Professional Documents

Culture Documents

Financial Markets & Instruments: Investments Term 3 (2013-15)

Uploaded by

Vivek KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Markets & Instruments: Investments Term 3 (2013-15)

Uploaded by

Vivek KumarCopyright:

Available Formats

Financial Markets & Instruments

Investments Term 3 (2013-15)

Outline

What is investment? Real and financial assets Financial markets Axioms of finance What determines price?

What is Investment?

Deployment of money or resources in expectation of future benefits

Real or financial assets Benefits commensurate with risk Ability to convert back to money or resources

Real vs. Financial Assets

Real assets

Assets used to produce goods and services Examples: factories, land, human capital

Financial assets

Claims on real assets such as

Stocks Bonds

Derivatives (contingent claims)

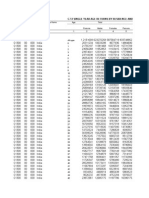

Savings of US Households

Source: Fed Reserve

Savings of Indian Households

Benefits of Financial Assets

Allocation of capital

Financing of projects

Allocation of risk

Diversification (risk-sharing) Hedging

Consumption smoothing

Moving consumption over time through saving and borrowing

Separation of ownership and control

Investors and managers can be different

Important Financial Assets

1. Money market securities 2. Fixed Income securities 3. Equities 4. Derivatives

I. Money Market Securities

Very short-term borrowing instrument (up to 1 year)

Working capital Cash flow smoothing Government is a major issuer

Usually issued by reputable issuers No coupons (adjustment in price) Highly liquid (high volume/low cost of trading)

10

Money Market Securities

Treasury bills Federal Funds

Certificates of Deposit (CDs) Repurchase Agreements (Repos) Bankers Acceptance

Commercial Paper (CPs) Eurodollars LIBOR Market

11

Crisis in the CP Market

12

II. Fixed Income Securities

Borrowing instruments for longer maturities (greater than 1 year)

Funding longer duration projects Financing deficit

Issued by governments, municipalities, corporates Pre-specified cash-flows (coupons and principal)

Valuation through time value of money (TVM) Example: a 10-year, 8%, semi-annual coupon bond with $1000 face value

Risk of default varies

Credit rating of issuances

Liquidity varies

13

Treasury Bonds

Two types

Treasury notes (1-10 years maturity) Treasury bonds (10-30 years maturity)

Semi-annual coupon payments Regular issues (often preannounced schedule) Proceeds used to fund government expenditure/deficit Attractive for investors with longer durations

Pensions/insurance companies

14

A Concept Question

Which bond would pay a higher interest rate?

A 10-year T-bond or a 1-year T-note? A US government 1o-year T-bond or Zimbabwean government 10-year T-bond?

15

Muni Bonds

Issued by state and local governments

Exempt from federal income tax Exempt from (issuing) state and local tax General obligation bonds (for no specific purpose and backed by full faith of credit of the issuer, i.e., taxes)

Two types

Revenue bonds (for a specific purpose like building a bridge and backed by revenue generated by the project)

16

A Concept Question

A muni bond pays 4% interest. A Treasury bond of similar maturity pays 5% interest.

If your marginal tax rate is 20%, which bond would you prefer?

What if the tax rate is 30%?

17

Corporate Bonds

Issued by companies for longer term maturities Significant default risk

Investment grade Non-investment grade (junk)

Seniority Embedded features

Callable/puttable Convertible

Less liquid

18

19

III. Equity Securities

Ownership in a firm Future cash-flows (dividends) are uncertain Involves risk and variable liquidity Maturity is indefinite Two types

Preferred equity or stock (fixed dividend, non-voting, senior) Common equity or stock (residual dividend, voting rights, junior)

Common stock

Valuation: TVM + risk adjustment

20

Googles Stock Price Over Last 5 Years

http://finance.yahoo.com

21

Equity Market Performance

Dow Jones Industrial Average (DJIA)

Price-weighted index Includes 30 blue-chip companies

Standard & Poors Composite 500 Index (S&P 500)

Value-weighted index Includes 500 firms across varied sectors

S&P BSE Sensex

Value-weighted index 30 stocks

CNX NSE Nifty Index

Value-weighted index 50 stocks

22

Google vs. S&P500

http://finance.yahoo.com

23

Long-term Performance of Stocks, Bonds and Treasury Bills

Source: Ibbotson and Associates

24

IV. Derivative Securities

Securities whose cash flows depend on values of other assets

Examples: options, futures, swaps, bonds with option features (convertible or callable bonds)

Options are rights to buy (sell) the underlying asset Futures are obligations to buy (sell) the underlying asset Swaps are exchanges of one type of cash flow for another

Valuation: TVM + risk + option adjustment

25

Axioms Governing Investment Theory

1. Investors prefer more to less 2. Investors are risk averse in general 3. Money paid in the future is worth less than the same amount today 4. Financial markets are mostly competitiveno arbitrage

26

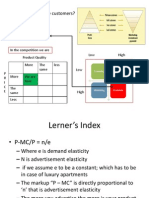

Equilibrium Prices

What determines the price?

