Professional Documents

Culture Documents

CH 07

Uploaded by

Anbuoli ParthasarathyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 07

Uploaded by

Anbuoli ParthasarathyCopyright:

Available Formats

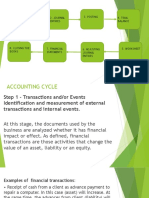

CHAPTER SEVEN

The General Journal

7-3

THE GENERAL JOURNAL

Objectives:

1. Record transactions in a general journal. 2. Use a chart of accounts. 3. Correct errors in the journal.

McGraw-Hill/Irwin Accounting Fundamentals, 7/e

2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-4

The Use of the General Journal

The accounting record known as a journal is used to list all the necessary information about a transaction in one place.

The journal is known as the book of original entry.

McGraw-Hill/Irwin Accounting Fundamentals, 7/e

2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-5

The Use of the General Journal

(continued)

The process of recording these transactions in the journal is known as journalizing, or recording journal entries.

Double-entry accounting is the system of journalizing when each transaction affects at least two accounts.

McGraw-Hill/Irwin Accounting Fundamentals, 7/e 2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-6

Journalizing a Businesss Transactions

Accounts used in the recording of transactions are taken from a chart of accounts.

The chart of accounts lists, by number in chronological order, the accounts determined to be used by the business.

McGraw-Hill/Irwin Accounting Fundamentals, 7/e 2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-7

Journalizing a Businesss Transactions (continued)

Pencil footings are used at the bottom of the money columns to provide balance of debits and credits.

Entries may contain more than one debit and/or credit.

McGraw-Hill/Irwin Accounting Fundamentals, 7/e

2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-8

Transaction

Record the owners investment in the business:

Cash, $32,000 Accounts Receivable, $2,000 Office Equipment, $12,000 Delivery Trucks, $60,000 Accounts Payable, $20,000 Capital, $86,000

McGraw-Hill/Irwin Accounting Fundamentals, 7/e 2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-9

Transaction Analysis

The assets (debits) and liabilities (credit) and owners equity account (credit) are recorded in the journal.

Date

20 xx

Description 1 Cash Accounts Receivable Office Equipment Delivery Trucks Accounts Payable Christopher Johns, Capital

Investment in the business

Post Ref

Debit 32,000 2,000 12,000 60,000

Credit

Nov

20,000 86,000

McGraw-Hill/Irwin Accounting Fundamentals, 7/e

2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-10

Transaction

Paid $1800 to Wilson Management for the November rent.

McGraw-Hill/Irwin Accounting Fundamentals, 7/e

2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-11

Transaction Analysis

An increase in expenses decreases owners equity (debit Rent Expense).

An asset decreases (credit Cash).

Date

20 xx

Description 1 Rent Expense Cash

Paid November rent.

Post Ref

Debit 1,800

Credit

1,800

McGraw-Hill/Irwin Accounting Fundamentals, 7/e

2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-12

Transaction

Paid $400 to Kenworth Truck Sales on account.

McGraw-Hill/Irwin Accounting Fundamentals, 7/e

2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-13

Transaction Analysis

A liability decreases (debit Accounts Payable). An asset decreases (credit Cash).

Date

20 xx

Description 10 Accounts Payable Cash

Paid Kenw orth Truck Sales on account

Post Ref

Debit 400

Credit

400

McGraw-Hill/Irwin Accounting Fundamentals, 7/e

2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-14

Transaction

Paid $150 for gasoline and oil for the trucks.

McGraw-Hill/Irwin Accounting Fundamentals, 7/e

2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-15

Transaction Analysis

An increase in expenses decreases owners equity (debit Truck Expense).

An asset decreases (credit Cash).

Date

20 xx Post Ref

Description 13 Truck Expense Cash

Paid for gasoline and oil.

Debit 150

Credit

150

McGraw-Hill/Irwin Accounting Fundamentals, 7/e

2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-16

Accounting Terminology

Chart of accounts

Chronological order Compound entry

Double-entry accounting

General journal Journal Journalizing Opening Entry

McGraw-Hill/Irwin Accounting Fundamentals, 7/e 2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-17

Chapter Summary

A journal is used to keep a record of the day-to-day financial activities of a business. Some people use T accounts to analyze the transactions before entering them into the journal.

McGraw-Hill/Irwin Accounting Fundamentals, 7/e 2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-18

Chapter Summary(continued)

The journal is used to list essential information about each transaction. The journal is called the book or record of original entry. A general journal is a common type of journal.

