Professional Documents

Culture Documents

Eco Lec3 Fin Math

Uploaded by

Miguel TorienteCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eco Lec3 Fin Math

Uploaded by

Miguel TorienteCopyright:

Available Formats

LECTURE 3

MONEY-TIME

RELATIONSHIPS AND

EQUIVALENCE

MONEY

Medium of Exchange --

Means of payment for goods or services;

What sellers accept and buyers pay ;

Store of Value --

A way to transport buying power from one time

period to another;

Unit of Account --

A precise measurement of value or worth;

Allows for tabulating debits and credits;

CAPITAL

Wealth in the form of money or

property that can be used to

produce more wealth.

KINDS OF CAPITAL

Equity capital is that owned by individuals who

have invested their money or property in a

business project or venture in the hope of

receiving a profit.

Debt capital, often called borrowed capital, is

obtained from lenders (e.g., through the sale of

bonds) for investment.

Financing

Definition Instrument

Description

Debt

financing

Equity

financing

Borrow

money

Sell partial

ownership of

company;

Bond

Stock

Promise to

pay

principle &

interest;

Exchange

shares of

stock for

ownership of

company;

Financing

Definition Instrument

Description

Debt

financing

Equity

financing

Borrow

money

Sell partial

ownership of

company;

Bond

Stock

Promise to

pay

principle &

interest;

Exchange

shares of

stock for

ownership of

company;

Financing

Definition Instrument

Description

Debt

financing

Equity

financing

Borrow

money

Sell partial

ownership of

company;

Bond

Stock

Promise to

pay

principle &

interest;

Exchange

shares of

stock for

ownership of

company;

Exchange

money for

shares of

stock as

proof of

partial

ownership

INTEREST

The fee that a borrower pays to a lender for

the use of his or her money.

INTEREST RATE

The percentage of money being borrowed

that is paid to the lender on some time

basis.

SIMPLE INTEREST

The total interest earned or charged is linearly

proportional to the initial amount of the loan

(principal), the interest rate and the number of

interest periods for which the principal is

committed.

When applied, total interest I may be found by

I = ( P ) ( N ) ( i ), where

P = principal amount lent or borrowed

N = number of interest periods ( e.g., years )

i = interest rate per interest period

COMPOUND INTEREST

Whenever the interest charge for any interest

period is based on the remaining principal amount

plus any accumulated interest charges up to the

beginning of that period.

Period Amount Owed Interest Amount Amount Owed

Beginning of for Period at end of

period ( @ 10% ) period

1 $1,000 $100 $1,100

2 $1,100 $110 $1,210

3 $1,210 $121 $1,331

ECONOMIC EQUIVALENCE

Established when we are indifferent between a

future payment, or a series of future payments,

and a present sum of money .

Considers the comparison of alternative options,

or proposals, by reducing them to an equivalent

basis, depending on:

interest rate;

amounts of money involved;

timing of the affected monetary receipts and/or

expenditures;

manner in which the interest , or profit on invested

capital is paid and the initial capital is recovered.

ECONOMIC EQUIVALENCE FOR FOUR

REPAYMENT PLANS OF AN $8,000 LOAN

Plan #1: $2,000 of loan principal plus 10% of BOY principal

paid at the end of year; interest paid at the end of each

year is reduced by $200 (i.e., 10% of remaining principal)

Year Amt. Owed Interest Total Tot. payment Total

B.O.Y. Accrued Principal principal payment

EOY + Interest EOY

1 $8,000 $800 $8,800 $2,000 $2,800

2 $6,000 $600 $6,600 $2,000 $2,600

3 $4,000 $400 $4,400 $2,000 $2,400

4 $2,000 $200 $2,200 $2,000 $2,200

Total interest paid ($2,000) is 10% of total dollar-years

($20,000)

ECONOMIC EQUIVALENCE FOR FOUR REPAYMENT

PLANS OF AN $8,000 LOAN

Plan #3: $2,524 paid at the end of each year; interest paid

at the end of each year is 10% of amount owed at the

beginning of the year.

