, in case the company is listed solely on regional stock exchange. Provide facility of post ballot and e-voting for seeking approval of the shareholders to the scheme .. The votes cast by public shareholders in favour of scheme must at least be two times in the vote cast against for the special resolution to be acted up on.

One listed and an unlisted company are considering coming together by Merger Conti..

Exemption in Regulation 10 (1) (d) of the Takeover Code acquisition pursuant to a scheme under any law or regulation, Indian or foreign including amalgamation, merger or demerger, pursuant to an order of a court subject to condition that: -component of cash and cash equivalents in the consideration paid being less than twenty-five per cent of the consideration paid under the scheme; and -persons directly or indirectly holding at least thirty-three per cent of the voting rights in the combined entity are the same as the persons who held the entire voting rights before the implementation of the scheme.

One listed and an unlisted company are considering coming together by Merger Conti..

Implication: Rent Act and Assignment of Tenancies

Though court order judgment in rem, High court while sanctioning such a transfer of undertaking, has no powers to override the provisions of the state laws relating to tenancy . tenancy rights cannot be transferred without the permission of the landlord. If such a transfer is made, the landlord may be legally entitled to evict the tenant. General Radio and Appliances Co Ltd vs MA Khader (1986) 60 Com Cases 1013 (SC). Brooke Bond Lipton India Ltd, Re, (1998) 15 SCL 81 (Cal) that if a scheme of amalgamation comes before the court which contains transfer of a tenancy, it will not hold back sanction merely because the prior permission of the landlord was not obtained. It held that so long there was no other problem, it will sanction it and thereafter, it would be a matter between the landlord and the transferor/transferee companies.

One listed and an unlisted company are considering coming together by Takeover..

Implications: Stamp Duty The Share Purchase Agreement (SPA) is an Instrument transferring title to the Acquirer form the Promoters required to be stamped. Share Transfer Form covered by Article 62 of the ISA.Demat by Article 8 A ISA. Tax wise but not twice is well settled. Article 5(h)(A) Schedule I to the BSA. Article 5(h)(A) (I) to (V). This Article generally seeks to bring in all instruments/ contracts where specific performance is sought for in case of value of such contract exceeds Rs.1 Lakh as also a contract which creates any obligation, right or interest having monetary value and assignment of copyrights, is liable to be stamped in accordance with the New Article 5(h) (A). Article 5 (h) (B) retained and deals with all other miscellaneous categories of instruments/ contracts which are not otherwise provided. In that sense, Article 5 (h) (B) overrides all the other sub-articles of Article 5(A) including Article 5(h)(A) of Schedule attached to the BSA and seeks to levy stamp duty on such miscellaneous categories of contracts with a fix rate rather than ad-veloram. A SPA is not defined under the BSA or any other statute and is not otherwise covered by any entry of the Schedule to the BSA therefore, an argument can be made that it thus falls in a residuary Article 5 (h) (B) of the BSA and is thus chargeable with a Stamp Duty of only Rs.100/-. Enforceability: Section34 Inadmissibility in evidence after regularizing and payment of penalty @ 2% PM.

One listed and an unlisted company are considering coming together by Takeover Conti..

Implications: Take Over Code/Listing Agreement

Negative Control and Enforceability of Put Call options Shubhkam Ventures : Dispute in this case was whether these rights i.e. the right to nominate a director on the board of the company, the right to be present to constitute quorum and the affirmative voting rights all of which is essentially negative control rights constituted control for the purposes of the takeover code regulations. SEBI and Subhkam Ventures have reached an out of court settlement in the matter and hence in November 2011 the Supreme Court passed an order disposing off the appeal. The order of the Supreme Court also specifically stated that the order of the SAT would not be treated as a precedent in the matter of law. under the New Takeover Regulations definition of control remains unchanged, the ambiguity regarding negative control continues. Enforceability of Put call options in shareholders Agreement SEBI Circular of 3rd October,2013. Compliance with Listing Agreement and Clause 40-A. Minimum Public Shareholding frozen at 25%.

