Professional Documents

Culture Documents

CH 3

Uploaded by

dip_g_007Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 3

Uploaded by

dip_g_007Copyright:

Available Formats

BBn

Current factors or conditions

Past experience in a similar situation

Forecasts are the basis for budgeting,

planning capacity, sales, production and

inventory, personnel, purchasing and

more.

Forecasts play an important role in the

planning process because they enable a

manager to anticipate the future so he

can plan accordingly.

Accounting: New product cost estimates,

profit projections, cash management etc.

Human resources: Hiring activities,

recruitment, training etc.

Operations: Scheduling, work assignment,

inventory planning etc.

To help managers plan the system

To help them plan the use of the system

long-term

plans about the types of products to

offer, what facilities and equipments to

have, where to locate etc.

short-term and intermediate-term

planning which involves planning

inventory and work force, planning

purchasing and production, budgeting

and scheduling.

Forecasting techniques generally assume that the same

underlying casual system that existed in the past will

continue to exist in the future.

Forecasts are rarely perfect; actual results usually differ

from predicted values.

Forecasts for groups of items tend to be more accurate

than forecasts for individual items. Because forecasting

errors among items in a group usually has a cancelling

effect.

Forecast accuracy decreases as the time horizon increases.

Short term forecasts have lower uncertainties than the

long-term forecasts.

A properly prepared forecast should fulfill certain

requirements. The forecasts should be:

timely: The forecasting must cover the time

necessary to implement possible changes.

accurate: This enables users to plan for possible

errors and provides a basis for comparing

alternatives

reliable: A technique that sometimes provide

good forecasts and sometimes poor one leaves

users with the uneasy feelings.

in meaningful units: Financial planner needs to

know how many dollars will be needed?

Schedulers should know what machines and skills

will be required?

in writing: A written forecast permits an objective

basis for evaluating the forecast once actual

results are in.

simple to understand: Simple forecasting

techniques enjoy wide spread popularity because

users are more comfortable working with them.

There are six basic steps in the forecasting process:

Determining the purpose of the forecast: How

will it be used and when will it be needed? It will

provide an indication of the level of detail

required in the forecast and the level of the

accuracy necessary.

Establish a time horizon: The forecasts must

indicate a time interval, keeping in mind that

accuracy decreases as the time horizon

increases.

Select a forecast technique

Gather and analyze relevant data: It helps in identifying

any assumptions that are made in conjunction with

preparing and using forecast.

Make the forecast.

Monitor the forecast: It determines whether it is performed

in a satisfactory manner. If it is not, reexamine the

method.

Either or both approaches might be used to

develop forecasts.

Qualitative method: It involves subjective inputs,

numerical description. It includes soft

information (human factor, personal opinion etc)

in the forecasting process.

Quantitative method: It involves either the

projection of historical data or the development

of associative methods which utilize explanatory

variables to make forecasts. This method mainly

analyzes data.

Judgmental

Time series

Associative

Judgmental forecasts rely on analysis of

subjective inputs obtained from various

sources such as opinion from consumer

surveys, sales staff, managers and executives

and experts

Forecasts that project patterns identified in

recent time series observations. It project

past experience into the future

Forecasting technique that uses explanatory

variables to predict future demand. For

example, demand for paint might be related

to variables such as the price per gallon and

the amount spent on advertising and drying

time, ease of cleanup etc.

In some situations, forecasts rely solely on

judgment and opinion. For instances,

If the management must have a forecast quickly, there

may not be enough time to gather and analyze

quantitative data.

At another time, especially when political and

economic conditions are changing, available data may

be out of date and more up-to-date information

might not yet be available.

In such instances forecasts are based on executive

opinions, sales force opinions, consumer surveys, etc.

Marketing manager, financial manager and

operations manager may meet and

collectively develop a forecast. This approach

is used for long-term planning and new

product development.

The sales staff or the customer service staff is

often a good source of information because

of their direct contact with customers. They

are often aware of any plans the customers

may be considering for the future. One of the

drawbacks of this approach is that they may

be unable to distinguish between what

customers would like to do and what they

actually will do.

Since consumers determine demand, it is

better to collect information from them. If

possible every customer or potential

customer can be contacted. However, it is not

all time possible to identify all the customer

or potential customers. So, managers often

rely on sample consumer opinions.