Year Amt. Owed Interest Total Tot. payment Total

B.O.Y. Accrued Principal principal payment

EOY + Interest EOY

1 $8,000 $800 $8,800 $1,724 2,524

2 $6,276 $628 $6,904 $1,896 $2,524

3 $4,380 $438 $4,818 $2,086 $2,524

4 $2,294 $230 $2,524 $2,294 $2,524

Total interest paid ($2,096) is 10% of total dollar-years

($20,950)

PLan #2: $0 of loan principal paid until end of fourth year;

$800 interest paid at the end of each year

Year Amt. Owed Interest Total Tot. payment Total

B.O.Y. Accrued Principal principal payment

EOY + Interest EOY

1 $8,000 $800 $8,800 $0 $800

2 $8,000 $800 $8,800 $0 $800

3 $8,000 $800 $8,800 $0 $800

4 $8,000 $800 $8,800 $8,000 $8,800

Total interest paid ($3,200) is 10% of total dollar-years

($32,000)

ECONOMIC EQUIVALENCE FOR FOUR

REPAYMENT PLANS OF AN $8,000 LOAN

ECONOMIC EQUIVALENCE FOR FOUR REPAYMENT

PLANS OF AN $8,000 LOAN

Plan #4: No interest and no principal paid for first three

years. At the end of the fourth year, the original principal

plus accumulated (compounded) interest is paid.

Year Amount Owed Interest Accrued Total Principal Total end

at beginning for Year Money Payment of Year

of Year owed at Payment (

BOY ) end

of Year

1 $8,000 $800 $8,800 $0 $0

2 $8,800 $880 $9,680 $0 $0

3 $9,680 $968 $10,648 $0 $0

4 $10,648 $1,065 $11,713 $8,000 $11,713

Total interest paid ($3,713) is 10% of total dollar-years

($37,128)

Notation

i = interest rate (per time period)

N = # of time periods

P = money at present

F = money in future

After n time periods

Equivalent to P now, at interest rate i

A = payment at end of each time period

E.g., annual

Assumptions

Assume all cash flow occurs at the end of each time

period

For example, all year 1 payments are due on December 31

of year 1

The present is the end of period 0

1

8

Cash flows

Cash flows describe income and outflow of

money over time

Disbursements =outflows -

Receipts =inflows +

Beginning of first year is traditionally defined

as Time 0

1

9

Equivalence

Translating cashflows over time into common

units

Present values of future payments

Future value of present payments

Present value of continuous uniform

payments

Continuous payments equivalent to present

payment

2

0

Single Payment Compound Interest

P= (P)resent sum of money

i= (i)nterest per time period (usually years)

MARR=Minimal Acceptable Rate of Return

n= (n)umber of time periods (usually years)

F= (F)uture sum of money that is equivalent to

P given an interest rate i for n periods

F=P(1+i)

n

P=F(1+i)

-n

F=P(F/P,i,n) P=F(P/F,i,n)

Overview

Converting from P to F, and from F to P

Converting from A to P, and from P to A

Converting from F to A, and from A to F

(No gradient methods!)

Sensitivity analysis

Present to Future,

and Future to Present

Converting from Present to

Future

To find F given P:

P

0

F

n

n

.

Compound forward in time

Derive by Recursion

Invest an amount P at rate i:

Amount at time 1 = P (1+i)

Amount at time 2 = P (1+i)

2

Amount at time n = P (1+i)

N

So we know that F = P(1+i)

N

(F/P, i%, n) = (1+i)

N

Single payment compound amount factor

F

n

= P (1+i)

N

F

n

= P (F/P, i%, N)

ExamplePresent to Future

Invest P=$1,000, n=3, i=10%

What is the future value, F?

0 1 2 3

P = $1,000

F = ??

i = 10%/year

F

3

= $1,000 (F/P, 10%, 3) = $1,000 (1.10)

3

= $1,000 (1.3310) = $1,331.00

EX2: If $1000 is borrowed at 10% per year

simple interest, the total amount due at the

end of five years is nearest to:

Interest = Pin = (1000) (0.10) (5) = $500

Total amount due = _____________

EX3: The amount of money five years ago that is

equivalent to $1000 now at 10% per year

compound interest is nearest to:$1,611

1. What is the future value in 10 years of

$1,500 payments received at the end of each

year for the next 10 years? Assume an

interest rate of 8%.

Converting from Future to

Present

To find P given F:

Discount back from the future

P

F

n

n

.

Bring a single sum in future

back to the present

Illustration of Discounting

0

20

40

60

80

100

0 2 4 6 8

1

0

1

2

1

4

1

6

1

8

2

0

Time

P

r

e

s

e

n

t

V

a

l

u

e

0

0.01

0.05

0.1

0.2

0.3

Converting from Future to Present

Amount F at time n:

Amount at time N-1 = F/(1+i)

Amount at time N-2 = F/(1+i)

2

Amount at time 0 = F/(1+i)

N

So we know that P = F/(1+i)

N

(P/F, i%, N) = 1/(1+i)

N

Single payment present worth factor

ExampleFuture to Present

Assume we want F = $100,000 in 9 years.

