Professional Documents

Culture Documents

Special Inventory MGMT Models

Uploaded by

Pradeep SethiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Special Inventory MGMT Models

Uploaded by

Pradeep SethiaCopyright:

Available Formats

Special Inventory

Management & Control

Models

Non-instantaneous replacement

Quantity discount (Price break model)

One period decision (Single period model)

Noninstantaneous

Replenishment

Maximum cycle inventory to be decided!

Item used or sold as it is completed

Usually production rate, p, exceeds the demand

rate, d, so there is a buildup of (p d) units per

time period

Both p and d expressed in same time interval

Buildup continues for Q/p days to reach the

maxm cycle inventory

Noninstantaneous

Replenishment

Production quantity

Q

Maximum inventory

I

max

Production

and demand

Demand or

Consumption

only

TBO

p d

Demand during

production interval

O

n

-

h

a

n

d

i

n

v

e

n

t

o

r

y

Time

Lot Sizing with Noninstantaneous Replenishment

p

d

Noninstantaneous

Replenishment

Maximum cycle inventory is:

Cycle inventory is no longer Q/2, it is I

max

/2

where

p = production rate

d = demand rate

Q = lot size

( ) |

.

|

\

|

= =

p

d p

Q d p

p

Q

I

max

Noninstantaneous

Replenishment

Total annual cost = Annual holding cost

+ Annual ordering or setup cost

D is annual demand and Q is lot size

d is daily demand; p is daily production rate

( ) ( ) ( ) ( ) S

Q

D

H

p

d p Q

S

Q

D

H

I

C + |

.

|

\

|

= + =

2 2

max

Noninstantaneous

Replenishment

Economic Production Lot Size (ELS): optimal lot size

Derived by calculus

Because the second term is greater than 1,

the ELS results in a larger lot size than the

EOQ

d p

p

H

DS

ELS

=

2

Finding the Economic Production Lot

Size

EXAMPLE D.1

A plant manager of a chemical plant must determine the lot

size for a particular chemical that has a steady demand of

30 barrels per day. The production rate is 190 barrels per

day, annual demand is 10,500 barrels, setup cost is $200,

annual holding cost is $0.21 per barrel, and the plant

operates 350 days per year.

a. Determine the economic production lot size (ELS)

b. Determine the total annual setup and inventory

holding cost for this item

c. Determine the time between orders (TBO), or cycle

length, for the ELS

d. Determine the production time per lot

What are the advantages of reducing the setup time by 10

percent?

Finding the Economic Production

Lot Size

SOLUTION

a. Solving first for the ELS, we get

d p

p

H

DS

=

2

ELS

( )( )

barrels 4,873.4

30 190

190

21 0

200 500 10 2

=

=

. $

$ ,

b. The total annual cost with the ELS is

( ) ( ) S

Q

D

H

p

d p Q

C + |

.

|

\

|

=

2

( ) ( ) 200

4 873 4

500 10

21 0

190

30 190

2

4 873 4

$

. ,

,

. $

. ,

+

|

.

|

\

|

=

82 861 91 430 91 430 . $ . $ . $ = + =

Finding the Economic Production

Lot Size

c. Applying the TBO formula to the ELS, we get

( ) = = days/year 350

ELS

TBO

ELS

D

days 162 or 162.4 =

d. The production time during each cycle is the lot size divided

by the production rate:

=

p

ELS

( ) 350

500 10

4 873 4

,

. ,

days 26 or 25.6

190

4 873 4

=

. ,

Application D.1

A domestic automobile manufacturer schedules 12 two-

person teams to assemble 4.6 liter DOHC V-8 engines per

work day. Each team can assemble 5 engines per day. The

automobile final assembly line creates an annual demand for

the DOHC engine at 10,080 units per year. The engine and

automobile assembly plants operate 6 days per week, 48

weeks per year. The engine assembly line also produces

SOHC V-8 engines. The cost to switch the production line

from one type of engine to the other is $100,000. It costs

$2,000 to store one DOHC V-8 for one year.

a. What is the economic lot size?

b. How long is the production run?

c. What is the average quantity in inventory?

d. What is the total annual cost?