10

One listed and an unlisted company are considering coming together by Business/ Asset Sale.. Implications: Stamp Duty

Business Transfer Agreement(BTA) not defined in the BSA and is not otherwise covered by any entry of the Schedule to the BSA therefore, an argument can be made that it thus falls in a residuary Article 5 (h) (B) of the BSA and is thus chargeable with a Stamp Duty of only Rs.100/-. If sale of undertaking on a going concern basis under a BTA includes and covers sale and transfer of immovable properties with or without movable properties, then it may be contended by Revenue that it operate as a Conveyance under Section 2(g) of the BSA read with Article 25 of the Schedule I. The issue whether fixed assets comprising of plant and machinery would be treated as immovable property or not has also been dealt with by the Supreme Court in the case of Dunccans Industries Ltd. vs. State of UP and others AIR 2000 SC at 355, held that when there is an intention to transfer the entire business undertaking on an as-is-where-is basis including plant, machinery and other assets, the machinery which formed the fertilizer plant were permanently embedded to the earth with an intention of running, that the machinery is to be treated as immovable property and liable to stamp duty as conveyance.

11

One listed and an unlisted company are considering coming together by Business/ Asset Sale Conti..

sale and transfer of tangible movable property: under the provisions of TP Act read with Section 17 and 18 of the Registration Act, the transfer can be effected by handing over/physical delivery of such movable property by obtaining a suitable receipt to that effect recording and/or acknowledging the passage of title in movables from one party to the other. Such a transfer of movables physical deliver does not require registration or stamping.

sale and transfer of intangible movable property: Trade Marks, Goodwill, Book Debts is proposed to be affected, then in such a case, it would be advisable to execute separate instrument in the nature of Deed of Assignment of Trade marks and/or Deed of Assignment of Book Debts for the purposes of payment of Stamp Duty.

12

One listed and an unlisted company are considering coming together by Business/ Asset Sale.. Conti..

Implications: Takeover Code

Obligations of the Acquirer. Regulation 25

In the event the acquirer has not declared an intention in the detailed public statement and the letter of offer to alienate any material assets of the target company or of any of its subsidiaries whether by way of sale, lease, encumbrance or otherwise outside the ordinary course of business, the acquirer, where he has acquired control over the target company, shall be debarred from causing such alienation for a period of two years after the offer period: Provided that in the event the target company or any of its subsidiaries is required to so alienate assets despite the intention to alienate not having been expressed by the acquirer, such alienation shall require a special resolution passed by shareholders of the target company, by way of a postal ballot and the notice for such postal ballot shall inter alia contain reasons as to why such alienation is necessary. Obligations of the target company. Regulation 26 (2) During the offer period, unless the approval of shareholders of the target company by way of a special resolution by postal ballot is obtained, the board of directors of either the target company or any of its subsidiaries shall not, (a) alienate any material assets whether by way of sale, lease, encumbrance or otherwise or enter into any agreement therefor outside the ordinary course of business; (b) effect any material borrowings outside the ordinary course of business; (c) issue or allot any authorised but unissued securities entitling the holder to voting rights.

13

One listed and an unlisted company are considering coming together by Business/ Asset Sale.. Conti.. Implications: Companies Act,2013

section 180/293 applicability Scope widened and the new section applicable to all the companies public or private. Sale of undertaking subject to consent of the company in general meeting are now to be approved by passing of special resolution. Undertaking now defined in section 180.

Implications: Rent Act Transfer of Tenancies Assignment is not automatic but a deed of assignment of leasehold rights will have to be executed as purchaser entity will be different. Another argument that can be advanced is that of Successors and assigns clause. Clever drafting of the Lease Deed will never allow Successors and assigns of the tenant to hold and continue with the tenancy.