How much do we need to invest now, if the interest rate i

= 15%?

0 1 2 3 8 9

F

9

= $100,000

P= ??

i = 15%/yr

P = $100,000 (P/F, 15%, 9) = $100,000 [1/(1.15)

9

]

= $100,000 (0.1111) = $11,110 at time t = 0

1. You wish to deposit a certain quantity of

money now so that you will have $500 at the

end of 5 years. Assume an interest of 6%.

The amount you need to deposit now is

approximately..

Expenses for water treatment at a state park

are expected to be $60,000 now, $25,000 in

year one, and $10,000 per year thereafter

forever. At an interest rate of 8% per year, the

capitalized cost of the treatment is nearest to:

P = 60,000 + 25,000(P/F, 8%, 1) +

10,000/0.08(P/F, 8%, 1)

= 60,000 + 25,000(0.9259) + 125,000(0.9259)

= $198,885

Annual to Present,

and Present to Annual

Converting from Annual to

Present

Fixed annuityconstant cash flow

$A per period

P = ??

0

..

n 1 2 3 .. .. n-1

Converting from Annual to

Present

We want an expression for the present

worth P of a stream of equal, end-of-period

cash flows A

0 1 2 3 n-1 n

A is given

P = ??

Converting from Annual to

Present

Write a present-worth expression for each year

individually, and add them

1 2 1

11 1 1

..

(1)(1) (1)(1)

n n

PA

i i i i

(

= +++ +

(

++ + +

The term inside the brackets is a geometric progression.

This sum has a closed-form expression!

Converting from Annual to

Present

Write a present-worth expression for each

year individually, and add them

1 2 1

11 1 1

..

(1)(1) (1)(1)

n n

PA

i i i i

(

= +++ +

(

++ + +

(1) 1

0

(1)

n

n

i

PA fori

i i

(

+

= =

(

+

Converting from Annual to

Present

This expression will convert an annual cash flow

to an equivalent present worth amount:

(One period before the first annual cash flow)

(1) 1

0

(1)

n

n

i

PA fori

i i

(

+

= =

(

+

The term in the brackets is (P/A, i%, n)

Uniform series present worth factor

Converting from Present to Annual

This is how mortgages and car loans work:

The bank gives you an amount P today

You pay equal amounts A until you have paid the loan plus

interest

In the first year, you pay mainly interest, and little of the

principal

In the last year, you pay mainly the principal, and little

interest (since little of your original loan amount P is still

owed)

Converting from Present to

Annual

Given the P/A relationship:

(1) 1

0

(1)

n

n

i

PA fori

i i

(

+

= =

(

+

(1 )

(1 ) 1

n

n

i i

AP

i

(

+

=

(

+

We can just solve for A in terms of P, yielding:

Remember: The present is

always one period before

the first annual amount!

The term in the brackets is (A/P, i%, n)

Capital recovery factor

Converting from Present to Annual

How is it possible to calculate a constant amount to repay, and

have the total be exactly equivalent to P?

It is sort of like magic!

The calculations would be easier if you paid an equal fraction

of the principal P every year, plus whatever interest is owed

on the unpaid portion of the principal:

But in that case almost nobody could afford to get a mortgage,

because the payments would be very high in the first few years!

EX1: A small manufacturing company is considering

purchasing a maintenance contract for its air

conditioning systems. Since all of its systems are new,

the company plans to begin the contract in year four

and continue through year ten. The cost of the

contract is $3,200 per year and the company's

minimum attractive rate of return is 12% per year.

P = 3200(P/A, 12%, 7)(P/F, 12%, 3)

= 3200(4.5638)(0.7118)

= $10,395.24

Ten annual deposits of $1,125 each are placed in a

savings account yielding 5% interest. Approximately

how much money has accumulated in the account

immediately following the tenth deposit?

The correct answer was: c. $14,150.

An individual wants to withdraw $15,000 from her

savings account at the end of every year for 6 years

starting at the end of this year. It is the beginning of

the year now. Approximately how much should be

deposited now to provide for these six withdrawals?

Assume an interest rate of 6%.

The correct answer was: b. $73,755.