Application D.1

SOLUTION

a. Demand per day = d = 10,080/[(48)(6)] = 35

d p

p

H

DS

=

2

ELS

( )( )

38 555 1

35 60

60

000 2

000 100 080 10 2

. ,

,

, ,

=

=

or 1,555 engines

b. The production run

=

p

Q

days production 26 or 25.91

60

555 1

=

,

Application D.1

c. Average inventory

d. Total annual cost

engines 324

60

35 60

2

555 1

=

|

.

|

\

|

,

( ) ( ) ( ) ( ) S

Q

D

H

p

d p Q

S

Q

D

H

I

C + |

.

|

\

|

= + =

2 2

max

( ) ( ) 000 100

555 1

080 10

000 2

60

35 60

2

555 1

, $

,

,

, $

,

+

|

.

|

\

|

=

148 296 1

231 648 917 647

, , $

, $ , $

=

+ =

= |

.

|

\

|

=

p

d p Q I

2 2

max

Quantity Discounts

Price incentives to purchase large quantities create

pressure to maintain a large inventory

Items price is no longer fixed

If the order quantity is increased enough, then the price

per unit is discounted

A new approach is needed to find the best lot size that

balances:

Advantages of lower prices for purchased materials

and fewer orders

Disadvantages of the increased cost of holding more

inventory

Quantity Discounts

Total annual cost = Annual holding cost

+ Annual ordering or setup cost

+ Annual cost of materials

where P = price per unit, and

D = annual demand (consumption)

( ) ( ) PD S

Q

D

H

Q

C + + =

2

Quantity Discounts

Unit holding cost (H) is usually expressed as a

percentage of unit price

The lower the unit price (P) is, the lower the unit

holding cost (H) is

The total cost equation yields U-shape total cost

curves

There are cost curves for each price level

The feasible total cost begins with the top curve, then

drops down, curve by curve, at the price breaks

EOQs do not necessarily produce the best lot size

The EOQ at a particular price level may not be feasible

The EOQ at a particular price level may be feasible but

may not be the best lot size

Two-Step Solution Procedure

Step 1. Beginning with lowest price, calculate the EOQ

for each price level until a feasible EOQ is

found. It is feasible if it lies in the range

corresponding to its price. Each subsequent

EOQ is smaller than the previous one,

because P, and thus H, gets larger and

because the larger H is in the denominator of

the EOQ formula.

Step 2. If the first feasible EOQ found is for the

lowest price level, this quantity is the best

lot size. Otherwise, calculate the total cost

for the first feasible EOQ and for the larger

price break quantity at each lower price

level. The quantity with the lowest total cost

is optimal.

Quantity Discounts

(a) Total cost curves with purchased

materials added

(b) EOQs and price break quantities

PD for

P = $4.00

PD for

P = $3.50

PD for

P = $3.00

EOQ

4.00

EOQ

3.50

EOQ

3.00

T

o

t

a

l

c

o

s

t

(

d

o

l

l

a

r

s

)

Purchase quantity (Q)

0 100 200 300

First

price

break

Second

price

break

T

o

t

a

l

c

o

s

t

(

d

o

l

l

a

r

s

)

Purchase quantity (Q)

0 100 200 300

First

price

break

Second

price

break

C for P = $4.00

C for P = $3.50

C for P = $3.00

Total Cost Curves with Quantity Discounts

Find Q with Quantity

Discounts

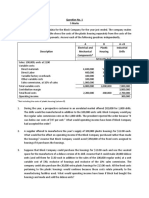

EXAMPLE D.2

A supplier for St. LeRoy Hospital has introduced quantity

discounts to encourage larger order quantities of a

special catheter. The price schedule is

Order Quantity Price per Unit

0 to 299 $60.00

300 to 499 $58.80

500 or more $57.00

The hospital estimates that its annual demand for this item is

936 units, its ordering cost is $45.00 per order, and its annual

holding cost is 25 percent of the catheters unit price. What

quantity of this catheter should the hospital order to minimize

total costs? Suppose the price for quantities between 300 and

499 is reduced to $58.00. Should the order quantity change?

Find Q with Quantity

Discounts

SOLUTION

Step 1: Find the first feasible EOQ, starting with the lowest price

level:

= =

H

DS 2

EOQ

00 57.

( )( )

( )

units 77

00 57 25 0

00 45 936 2

=

. $ .