14

Sanjay Buch Crawford Bayley & Co. State Bank Buildings, 4th Floor, NGN Vaidya Marg, Fort, Mumbai - 400 023 Tel: (+91 22) 2266 8000 Ext.111 Fax: (+91 22) 2266 0986 / 0355 Mob: +91 9820058507 sanjay_buch@crawfordbayley.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Week 4 Assignment 4 - SolvedDocument1 pageWeek 4 Assignment 4 - SolvedAmit GuptaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Week 2 Assignment 2 - SolvedDocument1 pageWeek 2 Assignment 2 - SolvedAmit GuptaNo ratings yet

- Week 3 Assignment 3 - UnsolvedDocument4 pagesWeek 3 Assignment 3 - UnsolvedAmit GuptaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Week 4 Assignment 4 - UnsolvedDocument5 pagesWeek 4 Assignment 4 - UnsolvedAmit GuptaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Unit 9 - Week 8 - Clustering Analysis and Prescriptive AnalyticsDocument4 pagesUnit 9 - Week 8 - Clustering Analysis and Prescriptive AnalyticsAmit GuptaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Activities Module 4Document5 pagesActivities Module 4Amit GuptaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Note Ban Could Lead To 20-25 % Cut in Home PricesDocument2 pagesNote Ban Could Lead To 20-25 % Cut in Home PricesAmit GuptaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Ace of Capital MarketsDocument4 pagesAce of Capital MarketsAmit GuptaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Assignment 1 SolvedDocument4 pagesAssignment 1 SolvedAmit GuptaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Release NotesDocument1 pageRelease NotesArun KumarNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Introduction To Data Analytics - AnnouncementsDocument16 pagesIntroduction To Data Analytics - AnnouncementsAmit GuptaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Euro Zone CrisisDocument82 pagesEuro Zone CrisisAmit GuptaNo ratings yet

- Club Mahindra EmailerDocument2 pagesClub Mahindra EmailerAmit GuptaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Feedback For The WebinarDocument3 pagesFeedback For The WebinarAmit GuptaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Itslowdown, Demonetisation - Doublewhammyforrealestate: 11 Nov 2016, by Ketan ChaphalkarDocument2 pagesItslowdown, Demonetisation - Doublewhammyforrealestate: 11 Nov 2016, by Ketan ChaphalkarAmit GuptaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- AAFM Registration (Final)Document2 pagesAAFM Registration (Final)Amit GuptaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Fin - MGMT - Working Capital MGMTDocument15 pagesFin - MGMT - Working Capital MGMTAmit GuptaNo ratings yet

- 10177GE003 - Principles of ManagementDocument69 pages10177GE003 - Principles of ManagementskrtamilNo ratings yet

- Financial ModelingDocument8 pagesFinancial ModelingAmit GuptaNo ratings yet

- Transport Corporation of IndiaDocument18 pagesTransport Corporation of IndiaSiddhartha Khemka100% (1)

- 160by2 ContactsDocument4 pages160by2 ContactsAmit GuptaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Article in Mint - Retirement PlanningDocument1 pageArticle in Mint - Retirement PlanningashishkrishNo ratings yet

- 100 Quant Facts Every CAT Aspirant Must KnowDocument8 pages100 Quant Facts Every CAT Aspirant Must Knowkumar5singhNo ratings yet

- AMFI ReportsDocument592 pagesAMFI ReportsAmit GuptaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The 2010 ExxonMobile Outlook For Energy: A View To 2030Document48 pagesThe 2010 ExxonMobile Outlook For Energy: A View To 2030Tabloid Post InternationalNo ratings yet

- Inter-Connected Stock Exchange of India LTD: Easier Access Wider ReachDocument5 pagesInter-Connected Stock Exchange of India LTD: Easier Access Wider ReachAmit GuptaNo ratings yet

- Political and Institutional Challenges of ReforminDocument28 pagesPolitical and Institutional Challenges of ReforminferreiraccarolinaNo ratings yet

- TestDocument56 pagesTestFajri Love PeaceNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Learner's Material: ScienceDocument27 pagesLearner's Material: ScienceCarlz BrianNo ratings yet