Future to Annual,

and Annual to Future

Converting from Future to

Annual

Find the annual cash flow that is equivalent to a

future amount F

0

$A per period??

$F

The future amount

$F is given!

0

..

n 1 2 3 .. .. n-1

Converting from Future to

Annual

Take advantage of what we know

Recall that:

and

1

(1 )

n

P F

i

(

=

(

+

(1 )

(1 ) 1

n

n

i i

AP

i

(

+

=

(

+

Substitute P and

simplify!

Converting from Future to

Annual

First convert future to present:

Then convert the resulting P to annual

Simplifying, we get:

1 (1)

(1) (1) 1

n

n n

i i

AF

i i

( ( +

=

( (

+ +

(1 ) 1

n

A

i

i

F =

(

(

+

The term in the brackets is (A/F, i%, n)

Sinking fund factor (from the year 1724!)

Example 1

How much money must Carol save each year

(starting 1 year from now) at 5.5%/year:

In order to have $6000 in 7 years?

Example 3.1

Solution:

The cash flow diagram fits the A/F factor (future

amount given, annual amount??)

A= $6000 (A/F, 5.5%, 7) = 6000 (0.12096) = $725.76

per year

The value 0.12096 can be computed (using the A/F

formula), or looked up in a table

Converting from Annual to Future

Given

Solve for F in terms of A:

(1 ) 1

n

i

AF

i

(

=

(

+

)

=A

(1 1

F

n

i

i

(

+

(

The term in the brackets is (F/A, i%, n)

Uniform series compound amount factor

Converting from Annual to Future

Given an annual cash flow:

0

$A per period

$F

Find $F, given the $A

amounts

0

..

n 1 2 3 .. .. n-1

More Numerical Examples

How Fast Does Our Money Grow?

Invest $1000 now for 64 years at 6%:

F = P (1+i)

n

= $1000 (1.06)

64

= $41,647

Things get big over time!

Invest $1000 each year for 64 years at 6%:

F = A [(1+i)

n

- 1]/i

= $1000 [(1.06)

64

- 1]/.06 = $677,450

This is really big!

EX3: A company plans to start a sinking fund so that it

will have money to purchase a new 18-wheeler ten

years from now. The cost of the truck is expected to

be $200,000 and the company uses an interest rate

of 10% per year. If the company makes the first

deposit three years from now, how much must each

one be in order to have the money at the end of year

ten?

A = 200,000(A/F, 10%, 8)

= 200,000(0.08744)

= $17,488.50

At a 10% interest rate, what uniform annual amount

should be deposited each year in order to

accumulate $1,000,000 at the time of the twentieth

annual deposit?

The correct answer was: a. $17,500.

If $175 is deposited in a savings account at the

beginning of each year for 15 years, and the account

earns interest at 6%, compounded annually, the

value of the account at the end of 15 years is

approximately

The correct answer was: c. $4,318.

EX4: An expenditure for maintaining a bridge occurs in

five-year cycles. If the cost is $100,000 now and

$100,000 every five years forever, the capitalized cost

of this expenditure at 10% per year is nearest to:

Annual worth of 100,000 every 5 years =

100,000(A/F, 10%, 5)

= 100,000 (0.1638)

= $16,380

P = 100,000 + 16,380/0.10

= $263,800

Non-Equal, Non-Annual Payments

Same basic ideas still work

Assume that you plan to invest:

$2000 in year 0

$1500 in year 2

$1000 in year 4

How much will you have in year 10?

$2000 (1+i)

10

+ $1500 (1+i)

8

+ $1000 (1+i)

6

A More Complicated Example

How much to invest (at 5%) to get:

$1200 in year 5

$1200 in year 10

$1200 in year 15

$1200 in year 20

Convert each future amount to present:

According to P = F/(1+i)

n

Invest $1200/(1.05)

5

+ $1200/(1.05)

10

+ $1200/(1.05)

15

+

$1200/(1.05)

20

= $2706

Sensitivity Analysis

Sensitivity Analysis

So far, we have assumed that all of the numbers

and parameters are known with certainty:

In reality, most of them will be estimates!

We can use sensitivity analysis to assess the

impact of each input parameter on the output

variable of interest (present worth, internal rate

of return, etc.):

Best performed using a spreadsheet!