A time series is a time-oriented sequence of

observations taken at regular intervals

(hourly, weekly, daily, etc). The data may be

measurements of demand, earnings, profits

etc. These techniques are based on the

assumption that future values of the series

can be estimated from the past values.

Analysis of time series data can be

accomplished by plotting the data in any of

the following patterns:

i. Trend

ii. Seasonality

iii. Cycles

iv. Irregular variations

v. Random variations

Trend: It refers to a long-term upward or

downward movement in the data.

Example: Population shifts, changing incomes

etc.

Trends

Seasonality: It refers to short-term regular

variations related to calendar or time of a day.

Example: Restaurants, supermarkets experiences

weekly or daily seasonality.

Seasonality

Cycles: Cycles are wavelike variations lasting

more than one year.

Example: Economic, political and agricultural

conditions.

Cycles

Irregular variations: It caused by unusual

circumstances, not relative of typical

behavior. These need to be identified and

remove from the data.

Irregular Trends

Random variations: Random variations are

residual variations that remains after all other

behaviors have been accounted for. The small

bumps in the figures are random variation.

Naive Methods: It is simple but widely used

method. This is the forecast for any period

equals the previous periods actual value. For

example, if the demand for a product last

week was 50 KGs, the forecast for this week

is 50 KGs. This method has several

advantages: it has no cost, it is quick and

easy, and it is easily understandable.

Techniques for Averaging:

Averaging techniques smooth fluctuations in

a time series because the individual highs and

lows in the data offset each other when they

are combined into an average. A forecast

based on an average thus tends to exhibit

less variability than the original data. The

minor variations are treated as random

variation and larger variations are viewed as

real changes.

The following three techniques widely used

for averaging.

i. Moving average

ii. Weighted moving average

iii. Exponential smoothing

Moving average: Technique that averages a

number of recent actual data values, updated as

new values become available is known as moving

average forecast. The moving average forecast

can be computed using the following formula:

n

A

MA F

n

i

i t

n t

=

= =

1

i = An index that corresponds to time period

n = No. of period in the moving average

A

t

= Actual value in period t-i

MA = Moving average

F

t

= Forecast for time period t

For example, MA

3

implies a three period

moving average forecast,and MA

5

implies a

fiveperiod moving average forecast.

Example: Compute a 3-period moving

average forecast given demand for shopping

carts for the last five periods.

Period Demand

1 42

2 40

3 43

4 40

5 41

i = An index that corresponds to time period

n =3= No. of period in the moving average

A

i

= Actual value in period t-i

MA = Moving average

F

t

= Forecast for time period t

The moving average for period 6 is,

33 . 41

3

41 40 43

3

3

1

3 6

=

+ +

= = =

=

i

i t

A

MA F

the actual demand in period 6 turns out to be 38, the moving average forecast

for period 7 would be :

67 . 39

3

38 41 40

3

3

1

3 7

=

+ +

= = =

=

i

i t

A

MA F

Note: The more periods in a moving average, the greater the

forecast will lag changes in the data.

* This technique is easy to compute and easy to understand.

* A possible disadvantage is that all values in the average are

weighted equally. For example, in a 10-period moving average,

each value has weight of 1/10. Hence, the oldest value has the

same weight as the most recent value. Decreasing the number of

values in the average increases in weight of more recent values.

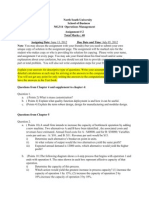

20

30

40

50

0 2 4 6 8 10

Period

D

e

m

a

n

d

A 3 and 5-period moving average forecast against actual demand

for 10 periods.

Example 2: Given the following data:

Period No. of

complaints

1 60

2 65

3 55

4 58

5 64

(i)Use naive approach to make the forecast for the

next period.

(ii)Compute a 3-period moving average forecast.

Weighted moving average:

A weighted average is similar to the

moving average, except that it

assigns more weight to the most

recent values in a time series. For

example, the most recent value

might be assigned a value of 0.4,

the next most recent value a weight

of 0.3, the next after that a weight

of 0.2, and the next after that a

weight of 0.1. Note that the sum of

the weights is 1.0.