. $

A 77-unit order actually costs $60.00 per unit, instead of the

$57.00 per unit used in the EOQ calculation, so this EOQ is

infeasible. Now try the $58.80 level:

= =

H

DS 2

EOQ

80 58.

( )( )

( )

units 76

80 58 25 0

00 45 936 2

=

. $ .

. $

This quantity also is infeasible because a 76-unit order is too

small to qualify for the $58.80 price. Try the highest price level:

Find Q with Quantity

Discounts

This quantity is feasible because it lies in the range

corresponding to its price, P = $60.00

= =

H

DS 2

EOQ

00 60.

( )( )

( )

units 75

00 60 25 0

00 45 936 2

=

. $ .

. $

Step 2: The first feasible EOQ of 75 does not correspond to

the lowest price level. Hence, we must compare its

total cost with the price break quantities (300 and 500

units) at the lower price levels ($58.80 and $57.00):

Find Q with Quantity Discounts

( ) ( ) PD S

Q

D

H

Q

C + + =

2

( )( ) | | ( ) ( ) 284 57 936 00 60 00 45

75

936

00 60 25 0

2

75

75

, $ . $ . $ . $ . = + + = C

( )( ) | | ( ) ( ) 382 57 936 80 58 00 45

300

936

80 58 25 0

2

300

300

, $ . $ . $ . $ . = + + = C

( )( ) | | ( ) ( ) 999 56 936 00 57 00 45

500

936

00 57 25 0

2

500

500

, $ . $ . $ . $ . = + + = C

The best purchase quantity is 500 units, which qualifies for the

deepest discount

Application D.2

A suppliers price schedule is:

Order Quantity Price per Unit

099 $50

100 or more $45

If ordering cost is $16 per order, annual holding cost is 20

percent of the purchase price, and annual demand is 1,800

items, what is the best order quantity?

Application D.2

SOLUTION

Step 1:

= =

H

DS 2

EOQ

00 45.

( )( )

( )( )

e) (infeasibl units 80

2 0 45

16 800 1 2

=

.

,

= =

H

DS 2

EOQ

00 50.

( )( )

( )( )

(feasible) units 76

2 0 50

16 800 1 2

=

.

,

Step 2:

=

76

C ( ) ( ) ( ) 759 90 800 1 50 16

76

800 1

2 0 50

2

76

, $ ,

,

. = + +

=

100

C ( ) ( ) ( ) 738 81 800 1 45 16

100

800 1

2 0 45

2

100

, $ ,

,

. = + +

The best order quantity is 100 units

One-Period Decisions

Seasonal goods are a dilemma facing many

retailers.

Newsboy problem

Step 1: List different demand levels and

probabilities.

Step 2: Develop a payoff table that shows the profit

for each purchase quantity, Q, at each

assumed demand level, D.

Each row represents a different order

quantity and each column represents a

different demand.

The payoff depends on whether all units are

sold at the regular profit margin which

results in two possible cases.

One-Period Decisions

If demand is high enough (Q D), then all of the cases

are sold at the full profit margin, p, during the regular

season

If the purchase quantity exceeds the eventual demand

(Q > D), only D units are sold at the full profit margin,

and the remaining units purchased must be disposed

of at a loss, l, after the season

Payoff = (Profit per unit)(Purchase quantity) = pQ

Payoff = (Demand)

Loss

per

unit

Profit per

unit sold

during

season

Amount

disposed

of after

season

= p X D l X (Q D)

One-Period Decisions

Step 3: Calculate the expected payoff of each Q by

using the expected value decision rule. For

a specific Q, first multiply each payoff by its

demand probability, and then add the

products.

Step 4: Choose the order quantity Q with the

highest expected payoff.

Finding Q for One-Period

Decisions

EXAMPLE D.3

One of many items sold at a museum of natural history is a

Christmas ornament carved from wood. The gift shop makes a

$10 profit per unit sold during the season, but it takes a $5

loss per unit after the season is over. The following discrete

probability distribution for the seasons demand has been

identified:

Demand 10 20 30 40 50

Demand Probability 0.2 0.3 0.3 0.1 0.1

How many ornaments should the museums buyer order?