- MSC in Healthcare Management (Top-Up) Degree From ARU - Delivered Online by LSBR, UKDocument19 pagesMSC in Healthcare Management (Top-Up) Degree From ARU - Delivered Online by LSBR, UKLSBRNo ratings yet

- Deseret First Credit Union Statement.Document6 pagesDeseret First Credit Union Statement.cathy clarkNo ratings yet

- W 26728Document42 pagesW 26728Sebastián MoraNo ratings yet

- Launchy 1.25 Readme FileDocument10 pagesLaunchy 1.25 Readme Fileagatzebluz100% (1)

- Reply To Pieta MR SinoDocument9 pagesReply To Pieta MR SinoBZ RigerNo ratings yet

- Cambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013Document1 pageCambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013RedrioxNo ratings yet

- Q3 Lesson 5 MolalityDocument16 pagesQ3 Lesson 5 MolalityAly SaNo ratings yet

- Concept of HalalDocument3 pagesConcept of HalalakNo ratings yet

- ICONS+Character+Creator+2007+v0 73Document214 pagesICONS+Character+Creator+2007+v0 73C.M. LewisNo ratings yet

- Intro To EthicsDocument4 pagesIntro To EthicsChris Jay RamosNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- China Daily 20181031Document24 pagesChina Daily 20181031JackZhangNo ratings yet

- List of Vocabulary C2Document43 pagesList of Vocabulary C2Lina LilyNo ratings yet

- 40+ Cool Good Vibes MessagesDocument10 pages40+ Cool Good Vibes MessagesRomeo Dela CruzNo ratings yet

- Grammar For TOEFLDocument23 pagesGrammar For TOEFLClaudia Alejandra B0% (1)

- Syllabus Biomekanika Kerja 2012 1Document2 pagesSyllabus Biomekanika Kerja 2012 1Lukman HakimNo ratings yet

- Gee 103 L3 Ay 22 23 PDFDocument34 pagesGee 103 L3 Ay 22 23 PDFlhyka nogalesNo ratings yet

- Tangazo La Kazi October 29, 2013 PDFDocument32 pagesTangazo La Kazi October 29, 2013 PDFRashid BumarwaNo ratings yet

- First Aid General PathologyDocument8 pagesFirst Aid General PathologyHamza AshrafNo ratings yet

- Group 4 - Regional and Social DialectDocument12 pagesGroup 4 - Regional and Social DialectazizaNo ratings yet

- L 1 One On A Page PDFDocument128 pagesL 1 One On A Page PDFNana Kwame Osei AsareNo ratings yet

- RSA ChangeMakers - Identifying The Key People Driving Positive Change in Local AreasDocument29 pagesRSA ChangeMakers - Identifying The Key People Driving Positive Change in Local AreasThe RSANo ratings yet

- All Zone Road ListDocument46 pagesAll Zone Road ListMegha ZalaNo ratings yet

- CHIR12007 Clinical Assessment and Diagnosis Portfolio Exercises Week 5Document4 pagesCHIR12007 Clinical Assessment and Diagnosis Portfolio Exercises Week 5api-479849199No ratings yet

- Karnu: Gbaya People's Secondary Resistance InspirerDocument5 pagesKarnu: Gbaya People's Secondary Resistance InspirerInayet HadiNo ratings yet

- Security Questions in UPSC Mains GS 3 2013 2020Document3 pagesSecurity Questions in UPSC Mains GS 3 2013 2020gangadhar ruttalaNo ratings yet

- A Beautiful Mind - Psychology AnalysisDocument15 pagesA Beautiful Mind - Psychology AnalysisFitto Priestaza91% (34)

- Engineeringinterviewquestions Com Virtual Reality Interview Questions Answers PDFDocument5 pagesEngineeringinterviewquestions Com Virtual Reality Interview Questions Answers PDFKalyani KalyaniNo ratings yet

- The Voice of God: Experience A Life Changing Relationship with the LordFrom EverandThe Voice of God: Experience A Life Changing Relationship with the LordNo ratings yet