In economic theory? In reality?

What is the equilibrium price? What is the mechanism that drives prices towards equilibrium?

Price Supply

P*=40

Demand

Q*=20,000 40,000 Quantity

27

Financial Market Setup

RETURN

Search Issuers

(Needers of Capital/ Risk Originators)

Transact

Enforce

Investors

(Providers of Capital/ Risk Takers)

RISK

28

Financial Market Setup

RETURN

Search Issuers

(Needers of Capital/ Risk Originators)

Transact

Enforce

Investors

(Providers of Capital/ Risk Takers)

REGULATORS

RISK

29

Asset Markets

Primary market

Issuance of new securities

Secondary market

Exchange of existing securities between investors

30

Primary Markets

Raises capital Price-setting mechanism differs

Government securities: typically auctioned Corporate securities, federal agency debt, municipal bonds, mortgage-backed securities: typically underwritten by investment banks

31

Secondary Markets

Investors can:

Trade with each other directly or Trade with each other with the help of brokers or Trade with dealers

Brokers dont commit any capital while dealers commit their own capital to the transaction Exchanges facilitate meeting of buyers and sellers

Clearing and settlement firms ensure agreement to terms and exchange of funds between the buyer and seller

Can guarantee the performance of the trade

Depositories maintain records and custody of securities

You might also like

- Equity Investment for CFA level 1: CFA level 1, #2From EverandEquity Investment for CFA level 1: CFA level 1, #2Rating: 5 out of 5 stars5/5 (1)

- Iapm - Unit 2 - 2024Document183 pagesIapm - Unit 2 - 2024vishalsingh9669No ratings yet

- Presentation On Treasury ProductsDocument48 pagesPresentation On Treasury ProductsSaurabh Vohra0% (2)

- Money, Banking & Finance: The Nature of Financial Intermediation K MatthewsDocument25 pagesMoney, Banking & Finance: The Nature of Financial Intermediation K MatthewsMuhammad SarmadNo ratings yet

- BUS329 Lecture 1Document40 pagesBUS329 Lecture 1PSiderNo ratings yet

- 1 4 Introduction 2016-17Document49 pages1 4 Introduction 2016-17Debjit AdakNo ratings yet

- Financial Markets: Lectures 3 - 4Document48 pagesFinancial Markets: Lectures 3 - 4Lê Mai Huyền LinhNo ratings yet

- Finmar ReportingDocument18 pagesFinmar ReportingJanna Rae BionganNo ratings yet

- Debt Market: Structure, Player, ProductDocument76 pagesDebt Market: Structure, Player, ProductImteyaz Ahmed KhanNo ratings yet

- Mutual Funds: Concept and CharacteristicsDocument179 pagesMutual Funds: Concept and CharacteristicssiddharthzalaNo ratings yet

- Bond Markets: Presented by Group 2Document32 pagesBond Markets: Presented by Group 2ankit_kataryaNo ratings yet

- Chapter 1-2Document40 pagesChapter 1-2jakeNo ratings yet

- Investments: Background and IssuesDocument35 pagesInvestments: Background and IssuesKevin GilkensonNo ratings yet

- CH9 Money MarketsDocument42 pagesCH9 Money MarketsSaberNo ratings yet

- Corporate FinanceDocument36 pagesCorporate FinanceCHARAK RAYNo ratings yet

- Major Classes of Financial Assets and PMDocument35 pagesMajor Classes of Financial Assets and PMshaRUKHNo ratings yet

- Saving, Investment and The Financial SystemDocument47 pagesSaving, Investment and The Financial SystemKaifNo ratings yet

- Bond Markets Presented by Group 2Document33 pagesBond Markets Presented by Group 2raviNo ratings yet

- The IB Business of Debt - Fixed IncomeDocument36 pagesThe IB Business of Debt - Fixed IncomeNgọc Phan Thị BíchNo ratings yet