The weighted moving average can be computed by the

following formula:

1 1 2 2 ) 2 ( 2 ) 1 ( 1

......

+ + + + =

t t n t n n t n n t n t

A w A w A w A w A w F

The advantage of a weighted average over a simple

moving average is that the weighted average is more

reflective of the most recent occurrences. However, the

choice of the weight is somewhat arbitrary and generally

involves the use of trial and error to find a suitable

weighting scheme.

Example 1: Given the demand for shopping

carts for the last five periods.

Period Demand

1 42

2 40

3 43

4 40

5 41

(a) Compute a weighted moving average forecast using a

weight of 0.4 for the most recent period, 0.3 for the next

most recent, 0.2 for the next, and the next after that a

weight of 0.1.

(b) If the actual demand for period 6 is 39, forecast demand

for period 7 using the same weights as in part (a).

Solution: (a)

0 . 41 41 * 4 . 0 40 * 3 . 0 43 * 2 . 0 40 * 1 . 0

......

1 1 2 2 3 3 4 4 6

1 1 2 2 ) 2 ( 2 ) 1 ( 1

= + + + =

+ + + =

+ + + + =

t t t t

t t n t n n t n n t n t

A w A w A w A w F

A w A w A w A w A w F

Solution: (b)

2 . 40 39 * 4 . 0 41 * 3 . 0 40 * 2 . 0 43 * 1 . 0

......

1 1 2 2 3 3 4 4 7

1 1 2 2 ) 2 ( 2 ) 1 ( 1

= + + + =

+ + + =

+ + + + =

t t t t

t t n t n n t n n t n t

A w A w A w A w F

A w A w A w A w A w F

Example 2: Given the following data:

Period No. of complaints

1 60

2 65

3 55

4 58

5 64

(a) Compute a weighted moving average forecast using a

weight of 0.4 for the most recent period, 0.3 for the next

most recent, 0.2 for the next, and the next after that a weight

of 0.1.

(b) If the actual demand for period 6 is 59, forecast demand

for period 7 using the same weights as in part (a).

Exponential smoothing:

Weighted averaging method based on previous forecast plus a

percentage of the forecast error.

It is sophisticated weighted average method that is still relatively easy to

use and understand.

Next forecast = Previous forecast +

o

(actual previous forecast)

That is,

( )

1 1 1

+ =

t t t t

F A F F o

= The smoothing constant = % of the error

= Actual value in the previous period

= Forecast for time period t

= Forecast for the previous time period

o

1 t

A

t

F

1 t

F

o

o

Commonly used value of

ranges from 0.05 to 0.5. Low values are used when the average tends to be stable. Higher values of

are used when the average is not stable.

Example 1: Given the following data:

Period No. of complaints

1 60

2 65

3 55

4 58

5 64

Use exponential smoothing approach with a smoothing constant of 0.4 to make the forecast for the next period.

Solution:

Period No. of complaints Forecast Calculations

1 60 60 is the initial forecast

2 65 60 60 + 0.4(65-60) = 62

3 55 62 62 + 0.4(55-62) = 59.2

4 58 59.2 59.2 + 0.4(58-59.2) = 58.72

5 64 58.72 58.72 + 0.4(64-58.72) = 60.83

6 60.83

Example 2: Given the demand for shopping carts

for the last five periods.

Period Demand

1 42

2 40

3 43

4 40

5 41

Use exponential smoothing approach with a

smoothing constant of 0.3 to make the forecast

for the next period.

Example: Cell phone for a firm over the last 10 weeks are shown as follows. Would a linear

trend line be appropriate? Determine the equation of the trend line and predict sales for weeks

11 and 12.

Week 1 2 3 4 5 6 7 8 9 10

Unit Sales 700 724 720 728 740 742 758 750 770 775

t y ty

1 700 700

2 724 1448

3 720 2160

4 728 2912

5 740 3700

6 742 4452

7 758 5306

8 750 6000

9 770 6930

10 775 7750

7407 41358

690

700

710

720

730

740

750

760

770

780

0 2 4 6 8 10

Weeks

S

a

l

e

s

This plot suggests that a linear trend is appropriate.