McGraw-Hill/Irwin Accounting Fundamentals, 7/e 2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-19

Chapter Summary(continued)

A systematically arranged list of a businesss accounts is known as a chart of accounts. The chart of accounts shows account classifications (assets, liabilities, owners equity, revenue, and expenses) as well as the name and number of each account.

McGraw-Hill/Irwin Accounting Fundamentals, 7/e 2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-20

Chapter Summary(continued)

A journal entry may contain more than one debit and/or credit. This type of entry is called a compound entry. The totals of the debit and credit columns must be equal no matter how many accounts are used in a transaction.

McGraw-Hill/Irwin Accounting Fundamentals, 7/e 2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-21

Topic Quiz

Answer the following true/false questions:

1. T accounts may be used in place of journalizing. 2. The journal is known as the record or book of original entry. 3. Revenue and expense accounts are not on the chart of accounts.

McGraw-Hill/Irwin Accounting Fundamentals, 7/e

FALSE

TRUE

FALSE

2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-22

Investigating on the Internet

Sources of information about general journals can be accessed at the websites of most businesses. As a research assignment, access a business website and report those sources of information that might concern the use of journals in business.

McGraw-Hill/Irwin Accounting Fundamentals, 7/e 2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

7-23

1. T accounts may be used in place of journalizing.

FALSE

T accounts may be used to analyze a transaction, but the journal must be used to record the financial activity and the accounts affected.

McGraw-Hill/Irwin Accounting Fundamentals, 7/e

2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

(Return to Topic Quiz)

7-24

3. Revenue and expense accounts are not on the chart of accounts.

FALSE

All accounts are listed on the chart of accounts.

McGraw-Hill/Irwin Accounting Fundamentals, 7/e

2006 The McGraw-Hill Companies, Inc., All Rights Reserved.

(Return to Topic Quiz)

You might also like

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursFrom EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo ratings yet

- Major Accounts and the Accounting CycleDocument23 pagesMajor Accounts and the Accounting CycleVicky Ann SoriaNo ratings yet

- Financial and Management Accounting - MB0041: Answer 1Document8 pagesFinancial and Management Accounting - MB0041: Answer 1aditya_sikkhimNo ratings yet

- Unit 2Document58 pagesUnit 2Wenkhosi MalingaNo ratings yet

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- Q2 Week 7 - ADM ModuleDocument3 pagesQ2 Week 7 - ADM ModuleCathleenbeth MorialNo ratings yet

- Topic 3: Introduction To Transaction ProcessingDocument45 pagesTopic 3: Introduction To Transaction ProcessingTeo ShengNo ratings yet

- Fabm2 LC1 4Document32 pagesFabm2 LC1 4gabezarate071No ratings yet

- Chap002 AccountingMBADocument49 pagesChap002 AccountingMBAaliceaharp_621918018No ratings yet

- AIS Chapter 2Document69 pagesAIS Chapter 2Loren Jel HallareNo ratings yet

- The Accounting Cycle: Capturing Economic Events: Mcgraw-Hill/IrwinDocument45 pagesThe Accounting Cycle: Capturing Economic Events: Mcgraw-Hill/IrwinSobia NasreenNo ratings yet

- Intermediate Accounting: Eleventh Canadian EditionDocument62 pagesIntermediate Accounting: Eleventh Canadian EditionthisisfakedNo ratings yet

- Information For DecisionsDocument50 pagesInformation For Decisionssaeed786786No ratings yet

- CH 07Document5 pagesCH 07kurt_jones_4No ratings yet

- Accounting PDFDocument11 pagesAccounting PDFLinh NguyễnNo ratings yet

- Accounting Cycle GuideDocument18 pagesAccounting Cycle GuideKarysse Arielle Noel JalaoNo ratings yet

- Accounting Principles - AllDocument104 pagesAccounting Principles - AllAHMED100% (1)

- Journal, Ledger, Trial Balance, Trading & Profit Loss Accounts & Balance SheetDocument28 pagesJournal, Ledger, Trial Balance, Trading & Profit Loss Accounts & Balance SheetManan MullickNo ratings yet

- Intro to Accounting FundamentalsDocument60 pagesIntro to Accounting FundamentalsAyanChatterjee100% (1)

- Journal Accounts To Trial BalanceDocument47 pagesJournal Accounts To Trial Balancebhaskyban100% (1)

- Oracle Applications White Paper O EBS R12 R C P P: Racle Eceivables Losing Eriod RoceduresDocument18 pagesOracle Applications White Paper O EBS R12 R C P P: Racle Eceivables Losing Eriod RoceduresAli ShahNo ratings yet