- Week 1Document64 pagesWeek 1Vimal ChauhanNo ratings yet

- Dinh Che Tai ChinhDocument38 pagesDinh Che Tai ChinhEli LiNo ratings yet

- Securities Markets: Ma. Roma Angela R. Miranda-Gaton, LPT, MMBMDocument32 pagesSecurities Markets: Ma. Roma Angela R. Miranda-Gaton, LPT, MMBMjanrei agudosNo ratings yet

- Saving: Investments 1 Today's 4 ItemsDocument8 pagesSaving: Investments 1 Today's 4 ItemsrawrrishiNo ratings yet

- Capital MarketDocument27 pagesCapital MarketNITISH BHARDWAJNo ratings yet

- CH - 12 (Global Capital Market)Document24 pagesCH - 12 (Global Capital Market)AhanafNo ratings yet

- Capital Market Primary and Secondary MarketDocument27 pagesCapital Market Primary and Secondary Marketswastik guptaNo ratings yet

- Moving Funds Through The Financial SystemDocument27 pagesMoving Funds Through The Financial Systemjuan pranataNo ratings yet

- Week 7: Managing Short Term Resources and Obligations: Public Health Budgeting and Accounting Lili Elkins-ThompsonDocument47 pagesWeek 7: Managing Short Term Resources and Obligations: Public Health Budgeting and Accounting Lili Elkins-Thompsons430230No ratings yet

- CH 1Document37 pagesCH 1xyzNo ratings yet

- Chapter 12 The Bond MarketDocument42 pagesChapter 12 The Bond MarketJay Ann DomeNo ratings yet

- Topic - Money Market Group Members: Kunal Gharat Deepak Gohil Pradeep Gore Meenakshi Jadhav Sandeep JaigudeDocument30 pagesTopic - Money Market Group Members: Kunal Gharat Deepak Gohil Pradeep Gore Meenakshi Jadhav Sandeep Jaigudek_vikNo ratings yet

- Lecture 1 The Investment EnvironmentDocument43 pagesLecture 1 The Investment Environmentnoobmaster 0206No ratings yet

- Innovative International Financial Products & Markets & Future of International FinanceDocument25 pagesInnovative International Financial Products & Markets & Future of International FinanceJaiswar ManojNo ratings yet

- Saving and Investment: Principles of Economics by G. Mankiw (Chapter 26) Core Economics (Unit 13: 13.7)Document40 pagesSaving and Investment: Principles of Economics by G. Mankiw (Chapter 26) Core Economics (Unit 13: 13.7)Tawasul Hussain Shah RizviNo ratings yet

- Lecture 1 PG 1Document47 pagesLecture 1 PG 1carinaNo ratings yet

- Bond MathsDocument193 pagesBond Mathsmeetniranjan14No ratings yet

- 2023 Understanding Financial Markets and Financial InstitutionsDocument55 pages2023 Understanding Financial Markets and Financial Institutionsdemo040804No ratings yet

- Money Simplified ModifiedDocument84 pagesMoney Simplified Modifiedvighnesh15b4774No ratings yet

- Introduction HUL463Document28 pagesIntroduction HUL463GBMS gorakhnagarNo ratings yet

- Ch1 FundamentalsDocument45 pagesCh1 FundamentalsFebri RahadiNo ratings yet

- Event Driven Hedge Funds PresentationDocument77 pagesEvent Driven Hedge Funds Presentationchuff6675No ratings yet

- Constituents of The Financial System DD Intro NewDocument17 pagesConstituents of The Financial System DD Intro NewAnonymous bf1cFDuepPNo ratings yet

- Chap 5 Money Bond MarketsDocument37 pagesChap 5 Money Bond MarketsGayatheri PerumalNo ratings yet

- Chapter+2.+Financial+markets-đã GộpDocument232 pagesChapter+2.+Financial+markets-đã GộpThảo Nhi LêNo ratings yet

- Module 1 Money & Banking FinalDocument28 pagesModule 1 Money & Banking Finalblue252436No ratings yet

- Financial Management 1Document63 pagesFinancial Management 1geachew mihiretuNo ratings yet

- Introduction To Investment and SecuritiesDocument34 pagesIntroduction To Investment and SecuritiesAnkit SharmaNo ratings yet

- Chapter 3 FIIMDocument64 pagesChapter 3 FIIMDanielNo ratings yet

- Financial: Fin 6212 PolicyDocument86 pagesFinancial: Fin 6212 PolicyYuhan KENo ratings yet