Given

385 , 55 , 10

2

= = =

t t n

( )

51 . 7

55 55 385 10

407 , 7 55 358 , 41 10

2

2

=

=

=

t t n

y t ty n

b

4 . 699

10

55 51 . 7 407 , 7

=

=

=

n

t b y

a

The trend line is

t t b a F

t

51 . 7 4 . 699 + = + =

where t = 0 for period 0.

The forecast for period 11 is

01 . 782 11 51 . 7 4 . 699

11

= + = + = t b a F

The forecast for period 12 is

52 . 789 12 51 . 7 4 . 699

11

= + = + = t b a F

690

700

710

720

730

740

750

760

770

780

790

800

-3 2 7 12

Weeks

S

a

l

e

s

Example2: Plot the following data on a graph and verify visually that a

linear trend line is appropriate. Develop a line trend equation. Then

use the equation to predict the next two values of the series.

Period 1 2 3 4 5 6 7 8 9

Demand 44 52 50 54 55 55 60 56 62

Associative forecasting techniques

The essence of associative techniques is the development

of an equation that summarizes the effects of predictor

variables (which is used to predict values of the variable of

interest). Linear regression method is used for this analysis.

Linear regression method

Technique for fitting a line to a set of points. The objective

in linear regression is to obtain an equation of a straight

line that minimizes the sum of squared vertical deviations

of data points from the line. The least squares line has the

equation

bx a y

c

+ =

bx a y

c

+ =

x A

y A

x

y

b

A

A

=

a x

y

x = predictor or independent variable

a= Value of at x = 0

b= Slope of the line

y

c

= Predicted or dependent variable

The line intersect the y axis where y = a.

The slope of the line is b.

The coefficients of the line a and b can be

computed from the formulas:

( )

2

2

=

x x n

y x xy n

b

and

x b y

n

x b y

a =

=

where n is the number of periods and y is the time

series.

Example: Healthy hamburger has a chain of 12 stores in California. Sales figures and profits for the

stores given below. Obtain a regression line for the data and predict for a store assuming sales of

$10 million.

Unit sales x $

million

7 2 6 4 14 15 16 12 14 20 15 7

Profit y

$ million

0.15 0.10 0.13 .15 .25 0.27 0.24 0.2 0.27 0.44 0.34 0.17

Solution:

Step1: Plot the data and decide if a linear model is reasonable.

x y Forecasts

7 .15 0.1621124

2 0.10 0.0824612

6 0.13 0.1461822

4 0.15 0.1143217

14 0.25 0.273624

15 0.27 0.2895543

16 0.24 0.3054845

12 0.20 0.2417636

14 0.27 0.273624

20 0.44 0.3692054

15 0.34 0.2895543

7 0.17 0.1621124

y

0

5

10

15

20

25

30

35

40

45

50

0 5 10 15 20 25

Step2:

( )

0159 . 0

132 132 1796 12

271 132 3529 12

2

2

=

=

=

x x n

y x xy n

b

0506 . 0

12

132 0159 . 0 271

=

=

=

n

x b y

a

Obtain the regression

x y

c

0159 . 0 0506 . 0 + =

For example, for sale of x = 7, estimated profit is

1621124 . 0 7 0159 . 0 0506 . 0 = + =

c

y

or $162,1124

Example: The owner of a hardware store has noted a sales pattern for window locks that

seems to be parallel the number of break-ins reported each week in the newspaper. The

data are:

sales 46 18 20 22 27 34 14 37 30

Break-ins 3 3 3 5 4 7 2 6 4

a. Plot the data to see the type of the graph

b. Obtain a regression equation for the data.

c. Estimate sales when the number of break-ins is 5.

Variations around the line are random.

Deviations around the line should be narrowly

distributed.

Predictions are made within the range of the

observed values.

Forecasting accuracy is a significant factor when deciding among forecasting

alternatives. Accuracy is based on the historical error performance of a forecast.

Three common methods for measuring historical errors are:

(i) Mean absolute deviation (MAD): Average absolute error. MAD =

n

F A

t t

(ii) Mean squared error (MSE): Average of squared errors. MSE =

( )

1

2

n

F A

t t

(iii) Mean absolute percent error (MAPE): Average absolute percent error.