- LMT School of Management, Thapar University Masters of Business AdministrationDocument18 pagesLMT School of Management, Thapar University Masters of Business Administrationgursimran jit singhNo ratings yet

- Notes On Chapter 7: 7.1 Purposes of The Trading and Profit and Loss AccountDocument3 pagesNotes On Chapter 7: 7.1 Purposes of The Trading and Profit and Loss AccountPriya SunderNo ratings yet

- Module 2 Intro To Transaction Processing SystemDocument65 pagesModule 2 Intro To Transaction Processing SystemiiyoNo ratings yet

- AcctIS10E - Ch04 - CE - PART 1 - FOR CLASSDocument32 pagesAcctIS10E - Ch04 - CE - PART 1 - FOR CLASSLance CaveNo ratings yet

- Romney Ch02Document112 pagesRomney Ch02Maryjane YaranonNo ratings yet

- Acc Project VANSHDocument12 pagesAcc Project VANSHVansh SehgalNo ratings yet

- 02 - General Ledger AccountingDocument24 pages02 - General Ledger AccountingYen Yen ChubiezNo ratings yet

- Introduction To Transaction ProcessingDocument78 pagesIntroduction To Transaction ProcessingNurAuniNo ratings yet

- Accounting: The Language of BusinessDocument43 pagesAccounting: The Language of BusinessElbert EinsteinNo ratings yet

- Chap 02 Introduction To Transaction ProcessingDocument77 pagesChap 02 Introduction To Transaction ProcessingJanet GriponNo ratings yet

- Accounting: Information For Decision Making: Mcgraw-Hill/IrwinDocument10 pagesAccounting: Information For Decision Making: Mcgraw-Hill/IrwinjawadzaheerNo ratings yet

- The Bookkeeping Process and Transaction AnalysisDocument54 pagesThe Bookkeeping Process and Transaction AnalysisdanterozaNo ratings yet

- WRD 26e - Se PPT - CH 01Document19 pagesWRD 26e - Se PPT - CH 01Vĩnh TríNo ratings yet

- CHAPTER 7 Accounting Information SystemsDocument6 pagesCHAPTER 7 Accounting Information SystemsAhmed RawyNo ratings yet

- 1 The Accounting Equation Accounting Cycle Steps 1 4Document6 pages1 The Accounting Equation Accounting Cycle Steps 1 4Jerric CristobalNo ratings yet

- Book of Accounts WD ActivityDocument3 pagesBook of Accounts WD ActivityChristopher SelebioNo ratings yet

- AccountingDocument13 pagesAccountingArjun SrinivasNo ratings yet

- Serenity Dugan - Accounting - CH - 07-BookDocument33 pagesSerenity Dugan - Accounting - CH - 07-BookSerenity DuganNo ratings yet

- Record Keeping For EntrepreneursDocument41 pagesRecord Keeping For Entrepreneursarthur100% (2)

- Notes For IGCSE AccountingsDocument33 pagesNotes For IGCSE AccountingsLai YeeNo ratings yet

- Information Sheet 1.1-1Document14 pagesInformation Sheet 1.1-1Sharon galabinNo ratings yet

- Foundations of Entrepreneurship: Basic Accounting and Financial StatementsDocument89 pagesFoundations of Entrepreneurship: Basic Accounting and Financial StatementsTejaswi BandlamudiNo ratings yet

- Accounting Books - Journal, Ledger and Trial BalanceDocument35 pagesAccounting Books - Journal, Ledger and Trial BalanceGhie Ragat100% (3)

- Remember TheseDocument2 pagesRemember TheseSIMON CHRISTOPHER ARADANo ratings yet

- Session 3 - Financial Statements of BanksDocument34 pagesSession 3 - Financial Statements of Banksvasuraj002No ratings yet

- Ross 7 e CH 27Document29 pagesRoss 7 e CH 27Meddy YogastoroNo ratings yet

- Chapter-2 Theory - 1-21 - Financial AccountingDocument8 pagesChapter-2 Theory - 1-21 - Financial AccountingOmor FarukNo ratings yet

- Service Bus - Acctg CycleDocument34 pagesService Bus - Acctg CycleJenniferNo ratings yet

- Powerpoint Journal Ledger and Trial BalanceDocument40 pagesPowerpoint Journal Ledger and Trial BalanceChris Iero-Way100% (1)

- Module 1 Intro To Financial Management 1Document22 pagesModule 1 Intro To Financial Management 1Jenalyn OrtegaNo ratings yet