- Saving, Investment, and The Financial SystemDocument47 pagesSaving, Investment, and The Financial Systemjoebob1230No ratings yet

- Session 1 DebtMarketHowItworksDocument22 pagesSession 1 DebtMarketHowItworksSiddhant SanjeevNo ratings yet

- FM01 Introduction 0108Document56 pagesFM01 Introduction 0108Derek LowNo ratings yet

- Lecture Note 01 - IntroductionDocument45 pagesLecture Note 01 - Introductionben tenNo ratings yet

- Fixed Income MarketsDocument69 pagesFixed Income Marketsniravthegreate999No ratings yet

- Financial MarketsDocument34 pagesFinancial Marketsmouli poliparthiNo ratings yet

- CH 2 Indian Financial SystemDocument46 pagesCH 2 Indian Financial SystemAkshay AhirNo ratings yet

- Analysis and Valuation of DebtDocument83 pagesAnalysis and Valuation of Debtupvoteintern06No ratings yet

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingFrom EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingNo ratings yet

- Age DataDocument147 pagesAge DataVivek KumarNo ratings yet

- MM Case Presentation - V4Document18 pagesMM Case Presentation - V4Vivek KumarNo ratings yet

- Leasecalculator: Keyed To "Valuation of Financial Lease Contracts," Myers SC, Dill DA, Bautista, AJ InputDocument3 pagesLeasecalculator: Keyed To "Valuation of Financial Lease Contracts," Myers SC, Dill DA, Bautista, AJ InputVivek KumarNo ratings yet

- Wizz AirDocument2 pagesWizz AirVivek KumarNo ratings yet

- Ru 3 SQ de Y7 U 4 Uux QIDocument6 pagesRu 3 SQ de Y7 U 4 Uux QIVivek KumarNo ratings yet

- PrabhaSingh HealthStatusReport 101904Document9 pagesPrabhaSingh HealthStatusReport 101904Vivek KumarNo ratings yet

- Travel PolicyDocument4 pagesTravel PolicyVivek KumarNo ratings yet

- PassportddDocument1 pagePassportddVivek KumarNo ratings yet

- CCS ProposalDocument4 pagesCCS ProposalVivek KumarNo ratings yet

- MM - Sec F GroupsDocument2 pagesMM - Sec F GroupsVivek KumarNo ratings yet

- Kartik - Oki Doki Hostel Booking ConfirmationDocument2 pagesKartik - Oki Doki Hostel Booking ConfirmationVivek KumarNo ratings yet

- Industry SummaryDocument2 pagesIndustry SummaryVivek KumarNo ratings yet

- Information On Visa Application Photograph: in Case An Applicant Wears GlassesDocument1 pageInformation On Visa Application Photograph: in Case An Applicant Wears GlassesVivek KumarNo ratings yet

- AdvMicroSolutions PDFDocument27 pagesAdvMicroSolutions PDFĐỗ Huy HoàngNo ratings yet

- Excel Tool VBA Password RecoveryDocument1 pageExcel Tool VBA Password RecoveryMohammad AlshikhNo ratings yet

- Assignment 2Document9 pagesAssignment 2Vivek KumarNo ratings yet

- Pre-Test Chapter 6 Ed17Document8 pagesPre-Test Chapter 6 Ed17Vivek KumarNo ratings yet

- FUTURES SDocument20 pagesFUTURES SVivek KumarNo ratings yet

- RobinhoodDocument2 pagesRobinhoodApurva NadkarniNo ratings yet

- Leadership MatrixDocument17 pagesLeadership MatrixVivek KumarNo ratings yet

- Bi BiDocument23 pagesBi BiJosephat MandaraNo ratings yet

- Excel Tool VBA Password RecoveryDocument1 pageExcel Tool VBA Password RecoveryMohammad AlshikhNo ratings yet

- Plagiarism Checker - Viper - Free Plagiarism Checker and Scanner SoftwareDocument3 pagesPlagiarism Checker - Viper - Free Plagiarism Checker and Scanner SoftwareVivek Kumar0% (1)

- Error SheetDocument3 pagesError SheetVivek KumarNo ratings yet

- Saraansh Volume3Document2 pagesSaraansh Volume3Vivek KumarNo ratings yet

- Solution Q 2Document2 pagesSolution Q 2Vivek KumarNo ratings yet

- Matching Dell - Cost AnalysisDocument1 pageMatching Dell - Cost AnalysisVivek Kumar100% (2)