Finding Q for One-Period

Decisions

SOLUTION

Each demand level is a candidate for best order quantity,

so the payoff table should have five rows. For the first

row, where Q = 10, demand is at least as great as the

purchase quantity. Thus, all five payoffs in this row are

This formula can be used in other rows but only for those

quantitydemand combinations where all units are sold

during the season. These combinations lie in the upper-

right portion of the payoff table, where Q D. For example,

the payoff when Q = 40 and D = 50 is

Payoff = pQ = ($10)(10) = $100

Payoff = pQ = ($10)(40) = $400

Finding Q for One-Period

Decisions

The payoffs in the lower-left portion of the table represent

quantitydemand combinations where some units must be

disposed of after the season (Q > D). For this case, the payoff

must be calculated with the second formula. For example,

when Q = 40 and D = 30,

Using OM Explorer, we obtain the payoff table in Figure D.5

Payoff = pD l(Q D) = ($10)(30) ($5)(40 30) = $250

Now we calculate the expected payoff for each Q by multiplying

the payoff for each demand quantity by the probability of that

demand and then adding the results. For example, for Q = 30,

Payoff = 0.2($0) + 0.3($150) + 0.3($300) + 0.1($300) + 0.1($300)

= $195

Application D.3

For one item, p = $10 and l = $5. The probability distribution for the

seasons demand is:

Demand Demand

(D) Probability

10 0.2

20 0.3

30 0.3

40 0.1

50 0.1

Complete the following payoff matrix, as well as the column on

the right showing expected payoff. What is the best choice for

Q?

Application D.3

D

Expected

Payoff Q 10 20 30 40 50

10 $100 $100 $100 $100 $100 $100

20 50 200 200 200 200 170

30 0 300 300

40 50 100 250 400 400 175

50 100 50 200 350 500 140

Application D.3

Payoff if Q = 30 and D = 20:

pD l(Q D) = 10(20) 5(30 20) = $150

Payoff if Q = 30 and D = 40:

Expected payoff if Q = 30:

pD = 10(30) = $300

0(0.2) + 150(0.3) + 300(0.3 + 0.1 + 0.1) = $195

Q = 30 has the highest payoff at $195.00

D

Expected

Payoff Q 10 20 30 40 50

10 $100 $100 $100 $100 $100 $100

20 50 200 200 200 200 170

30 0 300 300

40 50 100 250 400 400 175

50 100 50 200 350 500 140

150 300 195

Solved Problem 1

Peachy Keen, Inc., makes mohair sweaters, blouses with

Peter Pan collars, pedal pushers, poodle skirts, and other

popular clothing styles of the 1950s. The average demand

for mohair sweaters is 100 per week. Peachys production

facility has the capacity to sew 400 sweaters per week.

Setup cost is $351. The value of finished goods inventory

is $40 per sweater. The annual per-unit inventory holding

cost is 20 percent of the items value.

a. What is the economic production lot size (ELS)?

b. What is the average time between orders (TBO)?

c. What is the total of the annual holding cost and setup cost?

Solved Problem 1

SOLUTION

a. The production lot size that minimizes total cost is

d p

p

H

DS

=

2

ELS

( )( )

( ) 100 400

400

40 20 0

351 52 100 2

=

$ .

$

sweaters 780

3

4

300 456 = = ,

b. The average time between orders is

= =

D

ELS

O TB

ELS

year 0.15

200 5

780

=

,

Converting to weeks, we get

( )( ) weeks 7.8 r weeks/yea 52 year 0.15 TBO

ELS

= =

Solved Problem 1

c. The minimum total of setup and holding costs is

( ) ( ) S

Q

D

H

p

d p Q

C + |

.

|

\

|

=

2

( ) ( ) 351

780

200 5

40 20 0

400

100 400

2

780

$

,

$ . +

|

.

|

\

|

=

r $4,680/yea r $2,340/yea r $2,340/yea = + =

Solved Problem 2

A hospital buys disposable surgical packages from Pfisher, Inc.

Pfishers price schedule is $50.25 per package on orders of 1 to 199

packages and $49.00 per package on orders of 200 or more

packages. Ordering cost is $64 per order, and annual holding cost is

20 percent of the per unit purchase price. Annual demand is 490

packages. What is the best purchase quantity?

SOLUTION

We first calculate the EOQ at the lowest price:

= =

H

DS 2

EOQ

00 49.