Vary the input parameters within ranges,

observe the change in the output variable

Sensitivity Analysis

Perform what-if analysis on one or more input

parameters:

Observe any changes in the output variable

You can easily do this by hand in a spreadsheet

Commercial Excel add-ins are also available:

For example, Palisade Corporations TopRank

Sensitivity Analysis

Varying one or more input parameters:

Store the results of each change

Plot the results as a function of input values

If a small change in an input parameter leads to

a large change in the output:

Then the output is sensitive to that input

Either more effort should go into estimating that

parameter:

Or you should choose a decision that is not

sensitive to that input!

Sensitivity Analysis

If the output is not as sensitive to some input

parameters:

Then not as much effort is required to

estimate those parameters!

Because they do not have much impact on the

output variable of interest

Summary

Summary

This lecture presented the fundamental time-

value-of-money relationships common to

most engineering economic analysis

calculations

We learned how to convert:

Present to future, and vice versa

Annual to present, and vice versa

Future to annual, and vice versa

We saw that costs get big over time

We learned about sensitivity analysis

Summary

You must master these basic relationships in order to

use them in economic analysis and decision making:

These relationships will be important to you, both

professionally and in your personal life!

Make sure you have a good grasp of these concepts, so

you can use them correctly!

Practice Problems

1. The cost of a small flood control dam is expected to be

$40,000 now, $3,000 one year from now, $4,000 two years

from now and amounts increasing by $1,000 per year through

year ten, after which they will remain constant. At an interest

rate of 10% per year, the capitalized cost of the dam is nearest

to:

For year 10 on the annual cost is $12,000. Find its capitalized

cost P/I in year 10 and use the P/F factor for its present worth.

P

cap

= 40,000 + 3,000(P/A, 10%, 10) +1000(P/G, 10%, 10)

+(12,000/0.10)(P/F, 10%, 10)

= 40,000 + 3,000(6.1446) +1000(22.8913)

+(12,000/0.10)(0.3855)

= $127,585

2. A machine that has a five year life has a first

cost of $50,000, an operating cost of $4,000

per month and a $10,000 salvage value. At an

interest rate of 12% per year compounded

monthly, the capitalized cost of the machine is

nearest to: $498,800

3. An apartment complex wishes to establish a fund at the

end of 2004 that by the end of 2021, will grow to an amount

large enough to place new roofs on its 39 apartment units.

Each new roof is estimated to cost $ 2,500 in 2019, at which

the time 13 apartments will be roofed. In 2020, another 13

apartments will be roofed but the unit cost will be $ 2,625.

the last 13 apartments will be roofed in 2021 at a unit cost of

$ 2,750.

The annual effective interest rate that can be earned on this

fund is 4%. How much money each year must be put aside

(saved) starting at the end of 2005 to pay for all 39 roofs?

A = $ 4,490/year

By doing annual updating of a certain

production line, a manufacturing company

can avoid spending $100,000 for a new

system ten years from now. At an interest rate

of 10% per year, the annual amount the

company could afford to spend beginning one

year from now is nearest to: $16,270

At an interest rate of 10% per year, annual

deposits of $1,000 in years one through ten

would accumulate to how much immediately

after the last deposit?A)$6,145

If a company wanted to make a single

investment now instead of spending $20,000

five years from now, how much would the

investment be at an interest rate of 10% per

year? P = 20,000(P/F, 10%, 5)

= 20,000(0.6209)

If a company invests $25,000 in new packaging

equipment, by how much must it reduce its annual

costs if it expects to recover the investment in seven

years at an interest rate of 10% per year?A)$2,635

In order to update a production process, a company

can spend money now or four years from now. If the

amount now would be $20,000, what equivalent

amount could the company spend four years from

now at an interest rate of 10% per year? $35,620

If a small company invests its annual profits of

$150,000 in a stock fund which earns 18% per

year, the amount in the fund after ten years

will be nearest to:$2,153,000

What is the equivalent amount in year ten of

an expenditure of $5,000 in year one, $6,000

in year two, and amounts increasing by

$1,000 per year through year ten?

Assume the interest rate is 10% per year.

A short-haul trucking company purchased a

used dump truck for $12,000. The company

paid $5,000 down and financed the balance at

an interest rate of 10% per year for five years.