- Matching Dell - Cost AnalysisDocument1 pageMatching Dell - Cost AnalysisVivek Kumar100% (2)

- Viv 2Document9 pagesViv 2Vivek KumarNo ratings yet

- Ebusiness and e CommerceDocument4 pagesEbusiness and e CommercethaskumarNo ratings yet

- SWOT Analysis of XiaomiDocument2 pagesSWOT Analysis of XiaomiSreyasNo ratings yet

- MGT301-FinalTerm-COMPOSED BY SADIA ALI SADI MBADocument8 pagesMGT301-FinalTerm-COMPOSED BY SADIA ALI SADI MBAABDURREHMAN Muhammad IbrahimNo ratings yet

- Active Trend Trading Strategy 2-1-14aDocument46 pagesActive Trend Trading Strategy 2-1-14aanalyst_anil1425% (4)

- Module 4 Market Forces Demand and SupplyDocument29 pagesModule 4 Market Forces Demand and SupplyRoel P. Dolaypan Jr.No ratings yet

- Microeconomics NotesDocument8 pagesMicroeconomics Notesenis oppaiNo ratings yet

- Fixed Income Securities: Bond Basics: CRICOS Code 00025BDocument43 pagesFixed Income Securities: Bond Basics: CRICOS Code 00025BNurhastuty WardhanyNo ratings yet

- EJMCM - Reliance Trends and WestsideDocument10 pagesEJMCM - Reliance Trends and WestsideShubhangi KesharwaniNo ratings yet

- Algorithmic and High-Frequency TradingDocument360 pagesAlgorithmic and High-Frequency TradingSonyyno75% (12)

- Cloudstrat: Managing Migration To The CloudDocument12 pagesCloudstrat: Managing Migration To The CloudRio SamNo ratings yet

- Vishal Pandey ResumeDocument3 pagesVishal Pandey ResumeAnant BhargavaNo ratings yet

- This Study Resource Was: Problem SetDocument3 pagesThis Study Resource Was: Problem Setanon_954124867No ratings yet

- Bacc 1 - Course-Module-3 Basic MicroeconomicsDocument17 pagesBacc 1 - Course-Module-3 Basic MicroeconomicsJordan Diaz100% (1)

- Sulalitha Economics EMDocument74 pagesSulalitha Economics EMrakeshsi563100% (1)

- Rosewood StrategyDocument4 pagesRosewood StrategyJohn SmithNo ratings yet

- CH 23 Pure CompetitionDocument25 pagesCH 23 Pure CompetitionPj Sorn100% (2)

- Indian Financial SystemDocument5 pagesIndian Financial SystemDurga Prasad NallaNo ratings yet

- Chapter 04 - Organizing The Sales EffortDocument42 pagesChapter 04 - Organizing The Sales EffortAhmad SheiKhNo ratings yet

- LNKD - Content Marketing Strategy Template FY19 - Toolkit - USDocument12 pagesLNKD - Content Marketing Strategy Template FY19 - Toolkit - USMarko GrbicNo ratings yet

- Prices & Market Assignment 2Document4 pagesPrices & Market Assignment 2Muhammad RilwanNo ratings yet

- Marketing ManagementDocument13 pagesMarketing ManagementHOMEWARE GALAXYNo ratings yet

- Amazon in JapanDocument1 pageAmazon in JapanLance PasaholNo ratings yet

- Quiz 2Document2 pagesQuiz 2Nathaniel Malabay100% (1)

- 13 - 47, 48Document2 pages13 - 47, 48Binar Arum NurmawatiNo ratings yet

- Extra Credit - Supply and Demand Infographic - Answer KeyDocument6 pagesExtra Credit - Supply and Demand Infographic - Answer Keyrowena vocesNo ratings yet

- Trabajo Ingles Ap 8Document8 pagesTrabajo Ingles Ap 8Julian Pinilla SantanaNo ratings yet

- Investment Analysis & Portfolio Management - FIN630 Spring 2009 Mid Term PaperDocument68 pagesInvestment Analysis & Portfolio Management - FIN630 Spring 2009 Mid Term Papermukeshkumar@ibasukkurNo ratings yet

- Who Are The Customers?: What Are We Doing or in Short Where Are We?Document9 pagesWho Are The Customers?: What Are We Doing or in Short Where Are We?Saurav BhargavNo ratings yet

- Applied EconomicsDocument42 pagesApplied EconomicsAngeline RegatonNo ratings yet

- Tape Reading and Active TradingDocument97 pagesTape Reading and Active TradingOliver Bradley100% (3)