( )( )

( )

packages 80 400 6

00 49 20 0

00 64 490 2

= = ,

. $ .

. $

Solved Problem 2

This solution is infeasible because, according to the price

schedule, we cannot purchase 80 packages at a price of

$49.00 each. Therefore, we calculate the EOQ at the next

lowest price ($50.25):

= =

H

DS 2

EOQ

25 50.

( )( )

( )

packages 79 241 6

25 50 20 0

00 64 490 2

= = ,

. $ .

. $

This EOQ is feasible, but $50.25 per package is not the lowest

price. Hence, we have to determine whether total costs can be

reduced by purchasing 200 units and thereby obtaining a

quantity discount.

Solved Problem 2

( ) ( ) PD S

Q

D

H

Q

C + + =

2

( ) ( ) ( ) 490 25 50 00 64

79

490

25 50 20 0

2

79

79

. $ . $ . $ . + + = C

( ) ( ) ( ) 490 00 49 00 64

200

490

00 49 20 0

2

200

200

. $ . $ . $ . + + = C

/year $25,416.44 $24,622.50 ar $396.68/ye ar $396.98/ye = + + =

/year $25,146.80 $24,010.00 ar $156.80/ye ar $980.00/ye = + + =

Purchasing 200 units per order will save $269.64/year,

compared to buying 79 units at a time.

Solved Problem 3

Swell Productions is sponsoring an outdoor conclave for

owners of collectible and classic Fords. The concession stand

in the T-Bird area will sell clothing such as T-shirts and official

Thunderbird racing jerseys. Jerseys are purchased from

Columbia Products for $40 each and are sold during the event

for $75 each. If any jerseys are left over, they can be returned

to Columbia for a refund of $30 each. Jersey sales depend on

the weather, attendance, and other variables. The following

table shows the probability of various sales quantities. How

many jerseys should Swell Productions order from Columbia

for this one-time event?

Sales Quantity Probability Quantity Sales Probability

100 0.05 400 0.34

200 0.11 500 0.11

300 0.34 600 0.05

Solved Problem 3

SOLUTION

Table next slide is the payoff table that describes this one-

period inventory decision. The upper right portion of the table

shows the payoffs when the demand, D, is greater than or

equal to the order quantity, Q. The payoff is equal to the per-

unit profit (the difference between price and cost) multiplied by

the order quantity. For example, when the order quantity is

100 and the demand is 200,

Payoff = (p c)Q = ($75 - $40)100 = $3,500

Solved Problem 3

PAYOFFS table

Demand, D

Expected

Payoff Q 100 200 300 400 500 600

100 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500

200 $2,500 $7,000 $7,000 $7,000 $7,000 $7,000 $6,775

300 $1,500 $6,000 $10,500 $10,500 $10,500 $10,500 $9,555

400 $500 $5,000 $9,500 $14,000 $14,000 $14,000 $10,805

500 ($500) $4,000 $8,500 $13,000 $17,500 $17,500 $10,525

600 ($1,500) $3,000 $7,000 $12,000 $16,500 $21,000 $9,750

Solved Problem 3

The lower-left portion of the payoff table shows the payoffs

when the order quantity exceeds the demand. Here the

payoff is the profit from sales, pD, minus the loss

associated with returning overstock, l(Q D), where l is the

difference between the cost and the amount refunded for

each jersey returned and Q D is the number of jerseys

returned. For example, when the order quantity is 500 and

the demand is 200,

Payoff = pD l(Q D) = ($75 - $40)200 ($40 $30)(500 200)

= $4,000

The highest expected payoff occurs when 400 jerseys are

ordered:

Expected payoff

400

= ($500 0.05) + ($5,000 0.11)

+ ($9,500 0.34) + ($14,000 0.34)

+ ($14,000 0.11) + ($14,000 0.05)

= $10,805

You might also like

- Foodics Analysis Market and PlanDocument4 pagesFoodics Analysis Market and PlanSaid Ezz Eldin100% (1)

- Chicagoland Sweets (Questions 3 and 4) Chicagoland Sweets, A Commercial Baker, UsesDocument5 pagesChicagoland Sweets (Questions 3 and 4) Chicagoland Sweets, A Commercial Baker, UsesIpsita RathNo ratings yet