MAPE =

n

A

F A

t

t t

% 100

Error

2

Error ( ) 100 Actual Error Period Actual Forecast Error (A-F)

1 217 215 2 2 4 0.92%

2 213 216 -3 3 9 1.41

3 216 215 1 1 1 0.46

4 210 214 -4 4 16 1.9

5 213 211 2 2 4 0.94

6 219 214 5 5 25 2.28

7 216 217 -1 1 1 0.46

8 212 216 -4 4 16 1.89

-2 22 76 10.26%

(i) Mean absolute deviation (MAD) =

75 . 2

8

22

= =

n

F A

t t

(ii) Mean squared error (MSE) =

( )

86 . 10

1 8

76

1

2

=

n

F A

t t

(iii) Mean absolute percent error (MAPE) =

% 28 . 1

8

% 26 . 10

% 100

= =

n

A

F A

t

t t

Month Demand Forecast

Technique 1 Technique 2

1 492 488 495

2 470 484 482

3 485 480 478

4 493 490 488

5 498 497 492

6 492 493 493

You might also like

- Chapter 3Document59 pagesChapter 3romel100% (1)

- Ch3 Forecasts MGT 314 C Z CFUIZ CUIZX CIZX UIZDZDUCUJZX UIZIZI IZDDocument16 pagesCh3 Forecasts MGT 314 C Z CFUIZ CUIZX CIZX UIZDZDUCUJZX UIZIZI IZDMahin ChowdhuryNo ratings yet

- UntitledDocument47 pagesUntitledSaimur RahmanNo ratings yet

- Time Series Forecasting FundamentalsDocument37 pagesTime Series Forecasting Fundamentalsravi mNo ratings yet

- Forecasting in OPMDocument33 pagesForecasting in OPMAyushi Singh. 214 - BNo ratings yet

- Demand Forecast Process and Inventory ManagementDocument17 pagesDemand Forecast Process and Inventory ManagementAbhishek KumarNo ratings yet

- 02 OM Chapter 1 ForecastingDocument15 pages02 OM Chapter 1 ForecastingLee K.No ratings yet

- Forecasting Lec 1 & 2 EditedDocument27 pagesForecasting Lec 1 & 2 EditedJungle DiffNo ratings yet

- Chapter Four: (Demand Management)Document9 pagesChapter Four: (Demand Management)Marica ShaneNo ratings yet

- CH III - ForecastingDocument52 pagesCH III - ForecastingSanjay ThakurNo ratings yet

- Business ForecastingDocument3 pagesBusiness ForecastingHope Lacea Domingo BinsegNo ratings yet

- Production and Operations ForecastingDocument38 pagesProduction and Operations ForecastingimranmatolaNo ratings yet

- Chapter TwoDocument26 pagesChapter TwoEthiopian Ayele SeyfeNo ratings yet

- Chapter Three: ForecastingDocument36 pagesChapter Three: ForecastingFreedom YenesewNo ratings yet

- Forecasting TechniquesDocument9 pagesForecasting TechniquesJohn Jay NalicatNo ratings yet

- POM Chapter 2 ForecastingDocument65 pagesPOM Chapter 2 ForecastingPhúc huy LêNo ratings yet

- Forecasting Techniques and AccuracyDocument20 pagesForecasting Techniques and AccuracyLouisza CabreraNo ratings yet

- Forecasting: Central Luzon State UniversityDocument11 pagesForecasting: Central Luzon State UniversityJOSHUA TROY MOSENo ratings yet

- FORECASTING TECHNIQUESDocument7 pagesFORECASTING TECHNIQUESNicolas Jamon Magbanua INo ratings yet

- Demand Forecasting - Lecture NotesDocument30 pagesDemand Forecasting - Lecture Noteshjahongir100% (1)

- Steps in Forecasting ProcessDocument7 pagesSteps in Forecasting Processstephanie roswellNo ratings yet

- Demand ForecastingDocument28 pagesDemand ForecastingRamteja SpuranNo ratings yet

- 1Document8 pages1NoreNo ratings yet

- Time Series AnalysisDocument3 pagesTime Series AnalysisSenai21dragoNo ratings yet

- DEMAND FORECASTING METHODSDocument4 pagesDEMAND FORECASTING METHODSMadhan kumarNo ratings yet

- Demand Forecasting Techniques in 40 CharactersDocument7 pagesDemand Forecasting Techniques in 40 CharacterssanowarecekuNo ratings yet