- Sample UGC NET CommerceDocument8 pagesSample UGC NET Commercefaltuid1430No ratings yet

- ACCOUNTING CYCLE STEPSDocument33 pagesACCOUNTING CYCLE STEPSKristelle JoyceNo ratings yet

- Financial Accounting & AnalysisDocument11 pagesFinancial Accounting & Analysisheet jainNo ratings yet

- Section 1 (Chapter 1)Document10 pagesSection 1 (Chapter 1)may thansinNo ratings yet

- Accounting Information Systems: QuestionsDocument53 pagesAccounting Information Systems: Questionstisha10rahman100% (1)

- Basic AccountingDocument7 pagesBasic AccountingBaby PinkNo ratings yet

- Bonus ActDocument1 pageBonus ActAnbuoli ParthasarathyNo ratings yet

- Unit - 5 Employees State Insurance Act, 1948 - Objectives - Definitions - Standing Committee - Contribution, Kinds of Benefits and EligibilityDocument1 pageUnit - 5 Employees State Insurance Act, 1948 - Objectives - Definitions - Standing Committee - Contribution, Kinds of Benefits and EligibilityAnbuoli ParthasarathyNo ratings yet

- Influencing The Online Consumer's Behavior: The Web ExperienceDocument17 pagesInfluencing The Online Consumer's Behavior: The Web ExperienceAnbuoli ParthasarathyNo ratings yet

- IntroductionDocument24 pagesIntroductionAnbuoli ParthasarathyNo ratings yet

- Unit 1 Ed Word FormatDocument46 pagesUnit 1 Ed Word FormatAnbuoli ParthasarathyNo ratings yet

- Ba8202 Business Research MethodsDocument5 pagesBa8202 Business Research MethodsAnbuoli ParthasarathyNo ratings yet

- Payment of Bonus Act 1965Document22 pagesPayment of Bonus Act 1965Santhosh RMNo ratings yet

- IrlwDocument6 pagesIrlwAnbuoli ParthasarathyNo ratings yet

- Entrepreneurial Intention: A Study Among Under Graduate Students of Arts and Science Colleges in MaduraiDocument1 pageEntrepreneurial Intention: A Study Among Under Graduate Students of Arts and Science Colleges in MaduraiAnbuoli ParthasarathyNo ratings yet

- Meaning:: PrivatisationDocument3 pagesMeaning:: PrivatisationAnbuoli ParthasarathyNo ratings yet

- IntroductionDocument24 pagesIntroductionAnbuoli ParthasarathyNo ratings yet

- Unit IDocument27 pagesUnit IAnbuoli ParthasarathyNo ratings yet

- API CalculationDocument38 pagesAPI CalculationAnbuoli ParthasarathyNo ratings yet

- Export DocumentationDocument12 pagesExport DocumentationAnbuoli ParthasarathyNo ratings yet

- ch02 121130124841 Phpapp02Document37 pagesch02 121130124841 Phpapp02Anbuoli ParthasarathyNo ratings yet

- Financial Formulas - Ratios (Sheet)Document3 pagesFinancial Formulas - Ratios (Sheet)carmo-netoNo ratings yet

- Accounting ConceptsDocument14 pagesAccounting ConceptsAnbuoli ParthasarathyNo ratings yet

- About TNSFDocument12 pagesAbout TNSFAnbuoli ParthasarathyNo ratings yet

- Fundamental Accounting Principles: 17 Edition Larson Wild ChiappettaDocument42 pagesFundamental Accounting Principles: 17 Edition Larson Wild ChiappettaAnbuoli ParthasarathyNo ratings yet

- Accounting Cycle (I) : Journalizing Posting and Preparing Trial BalanceDocument17 pagesAccounting Cycle (I) : Journalizing Posting and Preparing Trial BalanceAnbuoli ParthasarathyNo ratings yet

- INCOTERMSDocument11 pagesINCOTERMSAnbuoli ParthasarathyNo ratings yet

- AccountingDocument336 pagesAccountingVenkat GV100% (2)

- A Study On Sustainability of Non-Governmental Organizations in TamilnaduDocument14 pagesA Study On Sustainability of Non-Governmental Organizations in TamilnaduAnbuoli ParthasarathyNo ratings yet

- Financial Management DBA1654Document130 pagesFinancial Management DBA1654Anbuoli ParthasarathyNo ratings yet

- Micro FinanceDocument4 pagesMicro FinanceShishir GuptaNo ratings yet

- Entrepreneurial Development in India and EDPDocument15 pagesEntrepreneurial Development in India and EDPynkamat100% (2)