- Practice ProblemsDocument4 pagesPractice ProblemsArvind KumarNo ratings yet

- More Vino Projected EarningsDocument4 pagesMore Vino Projected EarningsTERESANo ratings yet

- Industry Immersion Project On Production and Operation ManagementDocument13 pagesIndustry Immersion Project On Production and Operation ManagementAbhinav AroraNo ratings yet

- Company Profile of Procter & GambleDocument23 pagesCompany Profile of Procter & Gambleroy874No ratings yet

- Calculate Sewing Thread ConsumptionDocument6 pagesCalculate Sewing Thread Consumptionrgvarma1230% (1)

- Chap015 Inventory ControlDocument43 pagesChap015 Inventory ControlKhushbu ChandnaniNo ratings yet

- Quantity Discounts For The Eoq ModelDocument13 pagesQuantity Discounts For The Eoq Modelnatalie clyde matesNo ratings yet

- EVA Practice SheetDocument17 pagesEVA Practice SheetVinushka GoyalNo ratings yet

- MAC Costing ReportDocument10 pagesMAC Costing ReportRohanNo ratings yet

- Inventory Management (2021)Document8 pagesInventory Management (2021)JustyNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1rohini jha0% (1)

- Marketing On Elkos PernDocument9 pagesMarketing On Elkos PernAJAI SINGHNo ratings yet

- Quiz 2Document6 pagesQuiz 2Mukund AgarwalNo ratings yet

- Accounts CIA 2 - BudgetDocument107 pagesAccounts CIA 2 - Budgetjeta_prakash100% (1)

- Buyback of Shares of HulDocument7 pagesBuyback of Shares of HulBoota DeolNo ratings yet

- LPP FormulationDocument15 pagesLPP FormulationGaurav Somani0% (2)

- Quanti Question and AnswersDocument22 pagesQuanti Question and AnswersOFORINo ratings yet

- Various Inventory Costs: - Holding / - Ordering Costs - Purchase Costs - Total CostDocument28 pagesVarious Inventory Costs: - Holding / - Ordering Costs - Purchase Costs - Total CostAditya Dashputre100% (2)

- Cash Management NumericalsDocument5 pagesCash Management NumericalsAnjali Jain100% (1)

- MRPDocument70 pagesMRPburanNo ratings yet

- AMD - Note On PV Ratio-1Document4 pagesAMD - Note On PV Ratio-1Bharath s kashyapNo ratings yet

- BPB31103 Production & Operations Management ch10Document89 pagesBPB31103 Production & Operations Management ch10Anis TajuldinNo ratings yet

- EOQDocument4 pagesEOQHassan Ali100% (2)

- Prof. (DR.) Sandeep Nemlekar: Phone # Email More Details On Youtube &Document30 pagesProf. (DR.) Sandeep Nemlekar: Phone # Email More Details On Youtube &smith awesomeNo ratings yet

- F5 Handout 1 For Dec 2011Document18 pagesF5 Handout 1 For Dec 2011saeed@atcNo ratings yet

- Working Capital MGTDocument14 pagesWorking Capital MGTrupaliNo ratings yet

- Financial Accounting: A Managerial Perspective: Sixth EditionDocument15 pagesFinancial Accounting: A Managerial Perspective: Sixth EditionKARISHMA SANGHAINo ratings yet

- Stratagic Manegement Process: Orient Is A Symbol of Innovation in PakistanDocument3 pagesStratagic Manegement Process: Orient Is A Symbol of Innovation in PakistanUsama UsamaNo ratings yet

- L&T Cost of CapitalDocument17 pagesL&T Cost of Capitalbishnuchettri0% (1)

- Receivables ManagementDocument4 pagesReceivables ManagementVaibhav MoondraNo ratings yet

- Capital Rationing: Reporter: Celestial C. AndradaDocument13 pagesCapital Rationing: Reporter: Celestial C. AndradaCelestial Manikan Cangayda-AndradaNo ratings yet

- InventoryDocument46 pagesInventoryAnkit SharmaNo ratings yet

- CRM ProcessDocument17 pagesCRM ProcessSaurabh Rinku86% (7)