The amount of its annual payment is nearest

to:B)$1,846

In order to have money for their son's college

education, a young couple started a savings

plan into which they made intermittent

deposits. They started the account with a

deposit of $2,000 (in year zero) and then

added $3,000 in years two, five and six. The

amount they had in the account in year ten if

they earned interest at 12% per year was

nearest to:D)$23,647

Payments of $1,000 in year two and $4,000 in

year five are equivalent to uniform payments

in years three through seven at an interest

rate of 10% per year nearest to:$985

At an interest rate of 10% per year,

expenditures of $1,000 in years zero, three

and six could be replaced by a single

investment in year eight nearest to:$4964

The number of years from now that an initial

investment of $1,000,000 would be recovered

from uniform receipts of $131,000 per year

beginning three years from now at an interest

rate of 10% per year is nearest to:24

You might also like

- Engineering Economic Analysis: 2019-2020 SPRINGDocument43 pagesEngineering Economic Analysis: 2019-2020 SPRINGcicek cNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- الإقتصاد الهندسي - ppsx.ppsxDocument85 pagesالإقتصاد الهندسي - ppsx.ppsxdhia_albrihiNo ratings yet

- Time Value of Money 1Document17 pagesTime Value of Money 1tengyanNo ratings yet

- Relationships & EquavalanceDocument146 pagesRelationships & EquavalanceLee Boon HongNo ratings yet

- CH 3 Money-Time Part 1Document27 pagesCH 3 Money-Time Part 1IAN PAOLO BAUTISTANo ratings yet

- Notes - EE 3Document149 pagesNotes - EE 3Lloyd DionosaNo ratings yet

- Eee221 4Document64 pagesEee221 4simgesezen6No ratings yet

- ENGECO Zfod-1 - THE TIME VALUE OF MONEYDocument29 pagesENGECO Zfod-1 - THE TIME VALUE OF MONEYomerNo ratings yet

- Engineering Economics: By: Maher Falih Hussein Msc. in Petroleum Engineering Assistant Chief Engineer Boc / ZfodDocument13 pagesEngineering Economics: By: Maher Falih Hussein Msc. in Petroleum Engineering Assistant Chief Engineer Boc / Zfodali rizaNo ratings yet

- Principal of Money - Time RelationshipsDocument26 pagesPrincipal of Money - Time RelationshipsAli TreeshNo ratings yet

- Topic 3 ReportDocument114 pagesTopic 3 ReportMc John PobleteNo ratings yet

- Time Value of MoneyDocument52 pagesTime Value of MoneyJasmine Lailani ChulipaNo ratings yet

- Yıldız Technical University Civil Engineering Department Construction Management DivisionDocument36 pagesYıldız Technical University Civil Engineering Department Construction Management DivisionBulut ŞakirNo ratings yet

- Engineering Economics Lecture 3 PDFDocument44 pagesEngineering Economics Lecture 3 PDFNavinPaudelNo ratings yet

- Ce22 04 TVM 1 PDFDocument36 pagesCe22 04 TVM 1 PDFEmman Joshua BustoNo ratings yet

- Engineering Economics Lect 3Document43 pagesEngineering Economics Lect 3Furqan ChaudhryNo ratings yet

- PEB4102 Chapter 4 - UpdatedDocument79 pagesPEB4102 Chapter 4 - UpdatedLimNo ratings yet

- M T R E: Oney-Ime Elationship and QuivalenceDocument53 pagesM T R E: Oney-Ime Elationship and QuivalenceKIM JINHWANNo ratings yet

- Module 2Document60 pagesModule 2lizNo ratings yet

- Ch1 Lecture NotesDocument44 pagesCh1 Lecture NotesSarfraz AhmedNo ratings yet

- MODULE #2 Topic 1Document13 pagesMODULE #2 Topic 1Alen Genesis CoronelNo ratings yet

- Chapter 5 NotesDocument7 pagesChapter 5 NoteshannahandrearosarioNo ratings yet

- Foundations of Engineering EconomyDocument39 pagesFoundations of Engineering EconomyThomas TanNo ratings yet

- Engineering Economy: Chapter 3: The Time Value of MoneyDocument32 pagesEngineering Economy: Chapter 3: The Time Value of MoneyAhmad Medlej100% (1)

- Chapter 4Document69 pagesChapter 4xffbdgngfNo ratings yet

- Issues in Corporate Finance: ValuationDocument52 pagesIssues in Corporate Finance: ValuationMD Hafizul Islam HafizNo ratings yet

- PEB4102 Chapter 4Document61 pagesPEB4102 Chapter 4LimNo ratings yet

- 604 ch3Document72 pages604 ch3Hazel Grace SantosNo ratings yet

- CUZ CORP FIN Time Value For Money-1Document16 pagesCUZ CORP FIN Time Value For Money-1KIMBERLY MUKAMBANo ratings yet