- CHAPTER 16 Forecasting and Time Series AnalysisDocument94 pagesCHAPTER 16 Forecasting and Time Series AnalysisAyushi Jangpangi100% (1)

- Powerful Forecasting With MS Excel SampleDocument225 pagesPowerful Forecasting With MS Excel SampleDouglas Brantome SanchezNo ratings yet

- Treasury 6 Part 1Document29 pagesTreasury 6 Part 1sobiric395No ratings yet

- Forecasting - Introduction To Operations ManagementDocument24 pagesForecasting - Introduction To Operations ManagementLEXIE INGRID AMOSNo ratings yet

- Production Planning and Control: Unit Iii Mba Ii Sem Operations ManagementDocument58 pagesProduction Planning and Control: Unit Iii Mba Ii Sem Operations ManagementarNo ratings yet

- Managerial Economics (Unit-3)Document92 pagesManagerial Economics (Unit-3)Ankur AgrawalNo ratings yet

- Production and Project Management Cheg5211 Sales ForecastingDocument31 pagesProduction and Project Management Cheg5211 Sales ForecastingBiniyam HaileNo ratings yet

- Demand Forecasting' Compiled by Anjay Mishra, Nec College,: A Reference Note of Kathmandu NepalDocument4 pagesDemand Forecasting' Compiled by Anjay Mishra, Nec College,: A Reference Note of Kathmandu NepalUjjwal ShresthaNo ratings yet

- HR ForecastingDocument5 pagesHR ForecastingObaidullah HamaasNo ratings yet

- Forecasting Techniques & ElementsDocument15 pagesForecasting Techniques & ElementsDereje GudisaNo ratings yet

- Demand Forecasting: Demand Forecasting Is The Activity of Estimating TheDocument54 pagesDemand Forecasting: Demand Forecasting Is The Activity of Estimating TherambalakyadavNo ratings yet

- INTRO TO FORECASTING TECHNIQUESDocument6 pagesINTRO TO FORECASTING TECHNIQUESGela LaceronaNo ratings yet

- Chapter Two Forecasting 2.1 Definition A. What Is A Forecast?Document16 pagesChapter Two Forecasting 2.1 Definition A. What Is A Forecast?Yosef KetemaNo ratings yet

- OM Narrative ReportDocument9 pagesOM Narrative ReportJinx Cyrus RodilloNo ratings yet

- Unit 2 Part 2 Sales ForecastingDocument30 pagesUnit 2 Part 2 Sales ForecastingVishal MeenaNo ratings yet

- By: Gerline Mae Ocampo PableoDocument5 pagesBy: Gerline Mae Ocampo PableoGerline MaeNo ratings yet

- 1 (B) Techniques of Demand ForecastingDocument6 pages1 (B) Techniques of Demand ForecastingraamachandrenNo ratings yet

- Features Common To All ForecastsDocument5 pagesFeatures Common To All ForecastsGeneVive Mendoza40% (5)

- MNGT 3108 - M4-ForecastingDocument11 pagesMNGT 3108 - M4-ForecastingMa. Angela RosauroNo ratings yet

- Operations & Material Management Ass-1 PDFDocument25 pagesOperations & Material Management Ass-1 PDFselvasolairithiNo ratings yet

- Chapter III FORECASTINGDocument14 pagesChapter III FORECASTINGYohannis YoniNo ratings yet

- FORECASTING in Operation and Production Management NOTESDocument8 pagesFORECASTING in Operation and Production Management NOTESzulqarnain7711No ratings yet

- Methods of Demand ForecastingDocument7 pagesMethods of Demand ForecastingRajasee ChatterjeeNo ratings yet

- Chap 5Document8 pagesChap 5roby ashariNo ratings yet

- ForecastingDocument17 pagesForecastingFaye BazarteNo ratings yet

- Demand Estimation and For CastingDocument4 pagesDemand Estimation and For Castinggadhiya_daxesh47No ratings yet

- Module 6: Introduction To Time Series Forecasting: Titus Awokuse and Tom IlventoDocument26 pagesModule 6: Introduction To Time Series Forecasting: Titus Awokuse and Tom IlventoAshutoshSrivastavaNo ratings yet