- Discounted Cash Flow Method:: NPV PVB - PVC Where, PVB Present Value of BenefitsDocument3 pagesDiscounted Cash Flow Method:: NPV PVB - PVC Where, PVB Present Value of BenefitsReven BalazonNo ratings yet

- ACF 100 Resit CourseworkDocument4 pagesACF 100 Resit CourseworkAyush JainNo ratings yet

- Book Building ProcessDocument3 pagesBook Building ProcessgiteshNo ratings yet

- Coordination in Supply Chain ManagementDocument16 pagesCoordination in Supply Chain ManagementAman Vinny Vinny100% (1)

- International Marketing TybmsDocument4 pagesInternational Marketing Tybmssglory dharmarajNo ratings yet

- Price Level Accounting by Rekha - 5212Document30 pagesPrice Level Accounting by Rekha - 5212Khesari Lal YadavNo ratings yet

- Question No. 1 5 Marks: Not Including The Costs of Plastic Housing (Column B)Document13 pagesQuestion No. 1 5 Marks: Not Including The Costs of Plastic Housing (Column B)Mawaz Khan MirzaNo ratings yet

- Case Study On Bajaj AvisekDocument9 pagesCase Study On Bajaj AvisekAvisek SarkarNo ratings yet

- Textbook Solution Ch8Document10 pagesTextbook Solution Ch8coffeedanceNo ratings yet

- Financial Management Mcqs With Answers: Eguardian India Banking and Finance McqsDocument27 pagesFinancial Management Mcqs With Answers: Eguardian India Banking and Finance McqsDeeparsh SinghalNo ratings yet

- Meaning of CostDocument9 pagesMeaning of Costsanket8989100% (1)

- Inventory Assignment 2 PDFDocument10 pagesInventory Assignment 2 PDFMuhammad Naveed IkramNo ratings yet

- Final BRMDocument59 pagesFinal BRMabhilasha_babbarNo ratings yet

- Victoria Kite CompanyDocument2 pagesVictoria Kite CompanyVaibhav AgarwalNo ratings yet

- Problems in Cash Budget: Venture FinanceDocument5 pagesProblems in Cash Budget: Venture FinanceAmaldevNo ratings yet

- of Management ScienceDocument31 pagesof Management ScienceNusa FarhaNo ratings yet

- Graphical Method of Solving Linear Programming ProblemDocument25 pagesGraphical Method of Solving Linear Programming ProblemGuruvayur Maharana67% (3)

- Cost of Capital (Ch-3)Document26 pagesCost of Capital (Ch-3)Neha SinghNo ratings yet

- Worksheet 17 CBDocument8 pagesWorksheet 17 CBTrianbh SharmaNo ratings yet

- Buyback DelistingDocument51 pagesBuyback DelistingSowjanya Hp SowjuNo ratings yet

- 2 CRM AT TATA SKY - Group 2Document17 pages2 CRM AT TATA SKY - Group 2manmeet kaurNo ratings yet

- Lubol India LimitedDocument13 pagesLubol India LimitedSarvesh Hiremath100% (2)

- Presentation of Summer InternshipDocument22 pagesPresentation of Summer Internshippriya_singh01100% (1)

- Ratio Analysis of Samsung Electronics Co., LTDDocument21 pagesRatio Analysis of Samsung Electronics Co., LTDUroOj SaleEm100% (1)

- Applications and Solutions of Linear Programming Session 1Document19 pagesApplications and Solutions of Linear Programming Session 1Simran KaurNo ratings yet

- Aggregate Planning: OMII, Term III, Sessions 8-10 Harpreet KaurDocument44 pagesAggregate Planning: OMII, Term III, Sessions 8-10 Harpreet Kaurayushmehar22No ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Positives of Using Sy MedDocument3 pagesPositives of Using Sy MedPradeep SethiaNo ratings yet

- Airbus and Ethics: Avinash Mohanty Amar K Prameet Ghosh Pradeep SethiaDocument6 pagesAirbus and Ethics: Avinash Mohanty Amar K Prameet Ghosh Pradeep SethiaPradeep SethiaNo ratings yet

- Presentation For SM - New Service DesignDocument29 pagesPresentation For SM - New Service DesignPradeep SethiaNo ratings yet

- Term Assignment Services Marketing WhitepaperDocument4 pagesTerm Assignment Services Marketing WhitepaperPradeep SethiaNo ratings yet