- Simple and Compound Interest: EC - Lec 07Document12 pagesSimple and Compound Interest: EC - Lec 07Junaid YNo ratings yet

- Interest TheoryDocument20 pagesInterest TheoryHeng MokNo ratings yet

- FM I CH IiiDocument8 pagesFM I CH IiiDùķe HPNo ratings yet

- Feedback and Warm-Up Review: - Feedback of Your Requests - Cash Flow - Cash Flow Diagrams - Economic EquivalenceDocument30 pagesFeedback and Warm-Up Review: - Feedback of Your Requests - Cash Flow - Cash Flow Diagrams - Economic EquivalenceSajid IqbalNo ratings yet

- M T R E: Oney-Ime Elationship and QuivalenceDocument30 pagesM T R E: Oney-Ime Elationship and QuivalenceClifford BacsarzaNo ratings yet

- Engineering Economy CH 4Document91 pagesEngineering Economy CH 4Omar AljilaniNo ratings yet

- Chapter 4 Updated PDFDocument91 pagesChapter 4 Updated PDFI am SmoothieNo ratings yet

- CH 1 and 2Document112 pagesCH 1 and 2DanialNo ratings yet

- 04 Time Value of MoneyDocument39 pages04 Time Value of Moneyselcen sarıkayaNo ratings yet

- Chapter 1 StudentDocument24 pagesChapter 1 Studentmaha aleneziNo ratings yet

- Chapter 3 - Inflation and EscalationDocument29 pagesChapter 3 - Inflation and EscalationFiena AzmiNo ratings yet

- Time Value of Money Part IIDocument3 pagesTime Value of Money Part IINailiah MacakilingNo ratings yet

- ChE 411 - Class Lecture - MR PDFDocument170 pagesChE 411 - Class Lecture - MR PDFTamzidul Alam100% (1)

- Week 5-Chapter 6 Discounted Cash Flow ValuationDocument70 pagesWeek 5-Chapter 6 Discounted Cash Flow ValuationOkura TsukikoNo ratings yet

- RonyDocument31 pagesRonymeraheNo ratings yet

- Time Value of MoneyDocument37 pagesTime Value of Moneyansary75No ratings yet

- Time Value of MoneyDocument78 pagesTime Value of Moneyneha_baid_167% (3)

- 01.2, Eng. EconomyDocument20 pages01.2, Eng. EconomyranaNo ratings yet

- Managerial Finance chp5Document13 pagesManagerial Finance chp5Linda Mohammad FarajNo ratings yet

- Middle East Technical University Civil Engineering DepartmentDocument33 pagesMiddle East Technical University Civil Engineering DepartmentCenk BudayanNo ratings yet

- Chapter 3 FMDocument79 pagesChapter 3 FMHananNo ratings yet

- Chapter 4 The Time Value of MoneyDocument39 pagesChapter 4 The Time Value of MoneyQuỳnh NguyễnNo ratings yet

- Chapter 4 The Time Value of MoneyDocument39 pagesChapter 4 The Time Value of Moneytrần thị ngọc trâmNo ratings yet

- Time Value of MoneyDocument10 pagesTime Value of MoneyAnu LundiaNo ratings yet

- FE Review - EconomyDocument26 pagesFE Review - EconomylonerstarNo ratings yet

- ManagmentDocument91 pagesManagmentHaile GetachewNo ratings yet

- FIN2004 - 2704 Week 3Document84 pagesFIN2004 - 2704 Week 3ZenyuiNo ratings yet

- MR Economics SlidesDocument170 pagesMR Economics SlidesMahmud ShetuNo ratings yet

- Proposed Rule: Commodity Exchange Act: Investment of Customer Funds and Related Recordkeeping RequirementsDocument17 pagesProposed Rule: Commodity Exchange Act: Investment of Customer Funds and Related Recordkeeping RequirementsJustia.comNo ratings yet

- Financial Instruments: Lesson 1.4Document66 pagesFinancial Instruments: Lesson 1.4Friendlyn AzulNo ratings yet

- FINA Exam1 - PracticeDocument6 pagesFINA Exam1 - Practicealison dreamNo ratings yet

- ASL Midterms Samplex With AnswersDocument4 pagesASL Midterms Samplex With AnswersAngelNo ratings yet