- Demand ForecastingDocument29 pagesDemand ForecastingAvinash SahuNo ratings yet

- Ch-2 - EditedDocument19 pagesCh-2 - EditedmelkecoopNo ratings yet

- Essential Prerequisites and Techniques for Effective Demand ForecastingDocument15 pagesEssential Prerequisites and Techniques for Effective Demand ForecastingPrachiranjan SwainNo ratings yet

- Demand Forecasting: 1. Survey Methods 2. Statistical Methods 3. Expert Opinion MethodsDocument3 pagesDemand Forecasting: 1. Survey Methods 2. Statistical Methods 3. Expert Opinion MethodsKuthubudeen T MNo ratings yet

- Start Your BusinessDocument8 pagesStart Your BusinessIqbal MOUSSANo ratings yet

- Financial Plans for Successful Wealth Management In Retirement: An Easy Guide to Selecting Portfolio Withdrawal StrategiesFrom EverandFinancial Plans for Successful Wealth Management In Retirement: An Easy Guide to Selecting Portfolio Withdrawal StrategiesNo ratings yet

- Using Forecasting Methodologies to Explore an Uncertain FutureFrom EverandUsing Forecasting Methodologies to Explore an Uncertain FutureNo ratings yet

- Rprogramming PDFDocument179 pagesRprogramming PDFdip_g_007No ratings yet

- Exam 1 Solution 06Document5 pagesExam 1 Solution 06dip_g_007No ratings yet

- An Introduction To R: W. N. Venables, D. M. Smith and The R Core TeamDocument105 pagesAn Introduction To R: W. N. Venables, D. M. Smith and The R Core TeamMahadiNo ratings yet

- MTO Driver's Handbook Working Group Proposes Changes to Rules for Cyclists & PedestriansDocument144 pagesMTO Driver's Handbook Working Group Proposes Changes to Rules for Cyclists & PedestrianssdsashokNo ratings yet

- MD - Ullah Al MamunDocument137 pagesMD - Ullah Al Mamunsolaiman011No ratings yet

- MD - Ullah Al MamunDocument137 pagesMD - Ullah Al Mamunsolaiman011No ratings yet

- Company OrientationDocument16 pagesCompany Orientationdip_g_007No ratings yet

- Chapter 1. IntroductionDocument1 pageChapter 1. Introductiondip_g_007No ratings yet

- Law 200Document11 pagesLaw 200dip_g_007No ratings yet

- Brac Bank History in BriefDocument2 pagesBrac Bank History in Briefdip_g_007No ratings yet

- Proposed Sales Organogram-RML - 2013 Total 142: Marked Is The Same PersonDocument1 pageProposed Sales Organogram-RML - 2013 Total 142: Marked Is The Same Persondip_g_007No ratings yet

- LAW 200 AssignmentDocument8 pagesLAW 200 Assignmentdip_g_007No ratings yet

- Ch1 Production ManagementDocument4 pagesCh1 Production ManagementQuazi Tafsir AmitNo ratings yet

- Case 1.1 Dell DataDocument44 pagesCase 1.1 Dell Datadip_g_007No ratings yet

- LAW 200 AssignmentDocument8 pagesLAW 200 Assignmentdip_g_007No ratings yet

- Final Exam FormatDocument2 pagesFinal Exam Formatdip_g_007No ratings yet

- Z E ViewsDocument151 pagesZ E Viewsdip_g_007No ratings yet

- MG314 Operations Management Assignment SolutionsDocument2 pagesMG314 Operations Management Assignment Solutionsdip_g_007No ratings yet

- BCG Matrix ExplainedDocument2 pagesBCG Matrix Explaineddip_g_007No ratings yet

- Ts DecompositionDocument5 pagesTs DecompositionSudipto GhoshNo ratings yet

- OLSDocument6 pagesOLSdip_g_007No ratings yet

- The Power of Appreciation in Everyday LifeDocument213 pagesThe Power of Appreciation in Everyday Lifekrshankar18100% (1)

- Agamata Chapter 5Document10 pagesAgamata Chapter 5Drama SubsNo ratings yet

- Philippine Folk Dances Explored in DetailDocument7 pagesPhilippine Folk Dances Explored in DetailLee Mah Ri60% (5)