- Pre-Shipment and Post-Shipment Finance: Dr. A.K. Sengupta Former Dean, Indian Institute of Foreign TradeDocument7 pagesPre-Shipment and Post-Shipment Finance: Dr. A.K. Sengupta Former Dean, Indian Institute of Foreign TradeimadNo ratings yet

- DRC 21 - 1 - Functional Management - IDocument22 pagesDRC 21 - 1 - Functional Management - IAnbuoli ParthasarathyNo ratings yet

- EntrepreneurshipDocument20 pagesEntrepreneurshipGaurav100% (23)

- NFJPIA Mock Board 2016 - AuditingDocument8 pagesNFJPIA Mock Board 2016 - AuditingClareng Anne100% (1)

- Group 6 - Mid-Term - PNJ PosterDocument1 pageGroup 6 - Mid-Term - PNJ PosterMai SươngNo ratings yet

- Isaca Cisa CoursewareDocument223 pagesIsaca Cisa Coursewareer_bhargeshNo ratings yet

- TQM OverviewDocument125 pagesTQM OverviewSamNo ratings yet

- Tea UnderstandingDocument3 pagesTea UnderstandingSadiya SaharNo ratings yet

- Barilla-SpA CaseStudy Short Reaction PaperDocument3 pagesBarilla-SpA CaseStudy Short Reaction Papersvk320No ratings yet

- Build Customer Relationships Through Relationship MarketingDocument15 pagesBuild Customer Relationships Through Relationship MarketingPranav LatkarNo ratings yet

- Abhay KumarDocument5 pagesAbhay KumarSunil SahNo ratings yet

- Executive SummaryDocument32 pagesExecutive SummaryMuhammad ZainNo ratings yet

- Blank Hundred ChartDocument3 pagesBlank Hundred ChartMenkent Santisteban BarcelonNo ratings yet

- Strengthen PECs in DressmakingDocument1 pageStrengthen PECs in DressmakingLeticia AgustinNo ratings yet

- Adrian MittermayrDocument2 pagesAdrian Mittermayrapi-258981850No ratings yet

- Challan Form PDFDocument2 pagesChallan Form PDFaccountsmcc islamabadNo ratings yet

- Assessment Information Plan WorkshopDocument4 pagesAssessment Information Plan WorkshopLubeth CabatuNo ratings yet

- Exam Review: Market Equilibrium and ExternalitiesDocument24 pagesExam Review: Market Equilibrium and ExternalitiesDavid LimNo ratings yet

- Kennedy Geographic Consulting Market Outlook 2014 Latin America SummaryDocument8 pagesKennedy Geographic Consulting Market Outlook 2014 Latin America SummaryD50% (2)

- SAE1Document555 pagesSAE1Aditya100% (1)

- SOP Template Food and Drink Service OBT 08LTB OSP T1FDS 11 12 3Document15 pagesSOP Template Food and Drink Service OBT 08LTB OSP T1FDS 11 12 3Jean Marie Vallee100% (1)

- UNDP Interview Questions - GlassdoorDocument6 pagesUNDP Interview Questions - GlassdoorKumar SaurabhNo ratings yet

- Terminology Test - Petty CashDocument2 pagesTerminology Test - Petty CashStars2323100% (1)

- Maintainance Contract FormatDocument3 pagesMaintainance Contract Formatnauaf101No ratings yet

- Ripple CryptocurrencyDocument5 pagesRipple CryptocurrencyRipple Coin NewsNo ratings yet

- Some Information About The Exam (Version 2023-2024 Groep T)Document17 pagesSome Information About The Exam (Version 2023-2024 Groep T)mawiya1535No ratings yet

- LS 4 Life and Career Skills!Document24 pagesLS 4 Life and Career Skills!Markee JoyceNo ratings yet

- KYC - FidelityDocument2 pagesKYC - FidelityMohammad Munazir AliNo ratings yet

- BSC Hospital 1Document24 pagesBSC Hospital 1sesiliaNo ratings yet

- Nueva Ecija Elwctric Coop vs. NLRCDocument2 pagesNueva Ecija Elwctric Coop vs. NLRCJholo AlvaradoNo ratings yet

- Gmail - Payment Confirmation - Cambridge College of Business & ManagementDocument2 pagesGmail - Payment Confirmation - Cambridge College of Business & Managementslinky1No ratings yet

- Resa Law24Document3 pagesResa Law24NaSheengNo ratings yet

- Amazon Service Marketing Case StudyDocument36 pagesAmazon Service Marketing Case StudyAbhiNo ratings yet