- Debt Vs EquityDocument10 pagesDebt Vs EquityKedar ParabNo ratings yet

- Project Report On Tata Aig Life InsuranceDocument53 pagesProject Report On Tata Aig Life Insurancerohitmalik0577% (13)

- ACG3141-Chap 14Document35 pagesACG3141-Chap 14Minh NguyễnNo ratings yet

- Corporate Banking: 11/04/21 Om All Rights Reserved. 1Document180 pagesCorporate Banking: 11/04/21 Om All Rights Reserved. 1Pravah ShuklaNo ratings yet

- Annex F Revised Statement of Indebtedness Payments and BalancesDocument5 pagesAnnex F Revised Statement of Indebtedness Payments and BalancesRuth Jimenez BayagNo ratings yet

- Tendernotice 1Document38 pagesTendernotice 1Photostat CenterNo ratings yet

- FF Full Eng PDFDocument146 pagesFF Full Eng PDFAnonymous YgBIdKxvNo ratings yet

- MC0620179975 HDFC Life Capital Shield Retail BrochureDocument12 pagesMC0620179975 HDFC Life Capital Shield Retail BrochureVenkatesh SivaramanNo ratings yet

- NAME: Jimenez, Ross John C. Year-Course-Section: 3-BSMA-A: InstrumentsDocument2 pagesNAME: Jimenez, Ross John C. Year-Course-Section: 3-BSMA-A: InstrumentsRoss John JimenezNo ratings yet

- Financial Markets (Chapter 5)Document3 pagesFinancial Markets (Chapter 5)Kyla DayawonNo ratings yet

- Country Default Spreads and Risk Premiums - 2011Document2 pagesCountry Default Spreads and Risk Premiums - 2011cleversweet100% (1)

- SSRN Id3000499Document100 pagesSSRN Id3000499FFNo ratings yet

- SYBMS 2023-2024 BW From2017-2018Document117 pagesSYBMS 2023-2024 BW From2017-2018jhkadliNo ratings yet

- Bond PricingDocument4 pagesBond PricingKyrbe Krystel AbalaNo ratings yet

- ACT 320 Chapter 14Document74 pagesACT 320 Chapter 14Imrul JoyNo ratings yet

- Annual Report Emea PLC PDFDocument550 pagesAnnual Report Emea PLC PDFNikhil ChaudharyNo ratings yet

- Language of The-Stock Market-Powerpoint Presentation 1122g1Document44 pagesLanguage of The-Stock Market-Powerpoint Presentation 1122g1deepag100% (13)

- Yakov Amihud, Haim Mendelson, Lasse Heje Pedersen-Market Liquidity - Asset Pricing, Risk, and Crises-Cambridge University Press (2012) PDFDocument293 pagesYakov Amihud, Haim Mendelson, Lasse Heje Pedersen-Market Liquidity - Asset Pricing, Risk, and Crises-Cambridge University Press (2012) PDFsam100% (1)

- Act 1 - Personal Finance - Rica S MendozaDocument2 pagesAct 1 - Personal Finance - Rica S Mendozariri mNo ratings yet

- Ankit Gupta Pgma2009 Asingment2Document39 pagesAnkit Gupta Pgma2009 Asingment2ANKIT GUPTANo ratings yet

- Chapter 11 - Financial Aspect of Corporate Restructuring PDFDocument38 pagesChapter 11 - Financial Aspect of Corporate Restructuring PDFArdi Meidianto Putra100% (1)

- SASF Mock Exam Level II 2002 AnsDocument44 pagesSASF Mock Exam Level II 2002 Ansapi-3703582No ratings yet

- Review - Bond & Stock ValuationDocument24 pagesReview - Bond & Stock ValuationkerenkangNo ratings yet

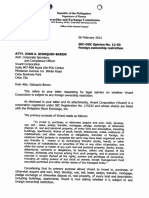

- Securities and Exchange Commission: SEC-OGC Opinion No. 12-03 Foreign Ownership Restriction Atty. Joan A. Giduquio-BaronDocument3 pagesSecurities and Exchange Commission: SEC-OGC Opinion No. 12-03 Foreign Ownership Restriction Atty. Joan A. Giduquio-BaronsarNo ratings yet

- Indus Bank - Report On Summer TrainingDocument34 pagesIndus Bank - Report On Summer TrainingZahid Bhat100% (1)

- Chapter Five Security Analysis and ValuationDocument66 pagesChapter Five Security Analysis and ValuationKume MezgebuNo ratings yet