- Sigram Schindler Beteiligungsgesellschaft PetitionDocument190 pagesSigram Schindler Beteiligungsgesellschaft PetitionjoshblackmanNo ratings yet

- String Harmonics in Ravel's Orchestral WorksDocument97 pagesString Harmonics in Ravel's Orchestral WorksYork R83% (6)

- New Technology To Reduce Yarn WastageDocument3 pagesNew Technology To Reduce Yarn WastageDwi Fitria ApriliantiNo ratings yet

- The Bible in Picture and Story (1889)Document250 pagesThe Bible in Picture and Story (1889)serjutoNo ratings yet

- ''Let All God's Angels Worship Him'' - Gordon AllanDocument8 pages''Let All God's Angels Worship Him'' - Gordon AllanRubem_CLNo ratings yet

- SAP FICO Asset Accounting 1Document3 pagesSAP FICO Asset Accounting 1Ananthakumar ANo ratings yet

- Ds Mini ProjectDocument12 pagesDs Mini ProjectHarsh VartakNo ratings yet

- Female by CourseDocument40 pagesFemale by CourseMohamed AymanNo ratings yet

- Dendrinos, Multilingualism Language Policy in The EU TodayDocument20 pagesDendrinos, Multilingualism Language Policy in The EU Todayi.giommettiNo ratings yet

- Data Acquisition Systems Communicate With Microprocessors Over 4 WiresDocument2 pagesData Acquisition Systems Communicate With Microprocessors Over 4 WiresAnonymous Y6EW7E1Gb3No ratings yet

- Marketing Communications and Corporate Social Responsibility (CSR) - Marriage of Convenience or Shotgun WeddingDocument11 pagesMarketing Communications and Corporate Social Responsibility (CSR) - Marriage of Convenience or Shotgun Weddingmatteoorossi100% (1)

- Vector DifferentiationDocument2 pagesVector DifferentiationJayashree MisalNo ratings yet

- Woodman Et Al 1993Document30 pagesWoodman Et Al 1993Azim MohammedNo ratings yet

- Agenda For Regular Board Meeting February 18, 2022 Western Visayas Cacao Agriculture CooperativeDocument2 pagesAgenda For Regular Board Meeting February 18, 2022 Western Visayas Cacao Agriculture CooperativeGem Bhrian IgnacioNo ratings yet

- Logic and Its Metatheory: Instructor InformationDocument6 pagesLogic and Its Metatheory: Instructor InformationMarco StoroniMazzolani Di MaioNo ratings yet

- Physics 5th Edition Walker Test BankDocument24 pagesPhysics 5th Edition Walker Test BankKathyHernandeznobt100% (31)

- Somatic Symptom DisorderDocument26 pagesSomatic Symptom DisorderGAYATHRI NARAYANAN100% (1)

- Francis Asbury Revival Study PDFDocument10 pagesFrancis Asbury Revival Study PDFLauRa Segura VerasteguiNo ratings yet

- Conservation of Arabic ManuscriptsDocument46 pagesConservation of Arabic ManuscriptsDr. M. A. UmarNo ratings yet

- 일반동사 부정문 PDFDocument5 pages일반동사 부정문 PDF엄태호No ratings yet

- 01 Petrolo 224252Document7 pages01 Petrolo 224252ffontanesiNo ratings yet

- Present Tense Review for Motorcycle RepairDocument2 pagesPresent Tense Review for Motorcycle RepairFaheemuddin Veterans50% (2)

- Optimizing Local Geoid Undulation Model Using GPS Levelling Measurements and Heuristic Regression ApproachesDocument12 pagesOptimizing Local Geoid Undulation Model Using GPS Levelling Measurements and Heuristic Regression ApproachesLeni HelianiNo ratings yet

- Mythical Origins of The Hungarian Medieval LegislationDocument8 pagesMythical Origins of The Hungarian Medieval LegislationLucas LixaNo ratings yet

- Mabvax v. Harvey Kesner MTD 05-09-2019 OrderDocument49 pagesMabvax v. Harvey Kesner MTD 05-09-2019 OrderTeri BuhlNo ratings yet

- GUINNESS F13 Full Year BriefingDocument27 pagesGUINNESS F13 Full Year BriefingImoUstino ImoNo ratings yet