- B2BM Project Report - Business To Business MarketingDocument18 pagesB2BM Project Report - Business To Business MarketingPradeep SethiaNo ratings yet

- ITS Fundamental Principles of Network SecurityDocument13 pagesITS Fundamental Principles of Network SecurityPradeep SethiaNo ratings yet

- Accounting Practices of Selected Grocery Stores in BacarraDocument4 pagesAccounting Practices of Selected Grocery Stores in BacarraNoelle BagcalNo ratings yet

- Restaurant: Business Plan American DinerDocument15 pagesRestaurant: Business Plan American DinerpanjatinNo ratings yet

- HR Competency Mapp Retail Sector ThesisDocument89 pagesHR Competency Mapp Retail Sector ThesisSANDEEP ARORA100% (6)

- Unbranded To Branded Exchange FestivalDocument2 pagesUnbranded To Branded Exchange FestivalEr Tapanta MukherjeeNo ratings yet

- PGCL Quality ManualDocument85 pagesPGCL Quality Manualsahadat0% (2)

- InvoiceDocument1 pageInvoicesunil sharmaNo ratings yet

- Examen Ingles Selectividad Madrid Junio 2013 Solucion PDFDocument4 pagesExamen Ingles Selectividad Madrid Junio 2013 Solucion PDFAndres GómezNo ratings yet

- Amazon IncDocument15 pagesAmazon Incabdul basitNo ratings yet

- Consumer BehaviourDocument6 pagesConsumer BehaviourTeresia NiaNo ratings yet

- Marketing Management McDonald Vs SubwayDocument13 pagesMarketing Management McDonald Vs SubwayKirtanChauhan50% (2)

- Supply Chain Management "Amazon Case Study Analysis": by Krishna Yeldi MBA07059Document4 pagesSupply Chain Management "Amazon Case Study Analysis": by Krishna Yeldi MBA07059KRISHNA YELDINo ratings yet

- FAQs Omaxe Chandni ChowkDocument8 pagesFAQs Omaxe Chandni Chowksishir mandalNo ratings yet

- A Study of Pepsi's Distribution Channel in NOIDA (2) .Docx 123Document80 pagesA Study of Pepsi's Distribution Channel in NOIDA (2) .Docx 123Mazhar ZamanNo ratings yet

- Lijjat PapadDocument23 pagesLijjat PapadAnonymous MrE0VJQ6YANo ratings yet

- STP Report (16dm181)Document10 pagesSTP Report (16dm181)Rohit SinhaNo ratings yet

- Costco's Case StudyDocument3 pagesCostco's Case StudyNazneen Binte AminNo ratings yet

- PensonicDocument2 pagesPensonicNur AqilahNo ratings yet

- E Commerce DefinitionDocument10 pagesE Commerce DefinitionShashank PrasarNo ratings yet

- Harley Davidson Marketing AuditDocument17 pagesHarley Davidson Marketing AuditAbhishek GuptaNo ratings yet

- Film DistributionDocument21 pagesFilm DistributionSulekha BhattacherjeeNo ratings yet

- Bed Stuy Restoration 2017 InviteDocument2 pagesBed Stuy Restoration 2017 InviteNorman OderNo ratings yet

- Supply Chain Activities of Atlas Honda Motorcycles PakistanDocument31 pagesSupply Chain Activities of Atlas Honda Motorcycles PakistanJaved MalikNo ratings yet

- A Study of Marketing Statergy of Haldiram ProjectDocument17 pagesA Study of Marketing Statergy of Haldiram Projectpratibha bawankuleNo ratings yet

- Intelligent StoreDocument8 pagesIntelligent Storecernat katiNo ratings yet

- "Mobile Retailing Blueprint" G P: Comprehensive Guide For Mobile in RetailDocument31 pages"Mobile Retailing Blueprint" G P: Comprehensive Guide For Mobile in RetailHermes TriNo ratings yet

- Aling Presing ChichacornDocument2 pagesAling Presing ChichacornMhel Joshua Bautista HermitanioNo ratings yet

- Proceedings of Business Logistics in Modern Management 2015Document330 pagesProceedings of Business Logistics in Modern Management 2015Breanne JacksonNo ratings yet